Market Overview

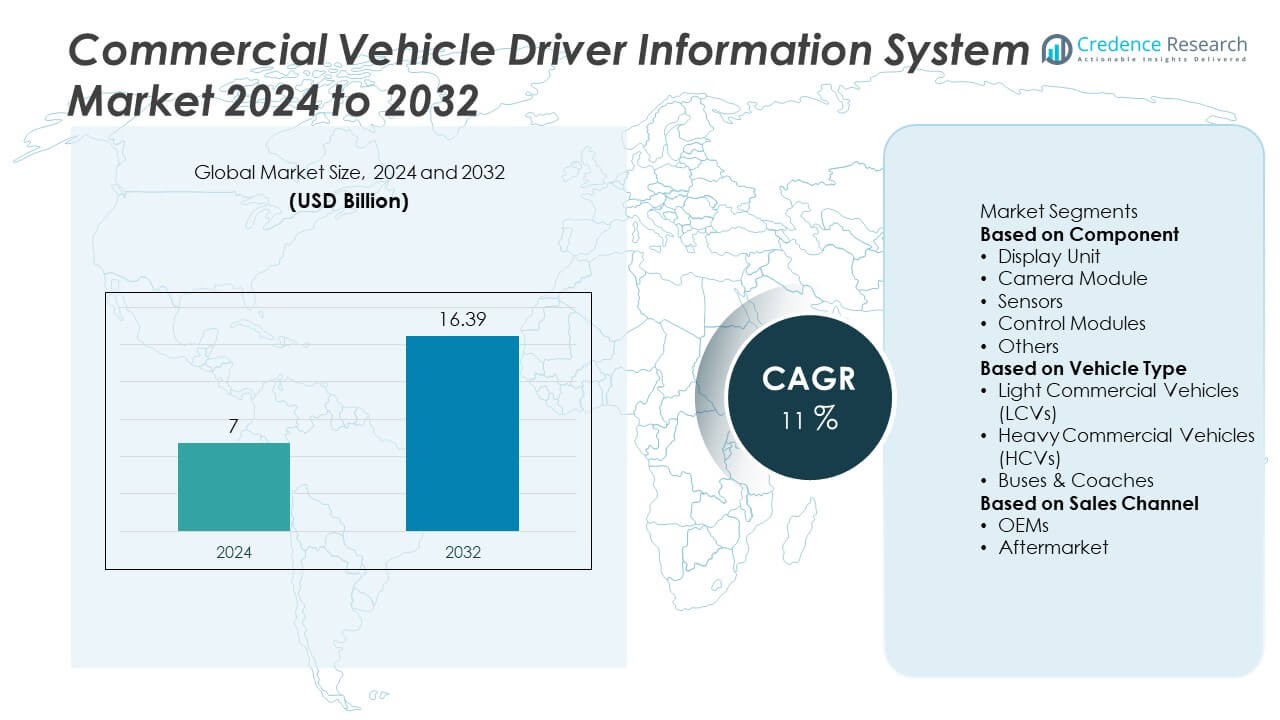

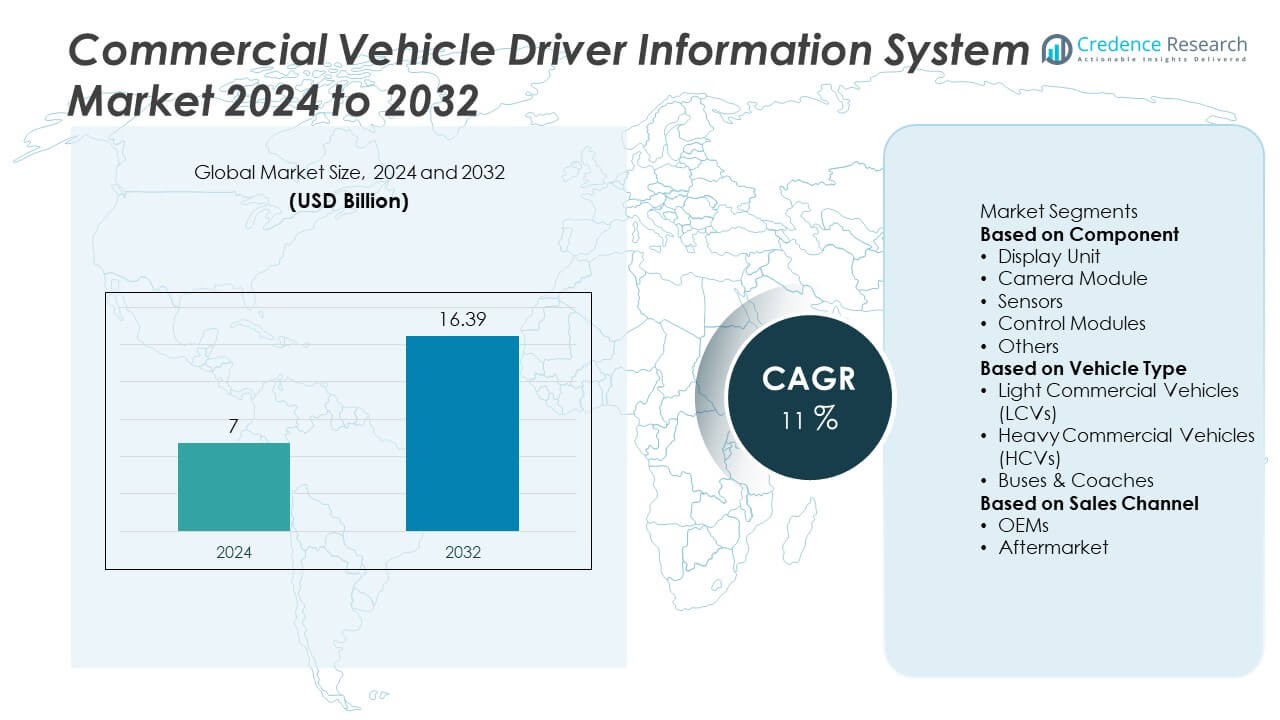

The Global Commercial Vehicle Driver Information System Market was valued at USD 7 billion in 2024 and is projected to reach USD 16.39 billion by 2032, growing at a CAGR of 11 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Vehicle Driver Information System Market Size 2024 |

USD 7 Billion |

| Commercial Vehicle Driver Information System Market, CAGR |

11 % |

| Commercial Vehicle Driver Information System Market Size 2032 |

USD 16.39 Billion |

The commercial vehicle driver information system market is led by key players including Panasonic Corporation, Renesas Electronics Corporation, Valeo, Continental AG, Texas Instruments Incorporated, Magna International Inc., Autoliv Inc., Robert Bosch GmbH, NXP Semiconductors, and DENSO Corporation. These companies focus on delivering advanced telematics, display systems, and driver monitoring solutions to improve fleet safety and operational efficiency. North America held the largest share with 36% in 2024, supported by strict ELD regulations and high adoption of connected fleets. Europe followed with 28% share, driven by ADAS mandates and Vision Zero initiatives, while Asia-Pacific captured 25% share, fueled by rapid e-commerce growth and rising logistics digitization in China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The commercial vehicle driver information system market was valued at USD 7 billion in 2024 and is projected to reach USD 16.39 billion by 2032, growing at a CAGR of 11%.

- Rising adoption of connected vehicle solutions, telematics, and driver monitoring systems is driving market demand across logistics, public transport, and delivery fleets.

- Key trends include integration of AI-driven predictive analytics, expansion of ADAS features such as lane departure warning and collision alerts, and growing use of high-resolution display units and sensors.

- The market is competitive with Panasonic Corporation, Renesas Electronics Corporation, Valeo, Continental AG, and Robert Bosch GmbH focusing on OEM partnerships, AI-based solutions, and cost-efficient systems for fleet operators.

- North America led with 36% share in 2024, followed by Europe with 28% and Asia-Pacific with 25%, while light commercial vehicles held over 45% share, dominating the market by vehicle type.

Market Segmentation Analysis:

By Component

Display units dominated the commercial vehicle driver information system market, accounting for over 35% share in 2024. Their demand is driven by increasing adoption of digital dashboards, advanced infotainment systems, and navigation displays in commercial fleets. Fleet operators prefer integrated display systems that provide real-time vehicle diagnostics, fuel data, and route information to improve operational efficiency. The rise of connected vehicles and smart telematics solutions is further boosting adoption. Growing use of high-resolution TFT and LCD panels with touch control functionality is supporting technological upgrades across both light and heavy commercial vehicles.

