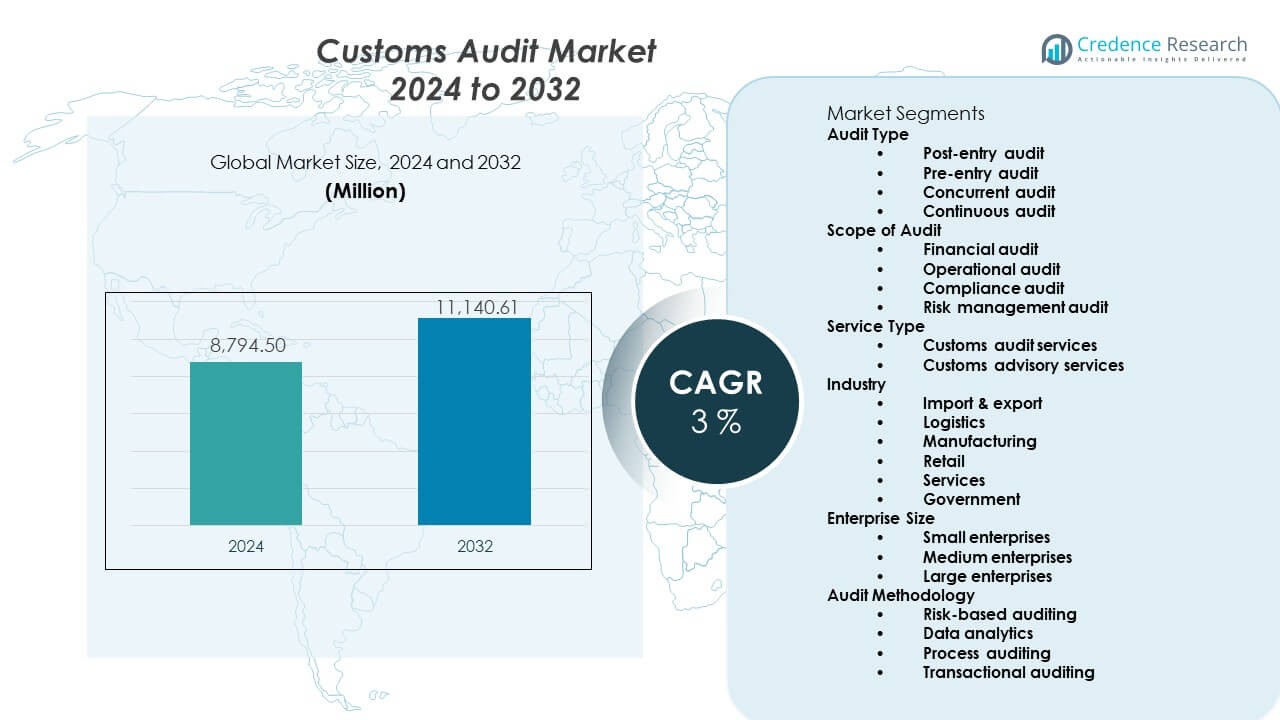

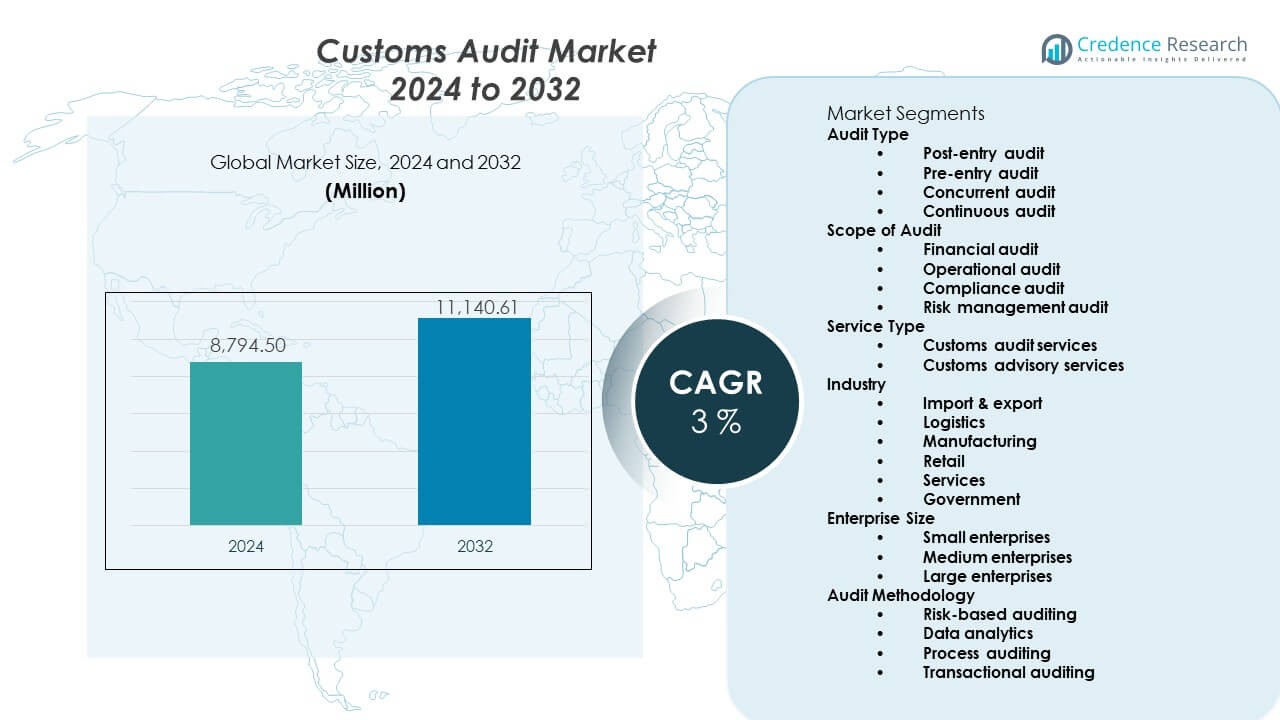

The Customs audit market is projected to grow from USD 8,794.5 million in 2024 to an estimated USD 11,140.61 million by 2032, with a compound annual growth rate (CAGR) of 3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Customs audit Market Size 2024 |

USD 8,794.5 Million |

| Customs audit Market, CAGR |

3% |

| Customs audit Market Size 2032 |

USD 11,140.61 Million |

The market expands due to rising enforcement, stricter compliance norms, and growing supply-chain complexity. Audit teams monitor duty payments, classification accuracy, and documentation alignment to avoid disruptions. Traders adopt digital tools that help meet evolving data-submission rules. Governments push automation across customs checkpoints to cut delays. Multinational enterprises use structured audit cycles to improve risk control. Trade agreements drive process revisions that require frequent compliance checks. Technology vendors support teams with AI-based review tools that speed error detection. Strong regulatory pressure keeps adoption high across major industries.

North America leads due to strong digital adoption and mature trade-compliance frameworks. Europe follows with strict regulatory standards and structured customs modernization programs. Asia Pacific emerges as a fast-growing region due to rising cross-border trade and complex tariff structures. China, India, and Southeast Asian countries invest in customs digitalization to reduce processing delays. The Middle East strengthens its position with new free-trade zones and updated compliance rules. Latin America shows steady progress as countries modernize border systems and expand electronic documentation. Africa gains traction through customs reform efforts and improved digital infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Customs audit market is valued at USD 8,794.5 million in 2024 and is projected to reach USD 11,140.61 million by 2032, advancing at a 3% CAGR driven by stricter enforcement requirements and expansion of automated audit systems.

