Market Overview:

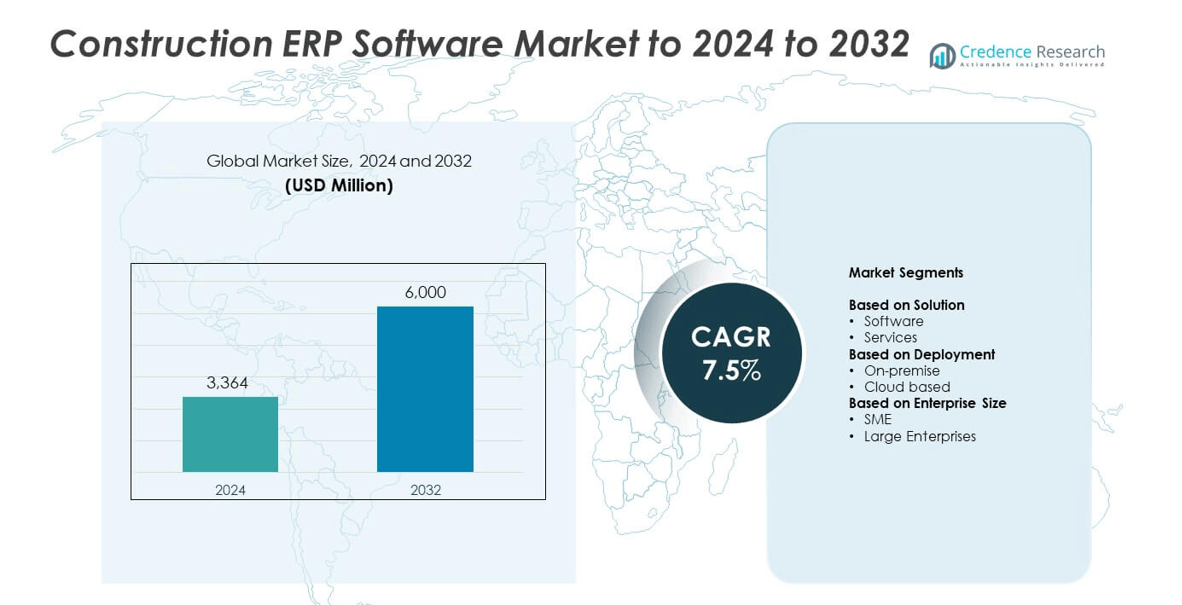

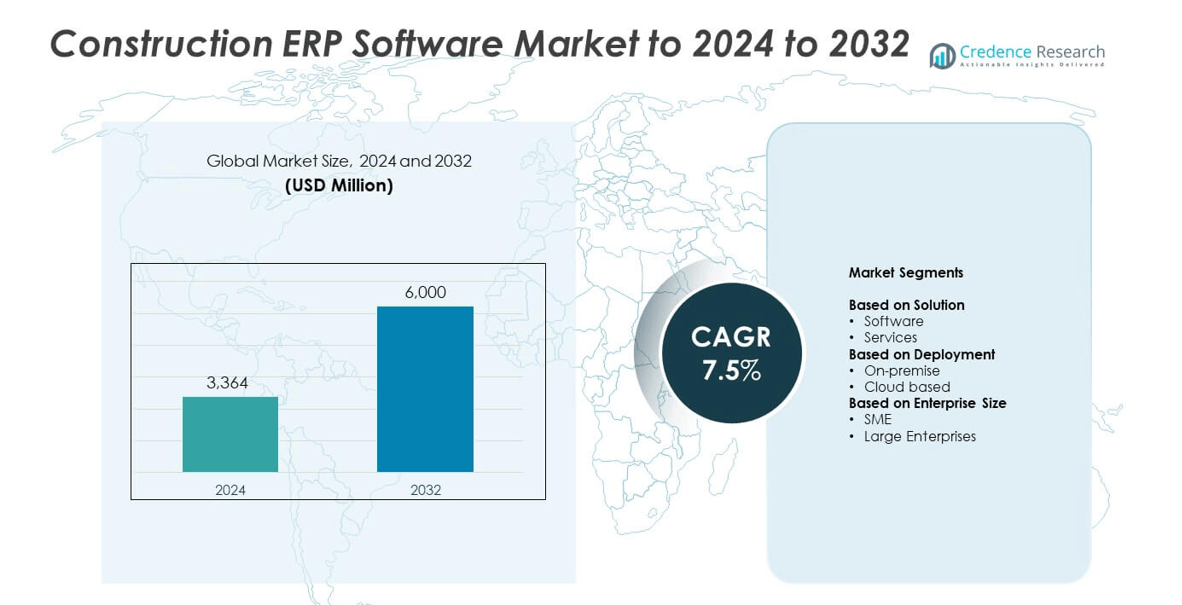

Construction ERP Software Market size was valued USD 3,364 million in 2024 and is anticipated to reach USD 6,000 million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction ERP Software Market Size 2024 |

USD 3,364 million |

| Construction ERP Software Market, CAGR |

7.5% |

| Construction ERP Software Market Size 2032 |

USD 6,000 million |

The construction ERP software market is led by major players including Oracle, Procore Technologies, SAP, Microsoft, CMiC Global Inc, Autodesk, In4Velocity Systems, Deltek, Sage Group, and Viewpoint. These companies dominate through advanced cloud-based ERP solutions that integrate project management, financial planning, and analytics for construction enterprises. North America held the largest market share of 38% in 2024, driven by high digital adoption and strong presence of global ERP providers. Europe followed with 25%, supported by regulatory compliance and modernization in construction operations. Asia-Pacific, with a 22% share, emerged as the fastest-growing region due to rapid urbanization and infrastructure expansion.

Market Insights

- The construction ERP software market was valued at USD 3,364 million in 2024 and is projected to reach USD 6,000 million by 2032, growing at a CAGR of 7.5%.

- Growing demand for real-time project management, cost tracking, and resource optimization is driving ERP adoption across construction enterprises.

- Cloud-based deployment held a 57.9% share in 2024, supported by rising digitalization and the need for remote accessibility in construction operations.

- The market remains competitive, with global players focusing on AI integration, mobile accessibility, and modular ERP platforms to enhance operational efficiency.

- North America led the market with a 38% share in 2024, followed by Europe at 25% and Asia-Pacific at 22%, driven by rapid infrastructure development and government investments in smart construction initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution

The software segment dominated the construction ERP software market with a 64.7% share in 2024. Its leadership is driven by the growing use of integrated modules for project management, accounting, and supply chain operations. Software solutions help contractors manage resources, track progress, and enhance decision-making through real-time analytics. Increasing demand for centralized platforms that streamline workflows across departments supports this dominance. The services segment is expanding as enterprises seek implementation, customization, and maintenance support to improve operational efficiency and user adoption.

- For instance, Procore Technologies’ unified platform supports over 17,000 customers and more than 2 million annual users globally, across more than 150 countries. As of early 2024 data, over 3 million projects have run on the Procore platform.

By Deployment

The cloud-based segment held the largest share of 57.9% in 2024. Its growth is attributed to cost efficiency, scalability, and accessibility across remote project sites. Cloud deployment enables real-time data synchronization and collaboration between field teams and management, improving project transparency. Construction firms prefer cloud platforms for lower IT infrastructure costs and faster software updates. The on-premise model continues to attract large enterprises with strict data control and security requirements, particularly in regions with limited internet reliability.

- For instance, Oracle Corporation has a large customer base for its two main cloud ERP products. The company has a community of more than 11,000 customers using Oracle Fusion Cloud ERP and over 38,000 customers using Oracle NetSuite globally, totaling over 49,000 organizations as of late 2024.

By Enterprise Size

The large enterprise segment accounted for a 62.3% share in 2024. These organizations adopt ERP solutions to manage multiple construction projects, suppliers, and subcontractors across geographies. Advanced analytics and automation tools in ERP systems enhance compliance and cost tracking for large-scale operations. Demand is also fueled by the need to integrate financial and resource planning within corporate systems. Small and medium enterprises (SMEs) are increasingly embracing cloud-based ERP platforms to improve project visibility and reduce administrative costs.

