Market Overview

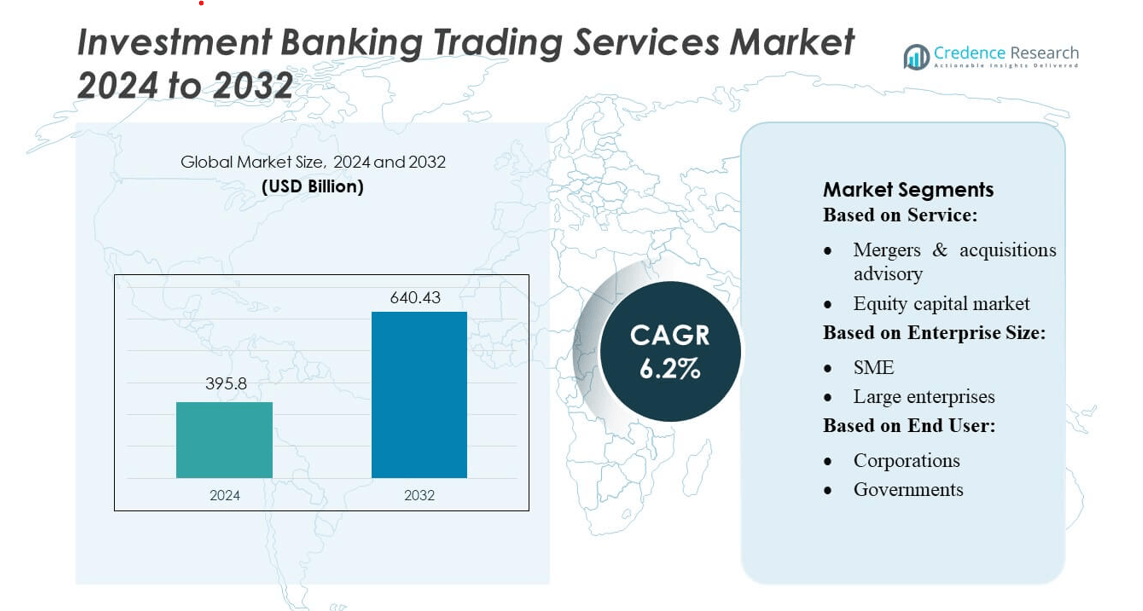

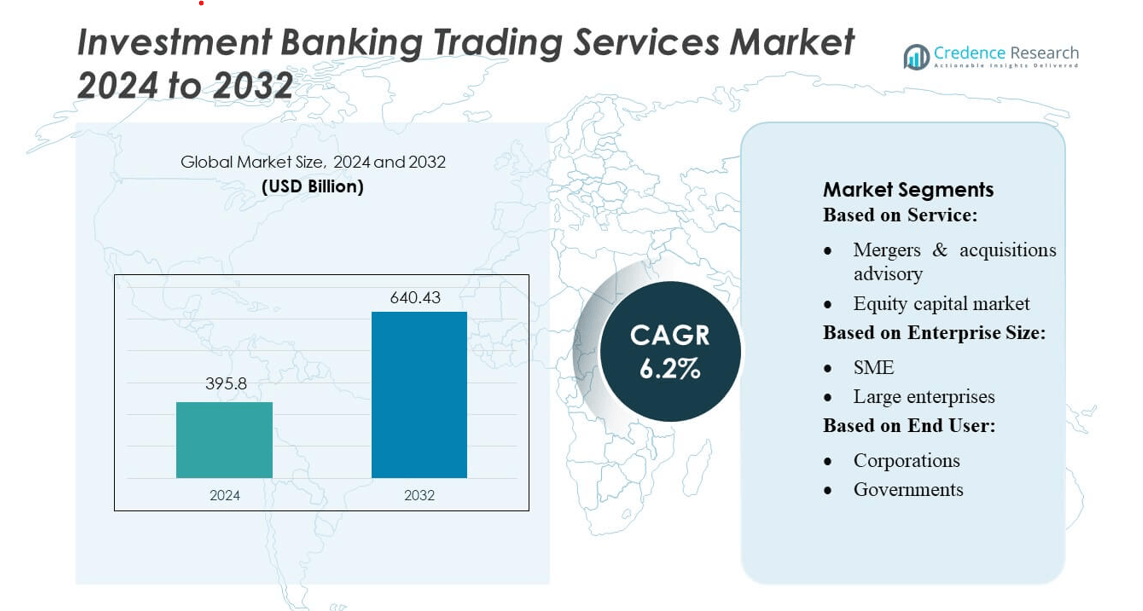

Investment Banking Trading Services Market size was valued USD 395.8 billion in 2024 and is anticipated to reach USD 640.43 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Investment Banking Trading Services Market Size 2024 |

USD 395.8 billion |

| Investment Banking Trading Services Market, CAGR |

6.2% |

| Investment Banking Trading Services Market Size 2032 |

USD 640.43 billion |

The Investment Banking Trading Services Market is shaped by leading global institutions such as JPMorgan Chase & Co., Goldman Sachs Group, Morgan Stanley, Citigroup Inc., and Bank of America Merrill Lynch, alongside strong international participants including Barclays, UBS, Credit Suisse, and Deutsche Bank. These firms maintain competitive strength through advanced trading technology, diversified product portfolios, and deep institutional client networks. North America emerges as the leading region, holding approximately 38–40% of the global market share, supported by highly liquid capital markets, strong regulatory frameworks, and the concentration of major investment banks and trading infrastructure.

Market Insights

- The Investment Banking Trading Services Market was valued at USD 395.8 billion in 2024 and is projected to reach USD 640.43 billion by 2032, expanding at a CAGR of 6.2%, driven by rising capital-raising activities and growing digital trading adoption.

- Increasing corporate demand for M&A advisory, ECM, and DCM services acts as a major market driver, with M&A advisory accounting for the largest service share at 32–35%.

- Advanced algorithmic trading, cloud-based execution platforms, and AI-enabled analytics represent key market trends, strengthening efficiency and multi-asset trading capabilities.

- Competitive intensity remains high as major institutions leverage technology upgrades and diversified portfolios, while regulatory pressures and compliance costs persist as significant restraints.

