Market Overview:

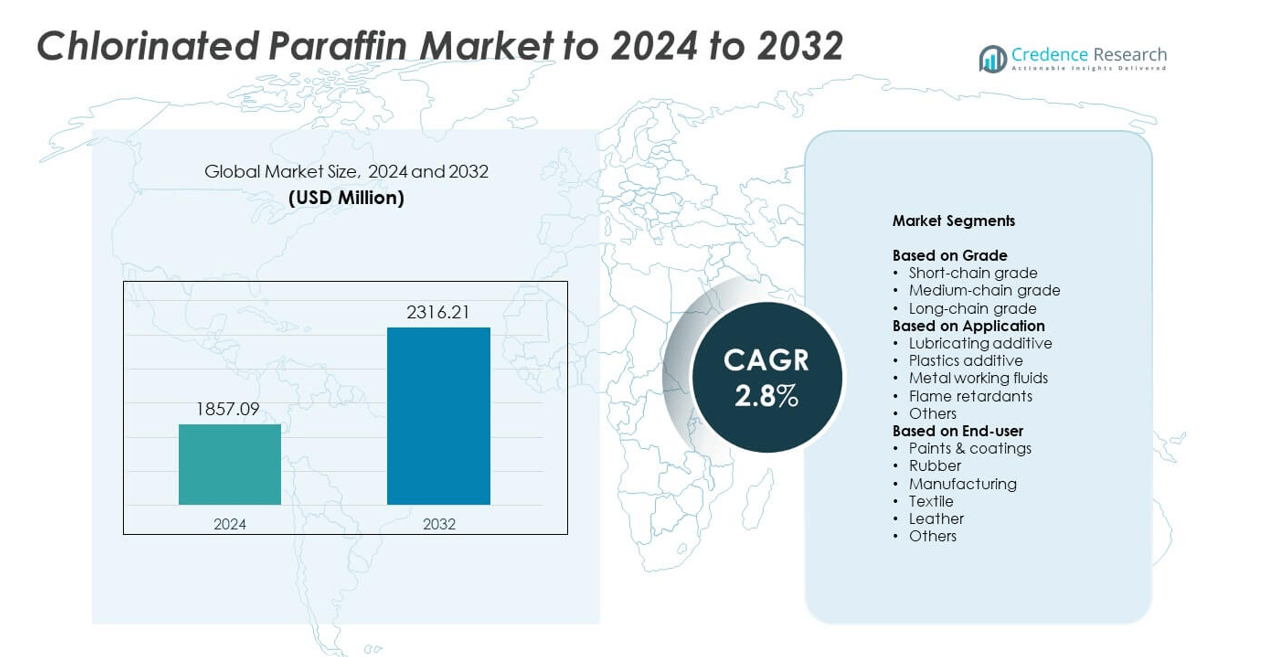

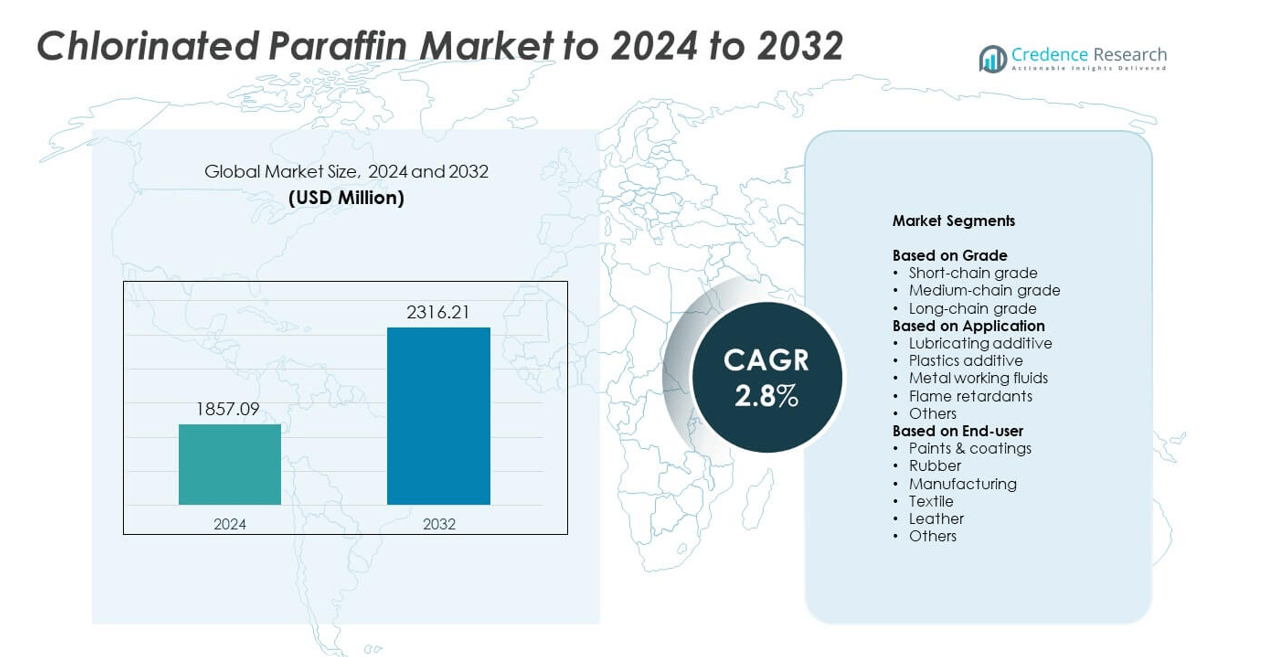

Chlorinated Paraffin market size was valued at USD 1857.09 million in 2024 and is anticipated to reach USD 2316.21 million by 2032, at a CAGR of 2.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlorinated Paraffin Market Size 2024 |

USD 1857.09 million |

| Chlorinated Paraffin Market, CAGR |

2.8% |

| Chlorinated Paraffin Market Size 2032 |

USD 2316.21 million |

The chlorinated paraffin market is led by key players such as INOVYN, Dover Chemical, Aditya Birla Chemicals, LEUNA-Tenside GmbH, Quimica del Cinca, S.A, United Group, Altair Chimica SpA, Payal Group, INEOS Chlor, and Caffaro Industrie. These companies dominate through strong product portfolios, advanced manufacturing capabilities, and global distribution networks. They focus on sustainable production methods and compliance with evolving environmental standards to maintain competitiveness. Asia Pacific emerged as the leading region in 2024, accounting for 36.8% of the global market share, driven by rapid industrialization, high PVC demand, and expanding construction and manufacturing sectors.

Market Insights

- The chlorinated paraffin market was valued at USD 1857.09 million in 2024 and is projected to reach USD 2316.21 million by 2032, growing at a CAGR of 2.8% during the forecast period.

- Growing demand for medium-chain grade chlorinated paraffin in PVC, lubricants, and coatings industries drives market expansion across industrial sectors.

- The market is witnessing a trend toward eco-friendly and low-chlorine formulations as regulatory compliance and sustainability gain focus globally.

- Leading manufacturers emphasize technological upgrades, capacity expansions, and regional partnerships to maintain competitiveness amid tightening environmental standards.

- Asia Pacific led the market with 36.8% share in 2024, followed by North America at 27.4% and Europe at 24.1%, while the medium-chain grade segment accounted for 47.3% of the total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

Medium-chain grade chlorinated paraffin dominated the market in 2024, accounting for 47.3% of the total share. Its strong position stems from widespread use as a plasticizer and flame retardant in PVC and rubber products. Medium-chain variants provide optimal thermal stability and viscosity balance, making them suitable for cable insulation, flooring, and sealants. Their compatibility with a broad range of industrial materials drives steady demand across construction and automotive manufacturing. Expanding infrastructure projects in Asia-Pacific further support the growth of this grade segment.