- For instance, Panasonic Automotive has integrated a 12.3-inch TFT-LCD full-display instrument cluster into vehicles like the Mazda CX-70. In more advanced concepts, platforms such as the SPYDR cockpit domain controller are capable of driving multiple displays, including those with 1920 x 720 resolution, to simultaneously visualize navigation, safety, and diagnostic information.

By Vehicle Type

Light commercial vehicles (LCVs) led the market with over 45% share in 2024, supported by high production volumes and rising demand for last-mile delivery solutions. The growth of e-commerce and urban logistics has driven adoption of driver information systems in LCV fleets to optimize routes and monitor driver performance. Advanced telematics, driver assistance alerts, and fuel efficiency monitoring features are key contributors to uptake. Fleet managers in logistics and transportation sectors are investing in digital dashboards and camera-based monitoring systems to ensure regulatory compliance and minimize vehicle downtime.

- For instance, Mahindra’s iMAXX telematics solution is equipped on its BS6 commercial vehicles, including LCVs, to support fleet management with features like real-time route monitoring, vehicle health tracking, and remote diagnostics. Mahindra supplies both electric and internal combustion engine commercial vehicles to companies within India’s e-commerce sector.

By Sales Channel

OEMs held the largest share, representing over 70% of the market in 2024, as manufacturers increasingly integrate driver information systems during production. OEM-installed systems offer seamless connectivity, warranty coverage, and compatibility with vehicle electronic architectures, making them the preferred choice for fleet operators. The shift toward factory-fitted telematics, ADAS features, and smart infotainment systems supports growth in this channel. The aftermarket segment continues to grow at a steady pace, driven by retrofitting solutions for older fleets and small operators seeking cost-effective upgrades for enhanced driver monitoring and safety.

Key Growth Drivers

Growing Demand for Connected Vehicle Solutions

Fleet operators are rapidly adopting connected vehicle technologies to enhance operational efficiency and driver safety. Real-time telematics, route optimization, and remote diagnostics provided through driver information systems reduce fuel costs and downtime. The growing penetration of 4G/5G networks supports seamless data transfer and live monitoring. This trend is particularly strong in logistics and transportation, where time-sensitive deliveries require accurate vehicle tracking and performance data, driving adoption of integrated display units, control modules, and camera-based monitoring systems across commercial vehicle fleets.

- For instance, Geotab Inc. and Mercedes-Benz USA launched an OEM-integrated platform in June 2025 that streams a wide range of rich, high-quality data points—including live engine diagnostics, route history, fuel consumption, and EV charging status—from eligible Mercedes-Benz passenger cars and vans, such as the Sprinter, directly into the MyGeotab dashboard, enabling enhanced fleet visibility and predictive maintenance.

Regulatory Push for Driver Safety Compliance

Governments worldwide are mandating the integration of driver monitoring and assistance systems in commercial vehicles. Regulations around electronic logging devices (ELDs), advanced driver-assistance systems (ADAS), and driver fatigue monitoring are fueling demand. Compliance requirements encourage fleet operators to equip vehicles with camera modules, sensors, and control units for enhanced safety. These regulations are especially prominent in North America and Europe, where strict road safety norms and commercial fleet oversight programs are in place, ensuring long-term market growth for driver information solutions.

- For instance, following the U.S. ELD mandate, Platform Science acquired Trimble’s global transportation telematics business units in February 2025. This supported numerous commercial trucks in North America with ELD-compliant telematics hardware and safety analytics modules. The technology enables electronic hours-of-service tracking and automated safety alerts for regulatory compliance audits.

Rising E-commerce and Urban Logistics Needs

The boom in e-commerce and last-mile delivery services is significantly increasing demand for light commercial vehicles equipped with advanced driver information systems. Fleet managers require real-time data on vehicle health, driver behavior, and delivery schedules to ensure timely service and lower operational costs. Driver information systems offer route planning, fuel monitoring, and predictive maintenance alerts that enhance productivity. This surge in urban freight movement drives the adoption of digital dashboards, telematics platforms, and integrated sensor solutions across large and small logistics fleets.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

The market is witnessing the adoption of AI-powered analytics to improve decision-making and driver performance. Predictive maintenance powered by machine learning reduces vehicle downtime and maintenance costs. Advanced driver monitoring systems use AI to detect fatigue, distraction, or unsafe driving patterns in real time. This creates opportunities for technology providers to deliver smart solutions that improve safety compliance and operational efficiency. Fleet operators benefit from data-driven insights that enhance vehicle utilization and optimize total cost of ownership.

