Market Overview

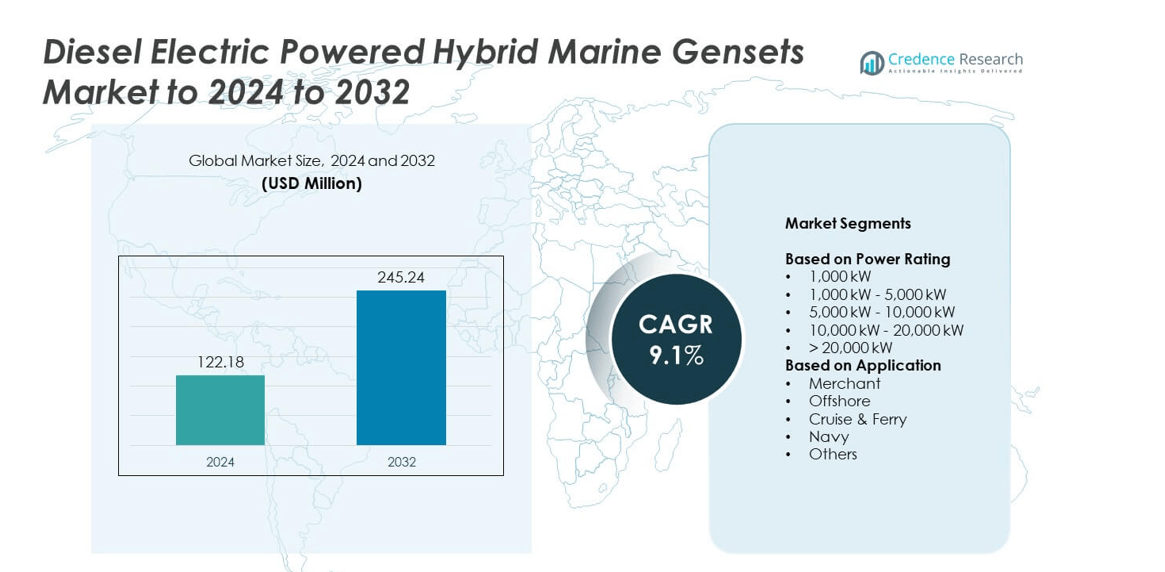

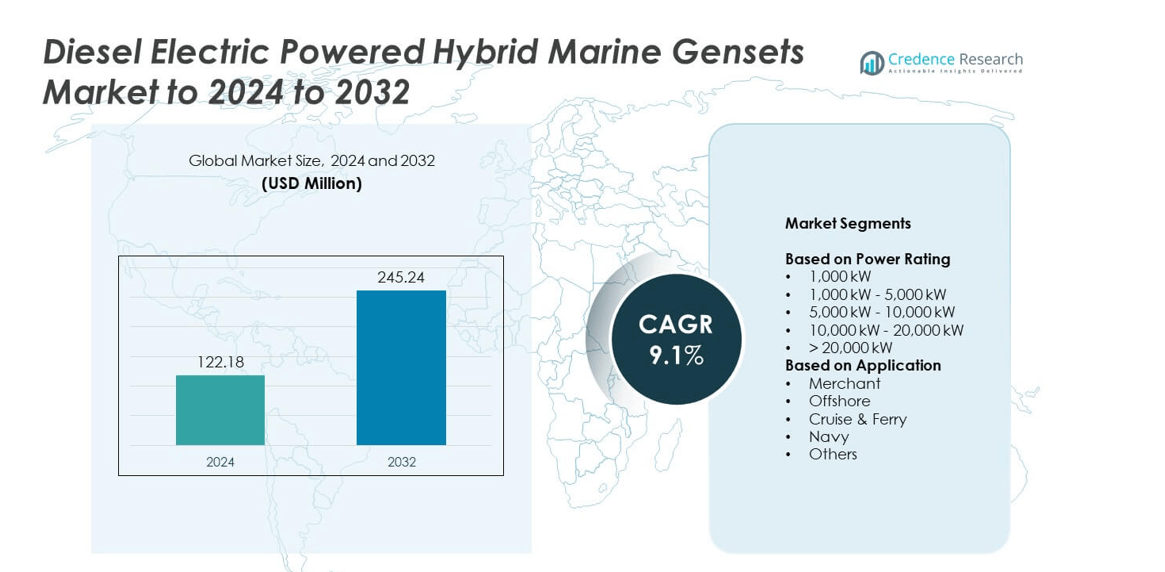

Diesel Electric Powered Hybrid Marine Gensets Market size was valued at USD 122.18 million in 2024 and is anticipated to reach USD 245.24 million by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Electric Powered Hybrid Marine Gensets Market Size 2024 |