- North America holds 34–36%, supported by mature compliance systems; Europe follows with 28–30%, backed by harmonized regulatory frameworks; Asia-Pacific holds 22–24%, driven by rising trade flows and large manufacturing hubs.

- Asia-Pacific is the fastest-growing region with a 22–24% share, expanding due to customs modernization, rising export volumes, and rapid adoption of digital compliance tools.

- The audit type segment is led by post-entry audits with around 40% share, driven by strong demand for duty verification and post-clearance checks across high-volume importers.

- The scope-of-audit segment is dominated by compliance audits holding nearly 35% share, supported by increased regulatory scrutiny and the need to validate classification, valuation, and documentation accuracy.

Market Drivers:

Rising Enforcement Pressure and Stronger Regulatory Alignment

Governments tighten inspection rules that push enterprises to raise compliance efforts across borders. The Customs audit market gains steady demand due to rising documentation checks. Trade groups adopt standard procedures that lower classification errors. Companies use automated review tools that improve data accuracy. Regulators promote structured record-keeping to reduce fraud risk. Audit teams track tariff changes that influence supply-chain decisions. High-risk sectors adopt internal review cycles to maintain control. Digital frameworks support faster verification across global shipments.

- For instance, SAP Global Trade Services (GTS) is used by approximately 1,150 to over 2,000 companies globally and automates classification and compliance checks across thousands of daily cross-border transactions. The exact number of verified companies as of August 2025 is reported to be 943.

