Market Overview

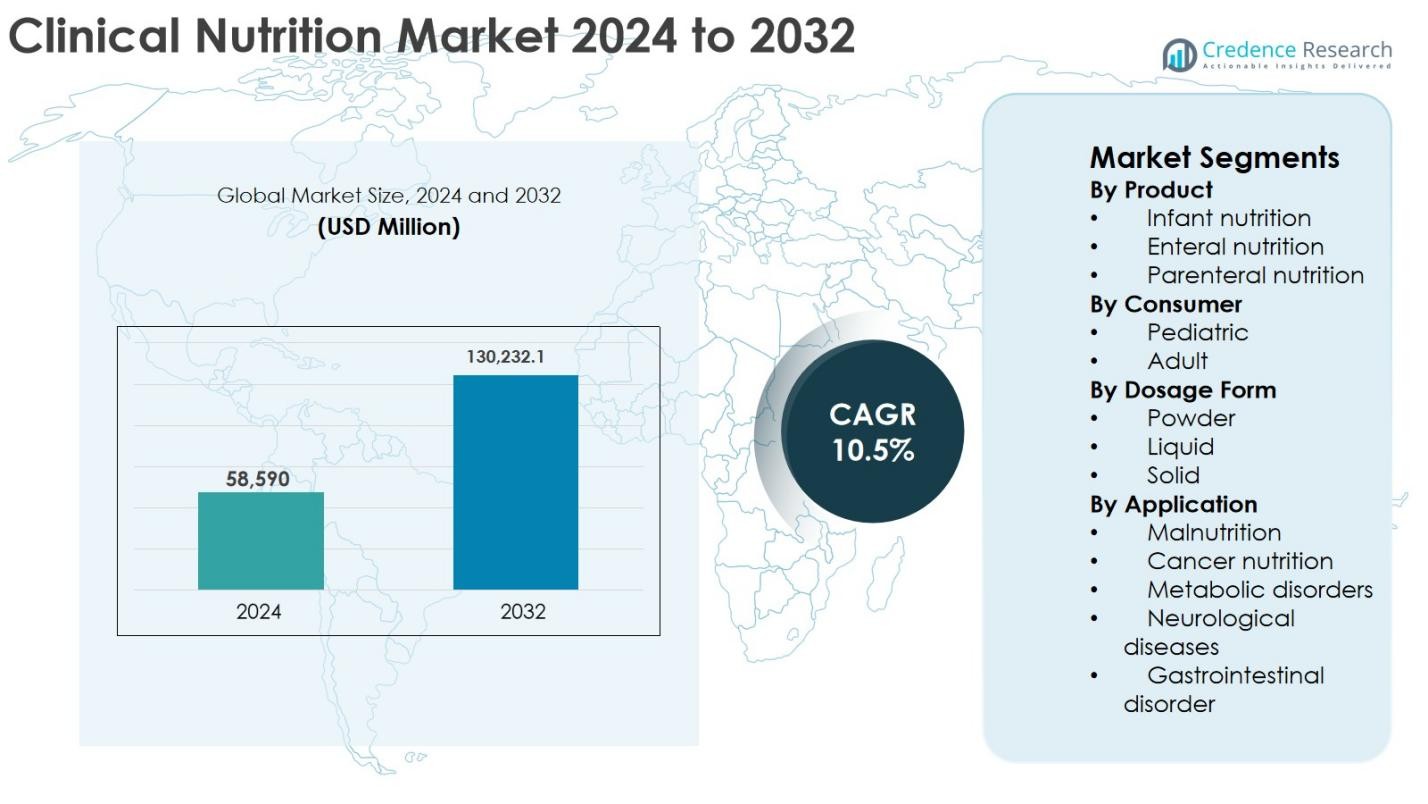

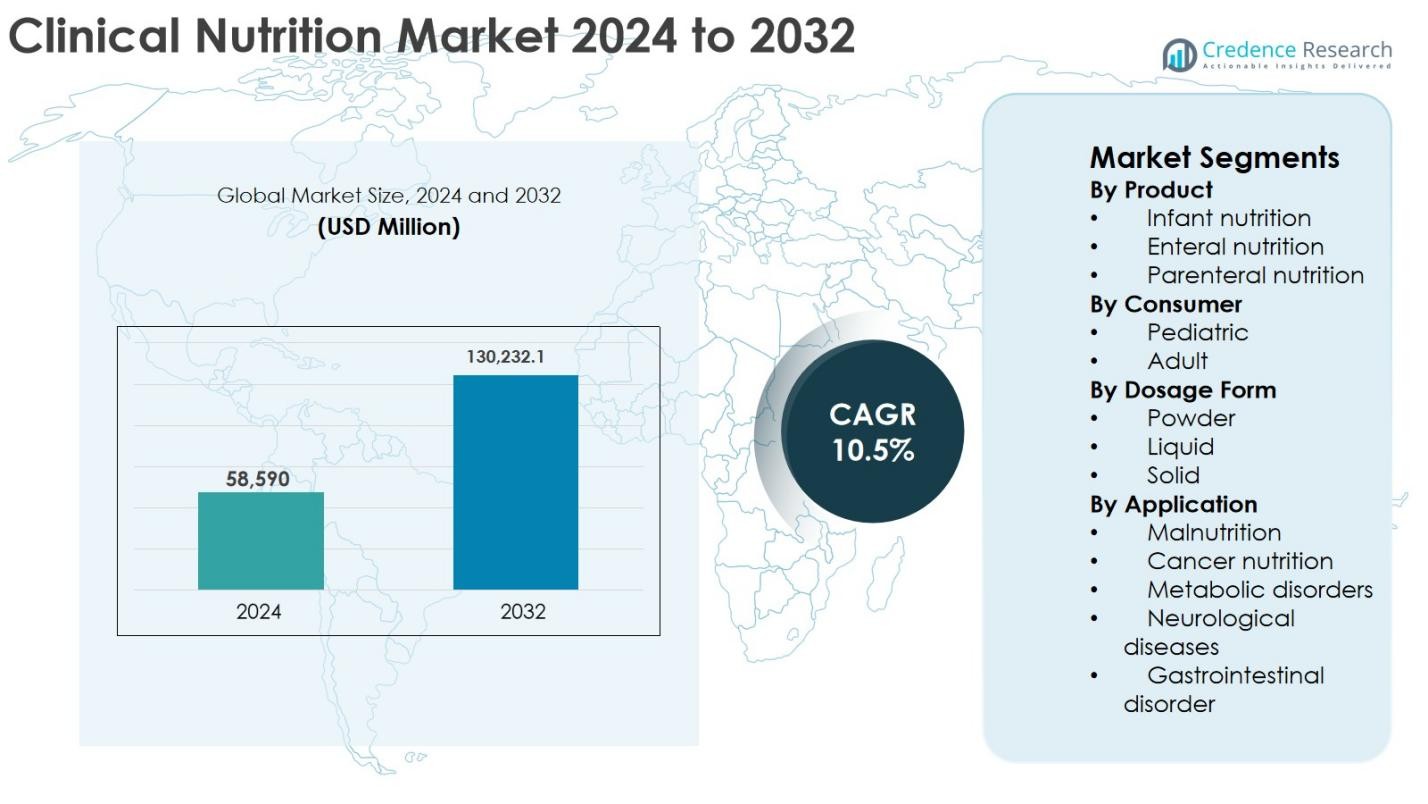

The Clinical Nutrition Market size was valued at USD 58,590 million in 2024 and is anticipated to reach USD 130,232.1 million by 2032, expanding at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Nutrition Market Size 2024 |

