Market Overview:

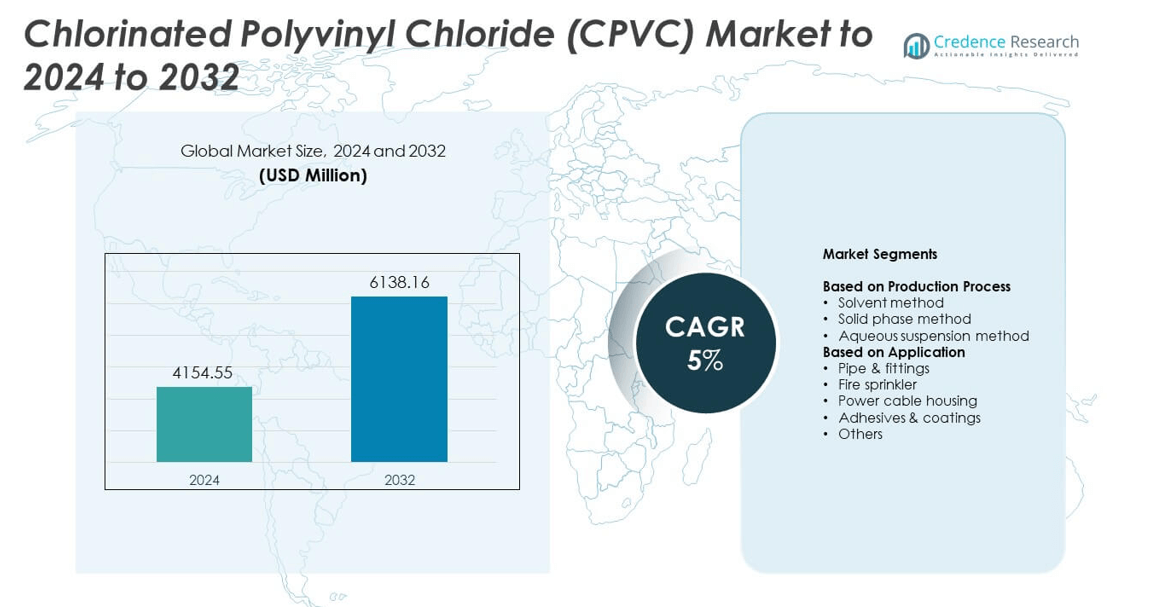

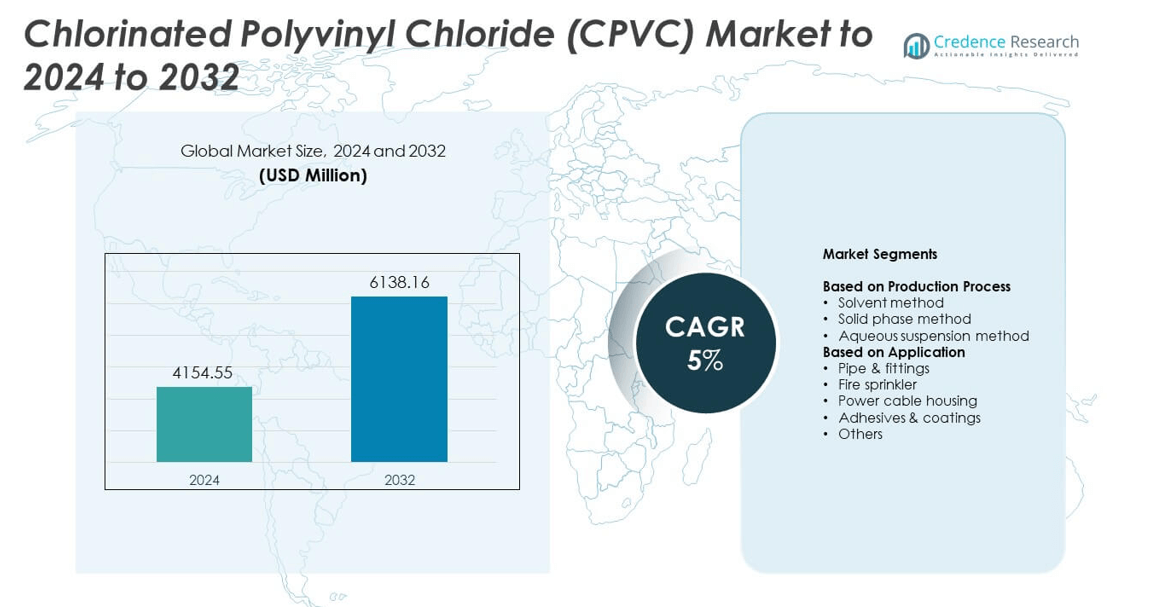

The Chlorinated Polyvinyl Chloride (CPVC) market size was valued at USD 4154.55 million in 2024 and is anticipated to reach USD 6138.16 million by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlorinated Polyvinyl Chloride (CPVC) Market Size 2024 |

USD 4154.55 million |

| Chlorinated Polyvinyl Chloride (CPVC) Market, CAGR |

5% |

| Chlorinated Polyvinyl Chloride (CPVC) Market Size 2032 |

USD 6138.16 million |

The Chlorinated Polyvinyl Chloride (CPVC) market is led by major players including BASF SE, DCW Ltd., Kaneka Corporation, Avient Corporation, Shandong Xiangsheng New Materials Technology, KEM ONE, Jiangsu Tianteng Chemical Industry, Lubrizol Corporation, Hangzhou Electrochemical Group, Novista Group, and Sekisui Chemical. These companies maintain strong market positions through advanced polymer technologies, capacity expansions, and regional distribution networks. Asia-Pacific emerged as the dominant region in 2024, accounting for 35.6% of the global share, driven by rapid urbanization, construction growth, and industrial development. North America followed with 31.4%, supported by infrastructure renovation and fire protection applications. Europe contributed 24.7%, emphasizing sustainable and high-performance CPVC solutions.

Market Insights

- The Chlorinated Polyvinyl Chloride (CPVC) market was valued at USD 4154.55 million in 2024 and is projected to reach USD 6138.16 million by 2032, expanding at a CAGR of 5%.

- The market growth is driven by rising demand for corrosion-resistant and heat-stable piping systems across construction, industrial, and fire protection applications.

- Increasing focus on sustainable materials and advanced CPVC formulations with improved performance is shaping product innovation trends.

- The market is moderately consolidated, with major players investing in production capacity, partnerships, and R&D to strengthen competitiveness.

- Asia-Pacific led with a 35.6% share in 2024, followed by North America at 31.4% and Europe at 24.7%, while pipe and fittings remained the dominant segment with 49.2% of total demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Production Process

The solvent method dominated the Chlorinated Polyvinyl Chloride (CPVC) market in 2024, accounting for 46.7% of the total share. Its strong presence is driven by high product purity, uniform chlorination, and superior heat stability. This process ensures consistent polymer structure, making it ideal for high-performance industrial and plumbing applications. Growing demand from chemical processing and construction sectors supports its leadership. Increasing adoption of solvent-based CPVC production in Asia-Pacific, particularly in China and India, enhances cost efficiency and output scalability for major manufacturers expanding capacity to meet infrastructure growth.

- For instance, DCW’s CPVC production capacity at its Sahupuram facility was 20,000 tonnes per annum (TPA) before a major expansion project was announced to reach a total capacity of 50,000 TPA. The first phase of this expansion, which added 20,000 TPA of capacity, was commissioned ahead of schedule on July 22, 2025, effectively doubling the current operational capacity to 40,000 TPA.

By Application

Pipe and fittings emerged as the leading application segment in 2024, holding 49.2% of the overall market share. Its dominance stems from CPVC’s superior corrosion resistance, pressure tolerance, and thermal stability compared to traditional PVC materials. The growing replacement of metal pipes in hot and cold-water systems, along with expanding use in industrial fluid handling, strengthens this segment. Rising adoption of CPVC piping in residential and commercial projects, driven by urbanization and water infrastructure upgrades, continues to boost demand globally, with significant consumption observed across North America and Asia-Pacific markets.

- For instance, Astral reported a total consolidated manufacturing capacity of approximately 512,582 TPA across its domestic operations as of March 31, 2024. This total capacity includes 334,040 TPA specifically for the production of pipes and water tanks, and approximately 105,856 TPA for adhesives and sealants (excluding international operations), supporting large-scale supply across its various building material product lines.

Key Growth Drivers

Expansion of Construction and Infrastructure Projects

The rapid expansion of residential, commercial, and industrial construction drives the demand for CPVC materials. These polymers are widely used in plumbing, HVAC systems, and water distribution networks due to their corrosion resistance and heat stability. Infrastructure modernization in Asia-Pacific and the Middle East supports strong adoption. Government initiatives promoting smart city projects further enhance usage in piping and fittings. The need for reliable, long-lasting piping solutions continues to make CPVC a preferred material for large-scale infrastructure development.

- For instance, Lubrizol and Grasim broke ground on the first phase of a 100,000 tonnes per annum (TPA) CPVC resin plant at Vilayat, which will be the world’s largest single-site CPVC resin manufacturing facility.

