Market Overview

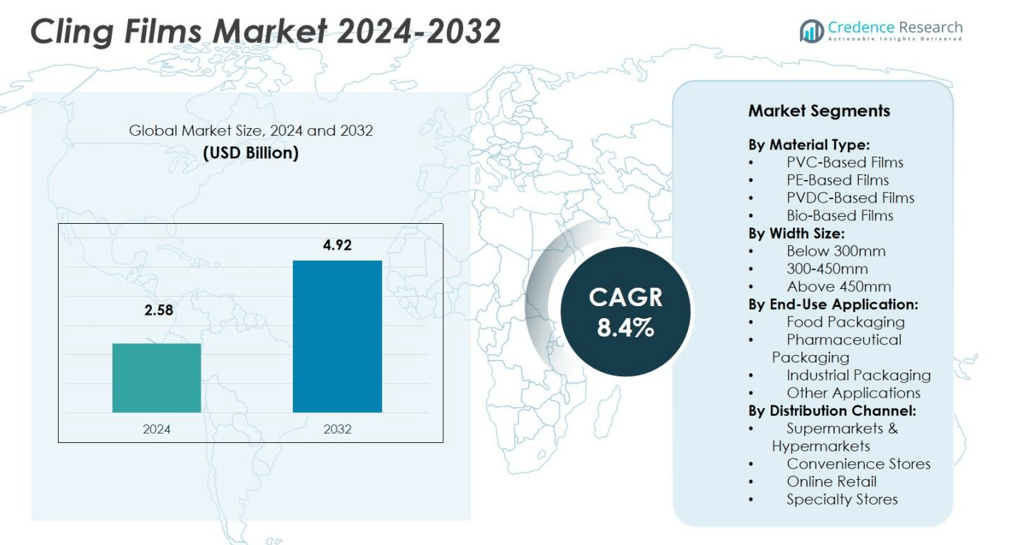

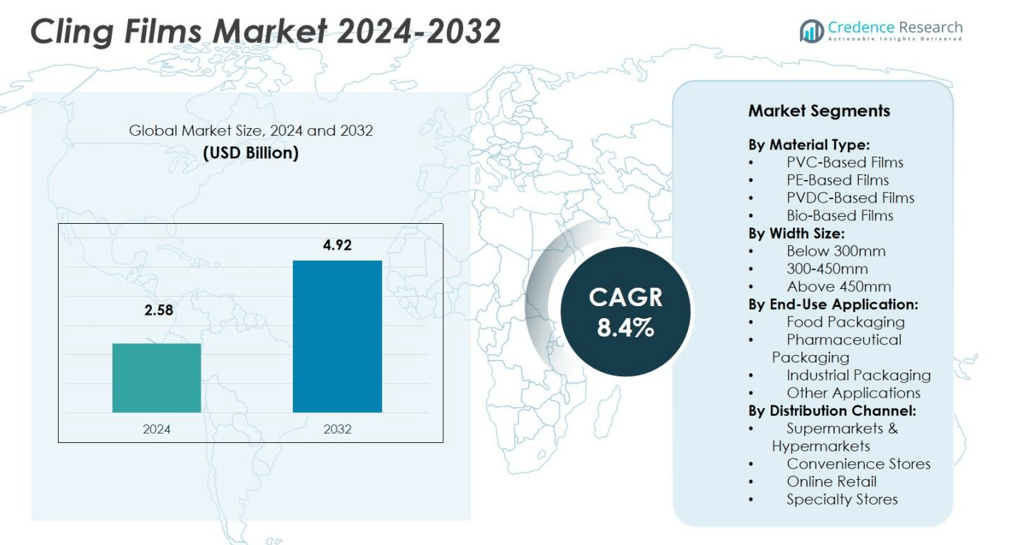

Cling Films Market size was valued USD 2.58 Billion in 2024 and is anticipated to reach USD 4.92 Billion by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cling Films Market Size 2024 |

