Market Overview

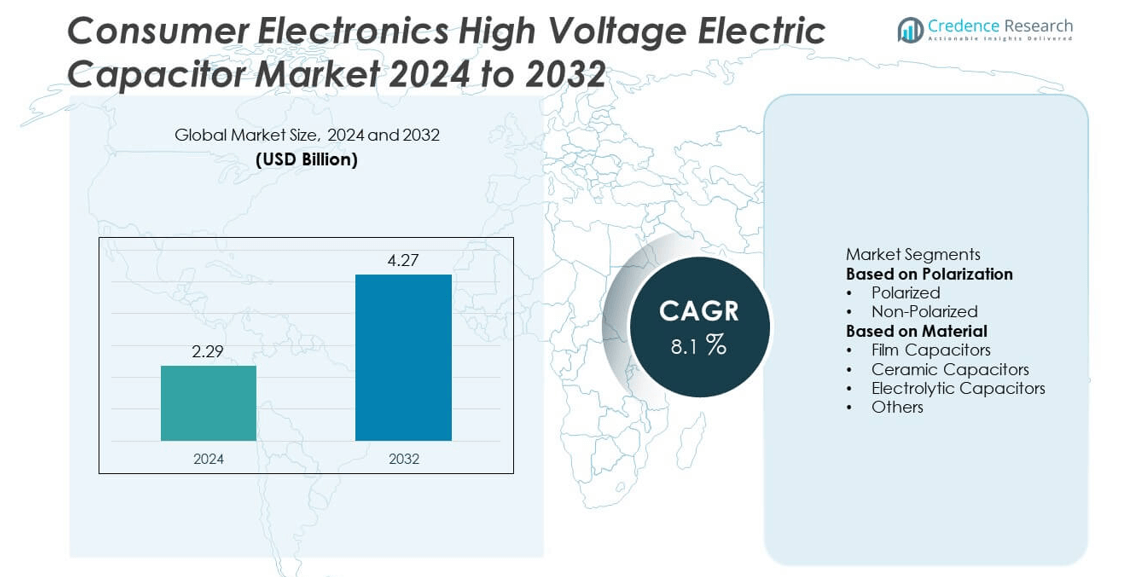

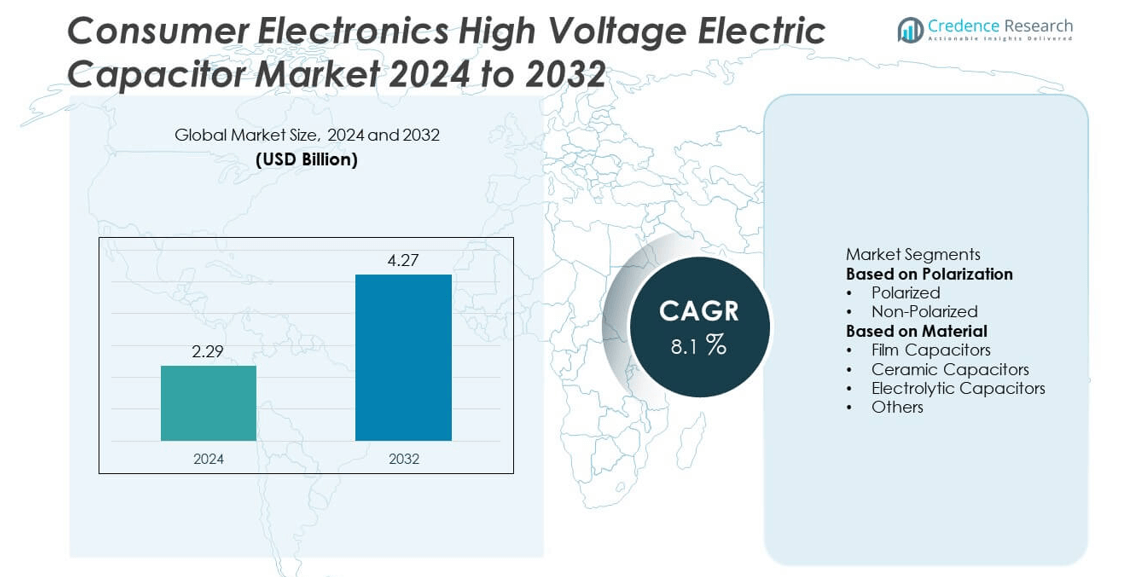

The Consumer Electronics High Voltage Electric Capacitor market was valued at USD 2.29 billion in 2024 and is projected to reach USD 4.27 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Consumer Electronics High Voltage Electric Capacitor Market Size 2024 |

