Market Overview

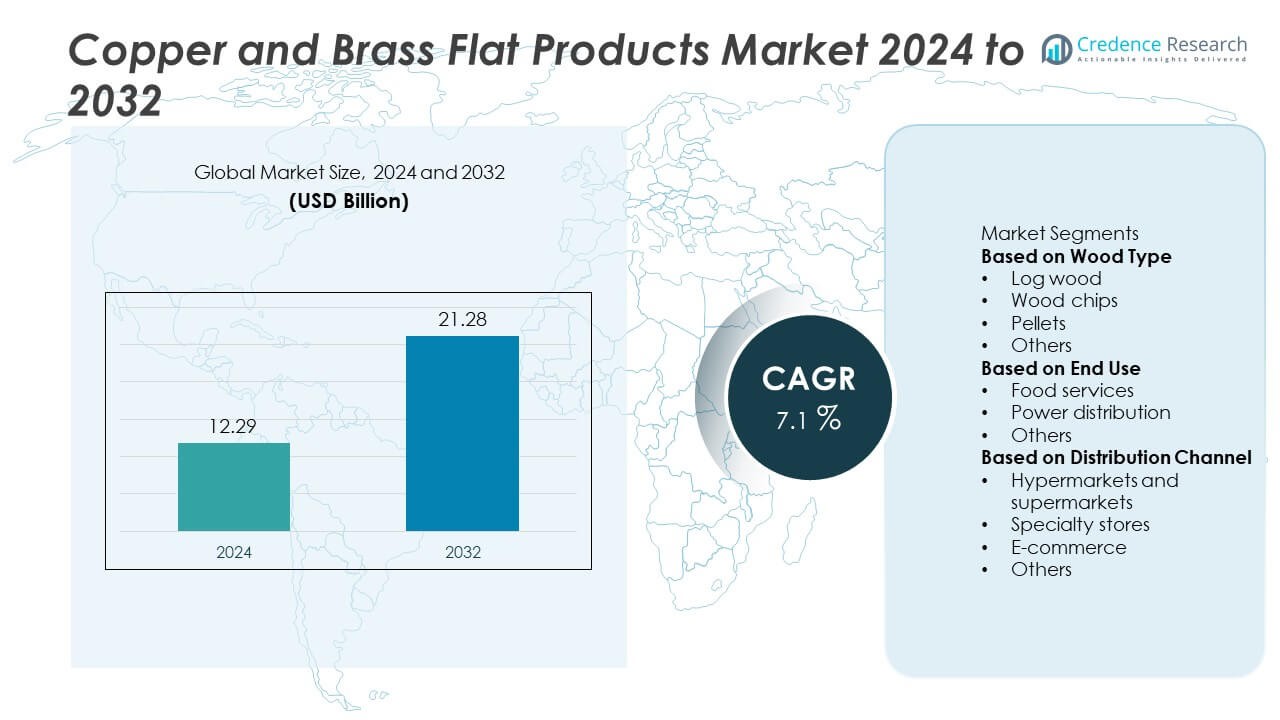

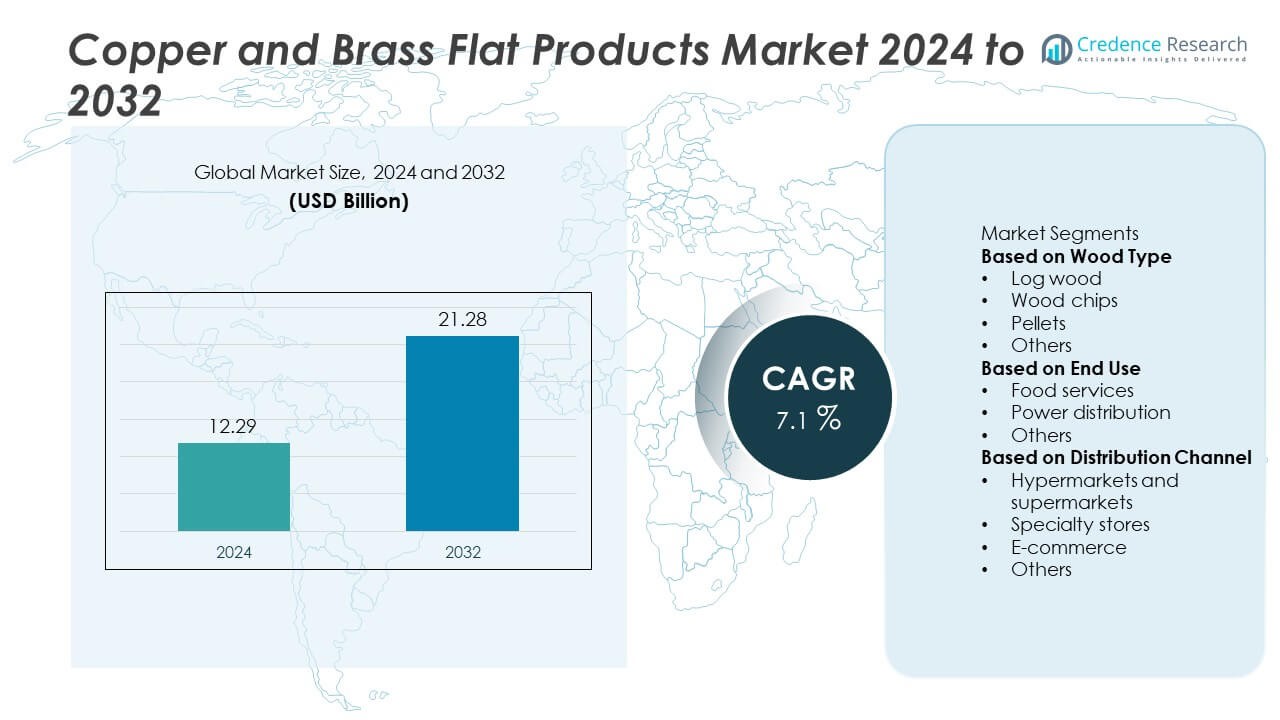

The Copper and Brass Flat Products Market was valued at USD 12.29 billion in 2024 and is projected to reach USD 21.28 billion by 2032, growing at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Copper and Brass Flat Products Market Size 2024 |

USD 12.29 Billion |

| Copper and Brass Flat Products Market, CAGR |

7.1% |

| Copper and Brass Flat Products Market Size 2032 |

USD 21.28 Billion |

The Copper and Brass Flat Products Market is dominated by major players including Aurubis AG, Wieland-Werke AG, KME Group, Mitsubishi Materials Corporation, JX Nippon Mining & Metals Corporation, Olin Brass, Lebronze Alloys, Nippon Shindo Co., Ltd., Mueller Industries, Inc., and PMX Industries, Inc. These companies maintain leadership through strong production capabilities, global distribution networks, and innovation in high-conductivity and corrosion-resistant materials. Asia-Pacific emerged as the leading region in 2024 with a 36% market share, driven by rapid industrialization and infrastructure growth. North America followed with 29%, supported by steady demand from electrical and construction industries, while Europe held 26%, backed by advanced manufacturing and sustainability-focused material applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Copper and Brass Flat Products Market was valued at USD 12.29 billion in 2024 and is projected to reach USD 21.28 billion by 2032, growing at a CAGR of 7.1%.

- Growing demand from electrical, automotive, and construction sectors is driving market expansion, supported by the excellent conductivity and corrosion resistance of copper and brass alloys.

- The market trend is shifting toward high-performance and recyclable flat products, with manufacturers investing in energy-efficient rolling and refining technologies to meet sustainability goals.

- Leading players such as Aurubis AG, Wieland-Werke AG, and Mitsubishi Materials Corporation dominate the market through advanced production capabilities and global supply networks.

- Asia-Pacific led the market with a 36% share in 2024, followed by North America at 29% and Europe at 26%; by end use, the power distribution segment accounted for 41% share, driven by increased renewable grid investments and industrial electrification.

