Market Overview

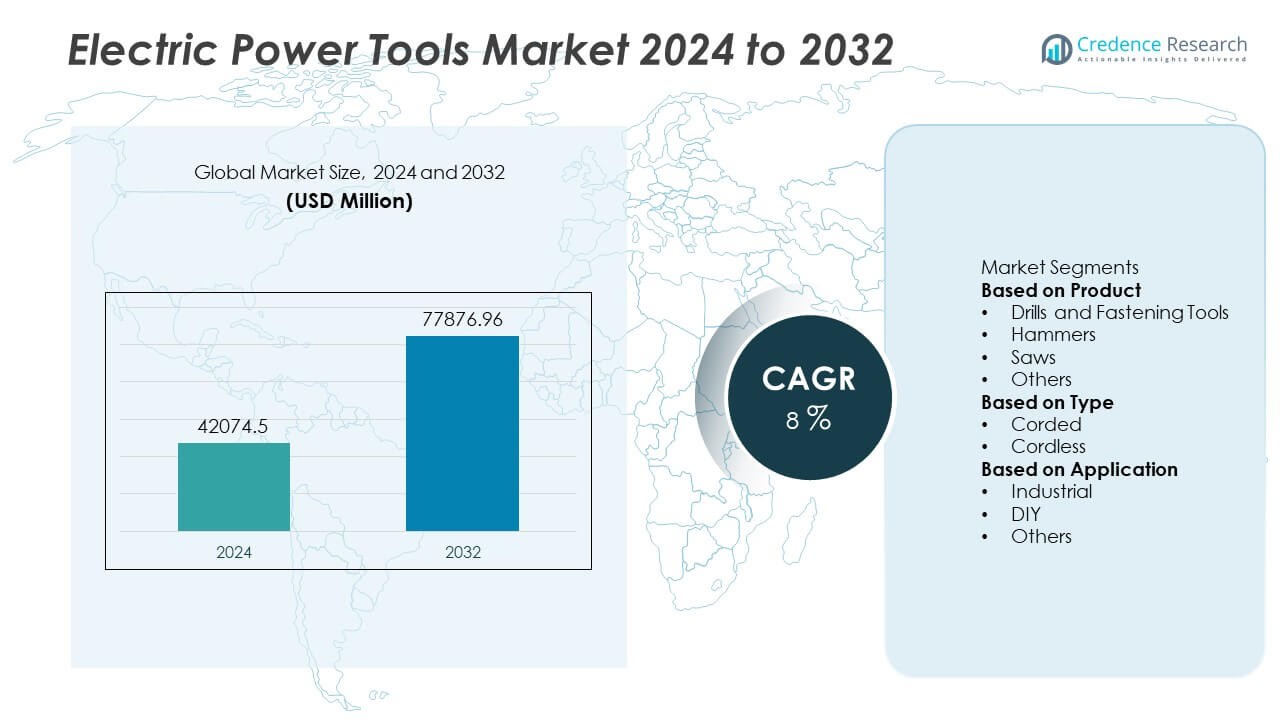

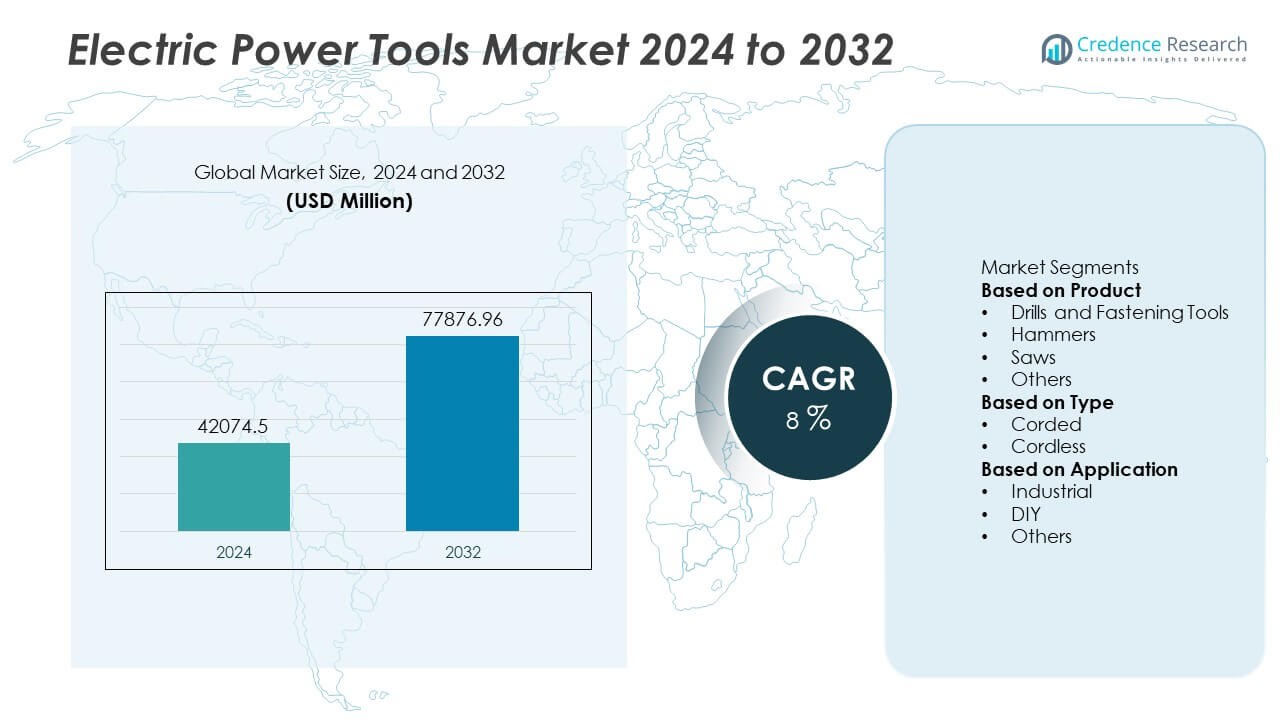

The Electric Power Tools market was valued at USD 42,074.5 million in 2024 and is projected to reach USD 77,876.96 million by 2032, registering a CAGR of 8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Power Tools Market Size 2024 |

USD 42,074.5 Million |

| Electric Power Tools Market, CAGR |

8 % |

| Electric Power Tools Market Size 2032 |

USD 77,876.96 Million |

The Electric Power Tools market is led by major players including Makita Corporation, Hilti Corporation, Fein Power Tools Inc., Panasonic Corporation, Atlas Copco AB, Festool Group, Milwaukee Electric Tool Corporation, Hitachi Koki Co., Ltd., DeWalt, and Emerson Electric Co. These companies dominate through innovation in cordless technology, high-efficiency brushless motors, and advanced battery systems that enhance productivity and durability. North America emerged as the leading region with a 32% market share in 2024, driven by strong construction and industrial activity. Asia-Pacific followed with 30%, supported by rapid urbanization and manufacturing growth, while Europe accounted for 28%, emphasizing sustainability and premium tool performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Power Tools market was valued at USD 42,074.5 million in 2024 and is projected to reach USD 77,876.96 million by 2032, growing at a CAGR of 8%.

- Market growth is driven by the increasing demand for cordless and battery-operated tools across construction, manufacturing, and automotive sectors, supported by expanding infrastructure projects.

- The market is witnessing strong trends toward smart, connected, and energy-efficient power tools integrated with brushless motors and digital control systems.

- Leading players such as Makita Corporation, Hilti Corporation, and Milwaukee Electric Tool Corporation are investing in R&D, acquisitions, and product innovations to enhance performance and global reach.

- North America led the market with 32% share in 2024, followed by Asia-Pacific with 30% and Europe with 28%, while the cordless segment dominated by type with 65% share, driven by its portability and flexibility.

