Market Overview

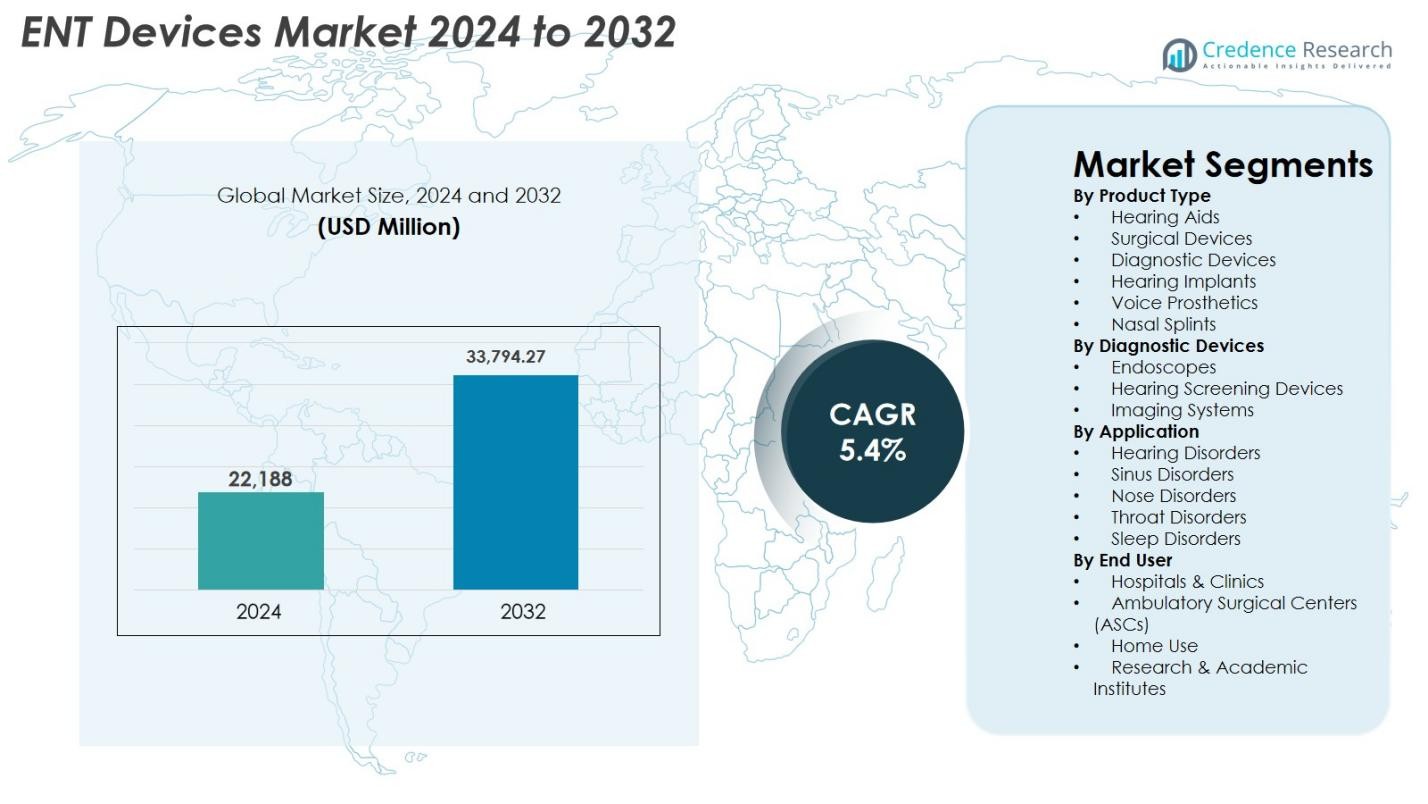

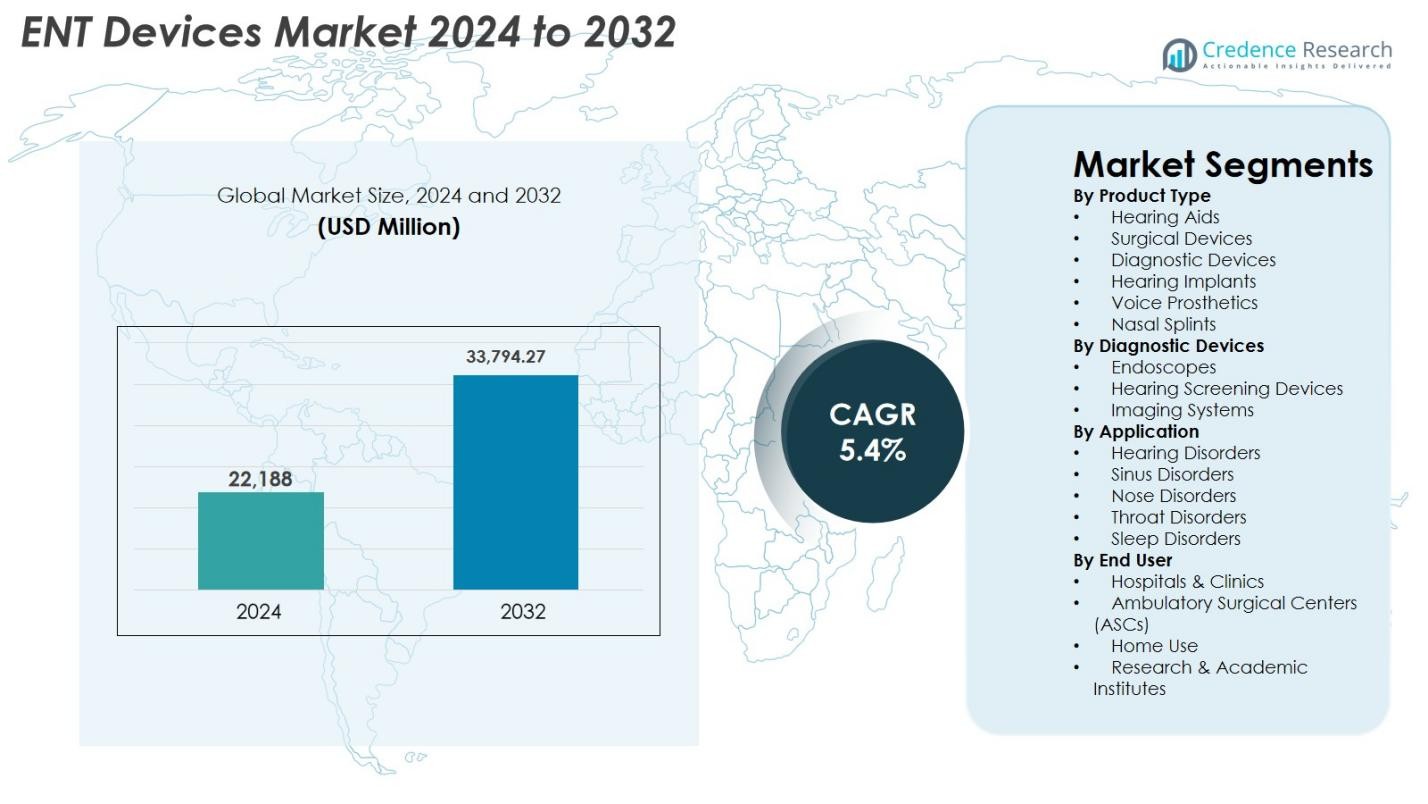

ENT Devices Market size was valued at USD 22,188 Million in 2024 and is anticipated to reach USD 33,794.27 Million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ENT Devices Market Size 2024 |