- North America leads the market with 38–40% share, supported by deep capital markets, while large enterprises dominate the enterprise-size segment with 65–70% share, reinforcing demand for high-value trading and advisory services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

Mergers & acquisitions (M&A) advisory dominates the Investment Banking Trading Services Market, capturing an estimated 32–35% share, driven by strong demand for cross-border consolidation, private equity dealmaking, and restructuring transactions. M&A advisory benefits from higher fee structures and consistent deal pipelines in sectors such as technology, energy, and financial services. Equity capital market (ECM) and debt capital market (DCM) services follow as fast-growing segments as corporates seek diversified funding. Corporate finance advisory, asset management, wealth management, and other services expand steadily, supported by portfolio diversification needs and complex capital-raising requirements.

- For instance, Symphony supports this workflow by connecting more than 600,000 users across 1,300 financial institutions, enabling real-time, secure messaging, voice communications, and low-code automation around deal negotiations.

By Enterprise Size

Large enterprises lead this segment with an estimated 65–70% market share, primarily due to their substantial transaction volumes, larger fundraising mandates, and reliance on comprehensive advisory and capital market services. These firms drive demand for structured financing, risk management solutions, and multi-jurisdictional deal execution. SMEs, while smaller in share, show increasing adoption of investment banking services as they pursue growth capital, succession planning, and market expansion. Enhanced digital advisory platforms and simplified capital-raising processes accelerate SME participation, but large enterprises continue to dominate due to higher deal values and recurring mandates.

- For instance, MetaQuotes migrated MQL5 version control from Subversion to Git and introduced MQL5 Algo Forge, a new online hub supporting Git-based collaboration for algorithmic developers.