- For instance, Química del Cinca produces chlorinated paraffins (CPs), including medium-chain chlorinated paraffins (MCCPs) from C14–C17 chains, using processes such as photochemical chlorination, in one widely cited study for characterization purposes, the company synthesized 9 CP batches with single-chain lengths of C14 and C15 (five C14 CPs and four C15 CPs) and varying degrees of chlorination.

By Application

The lubricating additive segment held the largest share of 42.1% in 2024, driven by extensive use in metalworking and machinery maintenance. Chlorinated paraffin enhances extreme pressure resistance and minimizes wear in industrial lubricants. Its ability to withstand high temperatures and provide superior load-carrying capacity makes it indispensable in cutting and drawing oils. Increasing industrial automation and demand for heavy-duty lubricants across automotive and manufacturing sectors continue to boost consumption. The growing shift toward cost-effective performance additives strengthens this segment’s leadership.

- For instance, Tri-ISO Specialty Products reports Cereclor E50 at 50% chlorine with viscosity about 820 SUS at 100 °F for extreme-pressure metalworking fluids.

By End-user

The paints and coatings segment accounted for the dominant share of 38.6% in 2024, supported by rising infrastructure and construction activities worldwide. Chlorinated paraffin acts as a secondary plasticizer, improving flexibility, chemical resistance, and water repellence in coatings. Its ability to enhance weather durability makes it preferred for industrial and marine coatings. Rapid urbanization and growing demand for corrosion-resistant finishes in heavy equipment and architectural applications drive its adoption. Continuous innovations in PVC-based coating formulations further reinforce the segment’s strong market position.

Key Growth Drivers

Rising Demand from PVC and Plastic Manufacturing

The growing use of chlorinated paraffin as a secondary plasticizer in PVC products is a key growth driver. Its compatibility with PVC enhances flexibility, durability, and flame resistance, supporting applications in cables, flooring, and sealants. Expanding construction and infrastructure projects in emerging economies boost PVC demand, driving consistent consumption. The material’s cost-effectiveness compared to alternative plasticizers further strengthens its preference in the plastic processing and automotive sectors.

- For instance, KLJ Organic Limited is the largest manufacturer of chlorinated paraffin in the world and has a capacity of 280,000 tonnes per annum (tpa) at its Bharuch, India facility.

Expansion of Metalworking and Lubricant Industries

Increasing industrialization and machinery production have accelerated the demand for chlorinated paraffin in lubricants and metalworking fluids. The compound provides superior load-carrying capacity and thermal stability under high-pressure conditions, ensuring improved performance and tool life. Growth in automotive manufacturing, shipbuilding, and heavy engineering sectors enhances lubricant consumption. Manufacturers continue to integrate chlorinated paraffin in formulations for cutting, drilling, and rolling oils, reinforcing its role in industrial process efficiency.

- For instance, Dover Chemical’s Chlorowax 50® shows a typical chlorine content of 47% and a viscosity of approximately 120 poise at 25 °C. It is indeed formulated for use as an extreme-pressure additive in various applications, including machining, drawing, and stamping oils.

Growing Use in Flame Retardant Applications

The rising focus on safety regulations and fire-resistant materials drives the adoption of chlorinated paraffin as a flame retardant. It is widely incorporated in paints, coatings, and rubber-based materials for its ability to reduce flammability. Demand from electrical cable insulation and building materials further supports this growth. The compound’s versatility across consumer and industrial products ensures consistent utilization, especially in regions emphasizing fire safety compliance in construction and manufacturing.

Key Trends & Opportunities

Shift Toward Eco-Friendly Formulations

Manufacturers are focusing on developing environmentally safer chlorinated paraffin alternatives to meet regulatory standards. Advances in low-chlorine formulations and biodegradable variants are gaining momentum, particularly in Europe and North America. This shift aligns with global sustainability initiatives promoting reduced environmental impact and safer production practices. Companies investing in cleaner technologies and compliance-focused formulations are expected to gain long-term market advantages.

