Market Overview

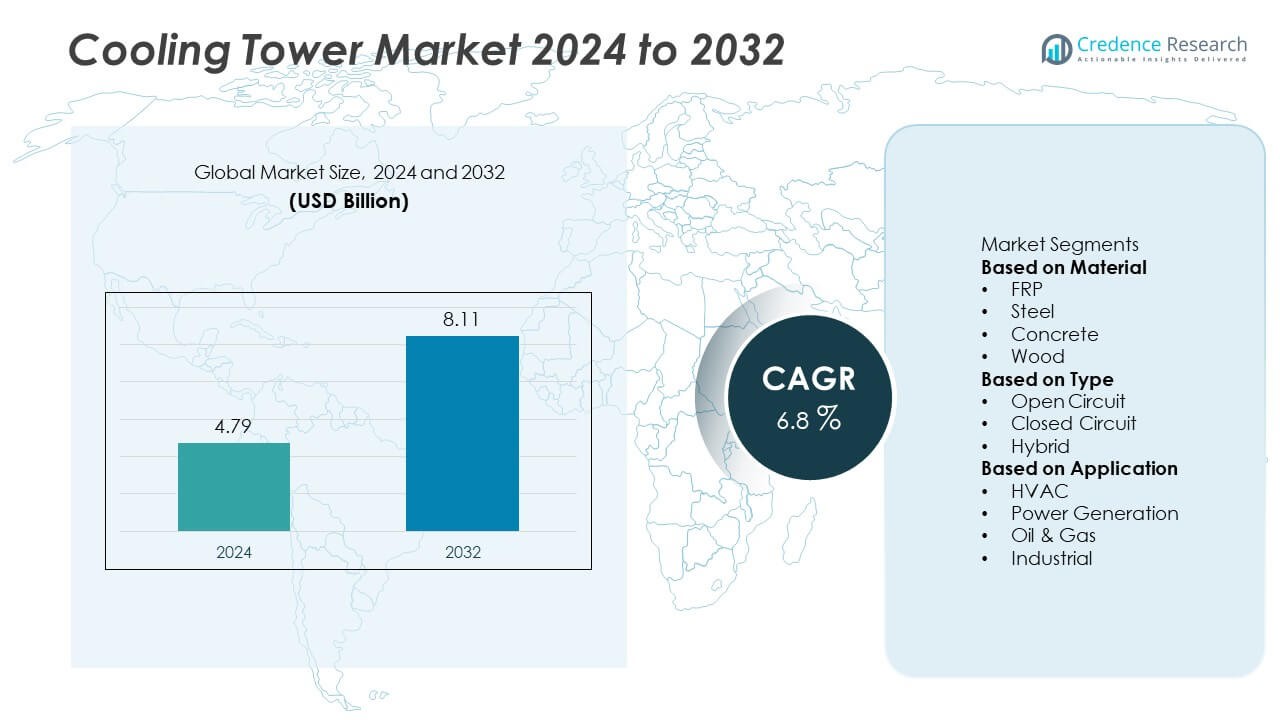

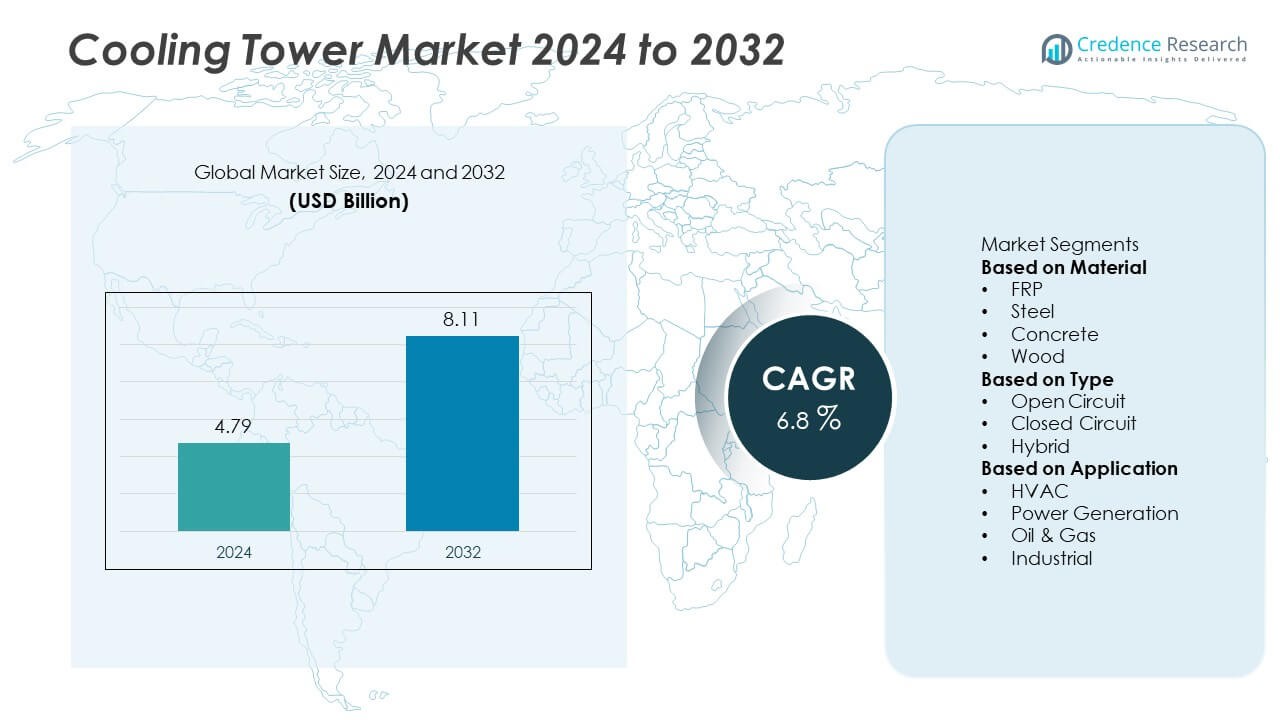

The Cooling Tower Market was valued at USD 4.79 billion in 2024 and is projected to reach USD 8.11 billion by 2032, expanding at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooling Tower Rental Market Size 2024 |

USD 4.79 Billion |

| Cooling Tower Rental Market, CAGR |

6.8% |

| Cooling Tower Rental Market Size 2032 |

USD 8.11 Billion |

The cooling tower market is dominated by key players such as EVAPCO, Inc., Johnson Controls International Plc., Delta Cooling Towers Inc., Kelvion Holdings GmbH, and Baltimore Aircoil Company. These companies lead through innovation in energy-efficient, corrosion-resistant, and low-noise cooling systems. EVAPCO and Johnson Controls maintain strong global positions through advanced hybrid and closed-circuit tower solutions designed for industrial and HVAC applications. Regionally, Asia-Pacific led the market with a 37% share in 2024, driven by rapid industrialization and growing power generation demand. North America followed with 29%, supported by modernization of thermal plants and the rising adoption of sustainable cooling technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cooling tower market was valued at USD 4.79 billion in 2024 and is projected to reach USD 8.11 billion by 2032, growing at a CAGR of 6.8%.

- Market growth is driven by rising demand for energy-efficient cooling systems across HVAC, industrial, and power generation sectors.

- Key trends include increasing adoption of FRP-based cooling towers, hybrid systems for water conservation, and smart monitoring technologies for efficiency optimization.

- The market is competitive, with leading players such as EVAPCO, Johnson Controls, and Kelvion focusing on advanced designs, modular systems, and global expansion.

- Asia-Pacific led with a 37% share in 2024, followed by North America at 29% and Europe at 24%, while the open-circuit type dominated with a 46% share due to its affordability and suitability for large-scale operations.

