Market Overview

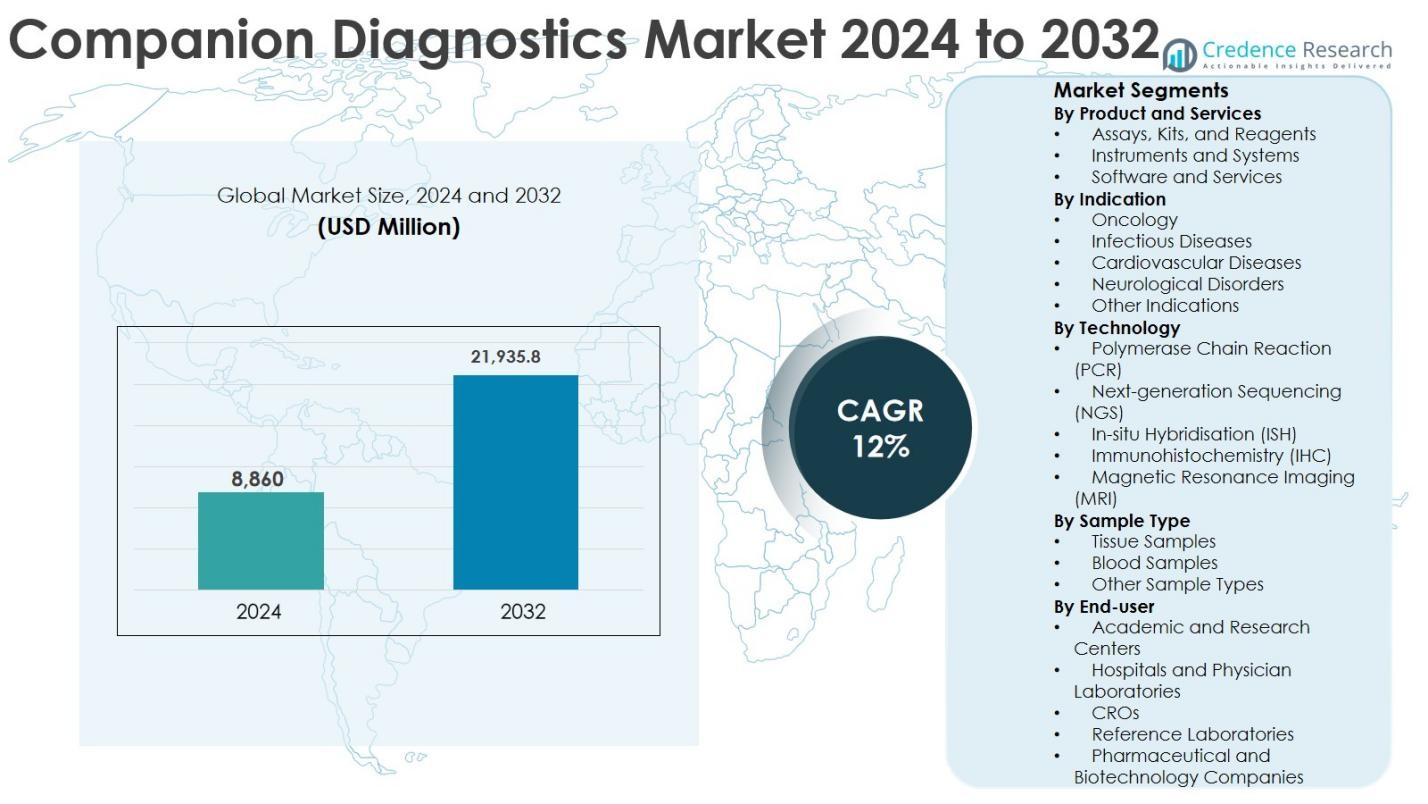

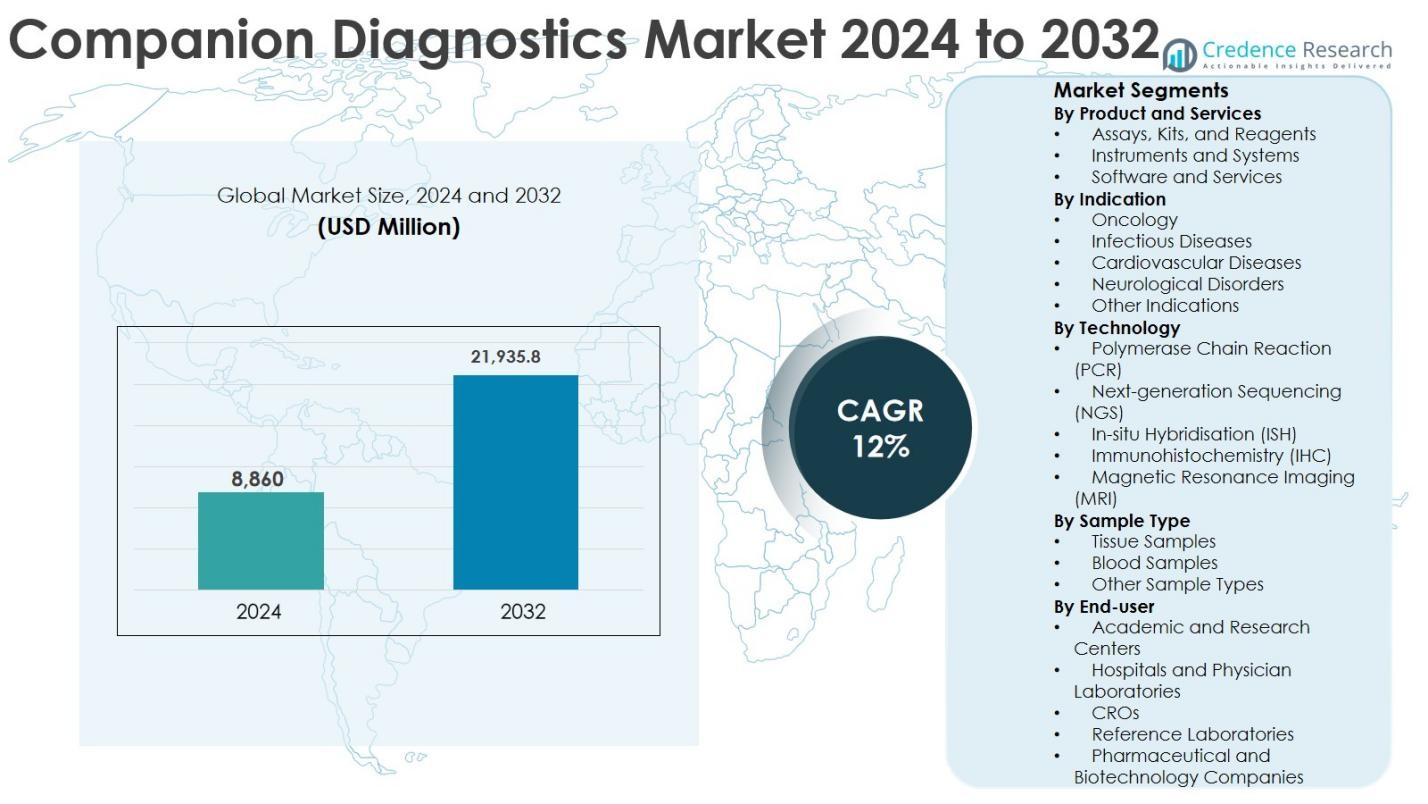

The Companion Diagnostics Market size was valued at USD 8,860 million in 2024 and is anticipated to reach USD 21,935.8 million by 2032, growing at a CAGR of 12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Companion Diagnostics Market Size 2024 |

USD 8,860 Million |

| Companion Diagnostics Market, CAGR |

12% |

| Companion Diagnostics Market Size 2032 |

USD 21,935.8 Million |

The Companion Diagnostics market is led by established players such as QIAGEN, Abbott, Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd, Foundation Medicine, Myriad Genetics, and Illumina, Inc., which collectively drive innovation through advanced molecular assays, sequencing platforms, and strategic collaborations with pharmaceutical companies. These players focus on co-development models to align diagnostics with targeted therapies, particularly in oncology. Regionally, North America dominates the Companion Diagnostics market with an exact market share of 41%, supported by strong regulatory frameworks, high adoption of precision medicine, and extensive oncology drug pipelines. Europe follows with a 28% share, driven by growing biomarker-based testing, while Asia Pacific accounts for 22%, reflecting rapid healthcare expansion and increasing adoption of advanced diagnostic technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Companion Diagnostics market was valued at USD 8,860 million in 2024 and is projected to reach USD 21,935.8 million by 2032, registering a CAGR of 12% during the forecast period.

- Market growth is driven by rising adoption of precision medicine and targeted therapies, particularly in oncology, where mandatory companion testing improves treatment outcomes and drug approval success. Assays, kits, and reagents dominate the product segment with around 54% share, supported by their recurring clinical usage and wide regulatory approvals.

- Key market trends include increasing adoption of next-generation sequencing, which holds nearly 38% technology share, due to its multiplexing capability and high diagnostic accuracy, along with growing pharma–diagnostic co-development models.

- Leading players such as QIAGEN, Abbott, Thermo Fisher Scientific, F. Hoffmann-La Roche, Illumina, and Agilent compete through innovation, strategic collaborations, and expanded oncology-focused test portfolios.

- Regionally, North America leads with a 41% market share, followed by Europe at 28% and Asia Pacific at 22%, while Latin America and Middle East & Africa collectively account for the remaining share, supported by improving healthcare infrastructure.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product and Services

The Companion Diagnostics market by product and services is dominated by assays, kits, and reagents, which accounted for 54% market share in 2024. This dominance is driven by their recurring usage across diagnostic laboratories, hospitals, and pharmaceutical-sponsored clinical trials, ensuring consistent demand. High adoption of biomarker-based testing, increasing regulatory approvals for assay-specific companion tests, and growing use in targeted therapy selection support growth. Instruments and systems hold a significant share due to advanced automation, while software and services gain traction through data interpretation, regulatory compliance support, and integration with precision medicine workflows.

- For instance, Roche’s cobas® EGFR Mutation Test v2 is routinely used to detect EGFR mutations in non–small cell lung cancer patients to guide EGFR-directed therapies, and it has received multiple regulatory clearances in major markets.

By Indication

Oncology represents the dominant indication segment in the Companion Diagnostics market, capturing 62% market share in 2024. The strong position of oncology is driven by rising global cancer prevalence, increasing approvals of targeted therapies, and mandatory companion testing for drugs in breast, lung, colorectal, and hematological cancers. Expanding immuno-oncology pipelines and personalized treatment protocols further reinforce demand. Infectious diseases and cardiovascular diseases follow, supported by biomarker-driven therapies, while neurological disorders and other indications grow steadily due to advancements in molecular profiling and early disease detection initiatives.

- For instance, Agilent Technologies provides PD-L1 IHC assays (such as PD-L1 IHC 22C3 pharmDx) used to guide treatment decisions for pembrolizumab in non–small cell lung cancer and other tumors.

By Technology

Next-generation sequencing (NGS) held the largest share of 38% in the Companion Diagnostics market in 2024, making it the dominant technology segment. NGS leads due to its high accuracy, multiplexing capability, and ability to detect complex genetic alterations across multiple biomarkers simultaneously. Increasing use in oncology drug development and clinical decision-making drives adoption. Polymerase chain reaction (PCR) remains widely used for its speed and cost efficiency, while immunohistochemistry (IHC) and in-situ hybridisation (ISH) maintain strong demand in tissue-based diagnostics.

Key Growth Drivers

Rising Adoption of Precision Medicine and Targeted Therapies

The Companion Diagnostics market is strongly driven by the rising adoption of precision medicine and targeted therapies across oncology and chronic disease management. Companion diagnostics enable accurate identification of patient sub-groups most likely to benefit from specific therapies, improving treatment efficacy and minimizing adverse effects. Regulatory agencies increasingly mandate companion diagnostic testing alongside targeted drug approvals, reinforcing their clinical necessity. Growing clinician awareness of personalized treatment approaches and the shift toward value-based healthcare further accelerate adoption. Additionally, pharmaceutical companies rely on companion diagnostics to optimize therapy outcomes and improve drug success rates, making them integral to modern therapeutic strategies. This growing reliance positions companion diagnostics as a foundational element in personalized healthcare delivery.

- For instance, the FDA-approved cobas® EGFR Mutation Test v2 from Roche is a companion diagnostic for EGFR-targeted therapies in non–small cell lung cancer, ensuring only patients with qualifying EGFR mutations receive these drugs.

Expansion of Oncology Drug Development and Biomarker Discovery

The rapid expansion of oncology drug development significantly fuels the Companion Diagnostics market. Rising global cancer prevalence has increased investments in biomarker discovery and molecular profiling technologies. Companion diagnostics play a critical role in clinical trials by enabling precise patient selection, improving trial efficiency, and increasing regulatory approval success rates. Pharmaceutical and biotechnology companies increasingly collaborate with diagnostic developers to co-develop drugs and corresponding tests, aligning development timelines. This approach reduces clinical risks and accelerates commercialization. As oncology pipelines expand across solid tumors and hematological malignancies, demand for advanced companion diagnostic solutions continues to grow steadily.

- For instance, Merck & Co. and Agilent/Dako co-developed the PD-L1 IHC 22C3 pharmDx assay as a companion diagnostic to identify patients eligible for pembrolizumab across multiple tumor types, integrating testing into pivotal trials.

Supportive Regulatory Frameworks and Growing Test Approvals

Supportive regulatory frameworks are a major driver of growth in the Companion Diagnostics market. Regulatory bodies increasingly recognize the clinical value of companion diagnostics in improving drug safety and efficacy. Clear guidelines for co-development and co-approval of drugs and diagnostics encourage manufacturers to invest in innovation. Streamlined approval pathways reduce time-to-market, while growing reimbursement recognition for biomarker testing supports clinical adoption. These regulatory advancements lower development risks and promote market expansion beyond oncology into infectious, cardiovascular, and neurological diseases. As regulatory clarity improves globally, companion diagnostics continue to gain wider acceptance in routine clinical practice.

Key Trends & Opportunities

Integration of Next-Generation Sequencing and Advanced Molecular Technologies

The integration of next-generation sequencing and advanced molecular technologies is a prominent trend in the Companion Diagnostics market. NGS enables comprehensive genomic profiling by identifying multiple biomarkers simultaneously, enhancing diagnostic accuracy and clinical decision-making. Advances in automation, bioinformatics, and artificial intelligence further improve workflow efficiency and data interpretation. Declining sequencing costs and increasing clinical utility are expanding adoption beyond specialized centers into routine diagnostics. This technological evolution creates strong opportunities for market players to develop scalable, high-throughput companion diagnostic solutions aligned with personalized medicine initiatives.

- For instance, Illumina’s TruSight Oncology 500 assay allows broad biomarker assessment, including tumor mutational burden and microsatellite instability, to support therapy selection and clinical research.

Increasing Strategic Collaborations and Co-development Models

Strategic collaborations between pharmaceutical companies and diagnostic developers represent a key opportunity in the Companion Diagnostics market. Co-development models align drug and diagnostic development timelines, improving regulatory approval success and market penetration. These partnerships support biomarker validation, optimized clinical trial design, and effective commercialization strategies. Expansion of such collaborations into emerging markets further enhances global accessibility to companion diagnostics. As precision medicine continues to advance, increased collaboration is expected to drive innovation, broaden test availability, and support sustained market growth.