- For instance, Altair Chimica added a fourth reactor in January 2022 for the production of its “eco-bio” chlorinated paraffins (specifically the ESSEBIOCHLOR line), which boosted the photo-chlorination plant’s production potential by 25%.

Rising Demand from Emerging Economies

Rapid industrialization in countries such as China, India, and Indonesia presents major opportunities for market expansion. Increasing construction, automotive, and textile manufacturing activities drive chlorinated paraffin usage across multiple applications. Local production capacity expansions and favorable trade policies further stimulate supply chains. The growing demand for cost-effective additives and lubricants in developing economies is expected to strengthen global market presence.

- For instance, Lords Chloro Alkali is currently operating with a capacity of 50 tonnes per day (TPD) for Chlorinated Paraffin Wax (CPW) at its Rajasthan facility, and has announced a plan to expand this capacity to 100 TPD.

Integration with Advanced Manufacturing Processes

Technological innovations in production and process automation are improving chlorinated paraffin quality and efficiency. Advanced chlorination techniques allow better control over chain length and chlorine content, ensuring consistency and compliance. Integration with digital monitoring systems optimizes resource use and reduces operational costs. These advancements enhance competitiveness among producers and create new opportunities for sustainable product development.

Key Challenges

Stringent Environmental and Health Regulations

Regulatory restrictions concerning the environmental persistence and toxicity of short-chain chlorinated paraffins present a key challenge. Bans and usage limitations in regions like the European Union have pressured producers to adopt safer formulations. Compliance with REACH and EPA guidelines increases operational costs and requires significant research investments. These regulations limit global trade flexibility, forcing manufacturers to adapt their product portfolios for different markets.

Availability of Safer Substitutes

The emergence of alternative plasticizers and flame retardants with lower environmental risks poses strong competition. Materials such as phosphate esters and non-chlorinated paraffins are increasingly preferred for their safety and compliance advantages. Rising adoption of green additives in PVC and lubricant applications reduces dependence on chlorinated variants. This growing shift toward sustainable materials challenges long-term market growth and profitability for conventional chlorinated paraffin producers.

Regional Analysis

North America

North America held a market share of 27.4% in 2024, driven by strong demand from the construction, automotive, and manufacturing sectors. The region benefits from well-established PVC and lubricant industries that rely on chlorinated paraffin for flexibility and performance enhancement. Increasing infrastructure renovation and housing development support consistent product consumption. The United States leads regional adoption due to high usage in cable coatings and metalworking fluids. Regulatory initiatives promoting safer formulations are encouraging manufacturers to invest in environmentally compliant grades, ensuring sustainable market growth across industrial and consumer applications.

Europe

Europe accounted for 24.1% of the global market share in 2024, supported by robust demand from the paints and coatings, textile, and automotive industries. Germany, the United Kingdom, and France dominate the regional landscape with advanced manufacturing capabilities and strong regulatory compliance. The shift toward low-chlorine and environmentally friendly variants has spurred innovation in production technologies. Strict European Union environmental standards limit short-chain grades, fostering investment in safer alternatives. Rising construction projects and increased adoption of flame-retardant coatings across industrial sectors continue to drive steady market expansion in the region.

Asia Pacific

Asia Pacific dominated the global chlorinated paraffin market with a 36.8% share in 2024, making it the leading region. Rapid industrialization, infrastructure growth, and expanding automotive production across China, India, and Japan drive significant demand. The region’s dominance is fueled by large-scale PVC manufacturing and extensive use of lubricants in heavy industries. Competitive pricing, abundant raw material availability, and supportive government initiatives enhance regional supply capabilities. Increasing construction activity and the growing need for cost-efficient additives in developing economies further strengthen Asia Pacific’s leadership in global market development.