Market Segmentation Analysis:

By Material

The FRP segment dominated the cooling tower market in 2024, accounting for a 46% share. Its leadership is attributed to high corrosion resistance, lightweight design, and ease of installation, making it ideal for industrial and HVAC applications. FRP cooling towers require less maintenance and provide a longer operational life compared to steel or wood structures. Their adaptability to various climatic conditions and cost efficiency further strengthen their adoption. Rising demand for durable, energy-efficient materials in petrochemical, manufacturing, and power generation sectors continues to drive growth for FRP-based cooling towers globally.

- For instance, Delta Cooling Towers Inc. launched its TMX Series FRP towers with a 20-foot-long seamless HDPE/FRP casing and 20-year warranty, providing complete corrosion resistance for continuous operation in harsh chemical environments.

By Type

The open-circuit segment held the largest market share of 52% in 2024, driven by its widespread use in power generation and large-scale industrial facilities. Open-circuit cooling towers are favored for their operational simplicity, cost-effectiveness, and efficient heat transfer capabilities. These systems offer easy integration with existing cooling infrastructure, which reduces installation costs and enhances process reliability. However, hybrid systems are gaining traction as industries seek water-saving and low-emission alternatives. The open-circuit type continues to dominate due to its balance of performance, scalability, and low operating costs.

- For instance, Baltimore Aircoil Company introduced its Series 3000 Open-Circuit Cooling Tower, featuring a patented BACross fill media that promotes maximum air and water contact and offers XE models for enhanced energy efficiency. The Series 3000 product line includes multiple models with varying thermal capacities and fan motor ratings to match specific project requirements.

By Application

The power generation segment led the cooling tower market in 2024 with a 39% share, supported by growing global electricity demand and increasing adoption of thermal and nuclear power plants. Cooling towers are essential for maintaining turbine efficiency and managing condenser heat rejection in power stations. Expanding capacity additions across Asia-Pacific and modernization of existing plants in North America and Europe boost demand. Additionally, government emphasis on improving energy efficiency and reducing carbon emissions promotes the use of advanced, water-efficient cooling systems in the power generation industry.

Key Growth Drivers

Rising Demand for Energy-Efficient Cooling Solutions

Increasing focus on energy conservation and sustainable industrial operations is driving the demand for high-efficiency cooling towers. Modern cooling systems reduce water consumption, optimize heat exchange, and lower operational costs. Industries such as power generation, petrochemical, and HVAC are rapidly adopting advanced designs like hybrid and closed-circuit towers to minimize environmental impact. Government policies promoting energy-efficient infrastructure and green certification standards are further accelerating market adoption, particularly in regions emphasizing carbon footprint reduction and industrial energy optimization.

- For instance, Kelvion Holdings GmbH develops a wide range of closed-circuit cooling towers, such as the Tundracel series, which are designed for high thermal performance with efficient drift eliminators to minimize water losses. These systems can achieve very low drift rates, with some modern technologies designed to reduce water loss to less than 0.0005% of the circulating water flow rate.

Expansion of Power and Industrial Infrastructure

Rapid industrialization and the growing need for reliable power supply are key growth drivers in the cooling tower market. Rising construction of thermal, nuclear, and renewable power plants increases the demand for robust heat rejection systems. Industrial sectors, including oil and gas, steel, and chemical processing, rely on cooling towers for temperature control and equipment protection. Expanding manufacturing bases in Asia-Pacific and the Middle East, coupled with modernization of older facilities, continue to create sustained demand for advanced cooling technologies.

- For instance, Babcock & Wilcox Enterprises, Inc., through its subsidiary SPIG, offers natural draft cooling tower systems for thermal power facilities, including in India, to help optimize condenser backpressure efficiency.

Increasing Adoption of FRP and Corrosion-Resistant Materials

The shift toward fiber-reinforced plastic (FRP) and other corrosion-resistant materials is transforming the cooling tower industry. FRP towers offer superior durability, lightweight design, and resistance to moisture and chemical exposure, making them ideal for harsh industrial environments. Manufacturers are focusing on material innovations that enhance structural integrity while reducing maintenance costs. The growing preference for long-lasting, low-maintenance cooling towers in sectors such as petrochemicals, pharmaceuticals, and manufacturing is expected to drive significant market growth over the forecast period.

Key Trends & Opportunities

Technological Advancements in Smart Cooling Systems

The integration of IoT, automation, and real-time monitoring technologies is a major trend in cooling tower operations. Smart systems enable predictive maintenance, automatic fan speed control, and optimized water flow, improving efficiency and extending equipment lifespan. Manufacturers are developing digitalized cooling solutions that monitor performance parameters and reduce downtime. These advancements not only enhance energy savings but also align with the growing trend of Industry 4.0 adoption across industrial facilities.

- For instance, Johnson Controls International Plc. introduced its OpenBlue Connected Chiller Platform, which uses IoT-based analytics to monitor hundreds of real-time data points, enabling proactive and predictive maintenance to reduce unplanned downtime.

Shift Toward Hybrid and Water-Saving Cooling Towers

Environmental concerns and increasing water scarcity are driving demand for hybrid cooling towers that combine wet and dry cooling principles. These systems reduce water consumption and thermal discharge while maintaining optimal cooling performance. Industries in arid regions are rapidly adopting hybrid models to meet environmental regulations and sustainability goals. Manufacturers are innovating with designs that improve energy efficiency and environmental compliance, creating strong growth potential for hybrid cooling technologies worldwide.

- For instance, Baltimore Aircoil Company (BAC) offers the HXC Hybrid Condenser, which can achieve significant water savings over the course of a year. It uses a patented combined heat transfer system with different operating modes, including a dry mode, to balance energy and water consumption.

Key Challenges

High Maintenance and Operational Costs

Cooling towers require regular cleaning, water treatment, and mechanical upkeep to maintain performance, contributing to high operational expenses. Scaling, corrosion, and biological growth can degrade efficiency and increase maintenance costs. In older industrial setups, retrofitting existing systems adds further expense. Small and medium enterprises often face challenges in managing these recurring costs, limiting large-scale adoption. The market’s growth relies on developing low-maintenance designs and materials that reduce long-term operational expenditure.

Stringent Environmental and Water Usage Regulations

Government regulations on water consumption, thermal discharge, and emissions present challenges for cooling tower manufacturers and operators. Compliance with environmental norms requires investment in advanced filtration, drift eliminators, and water treatment technologies. In regions with limited freshwater availability, restrictions on industrial water use impact system operation. Meeting these environmental standards without compromising efficiency increases both cost and design complexity. Manufacturers must innovate to balance performance, cost, and regulatory compliance to sustain market competitiveness.

Regional Analysis

North America

North America held a 29% share of the cooling tower market in 2024, driven by robust demand across HVAC, power generation, and industrial sectors. The United States leads the region with increasing adoption of energy-efficient cooling systems and retrofitting projects in existing power plants. Strict environmental regulations by the EPA are encouraging the use of hybrid and closed-circuit cooling towers. Growth in commercial infrastructure and data centers is further supporting product adoption. Continuous technological innovation and emphasis on sustainable cooling solutions reinforce North America’s strong position in the global market.

Europe

Europe accounted for 26% of the global cooling tower market in 2024, supported by stringent energy efficiency mandates and decarbonization policies. Countries such as Germany, France, and the United Kingdom are leading adopters of advanced cooling technologies in HVAC and industrial sectors. The region’s focus on reducing water consumption and thermal pollution has accelerated the shift toward hybrid and FRP-based systems. Rising refurbishment of aging power infrastructure and growing demand for district cooling in urban areas contribute to market expansion across Europe.

Asia-Pacific

Asia-Pacific dominated the cooling tower market with a 33% share in 2024, fueled by rapid industrialization, urbanization, and strong investments in energy and manufacturing sectors. China, India, and Japan are key contributors, with extensive infrastructure development and expanding industrial bases. The region’s increasing electricity demand has boosted installations in thermal and nuclear power plants. Additionally, expanding construction in commercial and residential spaces drives HVAC application growth. Government initiatives promoting energy efficiency and sustainable industrial operations continue to support Asia-Pacific’s leadership in the global cooling tower market.