USD 22,188 Million |

| ENT Devices Market, CAGR |

5.4% |

| ENT Devices Market Size 2032 |

USD 33,794.27 Million |

ENT Devices Market is shaped by a strong group of global manufacturers that continuously advance diagnostic, surgical, and hearing care technologies. Leading players such as Ambu A/S, Cochlear Ltd., Demant A/S, Sonova, GN Store Nord A/S, Olympus Corporation, Karl Storz, PENTAX Medical, Richard Wolf GmbH, and Rion Co., Ltd. drive innovation through digital hearing solutions, high-definition endoscopic systems, and minimally invasive surgical tools. North America remained the leading region with 38.2% share in 2024, supported by robust healthcare infrastructure and high adoption of advanced ENT technologies. Europe held 27.6%, while Asia-Pacific accounted for 24.1%, reflecting rapid expansion in hearing care and diagnostic capabilities.

Market Insights

Market Insights

- ENT Devices Market was valued at USD 22,188 Million in 2024 and is expected to rise to USD 33,794.27 Million by 2032, registering a CAGR of 5.4% throughout the forecast period.

- Market growth is driven by rising prevalence of hearing disorders, increasing adoption of minimally invasive ENT procedures, and rapid uptake of digital hearing aids and connected diagnostic systems.

- Key trends include expansion of AI-enhanced endoscopy, growth in cochlear implant adoption, and rising demand for outpatient ENT surgeries supported by advanced visualization and navigation technologies.

- Leading players such as Ambu A/S, Cochlear Ltd., Demant A/S, Sonova, Olympus Corporation, Karl Storz, PENTAX Medical, Richard Wolf GmbH, and GN Store Nord A/S expand portfolios through innovation and strategic partnerships, strengthening global presence.

- North America held 38.2% share in 2024, followed by Europe at 27.6% and Asia-Pacific at 24.1%, while hearing aids dominated the product segment with 38.6% share due to increasing demand for digital and AI-powered solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

The ENT Devices Market shows strong demand across multiple product categories, with hearing aids dominating the segment by capturing 38.6% share in 2024. This leadership is driven by the rising prevalence of age-related hearing loss, increasing adoption of digital and Bluetooth-enabled devices, and wider reimbursement support in developed markets. Surgical devices and diagnostic systems continue gaining traction due to increasing ENT procedures and technological improvements such as high-definition visualization and minimally invasive tools. Growing usage of hearing implants, voice prosthetics, and nasal splints further supports segment expansion, especially with the surge in outpatient ENT interventions.

- For Instance, Widex introduced its SmartRIC hearing aid a modern, discreet, rechargeable behind-the-ear model that emphasises natural sound quality and wireless connectivity, underscoring the shift toward advanced digital hearing solutions.

By Diagnostic Devices

Within diagnostic devices, endoscopes accounted for the largest share at 42.3% in 2024, propelled by higher utilization in sinus, throat, and vocal cord examinations. Advancements in flexible and rigid endoscopes, integration of HD and 4K imaging, and expanded use in ambulatory settings strengthen this dominance. Hearing screening devices continue expanding due to newborn screening mandates, while imaging systems grow with rising adoption of CT and MRI for complex ENT evaluations. Improved diagnostic accuracy, reduced turnaround times, and enhanced workflow efficiency remain key contributors to segment growth.

- For instance, Natus updated its ALGO Newborn Hearing Screening System to align with automated ABR protocols used in national early-hearing detection programs, supporting faster screening and reduced retesting rates.

By Application

Hearing disorders dominated the ENT Devices Market application segment with 44.8% share in 2024, supported by increasing global hearing impairment cases, early screening initiatives, and the availability of advanced amplification and implantable solutions. Sinus disorders represent the second-largest area due to growing incidence of chronic sinusitis and adoption of balloon sinuplasty and minimally invasive surgery tools. Nose, throat, and sleep disorders also contribute significantly as demand rises for accurate diagnosis and treatment of respiratory obstructions, vocal conditions, and sleep apnea. Technological improvements in diagnostic and surgical systems continue to drive adoption across all applications.

Key Growth Drivers

Growing Prevalence of Hearing Disorders

The rising global burden of hearing loss is a major driver propelling the ENT Devices Market. Increasing cases of age-related hearing impairment, noise-induced hearing loss, and congenital auditory disorders have created sustained demand for hearing aids, implants, and screening systems. Rapid population aging, particularly in regions such as Europe, Japan, and North America, further strengthens device adoption. Awareness programs initiated by the WHO and national health agencies encourage early diagnosis and treatment, expanding the patient pool. Technological innovations including AI-powered hearing aids, wireless connectivity, miniaturization, and rechargeable batteries enhance user comfort and satisfaction, boosting adoption rates. Additionally, expanding reimbursement coverage and improved affordability in developing markets are reducing barriers to access, supporting long-term market growth.

- For instance, WHO’s World Hearing Day campaign emphasized early screening and prevention, leading several countries to expand national audiology programs and newborn-hearing detection initiatives.

Advancements in Minimally Invasive ENT Procedures

Accelerating adoption of minimally invasive ENT procedures significantly contributes to market expansion. Innovations in endoscopes, surgical navigation systems, balloon dilation tools, and microdebriders allow surgeons to perform sinus, throat, and middle ear procedures with greater precision, reduced tissue damage, shorter recovery times, and fewer complications. Rising patient preference for outpatient and ambulatory surgeries aligns with this shift, increasing demand for compact, efficient, and high-performance devices. The integration of 4K and 3D imaging, robotics, and AI-driven visualization tools further strengthens clinical outcomes, encouraging hospitals to upgrade equipment. Growing ENT specialization in emerging markets and ongoing physician training support broader adoption of minimally invasive techniques.

- For instance, Medtronic expanded the use of its NuVent™ EM Balloon Sinus Dilation system, integrating electromagnetic navigation to support safer and more accurate minimally invasive sinus interventions.

Rising Adoption of Digital and Connected ENT Solutions

Digital transformation is accelerating within the ENT Devices Market as healthcare providers increasingly adopt smart and connected technologies. AI-powered audiology tools, remote diagnostic systems, and tele-otolaryngology platforms enhance clinical accuracy, workflow efficiency, and patient engagement. Digital hearing aids with smartphone connectivity, adaptive sound processing, and personalized tuning continue to gain traction globally. Remote care models that expanded during the pandemic remain relevant, enabling continuous monitoring and reducing clinic visits. Imaging and screening devices enhanced with machine learning support earlier diagnosis and improve treatment planning. These developments create strong growth opportunities and encourage manufacturers to prioritize software-driven innovation.

Key Trends and Opportunities:

Expansion of AI, Robotics, and Smart Visualization in ENT Care

Artificial intelligence, robotic-assisted systems, and next-generation visualization technologies are transforming ENT diagnostics and surgery. AI-based speech and hearing assessment tools, automated image analytics, and real-time anomaly detection improve diagnostic precision and reduce human error. Robotics-assisted interventions enhance surgical accuracy, reduce fatigue, and enable complex skull base, sinus, and laryngeal procedures. High-definition imaging, including 4K and 8K endoscopy, augmented reality overlays, and fluorescence-guided visualization, offers superior anatomical detail and improved surgical decision-making. These trends open new avenues for manufacturers to differentiate through intelligent systems and advanced software capabilities.

- For Instance, Sony introduced its latest 4K/8K medical-imaging solutions for endoscopic applications, delivering enhanced colour accuracy and depth perception for high-precision ENT visualization.

Growing Market Potential in Emerging Economies

Emerging markets offer substantial growth opportunities as healthcare investments rise and ENT infrastructure rapidly improves. Countries across Asia-Pacific, Latin America, and the Middle East are strengthening screening programs, expanding ENT clinics, and adopting advanced diagnostic and surgical systems. Increasing incidence of hearing loss, sinus disorders, and respiratory conditions linked to urban pollution further drives device demand. Government initiatives promoting early hearing screening and the availability of lower-cost digital hearing aids improve accessibility for underserved populations. Manufacturers leveraging localized production, distribution partnerships, and tailored product portfolios can capture significant market share in these regions.

- For instance, Saudi Arabia accelerated ENT-infrastructure upgrades through investments in advanced endoscopic and surgical-navigation platforms as part of broader healthcare modernization initiatives under Vision 2030.

Key Challenges:

High Cost of Advanced ENT Technologies

The high cost of advanced ENT devices remains a significant barrier to widespread adoption. Systems such as 4K/8K endoscopes, image-guided surgical platforms, and cochlear implants require major capital investment, limiting their accessibility, especially for smaller hospitals and clinics. In many regions, inadequate reimbursement for premium hearing aids and implants increases financial burden on patients, resulting in delayed treatment or underutilization. High maintenance and operating costs further discourage adoption. Balancing technological sophistication with affordability is essential for expanding access and enabling healthcare providers to deliver high-quality ENT care.

Shortage of Skilled ENT Specialists and Technicians

The global shortage of trained ENT surgeons, audiologists, and technical professionals presents an operational challenge for the ENT Devices Market. Advanced diagnostic and surgical systems require specialized training, certification, and continuous skill development that many healthcare systems, particularly in developing regions, currently lack. Even in developed markets, rising patient volumes often exceed specialist availability, causing treatment delays and reduced operational efficiency. This talent gap limits the utilization of high-end technologies and affects patient outcomes. Expanding training programs, strengthening academic partnerships, and designing user-friendly, automated devices are critical to addressing this gap.

Regional Analysis

North America

North America led the ENT Devices Market with 38.2% share in 2024, driven by advanced healthcare infrastructure, strong adoption of minimally invasive ENT procedures, and high demand for digital hearing aids and implants. The region benefits from favorable reimbursement policies, extensive newborn hearing screening programs, and strong penetration of AI-enabled diagnostic and surgical systems. The presence of leading manufacturers and continuous product innovation further strengthen its dominance. Rising prevalence of age-related hearing loss and chronic sinus disorders also contributes significantly to device uptake, while growing outpatient ENT surgeries support sustained market expansion across the U.S. and Canada.

Europe

Europe accounted for 27.6% share in 2024, supported by rising geriatric population, expanding ENT specialty clinics, and strong adoption of cochlear implants and advanced endoscopic systems. Countries such as Germany, France, and the U.K. lead regional demand due to well-established healthcare systems and increasing uptake of digital and connected audiology solutions. Regulatory emphasis on early hearing screening and improved access to minimally invasive procedures accelerates device utilization. Growing treatment rates for sinusitis, throat disorders, and sleep-related conditions further contribute to market growth. Continuous technology upgrades and strong R&D investments enhance Europe’s position in the global market.

Asia-Pacific

Asia-Pacific captured 24.1% share in 2024, emerging as the fastest-growing region due to large patient populations, rising income levels, and rapid improvement in healthcare infrastructure. Increasing prevalence of hearing impairment, chronic sinusitis, and pollution-related respiratory disorders drives strong demand for diagnostic and therapeutic ENT devices. Countries such as China, India, Japan, and South Korea are witnessing substantial investments in ENT departments, expanding surgical capacities, and growing adoption of digital hearing aids. Government-led newborn screening initiatives and improved access to affordable hearing care fuel additional growth. Rising medical tourism and technological modernization further strengthen the regional outlook.

Latin America

Latin America held 6.7% share in 2024, with market expansion driven by improving diagnostic capabilities, wider availability of ENT specialists, and rising demand for minimally invasive procedures. Brazil and Mexico are key contributors due to growing public and private healthcare investment, increasing awareness of hearing loss, and adoption of modern endoscopic technologies. Economic constraints limit access to premium devices, but expanding insurance coverage and government-led ENT health campaigns are gradually improving accessibility. Rising prevalence of chronic ENT conditions and increasing uptake of digital hearing aids support steady market growth across the region.