- For instance, Tesla began rolling out its Full Self-Driving (Supervised) v13 to some early access users with Hardware 4 vehicles in December 2024, but a broader public release was delayed. The company’s Q2 2025 Safety Report noted that vehicles using Autopilot technology experienced one crash for every 6.69 million miles driven, compared to one crash every 963,000 miles for those not using the technology.

Shift Toward Advanced Camera and Sensor Technology

The use of camera modules and high-precision sensors is expanding rapidly as ADAS features become standard in commercial vehicles. Technologies such as lane departure warning, blind-spot detection, and collision avoidance are integrated into driver information systems. These upgrades improve driver awareness, reduce accident risk, and comply with tightening global safety standards. Suppliers are focusing on compact, cost-effective sensor solutions that can be deployed across light and heavy commercial vehicles, creating opportunities for wider market penetration.

- For instance, Continental has produced over 200 million radar sensors for vehicle OEMs globally, with modern systems capable of long-range detection up to 300 meters, which, when used in a network of multiple units, enables 360-degree monitoring to support advanced driver-assistance systems such as lane-keeping, blind-spot detection, and collision mitigation.

Key Challenges

High Installation and Maintenance Costs

The cost of installing advanced driver information systems, including cameras, sensors, and telematics units, remains high for small fleet operators. Ongoing maintenance, software updates, and subscription fees for connected services add to total ownership costs. This can discourage adoption, particularly in price-sensitive markets. Manufacturers and solution providers must offer scalable and affordable packages to encourage adoption among small and mid-sized logistics companies and independent operators.

Data Security and Privacy Concerns

Driver information systems collect large volumes of data, including vehicle location, driver behavior, and fleet operations, raising cybersecurity and privacy concerns. Unauthorized access or data breaches can compromise sensitive operational information. Meeting compliance with data protection regulations such as GDPR and ensuring secure cloud connectivity remains a challenge for solution providers. Continuous investment in encryption, secure data storage, and cybersecurity measures is required to build trust among fleet operators and drivers.

Regional Analysis

North America

North America dominated the commercial vehicle driver information system market with 36% share in 2024, supported by strict regulatory mandates for driver monitoring and electronic logging devices (ELDs). The U.S. leads adoption, driven by Federal Motor Carrier Safety Administration (FMCSA) compliance requirements and high penetration of connected fleets. Demand is further supported by strong logistics and e-commerce sectors that rely on telematics and real-time monitoring to improve efficiency. Canada is also expanding investments in smart fleet management technologies. The region benefits from advanced infrastructure, widespread 4G/5G connectivity, and strong presence of leading OEMs and telematics providers.

Europe

Europe accounted for 28% share in 2024, driven by EU safety regulations and growing adoption of ADAS in commercial vehicles. Countries like Germany, France, and the U.K. are leading implementation of driver fatigue detection, lane departure warning, and collision avoidance systems. The European Union’s Vision Zero initiative and focus on reducing road fatalities encourage integration of advanced camera and sensor systems. The region also benefits from increasing electrification of commercial fleets, supporting adoption of digital dashboards and predictive analytics solutions for vehicle monitoring. Collaborative efforts between OEMs and technology providers strengthen market penetration across Europe.

Asia-Pacific

Asia-Pacific represented 25% share in 2024 and is the fastest-growing region due to rapid expansion of e-commerce, manufacturing, and logistics sectors in China, India, and Southeast Asia. Rising adoption of telematics and digital fleet management platforms is driven by the need to improve delivery efficiency and reduce operating costs. Governments are introducing safety mandates and driver assistance requirements, particularly in Japan and South Korea. Domestic OEMs are partnering with tech firms to integrate display units and sensor-based driver monitoring systems. Growing demand for LCVs in urban logistics further boosts market opportunities in the region.