Middle East & Africa

The Middle East & Africa region captured a 7% market share in 2024, driven by growing demand from the oil and gas, petrochemical, and power generation industries. Countries such as Saudi Arabia, the UAE, and South Africa are investing heavily in industrial infrastructure and desalination plants, creating opportunities for high-performance cooling towers. Harsh climatic conditions have accelerated the adoption of corrosion-resistant FRP and hybrid cooling systems. Government-backed projects under national transformation plans and the expansion of renewable energy facilities further strengthen regional market growth.

South America

South America held a 5% share of the cooling tower market in 2024, supported by industrial growth and infrastructure modernization across Brazil, Argentina, and Chile. Rising energy demand and investment in manufacturing and mining sectors are key drivers of market expansion. The region is witnessing growing adoption of FRP-based and open-circuit cooling systems due to cost efficiency and ease of maintenance. Increasing government focus on energy efficiency and sustainable industrial practices is promoting upgrades to modern cooling technologies. Economic recovery and industrial development initiatives further enhance South America’s market potential.

Market Segmentations:

By Material

By Type

- Open Circuit

- Closed Circuit

- Hybrid

By Application

- HVAC

- Power Generation

- Oil & Gas

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cooling tower market includes major players such as EVAPCO, Inc., Delta Cooling Towers Inc., Johnson Controls International Plc., Cooling Tower Systems, Inc., S.A. Hamon, Babcock & Wilcox Enterprises, Inc., Engie Refrigeration GmbH, Kelvion Holdings GmbH, Baltimore Aircoil Company, and Cenk Endüstri Tesisleri Imalat Ve Taahhüt A.Ş. These companies focus on product innovation, energy-efficient technologies, and expanding global service networks to strengthen their market presence. Leading manufacturers are emphasizing modular and hybrid cooling tower systems that reduce water usage and maintenance costs. Strategic mergers, acquisitions, and collaborations with industrial clients support portfolio diversification and international expansion. Continuous investment in corrosion-resistant materials, digital performance monitoring, and sustainable cooling designs further enhances competitiveness. The market remains moderately consolidated, with technological advancement and customization capabilities serving as key differentiators among major industry participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, SPX Cooling Technologies expanded its Marley® OlympusV™ Adiabatic Fluid Cooler line by introducing higher-capacity models. This strategic move aims to offer more flexible and efficient cooling solutions for operators and engineers across commercial HVAC, industrial process, and data center applications, reinforcing SPX’s leadership in advanced evaporative cooling technologies.

- In May 2025, Delta Cooling Towers demonstrated that its TMX system’s seamless HDPE casing reduces leak repair points by eliminating welds and joints common in metal towers.

- In January 2025, Delta Cooling Towers introduced the TMX Series, its largest HDPE cooling tower line, ranging from 300 to 3,250 cooling tons. Built with a seamless 20-foot sump, it reduces leak risks and simplifies maintenance. The launch includes a new West Virginia facility to support production. The TMX Series offers energy efficiency, durability, and a 20-year shell warranty.

- In August 2024, Baltimore Aircoil Company introduced the Loop™ Platform, an AI-based system that enhances cooling tower performance. It uses real-time data to optimize efficiency, reduce energy and water usage, and support predictive maintenance. The compact platform integrates easily with existing systems. This innovation aligns with BAC’s focus on sustainability and system longevity.

Report Coverage

The research report offers an in-depth analysis based on Material, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing adoption of energy-efficient cooling technologies.

- Hybrid and closed-circuit cooling towers will gain traction due to water conservation benefits.

- Asia-Pacific will continue leading growth supported by rapid industrialization and power sector investments.

- North America and Europe will focus on modernization of existing cooling infrastructure.

- FRP material will dominate future installations for its durability and corrosion resistance.

- Smart and IoT-enabled cooling systems will enhance monitoring and maintenance efficiency.

- Demand from HVAC and data center applications will rise significantly.

- Manufacturers will prioritize low-noise and low-emission cooling solutions.

- Strategic partnerships and mergers will strengthen global market competitiveness.

- Long-term growth will rely on sustainable, modular, and high-performance cooling tower designs.