Key Growth Drivers

Increasing Demand for Real-Time Project Management

The rising complexity of large-scale infrastructure projects has created a strong need for real-time project tracking and reporting. Construction ERP software enables centralized control over budgeting, scheduling, and procurement activities. Its ability to enhance collaboration across multiple departments and locations drives faster decision-making and reduces project delays. The growing preference for digital project management platforms among contractors and developers continues to accelerate ERP adoption across global markets.

- For instance, SAP S/4HANA reported that by mid-2018 it had been implemented by approximately 8,900 customers worldwide — highlighting its appeal to large-scale organisations.

Integration of IoT and Data Analytics in Construction

The integration of IoT sensors and advanced analytics into ERP systems enhances operational visibility and predictive planning. These technologies allow construction firms to monitor equipment, labor, and material usage in real time. By leveraging data-driven insights, companies can reduce downtime and improve asset performance. The growing focus on digital transformation in construction is strengthening the adoption of ERP platforms with built-in analytics and IoT capabilities.

- For instance, Caterpillar has 1.5 million+ connected assets generating operational telemetry.

Government Initiatives and Infrastructure Investments

Ongoing public infrastructure development and smart city projects are fueling ERP software demand. Governments worldwide are investing in road, bridge, and housing projects that require efficient resource and cost management systems. ERP solutions support compliance with project standards, timelines, and budget constraints. As infrastructure spending increases, construction companies are adopting ERP tools to meet regulatory demands and enhance transparency across the project lifecycle.

Key Trends & Opportunities

Shift Toward Cloud-Based ERP Solutions

Construction companies are increasingly adopting cloud-based ERP systems to streamline project operations and reduce IT costs. Cloud deployment allows real-time collaboration between field and office teams, improving communication and data accuracy. The flexibility of subscription-based models also supports scalability for growing firms. As construction businesses prioritize agility and remote accessibility, cloud ERP adoption is becoming a major opportunity in the market.

- For instance, NetSuite ERP, a cloud-native ERP platform, currently serves more than 43,000 customers, organizations, and subsidiaries globally, across over 220 countries and dependent territories.

Rise of AI-Driven Automation and Predictive Analytics

Artificial intelligence and predictive analytics are reshaping ERP functionality in the construction sector. These technologies enable automated scheduling, risk detection, and resource optimization. Predictive models help identify cost overruns and material shortages before they occur, improving project outcomes. The increasing use of AI-powered modules is creating opportunities for vendors to offer smarter, self-learning ERP platforms tailored for construction operations.

- For instance, According to an analysis by Deloitte, AI can reduce budget and timeline deviations by 10–20% in the construction industry, a finding often referenced in the context of companies like Autodesk

Growing Demand for Mobile ERP Applications

The expansion of mobile ERP applications is enabling on-site teams to access data and update project details in real time. Mobile tools improve coordination, reduce manual paperwork, and accelerate approval workflows. As construction sites become more digital, the demand for mobile-friendly ERP interfaces continues to grow. This trend offers vendors opportunities to develop intuitive, cross-platform mobile solutions for field operations.

Key Challenges

High Implementation and Maintenance Costs

The initial investment for ERP implementation remains a key barrier for many construction firms. Costs related to customization, training, and system integration can strain smaller enterprises with limited budgets. Ongoing expenses for upgrades and technical support further add to the financial burden. These factors often delay adoption or limit the scope of ERP deployment in cost-sensitive construction businesses.

Data Security and Integration Concerns

The growing use of cloud and mobile ERP platforms raises concerns about data privacy and cybersecurity. Construction projects involve sensitive financial and contractual data that require strict protection. Poor integration between ERP systems and existing project management tools can also lead to data inconsistencies. Addressing these security and compatibility challenges is crucial to ensuring broader ERP adoption across the industry.

Regional Analysis

North America

The North America market held approximately 38% share of the global construction ERP software market in 2024. The region leads due to strong infrastructure investment, high digital maturity among contractors, and the presence of major ERP software vendors headquartered in the U.S. Contractors increasingly adopt ERP systems to manage complex multi-site operations and control costs. The large enterprise segment drives demand as firms integrate project, procurement and financial modules within unified platforms across multiple geographies.

Europe

Europe accounted for about 25% of the market in 2024. Growth is supported by rising adoption of cloud-based solutions among construction firms in Western Europe and regulatory focus on transparency and efficiency in public-works contracts. Increasing retrofit and infrastructure upgrades in countries such as Germany and the UK boost demand for ERP systems tailored to resource-intensive projects. Local vendors and region-specific compliance capabilities further strengthen market uptake.

Asia-Pacific

The Asia-Pacific region captured around 22% share in 2024 and is projected as the fastest-growing region going forward. Rapid urbanisation, large government infrastructure programmes in China and India, and increasing digitalisation of the construction industry drive ERP adoption. Cloud deployment is particularly favoured in emerging markets due to cost flexibility and field mobility. As SMEs increasingly invest in ERP systems, the region’s share is expected to expand significantly.

Middle East & Africa

Middle East & Africa held roughly 8% of the market in 2024. The region benefits from major infrastructure projects in key Gulf states and rising demand for project transparency and resource optimisation. However, growth is moderated by lower overall construction IT spend and slower adoption in some parts of Africa. Country-specific regulatory and connectivity challenges create pockets of opportunity for specialised ERP vendors.

Latin America

Latin America contributed about 7% share in 2024. The region’s market growth is driven by infrastructure modernization efforts, especially in Brazil and Mexico, and increasing interest in ERP systems among medium-sized construction firms. Limited market maturity and economic volatility present adoption challenges, yet cloud-based and modular ERP offerings offer scalable entry points for local contractors and project-focused construction businesses.

Market Segmentations:

By Solution

By Deployment

By Enterprise Size

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction ERP software market features major players such as Oracle, Procore Technologies, SAP, Microsoft, CMiC Global Inc, Autodesk, In4Velocity Systems, Deltek, Sage Group, and Viewpoint. The competitive landscape is defined by continuous innovation, strategic partnerships, and product differentiation focused on project efficiency and real-time data management. Companies are enhancing their ERP platforms with AI, analytics, and mobile integration to support on-site operations and decision-making. Cloud-based deployment remains a central competitive advantage, offering flexibility and scalability to diverse construction firms. Vendors are increasingly targeting small and medium enterprises through subscription-based models and modular software designs. Continuous investment in security, user experience, and interoperability strengthens their positioning in a rapidly evolving digital construction environment. As global infrastructure development intensifies, competition is expected to deepen, driving innovation in automation, predictive analytics, and connected ecosystem solutions for end-to-end project lifecycle management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, In4Velocity Systems enhanced its existing In4Suite® ERP platform by integrating artificial intelligence capabilities.

- In 2023, Procore Technologies Inc. Launched Procore Pay, a new service integrated within its construction project management platform.

- In 2023, CMiC Global Inc Formed a strategic partnership with Arcoro, a provider of cloud-based human resources and workforce management solutions for the construction industry.

Report Coverage

The research report offers an in-depth analysis based on Solution, Deployment, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The construction ERP software market will witness steady expansion driven by digital transformation in construction.

- Cloud-based ERP adoption will continue to rise as firms prioritize scalability and flexibility.

- Integration of AI and machine learning will enhance predictive analytics and project forecasting.

- Mobile ERP applications will gain traction to support real-time field operations and updates.

- Growing demand for data-driven project management will boost adoption among mid-sized contractors.

- Vendors will focus on modular and customizable ERP solutions for diverse construction workflows.

- Government infrastructure programs will create sustained demand for centralized project management tools.

- Partnerships between ERP providers and construction technology firms will strengthen innovation pipelines.

- Cybersecurity and data protection features will become key differentiators for software vendors.

- The Asia-Pacific region will emerge as the fastest-growing market due to rapid construction digitalization.