Latin America

Latin America held a 6.5% share of the global chlorinated paraffin market in 2024, led by Brazil and Mexico. The region’s growth is supported by expanding industrial and construction activities, especially in urban infrastructure and automotive sectors. Rising investments in manufacturing and polymer industries drive product utilization across paints, coatings, and lubricants. However, regulatory differences and limited domestic production capacity slightly constrain market expansion. The increasing focus on modernizing industrial equipment and adopting energy-efficient lubricants provides opportunities for regional market players to enhance supply capabilities and competitiveness.

Middle East & Africa

The Middle East and Africa accounted for 5.2% of the global market share in 2024, supported by growing construction, oil and gas, and industrial development activities. Countries such as Saudi Arabia, the UAE, and South Africa are key contributors due to rising investments in infrastructure and manufacturing. Chlorinated paraffin is increasingly used in metalworking fluids and flame-retardant coatings for industrial safety. The region’s demand is also driven by expanding PVC and rubber applications. Ongoing urbanization projects and diversification of industrial output are expected to enhance market penetration in the coming years.

Market Segmentations:

By Grade

- Short-chain grade

- Medium-chain grade

- Long-chain grade

By Application

- Lubricating additive

- Plastics additive

- Metal working fluids

- Flame retardants

- Others

By End-user

- Paints & coatings

- Rubber

- Manufacturing

- Textile

- Leather

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chlorinated paraffin market features several prominent players, including INOVYN, Dover Chemical, Aditya Birla Chemicals, LEUNA-Tenside GmbH, Quimica del Cinca, S.A, United Group, Altair Chimica SpA, Payal Group, INEOS Chlor, Caffaro Industrie, Handy Chemical Corporation Ltd, Makwell Group, Ajinomoto Fine-Techno, and JSC Kaustik. The market is characterized by high competition and continuous innovation aimed at improving product quality and environmental compliance. Manufacturers are focusing on enhancing production efficiency through advanced chlorination technologies and automation to meet evolving regulatory standards. Strategic collaborations and capacity expansions are strengthening supply chains and regional market presence. Companies are increasingly investing in research to develop low-chlorine and eco-friendly formulations aligned with global sustainability trends. Rising demand from end-use industries, including PVC, lubricants, and coatings, continues to drive competitive differentiation. Ongoing focus on cost optimization, customized formulations, and compliance with international safety norms shapes the industry’s long-term growth outlook.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INOVYN

- Dover Chemical

- Aditya Birla Chemicals

- LEUNA-Tenside GmbH

- Quimica del Cinca, S.A

- United Group

- Altair Chimica SpA

- Payal Group

- INEOS Chlor

- Caffaro Industrie

- Handy Chemical Corporation Ltd

- Makwell Group

- Ajinomoto Fine-Techno

- JSC Kaustik

Recent Developments

- In 2024, Dover Chemical Corporation launched new long-chain chlorinated paraffins for high-temperature rubber processing, offering improved thermal resistance.

- In 2023, INOVYN expanded its product line of medium-chain chlorinated paraffins by launching a low-chlorine MCCP variant to comply with European Union eco-regulations.

- In March 2023, Payal Group officially launched a 35-kilo-tonne per annum (KTA) expansion for chlorinated paraffin production at its facility in Dahej, Gujarat, bringing its total capacity to 70 KTA.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for medium-chain chlorinated paraffin will continue to dominate due to its broad industrial use.

- Increasing investments in eco-friendly and low-chlorine formulations will shape product innovation.

- Expansion of construction and infrastructure projects will boost PVC and coating applications.

- Asia Pacific will remain the leading market, driven by rapid industrialization and manufacturing growth.

- Stricter environmental regulations will encourage the shift toward safer and biodegradable alternatives.

- Rising demand for flame-retardant materials will strengthen adoption in automotive and electrical sectors.

- Growth in lubricant and metalworking industries will sustain consistent product consumption.

- Technological advancements in production efficiency will enhance cost competitiveness.

- Emerging economies will offer strong growth potential through expanding polymer and textile industries.

- Strategic collaborations and capacity expansions will define competitive positioning among key manufacturers.