USD 2.58 Billion |

| Cling Films Market, CAGR |

8.4% |

| Cling Films Market Size 2032 |

USD 4.92 Billion |

The Cling Films Market is led by prominent players such as Amcor plc, Berry Global Inc., Sealed Air, Reynolds Consumer Products, Mitsubishi Chemical Group Corporation, Sigma Plastics Group, Anchor Packaging LLC, POLIFILM, IPG, and Greendot Biopak. These companies focus on innovation in recyclable and bio-based cling films to meet evolving environmental standards and consumer demand for sustainable packaging. Strategic collaborations, technological advancements in film extrusion, and product diversification strengthen their global presence. North America holds the leading regional position with a 34% market share in 2024, driven by robust retail and food packaging sectors, while Asia Pacific, with a 29% share, emerges as the fastest-growing region due to expanding food delivery networks and rising urbanization.

Market Insights

- The Cling Films Market was valued at USD 2.58 Billion in 2024 and is projected to reach USD 4.92 Billion by 2032, growing at a CAGR of 8.4% during the forecast period.

- Rising demand for fresh and hygienic food packaging drives market expansion, with the food packaging segment holding 63% share in 2024. Increasing use of cling films in supermarkets and e-commerce enhances convenience and shelf life.

- Sustainability trends encourage the adoption of bio-based and recyclable films, replacing conventional PVC-based options and aligning with global environmental regulations.

- Leading players such as Amcor plc, Berry Global Inc., Sealed Air, and Reynolds Consumer Products focus on innovation and strategic partnerships to strengthen market competitiveness.

- North America leads the global market with a 34% share, followed by Europe at 28% and Asia Pacific at 29%, which remains the fastest-growing region due to rapid urbanization and food delivery growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

PVC-based films dominate the Cling Films Market with a 46% share in 2024, owing to their strong stretchability, clarity, and superior cling properties. These films are widely used in food and industrial packaging due to cost-effectiveness and ease of processing. PE-based films hold a growing portion supported by demand for non-toxic and recyclable materials. PVDC-based variants find niche use in barrier packaging applications requiring moisture and gas resistance. Bio-based films expand rapidly as brands adopt sustainable and compostable alternatives aligned with eco-friendly regulations.

- For instance, Chyi Yang has integrated advanced adhesive syringe technology into its PE film production lines, which has enabled significantly improved flow rate control and cost reductions across over 60 years of refining production processes, resulting in sustainable PE cling film output scaling into the thousands of tons yearly.

By Width Size

The 300–450mm width segment leads the market with a 52% share in 2024, favored across retail, catering, and household packaging applications. This width provides the ideal balance between coverage area and ease of handling for standard food trays and storage wraps. Below 300mm films maintain demand in small food portions and pharmaceutical packs. Above 450mm variants cater to industrial packaging, particularly pallet wrapping and bulk food processing. Manufacturers focus on versatile roll sizes to meet diverse consumer and commercial requirements.

- For instance, CrystalWrap’s CW Catering Film is available in the 450mm width and 300m roll length, widely used in commercial food service packaging due to its high clarity and durability suitable for wrapping fresh and prepared food items.

By End-Use Application

Food packaging dominates the Cling Films Market, accounting for a 63% share in 2024, driven by rising demand for fresh produce, meat, and ready-to-eat meals. Cling films extend shelf life, prevent contamination, and improve product presentation in supermarkets and foodservice outlets. Pharmaceutical packaging utilizes films for product protection and sterile wrapping, while industrial applications include bundling and protective covering. The growing focus on hygienic food handling and increasing urban consumption trends continue to reinforce the dominance of food packaging applications globally.

Key Growth Drivers

Rising Demand for Fresh and Convenient Food Packaging

The growing consumption of fresh produce, ready-to-eat meals, and bakery items drives strong demand for cling films. Consumers prefer lightweight, transparent, and stretchable wraps that preserve freshness and prevent contamination. Retailers increasingly use these films for improved product visibility and hygiene. Expanding supermarket and e-commerce food delivery networks further accelerate usage. The trend toward smaller portion packaging in urban households continues to strengthen the adoption of cling films across food applications worldwide.

- For instance, Sealed Air developed the CRYOVAC Brand rBDF S10 film, which features a thickness of 21 microns, making it one third lighter and three times thinner than widely used conventional films.