By End User

Corporations represent the dominant end-user segment, holding approximately 50–55% market share, fueled by strategic M&A activity, capital restructuring, and ongoing requirements for equity and debt financing. Governments remain key users for sovereign bond issuances and public-sector financing programs, while high-net-worth individuals (HNWIs) drive growth in wealth management and bespoke investment structuring. Retail investors contribute to expanding brokerage and asset management services, supported by digital trading platforms. Other institutional clients, including pension funds and insurance companies, further bolster demand for advisory, trading, and risk-management solutions.

Key Growth Drivers

Expansion of Global Capital Flows

Rising cross-border investment activity drives substantial growth in the Investment Banking Trading Services Market. Corporations pursue international acquisitions, while sovereign funds and private equity firms increase allocations to diversified asset classes. This expansion fuels higher demand for advisory, underwriting, and trading services, particularly in emerging markets with high capital-raising needs. Investment banks benefit from increased fee income across equity, debt, and M&A transactions as global liquidity deepens. The push for international portfolio diversification further strengthens trading volumes, reinforcing sustained growth momentum in the sector.

- For instance, VIRTU Financial Inc. supports this expansion with its Open Technology Platform, which connects across 235+ trading venues in 36 countries and provides access to over 25,000 securities, enabling global firms to execute multi-asset trades efficiently.

Surge in Digital Trading and Algorithmic Platforms

Rapid digitalization accelerates market growth as investment banks deploy advanced trading engines, algorithmic platforms, and real-time analytics to enhance execution efficiency. Automation reduces latency, improves pricing accuracy, and supports high-frequency trading strategies for institutional clients. AI-driven tools help banks analyze market signals, mitigate risks, and optimize portfolios. This technological shift expands service capabilities, enabling banks to meet demand for faster, data-driven decision-making. The integration of cloud infrastructure and machine learning strengthens operational resilience and attracts clients seeking robust, scalable trading solutions.

- For instance, Kuberre Systems, Inc. released version 4.4.0 of its EDM / Data Science Optimization Platform, which introduces QTPy (Quantitative Techniques in Python) to provide a unified API layer and virtualized data access for over 100 internally modeled datasets, enabling data scientists to run machine-learning models without data duplication.

Increasing Corporate Demand for Capital Raising

Corporates across sectors expand their funding needs for acquisitions, debt restructuring, and strategic growth, driving demand for investment banking trading services. Equity issuances, bond offerings, and structured finance deals rise as firms pursue global expansion amid evolving interest-rate cycles. Investment banks support these activities with sophisticated advisory and market-making capabilities. Additionally, private companies exploring IPOs or private placements generate new growth opportunities. The continuous need for liquidity, refinancing, and optimized capital structures reinforces banks’ essential role in corporate financial strategy.

Key Trends & Opportunities

Rising Demand for ESG-Aligned Financial Products

ESG-linked bonds, sustainability-focused investment products, and green financing instruments create strong opportunities for investment banks. Corporations and governments increasingly pursue ESG compliance, prompting banks to develop specialized advisory and trading solutions. The trend accelerates capital flows into responsible investments and enhances banks’ ability to differentiate offerings through sustainable finance expertise. ESG disclosures and regulatory expectations also encourage innovation in risk assessment models. As sustainability becomes central to investment decisions, banks gain opportunities to expand underwriting pipelines and attract socially responsible investors.

- For instance, Kuberre Systems, Inc. released version 4.4.0 of its EDM / Data Science Optimization Platform, which introduces QTPy (Quantitative Techniques in Python) to unify API access to over 100 proprietary datasets, enabling data scientists to run machine-learning models without duplicating data.

Growth of WealthTech and Personalized Advisory Models

Wealth management clients, particularly high-net-worth individuals, increasingly adopt digital advisory tools that enhance portfolio customization and trading flexibility. Banks integrate robo-advisors, AI-based risk profiling, and predictive analytics to deliver tailored investment strategies. This trend broadens access to advanced trading platforms and strengthens client engagement. Hybrid advisory models combining human expertise with automation create opportunities to capture younger, tech-oriented investor segments. As wealth creation accelerates globally, personalized trading and advisory services evolve into key revenue-enhancing opportunities for investment banks.

