Market Overview

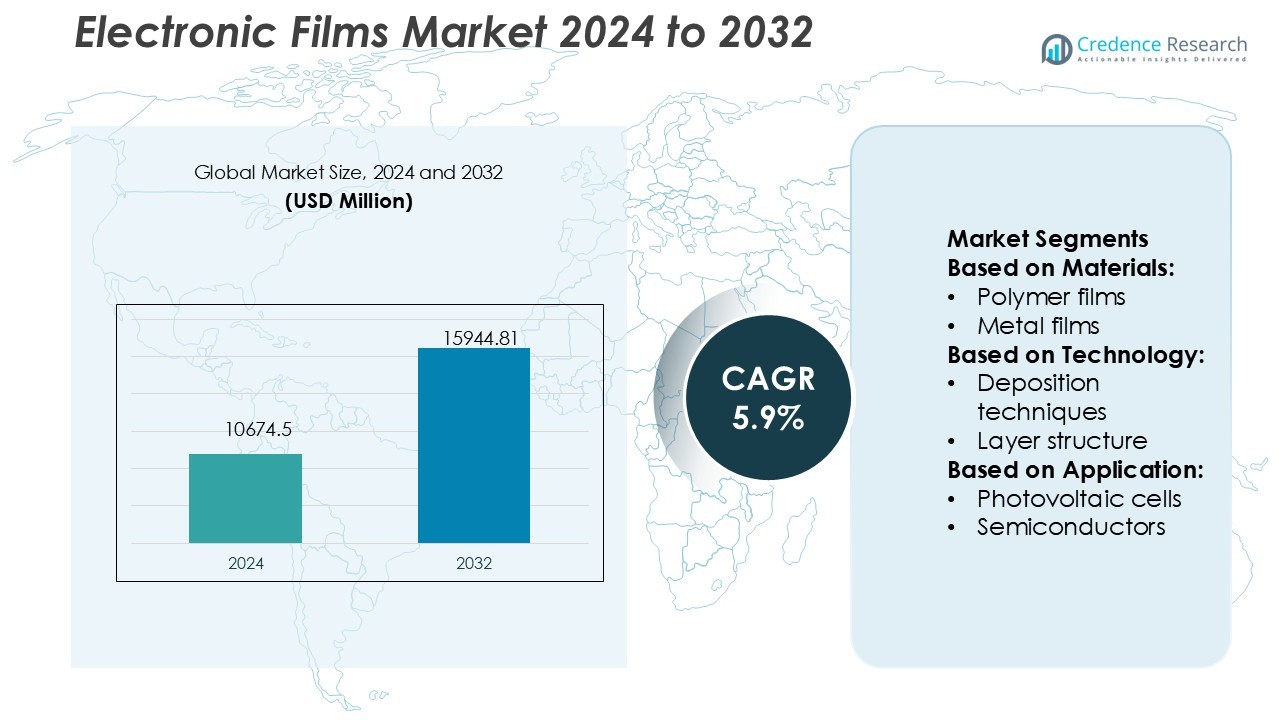

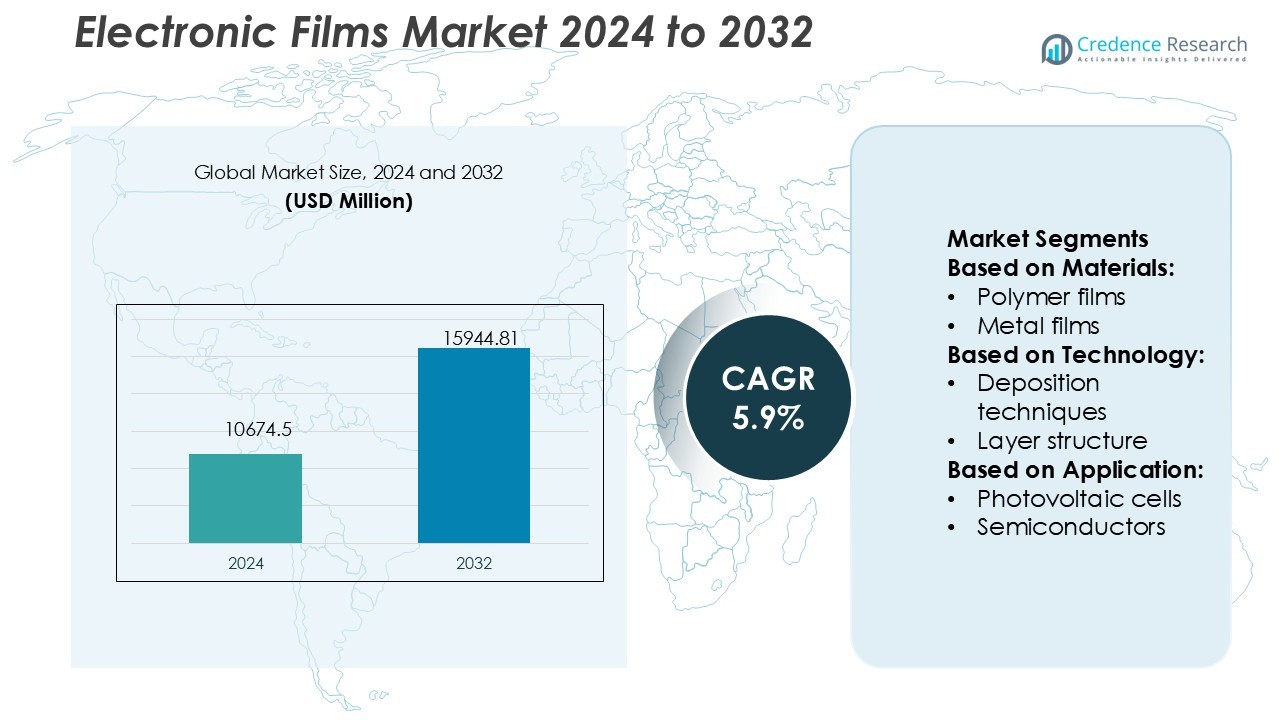

Electronic Films Market size was valued USD 10674.5 million in 2024 and is anticipated to reach USD 15944.81 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Films Market Size 2024 |

USD 10674.5 Million |

| Electronic Films Market, CAGR |

5.9% |

| Electronic Films Market Size 2032 |

USD 15944.81 Million |

The Electronic Films Market is dominated by leading companies such as Teijin Ltd., LG Chem, Toyobo Co., Ltd., KOLON Industries, Inc., 3M, Toray International, Inc., Hyosung Chemical, Mitsubishi Chemical Corp., Sumitomo Chemical Co., Ltd., and Nitto Denko Corp. These players focus on developing high-performance films with enhanced flexibility, conductivity, and transparency to cater to applications in semiconductors, displays, and photovoltaic cells. Asia Pacific leads the global market with a 36% share, driven by robust electronics manufacturing in China, Japan, and South Korea. The region’s technological expertise, expanding renewable energy projects, and growing demand for flexible devices further reinforce its leadership in electronic film production and innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electronic Films Market was valued at USD 10674.5 million in 2024 and is projected to reach USD 15944.81 million by 2032, growing at a CAGR of 5.9% during the forecast period.

- Market growth is driven by rising demand for flexible displays, semiconductors, and photovoltaic applications that require high-performance conductive and protective films.

- Ongoing trends include the development of eco-friendly, recyclable materials and the growing use of electronic films in printed electronics and smart devices.

- The competitive landscape is dominated by major players focusing on product innovation, R&D investments, and strategic expansion to strengthen market presence.

- Asia Pacific leads with a 36% market share, supported by strong electronics manufacturing in China, Japan, and South Korea, while the semiconductor segment accounts for the largest share due to rapid technological advancements and increasing global chip production.

Market Segmentation Analysis:

By Materials

