Market Overview:

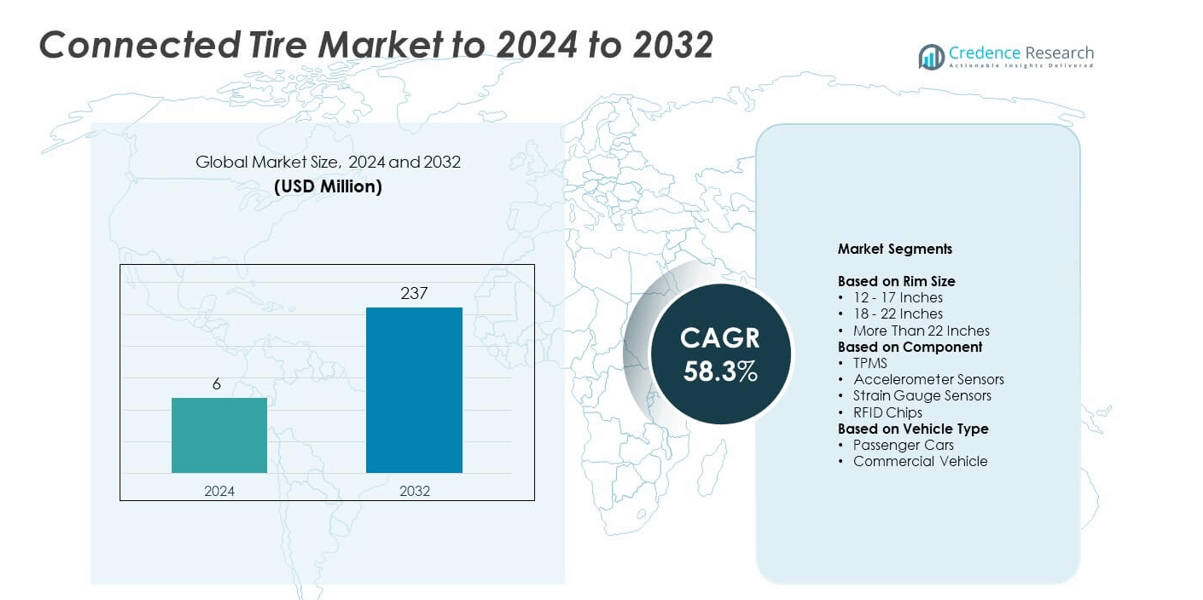

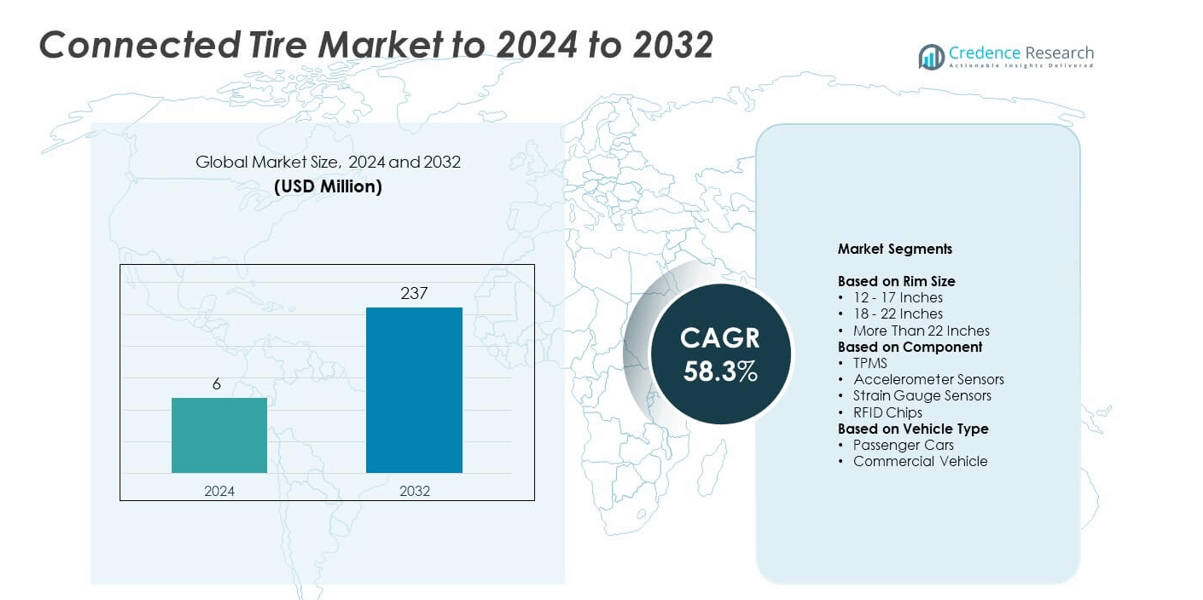

Connected Tire Market size was valued at USD 6 million in 2024 and is anticipated to reach USD 237 million by 2032, at a CAGR of 58.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Tire Market Size 2024 |

USD 6 million |

| Connected Tire Market, CAGR |

58.3% |

| Connected Tire Market Size 2032 |

USD 237 million |

The connected tire market is led by major players such as Bridgestone Corporation, Continental AG, Michelin, The Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Sumitomo Rubber Industries Ltd., and Nokian Tyres plc. These companies dominate through advancements in tire sensor technology, IoT integration, and data-driven mobility solutions. Europe held the largest regional share of 36% in 2024, supported by strong automotive manufacturing and regulatory standards for tire monitoring. North America followed with a 30% share, driven by high adoption of connected vehicle technologies. Asia Pacific accounted for 29%, fueled by rapid vehicle production and smart mobility initiatives.

Market Insights

- The connected tire market was valued at USD 6 million in 2024 and is projected to reach USD 237 million by 2032, expanding at a CAGR of 58.3%.

- Growth is driven by the integration of IoT and sensor technologies that enhance tire performance, safety, and predictive maintenance.

- Advancements in AI-based analytics and real-time monitoring platforms are shaping market trends, enabling smarter vehicle connectivity.

- The market is competitive, with global tire manufacturers focusing on partnerships with automotive OEMs and telematics providers to strengthen innovation and product portfolios.

- Europe dominated with a 36% share in 2024, followed by North America at 30% and Asia Pacific at 29%, while the 18–22 inch rim size and TPMS components led product demand globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Rim Size

