Market Overview:

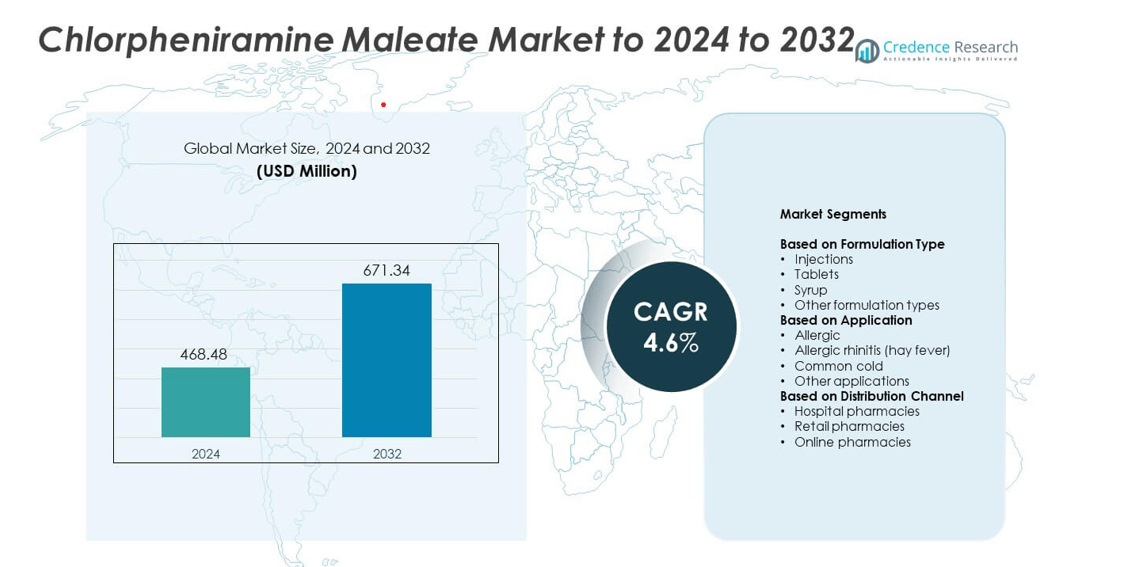

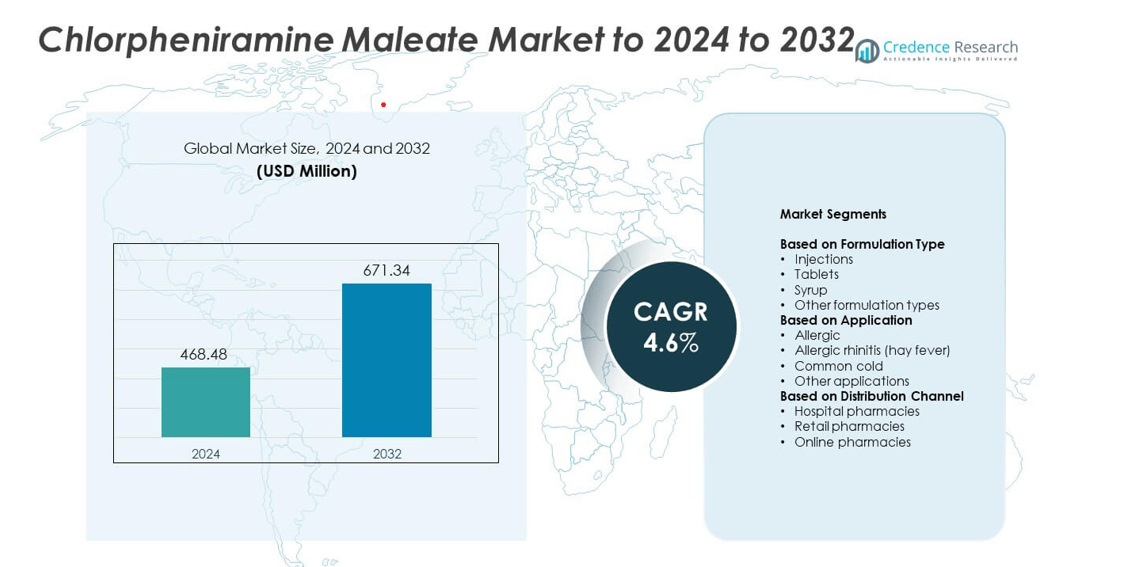

Chlorpheniramine Maleate market size was valued at USD 468.48 million in 2024 and is anticipated to reach USD 671.34 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlorpheniramine Maleate MarketSize 2024 |

USD 468.48 million |

| Chlorpheniramine Maleate Market, CAGR |

4.6% |

| Chlorpheniramine Maleate Market Size 2032 |

USD 671.34 million |

The chlorpheniramine maleate market is led by prominent companies including GlaxoSmithKline PLC, Zydus Lifesciences Limited, Viatris Inc., Bayer AG, Alkem Laboratories, Johnson & Johnson, Orion Life Science, Sun Pharmaceutical Industries Ltd., Novalab Healthcare Pvt. Ltd., Salvidas Pharmaceuticals Pvt. Ltd., and Ataby Pharmaceuticals. These players dominate through extensive product portfolios, strong research capabilities, and wide retail and online distribution networks. North America led the global market with a 38.2% share in 2024, supported by high allergy prevalence and robust over-the-counter drug sales. Europe followed with 27.4%, driven by aging populations and advanced healthcare infrastructure, while Asia-Pacific captured 23.6% due to rising allergic disorders and growing pharmaceutical production.

Market Insights

- The chlorpheniramine maleate market was valued at USD 468.48 million in 2024 and is projected to reach USD 671.34 million by 2032, growing at a CAGR of 4.6%.

• Rising allergy prevalence, urban pollution, and increasing self-medication practices are driving global demand for chlorpheniramine-based formulations.

• Market trends highlight the growing adoption of combination therapies, expansion of online pharmacies, and increased focus on low-sedation and pediatric-friendly products.

• Competitive dynamics are shaped by innovation in extended-release formulations, strategic collaborations, and the dominance of established pharmaceutical brands.

• North America led with a 38.2% share in 2024, followed by Europe at 27.4% and Asia-Pacific at 23.6%, while tablets held the largest product segment share of 46.5% in the same year.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Formulation Type

Tablets dominated the chlorpheniramine Maleate market in 2024, accounting for 46.5% of the total share. The segment’s leadership stems from their convenience, precise dosage, and wide availability in over-the-counter products. Tablets are preferred for long-term allergy management and ease of administration across all age groups. Growing use of combination formulations with decongestants further enhances adoption. Expanding production by pharmaceutical companies and consistent demand in emerging markets strengthen this segment’s position.

- For instance, Dr. Reddy’s had 86 U.S. FDA filings pending as of 31-Mar-2024, including 81 ANDAs, underscoring tablet pipeline depth.

By Application

The allergic rhinitis segment held the largest share of 42.8% in 2024, driven by the rising prevalence of pollen-related allergies and urban air pollution. Chlorpheniramine’s effectiveness in treating nasal congestion, sneezing, and runny nose supports its high demand. Increasing exposure to allergens and changing climatic conditions boost product use worldwide. Pharmaceutical innovation in extended-release formulations enhances treatment compliance.

- For instance, Glenmark’s Ryaltris secured marketing approval through the EU DCP enabling launches across 17 EU/UK countries.

By Distribution Channel

Retail pharmacies led the market with a 53.2% share in 2024, reflecting their wide accessibility and consumer preference for immediate purchase of antihistamine drugs. These outlets offer both branded and generic options, ensuring affordability and availability. Strong distribution networks and partnerships with healthcare providers increase product penetration. The expansion of organized pharmacy chains also supports segment growth.

Key Growth Drivers

Rising Prevalence of Allergic Disorders

The growing incidence of allergic rhinitis, asthma, and other hypersensitivity conditions drives the demand for chlorpheniramine maleate. Increasing exposure to environmental pollutants, dust, and pollen intensifies allergic reactions worldwide. Expanding patient awareness and the growing preference for cost-effective antihistamine therapies further strengthen market growth. Pharmaceutical companies continue to introduce advanced formulations to improve efficacy and patient compliance, enhancing product adoption across both developed and emerging markets.

- For instance, Lupin reported 442 cumulative ANDA and NDA filings with the U.S. FDA as of March 31, 2024.

Expanding Over-the-Counter Drug Accessibility

Wider availability of chlorpheniramine maleate as an over-the-counter medication significantly fuels market expansion. Consumers increasingly prefer self-medication for mild allergies and colds, supported by regulatory approvals promoting OTC sales. Retail pharmacy chains and online platforms are enhancing distribution reach and convenience. Increased marketing efforts by drug manufacturers also encourage product adoption. The trend is particularly strong in Asia-Pacific and North America, where OTC drug use has surged due to cost advantages and easy accessibility.

- For instance, Piramal Consumer Products directly serves ~250,000 outlets across 1,500+ towns, touching 70 million consumer lives.

Rising Pediatric and Geriatric Usage

Chlorpheniramine maleate is gaining traction in pediatric and geriatric populations due to its safety and tolerability. The formulation’s mild sedative properties and proven antihistamine action make it suitable for age-sensitive groups. Growing healthcare awareness and rising prescription rates for cold and allergy management among children and elderly patients support this demand. The expansion of pediatric-friendly formulations such as syrups and chewable tablets also widens its clinical acceptance globally.

Key Trends & Opportunities

Shift Toward Combination Formulations

The market is witnessing a growing shift toward multi-ingredient formulations that combine chlorpheniramine maleate with decongestants and analgesics. These combinations enhance therapeutic outcomes and patient convenience, especially for treating cold and flu symptoms. Pharmaceutical firms are leveraging this trend to diversify portfolios and target broader indications. This shift also supports higher prescription volumes in hospital and retail channels, particularly in regions emphasizing symptomatic treatment approaches.

- For instance, Alkem markets CPM-based combinations such as the Zukamin/Zukacold lines, which are available in different concentrations: the standard Zukamin syrup has labeled strengths of CPM 1 mg, phenylephrine 2.5 mg, and paracetamol 125 mg per 5 ml, while a stronger ‘DS’ oral suspension variant contains CPM 2 mg, phenylephrine 5 mg, and paracetamol 250 mg per 5 ml.

Rising Online Pharmacy Penetration

E-commerce platforms are emerging as a strong distribution channel for antihistamine products. Online pharmacies offer price transparency, doorstep delivery, and improved accessibility for patients in remote areas. Increasing digital adoption and consumer preference for contactless purchases post-pandemic are accelerating this shift. Manufacturers are collaborating with digital health platforms to expand visibility and improve patient engagement, strengthening online sales of chlorpheniramine-based products globally.

- For instance, Tata 1mg posted ₹2,392 crore turnover in FY25, highlighting strong e-pharmacy scale.

Key Challenges

Side Effects and Sedation Concerns

Chlorpheniramine maleate’s sedative effects and potential for drowsiness limit its use among working-age consumers. The risk of reduced alertness poses challenges for individuals operating machinery or driving. Healthcare providers increasingly recommend non-sedating antihistamines as alternatives, impacting product demand. Continuous education on safe dosage and improved formulation research remain necessary to mitigate these concerns while maintaining therapeutic effectiveness.

Stringent Regulatory and Quality Standards

The market faces regulatory challenges related to formulation approval, labeling, and pharmacovigilance compliance. Variations in national drug standards often delay product launches and increase development costs for manufacturers. Maintaining consistent product quality and meeting international Good Manufacturing Practice (GMP) standards are essential yet resource-intensive. These stringent requirements restrict smaller players’ entry and influence pricing strategies across key regional markets.

Regional Analysis

North America

North America held the largest share of 38.2% in the chlorpheniramine maleate market in 2024. The region’s dominance is driven by high allergy prevalence, advanced healthcare infrastructure, and strong over-the-counter drug sales. Increased consumer awareness and the availability of generic antihistamines support sustained demand. The United States remains the primary contributor due to robust pharmaceutical production and established retail pharmacy networks. Ongoing innovation in extended-release formulations further boosts regional growth, while Canada benefits from an expanding online pharmacy sector catering to self-medication trends.

Europe

Europe accounted for 27.4% of the global chlorpheniramine maleate market in 2024, supported by strong prescription sales and growing self-care practices. The region benefits from a mature pharmaceutical landscape, high regulatory standards, and an aging population prone to allergic conditions. Countries such as Germany, France, and the United Kingdom are key revenue contributors. Rising awareness of cost-effective antihistamines and favorable reimbursement policies sustain growth. Increasing product availability through both hospital and retail pharmacies further strengthens Europe’s market presence, especially in cold and allergy treatment segments.

Asia-Pacific

Asia-Pacific captured 23.6% of the chlorpheniramine maleate market in 2024, reflecting rapid urbanization, growing pollution levels, and increasing allergic disease prevalence. Expanding healthcare access in China, India, and Southeast Asia accelerates market penetration. Local pharmaceutical production and rising preference for low-cost antihistamines contribute to strong demand. The growth of e-commerce and online pharmacies enhances distribution efficiency. Additionally, a surge in pediatric and geriatric usage supports broader adoption, particularly in emerging economies where awareness of allergy management continues to expand.

Latin America

Latin America represented 6.8% of the global chlorpheniramine maleate market share in 2024. Growth in this region is supported by increasing healthcare expenditure, urbanization, and higher respiratory allergy incidence. Brazil and Mexico lead the market due to a growing middle-class population and expanding pharmaceutical distribution networks. Generic drug manufacturing and government initiatives to improve access to essential medicines further drive adoption. Rising self-medication trends and increased OTC drug availability strengthen market growth, although uneven regulatory frameworks present moderate challenges to new product launches.

Middle East and Africa

The Middle East and Africa accounted for 4.0% of the global chlorpheniramine maleate market in 2024. The region’s expansion is fueled by growing healthcare infrastructure and improving access to affordable allergy treatments. Demand is rising in countries such as Saudi Arabia, the UAE, and South Africa due to increasing air pollution and climatic allergies. Government-led healthcare initiatives and the establishment of new pharmacy chains enhance product reach. However, limited awareness in rural areas and dependency on imports constrain faster growth compared to more developed regions

Market Segmentations:

By Formulation Type

- Injections

- Tablets

- Syrup

- Other formulation types

By Application

- Allergic

- Allergic rhinitis (hay fever)

- Common cold

- Other applications

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chlorpheniramine maleate market is characterized by strong competition among key players such as GlaxoSmithKline PLC, Zydus Lifesciences Limited, Viatris Inc., Bayer AG, Alkem Laboratories, Johnson & Johnson, Orion Life Science, Sun Pharmaceutical Industries Ltd., Novalab Healthcare Pvt. Ltd., Salvidas Pharmaceuticals Pvt. Ltd., and Ataby Pharmaceuticals. The market dynamics are shaped by ongoing product innovation, regulatory compliance, and expansion into emerging economies. Companies focus on developing extended-release, low-sedation, and pediatric-friendly formulations to meet evolving consumer preferences. Strategic collaborations, mergers, and digital marketing initiatives enhance brand positioning and distribution reach. Growing emphasis on over-the-counter availability and patient-centric formulations has intensified competition, while partnerships with retail and online pharmacy chains strengthen global accessibility. Continuous R&D investments aimed at improving therapeutic efficacy and safety standards are expected to sustain long-term competitiveness in this segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GlaxoSmithKline PLC

- Zydus Lifesciences Limited

- Viatris Inc.

- Bayer AG

- Alkem Laboratories

- Johnson & Johnson

- Orion Life Science

- Sun Pharmaceutical Industries Ltd.

- Novalab Healthcare Pvt. Ltd.

- Salvidas Pharmaceuticals Pvt. Ltd.

- Ataby Pharmaceuticals

Recent Developments

- In 2025, GlaxoSmithKline’s consumer healthcare business (now Haleon) managed its FDCs containing chlorpheniramine maleate (e.g., T-Minic syrup) in India by complying with a new regulatory requirement implemented in April 2025.

- In 2025, Alkem Laboratories Strategically restructured its trade generics business to a new subsidiary to enhance focus on this segment, which includes multi-symptom relief products containing chlorpheniramine maleate (Alkof New Cofgels).

Report Coverage

The research report offers an in-depth analysis based on Formulation Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to expand steadily with rising global allergy cases.

- Demand for non-prescription antihistamines will continue to increase across developed regions.

- Combination formulations with decongestants and analgesics will gain more traction.

- Online pharmacies will emerge as a major distribution channel for antihistamine drugs.

- Manufacturers will invest in extended-release and low-sedation formulations.

- Pediatric-friendly products like syrups and chewables will see stronger adoption.

- Asia-Pacific will register the fastest growth due to increasing healthcare access.

- Regulatory harmonization across regions will streamline product approvals.

- Competitive pricing among generic producers will enhance market affordability.

- Continued R&D in allergy therapeutics will expand chlorpheniramine’s clinical applications.