Polymer films dominate the Electronic Films Market, holding a 46% market share in 2024. Their flexibility, lightweight properties, and superior electrical insulation make them essential in displays, solar cells, and flexible circuits. Rising demand for polyethylene terephthalate (PET) and polyimide films in high-performance electronics further drives growth. Manufacturers are focusing on sustainable polymer blends and recyclable materials to meet environmental regulations and improve performance efficiency. Metal and oxide films continue to gain relevance for specialized applications requiring higher conductivity and thermal resistance.

- For instance, Teijin commissioned a new production line for its Panlite® polycarbonate sheets and films that can produce 1,350 tonnes annually at thicknesses between 100 and 500 microns.

By Technology

Deposition techniques account for the largest share of 48% in the Electronic Films Market due to their critical role in enhancing surface functionality and uniform coating. Physical vapor deposition (PVD) and chemical vapor deposition (CVD) are widely adopted for precise thickness control and improved electrical properties. These methods enable superior film adhesion and durability in semiconductors and photovoltaic applications. The increasing miniaturization of electronic components and the rising need for high-density circuitry continue to drive innovation in deposition and multi-layer coating technologies.

- For instance, Toyobo developed the “SC836-20” PET film with a thickness of just 20 µm for shrink-label applications, certified under APR Design® for Recyclability.They also offer CYCLE CLEAN® films at 12 µm thickness, containing 80 % post-consumer recycled content.

By Application

Displays lead the Electronic Films Market with a 41% share in 2024, driven by demand from smartphones, OLED TVs, and automotive screens. High-transparency and anti-glare electronic films enhance visual quality and device longevity. Manufacturers are integrating flexible substrates to support foldable and wearable device trends. Growth in smart windows and printed electronics segments is accelerating as IoT and energy-efficient technologies advance. Expanding applications in photovoltaic cells and anti-static films further strengthen market prospects, supported by increasing investments in renewable energy and display innovations.