Growing Digital Integration Across Audit and Trade Compliance Systems

Digital tools support faster evaluation of customs records and clear workflow steps for teams. The Customs audit market benefits from wider shifts toward automated controls. Enterprises deploy AI-driven systems that highlight risk zones. Analytics tools improve decision quality during review cycles. Electronic documentation helps teams cut manual delays and avoid dispute cases. Governments build digital gateways that streamline border processes. Automation increases visibility across import and export filings. Audit teams use integrated dashboards to monitor compliance gaps in real time.

- For instance, Thomson Reuters ONESOURCE Global Trade, deployed across more than 180 countries, automates customs documentation and supports compliance screening for major multinational importers.

Expansion of Cross-Border Trade and Higher Documentation Volumes

Import growth lifts the need for error-free classification and duty checks across regions. The Customs audit market gains traction due to rising shipment volumes. Traders manage strict timelines that demand clean documentation. Businesses strengthen internal controls to avoid penalties. Review teams evaluate supplier data more closely for accuracy. Global supply chains rely on updated tariff structures to reduce risk. Companies revise audit procedures to meet new compliance demands. Digital filing platforms reduce bottlenecks across review processes.

Stronger Focus on Internal Risk Controls Among Global Enterprises

Large companies adopt structured audit cycles that reduce exposure to penalties. The Customs audit market grows with rising attention on internal governance. Audit groups monitor repeat classification issues that impact cash flow. Firms build compliance training programs for staff handling freight data. Leadership teams push transparency to avoid dispute cases. Importers and exporters adjust processes to meet dynamic regulatory shifts. Digital workflows reduce human error during complex filings. Global enterprises use predictive tools to identify risk trends early.

Market Trends:

Rising Shift Toward Predictive Analytics and Automated Risk Scoring Models

Enterprises deploy predictive tools that help audit teams flag irregularities. The Customs audit market adapts to rapid growth in automated risk scoring. Machine learning supports deeper trend evaluation across trade data. Companies use behavior-based alerts to focus on high-risk shipments. Cloud-based tools enable real-time access to audit outcomes. Governments experiment with AI-driven inspection engines. Audit teams trust automated models to reduce review cycles. Predictive scoring raises efficiency in large-volume environments.

- For instance, IBM Sterling Supply Chain Intelligence Suite uses AI models that analyze millions of supply-chain data points daily, helping enterprises detect anomalies linked to customs and trade-compliance risks.

Growing Adoption of Centralized Audit Management Platforms

Businesses unify customs review systems to avoid fragmented workflows and data silos. The Customs audit market evolves with rising interest in central dashboards. Unified platforms improve tracking of duty payments and tariff updates. Teams use controlled workflows to manage complex record sets. Cloud-based storage increases access for global compliance units. Central audit trails support faster dispute resolution. Vendors expand features to include full lifecycle monitoring. Enterprises depend on consolidated tools to maintain seamless oversight.

- For instance, KPMG operates in more than 143 countries, enabling enterprises to centralize customs audit oversight through globally aligned trade-compliance frameworks supported by a unified advisory network.

Expansion of Trade Automation Ecosystems and Digital Gateways

Governments upgrade border systems that integrate customs filing with real-time validation. The Customs audit market responds to stronger digitization across trade routes. Automated gateways cut clearance delays and reduce manual checks. Importers adopt structured data standards that lower document risks. Blockchain pilots support tamper-proof verification for sensitive goods. Cloud APIs support faster integration with enterprise systems. End-users gain better transparency through shared digital channels. Automated review stages shrink error rates across high-volume operations.

Growing Focus on Compliance Intelligence and Continuous Monitoring Cycles

Compliance units deploy intelligence tools that reveal early gaps in filing accuracy. The Customs audit market sees strong interest in continuous monitoring systems. Enterprises rely on rule-based engines to prevent classification errors. Dashboards offer real-time updates on changing regulatory rules. Teams evaluate supplier behavior to identify recurring risks. New monitoring models support faster documentation audits. Global traders integrate smart alerts into daily workflows. Businesses gain resilience through structured oversight tools.

Market Challenges Analysis

High Regulatory Complexity and Limited Standardization Across Global Trade Systems

Trade environments vary across regions, which increases compliance challenges for global companies. The Customs audit market faces hurdles due to frequent rule changes. Audit teams struggle to interpret new tariff schedules with limited notice. Variations in documentation formats slow verification cycles. Businesses face difficulty maintaining uniform internal procedures. Lack of standard digital adoption across borders raises review delays. Enterprises deal with repeated updates that demand constant training. Regulators introduce new rules that stretch internal audit resources.