- For instance, TMS offers more than 60 pre-built execution algorithms—including TWAP, VWAP, ArrivalPx, Pairs, and MarketMaker—and clients can access the source code to customize behavior.

Expansion of Private Market Investment Platforms

Private capital markets attract growing interest from institutional and retail-accredited investors seeking higher returns, prompting banks to develop digital platforms for private equity, venture capital, and private credit products. These platforms streamline access, due diligence, and secondary trading of private assets, creating new revenue streams. As traditional IPO pipelines fluctuate, private placements and direct listings gain importance. The expansion of alternative investment ecosystems positions banks to capture rising demand for non-public assets while deepening client relationships across institutional and high-net-worth segments.

Key Challenges

Regulatory Pressures and Compliance Costs

Increasingly stringent global financial regulations pose a major challenge, compelling investment banks to invest heavily in compliance infrastructure, reporting tools, and risk-management systems. Frameworks such as Basel III, MiFID II, and anti-money-laundering (AML) rules significantly raise operational costs and restrict certain trading activities. Complex disclosures and capital requirements reduce profit margins, particularly in high-risk or leveraged products. These constraints affect banks’ agility, limiting their ability to rapidly scale trading operations or introduce new instruments in highly regulated jurisdictions.

Market Volatility and Liquidity Constraints

Unpredictable macroeconomic conditions, geopolitical tensions, and fluctuating interest rates create volatility that affects trading performance and deal pipelines. Sudden liquidity shortages in debt or equity markets can delay issuances and reduce underwriting activity. Investors often shift to safer assets during downturns, diminishing demand for complex financial products. Prolonged instability weakens client confidence and may force banks to rebalance trading strategies, increase hedging costs, or absorb mark-to-market losses. These challenges restrict consistent revenue generation and elevate operational risk across trading services.

Regional Analysis

North America

North America holds the dominant position in the Investment Banking Trading Services Market with an estimated 38–40% share, driven by the strong presence of major global investment banks, highly liquid capital markets, and a mature trading ecosystem. The U.S. leads with deep equity and debt markets, robust derivatives trading, and consistent M&A activity. Corporations, institutional investors, and asset managers generate sustained demand for advisory and underwriting services. Regulatory clarity, technological innovation in algorithmic trading, and steady capital inflows further strengthen the region’s leadership, supporting high deal volumes and diversified trading products.

Europe

Europe accounts for approximately 25–27% of the market, supported by active financial centers such as London, Frankfurt, and Paris. The region benefits from solid cross-border M&A activity, sovereign and corporate bond issuances, and strong participation from institutional investors. Demand for ESG-focused financial products and sustainable bond issuances significantly boosts advisory and underwriting services. Despite regulatory complexities under MiFID II, Europe maintains a resilient trading landscape through advanced electronic trading platforms and multi-asset strategies. Continued investment in green finance, fintech integration, and capital market reforms reinforces the region’s stable growth trajectory.

Asia-Pacific

Asia-Pacific captures an estimated 22–24% market share, emerging as the fastest-growing region due to expanding corporate financing needs, rising wealth creation, and increasing participation from sovereign wealth funds. China, Japan, India, and Southeast Asia experience strong growth in equity and bond markets as companies pursue IPOs, private placements, and restructuring initiatives. Investment banks gain momentum from digital trading adoption and deeper capital market liberalization. Cross-border investments, infrastructure financing, and growing interest from global private equity firms further accelerate demand for trading and advisory services, positioning Asia-Pacific as a key growth engine.

Latin America

Latin America holds roughly 6–8% of the market, driven by capital-raising needs in sectors such as energy, mining, infrastructure, and banking. Brazil and Mexico lead regional activity with active bond markets and increasing cross-border investment flows. Economic reforms, privatization efforts, and corporate refinancing requirements support steady demand for advisory and underwriting services. Despite macroeconomic fluctuations, the region benefits from rising foreign investor participation and gradual modernization of trading platforms. Investment banks leverage opportunities in sovereign debt issuances, local capital market development, and expanding institutional investor bases to strengthen market presence.

Middle East & Africa

The Middle East & Africa region accounts for an estimated 5–6% market share, supported by sovereign wealth funds, large-scale infrastructure financing, and ongoing diversification initiatives in Gulf economies. The UAE, Saudi Arabia, and Qatar generate strong deal flow through IPOs, debt issuances, and cross-border investments. Growing wealth management demand and rising interest in alternative investments enhance trading activity. Africa contributes through corporate financing and sovereign bond issuances, though market depth remains limited. Despite geopolitical and economic challenges, increasing financial market reforms and capital market expansion create opportunities for investment banking service providers.

Market Segmentations:

By Service:

- Mergers & acquisitions advisory

- Equity capital market

By Enterprise Size:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Investment Banking Trading Services Market features a diverse mix of technology providers and service specialists, including Symphony, AlgoBulls Technologies Private Limited, MetaQuotes Ltd., VIRTU Finance Inc., Kuberre Systems, Inc., AlgoTrader, Tata Consultancy Services Limited, InfoReach, Inc., BNP Paribas Leasing Solutions, and Argo Software Engineering. The Investment Banking Trading Services Market is defined by rapid technological advancements, expanding multi-asset trading capabilities, and increasing demand for real-time, data-driven execution solutions. Market participants focus on developing sophisticated algorithmic trading platforms, low-latency connectivity, and AI-enabled analytics to improve trade accuracy and optimize execution strategies. Growing regulatory scrutiny drives firms to integrate advanced compliance automation, standardized reporting frameworks, and enhanced risk controls. Competition intensifies as companies pursue strategic collaborations with banks, fintechs, and liquidity providers to broaden service portfolios. Additionally, the shift toward cloud-native infrastructure and digital trading ecosystems strengthens innovation, enabling providers to deliver scalable, secure, and high-performance solutions to institutional investors worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, BNY Mellon and Mizuho Bank, the banking subsidiary of Japan-based Mizuho Financial Group, announced a strategic partnership to strengthen correspondent banking connectivity for global trade. The agreement is set to streamline cross-border transaction services and improve financial infrastructure for international commerce, reinforcing both institutions’ commitment to enabling efficient and secure trade financing across key global markets.

- In June 2024, HSBC launched WorldTrader, a pioneering digital trading platform that allows customers to trade a variety of financial instruments, including equities, exchange-traded funds (ETFs), and bonds, across 77 exchanges in 25 markets globally. Initially introduced in the UAE, WorldTrader aims to cater to the growing demand for international investment opportunities among affluent clients.

- In April 2024, AmplifyME launched its Investment Banking Pathway, an innovative program that transforms the traditional learning process by using a live, simulation-based experience to provide aspiring professionals with the practical skills and knowledge essential for success in the field

Report Coverage

The research report offers an in-depth analysis based on Service, Enterprise Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt AI-driven trading models to enhance execution precision and reduce operational inefficiencies.

- Algorithmic and high-frequency trading will expand as firms invest in low-latency infrastructure and advanced analytics.

- Digital transformation will accelerate, with cloud-based trading platforms becoming the industry standard.

- ESG-focused financial products will grow, creating new advisory and trading opportunities for investment banks.

- Cross-border M&A and capital-raising activities will intensify, driving higher demand for multi-jurisdictional advisory services.

- Wealth management and personalized trading solutions will expand as high-net-worth and retail investors seek tailored portfolios.

- Regulatory pressures will increase, pushing firms to adopt automated compliance and enhanced risk-management frameworks.

- Private market trading platforms will gain traction as investors demand greater access to non-public assets.

- Trading services will increasingly integrate blockchain solutions to support transparency and settlement efficiency.

- Global macroeconomic volatility will encourage stronger hedging activity and diversification across asset classes.