USD 2.29 billion |

| Consumer Electronics High Voltage Electric Capacitor Market, CAGR |

8.1% |

| Consumer Electronics High Voltage Electric Capacitor Market Size 2032 |

USD 4.27 billion |

The Consumer Electronics High Voltage Electric Capacitor market is led by major players such as KYOCERA AVX Components Corporation, SAMSUNG ELECTRO-MECHANICS, ABB, Panasonic Corporation, ELNA CO., LTD, KEMET Corporation, Murata Manufacturing Co., Ltd., Havells India Ltd., Cornell Dubilier, and Schneider Electric. These companies dominate through technological innovation, advanced material development, and strong global supply networks. Asia-Pacific remained the leading region with a 41% market share in 2024, driven by large-scale production of smartphones, smart TVs, and semiconductor components in China, Japan, and South Korea. North America followed with 24%, supported by demand for power-efficient consumer devices, while Europe, holding 22%, advanced through sustainable and miniaturized capacitor solutions across its electronics sector.

Market Insights

- The Consumer Electronics High Voltage Electric Capacitor market was valued at USD 2.29 billion in 2024 and is projected to reach USD 4.27 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Growth is driven by rising demand for high-performance consumer electronics, including smartphones, televisions, and wearables that require efficient voltage stabilization and power management.

- Market trends focus on miniaturized and multilayer ceramic capacitor (MLCC) designs, along with eco-friendly materials and improved heat resistance for compact, high-density electronic systems.

- The market is highly competitive, with leading players such as KYOCERA AVX Components Corporation, SAMSUNG ELECTRO-MECHANICS, and Murata Manufacturing focusing on innovation, cost optimization, and regional expansion strategies.

- Asia-Pacific leads with 41% market share, followed by North America with 24% and Europe with 22%, while the ceramic capacitor segment dominates with 47% share due to superior performance in compact consumer devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Polarization

The non-polarized capacitor segment dominated the market in 2024, accounting for nearly 58% of the total share. These capacitors are widely used in consumer electronics such as televisions, audio systems, and communication devices due to their versatility, stability, and ability to operate in AC circuits. Their longer lifespan and lower leakage current make them ideal for high-voltage and pulse applications. The growing production of advanced smartphones and wearable electronics further boosts adoption. In contrast, polarized capacitors, mainly used in DC circuits, continue to find demand in compact power supply and battery management systems.

- For instance, Murata Manufacturing Co., Ltd. developed the GRM155C81E475KE11 multilayer ceramic capacitor offering a capacitance of 4.7 µF and rated for 25 V, optimized for compact mobile devices operating under high-frequency conditions.

By Material

The ceramic capacitor segment led the market with around 47% share in 2024, driven by high dielectric strength, small size, and superior frequency response. These capacitors are preferred in consumer devices such as laptops, cameras, and smartphones, where miniaturization and reliability are essential. The rising integration of multilayer ceramic capacitors (MLCCs) supports enhanced energy density and voltage endurance. Film capacitors follow closely due to their growing use in high-frequency circuits and display technologies. Continuous advancements in ceramic materials and electrode design are expected to sustain segment leadership throughout the forecast period.

- For instance, SAMSUNG ELECTRO-MECHANICS introduced a 4.7 µF, 2.5 V MLCC in a 0201-inch package for use in high-performance computing applications, such as AI servers.

Key Growth Drivers

Rising Demand for Advanced Consumer Electronics

The growing adoption of smartphones, smart TVs, laptops, and wearable devices drives strong demand for high-voltage capacitors. These components ensure stable power distribution, noise suppression, and voltage regulation in compact circuits. The miniaturization trend in electronics has led to higher integration of multilayer ceramic and film capacitors. Increasing global production of connected and energy-efficient devices further supports market expansion. Manufacturers are focusing on capacitors with higher capacitance density and improved thermal stability to meet evolving consumer electronics requirements.

- For instance, Panasonic Corporation launched conductive polymer hybrid capacitors featuring endurance up to 10,000 hours at 135°C, ensuring superior voltage stability and reduced leakage current in advanced wearable and display modules.

Expansion of Power Management and Fast-Charging Systems

The rising need for efficient power management and quick-charging solutions in portable electronics is fueling capacitor demand. High-voltage electric capacitors are essential for managing voltage fluctuations and ensuring stable energy transfer in charging circuits. The growth of USB Type-C and wireless charging technologies further boosts adoption. Manufacturers are developing capacitors with low equivalent series resistance (ESR) and improved endurance to enhance reliability. This trend supports continuous innovation in compact, high-performance devices such as tablets and gaming consoles.

