Market Overview

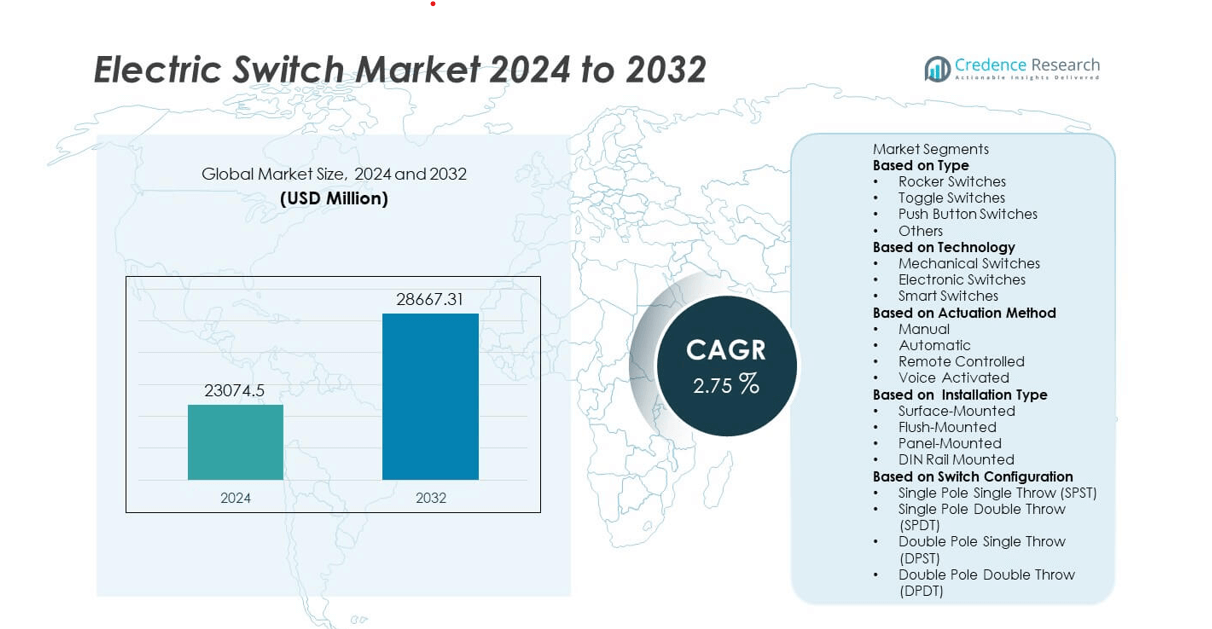

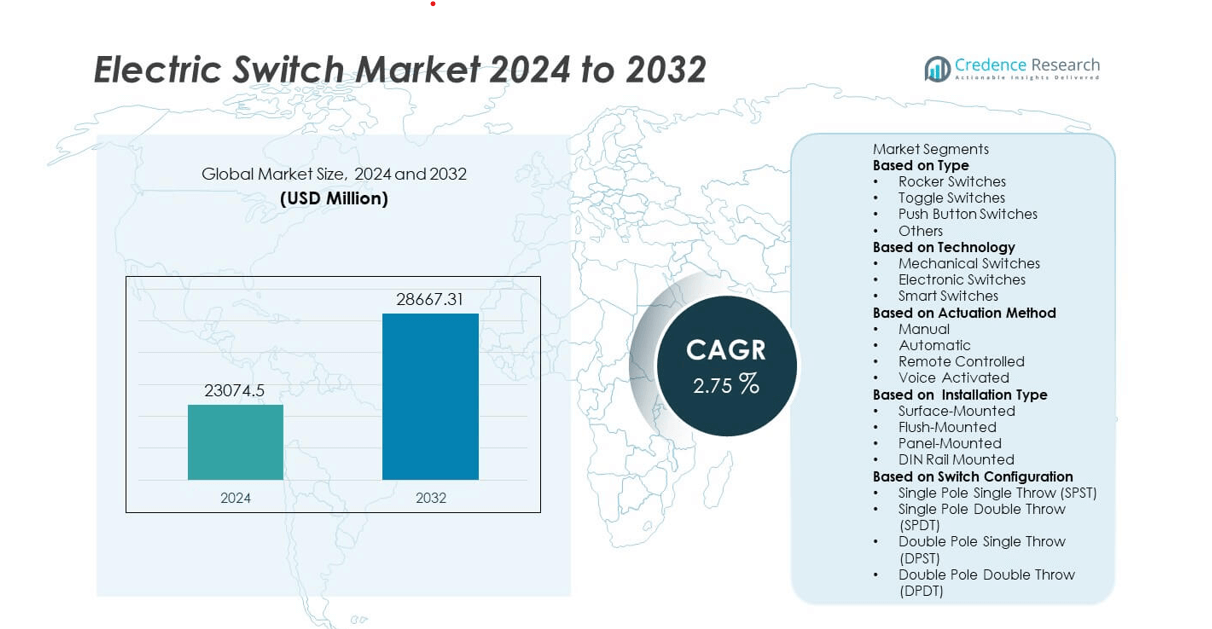

The Electric Switch Market was valued at USD 23,074.5 million in 2024 and is projected to reach USD 28,667.31 million by 2032, growing at a CAGR of 2.75 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Switch Market Size 2024 |