USD 122.18 million |

| Diesel Electric Powered Hybrid Marine Gensets Market, CAGR |

9.1% |

| Diesel Electric Powered Hybrid Marine Gensets Market Size 2032 |

USD 245.24 million |

The Diesel Electric Powered Hybrid Marine Gensets market is shaped by prominent players such as MAN Energy Solutions, YANMAR, Siemens Energy, Caterpillar, Wärtsilä, Rolls-Royce, ABB, and Cummins, Inc. These companies focus on advancing hybrid propulsion technologies, improving fuel efficiency, and complying with global emission standards. Strategic investments in R&D, system integration, and digital energy management are enhancing their market presence across commercial, offshore, and naval sectors. North America led the market with a 36% share in 2024, supported by strong adoption in offshore and defense applications, followed by Europe with 31% and Asia-Pacific with 27%, driven by fleet modernization and growing maritime trade.

Market Insights

- The Diesel Electric Powered Hybrid Marine Gensets market was valued at USD 122.18 million in 2024 and is projected to reach USD 245.24 million by 2032, growing at a CAGR of 9.1%.

- Rising demand for fuel-efficient and low-emission propulsion systems is driving market expansion across commercial and naval vessels.

- Key trends include the integration of smart energy management systems, hybrid battery technologies, and advanced load optimization solutions.

- The market is competitive, with players focusing on innovation, system scalability, and emission compliance to strengthen their global presence.

- North America led with a 36% share in 2024, followed by Europe at 31% and Asia-Pacific at 27%, while the 1,000 kW–5,000 kW segment dominated with 39% of the total market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The 1,000 kW – 5,000 kW segment dominated the Diesel Electric Powered Hybrid Marine Gensets market with a 39% share in 2024. This range is widely used across medium-sized vessels such as offshore support and merchant ships due to its efficiency, compact design, and reduced emissions. Increasing demand for flexible and fuel-efficient power systems in hybrid propulsion has further boosted adoption. Manufacturers are focusing on enhancing load response and integrating smart control systems to optimize power distribution and minimize fuel consumption during variable operating conditions.

- For instance, the hybrid tug Hermes, built for the Port of Aarhus, Denmark, is equipped with two Cummins QSK60 engines, each capable of developing 2,013 kW of power.

By Application

The merchant vessel segment led the market with a 41% share in 2024, driven by the global expansion of commercial shipping and rising focus on decarbonization. Hybrid gensets enable fuel optimization and compliance with strict emission norms in major ports. Growing adoption of dual-mode propulsion for cargo ships and bulk carriers supports the segment’s dominance. Additionally, fleet modernization programs and the shift toward electric-assisted propulsion systems across container and tanker ships continue to accelerate hybrid genset installations in the merchant marine sector.

- For instance, Wärtsilä’s HY system on the 5,000 dwt bulk carrier Misje Vita delivered fuel savings of up to 40% versus same-size fleet vessels.

Key Growth Drivers

Rising Demand for Fuel-Efficient Marine Power Systems

The growing need for energy-efficient propulsion systems is a major driver of the diesel electric powered hybrid marine gensets market. Ship operators are adopting hybrid solutions to reduce fuel consumption and operational costs while meeting global emission regulations. These gensets offer optimized load management, allowing vessels to switch between power modes depending on demand. Increasing fuel prices and stringent environmental norms by the International Maritime Organization are encouraging fleet owners to invest in hybrid configurations that deliver both economic and environmental benefits.

- For instance, ABB’s Azipod study showed up to 20% lower fuel use and about 10,000 t CO₂ reduction per year with twin 10 MW units on ferry routes.

Expansion of Offshore and Commercial Shipping Activities

The expansion of offshore exploration, logistics, and commercial shipping operations is significantly boosting genset demand. Offshore platforms, support vessels, and cargo carriers require reliable and flexible power generation for both propulsion and auxiliary functions. Hybrid gensets ensure uninterrupted performance even in demanding marine environments. The surge in maritime trade volumes and fleet modernization projects worldwide is further accelerating adoption, especially for vessels operating in remote locations where fuel efficiency and reliability are critical.

- For instance, Nidec Conversion’s battery ESS retrofit on Viking Queen cut fuel consumption by approximately 18% in offshore operations.

Technological Advancements in Hybrid Propulsion Systems

Advancements in hybrid propulsion technology, including smart energy management and battery integration, are fueling market growth. New hybrid genset systems feature digital monitoring and load-balancing capabilities, improving power efficiency and extending engine life. The combination of diesel engines with electric propulsion allows for reduced vibration, quieter operation, and lower emissions. As automation and digital control systems become more common, shipowners are investing in hybrid gensets to enhance operational flexibility and comply with green shipping initiatives.

Key Trends and Opportunities

Shift Toward Sustainable and Low-Emission Marine Operations

The maritime industry is rapidly shifting toward greener propulsion solutions, presenting strong growth opportunities for hybrid genset suppliers. Hybrid systems align with global decarbonization targets by reducing greenhouse gas emissions and improving energy utilization. Shipbuilders are integrating renewable-assisted technologies such as solar charging and battery hybridization to achieve cleaner operations. Governments’ support for green shipping corridors and port electrification is creating additional opportunities for market players focused on sustainable marine power solutions.

- For instance, Siemens Energy equips electric ferries with two 530 kWh batteries that recharge in roughly five minutes during turnarounds.

Adoption of Smart Monitoring and Automation Technologies

The adoption of digital technologies in marine power systems is transforming hybrid genset operations. Advanced automation enables real-time energy management, predictive maintenance, and data-driven decision-making for fuel optimization. Integration of IoT-enabled sensors and AI-based control systems improves performance tracking and enhances reliability at sea. These innovations offer significant opportunities for genset manufacturers to differentiate through technology, reduce downtime, and deliver intelligent, adaptive power solutions that meet the evolving demands of modern marine fleets.

- For instance, Rolls-Royce monitors the first two Liberty Lines hybrid fast ferries with mtu NautIQ Foresight, alongside 2 × 2,560 kW engines and 346 kWh batteries.

Key Challenges

High Initial Investment and Integration Costs

One of the primary challenges in adopting diesel electric hybrid gensets is the high initial investment. Integrating hybrid power systems requires complex configurations involving engines, batteries, converters, and control systems. The upfront cost of installation, along with specialized crew training and maintenance, increases capital expenditure. This limits adoption among smaller fleet operators with constrained budgets. Although long-term operational savings exist, high entry costs continue to deter widespread implementation in cost-sensitive segments of the marine industry.

Limited Charging and Energy Infrastructure

The lack of adequate hybrid-supporting infrastructure across ports and marine routes poses a significant challenge. Hybrid vessels rely on battery charging and energy storage facilities that remain underdeveloped in many regions. Limited port electrification and inconsistent regulatory frameworks slow down hybrid system adoption. This restricts operational flexibility and complicates voyage planning for long-distance routes. Expanding energy infrastructure and standardizing hybrid compatibility across ports are essential to unlock the full potential of hybrid marine gensets globally.

Regional Analysis

North America

North America held the largest share of 36% in the Diesel Electric Powered Hybrid Marine Gensets market in 2024. The region benefits from a well-established marine infrastructure and strong presence of commercial and naval shipbuilders. The U.S. and Canada are focusing on cleaner propulsion systems to meet emission norms set by the Environmental Protection Agency and the International Maritime Organization. Increasing demand for hybrid-powered vessels in offshore exploration, cargo transport, and defense fleets continues to drive market growth. Ongoing technological advancements and government incentives for green shipping further strengthen the regional market outlook.

Europe

Europe accounted for 31% of the market share in 2024, supported by its commitment to maritime decarbonization and environmental sustainability. Nations such as Norway, Germany, and the Netherlands are leading in hybrid vessel adoption across offshore and ferry operations. The region’s shipbuilding industry is integrating battery-assisted gensets to meet emission reduction goals under the European Green Deal. Investments in port electrification, coupled with stringent emission control regulations, are accelerating hybrid technology deployment. Additionally, regional collaborations between manufacturers and research organizations are advancing hybrid marine propulsion innovation and improving operational efficiency.

Asia-Pacific

Asia-Pacific captured a 27% share of the Diesel Electric Powered Hybrid Marine Gensets market in 2024. The region’s dominance is driven by rapid shipbuilding growth in China, South Korea, and Japan, along with rising maritime trade. Increasing investments in offshore energy exploration and naval modernization programs are supporting hybrid genset adoption. The region’s focus on energy-efficient propulsion to reduce operational costs and environmental impact further enhances demand. Ongoing government support for green shipping initiatives and regional manufacturing competitiveness position Asia-Pacific as one of the fastest-growing markets globally.

Latin America, the Middle East, and Africa

The Rest of the World region, including Latin America, the Middle East, and Africa, accounted for 6% of the global market share in 2024. Growing offshore drilling projects in the Middle East and rising coastal trade in Latin America are boosting hybrid genset installations. African countries are beginning to explore hybrid marine solutions to enhance operational efficiency and meet emerging emission standards. Though adoption remains in the early stages, infrastructure development and foreign investments in port and shipbuilding facilities are expected to create new growth opportunities across these regions over the forecast period.

Market Segmentations:

By Power Rating

- 1,000 kW

- 1,000 kW – 5,000 kW

- 5,000 kW – 10,000 kW

- 10,000 kW – 20,000 kW

- > 20,000 kW

By Application

- Merchant

- Offshore

- Cruise & Ferry

- Navy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Diesel Electric Powered Hybrid Marine Gensets market is led by companies such as MAN Energy Solutions, YANMAR, ZF Friedrichshafen AG, Siemens Energy, Caterpillar, and others. The competitive landscape is characterized by strong emphasis on product efficiency, emission reduction, and integration of hybrid propulsion systems. Leading manufacturers are investing heavily in research and development to enhance energy management, reduce noise, and optimize performance across diverse vessel types. Partnerships with shipbuilders and component suppliers are strengthening supply chains and supporting the development of next-generation hybrid gensets. Companies are also focusing on expanding service networks and offering customized solutions for commercial, offshore, and naval applications. Growing preference for low-emission technologies and digital monitoring solutions continues to drive innovation. Competitive differentiation is increasingly based on hybrid system scalability, lifecycle cost optimization, and compliance with environmental standards, positioning major players to meet the evolving energy and sustainability goals of the global marine industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MAN Energy Solutions

- YANMAR

- ZF Friedrichshafen AG

- Siemens Energy

- Caterpillar

- Nidec Industrial Solutions

- Wärtsilä

- Scania

- Northern Lights

- Rolls-Royce

- ABB

- Cummins, Inc.

- Anglo Belgian Corporation nv

- Steyr Motors

- Volvo Penta

- Fischer Panda

- MITSUBISHI TURBOCHARGER AND ENGINE

Recent Developments

- In 2024, Fischer Panda launched its new PowerMaster® power management system at the Metstrade exhibition, which enhances the control and efficiency of its hybrid generators by optimizing onboard power use

- In 2023, Caterpillar Marine Launched the new Cat® C13D diesel engine platform, designed to be more fuel-efficient and powerful. This advanced platform serves as a foundation for future marine gensets, including hybrid-electric models.

- In 2023, Northern Lights, Inc. Unveiled its new M4105 and M6105 genset series, offering higher power ratings and a robust, compact design for marine applications. These units feature world-class sound enclosures to reduce noise and vibration.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of hybrid marine gensets will expand with stricter global emission regulations.

- Integration of battery storage and smart energy management will enhance vessel efficiency.

- Shipbuilders will increasingly focus on modular and compact hybrid genset designs.

- Growth in offshore exploration and commercial shipping will drive continuous market demand.

- Advancements in digital monitoring and predictive maintenance will improve operational reliability.

- Expansion of green shipping corridors will create strong opportunities for hybrid fleet conversions.

- Government incentives and maritime decarbonization programs will accelerate hybrid system installations.

- Rising fuel costs will push ship operators toward hybrid propulsion for long-term savings.

- Collaboration between engine manufacturers and technology firms will lead to innovation in hybrid integration.

- Development of hybrid-supporting port infrastructure will strengthen the global adoption of marine gensets.