USD 58,590 Million |

| Clinical Nutrition Market, CAGR |

10.5% |

| Clinical Nutrition Market Size 2032 |

USD 130,232.1 Million |

Clinical Nutrition Market is led by established global players including Abbott, Nestlé Health Science S.A., Danone, Baxter, B. Braun, Reckitt Benckiser, Perrigo Company PLC, Ajinomoto, Hero Nutritionals, and Pfizer Inc., all of which compete through broad product portfolios and strong clinical distribution networks. These companies focus on enteral and parenteral nutrition, disease-specific formulations, and homecare-friendly products to strengthen market presence. Regionally, North America leads the Clinical Nutrition Market with an exact market share of 38.7%, supported by advanced healthcare infrastructure, high adoption of medical nutrition therapy, and favorable reimbursement policies. Europe follows with 29.4% share, driven by strong public healthcare systems, while Asia Pacific continues to expand rapidly due to rising healthcare investments and increasing awareness of clinical nutrition benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Clinical Nutrition Market size was valued at USD 58,590 million in 2024 and is projected to reach USD 130,232.1 million by 2032, expanding at a CAGR of 10.5% during the forecast period.

- Market growth is driven by the rising prevalence of chronic diseases, increasing geriatric population, and growing incidence of disease-related malnutrition, with enteral nutrition emerging as the leading segment holding 47.6% share due to widespread hospital and homecare adoption.

- Ongoing trends include growing demand for liquid formulations, which dominate the dosage form segment with a 55.9% share, and rising focus on personalized and disease-specific nutrition solutions tailored for oncology, diabetes, and critical care patients.

- The market is moderately consolidated, with leading players such as Abbott, Nestlé Health Science S.A., Danone, Baxter, and B. Braun focusing on portfolio expansion, clinical partnerships, and innovation in ready-to-use and homecare nutrition products.

- Regionally, North America leads with a 38.7% market share, followed by Europe at 29.4% and Asia Pacific at 22.1%, while Latin America and Middle East & Africa together account for the remaining share, supported by improving healthcare access and awareness.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

The Clinical Nutrition market, by product, is led by Enteral Nutrition, which accounted for 47.6% market share in 2024, driven by its wide adoption in hospitals, long-term care facilities, and homecare settings for patients with chronic illnesses and gastrointestinal disorders. Enteral nutrition benefits from cost-effectiveness, ease of administration, and lower infection risk compared to parenteral alternatives. Rising prevalence of cancer, neurological disorders, and critical care admissions continues to support demand. Infant nutrition follows, supported by neonatal care growth, while parenteral nutrition remains essential for patients unable to tolerate oral or enteral feeding.

- For instance, Abbott’s Jevity and Osmolite enteral formulas are widely used in U.S. hospitals for tube‑fed adults needing long‑term nutrition support.

By Consumer

By consumer, the Adult segment dominated the Clinical Nutrition market with a 68.3% share in 2024, supported by the growing aging population and increasing incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders. Higher hospitalization rates and greater use of clinical nutrition therapies in critical and post-acute care further reinforce adult segment leadership. Demand is also driven by malnutrition management among elderly patients. The pediatric segment continues to expand steadily, supported by rising awareness of early-life nutrition, premature birth management, and improved neonatal intensive care infrastructure.

- For instance, Nestlé Health Science’s Resource and Boost (licensed by Nestlé outside the U.S. and Canada) oral nutrition supplements are commonly used in clinical settings to manage disease‑related malnutrition, particularly among older patients recovering from surgery or serious illness.

By Dosage Form

Based on dosage form, Liquid formulations held the dominant share of 55.9% in 2024, owing to their ease of digestion, rapid absorption, and suitability for enteral tube feeding. Liquid products are widely preferred in hospitals and homecare due to convenience, accurate dosing, and improved patient compliance. Growth is further supported by innovations in ready-to-use formulations and flavor enhancements. Powder forms maintain strong demand for cost efficiency and longer shelf life, while solid forms cater to specific therapeutic and nutritional requirements in outpatient and supplemental nutrition settings.