USD 23,074.5 million |

| Electric Switch Market, CAGR |

2.75% |

| Electric Switch Market Size 2032 |

USD 28,667.31 million |

The Electric Switch Market is led by key players such as Siemens AG, ABB Ltd., Eaton Corporation, Schneider Electric SE, Honeywell International Inc., Legrand, Panasonic Corporation, Havells India Ltd., General Electric, and Lutron Electronics Co., Inc. These companies dominate through innovative designs, digital integration, and strong global distribution networks. Asia-Pacific emerged as the leading region with a 37 percent market share in 2024, driven by rapid urbanization, infrastructure expansion, and rising adoption of smart home technologies. North America followed with 28 percent, supported by energy-efficient building systems, while Europe accounted for 24 percent, emphasizing smart and sustainable electrical infrastructure.

Market Insights

- The Electric Switch Market was valued at USD 23,074.5 million in 2024 and is projected to reach USD 28,667.31 million by 2032, growing at a CAGR of 2.75 percent.

- Rising construction and renovation activities, along with growing adoption of smart home technologies, are key drivers boosting demand for modern and energy-efficient switches.

- The market is witnessing strong trends toward modular designs, touch-sensitive interfaces, and IoT-enabled switches that enhance convenience, safety, and aesthetics.

- Major players including Siemens, ABB, Schneider Electric, Eaton, and Honeywell focus on innovation, product diversification, and digital integration to maintain competitive advantage.

- Asia-Pacific led the market with a 37 percent share in 2024, followed by North America with 28 percent and Europe with 24 percent, while the rocker switch segment dominated with 42 percent share due to its widespread use in residential and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The rocker switch segment dominated the Electric Switch Market in 2024, accounting for 42 percent of the total share. Rocker switches are widely used in residential, automotive, and industrial applications due to their durability, simplicity, and cost-effectiveness. Their ability to handle varying voltage and current ratings makes them ideal for lighting and appliance control systems. Growing construction activities and the expansion of home renovation projects have increased demand for user-friendly switch designs. Manufacturers are focusing on enhanced aesthetics and safety features, such as backlit and waterproof models, to strengthen product adoption across end-use sectors.

- For instance, Legrand offers Arteor modular rocker switches with a rated voltage up to 250V AC and optional indicator lights for improved visual indication. The switches are designed for residential and commercial spaces, with a focus on aesthetic design and usability.

By Technology

The mechanical switch segment held the largest share of 48 percent in 2024, driven by its wide use in industrial control systems, home appliances, and commercial installations. These switches offer tactile feedback, reliability, and long operational life, making them preferred for traditional applications. Despite the rise of electronic and smart switches, mechanical designs remain essential in heavy-duty and low-cost environments. Continuous improvements in materials and contact mechanisms are enhancing performance. Additionally, hybrid models combining mechanical and electronic features are gaining attention for improved efficiency and durability.

- For instance, Eaton’s M22 mechanical switch series supports a rated operational current of 10 A and endurance exceeding 1 million operations.

By Actuation Method

The manual actuation segment led the market with a 55 percent share in 2024, supported by its extensive use in residential and commercial buildings. Manual switches remain popular for lighting, fan, and power control due to their affordability and ease of installation. Growth in smart city projects and housing developments continues to drive demand for advanced yet manually operated designs. Manufacturers are upgrading manual switches with enhanced safety mechanisms, modular designs, and improved aesthetics. The segment’s stability is sustained by consistent replacement demand and integration with hybrid smart systems for modern buildings.

Key Growth Drivers

Expansion of Smart Homes and Automation Systems

The rapid growth of smart home technologies is a major driver for the Electric Switch Market. Consumers are increasingly adopting IoT-enabled switches that allow remote control through smartphones and voice assistants. These systems improve convenience, energy efficiency, and safety. Rising disposable incomes and government initiatives supporting smart infrastructure are accelerating adoption. Manufacturers are integrating sensors, Wi-Fi, and Bluetooth connectivity into switches to enhance functionality. This shift toward intelligent living environments continues to create strong growth opportunities across residential and commercial spaces.

- For instance, Lutron Electronics launched the Caséta Diva Smart Dimmer switch, which operates using the proprietary Clear Connect RF technology and can be paired with the Lutron Smart Hub to enable compatibility with Apple HomeKit, Alexa, and Google Assistant.

Rising Demand from Construction and Renovation Activities

Expanding residential and commercial construction is significantly driving electric switch demand. Modern infrastructure projects require durable, efficient, and aesthetically appealing electrical systems. The growing emphasis on interior design and energy management supports increased installation of advanced switch types. Urbanization and renovation activities in both developed and developing countries contribute to steady market expansion. Builders and consumers are favoring modular and stylish switch designs that complement modern interiors while ensuring operational safety and energy efficiency.

- For instance, Havells India introduced its Fabio modular switch series featuring fire-retardant polycarbonate construction with a lifespan of over 200,000 operations. Each switch is tested for 1,000 V dielectric strength and 40 A short-circuit endurance, meeting IEC 60669-1 standards and catering to high-end residential and commercial building projects across India.

Technological Advancements in Electrical Components

Continuous technological innovation is enhancing switch performance, durability, and user experience. Advancements such as touch-sensitive interfaces, motion sensors, and wireless control systems are reshaping traditional switch functions. Manufacturers are adopting smart manufacturing practices and materials that improve electrical conductivity and safety standards. The integration of AI and IoT into switches enables predictive maintenance and energy monitoring. These innovations are strengthening the market by meeting evolving consumer needs and supporting sustainability goals through energy-efficient solutions.

Key Trends and Opportunities

Growing Adoption of Smart and Wireless Switches

Wireless and smart switches are gaining momentum as consumers shift toward connected living environments. These switches enable remote operation, scheduling, and integration with smart home ecosystems. The trend is driven by convenience, safety, and energy-saving features. Manufacturers are introducing compact, stylish designs compatible with voice assistants and mobile applications. The expansion of Wi-Fi and 5G networks supports seamless device connectivity, creating significant opportunities for smart switch adoption in both residential and commercial applications.

- For instance, Schneider Electric launched its Wiser Smart Switch range equipped with Zigbee 3.0 protocol, supporting over 120 connected devices per network. Each unit allows up to 300,000 switching cycles and integrates with Google Assistant and Amazon Alexa, enabling real-time voice and app-based control in connected home environments.

Rising Focus on Aesthetic and Modular Designs

Aesthetic appeal and flexibility have become key purchasing factors for modern consumers. Modular switches offering customizable designs, multiple color options, and easy installation are seeing strong demand. The trend is especially evident in urban housing and commercial interiors, where visual appeal complements functionality. Manufacturers are leveraging advanced materials and sleek finishes to cater to evolving design preferences. This shift toward modern, modular switch systems is opening opportunities for premium product lines in emerging markets.

- For instance, Legrand’s Myrius NextGen modular switch series is available in a variety of colors and finishes like Classic White, Ice White, Pearl Champagne, and Ice Black, with a modern, flat-plate design for flush wall mounting. Each module is rated up to 16 A at 250 V, offering reliable performance and durable build quality suitable for premium residential installations.

Key Challenges

High Cost of Smart and Electronic Switches

The higher cost of smart and electronic switches compared to traditional options remains a major restraint. These advanced models require sensors, microcontrollers, and wireless modules, increasing production and installation expenses. Price sensitivity in developing markets limits large-scale adoption. Although long-term savings from energy efficiency and automation exist, the initial investment discourages cost-conscious consumers. Manufacturers are focusing on optimizing production and introducing mid-range smart switch solutions to make technology more affordable.

Compatibility and Standardization Issues

Integration challenges across various smart ecosystems hinder widespread adoption. Many smart switches are designed for specific platforms, creating compatibility issues with other devices and networks. Lack of standardization in communication protocols such as Zigbee, Wi-Fi, and Bluetooth complicates installation and operation. Consumers and installers face difficulties ensuring seamless connectivity among devices. To address this, industry players are moving toward open-source platforms and universal compatibility standards to enhance interoperability and improve user experience.

Regional Analysis

North America

North America held a market share of 28 percent in 2024, driven by increasing adoption of smart home automation and energy-efficient electrical systems. The United States leads the regional market due to rising residential construction and the growing popularity of IoT-enabled switches. High consumer awareness of advanced lighting control systems further supports expansion. Manufacturers are focusing on stylish, modular, and touch-sensitive switches to meet aesthetic and performance needs. Government initiatives promoting sustainable energy use and modernization of electrical infrastructure continue to strengthen market growth across both residential and commercial sectors.

Europe

Europe accounted for 24 percent of the global Electric Switch Market in 2024, supported by rising investments in smart building technologies and strict energy efficiency regulations. Countries such as Germany, France, and the United Kingdom are adopting intelligent electrical systems across residential and commercial spaces. Demand for aesthetically designed, modular switches with advanced control features is increasing. The region’s focus on green construction and smart infrastructure enhances adoption of automated and sensor-based switches. Technological innovations by key European manufacturers are further driving product demand across industrial and domestic applications.

Asia-Pacific

Asia-Pacific dominated the Electric Switch Market with a 37 percent share in 2024, fueled by rapid urbanization, population growth, and expanding construction activities. China, India, and Japan are leading markets due to large-scale infrastructure development and rising middle-class spending. The adoption of smart homes and modern interior design trends is boosting demand for innovative switch designs. Governments are promoting energy-efficient housing and electrical safety standards, encouraging the use of high-quality switches. Local manufacturers are expanding production capacities to meet increasing domestic demand and export opportunities across emerging economies in the region.

Middle East and Africa

The Middle East and Africa captured 6 percent of the Electric Switch Market in 2024, supported by rapid infrastructure growth and modernization of commercial and residential facilities. The UAE and Saudi Arabia lead regional adoption through smart city initiatives and high-end construction projects. Growing focus on luxury housing and energy-efficient systems boosts demand for advanced switch technologies. In Africa, urbanization and electrification programs are increasing installation rates in both residential and industrial sectors. The rising availability of affordable modular switches further enhances market penetration across developing economies.

Latin America

Latin America accounted for 5 percent of the global Electric Switch Market in 2024, led by growing residential construction and renovation activities in Brazil and Mexico. Government efforts to expand housing projects and improve electrical safety standards are supporting steady growth. The market is witnessing rising adoption of smart and modular switches, especially in urban areas. Local manufacturers are focusing on cost-effective solutions to cater to budget-sensitive consumers. Increased digitalization and energy-efficient infrastructure development are expected to drive long-term market expansion across the region’s residential and commercial segments.

Market Segmentations:

By Type

- Rocker Switches

- Toggle Switches

- Push Button Switches

- Others

By Technology

- Mechanical Switches

- Electronic Switches

- Smart Switches

By Actuation Method

- Manual

- Automatic

- Remote Controlled

- Voice Activated

By Installation Type

- Surface-Mounted

- Flush-Mounted

- Panel-Mounted

- DIN Rail Mounted

By Switch Configuration

- Single Pole Single Throw (SPST)

- Single Pole Double Throw (SPDT)

- Double Pole Single Throw (DPST)

- Double Pole Double Throw (DPDT)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Switch Market includes major players such as Siemens AG, ABB Ltd., Eaton Corporation, Schneider Electric SE, Honeywell International Inc., Legrand, Panasonic Corporation, Havells India Ltd., General Electric, and Lutron Electronics Co., Inc. These companies dominate the market through extensive product portfolios, strong distribution networks, and continuous innovation. They focus on developing smart, modular, and energy-efficient switch solutions that cater to residential, commercial, and industrial applications. Strategic partnerships, mergers, and technology integration remain key growth strategies to enhance global presence. Leading manufacturers are investing in digital control technologies, touch-sensitive interfaces, and IoT-based systems to meet rising demand for automation and modern interior design. Sustainability, safety, and customization are becoming critical differentiators as companies compete to deliver durable and aesthetically appealing solutions for smart homes and commercial infrastructures worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- ABB Ltd.

- Eaton Corporation

- Schneider Electric SE

- Honeywell International Inc.

- Legrand

- Panasonic Corporation

- Havells India Ltd.

- General Electric

- Lutron Electronics Co., Inc.

Recent Developments

- In October 2025, Siemens AG rolled out its SIQuench arc mitigation system for GM-SG medium-voltage switchgear in the U.S., able to extinguish internal arcs in milliseconds and withstand up to five arc events without module replacement.

- In July 2025, ABB Ltd. achieved UL 98B certification for its 2 kV switch-disconnector, marking it as the first device to pass certification at that voltage level under the UL 98B standard.

- In May 2025, Schneider Electric rolled out new automatic transfer switch (ATS) solutions across its Acti9 line, supporting current ratings from 32 A to 1,600 A with swappable modules and switchover times as fast as 500 ms.

- In 2024, Siemens AG introduced its first F-gas-free medium-voltage GIS switchgear in the U.S., using clean air insulation and vacuum interrupters in hermetically sealed stainless-steel vessels with digital protection.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Actuation Method, Installation Type, Switch Configuration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for smart and energy-efficient switches.

- Integration of IoT and wireless technologies will drive the development of connected switch systems.

- Modular and customizable designs will gain popularity in modern residential and commercial spaces.

- Manufacturers will focus on improving durability, safety, and aesthetic appeal.

- Rising smart city projects will boost adoption of intelligent electrical infrastructure.

- Automation and voice-controlled switches will become mainstream in homes and offices.

- Emerging economies will experience rapid growth due to urbanization and infrastructure upgrades.

- Partnerships between technology firms and electrical manufacturers will strengthen innovation.

- Sustainability initiatives will encourage production of recyclable and eco-friendly switch materials.

- Asia-Pacific will remain the leading region driven by large-scale construction and smart housing development.