Rising Demand for Fire-Resistant and Durable Materials

CPVC’s inherent flame-retardant properties and high mechanical strength have made it a material of choice in safety-focused applications. Increasing awareness of fire safety in commercial and industrial buildings boosts its adoption in sprinkler and fire protection systems. Manufacturers are developing advanced CPVC formulations to improve heat distortion and chemical resistance. The shift from traditional metal systems to lightweight, non-corrosive CPVC materials aligns with global safety regulations, fueling steady market expansion across key industries.

- For instance, Viking lists BlazeMaster CPVC fittings rated for continuous service at 175 psi at 150 °F, with UL listings for fire systems.

Growing Adoption in Industrial Fluid Handling

Industries such as chemical processing, power generation, and water treatment increasingly rely on CPVC for transporting corrosive fluids. Its superior resistance to acids, alkalis, and high temperatures makes it an ideal substitute for metals. Industrial automation and process optimization are further promoting the use of CPVC in complex systems. Expansion of manufacturing capacity by chemical producers and increasing investments in industrial infrastructure are key factors accelerating the material’s demand in specialized fluid transport applications.

Key Trends & Opportunities

Shift Toward Sustainable Manufacturing Practices

Manufacturers are focusing on eco-efficient CPVC production methods that reduce emissions and waste. The growing use of aqueous suspension and solid-phase processes supports energy-efficient manufacturing with lower solvent consumption. Regulatory focus on sustainable polymers encourages investment in green processing technologies. Companies adopting circular economy principles are also emphasizing CPVC recycling and reuse in pipe systems, presenting long-term opportunities in environmentally responsible construction and industrial applications.

- For instance, Epigral commissioned an added 45,000 tpa CPVC line in April 2024 to reach 75,000 tpa, and also commissioned an 18.34 MW wind-solar hybrid plant.

Technological Advancements in CPVC Formulation

Continuous innovation in CPVC resin and compounding technology enhances product performance and market reach. New grades with improved thermal stability, impact resistance, and chemical compatibility are enabling broader applications across sectors. Integration of digital monitoring in pipe systems and performance testing further ensures reliability. As manufacturers pursue advanced formulations for industrial and commercial use, technological progress remains a key opportunity for achieving higher quality standards and expanding product differentiation.

- For instance, Charlotte Pipe’s Schedule 80 CPVC pipe is made with the Corzan® compound and meets the material classification of cell class 24448 per ASTM D1784. It conforms to NSF 14/61 standards and uses Iron Pipe Size (IPS) dimensions per ASTM F441.

Key Challenges

Volatility in Raw Material Prices

The CPVC market faces pricing challenges due to fluctuations in raw materials like chlorine and PVC resin. Supply chain disruptions and rising production costs affect manufacturers’ profit margins. Dependence on petrochemical feedstocks exposes the industry to energy price volatility and trade imbalances. Frequent price variations limit smaller producers’ competitiveness and impact large-scale procurement planning. Stabilizing raw material sourcing and adopting integrated production strategies are essential to mitigate these risks.

Environmental and Regulatory Compliance Issues

Stringent environmental regulations related to chlorine-based compounds pose hurdles for CPVC producers. Manufacturing processes involving chlorination must comply with strict emission and waste management norms. Inconsistent regional regulations across markets like North America, Europe, and Asia further complicate trade. Non-compliance risks can lead to production delays or penalties. Developing sustainable production technologies and improving waste treatment systems are crucial for maintaining long-term market sustainability and regulatory approval.

Regional Analysis

North America

North America held a 31.4% share of the Chlorinated Polyvinyl Chloride (CPVC) market in 2024, driven by strong demand from residential construction and fire protection systems. The United States leads regional consumption, supported by replacement of aging metal piping with CPVC alternatives. Rising adoption in industrial fluid transport and HVAC applications further strengthens regional growth. Stringent building safety standards and investment in infrastructure modernization continue to drive product penetration. The presence of established manufacturers and consistent innovation in CPVC formulations ensure steady expansion across both commercial and industrial sectors.

Europe

Europe accounted for 24.7% of the CPVC market share in 2024, supported by the region’s focus on energy-efficient and sustainable building materials. Germany, France, and the United Kingdom lead adoption due to stringent fire safety and environmental regulations. The growth of green construction and retrofitting projects has increased CPVC use in plumbing, sprinkler, and coating applications. Expanding industrial infrastructure in Eastern Europe also contributes to rising demand. Manufacturers in the region are investing in cleaner production processes and recyclable materials, aligning with the EU’s sustainability targets and promoting long-term adoption of CPVC systems.