Key Growth Drivers

Rising Demand for Flexible Electronic Devices

The rapid growth of flexible electronic devices is a major driver of the Electronic Films Market. Smartphones, foldable displays, and wearable sensors require lightweight, flexible, and durable films for protection and conductivity. Manufacturers are investing in advanced polymer-based films to improve flexibility and transparency while maintaining electrical performance. The increasing adoption of flexible OLEDs and e-paper displays in consumer electronics and automotive sectors is accelerating film demand, strengthening the market’s position in emerging technology applications.

- For instance, KOLON’s CPI® (colorless polyimide) film achieves optical transmittance above 90 % at 550 nm, while maintaining a coefficient of thermal expansion (CTE) near 10 ppm/°C.

Expansion of Renewable Energy and Photovoltaic Applications

The growth of renewable energy, particularly solar power, is driving electronic film usage in photovoltaic cells. Electronic films enhance light absorption, protect cells from environmental stress, and improve overall efficiency. Technological advances in thin-film solar cells and transparent conductive films are improving energy yield and durability. With government incentives supporting clean energy adoption, manufacturers are scaling production capacities, leading to wider use of advanced films in solar panels and energy storage applications.

- For instance, 3M’s Transparent Conductor Film (3M23-MS) features a copper mesh design on a PET substrate, achieving sheet resistance below 0.05 Ω per square and enabling continuous power handling up to 50 W.

Advancements in Semiconductor Manufacturing

The semiconductor industry’s shift toward miniaturization and high-performance devices is fueling the demand for precision-engineered electronic films. These films are crucial in insulation, dielectric layers, and wafer processing. The rising need for efficient thermal management and contamination control has encouraged the development of ultra-thin films with superior thermal stability and chemical resistance. As semiconductor fabs expand globally, film suppliers are innovating to meet stringent performance and purity standards.

Key Trends & Opportunities

Growing Adoption of Smart Windows and Display Technologies

Smart windows and advanced display technologies are emerging as key growth areas for electronic films. Films with electrochromic and photochromic properties are gaining traction in automotive, architectural, and aerospace industries. Manufacturers are integrating functional coatings that offer self-cleaning, UV protection, and energy efficiency. This trend aligns with sustainability initiatives and growing consumer interest in energy-saving materials.

- For instance, Lumirror® U8M film is a co-extruded, three-layer structure achieving tensile strength of 36,300 lb/in² in machine direction and elongation of 130 % while maintaining low haze.

Shift Toward Sustainable and Recyclable Materials

Sustainability is a defining trend in the Electronic Films Market. Companies are developing biodegradable, recyclable, and solvent-free films to reduce environmental impact. Bio-based polymer films are becoming popular among manufacturers aiming to meet regulatory compliance and achieve carbon neutrality. This shift presents new opportunities for innovation and differentiation in green electronics manufacturing.

- For instance, Nichigo G-Polymer™ BVE8049P, a vinyl alcohol copolymer barrier resin, was certified by Institute cyclos-HTP GmbH as recyclable in PE-based multilayer films when its loading is ≤ 5 wt % (i.e., ≤ 5 parts in 100).

Increased Investment in Printed Electronics

The rise of printed electronics creates strong opportunities for film manufacturers. Electronic films enable flexible circuitry, sensors, and RFID components for various applications. The low-cost, scalable production of printed devices supports IoT and wearable innovations. As research advances in conductive inks and flexible substrates, the integration of films in next-generation printed products continues to expand.

Key Challenges

High Manufacturing Costs and Complex Processes

The production of high-performance electronic films involves costly materials, precision equipment, and cleanroom operations. Achieving uniform thickness, conductivity, and defect-free surfaces requires advanced manufacturing setups. Small and medium manufacturers often face financial constraints that limit scalability, affecting market competitiveness. Cost optimization without compromising performance remains a significant industry challenge.

Environmental and Recycling Concerns

Disposal of non-recyclable polymer and metal films poses environmental challenges. Many films contain mixed materials that are difficult to separate during recycling. Stringent environmental regulations are pressuring manufacturers to adopt eco-friendly alternatives. Developing sustainable film solutions that maintain high electrical and mechanical properties while ensuring recyclability continues to challenge producers globally.

Regional Analysis

North America

North America holds a 32% market share in the Electronic Films Market, driven by strong demand from the semiconductor and consumer electronics sectors. The United States leads regional growth with major investments in flexible displays, solar panels, and printed electronics. Companies in the region are adopting advanced deposition and coating technologies to enhance film durability and conductivity. The presence of leading manufacturers and a well-developed R&D ecosystem supports continuous innovation. Additionally, government initiatives promoting renewable energy and electric vehicles further strengthen the demand for high-performance electronic films across industrial applications.