- For instance, AstraZeneca and Roche partnered to develop the cobas® EGFR Mutation Test v2 as a companion diagnostic for EGFR-targeted therapies such as osimertinib in non–small cell lung cancer, integrating testing into pivotal trials.

Key Challenges

High Development Costs and Complex Regulatory Compliance

High development costs and complex regulatory compliance remain significant challenges in the Companion Diagnostics market. Extensive biomarker validation, clinical trials, and stringent regulatory requirements increase development timelines and financial risk. Smaller diagnostic companies often face resource constraints, limiting innovation and market entry. Additionally, varying regulatory standards across regions complicate global commercialization strategies, increasing operational complexity. These factors collectively slow product development and restrict broader participation, posing challenges to sustained market expansion.

Limited Reimbursement Coverage and Infrastructure Constraints

Limited reimbursement coverage and infrastructure constraints present another major challenge for the Companion Diagnostics market. In many regions, inconsistent reimbursement policies restrict adoption despite rising demand for personalized therapies. Insufficient laboratory infrastructure, limited access to advanced diagnostic platforms, and shortages of skilled professionals further hinder market penetration. Lack of awareness among healthcare providers also slows clinical uptake. Addressing these challenges through policy reforms, infrastructure investments, and professional training is essential to ensure broader global adoption of companion diagnostics.

Regional Analysis

North America

North America dominated the Companion Diagnostics market with a market share of 41% in 2024. The region’s leadership is driven by high adoption of precision medicine, strong presence of pharmaceutical and biotechnology companies, and advanced healthcare infrastructure. Favorable regulatory frameworks supporting co-approval of drugs and diagnostics, along with widespread reimbursement for biomarker testing, accelerate market growth. The United States contributes the majority share due to extensive oncology drug pipelines, high cancer prevalence, and early adoption of next-generation sequencing and molecular diagnostic technologies in clinical practice.

Europe

Europe accounted for 28% of the Companion Diagnostics market share in 2024, supported by increasing adoption of personalized medicine across oncology and chronic diseases. Strong regulatory support from agencies promoting biomarker-based therapies and growing collaboration between pharmaceutical and diagnostic companies drive market expansion. Countries such as Germany, France, and the United Kingdom lead regional growth due to advanced healthcare systems and rising investment in molecular diagnostics. Increasing awareness among clinicians and expanding access to targeted therapies further strengthen demand across the region.

Asia Pacific

Asia Pacific held 22% of the Companion Diagnostics market share in 2024 and is expected to witness the fastest growth during the forecast period. Rapidly increasing cancer incidence, expanding healthcare infrastructure, and rising investments in biotechnology research support market growth. Countries such as China, Japan, and South Korea lead adoption due to improving regulatory frameworks and growing use of advanced diagnostic technologies. Expanding clinical trials, increasing pharmaceutical manufacturing, and government initiatives promoting precision medicine further accelerate regional market expansion.

Latin America

Latin America represented 5% of the Companion Diagnostics market share in 2024. Market growth is supported by improving healthcare access, rising awareness of personalized medicine, and increasing prevalence of cancer and chronic diseases. Brazil and Mexico are key contributors due to expanding diagnostic infrastructure and growing pharmaceutical presence. However, limited reimbursement coverage and uneven access to advanced molecular testing restrain faster adoption. Ongoing healthcare reforms and increased investments in diagnostic laboratories are expected to gradually improve market penetration.

Middle East & Africa

The Middle East & Africa accounted for about 4% of the Companion Diagnostics market share in 2024. Growth in this region is driven by rising investments in healthcare infrastructure, increasing cancer burden, and gradual adoption of advanced diagnostic technologies. Countries such as the UAE and Saudi Arabia lead regional demand due to improving regulatory support and private healthcare expansion. However, limited reimbursement frameworks, skilled workforce shortages, and infrastructure gaps continue to restrict widespread adoption, moderating overall market growth.