Shift Toward Sustainable and Recyclable Materials

Sustainability initiatives across packaging industries are a major growth catalyst for bio-based and recyclable cling films. Manufacturers invest in developing polyethylene and polylactic acid (PLA) films that meet performance standards while reducing plastic waste. Government regulations promoting eco-friendly packaging encourage the transition from PVC-based products. Major brands introduce compostable film ranges to meet retailer sustainability targets. The increasing consumer preference for environmentally responsible products is reshaping material innovation in the cling film market.

- For instance, KMA Packaging’s C-Range includes home-compostable cling films engineered for strength and clarity, which comply with European standards and are now trusted by fresh produce companies and supermarkets across Europe.

Expanding Applications in Industrial and Pharmaceutical Sectors

Beyond food packaging, cling films find growing adoption in industrial bundling, protective wrapping, and pharmaceutical packaging. Their ability to safeguard products against moisture, dust, and tampering enhances appeal across logistics and manufacturing. Pharmaceutical firms use high-clarity films for secure, sterile wrapping of medical devices and supplies. The rise in export-oriented packaging and temperature-sensitive goods boosts demand for high-performance films with barrier and anti-static features, broadening market reach across end-user industries.

Key Trends & Opportunities

Advancements in Film Technology and Manufacturing Efficiency

Ongoing innovation in film extrusion and polymer processing enhances film performance, clarity, and recyclability. Multi-layered films with superior cling and puncture resistance are gaining traction across both household and industrial applications. Automated film winding and cutting technologies improve consistency and reduce waste during production. These technological upgrades enable manufacturers to meet evolving performance demands while improving operational efficiency and profit margins.

- For instance, Dow Chemical’s multi-layer stretch films exhibit superior transverse directional tear resistance of up to 700 g/mil, enhancing puncture resistance for durable packaging.

Rising Adoption of Smart and Antimicrobial Films

Manufacturers increasingly explore smart cling films with antimicrobial and self-healing properties for safer food preservation. These films extend shelf life by reducing bacterial growth and spoilage. The growing interest in smart packaging solutions aligns with health and safety concerns among consumers. Integration of additives that enhance UV protection and odor control also creates new commercial opportunities for premium food packaging applications in global retail markets.

- For instance, chitosan-based films with natural antimicrobial properties have been effectively used to preserve fresh food and extend shelf life, demonstrating strong inhibition against foodborne pathogens like E. coli and S. aureus.

Key Challenges

Environmental and Regulatory Pressure on Plastic Use

Strict government regulations on single-use plastics present a major challenge for cling film producers. PVC-based films face increasing scrutiny due to non-biodegradable characteristics and recycling difficulty. Manufacturers must invest in developing recyclable or bio-based alternatives that comply with packaging waste directives. Meeting these evolving standards raises production costs and affects profit margins, especially for small-scale producers competing with global players.

Volatility in Raw Material Prices

Fluctuating prices of petrochemical-based raw materials such as polyethylene and PVC resins create uncertainty in production costs. Global supply chain disruptions and energy price volatility further impact material availability. These variations affect manufacturers’ pricing strategies and profit stability. Companies are increasingly turning to localized sourcing, material substitution, and long-term supplier contracts to minimize the effects of raw material price instability in the cling film industry.

Regional Analysis

North America

North America dominates the Cling Films Market, capturing a 34% share in 2024, driven by strong demand from the food packaging and retail sectors. The U.S. leads the region, supported by widespread adoption of high-quality, food-grade PVC and PE films in supermarkets and catering services. The presence of major players like Berry Global and Reynolds Consumer Products accelerates innovation in recyclable packaging. Regulatory emphasis on sustainability further promotes bio-based film development, while high disposable income and a growing meal-kit industry continue to support steady market growth.

Europe

Europe holds a 28% market share in 2024, led by Germany, the U.K., and France. The region’s growth is fueled by stringent environmental regulations favoring recyclable and compostable films. European manufacturers invest heavily in R&D to replace conventional PVC with eco-friendly materials such as PLA and PE. Rising consumer awareness of food hygiene and waste reduction drives cling film usage in households and retail packaging. The expansion of organized retail and strong sustainability commitments among EU nations further strengthen Europe’s market position.

Asia Pacific

Asia Pacific accounts for a 29% share in 2024, emerging as the fastest-growing region in the cling films industry. Rising urbanization, expanding retail infrastructure, and the booming food delivery sector in China, India, and Japan drive consumption. Local producers rapidly adopt cost-effective manufacturing and bio-based innovations to meet surging regional demand. Increasing middle-class income and preference for hygienic food packaging contribute to high-volume sales. Government initiatives promoting sustainable packaging further enhance market opportunities across developing economies in the region.

Latin America

Latin America holds a 6% market share in 2024, with Brazil and Mexico leading the demand. The market benefits from increasing adoption of packaged and ready-to-eat food products. Growing supermarket chains and food processing industries stimulate the use of cling films for food preservation and display. Manufacturers focus on low-cost PE and recyclable film production to serve domestic markets. However, limited recycling infrastructure and price sensitivity among consumers moderate growth potential across the region.

Middle East & Africa

The Middle East & Africa region captures a 3% share in 2024, driven by expanding retail formats and rising consumption of packaged food. The GCC countries show higher adoption rates supported by increasing disposable income and urban lifestyle trends. Demand for industrial-grade cling films also grows with regional trade and logistics development. However, dependence on imports for raw materials and limited local manufacturing capabilities pose challenges. Gradual expansion of foodservice chains and modern retail outlets continues to support steady growth in this region.

Market Segmentations:

By Material Type:

- PVC-Based Films

- PE-Based Films

- PVDC-Based Films

- Bio-Based Films

By Width Size:

- Below 300mm

- 300-450mm

- Above 450mm

By End-Use Application:

- Food Packaging

- Pharmaceutical Packaging

- Industrial Packaging

- Other Applications

By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cling Films Market features major players such as Amcor plc, Berry Global Inc., Sealed Air, Reynolds Consumer Products, Mitsubishi Chemical Group Corporation, Sigma Plastics Group, Anchor Packaging LLC, POLIFILM, IPG, and Greendot Biopak. These companies compete through product innovation, sustainability initiatives, and global distribution expansion. Leading firms focus on developing recyclable, bio-based, and compostable cling films to meet growing environmental regulations and consumer preferences. Strategic partnerships with food and retail brands enhance visibility and market penetration. Technological advancements in multi-layer extrusion and improved film clarity further strengthen competitive advantage. Regional players emphasize cost-effective production and customized film solutions to serve niche markets. Continuous R&D investments in high-performance and eco-friendly materials define the evolving market dynamics, with sustainability and packaging efficiency becoming the key differentiators among top competitors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In Nov 2025, NatureWorks and Sukano unveiled compostable BOPLA films at K 2025. The launch targets high-performance, mono-material packaging on existing BOPP lines. The duo emphasized printability and optical gains.

- In Sept 2025, Amcor highlighted Omni® Xtra+ recycle-ready PE cling film at Fachpack. The film is a PVC alternative with anti-fog and high clarity. Amcor positioned it for fresh-food wrap.

- In Feb 2025, Berry Global launched Bontite Sustane stretch film with 30% PCR. The film targets pallet wrap and retail distribution. It advances recycled-content films in food logistics.

- In Aug 2025, Cortec introduced Eco Works 100 compostable packaging film. The film is 100% biobased and industrially compostable. It suits wrap applications replacing petroleum films

Report Coverage

The research report offers an in-depth analysis based on Material Type, Width Size, End Use Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bio-based and recyclable cling films will rise due to sustainability regulations.

- Food packaging will continue to dominate, driven by growing consumption of ready-to-eat meals.

- Technological advancements will enhance film strength, clarity, and biodegradability.

- Asia Pacific will remain the fastest-growing region supported by urbanization and retail expansion.

- Manufacturers will invest in multilayer extrusion and advanced polymer technologies.

- Partnerships with foodservice and retail brands will strengthen global market presence.

- Smart and antimicrobial cling films will gain traction for improved food safety.

- Price fluctuations of petrochemical raw materials will influence production strategies.

- Online retail and e-commerce packaging applications will expand rapidly.

- Industry focus will shift toward circular economy practices and sustainable packaging solutions.