Europe

Europe accounts for a 27% share of the Electronic Films Market, supported by the region’s emphasis on sustainability and green manufacturing practices. Countries such as Germany, France, and the United Kingdom are leading producers of semiconductor and photovoltaic films. The growing focus on eco-friendly, recyclable materials aligns with the European Green Deal objectives, promoting innovation in biodegradable film solutions. Demand from the automotive and energy sectors is also rising, with electronic films being widely integrated into EV batteries and solar modules. Regional firms are also expanding collaborations to enhance flexible electronics production capabilities.

Asia Pacific

Asia Pacific dominates the Electronic Films Market with a 36% market share, led by China, Japan, and South Korea. The region’s strong electronics manufacturing base and rapid industrialization are major growth drivers. High adoption of smartphones, flexible displays, and photovoltaic panels is boosting film consumption. Japan and South Korea remain technology leaders in polymer and metal oxide film production, while China’s large-scale solar and semiconductor industries ensure steady demand. Supportive government policies and expanding investments in 5G and IoT applications further reinforce Asia Pacific’s leadership position in the global market.

Latin America

Latin America holds a 3% share of the Electronic Films Market, showing steady growth driven by the increasing adoption of renewable energy and consumer electronics. Brazil and Mexico are the leading contributors, supported by industrial modernization and expanding solar infrastructure. Investments in flexible and photovoltaic films are gaining traction, particularly within emerging electronics assembly sectors. The growing middle-class population and rising demand for energy-efficient technologies are also contributing to market expansion. However, limited local manufacturing capabilities and dependency on imports may restrict faster growth in the near term.

Middle East & Africa

The Middle East & Africa region accounts for a 2% share of the Electronic Films Market, primarily supported by renewable energy initiatives and smart infrastructure projects. Countries such as the UAE, Saudi Arabia, and South Africa are adopting electronic films for solar panels, smart windows, and display systems. Increasing investments in data centers, automation, and sustainable construction are further enhancing regional demand. Although market penetration remains low, rapid digital transformation and government-backed green energy programs are expected to create long-term opportunities for electronic film manufacturers across the region.

Market Segmentations:

By Materials:

- Polymer films

- Metal films

By Technology:

- Deposition techniques

- Layer structure

By Application:

- Photovoltaic cells

- Semiconductors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electronic Films Market is highly competitive, featuring key players such as Teijin Ltd., LG Chem, Toyobo Co., Ltd., KOLON Industries, Inc., 3M, Toray International, Inc., Hyosung Chemical, Mitsubishi Chemical Corp., Sumitomo Chemical Co., Ltd., and Nitto Denko Corp. The Electronic Films Market is characterized by intense competition and continuous innovation across product types and applications. Manufacturers are focusing on enhancing film performance through improved conductivity, flexibility, and thermal resistance to meet the needs of advanced electronics and renewable energy systems. Strategic investments in research and development are driving innovations in thin-film technology, enabling applications in semiconductors, flexible displays, and photovoltaic modules. Companies are also prioritizing sustainability by developing recyclable and bio-based materials to comply with environmental regulations. Expanding production capacities and forming technology-driven partnerships are helping firms strengthen global supply networks. The market’s competitiveness is further shaped by rapid technological advancements, evolving consumer electronics demand, and the growing integration of smart materials across multiple industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, SNF announced that it has signed agreements to acquire Ace Fluid Solutions and PfP Industries. The company aims to offer advanced solutions to its upstream oil and gas customers. PfP Industries specializes in slurry friction reducer technologies and related.

- In May 2024, Clariant AG launched a range of advanced solutions at NPE 2024 to significantly decrease the environmental impact of plastics, especially in specialty and high-performance films.

- In July 2023, Notpla partnered with home care and detergent MACK and launched a sustainable clothes detergent sachet, marking Notpla’s first commercial application of its film material in a refill cleaning product line.

- In January 2023, Covestro and LANXESS joined forces to greener raw materials, resulting in a yearly decrease of up to 120,000 tons in CO2 footprint.

Report Coverage

The research report offers an in-depth analysis based on Materials, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for flexible and lightweight films will rise with the growth of wearable electronics.

- Technological advancements will improve film durability, conductivity, and optical clarity.

- Adoption of sustainable and recyclable materials will increase due to strict environmental regulations.

- Expansion in solar energy projects will drive the use of films in photovoltaic applications.

- Growth in semiconductor manufacturing will boost demand for high-performance dielectric films.

- Development of printed and flexible electronics will create new market opportunities.

- Integration of smart and functional coatings will enhance product performance and versatility.

- Rising investments in R&D will accelerate innovation in polymer and metal oxide films.

- Asia Pacific will continue to dominate production due to its strong electronics base.

- Strategic collaborations and mergers will strengthen global supply chains and market competitiveness.