- For instance, KEMET Corporation produces the R75H series of automotive-grade, metallized polypropylene film capacitors for high-frequency DC and pulse applications, including DC-link filtering.

Technological Advancements in Capacitor Materials

Advancements in dielectric materials and electrode designs are improving capacitor performance and reducing device size. Ceramic and polymer-based capacitors with higher breakdown voltage and temperature resistance are gaining popularity. These developments enhance energy efficiency, prolong device lifespan, and support miniaturization in consumer applications. The shift toward lead-free and environmentally friendly materials aligns with global sustainability regulations. Continuous R&D investment from leading manufacturers is expected to create new opportunities for cost-effective and high-capacity solutions across the consumer electronics industry.

Key Trends & Opportunities

Growing Shift Toward Miniaturized and Multilayer Designs

Manufacturers are focusing on compact, high-capacitance designs to meet the demands of smaller, multifunctional consumer electronics. Multilayer ceramic capacitors (MLCCs) are becoming standard in devices requiring high power density and reliability. The use of thin-film and nanocomposite materials enhances performance under high-voltage conditions. This miniaturization trend also supports integration in advanced devices such as 5G smartphones and smart home systems, creating a steady stream of new market opportunities for high-efficiency capacitor solutions.

- For instance, KYOCERA AVX Components Corporation offers Ultra-Miniature MLCCs optimized for space-constrained 5G transceivers and other devices, including a recently developed high-capacitance 47 µF MLCC in a 0402-inch size, utilizing the X5R dielectric. The company provides a wide range of MLCCs with various specifications, including high-frequency and high-capacitance options for communications applications.

Integration of Capacitors in Electric and Smart Appliances

The increasing electrification of home appliances such as air conditioners, washing machines, and induction cooktops is driving capacitor demand. These components improve energy conversion efficiency and ensure protection from voltage surges. The growth of smart home technologies and IoT-enabled devices expands the role of capacitors in connectivity and control systems. Manufacturers are investing in long-life, heat-resistant capacitors suitable for continuous operation, meeting consumer expectations for performance, safety, and durability.

- For instance, Cornell Dubilier introduced its 947D series film capacitors rated up to 1,200 VDC with ripple current handling of 33 A RMS, ensuring long-term stability and protection in smart appliance power modules and high-frequency motor drive systems.

Key Challenges

Fluctuating Raw Material Prices

The market faces challenges due to volatile prices of raw materials such as tantalum, aluminum, and ceramic powders. These materials significantly influence the overall production cost of capacitors. Supply chain disruptions and geopolitical uncertainties have further intensified cost pressures for manufacturers. Price instability impacts profit margins and limits affordability for small-scale electronic device producers. To address this, companies are exploring alternative materials and optimizing manufacturing processes to ensure long-term cost stability and resource sustainability.

Design and Performance Limitations in Miniaturized Capacitors

As electronic devices continue to shrink, capacitors must offer higher capacitance in smaller footprints without sacrificing performance. However, excessive miniaturization can cause overheating, voltage breakdown, and shorter product lifespan. Balancing compact size with electrical reliability remains a significant design challenge. Manufacturers are focusing on advanced simulation tools, improved dielectric materials, and innovative layering techniques to overcome these constraints. Maintaining durability and stability under high-voltage stress is crucial for ensuring dependable performance in next-generation consumer devices.

Regional Analysis

North America

North America held a 24% market share in 2024, driven by high consumption of advanced consumer electronics and strong demand for power management components. The United States leads the region with widespread use of high-voltage capacitors in smart devices, home appliances, and gaming consoles. The presence of major electronic manufacturers and rapid adoption of 5G technology support steady growth. Increasing investment in miniaturized and energy-efficient electronic systems enhances market potential. Continuous R&D efforts and the integration of environmentally friendly materials further strengthen North America’s position in the global market.

Europe

Europe accounted for 22% of the global market share in 2024, supported by rising demand for high-performance electronic devices and sustainable capacitor technologies. Germany, France, and the United Kingdom remain key contributors due to advanced manufacturing capabilities and regulatory support for eco-friendly electronics. The expansion of electric appliances and connected home devices further boosts regional adoption. European manufacturers are focusing on producing RoHS-compliant, energy-efficient capacitors to meet strict environmental standards. The region’s commitment to digital transformation and innovation in materials technology continues to fuel steady market development.

Asia-Pacific

Asia-Pacific dominated the market with a 41% share in 2024, led by China, Japan, South Korea, and Taiwan. The region’s leadership stems from large-scale consumer electronics production, high-volume semiconductor manufacturing, and growing investment in 5G infrastructure. Rising demand for smartphones, smart TVs, and portable electronics drives strong capacitor utilization. Government initiatives promoting local electronic manufacturing further strengthen regional growth. Japan and South Korea lead in technological innovation, while China remains the largest producer and consumer. The expansion of domestic supply chains and cost-efficient manufacturing keeps Asia-Pacific at the forefront of global demand.

Latin America

Latin America captured 7% of the market share in 2024, with Brazil and Mexico driving regional growth. Expanding consumer electronics manufacturing and increasing use of energy-efficient devices are key contributors. The market benefits from rising disposable income and the growing popularity of smart TVs and connected home appliances. Regional demand is also supported by government programs encouraging local electronics production. While limited high-tech manufacturing capacity poses a challenge, foreign investments and distribution partnerships continue to strengthen Latin America’s participation in the global capacitor supply network.

Middle East & Africa

The Middle East and Africa region accounted for 6% of the market share in 2024, fueled by growing consumer electronics imports and expanding industrial applications. The United Arab Emirates, Saudi Arabia, and South Africa lead the market with increasing demand for high-performance capacitors in appliances and electronic systems. Investments in smart city infrastructure and renewable energy projects create new opportunities for electronic component suppliers. However, dependency on imports and limited local manufacturing capabilities restrain faster adoption. Global manufacturers are targeting partnerships in the region to improve distribution and technical support networks.

Market Segmentations:

By Polarization

By Material

- Film Capacitors

- Ceramic Capacitors

- Electrolytic Capacitors

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the Consumer Electronics High Voltage Electric Capacitor market includes key players such as KYOCERA AVX Components Corporation, SAMSUNG ELECTRO-MECHANICS, ABB, Panasonic Corporation, ELNA CO., LTD, KEMET Corporation, Murata Manufacturing Co., Ltd., Havells India Ltd., Cornell Dubilier, and Schneider Electric. These companies focus on developing compact, high-capacitance, and energy-efficient solutions to meet the growing demand for advanced consumer electronics. Strategic initiatives such as product innovation, capacity expansion, and regional partnerships strengthen their global presence. Leading manufacturers emphasize multilayer ceramic capacitor (MLCC) development and miniaturization to enhance performance in portable devices. Asian companies, particularly from Japan and South Korea, dominate production due to advanced material technologies and economies of scale. Meanwhile, European and North American firms prioritize sustainable designs and compliance with environmental standards. Continuous R&D investments in dielectric materials, heat resistance, and smart integration technologies are shaping future competition and market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, SAMSUNG ELECTRO-MECHANICS expanded its lineup to ultra-small, high-temperature, and high-voltage MLCCs, citing leadership in AI-server MLCC supply.

- In March 2025, KYOCERA AVX Components Corporation unveiled a world-first 47 µF MLCC in the 0402 size, with mass production slated for December 2025.

- In April 2024, KYOCERA AVX launched a new series of aluminium electrolytic capacitors. The new RES series of capacitors will aid communications, industrial, and consumer electronics manufacturers in saving board space in high-density PCB applications.

- In February 2024, Murata Manufacturing Co., Ltd. has introduced one of the smallest monolithic ceramic chip capacitors (MLCC) with a high-Q rating. This capacitor is designed for high-frequency module applications, including cellular communication infrastructure, and comes with a voltage rating of 100 V

Report Coverage

The research report offers an in-depth analysis based on Polarization, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with increasing production of advanced consumer electronics worldwide.

- Demand for high-capacitance and compact multilayer ceramic capacitors will rise sharply.

- Manufacturers will focus on developing energy-efficient and miniaturized capacitor designs.

- Integration of capacitors in 5G-enabled and IoT-connected devices will strengthen market growth.

- Rising adoption of electric and smart home appliances will create new application opportunities.

- Companies will invest more in eco-friendly and lead-free capacitor materials to meet sustainability goals.

- Asia-Pacific will remain the primary manufacturing hub due to strong electronics production capacity.

- Technological innovation in dielectric materials will enhance performance and durability.

- Partnerships between capacitor producers and device manufacturers will drive product customization.

- Continuous investment in automation and digital manufacturing will support long-term competitiveness and profitability.