Rising Skill Gaps and Limited Availability of Experienced Audit Professionals

Audit teams face shortages in trained experts who understand complex customs laws. The Customs audit market experiences strain due to growing demand for specialized skills. Companies deal with longer review cycles when talent gaps widen. Training programs require continuous updates to match new regulations. Many regions lack advanced compliance education that supports workforce needs. Teams struggle to manage large datasets without strong analytical expertise. Enterprises invest more to retain qualified professionals. Skill gaps slow improvement in audit efficiency across global markets.

Market Opportunities

Expansion of Digital Ecosystems and Adoption of AI-Powered Audit Solutions

Technology vendors launch advanced tools that automate classification and documentation checks. The Customs audit market gains opportunity from rising interest in predictive systems. AI engines help teams reduce manual review pressure. Cloud models expand access for global compliance units. Digital records support smoother integration with customs gateways. Enterprises upgrade infrastructure to meet regulatory digitalization. Predictive analytics helps traders avoid costly errors. Automation lifts accuracy across high-volume audits.

Rising Demand for Third-Party Compliance Services Across Global Trade Networks

Businesses outsource audit functions to reduce workload and gain expert support. The Customs audit market benefits from wider acceptance of managed services. Third-party firms offer deeper knowledge across regional rules. Enterprises focus on core operations while partners manage risk-heavy tasks. Outsourcing improves turnaround time for detailed reviews. Provider networks expand coverage across new trade routes. Demand rises in emerging markets with limited internal expertise. Managed services strengthen compliance resilience for global companies.

Market Segmentation Analysis:

Audit Type

The Customs audit market covers post-entry, pre-entry, concurrent, and continuous audits that support structured compliance across global trade operations. Post-entry audits verify duty accuracy after clearance. Pre-entry checks help reduce filing errors before shipment release. Concurrent audits track real-time movements to limit classification issues. Continuous audits support automated oversight for high-volume traders. Each audit type helps importers and exporters maintain stronger governance.

- For instance, EY’s global trade team operates across more than 150 countries, supporting companies with continuous audit and classification reviews aligned with multi-jurisdiction trade regulations.

Scope of Audit

Financial, operational, compliance, and risk management audits shape review depth across supply chains. Financial audits verify duty payments and valuation accuracy. Operational audits focus on workflow stability. Compliance audits measure alignment with regulatory rules. Risk management audits identify vulnerabilities in complex documentation cycles. This scope helps companies strengthen transparency.

- For instance, Deloitte’s Global Trade Advisory practice, operating across more than 150 countries, conducts financial, operational, and compliance audits for multinational importers under harmonized global review structures.

Service Type

Customs audit services and customs advisory services guide traders through evolving regulatory demands. Service teams support document checks, record validation, and strategic planning. Advisory units help enterprises redesign internal controls and avoid penalties. It gains value from rising complexity in multi-country operations.

Industry

Import and export groups lead adoption due to strict documentation needs. Logistics and manufacturing follow with high shipment volumes. Retail and service sectors adopt structured audits for smoother clearance cycles. Government agencies use audit programs to validate trade data quality.

Enterprise Size

Small, medium, and large enterprises deploy audit models that match their risk exposure. Large firms use integrated systems, while smaller firms rely on external support to manage complex checks.

Audit Methodology

Risk-based auditing, data analytics, process auditing, and transactional auditing help teams increase accuracy. Digital review tools highlight errors early. Structured methods lift reliability across audit stages.

Segmentation:

Audit Type

- Post-entry audit

- Pre-entry audit

- Concurrent audit

- Continuous audit

Scope of Audit

- Financial audit

- Operational audit

- Compliance audit

- Risk management audit

Service Type

- Customs audit services

- Customs advisory services

Industry

- Import & export

- Logistics

- Manufacturing

- Retail

- Services

- Government

Enterprise Size

- Small enterprises

- Medium enterprises

- Large enterprises

Audit Methodology

- Risk-based auditing

- Data analytics

- Process auditing

- Transactional auditing

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Customs audit market with around 34–36% due to strong regulatory oversight and high digital adoption across trade operations. The region benefits from advanced compliance frameworks that guide importers and exporters through complex documentation rules. Audit teams use structured digital tools that reduce classification errors and improve workflow efficiency. Large enterprises deploy integrated audit platforms to manage growing data volumes. Government agencies enforce strict customs procedures that increase demand for professional audit support. The market grows as traders expand cross-border flows with Canada and Mexico. It maintains leadership due to mature compliance culture and strong advisory presence.

Europe

Europe accounts for 28–30% share of the Customs audit market, supported by harmonized customs rules and high regulatory transparency. Companies operate under regional frameworks that demand detailed record-keeping and periodic audit cycles. Enterprises rely on advisory teams to manage complex VAT, duty, and classification obligations. It gains steady traction due to rising digitalization efforts under customs modernization programs. Manufacturing and logistics sectors drive strong adoption across high-volume trade corridors. Cross-border movements within the EU create a consistent need for structured verification processes. Audit service providers expand operations to meet demand from both regional and extra-EU traders.

Asia-Pacific

Asia-Pacific holds 22–24% share and remains the fastest-growing region due to expanding trade networks and complex tariff structures. Rapid industrial growth raises the need for structured audit systems across import and export operations. Enterprises face diverse regulatory environments that demand strong compliance management. The Customs audit market strengthens in the region due to rising adoption of automated filing and data analytics tools. It gains momentum as countries upgrade customs digital platforms to reduce clearance delays. Small and medium enterprises seek advisory support to manage new documentation standards. Growth accelerates in China, India, and Southeast Asia due to rising shipment volumes and supply-chain diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Deloitte Touche Tohmatsu Ltd.

- KPMG International Ltd.

- Ernst & Young Global Ltd. (EY)

- PricewaterhouseCoopers LLP (PwC)

- BDO International Ltd.

- Grant Thornton International Ltd.

- Baker Tilly International Ltd.

- Crowe LLP

- Mazars

- RSM International

- AlixPartners

- FTI Consulting

Competitive Analysis:

The Customs audit market features strong competition among global consulting firms, specialized audit providers, and technology-driven compliance platforms. Large firms expand service depth through integrated audit, advisory, and analytics solutions. The Customs audit market benefits from high domain expertise offered by leading players that support complex multi-country operations. It faces growing digital disruption as vendors introduce automated review engines and risk-scoring systems. Firms invest in AI tools to improve accuracy and shorten review cycles. Mid-size providers gain traction by offering niche audit capabilities and flexible service models. The competitive landscape remains dynamic as companies target regulated and high-volume trade sectors.

Recent Developments:

- In November 2025, PwC Ukraine’s Customs Regulation and International Trade team hosted business meetings to discuss key issues arising from amendments to Ukraine’s Customs Code. These changes have significantly impacted companies operating under various customs regimes, and PwC provided practical guidance on compliance assessments and effective use of authorisations to simplify customs procedures.

- In September 2025, Deloitte announced an expanded multi-year co-innovation agreement with HundredX Inc., a data and predictive insights company. This exclusive partnership is designed to deliver actionable, predictive insights that help C-suite leaders across industries reshape business strategy and drive stronger financial performance. The collaboration combines Deloitte’s Converge platforms with HundredX’s predictive analytics to provide real-time market intelligence.

- In September 2025, PwC US launched Data PRO and Acquisition Hub, two integrated AI audit tools that represent significant innovations in the firm’s 2025 audit experience. These tools automate data collection and preparation processes, making audit data gathering easier for clients and audit teams. The advancement reflects PwC’s ongoing multi-year audit transformation, combining advanced technology with deep industry knowledge.

- In August 2025, the U.S. Department of Justice, in coordination with the Department of Homeland Security, announced the creation of a Trade Fraud Task Force to increase enforcement against customs violations. PwC has been actively advising clients on compliance requirements and risk management strategies in response to this heightened enforcement environment, which targets duty evasion, smuggling, and other illicit trade activities.

Report Coverage:

The research report offers an in-depth analysis based on Audit Type and Scope of Audit. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing digital audit platforms will expand automation across high-volume trade operations.

- AI-driven risk scoring will strengthen early detection of classification errors.

- Advisory services will gain demand from SMEs with limited internal compliance teams.

- Cloud-based audit tools will improve cross-border document visibility.

- Data-driven audit methodologies will replace manual verification cycles.

- Regulatory tightening will increase adoption of continuous audit frameworks.

- Enterprise-wide compliance integration will create steady growth opportunities.

- Regional modernization programs will shape new digital filing standards.

- Outsourced audit models will rise in markets facing talent shortages.

- Advanced analytics will guide proactive customs audit planning for global traders.