Asia-Pacific

Asia-Pacific dominated the CPVC market in 2024 with a 35.6% share, making it the largest regional segment. Rapid urbanization, infrastructure growth, and industrial expansion in China, India, and Southeast Asia are major growth factors. Rising investments in housing and water management systems have accelerated CPVC pipe and fitting demand. Government-led smart city and sanitation programs further stimulate consumption. Regional manufacturers are scaling production capacity to meet surging domestic and export demand. Increasing awareness about corrosion-resistant and thermally stable materials positions CPVC as a preferred alternative to conventional piping systems in diverse end-use industries.

Latin America

Latin America represented 5.3% of the global CPVC market share in 2024, with Brazil and Mexico serving as major contributors. Expanding construction activity and growing use of CPVC pipes in water supply and irrigation systems support steady market growth. The region benefits from low-cost manufacturing and gradual modernization of building infrastructure. Local governments’ focus on improving water distribution and sanitation systems has boosted the adoption of durable polymer materials. Rising investment in residential development and public infrastructure projects continues to create growth opportunities for CPVC applications across Latin America’s emerging economies.

Middle East & Africa

The Middle East and Africa accounted for 3% of the CPVC market share in 2024, driven by demand in construction, oil and gas, and industrial sectors. Countries like Saudi Arabia, the UAE, and South Africa are witnessing rapid adoption of CPVC for high-temperature and chemical-handling systems. Large-scale urban development projects and water network upgrades drive regional growth. CPVC’s durability and resistance to extreme conditions make it suitable for harsh environments common in the region. Increasing government investment in housing, utilities, and infrastructure continues to support the expanding market base for CPVC materials.

Market Segmentations:

By Production Process

- Solvent method

- Solid phase method

- Aqueous suspension method

By Application

- Pipe & fittings

- Fire sprinkler

- Power cable housing

- Adhesives & coatings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Chlorinated Polyvinyl Chloride (CPVC) market features prominent players such as BASF SE, DCW Ltd., Kaneka Corporation, Avient Corporation, Shandong Xiangsheng New Materials Technology, KEM ONE, Jiangsu Tianteng Chemical Industry, Lubrizol Corporation, Hangzhou Electrochemical Group, Novista Group, and Sekisui Chemical. The market is moderately consolidated, with a mix of global producers and regional manufacturers focusing on product innovation, process efficiency, and sustainable production methods. Companies are emphasizing high-performance CPVC grades with enhanced thermal and chemical resistance to cater to diverse industrial and construction needs. Strategic partnerships, capacity expansions, and technology collaborations are central to maintaining competitiveness in rapidly growing regions such as Asia-Pacific. Moreover, firms are investing in localized production and distribution networks to reduce logistics costs and ensure consistent quality standards. Continuous R&D investments aimed at improving material recyclability and environmental compliance further define the evolving competitive dynamics of the global CPVC market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- DCW Ltd.

- Kaneka Corporation

- Avient Corporation

- Shandong Xiangsheng New Materials Technology

- KEM ONE

- Jiangsu Tianteng Chemical Industry

- Lubrizol Corporation

- Hangzhou Electrochemical Group

- Novista Group

- Sekisui Chemical

Recent Developments

- In 2024, Lubrizol opened a 42,000-square-foot Global Capability Center (GCC) in Pune, India, to support regional growth and innovation, which is part of a larger investment in India that also includes expanding its CPVC resin plant and doubling capacity at its Dahej site

- In 2024, Sekisui Chemical announced plans to increase its CPVC compound production capacity in Thailand by 1.6 times, with the new plant targeted to start by the end of March 2026.

- In 2023, DCW Ltd. commissioned a project to expand its CPVC production by 10,000 MT at its Sahupuram Plant in Tamilnadu.

Report Coverage

The research report offers an in-depth analysis based on Production Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The CPVC market is expected to witness steady growth due to rising infrastructure investments.

- Increasing replacement of traditional metal pipes with CPVC systems will drive demand.

- Expanding residential and commercial construction activities will strengthen market penetration.

- Rising adoption of CPVC in industrial fluid handling applications will enhance revenue potential.

- Technological advancements in chlorination processes will improve material performance and efficiency.

- Growing awareness of fire safety standards will support use in fire protection systems.

- Expansion of manufacturing capacity in Asia-Pacific will ensure stable supply and cost advantages.

- Adoption of sustainable and eco-efficient production practices will shape future competitiveness.

- Strategic collaborations between global manufacturers and local distributors will accelerate market expansion.

- Regulatory support for corrosion-resistant and energy-efficient materials will sustain long-term market growth.