Market Segmentation Analysis:

By Product

The drills and fastening tools segment dominated the Electric Power Tools market in 2024, accounting for over 35% of the total share. Their wide adoption across construction, woodworking, and metalworking industries drives this dominance. Drills and drivers offer high versatility, making them essential for both professional and DIY applications. The introduction of brushless motor technology and ergonomic, lightweight designs has improved performance and energy efficiency. Continuous innovations in cordless variants and interchangeable battery platforms further strengthen demand, particularly among contractors and industrial maintenance professionals.

- For instance, DeWalt introduced its 20V MAX XR brushless hammer drill (DCD999) powered by a FLEXVOLT 9.0 Ah battery, delivering up to 1,210 UWO of power and 38,250 BPM for masonry applications. The model includes a 3-speed all-metal transmission and a high-efficiency brushless motor capable of 2,000 RPM under load, offering extended runtime and improved drilling performance for heavy-duty tasks.

By Type

The cordless segment led the market with around 65% share in 2024, driven by advancements in lithium-ion battery technology that enhance tool portability and runtime. Users increasingly prefer cordless tools for their flexibility, safety, and ease of operation without dependency on power outlets. Manufacturers are introducing faster-charging systems and compact battery packs that maintain high torque output. The shift toward wireless job sites and growth in DIY activities worldwide continue to fuel the dominance of cordless power tools across residential and commercial applications.

- For instance, Milwaukee Electric Tool Corporation’s M18 FUEL line features a 12.0 Ah REDLITHIUM HIGH OUTPUT battery delivering up to 216 Wh of energy. The battery runs 50% cooler than standard REDLITHIUM HD packs during heavy applications. The M18 system powers over 250 compatible tools.

By Application

The industrial segment held the largest share of around 60% in 2024, supported by strong demand from construction, automotive, and manufacturing sectors. Industrial users rely on high-performance electric tools for precision, productivity, and durability under continuous operation. Expanding infrastructure projects and automation trends are accelerating tool adoption across professional environments. Manufacturers are developing heavy-duty, vibration-controlled models to improve efficiency and operator comfort. The integration of smart sensors and IoT-enabled diagnostics also enhances predictive maintenance, reinforcing the industrial sector’s leadership in the global market.

Key Growth Drivers

Rising Adoption of Cordless and Battery-Operated Tools

The growing shift toward cordless electric power tools is a major driver of market expansion. Lithium-ion batteries offer longer runtime, quick charging, and enhanced mobility, making them ideal for professional and household applications. Users prefer cordless tools for flexibility and reduced maintenance compared to corded models. Manufacturers are focusing on battery innovation, compatibility across tool platforms, and improved power efficiency to meet the rising demand from construction, automotive, and repair sectors worldwide.

- For instance, Makita Corporation developed its 40V max XGT® battery platform featuring a 4.0 Ah pack that delivers 144 Wh of power and supports over 125 compatible tools. The system integrates smart cell balancing and digital communication between tool and battery to optimize discharge rates. Makita’s XGT® platform achieves full charge within 45 minutes using the DC40RA rapid charger, enhancing productivity across demanding professional applications.

Expansion of Construction and Infrastructure Projects

Global construction growth is fueling higher demand for electric power tools across residential, commercial, and industrial sectors. Urbanization, infrastructure modernization, and government investments in housing and transportation projects are driving tool adoption. Contractors increasingly prefer electric tools for their precision, durability, and efficiency on large-scale projects. The need for quick assembly, concrete drilling, and fastening operations continues to boost demand for advanced electric tools in developing and developed markets alike.

- For instance, Hilti Corporation introduced the TE 2000-22 cordless jackhammer, powered by the Nuron 22V battery platform, delivering a single impact energy of 38.2 joules. The tool’s brushless motor requires less maintenance compared to its pneumatic counterparts.

Growing Popularity of DIY and Home Improvement Activities

The rise in do-it-yourself (DIY) culture has significantly boosted electric power tool sales among homeowners and hobbyists. Increased interest in home renovation, repair, and furniture building drives strong retail and online demand. Lightweight, user-friendly, and compact electric tools are attracting non-professional users seeking convenience and cost efficiency. Manufacturers are responding by offering affordable cordless kits and multi-functional tools tailored for DIY enthusiasts, further expanding market penetration.

Key Trends and Opportunities

Integration of Smart and Connected Tool Technologies

The integration of IoT and smart sensors is transforming the Electric Power Tools market. Connected tools enable remote diagnostics, performance monitoring, and theft prevention through mobile applications. This digital shift improves efficiency, safety, and predictive maintenance in industrial environments. Manufacturers leveraging data analytics and cloud connectivity are enhancing operational visibility for both professionals and enterprises, creating new opportunities in premium product segments.

- For instance, Milwaukee Electric Tool Corporation’s ONE-KEY platform connects over 120 compatible tools and devices via Bluetooth, allowing location tracking within a 90+ meter range. The system collects performance analytics and usage data from tools, such as the digital torque wrench which stores up to 28,500 entries, and transmits this data to a centralized cloud-based dashboard.

Sustainability and Energy-Efficient Design Innovations

Manufacturers are focusing on sustainable production and energy-efficient tool design to reduce environmental impact. Brushless motors, recyclable materials, and low-energy battery systems are becoming key differentiators. Eco-conscious consumers and industrial buyers increasingly favor electric tools over pneumatic or fuel-driven alternatives. This trend not only aligns with global carbon reduction goals but also enhances product performance and lifespan, supporting long-term market growth.

- For instance, Bosch offers high-efficiency brushless motors as part of its product lines, with some reaching high-power output. Bosch Group has also confirmed that since 2020, all of its over 400 worldwide locations, including those for Power Tools, have been operating on a carbon-neutral basis (Scopes 1 and 2), utilizing a combination of renewable energy, increased energy efficiency, and carbon credits.

Key Challenges

High Initial Costs and Battery Replacement Expenses

Despite technological progress, high upfront costs remain a major challenge for electric power tool adoption, particularly among small businesses and DIY users. Lithium-ion batteries and advanced components significantly increase product prices. Battery replacement and disposal also add to operational expenses over time. These factors limit market penetration in price-sensitive regions, pushing manufacturers to explore cost-effective battery technologies and modular tool systems to enhance affordability.

Workplace Safety Concerns and Counterfeit Products

Workplace injuries caused by improper tool handling and unregulated imports of low-quality electric tools pose growing safety concerns. Counterfeit products with poor insulation or inadequate safety standards can lead to accidents and tool failures. Manufacturers and regulators are emphasizing certification compliance and user training to mitigate these risks. Establishing robust quality assurance systems and tightening distribution controls are essential to ensure operator safety and maintain brand reliability.

Regional Analysis

North America

North America held a market share of 32% in the Electric Power Tools market in 2024. Growth in this region is driven by strong demand from the construction, automotive, and industrial manufacturing sectors. The United States dominates regional revenue due to widespread adoption of cordless and smart power tools by professionals and DIY users. Continuous infrastructure investment and home renovation trends also support market expansion. Major players are focusing on advanced lithium-ion batteries and digital connectivity features to enhance efficiency and performance across both commercial and residential applications.

Europe

Europe accounted for 28% of the Electric Power Tools market in 2024, supported by robust industrialization and increasing focus on sustainable tool manufacturing. Countries such as Germany, the United Kingdom, and France are key contributors, emphasizing high-quality, energy-efficient tools for construction and automotive use. Strict safety standards and growing adoption of brushless motor technology are boosting product demand. The region’s expanding renovation and green building activities further encourage the use of advanced electric tools across professional and consumer markets, strengthening Europe’s position as a key innovation hub.

Asia-Pacific

Asia-Pacific captured 30% of the Electric Power Tools market in 2024, driven by rapid urbanization, industrial expansion, and growing infrastructure projects. China, Japan, and India are major manufacturing hubs with rising adoption of power tools in construction and automotive assembly. Increasing investments in housing, commercial infrastructure, and manufacturing automation are fueling demand for cordless and ergonomic tools. Local and international brands are expanding production capacities to serve growing regional needs, while rising disposable income and DIY trends contribute to market growth across emerging economies.

Latin America

Latin America represented 6% of the Electric Power Tools market in 2024. Brazil and Mexico lead regional growth due to expanding construction activity and the modernization of industrial facilities. The rise in residential renovation projects and adoption of lightweight cordless tools by small contractors further boosts demand. Government initiatives supporting infrastructure development and urban housing also contribute to the market’s steady progress. However, limited access to advanced technologies and higher import costs present challenges that regional manufacturers are addressing through strategic partnerships and localized production.

Middle East and Africa

The Middle East and Africa held a market share of 4% in the Electric Power Tools market in 2024. Growth is primarily driven by large-scale construction, oil and gas projects, and urban infrastructure development. The United Arab Emirates and Saudi Arabia dominate the market, supported by ongoing megaprojects and growing industrial automation. Africa is experiencing rising adoption of cost-effective tools for small-scale manufacturing and repair applications. Increasing foreign investments in construction and economic diversification initiatives continue to strengthen demand for efficient and durable electric power tools in the region.

Market Segmentations:

By Product

- Drills and Fastening Tools

- Hammers

- Saws

- Others

By Type

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Power Tools market includes major players such as Makita Corporation, Hilti Corporation, Fein Power Tools Inc., Panasonic Corporation, Atlas Copco AB, Festool Group, Milwaukee Electric Tool Corporation, Hitachi Koki Co., Ltd., DeWalt, and Emerson Electric Co. These companies compete through continuous innovation, advanced battery technology, and ergonomic design to enhance tool efficiency and user comfort. Leading manufacturers are focusing on expanding cordless tool portfolios and integrating smart connectivity features for industrial and DIY applications. Strategic acquisitions, partnerships, and R&D investments are strengthening global distribution networks and product customization capabilities. The focus on energy-efficient brushless motors, high-performance lithium-ion batteries, and safety-enhancing sensors continues to define competition. Moreover, regional manufacturing expansion in Asia-Pacific and North America enables faster delivery and cost optimization, reinforcing the competitive position of established and emerging players in this growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Festool Group introduced updates to its Festool App, combining ordering, how-to, and work tools into a single app for better tool control.

- In January 2025, Makita Corporation lit up World of Concrete with new products including a 40V max XGT® brushless framing nailer.

- In January 2025, Hilti Corporation expanded its Nuron cordless tool platform, launching additional tools powered by the 22V Nuron battery.

- In 2025, Hilti added new Nuron cordless blower (NBL 6-22) to its product line—offering jobsite cleanup with battery integration into its Nuron system.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Power Tools market will continue expanding with growing industrial and construction activities worldwide.

- Cordless and battery-powered tools will dominate future demand due to convenience and flexibility.

- Advancements in lithium-ion and solid-state batteries will enhance tool efficiency and runtime.

- Integration of IoT and smart connectivity features will improve precision, safety, and productivity.

- Manufacturers will focus on lightweight, ergonomic, and durable designs to meet professional and DIY user needs.

- Sustainability goals will drive adoption of energy-efficient and recyclable tool components.

- Expansion in infrastructure projects across emerging economies will create strong market opportunities.

- Strategic collaborations between toolmakers and battery manufacturers will strengthen innovation pipelines.

- Automation and industrial modernization will boost the need for high-performance electric tools.

- North America and Asia-Pacific will remain key growth regions, supported by advanced manufacturing and rising consumer adoption.