Middle East & Africa

The Middle East & Africa captured 6% share in 2024, supported by infrastructure development projects and growing demand for commercial transport solutions. Gulf countries like Saudi Arabia and UAE are adopting telematics and monitoring systems to enhance fleet productivity and comply with road safety regulations. Investments in camera-based surveillance and route optimization systems are rising as governments focus on reducing accident rates and improving logistics efficiency. In Africa, adoption remains slower but is growing steadily, with South Africa and Kenya leading deployments in mining, oil and gas, and logistics sectors to improve vehicle utilization and driver safety.

Latin America

Latin America held 5% share in 2024, with Brazil and Mexico leading adoption of driver information systems across logistics and public transportation sectors. Rising concerns over road safety and theft prevention are driving the use of camera modules, GPS tracking, and driver behavior monitoring solutions. Government regulations supporting electronic logging and vehicle tracking are gradually strengthening. Fleet operators are investing in affordable aftermarket solutions to retrofit existing vehicles. Although economic volatility limits rapid growth, increased digitalization of logistics and cross-border trade activities is expected to drive steady demand for telematics and real-time monitoring technologies.

Market Segmentations:

By Component

- Display Unit

- Camera Module

- Sensors

- Control Modules

- Others

By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the commercial vehicle driver information system market is shaped by leading players such as Panasonic Corporation, Renesas Electronics Corporation, Valeo, Continental AG, Texas Instruments Incorporated, Magna International Inc., Autoliv Inc., Robert Bosch GmbH, NXP Semiconductors, and DENSO Corporation. These companies focus on developing advanced display units, camera modules, and sensor technologies that improve driver safety, compliance, and fleet efficiency. Strategic initiatives include collaborations with OEMs, partnerships with telematics providers, and investment in AI-powered driver monitoring solutions. Many players are prioritizing compact, energy-efficient, and cost-effective systems to meet rising demand from both light and heavy commercial vehicle segments. The market is highly competitive, with continuous innovation in ADAS integration, connectivity, and predictive analytics to meet regulatory requirements and customer expectations for enhanced driver awareness and vehicle performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic Corporation

- Renesas Electronics Corporation

- Valeo

- Continental AG

- Texas Instruments Incorporated

- Magna International Inc.

- Autoliv Inc.

- Robert Bosch GmbH

- NXP Semiconductors

- DENSO Corporation

Recent Developments

- In September 2025, Valeo showcased its upgraded Driver Monitoring System (DMS) for commercial vehicles at the IAA Mobility event. The system uses an interior-facing camera and AI-enhanced software for real-time driver attention monitoring, gaze tracking, and life function detection, supporting safety and autonomous transitions.

- In January 2025, Honda and Renesas announced a strategic collaboration on a new high-performance System-on-Chip (SoC) platform for Software-Defined Vehicles (SDVs), integrating fifth-generation R-Car X5 SoC and AI accelerators. The platform targets enhanced driver information and automation features with strong power efficiency for 2026 deployments.

- In January 2025, STRADVISION partnered with Renesas to demonstrate ADAS driver monitoring and 3D perception system integration (based on Renesas R-Car V4H) at CES 2025. This solution bridges ADAS and in-vehicle infotainment (IVI) with production targeted for 2026.

- In July 2024, Valeo advanced its Driver Monitoring System (DMS) by integrating Texas Instruments (TI) AM62 SoC for onboard processing and implementing proprietary computer vision algorithms to detect driver drowsiness, distraction, and identity.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered driver monitoring systems will expand to improve safety and compliance.

- Demand for connected telematics platforms will grow to enhance fleet visibility and operational efficiency.

- Integration of predictive maintenance features will reduce downtime and lower operating costs for fleets.

- Use of high-resolution digital display units will increase across light and heavy commercial vehicles.

- Camera-based ADAS features such as lane departure warning and blind-spot detection will become standard.

- OEM-installed driver information systems will dominate as manufacturers integrate them during production.

- Aftermarket retrofitting solutions will grow to upgrade older fleets with modern monitoring systems.

- Asia-Pacific will witness the fastest growth, driven by e-commerce expansion and urban logistics demand.

- Focus on cybersecurity and data privacy will intensify to protect fleet and driver information.

- Partnerships between technology providers and OEMs will accelerate innovation and market penetration globally.