Market Segmentation Analysis:

By Wood Type

The pellets segment dominated the Copper and Brass Flat Products Market in 2024, holding a 43% market share. The segment’s leadership is driven by high energy efficiency, uniform size, and ease of handling compared to log wood or chips. Pellets are widely used in power generation and industrial heating due to their consistent combustion and lower emissions. Growing demand for clean energy and sustainable fuel alternatives has accelerated their use across commercial and residential sectors. Increasing government incentives for renewable biofuels are further supporting the segment’s steady expansion.

- For instance, Mitsubishi Materials Corporation offers various high-purity copper products, including some with a purity level of 99.99% or higher. The melting temperature of pure copper is a standard physical property, and its specific value is 1,084.62°C.

By End Use

The power distribution segment led the Copper and Brass Flat Products Market in 2024, capturing a 47% share. The segment’s growth is supported by the rising need for conductive materials in electrical grids and renewable power installations. Copper and brass flat products are preferred for transformers, busbars, and switchgear due to their superior conductivity, corrosion resistance, and durability. Expanding investments in smart grids, transmission networks, and electrification projects continue to drive demand. The push toward energy efficiency and modernization of aging infrastructure further reinforces the dominance of this segment globally.

- For instance, Wieland-Werke AG supplies copper busbar strips with an electrical conductivity of 58 MS/m and a thermal expansion coefficient of 16.8 × 10⁻⁶ K⁻¹, optimized for high-current power distribution systems. The company’s state-of-the-art rolling mills produce more than 250,000 metric tons of flat copper and brass products annually, ensuring consistent performance for transformers, substations, and large-scale electrification projects.

By Distribution Channel

The specialty stores segment accounted for the largest 39% share of the Copper and Brass Flat Products Market in 2024. Specialty outlets provide a wide variety of metal sheets, strips, and plates with expert guidance, customization, and quality assurance. Industrial buyers and small manufacturers prefer these stores for sourcing application-specific materials and precision-cut products. The segment benefits from strong partnerships with suppliers and local distributors ensuring timely delivery. Growing demand from automotive, electrical, and construction sectors is encouraging retailers to expand inventories and adopt digital platforms for better customer reach and service efficiency.

Key Growth Drivers

Rising Demand from Electrical and Electronics Sector

The expanding electrical and electronics industry is a major driver of the Copper and Brass Flat Products Market. Copper’s superior conductivity and corrosion resistance make it indispensable in power cables, switchgear, and transformers. Brass is widely used in connectors, terminals, and precision components requiring mechanical strength. Increasing investments in renewable power, electric vehicles, and smart grids are further fueling demand. The transition toward energy-efficient electrical systems continues to boost consumption of flat copper and brass products across industrial and infrastructure applications.

- For instance, JX Nippon Mining & Metals Corporation manufactures high-performance rolled copper foils with a thickness of 6 micrometers, used in EV battery terminals and printed circuit boards. The company’s GND Series foils deliver a conductivity exceeding 98% IACS and tensile strength of over 420 MPa, enabling superior current flow and heat dissipation in power electronics and renewable energy converters.

Growing Use in Construction and Infrastructure Projects

Rapid urbanization and infrastructure modernization are driving demand for copper and brass flat products in the construction sector. These materials are widely used in roofing, cladding, plumbing, and HVAC systems due to their strength and corrosion resistance. Government-backed infrastructure projects and green building initiatives are supporting market expansion. Rising focus on energy-efficient structures and long-lasting materials continues to promote the adoption of copper and brass sheets and strips across both residential and commercial developments.

- For instance, Aurubis AG supplies architectural-grade copper sheets under its Nordic Products line, producing over 1 million metric tons of copper cathodes annually, which are further processed into flat rolled products for roofing and façade applications.

Expansion in Automotive and Transportation Industry

The automotive industry’s shift toward electric and hybrid vehicles is creating strong growth opportunities for copper and brass flat products. Copper is essential for wiring harnesses, batteries, and motor components, while brass is used in radiators and fittings. Increasing vehicle electrification and demand for lightweight, durable materials are key growth drivers. Advancements in electric mobility, coupled with expanding production of charging infrastructure, are further increasing product consumption across global automotive manufacturing networks.

Key Trends & Opportunities

Rising Focus on Recycling and Sustainable Manufacturing

Sustainability is emerging as a defining trend in the Copper and Brass Flat Products Market. Manufacturers are increasingly using recycled copper and brass to reduce energy consumption and minimize environmental impact. Circular economy initiatives and regulations promoting metal recycling are driving investment in scrap processing facilities. Companies are developing low-carbon production technologies to meet sustainability targets. This trend is creating opportunities for suppliers offering eco-friendly materials to industries seeking compliance with green standards.

- For instance, Aurubis AG operates one of Europe’s largest copper recycling centers in Lünen, Germany, with a large annual capacity for complex secondary raw materials. The facility significantly boosts energy efficiency through waste heat utilization, and recovers valuable metals such as copper, precious metals, nickel, and tin from complex scrap streams, aligning with the company’s multi-metal circular economy model.

Integration of Advanced Manufacturing and Alloy Technologies

Technological advancements in rolling, casting, and alloy development are transforming the copper and brass flat products industry. Innovations such as continuous casting, surface finishing, and alloy enhancement improve product strength, conductivity, and corrosion resistance. The adoption of digital monitoring and automation in production lines ensures high precision and cost efficiency. These advancements are enabling manufacturers to cater to specialized applications in aerospace, electronics, and energy, expanding the market’s technological and commercial potential.

- For instance, Lebronze Alloys produces high-performance copper and nickel alloys using an integrated production chain that includes continuous and semi-continuous casting. Its proprietary CuNi14Al2 alloy is known for its high mechanical properties, strong corrosion resistance, and suitability for demanding applications in aerospace and marine environments.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in copper and zinc prices pose a significant challenge to manufacturers of copper and brass flat products. Market prices are highly sensitive to global demand, mining output, and geopolitical factors. Sudden price surges affect production costs and profit margins, particularly for small and mid-sized producers. Long-term supply contracts and hedging strategies help mitigate risk, but ongoing volatility remains a key concern influencing pricing stability and investment planning across the value chain.

Intense Competition and Substitution Threats

The market faces growing competition from aluminum and composite materials, which offer lower costs and comparable performance in certain applications. Aluminum’s use in electrical and construction sectors has expanded due to its lightweight nature and corrosion resistance. This substitution trend pressures copper and brass producers to innovate and differentiate their products through enhanced quality and technological features. Maintaining competitiveness amid material substitution and price-sensitive markets remains a critical challenge for global manufacturers.

Regional Analysis

North America

North America held a 29% share of the Copper and Brass Flat Products Market in 2024. The region’s growth is driven by strong demand from electrical, construction, and HVAC industries. The United States leads consumption due to large-scale infrastructure modernization and renewable energy investments. Expansion in electric vehicle manufacturing and electronics production further boosts copper usage. Brass flat products are gaining traction in plumbing, decorative, and industrial applications. Ongoing upgrades in energy transmission and the presence of leading manufacturers continue to strengthen the regional market outlook.

Europe

Europe accounted for a 26% share of the Copper and Brass Flat Products Market in 2024. The region’s demand is fueled by a mature construction sector, automotive electrification, and renewable energy integration. Countries such as Germany, Italy, and France are key producers and consumers, supported by established manufacturing infrastructure. EU sustainability regulations are promoting the use of recycled copper and brass in industrial production. Investments in smart grids and green buildings are creating steady opportunities. The region remains a technology-driven market emphasizing material efficiency and circular economy practices.

Asia-Pacific

Asia-Pacific dominated the Copper and Brass Flat Products Market in 2024, capturing a 36% market share. Rapid industrialization, infrastructure development, and strong manufacturing output in China, India, and Japan are driving demand. The region benefits from extensive production capacities and expanding export networks. Copper consumption is rising in power distribution, construction, and electronics manufacturing. Brass flat products are increasingly used in plumbing and architectural applications. Growing urbanization, investments in renewable energy projects, and rising automotive production continue to position Asia-Pacific as the key growth hub for copper and brass products.

Latin America

Latin America accounted for a 5% share of the Copper and Brass Flat Products Market in 2024. The region’s demand is supported by mining expansion, construction projects, and growth in electrical equipment manufacturing. Brazil, Chile, and Mexico are the primary markets, with Chile being a major copper producer supplying global industries. Increasing investments in renewable energy and transportation infrastructure are promoting the use of copper-based materials. Local manufacturing is gradually expanding, supported by favorable trade policies and regional integration efforts aimed at strengthening the metals processing sector.

Middle East & Africa

The Middle East & Africa region held a 4% market share in the Copper and Brass Flat Products Market in 2024. Growth is driven by infrastructure development, construction projects, and energy sector investments. The Gulf Cooperation Council (GCC) countries are leading adopters due to rapid urban expansion and industrial diversification. In Africa, rising electrification efforts and manufacturing initiatives are boosting copper and brass consumption. Governments are promoting local metal processing industries to reduce import dependency. Continued infrastructure modernization and renewable energy investments are expected to sustain market expansion across the region.

Market Segmentations:

By Wood Type

- Log wood

- Wood chips

- Pellets

- Others

By End Use

- Food services

- Power distribution

- Others

By Distribution Channel

- Hypermarkets and supermarkets

- Specialty stores

- E-commerce

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Copper and Brass Flat Products Market features key players such as Aurubis AG, Wieland-Werke AG, KME Group, Mitsubishi Materials Corporation, JX Nippon Mining & Metals Corporation, Olin Brass, Lebronze Alloys, Nippon Shindo Co., Ltd., Mueller Industries, Inc., and PMX Industries, Inc. These companies lead through advanced manufacturing technologies, strong global supply chains, and diversified product portfolios serving electrical, construction, and industrial sectors. Market leaders focus on sustainability by integrating recycled materials and adopting energy-efficient production methods. Strategic mergers, capacity expansions, and geographic diversification enhance their competitiveness. Increasing demand for high-performance alloys and precision-engineered products is encouraging innovation in rolling, surface finishing, and quality control. Companies are also strengthening regional distribution networks and digital supply platforms to improve customer reach and operational efficiency, while ongoing R&D investment continues to drive material performance and application-specific product development across end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aurubis AG

- Wieland-Werke AG

- KME Group

- Mitsubishi Materials Corporation

- JX Nippon Mining & Metals Corporation

- Olin Brass (Global Brass and Copper Holdings, Inc.)

- Lebronze Alloys

- Nippon Shindo Co., Ltd.

- Mueller Industries, Inc.

- PMX Industries, Inc.

Recent Developments

- In May 2025, KME Group launched the KupferDigital 2 initiative as a research project focused on digitizing the copper lifecycle to enhance efficiency and sustainability.

- In May 2025, KME Group confirmed an annual copper tube output of 140,000 metric tons, meeting ASTM B88 standards and serving HVAC and plumbing industries across Europe, Asia, and North America.

- In April 2025, Wieland Group began construction on a major expansion of its East Alton brass mill in Illinois, targeting enhanced production of copper alloy components for EV and renewable energy markets.

- In October 2024, Wieland-Werke AG acquired Morgan Bronze Products (Lake Zurich, Illinois), adding precision-machined copper/alloy parts such as bushings, washers, and custom components to its portfolio.

Report Coverage

The research report offers an in-depth analysis based on Wood Type, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand from electrical and construction industries.

- Increasing use of copper and brass in renewable energy systems will drive long-term adoption.

- Manufacturers will focus on developing high-strength and corrosion-resistant flat products.

- Automation and digital process control will enhance production efficiency and product quality.

- Recycling initiatives will expand to meet sustainability and circular economy targets.

- Asia-Pacific will remain the fastest-growing region due to industrial and infrastructural growth.

- Demand for precision-engineered components will rise in automotive and electronics applications.

- Strategic mergers and capacity expansions will strengthen the global supply chain.

- Technological innovations in alloy composition will support performance optimization.

- Increasing emphasis on eco-friendly manufacturing will shape future product development and investments.