The 18–22 inches segment dominated the connected tire market with a 46.7% share in 2024. This size range is preferred in mid- to high-end passenger cars and light commercial vehicles due to improved stability, handling, and integration with smart sensors. Growing demand for advanced tire-monitoring systems in premium vehicles supports its dominance. Automakers are increasingly adopting connected tires with embedded sensors in this rim size to enhance real-time performance tracking and predictive maintenance, improving safety and overall driving efficiency.

- For instance, Continental’s ContiPressureCheck Gen-2 sensor works from 0–12 bar and −40 to 120 °C, weighs 26 g, and has a typical battery life of 6 years or 600,000 km.

By Component

The TPMS (Tire Pressure Monitoring System) segment held the largest share of 49.8% in 2024. Its dominance stems from strict regulatory mandates on tire pressure monitoring and increasing consumer awareness about road safety. TPMS sensors provide accurate pressure and temperature data, helping reduce fuel consumption and tire wear. Automakers are integrating TPMS with IoT-based platforms to enable remote diagnostics and maintenance alerts, supporting higher adoption in connected vehicles. The growth in autonomous and electric vehicles further accelerates the demand for advanced TPMS solutions.

- For instance, Sensata (Schrader) reports over 500 million TPMS sensors deployed worldwide, including Bluetooth-enabled units.

By Vehicle Type

The passenger car segment led the connected tire market with a 61.3% share in 2024. Rising production of connected and electric passenger vehicles drives strong demand for intelligent tire technologies. Consumers prefer connected tires for enhanced safety, fuel efficiency, and driving comfort. Manufacturers are equipping passenger cars with real-time monitoring sensors and cloud connectivity for performance optimization. The growing trend of smart mobility and vehicle telematics adoption further strengthens connected tire integration across compact, mid-size, and premium passenger vehicles.

Key Growth Drivers

Integration of IoT and Smart Mobility Solutions

The growing adoption of IoT in automotive systems is a major growth driver. Connected tires equipped with smart sensors collect real-time data on pressure, temperature, and tread depth. Automakers use this information to improve safety, fuel efficiency, and predictive maintenance. The expansion of smart mobility ecosystems and telematics platforms encourages greater use of connected tires in passenger and commercial vehicles, enhancing performance monitoring and reducing operational costs.

- For instance, NIRA Dynamics’ software TPMS (Tire Pressure Indicator) is installed on over 100 million vehicles globally, supplying continuous tyre health data without wheel-mounted sensors.

Rising Demand for Electric and Autonomous Vehicles

The rapid rise of electric and autonomous vehicles is accelerating connected tire adoption. These vehicles require advanced monitoring systems to ensure safety and energy optimization. Connected tires provide data to vehicle control systems for adaptive driving, load balancing, and regenerative braking support. As EV manufacturers focus on vehicle intelligence and predictive maintenance, connected tire integration becomes critical for efficient energy use and improved tire lifespan.

- For instance, Tesla delivered about 1.79 million vehicles in 2024, each equipped with TPMS, underscoring the scale of connected, sensor-rich EVs on the road.

Strict Safety and Emission Regulations

Government regulations mandating tire pressure monitoring systems and emission control are fueling market expansion. Authorities in North America, Europe, and Asia-Pacific are enforcing standards to reduce fuel waste and enhance road safety. These mandates encourage automakers to integrate smart tire systems that provide constant pressure and wear data. Compliance with such regulations supports higher adoption of connected tire technologies across vehicle categories.

Key Trends and Opportunities

Advancements in Real-Time Tire Analytics

Developments in tire sensor analytics are creating strong growth opportunities. Modern connected tires now transmit continuous data to cloud-based platforms for real-time diagnostics and performance insights. This supports predictive maintenance, reducing tire failures and downtime. The combination of AI and analytics is enabling smarter tire lifecycle management, driving adoption among fleet operators and premium vehicle manufacturers.

- For instance, NIRA Dynamics has surpassed 110 million software-based Tire Pressure Indicator (TPI) units globally as of mid-2025.

Expansion of Fleet Management and Aftermarket Services

Fleet operators are investing in connected tire technologies to improve operational efficiency. Real-time monitoring of tire health reduces maintenance costs and improves fuel performance. The aftermarket sector also benefits as service providers integrate connected tire systems for maintenance contracts and digital tire management. This trend enhances data-driven decision-making in logistics and commercial transportation.

- For instance, Bridgestone’s Webfleet serves 60,000+ customers and tracks over 130 million km daily, monitoring about 23 million litres of fuel and ~60,000 tonnes of CO₂ each day.

Key Challenges

High Cost of Connected Tire Integration

The high cost of smart sensors, communication modules, and integration limits adoption in low- and mid-range vehicles. Manufacturers face challenges in balancing cost efficiency with advanced functionality. The need for frequent sensor calibration and software updates adds to total ownership costs. These financial constraints hinder mass-market penetration, especially in price-sensitive regions.

Data Privacy and Connectivity Reliability

Data privacy and network reliability pose significant challenges in connected tire systems. Continuous data transmission between tires, vehicles, and cloud servers increases the risk of cybersecurity breaches. Connectivity disruptions can lead to inaccurate diagnostics or delayed alerts. Manufacturers are focusing on developing secure communication protocols and robust encryption technologies to protect user data and maintain system reliability.

Regional Analysis

North America

North America held a significant share of the connected tire market in 2024, estimated at approximately 30% of global revenue. The region benefits from a strong automotive electronics infrastructure and early adoption of connected and autonomous vehicles. U.S. smart city initiatives and investments in telematics platforms support connected tire integration in original equipment. Key drivers include high consumer awareness of tire-safety technologies and the presence of major tire and sensor manufacturers. The aftermarket is expanding as fleet operators seek predictive analytics and real-time tire condition monitoring.

Europe

Europe commanded roughly 36% of the connected tire market share in 2023 and maintained near-comparable strength in 2024. The region’s dominance stems from advanced automotive technology ecosystems, strict safety and emission regulations mandating tire-monitoring systems, and strong presence of leading tire companies. Connected tire adoption in premium vehicles is high across Germany, the UK and France. Growth is further supported by expanding electric vehicle fleets and infrastructure readiness for sensor-enabled mobility solutions.

Asia Pacific

Asia Pacific recorded more than 35% of the connected tire market in 2022, and is expected to increase its regional share by 2024. Rapid vehicle production in China, India and Japan and rising consumer demand for connected vehicles drive this expansion. Government initiatives for smart mobility, urbanisation and electric vehicle growth further enhance adoption of sensor-equipped tires. Manufacturers are leveraging this region to scale connected tire solutions, aiming to meet cost and volume objectives crucial in Asia Pacific markets.

Latin America

Latin America held a modest share of the connected tire market, estimated at around 5-6% of global revenue in recent years. Slower vehicle electrification, lower vehicle sensor penetration and budget sensitivity hamper growth in the region. However, increasing tyre replacement needs in commercial fleets and expanding telematics services offer opportunity for connected tire deployment. Infrastructure upgrades and rising interest in smart mobility could lift regional adoption rates over the forecast period.

Middle East & Africa

The Middle East & Africa region contributed roughly 4-5% to the global connected tire market share in 2024, reflecting its nascent stage of adoption. Growth in this region is supported by investments in transport infrastructure, smart city programmes, and growing logistics fleets. However, the pace of connected tire integration remains slower due to cost constraints and uneven digital infrastructure. Opportunities exist for aftermarket services and commercial vehicle monitoring in logistics hubs across the Gulf and African markets.

Market Segmentations:

By Rim Size

- 12 – 17 Inches

- 18 – 22 Inches

- More Than 22 Inches

By Component

- TPMS

- Accelerometer Sensors

- Strain Gauge Sensors

- RFID Chips

By Vehicle Type

- Passenger Cars

- Commercial Vehicle

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Bridgestone Corporation, Continental AG, Pirelli & C. S.p.A., The Goodyear Tire & Rubber Company, Sumitomo Rubber Industries Ltd., Michelin, and Nokian Tyres plc are prominent players shaping the competitive landscape of the connected tire market. The industry is witnessing strong investments in tire sensor innovation, IoT integration, and cloud-based monitoring platforms. Leading manufacturers are collaborating with automotive OEMs and telematics providers to enhance data analytics, improve real-time tire diagnostics, and support predictive maintenance solutions. Companies are expanding production capabilities to cater to the growing demand for connected tires in electric and autonomous vehicles. Continuous research focuses on developing lightweight, energy-efficient, and self-learning tire technologies to improve safety and performance. Strategic mergers, product launches, and regional expansions strengthen global market presence. The competition is intensifying as players emphasize digital platforms and mobility-as-a-service partnerships to deliver smarter, more sustainable tire solutions across both OEM and aftermarket channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Continental AG announced significant investment plans to expand car and light truck tire production in India, focusing on new SUV products, indicating strategic growth in connected and specialized tires for evolving vehicle segments.

- In 2025, Michelin N.V. Unveiled its first line of premium passenger car tires made in India from its Chennai plant.

- In 2024, The Goodyear Tire & Rubber Company Announced a collaboration with TDK Corporation to advance next-generation tire solutions.

Report Coverage

The research report offers an in-depth analysis based on Rim Size, Component, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The connected tire market will expand rapidly as automotive IoT ecosystems mature globally.

- Integration of AI-driven tire analytics will improve predictive maintenance and fleet efficiency.

- Growth in electric and autonomous vehicles will accelerate demand for sensor-based tire systems.

- Partnerships between tire makers and software providers will enhance connected mobility services.

- Advancements in low-power, long-range connectivity will make data transmission more reliable.

- Increasing regulatory mandates for safety and emissions will boost connected tire installations.

- Cloud-based tire monitoring platforms will gain traction in aftermarket and fleet operations.

- Cost optimization through large-scale production will drive adoption in mid-range vehicles.

- Emerging markets in Asia and Latin America will witness higher penetration through OEM collaborations.

- Cybersecurity solutions for data protection will become essential to sustain consumer trust.