Market Overview

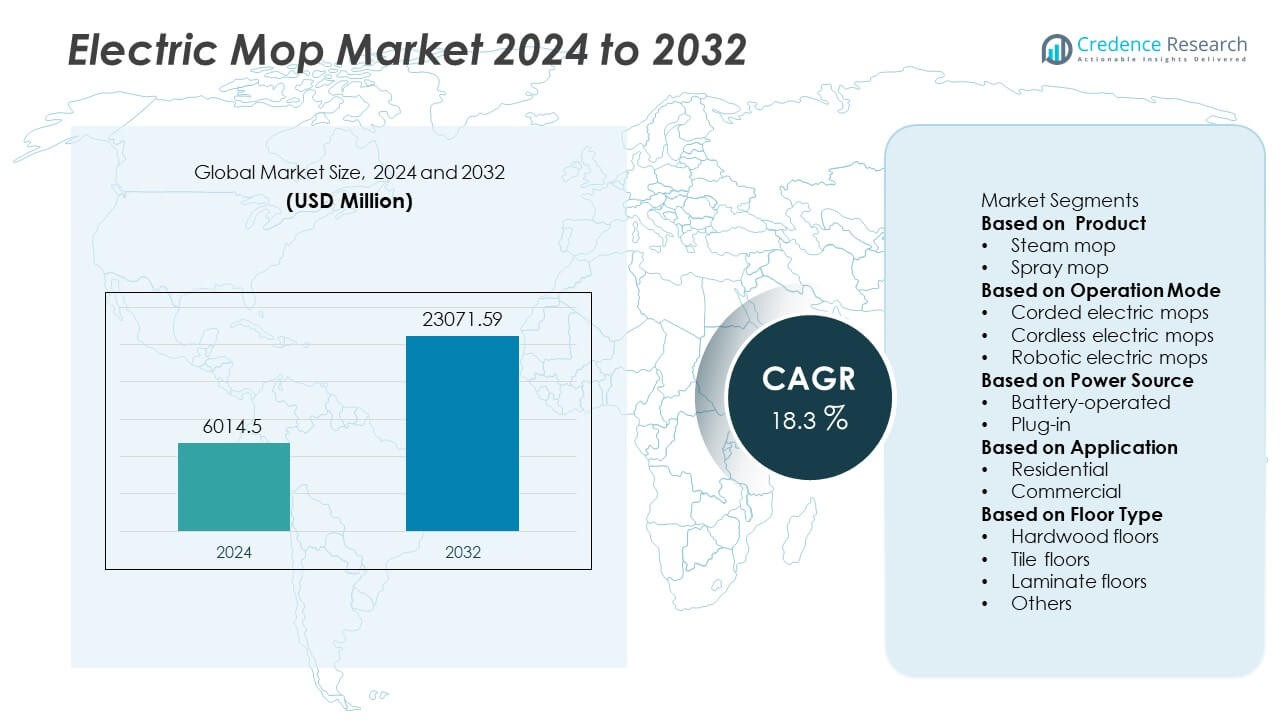

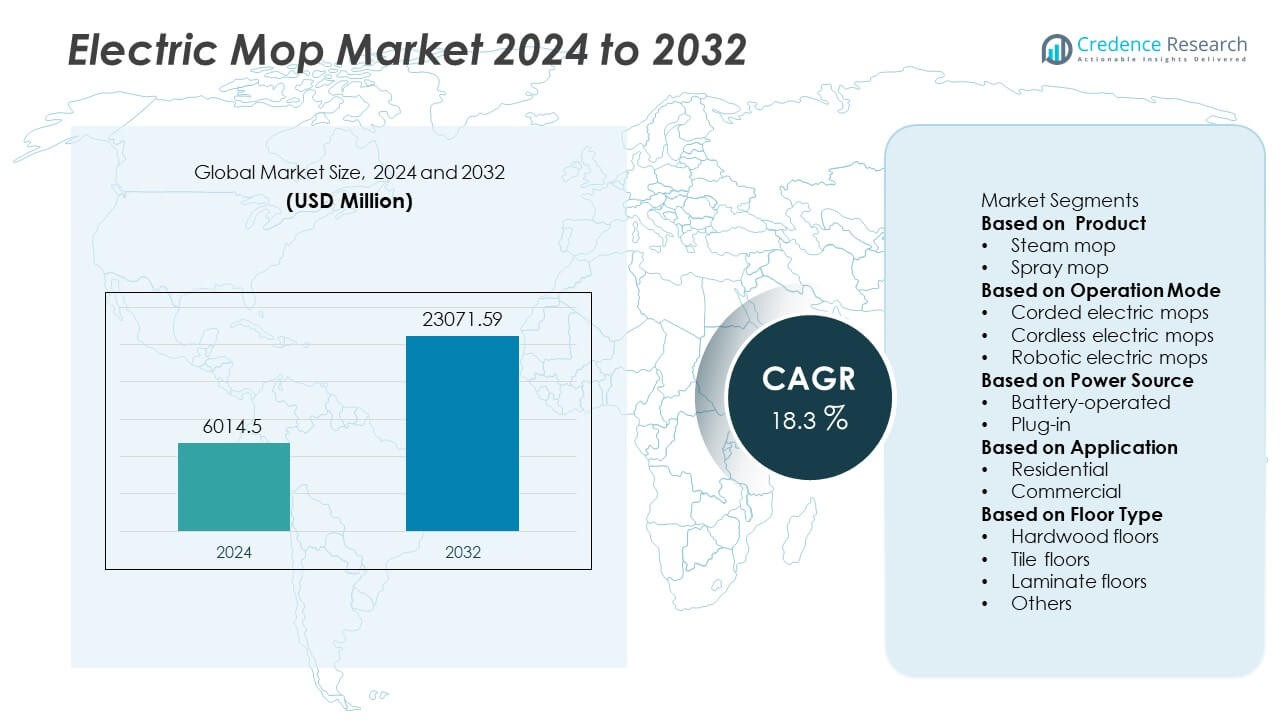

The Electric Mop Market was valued at USD 6,014.5 million in 2024 and is projected to reach USD 23,071.59 million by 2032, registering a CAGR of 18.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Mop Market Size 2024 |

USD 6,014.5 Million |

| Electric Mop Market, CAGR |

18.3% |

| Electric Mop Market Size 2032 |

USD 23,071.59 Million |

The electric mop market is led by major players including Roborock, ILIFE, Samsung, Bissell, iRobot, Hoover, Eufy, Kärcher, BLACK+DECKER, and Ecovacs. These companies dominate through innovations in cordless, robotic, and steam mop technologies, offering enhanced cleaning efficiency and convenience. North America emerged as the leading region in 2024, holding a 32% share of the global market, driven by high adoption of smart home appliances and strong retail penetration. Asia-Pacific followed with a 30% share, supported by urbanization and rising disposable incomes, while Europe accounted for 28%, emphasizing sustainable, energy-efficient cleaning products and eco-friendly household solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric mop market was valued at USD 6,014.5 million in 2024 and is projected to reach USD 23,071.59 million by 2032, growing at a CAGR of 18.3% during the forecast period.

- Rising demand for time-saving, smart cleaning devices and increasing hygiene awareness are key factors driving market growth globally.

- The market is witnessing strong trends in cordless, robotic, and AI-enabled mops, supported by innovations in battery efficiency and multi-surface cleaning technology.

- Key players including Roborock, Samsung, Bissell, iRobot, and Kärcher focus on advanced product features, online distribution, and eco-friendly materials to stay competitive.

- North America leads with 32% share, followed by Asia-Pacific with 30% and Europe with 28%, while the steam mop segment holds 55% of total product demand and battery-operated models account for 65% of power source preference.

Market Segmentation Analysis:

By Product

The steam mop segment dominated the electric mop market in 2024, holding over 55% of the total share. Its leadership stems from growing consumer preference for chemical-free deep cleaning and sanitization across both residential and commercial spaces. Steam mops effectively remove dirt, bacteria, and allergens using high-temperature steam, making them ideal for households with pets and children. The spray mop segment, accounting for 45% share, continues to grow due to its lightweight design and affordability. Increasing awareness of hygiene and convenience-based cleaning products further drives demand for steam-based mopping solutions.

- For instance, the Bissell PowerFresh Deluxe Steam Mop heats up in 30 seconds. It is also designed to eliminate 99.9% of household bacteria without chemicals and features a 12-inch cleaning path.

By Operation Mode

The cordless electric mop segment led the market in 2024 with a share of 50%, driven by strong demand for portable, easy-to-maneuver cleaning devices. Consumers prefer cordless models for their flexibility and compatibility with multiple surfaces, supported by advancements in lithium-ion battery technology. Robotic electric mops captured 30% share, gaining traction among tech-savvy users for automated and time-efficient cleaning. The corded segment, holding 20% share, remains relevant in commercial settings where continuous power is essential. Innovation in smart controls and self-cleaning features continues to enhance the appeal of cordless and robotic models globally.

- For instance, Roborock’s Dyad Pro Combo integrates a 4,000 mAh lithium-ion battery providing 43 minutes of runtime and a 17,000 Pa suction system combined with dual roller mops rotating at 180 rpm. The model supports automatic self-cleaning and drying cycles, ensuring minimal maintenance while maintaining consistent performance across tile, vinyl, and hardwood surfaces.

By Power Source

The battery-operated segment accounted for around 65% of the global market share in 2024, driven by increasing consumer adoption of rechargeable and energy-efficient appliances. These mops offer flexibility and convenience, eliminating the limitations of plug-in designs. The plug-in segment, holding 35% share, remains preferred in larger cleaning operations requiring extended runtime without charging interruptions. Growing innovation in fast-charging batteries and improved power management systems supports the dominance of battery-powered models. The ongoing shift toward cordless living and sustainable cleaning technologies continues to reinforce this segment’s leadership in the electric mop market.

Key Growth Drivers

Rising Demand for Smart and Time-Saving Cleaning Solutions

The growing preference for convenient, time-efficient home cleaning appliances is driving the electric mop market. Busy urban lifestyles and increasing dual-income households are fueling demand for automated and easy-to-use cleaning tools. Smart features such as self-cleaning systems, adjustable steam control, and one-touch operation are enhancing user convenience. Manufacturers are integrating digital technologies like app connectivity and scheduling to improve functionality. This shift toward intelligent cleaning solutions is reshaping household cleaning preferences and driving rapid market expansion globally.

- For instance, iRobot’s Roomba Combo j9+ integrates an AI-based mapping system with PrecisionVision Navigation and a fully-retractable mop that lifts completely when transitioning from hard floors to carpets. The system supports app-based scheduling through the iRobot OS platform, allowing users to automate multi-room cleaning cycles efficiently.

Increasing Awareness of Hygiene and Health

Rising hygiene awareness following the pandemic has significantly boosted demand for electric mops. Consumers are focusing on maintaining sanitized living environments to reduce exposure to bacteria and allergens. Steam-based electric mops, which clean without chemicals, have gained strong traction among health-conscious users. Their ability to eliminate 99% of germs using high-temperature steam makes them ideal for households with children and pets. As cleanliness becomes a key household priority, the market continues to benefit from the shift toward advanced, hygienic cleaning appliances.

- For instance, Kärcher’s SC 3 Upright EasyFix steam mop produces steam at 100 °C and achieves full heat readiness in 30 seconds with a 0.5 L water tank capacity. The unit is TÜV-certified to remove 99.99% of household bacteria and operates with a descaling cartridge system that extends component life during repeated sanitization cycles across home flooring surfaces.

Rapid Technological Advancements in Cleaning Devices

Continuous innovation in design, battery performance, and automation is accelerating market growth. Modern electric mops now feature longer battery life, stronger suction, and multi-surface compatibility. The integration of sensors, LED indicators, and self-drying mechanisms has elevated performance efficiency. Robotic and cordless electric mops are gaining popularity due to reduced manual effort and greater mobility. As smart home ecosystems expand, these technologically advanced devices are becoming a central component of modern households, driving sustained demand across developed and emerging economies.

Key Trends & Opportunities

Growth of Robotic and AI-Enabled Cleaning Systems

Artificial intelligence integration is transforming the electric mop market, enabling smarter and more autonomous cleaning. AI-powered robotic mops can map floor layouts, detect obstacles, and adjust cleaning intensity automatically. These systems appeal to tech-oriented consumers seeking hands-free cleaning solutions. The growing smart home trend and advancements in IoT connectivity are further strengthening this opportunity. As consumers shift toward fully automated household appliances, AI-driven electric mops are expected to capture an increasing share of the global market.

- For instance, the Ecovacs DEEBOT X2 Omni uses a built-in, dual-laser LiDAR system for navigation instead of a 3D ToF sensor. This system works alongside AI-controlled AIVI 3D 2.0 obstacle avoidance. The robot features an 8,000 Pa suction motor and an OZMO Turbo 2.0 mopping system with dual rotating mop heads that spin at 180 rpm and apply 6 N of downward pressure.

Rising Demand for Eco-Friendly and Battery-Efficient Products

Consumers are increasingly prioritizing sustainability, driving demand for eco-friendly electric mops. Manufacturers are developing energy-efficient, battery-operated models that reduce electricity consumption and eliminate chemical cleaning agents. Rechargeable lithium-ion batteries with fast-charging capabilities are becoming standard features. In addition, recyclable materials and low-noise operation are appealing to environmentally conscious buyers. This trend aligns with global sustainability goals, creating strong growth opportunities for brands focusing on green innovation and reduced carbon footprints in home appliances.

- For instance, Eufy’s MACH V1 Ultra cordless mop uses a 7,400 mAh lithium-ion battery that delivers up to 82 minutes of runtime per charge. The system features Eco-Clean Ozone disinfection technology for chemical-free cleaning, while its brushless motor maintains a low noise level of 65 dB during continuous operation.

Key Challenges

High Product Cost and Maintenance Requirements

Despite growing popularity, electric mops face challenges related to high initial costs and maintenance. Premium models with advanced features such as steam control and smart navigation remain expensive for price-sensitive consumers. Regular filter cleaning, battery replacement, and part maintenance also add to ownership costs. These factors limit market penetration in developing regions. To overcome this, manufacturers are introducing cost-effective variants and flexible pricing strategies to expand accessibility among middle-income households.

Limited Durability and Battery Performance Issues

Battery-operated electric mops often face criticism for limited runtime and durability. Frequent charging cycles and declining battery efficiency over time can affect cleaning performance. Heavy-duty use in large households or commercial settings further strains battery life. Additionally, replacement parts and servicing are not always easily available in developing markets. To address these concerns, manufacturers are investing in enhanced battery technologies, durable components, and improved after-sales support to ensure longer product lifespan and user satisfaction.

Regional Analysis

North America

North America dominated the electric mop market in 2024, holding a 32% share of the global market. Strong consumer awareness of smart home technologies and a preference for automated cleaning devices drive regional demand. The U.S. leads adoption, supported by high disposable incomes and a growing emphasis on home hygiene. Frequent product launches featuring cordless and robotic technologies strengthen market growth. The expanding retail and e-commerce infrastructure further boosts accessibility, while increasing adoption of energy-efficient and eco-friendly appliances continues to shape the market outlook across the region.

Europe

Europe accounted for 28% of the global electric mop market share in 2024, driven by increasing awareness of sustainable and low-noise cleaning devices. Countries such as Germany, France, and the United Kingdom lead adoption due to widespread acceptance of smart home appliances. Consumers in the region value energy efficiency, durability, and eco-friendly designs, which promote demand for cordless and steam-based electric mops. Stringent EU regulations on energy consumption also encourage the use of environmentally friendly technologies. Continuous innovation and expanding online distribution channels are further reinforcing Europe’s market position.

Asia-Pacific

Asia-Pacific captured a 30% share of the electric mop market in 2024, emerging as the fastest-growing region. Rapid urbanization, rising disposable incomes, and increasing household automation drive strong demand across China, Japan, and India. Growing awareness of hygiene and convenience among middle-income consumers boosts adoption of electric cleaning appliances. Local manufacturers offering affordable and multifunctional models enhance market accessibility. Expanding e-commerce platforms and government initiatives promoting energy-efficient home devices also support regional growth. Asia-Pacific’s expanding middle-class population and smart living trends will continue to accelerate market expansion in the coming years.

Latin America

Latin America held a 6% share of the global electric mop market in 2024, supported by growing urban populations and lifestyle changes emphasizing convenience and hygiene. Brazil and Mexico lead demand due to increased household spending and expanding retail networks. The region’s improving access to smart appliances through online platforms is boosting sales. However, high product costs and limited awareness in rural areas restrict faster penetration. Ongoing innovation in affordable cordless models and rising influence of global brands are expected to strengthen the market’s position in the region over time.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the global electric mop market in 2024, driven by increasing adoption of smart and energy-efficient home appliances. The United Arab Emirates and Saudi Arabia dominate regional demand due to strong infrastructure development and higher living standards. Rising awareness of hygiene and convenience is promoting the use of electric mops in both residential and commercial settings. Although limited brand presence and high import costs pose challenges, expanding online retail channels and growing disposable incomes are creating new opportunities for future market growth.

Market Segmentations:

By Product

By Operation Mode

- Corded electric mops

- Cordless electric mops

- Robotic electric mops

By Power Source

By Application

By Floor Type

- Hardwood floors

- Tile floors

- Laminate floors

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electric mop market includes key players such as Roborock, ILIFE, Samsung, Bissell, iRobot, Hoover, Eufy, Kärcher, BLACK+DECKER, and Ecovacs. These companies compete through innovation in cordless, robotic, and steam-based cleaning technologies designed to enhance user convenience and hygiene. Leading players focus on integrating AI, IoT connectivity, and advanced battery systems to improve efficiency and runtime. Product differentiation through lightweight designs, multi-surface compatibility, and self-cleaning mechanisms is a key growth strategy. Companies are also expanding their e-commerce presence and leveraging digital marketing to strengthen global reach. Strategic partnerships, smart home integration, and continuous R&D investments enable these brands to maintain competitiveness. With rising demand for automation and sustainable cleaning solutions, manufacturers are prioritizing eco-friendly materials and low-energy designs to align with evolving consumer preferences in the electric mop market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Roborock

- ILIFE

- Samsung

- Bissell

- iRobot

- Hoover

- Eufy

- Kärcher

- BLACK+DECKER

- Ecovacs

Recent Developments

- In September 2025, Roborock introduced the P20 Living Water Edition featuring a roller mop system. The roller spins at up to 220 rpm, provides 15 N downward force, and uses a self-cleaning dock that washes the mop with 75 °C water.

- In July 2025, iRobot launched the Roomba Max 705 Combo Robot + AutoWash Dock with 175× stronger suction compared to the Roomba 600 series and a roller mop system.

- In May 2025, Kärcher expanded its vacuum-mop product line with new multifunction devices featuring LED displays that show battery status and cleaning modes.

- In April 2025, Bissell introduced the CrossWave Edge, offering edge-to-edge cleaning using “ZeroGap™ Technology” plus 2× more suction than a leading competitor.

Report Coverage

The research report offers an in-depth analysis based on Product, Operation Mode, Power Source, Application, Floor Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric mop market will continue to grow with strong demand for smart and automated cleaning solutions.

- Cordless and robotic mops will dominate as consumers prefer convenience and mobility.

- Integration of AI and IoT technologies will enhance performance and customization.

- Eco-friendly and chemical-free cleaning options will gain more consumer attention.

- Manufacturers will focus on lightweight, ergonomic, and energy-efficient product designs.

- Online sales channels will expand rapidly due to higher digital adoption and brand accessibility.

- Asia-Pacific will remain the fastest-growing region with increasing urban households.

- Product innovation will center on battery longevity and self-cleaning functionalities.

- Strategic partnerships and new product launches will drive competitive differentiation.

- Rising global hygiene awareness will sustain long-term growth across both residential and commercial markets.