Key Growth Drivers

Rising Prevalence of Chronic Diseases and Malnutrition

The growing incidence of chronic diseases such as cancer, diabetes, gastrointestinal disorders, and neurological conditions is a key driver of the Clinical Nutrition market. These conditions significantly increase the risk of disease-related malnutrition, which negatively impacts recovery outcomes and length of hospital stay. Clinical nutrition products are increasingly integrated into treatment protocols to support metabolic needs, improve immune response, and accelerate patient recovery. Hospitals and long-term care facilities are emphasizing early nutritional screening and intervention, further strengthening demand. Additionally, the rising number of critically ill patients and post-surgical cases has increased reliance on enteral and parenteral nutrition. As awareness of the clinical and economic benefits of nutrition therapy grows, adoption continues to expand across acute, chronic, and rehabilitative care settings.

- For instance, the European Society for Clinical Nutrition and Metabolism (ESPEN) guidelines recommend early enteral nutrition in critically ill patients, and products such as Fresenius Kabi’s Fresubin and Abbott’s Jevity are routinely used in ICUs to meet protein and calorie needs

Expansion of Geriatric Population and Homecare Nutrition

The expanding geriatric population is a major growth catalyst for the Clinical Nutrition market, as elderly individuals are more vulnerable to malnutrition, muscle loss, and chronic health conditions. Age-related physiological changes often require specialized nutritional support to maintain strength, immunity, and overall quality of life. Clinical nutrition products are widely used in managing frailty, sarcopenia, and recovery after surgery or hospitalization. At the same time, healthcare systems are increasingly shifting toward home-based care to reduce costs and hospital burden. This transition has boosted demand for convenient, easy-to-administer nutrition solutions suitable for home use. Liquid and ready-to-consume formulations are gaining strong acceptance, enabling effective nutritional management outside traditional healthcare facilities.

- For instance, Danone’s Fortimel and Fortisip products are widely used in Europe as ready‑to‑consume oral nutritional supplements for community‑dwelling and nursing home residents, supporting nutritional management outside traditional hospital settings.

Increasing Healthcare Expenditure and Clinical Awareness

Rising healthcare expenditure globally is supporting the steady expansion of the Clinical Nutrition market. Governments and private healthcare providers are investing in advanced hospital infrastructure, critical care units, and specialized nutrition therapy programs. Clinical nutrition is increasingly recognized as a core component of comprehensive patient care, rather than a supportive add-on. Improved education and training among healthcare professionals have enhanced awareness of the role of nutrition in disease management and recovery. In parallel, the inclusion of nutrition therapy in clinical guidelines has strengthened adoption. Reimbursement support for enteral and parenteral nutrition in several regions has also improved accessibility, encouraging wider use of clinical nutrition products across diverse care settings.

Key Trends & Opportunities

Personalized and Disease-Specific Nutrition Solutions

Personalized and disease-specific nutrition is an emerging trend shaping the Clinical Nutrition market. Manufacturers are developing targeted formulations designed for specific conditions such as oncology, diabetes, renal disorders, and critical illness. These specialized products improve nutrient utilization, enhance patient tolerance, and support better clinical outcomes. Advances in diagnostics and metabolic profiling are enabling more precise nutritional planning, aligning with the broader shift toward personalized healthcare. This trend presents strong opportunities for innovation, premium product development, and differentiation. As healthcare providers increasingly adopt individualized treatment approaches, demand for tailored clinical nutrition solutions is expected to rise, creating long-term growth potential for market participants.

- For instance, Fresenius Kabi offers disease‑specific enteral feeds such as Fresubin Renal and Fresubin Hepa, formulated for patients with chronic kidney or liver disease, reflecting growing clinical adoption of condition‑targeted nutrition solutions.

Growth Opportunities in Emerging Markets and Homecare Settings

Emerging markets offer significant growth opportunities for the Clinical Nutrition market due to improving healthcare infrastructure, rising income levels, and increasing awareness of nutrition therapy. Expansion of private hospitals and specialty clinics is driving demand for advanced nutritional products. Additionally, the growing preference for homecare treatment is opening new avenues for clinical nutrition adoption. Companies are focusing on expanding distribution networks, introducing cost-effective formulations, and localizing production to strengthen presence in these regions. Digital health platforms and remote monitoring are also supporting home-based nutrition management. These factors collectively position emerging economies and homecare settings as key areas for future market expansion.

