Market Overview:

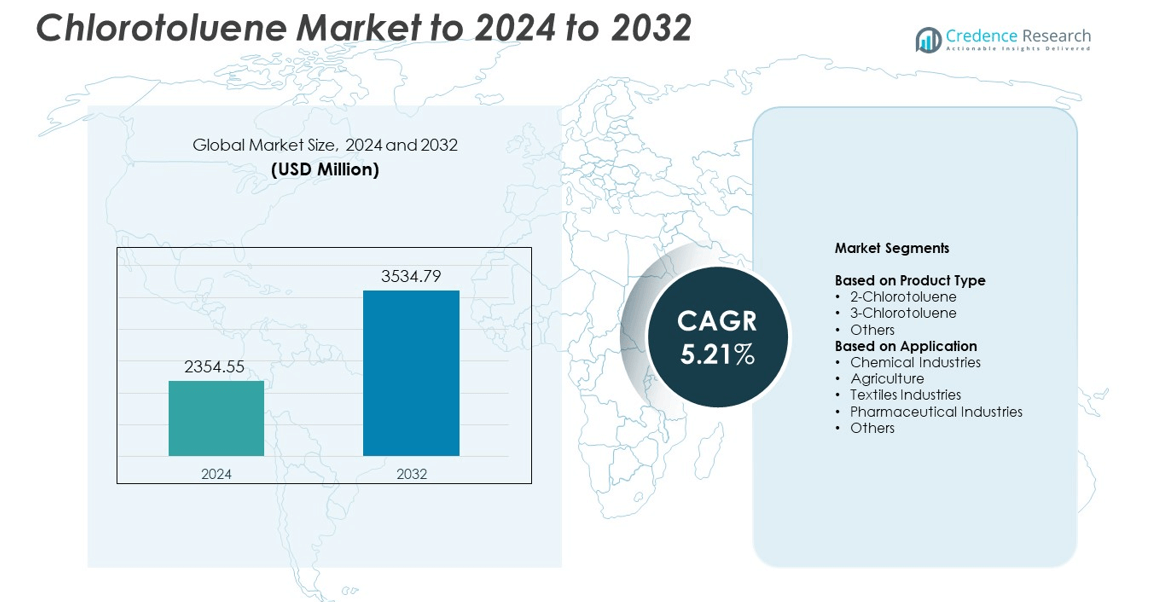

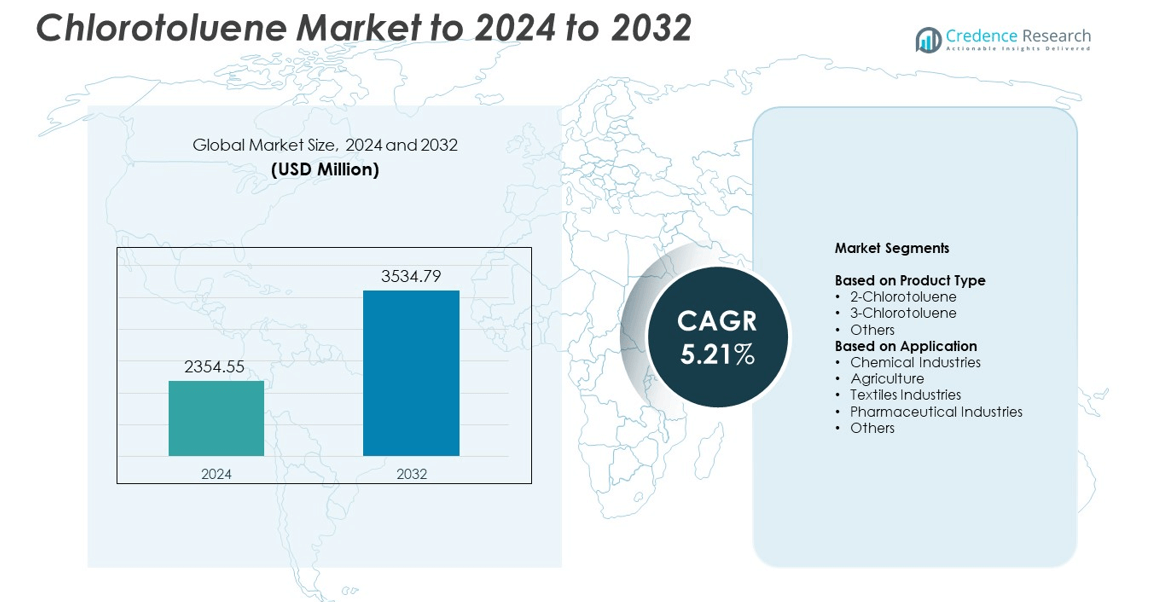

Chlorotoluene Market size was valued USD 2354.55 Million in 2024 and is anticipated to reach USD 3534.79 Million by 2032, at a CAGR of 5.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlorotoluene Market Size 2024 |

USD 2354.55 Million |

| Chlorotoluene Market, CAGR |

5.21% |

| Chlorotoluene Market Size 2032 |

USD 3534.79 Million |

The chlorotoluene market is led by major players including LANXESS, TORAY INDUSTRIES, INC., INEOS, Epigral Limited, WeylChem International GmbH, Valtris Specialty Chemicals, Gujarat Alkalies & Chemicals Limited, and IHARANIKKEI CHEMICAL INDUSTRY CO., LTD. These companies dominate through strong product portfolios, advanced manufacturing capabilities, and strategic regional presence. Asia-Pacific emerged as the leading region, accounting for 34.8% of the global market share in 2024, driven by expanding chemical and pharmaceutical production in China and India. North America followed with 29.4% share, supported by advanced industrial infrastructure and technological innovation. Europe held 25.6% share, sustained by growing demand for eco-friendly and specialty chemical formulations.

Market Insights

- The chlorotoluene market was valued at USD 2354.55 million in 2024 and is projected to reach USD 3534.79 million by 2032, growing at a CAGR of 5.21%.

- Increasing demand from chemical, pharmaceutical, and agrochemical industries drives market expansion due to its role as a key intermediate in various synthesis processes.

- Sustainable production practices and advancements in chlorination technology are emerging trends improving efficiency and reducing environmental impact.

- The market is moderately consolidated, with leading companies focusing on product innovation, capacity expansion, and regional collaborations to strengthen competitiveness.

- Asia-Pacific dominated the global market with 34.8% share in 2024, followed by North America with 29.4% and Europe with 25.6%, while 2-chlorotoluene held the largest product segment share of 48.3%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

2-Chlorotoluene dominated the chlorotoluene market in 2024, accounting for 48.3% of the total share. Its dominance stems from its wide use as an intermediate in the production of dyes, agrochemicals, and pharmaceuticals. The compound’s stability and ease of chlorination make it a preferred choice for chemical synthesis. Growing demand for herbicides, fungicides, and specialty chemicals continues to support its expansion. Increasing investments in chemical manufacturing across Asia-Pacific further enhance the segment’s adoption in large-scale industrial production processes.

- For instance, Gujarat Alkalies & Chemicals (GACL) has established India’s largest Chlorotoluenes Plant at its Dahej complex. This facility has an annual production capacity of 30,000 metric tonnes (MT) and will produce Benzyl Chloride (13,200 MTPA), Benzyl Alcohol (9,600 MTPA), and Benzaldehyde (7,200 MTPA).

By Application

Chemical industries held the largest market share of 42.7% in the chlorotoluene market in 2024. The segment’s leadership is driven by extensive use of chlorotoluene in producing benzyl chloride, phenylacetic acid, and other chemical intermediates. Rising demand from agrochemicals, dyes, and polymer sectors amplifies consumption. Expanding industrialization in developing economies and growing emphasis on chemical synthesis for high-performance materials also boost growth. The segment benefits from continuous R&D efforts aimed at improving yield efficiency and environmental performance in chlorination processes.

- For instance, China Salt Changzhou Chemical lists a chlorotoluene facility of 25,000 t/a, integrated with downstream benzyl chloride and other chlorination products for chemical intermediates.

Key Growth Drivers

Rising Demand from Chemical and Pharmaceutical Industries

Expanding use of chlorotoluene in the production of intermediates for pharmaceuticals, dyes, and agrochemicals is a major growth factor. Its role as a key solvent and precursor in synthesis processes drives adoption across multiple industries. Growing pharmaceutical manufacturing in regions like Asia-Pacific further strengthens market demand. Continuous advancements in chemical synthesis technologies also enhance product purity and process efficiency, making chlorotoluene an essential raw material in fine and specialty chemical production.

- For instance, Iharanikkei Chemical reports head-office chemical output of 50,000 t/yr, with chlorotoluene-related products reaching 26,000 t/yr—about half of site production.

Expanding Agrochemical Applications

The agriculture sector’s growing need for herbicides and pesticides supports chlorotoluene consumption. The compound is widely used in synthesizing active ingredients for crop protection products. Rising awareness about crop yield improvement and the need for sustainable farming solutions increase demand for high-quality intermediates. Government initiatives promoting agricultural productivity and the expanding agrochemical industry in emerging economies further reinforce the market’s growth trajectory.

- For instance, UPL’s Haldia site (Unit #09) planned a scale-up of technicals and intermediates capacity from 460 MTPM to 2,100 MTPM, indicating stronger precursor demand for crop protection synthesis.

Industrial Growth in Emerging Economies

Rapid industrialization and infrastructure expansion in emerging economies are key contributors to market growth. Increasing chemical manufacturing capacity and foreign investments in Asia-Pacific drive large-scale production and consumption. The development of industrial parks and favorable trade policies encourage chlorotoluene producers to expand operations. Rising demand for industrial solvents and intermediates from end-use industries such as textiles and coatings strengthens the overall market outlook.

Key Trends & Opportunities

Shift Toward Environmentally Sustainable Production

Manufacturers are increasingly adopting eco-friendly production techniques to reduce emissions and waste in chlorination processes. The introduction of closed-loop systems and green catalysts minimizes environmental impact while improving efficiency. Growing regulatory pressure for sustainable chemical production encourages R&D in cleaner technologies. This trend aligns with the global shift toward responsible manufacturing and positions companies focusing on sustainability for long-term competitive advantages.

- For instance, LANXESS has an SBTi-approved near-term target to cut Scope 1+2 emissions 42% by 2030 from a 2021 base, driving cleaner chlorination value chains.

Increasing Adoption in Specialty Chemical Manufacturing

Rising demand for high-performance chemicals across electronics, automotive, and coatings sectors creates opportunities for chlorotoluene-based intermediates. The compound’s versatility allows its integration into multiple downstream applications, boosting its commercial potential. Continuous product innovation and customization enable manufacturers to target niche markets. Expanding specialty chemical production in countries like India and China enhances the segment’s growth prospects over the coming years.

- For instance, Jiangsu Beyond Chemicals Co., Ltd. has a total project capacity of 600,000 tons/year for p-chlorotoluene and o-chlorotoluene and their downstream derivatives at its Zhenjiang complex, which feeds diverse downstream specialty routes for pharmaceuticals, pesticides, and new material intermediates.

Key Challenges

Stringent Environmental and Safety Regulations

Strict regulations governing the use and disposal of chlorinated compounds pose significant challenges for producers. Compliance with global standards such as REACH and EPA limits increases operational costs and complexity. Manufacturers face rising pressure to invest in emission control and waste treatment systems. These regulatory burdens may limit market entry for smaller firms, restricting competitive dynamics in the global chlorotoluene industry.

Fluctuating Raw Material Prices

Volatility in the prices of raw materials such as toluene and chlorine affects production economics. Frequent fluctuations driven by crude oil market instability lead to unpredictable manufacturing costs. This pricing uncertainty impacts profit margins and long-term planning for manufacturers. Developing efficient procurement strategies and adopting cost-effective production methods are crucial to maintaining competitiveness in a highly price-sensitive market.

Regional Analysis

North America

North America accounted for 29.4% of the chlorotoluene market share in 2024, driven by strong demand from chemical and pharmaceutical industries. The region benefits from established production facilities and advanced research in specialty chemicals. Rising use of chlorotoluene in agrochemicals and coatings also supports growth. The United States remains a key contributor due to its large-scale manufacturing capacity and regulatory emphasis on product quality. Continuous innovation in synthesis technologies and the adoption of cleaner production practices enhance regional competitiveness and sustain long-term market expansion.

Europe

Europe held a 25.6% share of the chlorotoluene market in 2024, supported by robust industrial infrastructure and growing emphasis on sustainable chemical production. The presence of major manufacturers and high demand from the automotive and coatings sectors drive regional growth. Stringent environmental regulations promote the use of advanced chlorination technologies to reduce emissions. Germany, France, and the United Kingdom lead consumption due to their well-developed chemical sectors. The transition toward low-impact manufacturing and continuous R&D in greener alternatives reinforce the region’s position in the global market.

Asia-Pacific

Asia-Pacific dominated the global chlorotoluene market with a 34.8% share in 2024. Rapid industrialization and expanding chemical manufacturing capacity across China, India, and Japan underpin this leadership. Growing demand from agrochemical and pharmaceutical industries continues to boost consumption. Favorable government policies and lower production costs attract foreign investments in large-scale facilities. The region’s focus on export-driven chemical production and improving environmental compliance further enhance its global market presence. Rising innovation in intermediate manufacturing and technological advancements support sustained growth throughout the forecast period.

Latin America

Latin America captured 6.3% of the chlorotoluene market share in 2024, primarily driven by demand from agriculture and industrial chemical sectors. Brazil and Mexico lead consumption due to expanding agrochemical production and rising investment in industrial processing. The increasing focus on enhancing crop yields and adopting efficient chemical intermediates strengthens regional demand. Limited local manufacturing capabilities, however, result in higher import dependence. Ongoing infrastructure development and the expansion of industrial parks are expected to improve domestic production capacity and support market growth in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for 3.9% of the chlorotoluene market share in 2024. Growth is supported by the expansion of petrochemical industries and rising demand for industrial solvents. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are witnessing growing investment in downstream chemical production. Increasing urbanization and industrial diversification initiatives further encourage adoption. However, limited technological capabilities and regulatory constraints restrict market potential. Strategic partnerships with global manufacturers and advancements in process efficiency are expected to enhance regional competitiveness.

Market Segmentations:

By Product Type

- 2-Chlorotoluene

- 3-Chlorotoluene

- Others

By Application

- Chemical Industries

- Agriculture

- Textiles Industries

- Pharmaceutical Industries

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chlorotoluene market features prominent players such as LANXESS, Falcon Electric, Inc., TORAY INDUSTRIES, INC., Epigral Limited, Johnson Controls, Inc., Gujarat Alkalies & Chemicals Limited, Stulz GmbH, Asetek A/S, Socomec, INEOS, WeylChem International GmbH, SPX Corporation, Valtris Specialty Chemicals, Xiamen Kehua Hengsheng Co., Ltd., Daikin Industries, Ltd., Nortek Air Solutions, LLC, IHARANIKKEI CHEMICAL INDUSTRY CO., LTD., and Siemens. The competitive landscape is characterized by continuous product innovation, strategic collaborations, and capacity expansions to strengthen market positioning. Companies are focusing on sustainable production technologies, high-purity chemical synthesis, and customized formulations to meet growing industrial demands. Investments in R&D and advanced chlorination processes enhance operational efficiency and product consistency. Regional expansion, particularly across Asia-Pacific, remains a key strategic priority to capture the rising demand from agrochemical and pharmaceutical industries. Partnerships with end-user industries and adoption of green manufacturing practices further define the competition among leading global and regional producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LANXESS

- Falcon Electric, Inc.

- TORAY INDUSTRIES, INC.

- Epigral Limited

- Johnson Controls, Inc.

- Gujarat Alkalies & Chemicals Limited

- Stulz GmbH

- Asetek A/S

- Socomec

- INEOS

- WeylChem International GmbH

- SPX Corporation

- Valtris Specialty Chemicals

- Xiamen Kehua Hengsheng Co., Ltd.

- Daikin Industries, Ltd.

- Nortek Air Solutions, LLC

- IHARANIKKEI CHEMICAL INDUSTRY CO., LTD.

- Siemens

Recent Developments

- In 2025, Epigral Limited: Successfully commissioned India’s first Chlorotoluenes Value Chain Facility at its Dahej Complex in Gujarat.

- In 2024, INEOS: Introduced a new, more eco-friendly production process for chlorotoluene, focusing on reduced solvent use and energy consumption.

- In 2023, LANXESS Corporation expanded its chlorotoluene production capacity by 20% to meet growing demand in various downstream applications, particularly in the agrochemical and pharmaceutical sectors.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The chlorotoluene market is expected to witness steady growth driven by rising chemical production.

- Expanding applications in agrochemicals and pharmaceuticals will strengthen long-term demand.

- Asia-Pacific will remain the dominant regional market with rapid industrial expansion.

- Increasing investment in eco-friendly manufacturing processes will shape market competitiveness.

- Technological advancements in chlorination and purification will enhance product quality.

- Growing demand for specialty chemicals will create new opportunities for manufacturers.

- Strategic collaborations and capacity expansions will drive global market consolidation.

- Regulatory focus on environmental compliance will encourage process innovation.

- Volatile raw material prices may challenge profitability across smaller producers.

- Continuous R&D toward sustainable and high-purity formulations will support future market stability.