Market Segmentations:

By Product and Services

- Assays, Kits, and Reagents

- Instruments and Systems

- Software and Services

By Indication

- Oncology

- Infectious Diseases

- Cardiovascular Diseases

- Neurological Disorders

- Other Indications

By Technology

- Polymerase Chain Reaction (PCR)

- Next-generation Sequencing (NGS)

- In-situ Hybridisation (ISH)

- Immunohistochemistry (IHC)

- Magnetic Resonance Imaging (MRI)

By Sample Type

- Tissue Samples

- Blood Samples

- Other Sample Types

By End-user

- Academic and Research Centers

- Hospitals and Physician Laboratories

- CROs

- Reference Laboratories

- Pharmaceutical and Biotechnology Companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Companion Diagnostics market features a well-established presence of global diagnostics and life-science companies focusing on innovation, regulatory alignment, and strategic collaborations with pharmaceutical firms. Leading players such as QIAGEN, Agilent Technologies, Inc., Abbott, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd, Foundation Medicine, Myriad Genetics, and Illumina, Inc. dominate the market through strong assay portfolios, advanced sequencing platforms, and extensive global distribution networks. These companies actively pursue co-development agreements with drug manufacturers to align diagnostic approvals with targeted therapies, particularly in oncology. Continuous investment in next-generation sequencing, PCR-based solutions, and bioinformatics capabilities strengthens their market positioning. Smaller and emerging players focus on niche biomarker applications and innovative technologies to enhance competitiveness. Overall, competition centers on technological differentiation, regulatory expertise, and the ability to support precision medicine workflows across clinical and research settings.

Key Player Analysis

- Illumina, Inc.

- Abbott

- Guardant Health

- Agilent Technologies, Inc.

- Myriad Genetics

- Bio-Rad Laboratories, Inc.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Foundation Medicine

- F. Hoffmann-La Roche Ltd

Recent Developments

- In January 2025, Roche announced that the FDA approved a label expansion for the PATHWAY anti-Rabbit Monoclonal Primary Antibody. This expanded indication supports the identification of patients with HR-positive, HER2-ultralow metastatic breast cancer who may be eligible for targeted treatment.

- In August 2024, the FDA granted approval to Illumina’s cancer biomarker test incorporating two companion diagnostics, enabling rapid matching of patients to targeted therapies. The test evaluates 500 genes to comprehensively profile solid tumors and improve detection of immuno-oncology and clinically actionable biomarkers.

- In April 2024, Labcorp announced FDA approval of its nAbCte Anti-AAVRh74var HB-FE Assay. This companion diagnostic is intended to determine patient eligibility for BEQVZ™, Pfizer’s FDA-approved gene therapy for hemophilia B.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product and Services, Indication , Technology,Sample Type,End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Companion Diagnostics market will continue to expand with increasing integration of precision medicine into routine clinical practice.

- Growing approvals of targeted and biomarker-driven therapies will sustain long-term demand for companion diagnostic tests.

- Next-generation sequencing adoption will accelerate due to its ability to deliver comprehensive and rapid genomic insights.

- Oncology will remain the primary application area, supported by expanding immuno-oncology and personalized cancer therapies.

- Pharmaceutical and diagnostic co-development partnerships will intensify to align drug and test development timelines.

- Regulatory frameworks will further evolve to support faster co-approval of drugs and companion diagnostics.

- Artificial intelligence and advanced bioinformatics will enhance data interpretation and diagnostic accuracy.

- Expansion of companion diagnostics into non-oncology indications will diversify revenue opportunities.

- Emerging markets will witness higher adoption as healthcare infrastructure and awareness improve.

- Increased focus on early disease detection and preventive care will strengthen the clinical relevance of companion diagnostics.

Market Segmentation Analysis:

Market Segmentation Analysis: