Market Overview

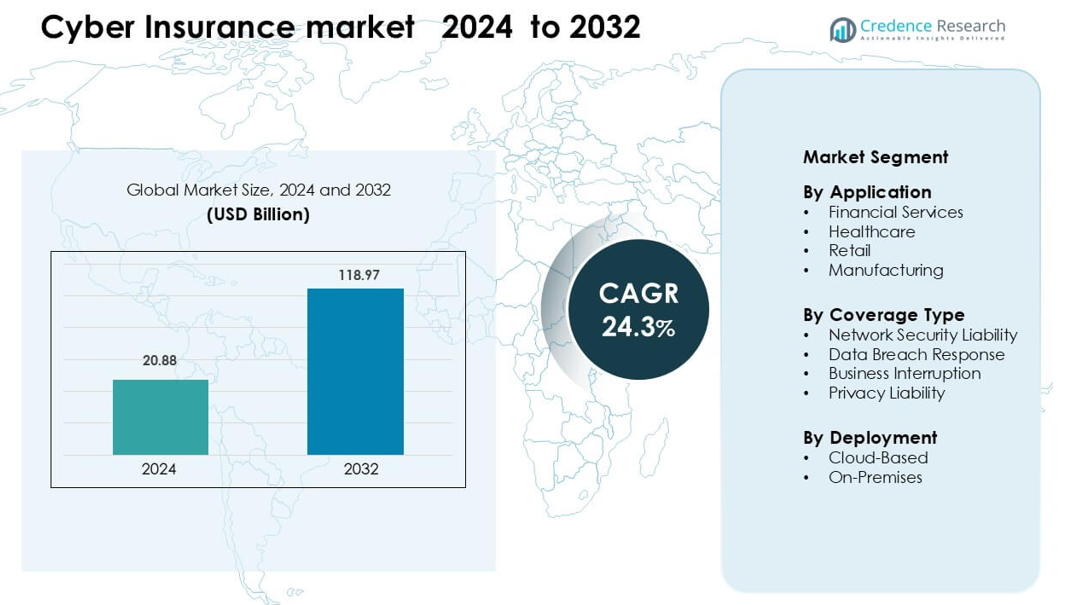

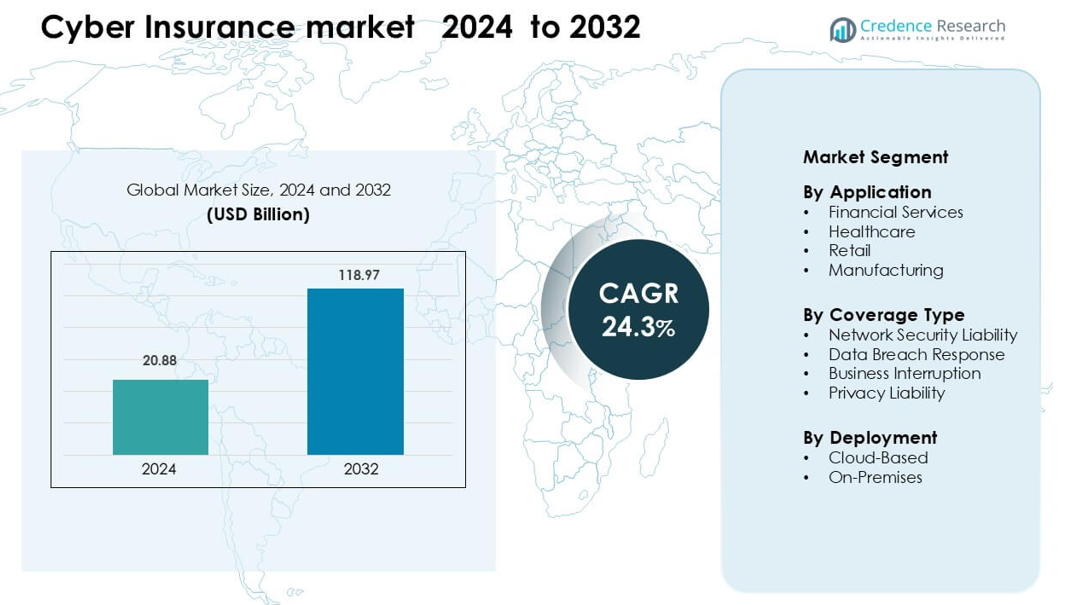

Cyber Insurance market was valued at USD 20.88 billion in 2024 and is anticipated to reach USD 118.97 billion by 2032, growing at a CAGR of 24.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyber Insurance Market Size 2024 |

USD 20.88 billion |

| Cyber Insurance Market, CAGR |

24.3% |

| Cyber Insurance Market Size 2032 |

USD 118.97 billion |

The Cyber Insurance market is shaped by major players such as Munich ReGroup, Zurich Insurance Company Limited, Lockton Companies Inc., Berkshire Hathaway Inc., AXA XL, Lloyd’s of London, American International Group Inc., Chubb Limited (ACE Limited), Allianz Group, and AON Plc. These insurers compete through advanced underwriting tools, stronger incident-response partnerships, and broader coverage offerings tailored for high-risk sectors. North America leads the market with about 38% share due to strict regulations, high digital adoption, and rising cyberattack frequency, making the region the strongest contributor to global demand.

Market Insights

- Cyber Insurance market was valued at USD 20.88 billion in 2024 and is anticipated to reach USD 118.97 billion by 2032, growing at a CAGR of 24.3 % during the forecast period.

- Growing ransomware frequency and rising breach-related costs drive heavy adoption across financial services, which hold the largest share at about 38% due to high exposure and strong compliance pressure.

- AI-driven underwriting, automated threat scoring, and bundled security services shape key trends as insurers shift toward predictive models and real-time monitoring partnerships.

- Competition intensifies as major players expand incident-response networks and tighten underwriting to control rising claim ratios; premium adjustments and stricter policy terms remain common.

- North America leads with roughly 38% share, followed by Europe at about 28% and Asia Pacific near 22%, supported by rapid digital adoption and higher regulatory enforcement across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Financial services hold the dominant share at about 38% in 2024 because banks and insurers face frequent ransomware, fraud, and data-theft attacks. The sector adopts cyber insurance to manage regulatory penalties and reduce recovery costs after breaches. Strong digital adoption in payments, mobile banking, and wealth platforms increases exposure across networks. Healthcare follows as hospitals expand electronic record systems, while retail and manufacturing gain traction due to rising attacks on POS systems and connected production lines. Demand rises as firms seek rapid incident response, forensic support, and legal protection.

- For instance, in a major incident, JPMorgan Chase disclosed a cyber breach that compromised data from over 83 million customer accounts.

By Coverage Type

Network security liability leads this segment with nearly 35% share in 2024 due to rising attacks targeting firewalls, servers, and enterprise networks. Companies prefer this coverage because it offers protection against unauthorized access, malware infiltration, and operational shutdowns. Data breach response grows as firms prioritize quick notification, credit monitoring, and digital forensics after exposure events. Business interruption coverage expands as cloud outages and cyber incidents disrupt daily operations, while privacy liability gains momentum as stricter global data-protection rules increase compliance risks.

- For instance, Beazley describes a claim in which a threat actor accessed three separate Office 365 accounts as part of a malicious attack, which ultimately resulted in over a thousand employees requiring breach notification and credit-monitoring services.

By Deployment

Cloud-based deployment dominates with about 57% share in 2024 as enterprises shift workloads to public and hybrid cloud environments. Insurers offer scalable policies that align with multi-cloud setups, real-time monitoring, and rapid threat detection. Adoption rises because cloud platforms face heightened risks from misconfigurations, insecure APIs, and credential theft. On-premises solutions continue in sectors with strict data-control rules, yet growth remains slower due to higher maintenance costs. The shift toward SaaS applications, remote work models, and digital transformation drives strong preference for cloud-aligned coverage.

Key Growth Drivers

Rising Frequency and Severity of Cyberattacks

Growing attack volumes push companies toward structured cyber-risk transfer. Enterprises face higher ransomware payouts, credential-theft cases, and business-email compromise events, which damage operations and reputation. Many organizations now store critical data on cloud and hybrid systems, increasing exposure across multiple access points. Attackers use AI-driven phishing and automated intrusion tools that bypass traditional defenses. This shift forces firms to adopt policies that cover financial loss, forensic analysis, and legal liabilities. Demand rises as insurers enhance underwriting models and offer broader coverage to support faster recovery and stronger resilience.

- For instance, Aon reported that in Q4 2024, its clients average ransom payment was US$553,959, while the median was US$110,890, reflecting more granular risk modeling.

Expanding Regulatory and Compliance Pressure

Governments enforce stricter rules on data handling, breach reporting, and consumer privacy. Firms must meet timelines for notifying authorities and affected customers after an incident, which raises financial and legal obligations. Regulations like GDPR, HIPAA, and sector-specific mandates increase penalties for improper data protection. Companies adopt cyber insurance to support compliance, cover investigation expenses, and ensure structured response. Growing audits, risk assessments, and certification needs also encourage demand. Businesses rely on insurance to handle privacy-related claims and minimize exposure during enforcement actions, driving wider market acceptance.

- For instance, Amazon received a GDPR fine of €746 million issued by Luxembourg’s CNPD for violations related to targeted advertising, making it the largest penalty imposed undr the regulation.

Rapid Digital Transformation Across Industries

Organizations invest in cloud platforms, mobile applications, automation, and connected devices to boost efficiency. This rapid digital shift introduces new vulnerabilities, especially across distributed workforces and third-party systems. Hybrid architectures link multiple networks, raising risks linked to misconfigurations and unauthorized access. Industries with complex supply chains depend on integrated IT systems, which increases the impact of disruptions. Cyber insurance helps companies manage downtime, cover operational losses, and strengthen continuity planning. Rising adoption of digital tools ensures steady growth as firms seek structured financial protection.

Key Trend & Opportunity

Integration of Advanced Analytics and AI in Underwriting

Insurers adopt AI-based tools to improve risk scoring, threat prediction, and real-time monitoring. Analytics support accurate pricing and reduce uncertainty linked to evolving attack patterns. Companies benefit from personalized policies aligned with network size, security maturity, and industry behavior. AI-enabled dashboards help organizations detect anomalies, improve patch cycles, and measure compliance readiness. This integration creates opportunities for insurers to offer value-added advisory services. Strong demand for proactive defense models, rather than reactive claims support, drives new product offerings and deeper market engagement.

- For instance, Munich Re’s automated underwriting platform REALYTIX ZERO (with its CoPilot feature) is used by 50 clients in 15 countries, supports more than 25 insurance products, and has over 4,000 users, enabling rapid product design and real-time risk evaluation.

Growth in Cyber Insurance for SMEs

Small and midsize firms adopt digital tools but lack advanced cybersecurity resources. They face increasing phishing, ransomware, and credential-theft incidents that create high operational loss. Insurers develop simplified policies with faster onboarding, lower premiums, and bundled security services. Managed detection, automated backup support, and security training programs increase adoption. Opportunities grow as SMEs seek affordable coverage that includes response teams and legal support. Rising attacks targeting vulnerable small businesses strengthen demand, expanding the market beyond traditional large-enterprise clients.

- For instance, Coalition reports that in 44% of ransomware events its Incident Response (IR) team negotiated ransom payments down by an average of 60%.

Key Challenge

High Loss Ratios and Rising Claim Costs

Increasing ransomware events raise claim payouts, which strain insurer profitability. Many policies now face frequent filing due to evolving malware and targeted intrusions. High recovery expenses linked to system restoration, legal actions, and breach notification increase financial pressure. Insurers tighten underwriting standards and raise premiums, creating barriers for customers. Some firms face reduced coverage limits or stricter policy conditions. Managing loss ratios while expanding market reach remains a key challenge as attackers improve tools and exploit growing digital footprints.

Limited Historical Data and Underwriting Complexity

Cyber risks evolve faster than traditional insurance categories, creating gaps in long-term claim modeling. Lack of standardized reporting makes it difficult to measure incident frequency, severity, and root causes. Insurers struggle to price policies accurately due to variables like network size, cybersecurity maturity, and third-party exposure. Uncertain risks linked to cloud outages, supply chain attacks, and zero-day vulnerabilities add complexity. This limited visibility forces companies to refine assessment tools and rely on cautious underwriting, slowing broader adoption and posing challenges to stable growth.

Regional Analysis

North America

North America holds the largest share at about 38% in 2024 due to strong adoption across banking, healthcare, and technology firms that operate large digital systems. Demand grows as companies face high ransomware activity and strict reporting rules. U.S. enterprises deploy cyber insurance to manage breach-related costs, operational downtime, and legal liabilities. Cloud migration and remote-work expansion increase exposure, pushing insurers to offer broader coverage. Canada also sees steady growth as mid-sized firms strengthen cybersecurity programs. Strong regulatory pressure and rising cybercrime keep North America in a leading position.

Europe

Europe accounts for nearly 28% share in 2024 as firms face strict GDPR-driven compliance requirements that raise financial and legal risks. Companies adopt cyber insurance to meet breach-notification timelines and reduce penalties tied to improper data handling. Strong uptake appears in financial services, manufacturing, and retail, where digital systems remain vulnerable. The U.K., Germany, and France lead demand due to frequent cyberattacks. Insurers offer specialized privacy-liability coverage to support growing digital operations. Increasing IoT usage, cross-border data activity, and rapid digitization boost Europe’s overall market expansion.

Asia Pacific

Asia Pacific captures around 22% share in 2024 as digital adoption accelerates across financial services, e-commerce, telecom, and manufacturing. Companies face rising ransomware, cloud-security failures, and supply-chain intrusions as they scale operations. China, Japan, South Korea, and India drive most demand due to growing enterprise networks and large consumer-data volumes. Firms use cyber insurance to manage business interruption and regulatory exposure linked to data-protection laws. Expanding digital payments, mobile-commerce growth, and connected-device usage support strong market momentum across the region.

Latin America

Latin America holds about 7% share in 2024 as businesses strengthen cybersecurity in response to growing malware, phishing, and financial-fraud incidents. Brazil and Mexico lead adoption due to expanding digital banking and e-commerce platforms that store sensitive user data. Companies seek cyber insurance to offset financial loss and operational disruptions linked to attacks. Rising cloud migration also increases risk exposure across corporate networks. Limited cybersecurity readiness among small and midsize enterprises creates demand for affordable and simplified coverage options, supporting steady market expansion in the region.

Middle East & Africa

Middle East & Africa account for nearly 5% share in 2024 as governments and large enterprises modernize digital infrastructure. Banks, energy firms, and telecom operators face targeted cyber threats, driving adoption of network-security liability and business-interruption coverage. Countries like the UAE, Saudi Arabia, and South Africa lead due to strong digital-transformation programs. Organizations invest in cyber insurance to manage compliance risks and rising breach-response costs. Growing cloud adoption and smart-city initiatives widen exposure, creating gradual but consistent demand across the region.

Market Segmentations:

By Application

- Financial Services

- Healthcare

- Retail

- Manufacturing

By Coverage Type

- Network Security Liability

- Data Breach Response

- Business Interruption

- Privacy Liability

By Deployment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cyber Insurance market features strong competition led by major players such as Munich ReGroup, Zurich Insurance Company Limited, Lockton Companies Inc., Berkshire Hathaway Inc., AXA XL, Lloyd’s of London, American International Group Inc., Chubb Limited (ACE Limited), Allianz Group, and AON Plc. These companies expand their portfolios with advanced cyber-risk modeling, threat-intelligence partnerships, and real-time monitoring tools that improve underwriting accuracy. Many insurers introduce flexible policies tailored for SMEs, large enterprises, and high-risk sectors such as finance and healthcare. Strategic collaborations with cybersecurity firms, incident-response providers, and cloud-service platforms strengthen preparedness and reduce claim severity. Growing ransomware attacks and rising claim costs push insurers to refine coverage limits, enhance assessment frameworks, and develop proactive risk-mitigation services. This competitive ecosystem encourages continuous innovation in coverage design, pricing structures, and digital-risk advisory solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, AXA XL launched a new cyber solution for construction firms in Europe, Asia, and Australia, offered as an endorsement to its cyber insurance policies to address sector-specific operational and ransomware risks.

- In April 2025, Lloyd’s of London invested in cyber-risk analytics firm BreachBits to help syndicates and brokers assess cyber exposures more accurately and improve cyber insurance performance across the Lloyd’s market.

- In November 2024, Lloyd’s also co-published guidance with the Association of British Insurers on how (re)insurers should define and manage major cyber events, supporting more consistent wording and claims handling in cyber insurance contracts

Report Coverage

The research report offers an in-depth analysis based on Application, Coverage Type, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as firms integrate advanced cybersecurity tools and seek stronger financial protection.

- Insurers will expand AI-driven underwriting to improve pricing accuracy and reduce claim uncertainty.

- Ransomware risks will push companies toward broader business-interruption coverage.

- Small and midsize enterprises will adopt cyber insurance faster due to rising digital exposure.

- Cloud-security failures will drive development of specialized policies for multi-cloud environments.

- Partnerships between insurers and cybersecurity vendors will expand to offer bundled defense services.

- Regulators will enforce stricter reporting rules, increasing demand for compliance-aligned coverage.

- Global supply-chain attacks will encourage policies focused on third-party risk.

- Coverage limits and policy terms will evolve as insurers manage higher loss ratios.

- Emerging technologies like IoT and AI will reshape risk models and create new coverage opportunities.