Middle East & Africa

The Middle East & Africa region accounted for 3.4% share in 2024, supported by growing healthcare modernization, increasing ENT procedure volumes, and rising awareness of hearing and sinus disorders. Countries such as the UAE, Saudi Arabia, and South Africa are investing in advanced diagnostic systems, ENT surgical units, and newborn screening programs. While access to high-end devices remains uneven across the region, expanding private healthcare networks and medical tourism drive adoption of advanced ENT technologies. Gradual improvements in affordability, stronger government initiatives, and enhanced training infrastructure are expected to support continued market expansion.

Market Segmentations

By Product Type

- Hearing Aids

- Surgical Devices

- Diagnostic Devices

- Hearing Implants

- Voice Prosthetics

- Nasal Splints

By Diagnostic Devices

- Endoscopes

- Hearing Screening Devices

- Imaging Systems

By Application

- Hearing Disorders

- Sinus Disorders

- Nose Disorders

- Throat Disorders

- Sleep Disorders

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Use

- Research & Academic Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ENT Devices Market features a diverse and innovation-driven landscape, with global manufacturers focusing on product advancement, strategic collaborations, and expanding clinical applications. Key players such as Ambu A/S, Cochlear Ltd., Demant A/S, Sonova, GN Store Nord A/S, Olympus Corporation, Karl Storz, PENTAX Medical, Richard Wolf GmbH, and Rion Co., Ltd. actively strengthen their portfolios through next-generation hearing aids, cochlear implants, surgical navigation tools, and high-definition endoscopy systems. Many companies prioritize miniaturization, connectivity, and AI-enabled diagnostics to enhance precision and patient outcomes. Growing investment in R&D supports the development of digital audiology platforms, minimally invasive surgical devices, and integrated imaging solutions. Partnerships with hospitals, ENT specialists, and technology providers accelerate adoption and expand global reach, while emerging players target niche segments such as tele-audiology and voice prosthetics. As competition intensifies, manufacturers increasingly differentiate through software capabilities, user-friendly designs, and cost-efficient solutions tailored for both advanced and emerging healthcare markets.

Key Player Analysis

- Richard Wolf GmbH

- GN Store Nord A/S

- Cochlear Ltd.

- Olympus Corporation

- Sonova

- Rion Co., Ltd.

- PENTAX Medical

- Ambu A/S

- Karl Storz

- Demant A/S

Recent Developments

- In July 2025, Innovia Medical completed acquisitions of Grace Medical and Hurricane Medical expanding its ENT and ophthalmic surgical products business.

- In April 2024, Integra LifeSciences completed acquisition of Acclarent, Inc. to broaden its ENT surgical solutions portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Diagnostic Devices, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of AI-enabled diagnostic and surgical ENT systems to enhance accuracy and clinical efficiency.

- Growth in digital and connected hearing aids will accelerate as consumers prefer personalized and smartphone-integrated solutions.

- Minimally invasive ENT procedures will expand rapidly, supported by advancements in endoscopy, image guidance, and surgical navigation.

- Demand for cochlear implants and implantable hearing solutions will rise as awareness and accessibility improve globally.

- Outpatient and ambulatory ENT procedures will increase as healthcare shifts toward faster recovery and lower-cost care models.

- Emerging markets will witness strong growth due to improved healthcare infrastructure and broader access to advanced ENT technologies.

- Integration of robotics and 4K/8K imaging systems will enhance precision in complex ENT surgeries.

- Tele-audiology and remote ENT diagnostics will gain momentum, improving care delivery and patient monitoring.

- Manufacturers will prioritize compact, user-friendly, and cost-efficient devices to serve diverse healthcare settings.

- Collaborative partnerships between device makers and healthcare providers will strengthen innovation and accelerate global market expansion.

Market Insights

Market Insights