- For instance, Danone has invested in medical nutrition capacity and market development in China and other emerging economies, promoting products such as Nutricia’s oral nutritional supplements to support home‑based care and disease‑related malnutrition management.

Key Challenges

High Product Costs and Limited Reimbursement Coverage

High costs associated with clinical nutrition products pose a significant challenge to market growth, particularly in price-sensitive regions. Specialized formulations require advanced manufacturing processes, strict quality controls, and compliance with regulatory standards, all of which increase production costs. Limited or inconsistent reimbursement policies further restrict patient access, especially for long-term or home-based nutrition therapy. In many cases, out-of-pocket expenses discourage adoption, leading healthcare providers to rely on less effective alternatives. Addressing affordability through improved reimbursement frameworks, cost optimization, and value-based healthcare models remains critical to expanding market penetration and ensuring equitable access to clinical nutrition solutions.

Regulatory Complexity and Product Standardization Issues

The Clinical Nutrition market faces ongoing challenges related to complex and fragmented regulatory environments. Products are subject to strict safety, quality, and labeling requirements, which vary significantly across regions. Differences in how clinical nutrition is classified, whether as food, medical food, or pharmaceutical products, add further complexity. These regulatory variations increase development timelines, compliance costs, and barriers to market entry. Ensuring consistent product quality while meeting diverse regional standards can also limit innovation. Manufacturers must invest heavily in clinical validation, documentation, and regulatory expertise, which can strain resources and slow the introduction of new and improved clinical nutrition products.

Regional Analysis

North America

North America dominated the Clinical Nutrition market with a 38.7% share in 2024, supported by advanced healthcare infrastructure, high awareness of medical nutrition therapy, and strong presence of leading manufacturers. The region benefits from a high prevalence of chronic diseases, a rapidly aging population, and widespread adoption of enteral and parenteral nutrition in hospitals and homecare settings. Favorable reimbursement frameworks and well-established clinical guidelines further strengthen market growth. Continuous product innovation, coupled with strong investments in personalized nutrition and home-based care solutions, continues to reinforce North America’s leadership in the global Clinical Nutrition market.

Europe

Europe accounted for a 29.4% share of the Clinical Nutrition market in 2024, driven by robust public healthcare systems and rising focus on malnutrition management across hospitals and long-term care facilities. Increasing elderly population and growing incidence of chronic and lifestyle-related diseases support steady demand. Strong regulatory oversight ensures high product quality, while national nutrition programs promote early nutritional intervention. Expansion of homecare services and greater integration of clinical nutrition into standard treatment protocols further contribute to growth. Western Europe leads regional adoption, while Central and Eastern Europe are experiencing accelerating uptake.

Asia Pacific

Asia Pacific captured 22.1% of the Clinical Nutrition market in 2024 and represents the fastest-growing regional segment. Growth is driven by rapidly expanding healthcare infrastructure, rising healthcare expenditure, and increasing awareness of clinical nutrition benefits. Large aging populations, growing burden of chronic diseases, and improving hospital and critical care capacity are supporting demand. Governments are investing in healthcare modernization, while private sector participation is increasing. Expansion of medical tourism and improving access to advanced nutrition therapies further enhance market potential across key countries in the region.

Latin America

Latin America held a 6.1% share of the Clinical Nutrition market in 2024, supported by improving healthcare access and growing awareness of nutritional therapy. Rising incidence of chronic diseases and increasing hospitalization rates are driving adoption of enteral and parenteral nutrition. Expansion of private healthcare facilities and gradual improvement in reimbursement policies are strengthening market penetration. Brazil and Mexico remain the primary contributors due to larger patient populations and better-developed healthcare systems. Despite cost constraints, ongoing healthcare reforms and growing focus on malnutrition management continue to support regional growth.

Middle East & Africa

The Middle East & Africa region accounted for a 3.7% share of the Clinical Nutrition market in 2024, driven by rising healthcare investments and expanding hospital infrastructure. Increasing prevalence of chronic diseases, coupled with improving access to medical nutrition therapies, is supporting demand. Gulf Cooperation Council countries lead regional growth due to higher healthcare spending and adoption of advanced treatment protocols. In Africa, market expansion remains gradual, constrained by limited reimbursement and affordability challenges, although increasing awareness and international healthcare initiatives are contributing to steady long-term growth.

Market Segmentations:

By Product

- Infant nutrition

- Enteral nutrition

- Parenteral nutrition

By Consumer

By Dosage Form

By Application

- Malnutrition

- Cancer nutrition

- Metabolic disorders

- Neurological diseases

- Gastrointestinal disorder

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Clinical Nutrition market features a well-established competitive landscape characterized by the presence of global multinational companies and specialized nutrition providers focusing on product innovation, portfolio expansion, and geographic reach. Leading players such as Abbott, Nestlé Health Science S.A., Danone, Baxter, and B. Braun maintain strong market positions through comprehensive enteral and parenteral nutrition offerings and deep integration with hospital and homecare channels. Companies including Perrigo Company PLC, Reckitt Benckiser, Ajinomoto, Hero Nutritionals, and Pfizer Inc. strengthen competition by expanding specialized and disease-specific nutrition formulations. Strategic initiatives such as new product launches, clinical collaborations, acquisitions, and investments in research and development are widely adopted to address evolving patient needs. Emphasis on personalized nutrition, ready-to-use formulations, and emerging market expansion continues to shape competitive dynamics and long-term growth strategies across the Clinical Nutrition market.

Key Player Analysis

- Ajinomoto

- Abbott

- Reckitt Benckiser

- B. Braun

- Pfizer Inc.

- Nestlé Health Science S.A.

- Hero Nutritionals

- Baxter

- Danone

- Perrigo Company PLC

Recent Developments

- In January 2025, Otsuka Pharmaceutical launched ENOSOLID, a semi-solid enteral nutrition formula designed to align with traditional Japanese dietary preferences.

- In November 2024, Cadila Pharmaceuticals introduced Militol, an iron supplement formulated to optimize nutrient balance for improved absorption and gastrointestinal tolerance. The product effectively addresses iron deficiency by incorporating components that enhance iron uptake while supporting overall well-being.

- In September 2024, Dutch Medical Food B.V. partnered with Pristine Pearl Pharma Pvt. Ltd. to introduce innovative medical nutrition products in India. This collaboration focuses on addressing conditions such as cancer, pediatric malnutrition, COPD, and drug-resistant epilepsy, aiming to significantly improve patient outcomes across the Indian healthcare landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Consumer, Dosage Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Clinical Nutrition market is expected to witness sustained demand due to the rising burden of chronic and lifestyle-related diseases across all age groups.

- Increasing focus on early nutritional intervention will strengthen the integration of clinical nutrition into standard treatment protocols.

- Personalized and disease-specific nutrition formulations will gain wider adoption in hospitals and homecare settings.

- Growth in the global geriatric population will continue to drive demand for long-term and supportive nutrition therapies.

- Expansion of home-based healthcare will increase the use of ready-to-consume and easy-to-administer nutrition products.

- Ongoing innovation in enteral and parenteral nutrition will improve patient outcomes and treatment efficiency.

- Emerging markets will experience accelerated growth supported by healthcare infrastructure development and rising awareness.

- Digital health and remote monitoring will enhance nutrition management and patient compliance.

- Strategic collaborations and acquisitions will remain central to competitive positioning among leading players.

- Strong emphasis on regulatory compliance and quality standards will shape product development and market expansion.

Market Segmentation Analysis:

Market Segmentation Analysis: