Market Overview

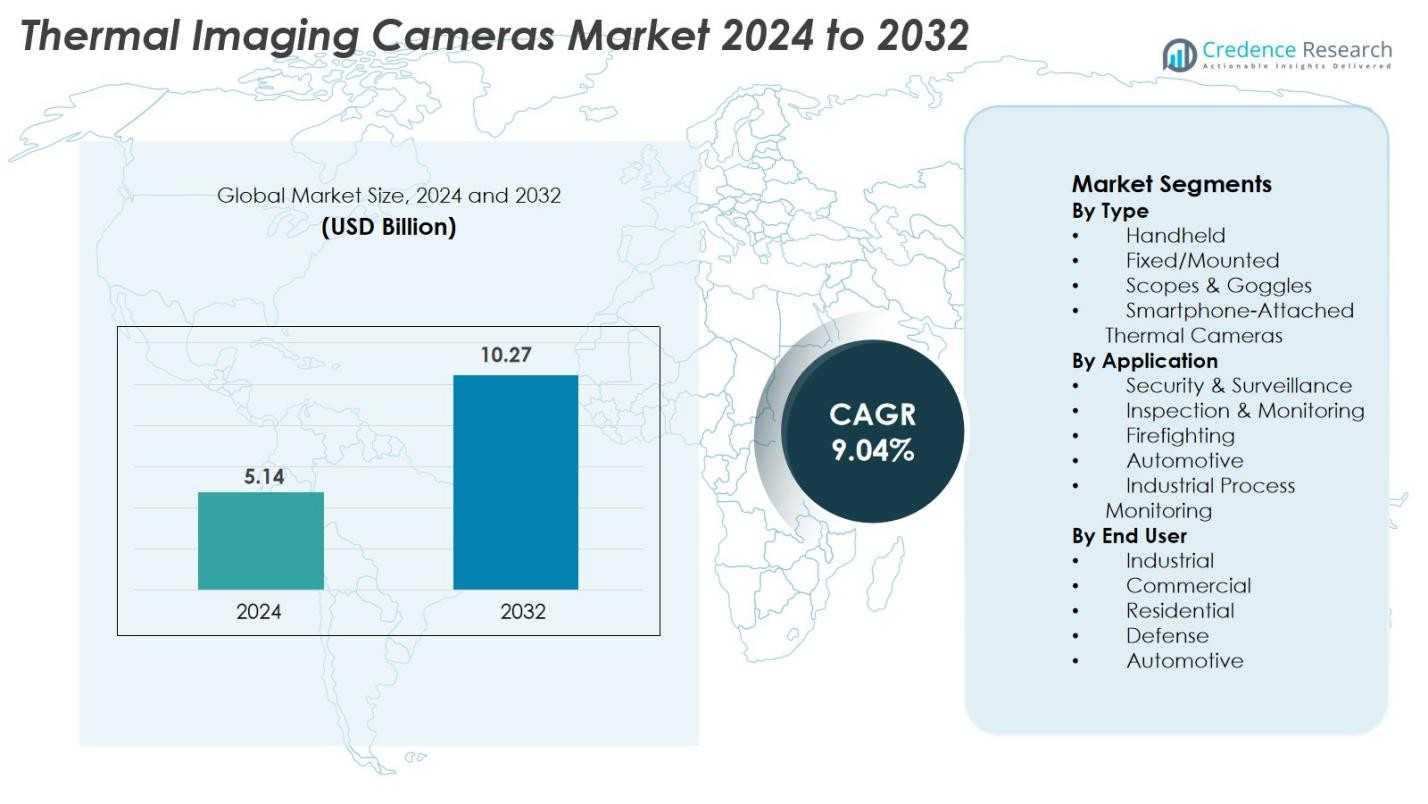

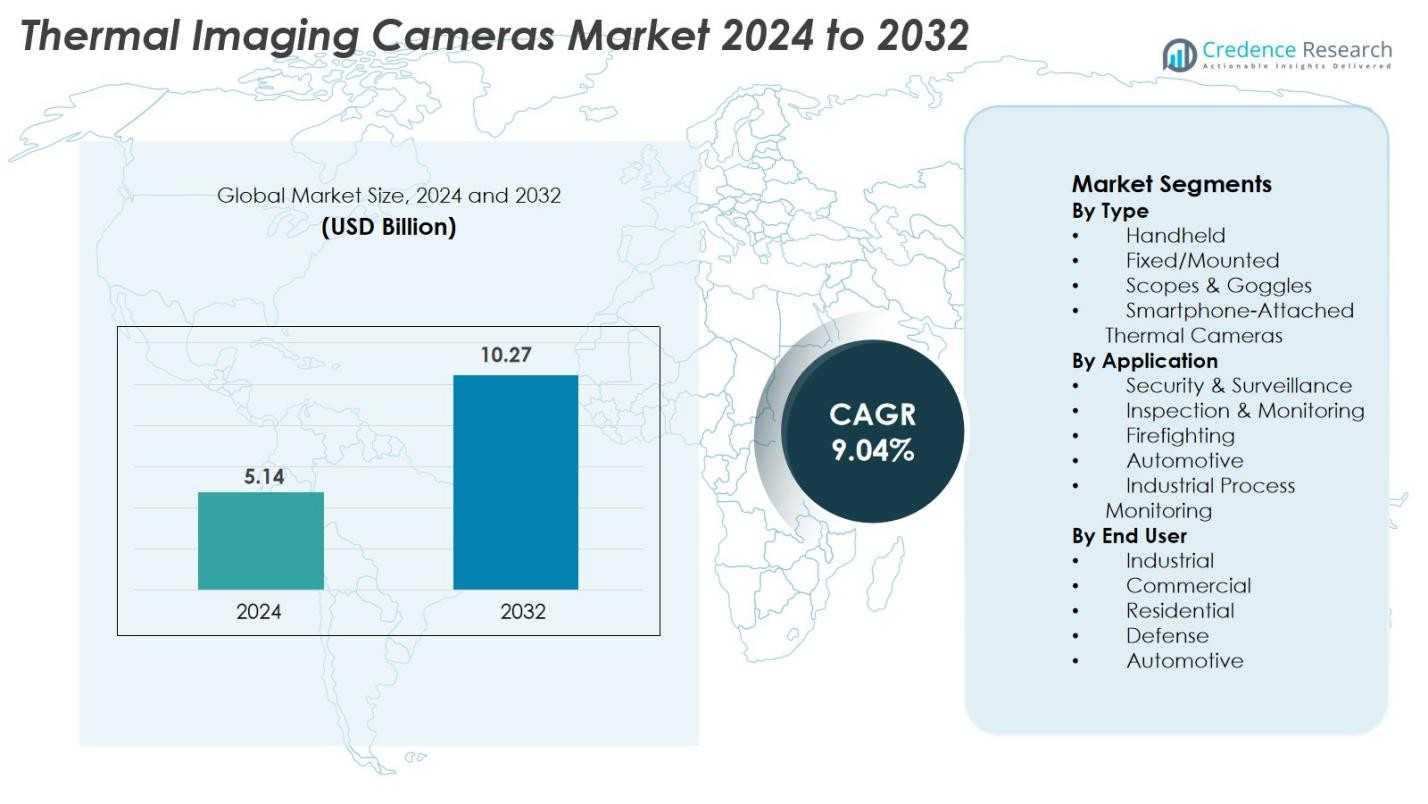

Thermal Imaging Cameras Market size was valued at USD 5.14 Billion in 2024 and is anticipated to reach USD 10.27 Billion by 2032, at a CAGR of 9.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thermal Imaging Cameras Market Size 2024 |

USD 5.14 Billion |

| Thermal Imaging Cameras Market, CAGR |

9.04% |

| Thermal Imaging Cameras Market Size 2032 |

USD 10.27 Billion |

Thermal Imaging Cameras Market is shaped by leading players that deliver advanced infrared imaging technologies across defense, industrial, and commercial sectors. Key companies such as BAE Systems, Elbit Systems, InfraTec GmbH, Hangzhou Hikvision Digital Technology, Fortive Corp., Bullard, and CorDEX Instruments continue to strengthen their portfolios through high-resolution sensors, AI-enabled analytics, and rugged designs for mission-critical applications. The market remains innovation-driven, with manufacturers focusing on compact, energy-efficient, and cost-effective thermal solutions to address expanding uses in surveillance, industrial inspection, firefighting, and automotive safety. Regionally, North America leads the market with a 34.7% share, supported by robust defense spending, advanced surveillance infrastructure, and widespread industrial adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Thermal Imaging Cameras Market reached USD 5.14 Billion in 2024 and is projected to reach USD 10.27 Billion by 2032, growing at a CAGR of 9.04% during the forecast period, driven by rising adoption across industrial, defense, and commercial sectors.

- Market growth is supported by increasing demand for thermal systems in security and surveillance, predictive maintenance, and firefighting, with the handheld segment leading at 41.6% share due to its portability and wide industrial usage.

- Key trends include integration of AI, IoT, and edge analytics into thermal cameras, enabling automated anomaly detection, enhanced image processing, and real-time monitoring across industrial and defense applications.

- The market remains highly dynamic, with players such as BAE Systems, Elbit Systems, InfraTec GmbH, Hikvision, and Fortive Corp. focusing on high-resolution sensors, rugged designs, and cost-efficient uncooled technologies.

- Regionally, North America holds 34.7% share, followed by Europe at 28.3% and Asia Pacific at 25.6%; security & surveillance applications dominate with a 38.4% share globally.

Market Segmentation Analysis

By Type

The Thermal Imaging Cameras Market is dominated by the Handheld segment, capturing 41.6% of the market share in 2024. Its leadership is driven by high adoption across industrial inspection, firefighting, maintenance, and law-enforcement applications due to portability, ease of operation, and lower cost compared to cooled systems. Fixed/Mounted systems continue to grow in manufacturing and critical infrastructure monitoring, while Scopes & Goggles gain traction in defense and tactical missions. Smartphone-attached thermal cameras witness rising demand from consumer, DIY, and small-business users seeking affordable thermal diagnostics and home inspection tools.

- For Instance, Fire-rescue teams frequently deploy handheld thermal imagers such as the FLIR Systems K-series (e.g. K75, K85) for firefighting. These devices help crews quickly locate trapped victims or fellow firefighters in smoke-filled environments, improving safety and response times.

By Application

The Security & Surveillance segment held the largest share at 38.4% in 2024, supported by increasing demand for perimeter monitoring, border protection, and 24/7 visibility across low-light and harsh environments. Governments and private enterprises deploy thermal cameras for intrusion detection, critical facility protection, and search-and-rescue operations. Inspection & Monitoring applications grow steadily due to rising adoption in electrical audits, HVAC checks, and predictive maintenance. Firefighting applications benefit from tactical thermal imaging for hotspot detection, while Automotive adoption accelerates with the integration of thermal sensors in ADAS and autonomous vehicles.

- For Instance, FLIR thermal cameras were deployed in the U.S. Customs and Border Protection (CBP) program, where long-range systems such as the FLIR Star SAFIRE and FLIR HRC are used for border surveillance, providing thermal detection capabilities exceeding several kilometers.

By End User

The Defense sector emerged as the dominant end-user, accounting for 36.2% of the market share in 2024, driven by large-scale thermal imaging deployments in surveillance systems, target acquisition, night-vision equipment, and reconnaissance platforms. Industrial users expand adoption for predictive maintenance, machine condition monitoring, and energy audits. The Commercial segment grows with increasing use in building inspections, facility safety, and quality control. Residential use rises with the availability of low-cost thermal devices for home diagnostics, while Automotive manufacturers integrate thermal sensors for enhanced visibility, pedestrian detection, and all-weather driver-assistance systems.

Key Growth Drivers

Rising Security & Surveillance Requirements Across Critical Infrastructure

The growing emphasis on continuous surveillance across airports, borders, seaports, power plants, industrial facilities, and public spaces remains a major driver for the Thermal Imaging Cameras Market. Governments and private operators increasingly prioritize 24/7 monitoring capabilities that can operate effectively in darkness, fog, smoke, and adverse weather—conditions where conventional cameras fail. Thermal imaging’s ability to detect heat signatures provides superior intrusion detection and situational awareness for perimeter protection and threat prevention. Rising geopolitical tensions, terrorism risks, and modernization of homeland security programs strengthen adoption across stationary and mobile surveillance platforms. Defense and law-enforcement agencies deploy thermal optics for surveillance towers, night-vision goggles, vehicle-mounted systems, and UAVs. Expanding smart city surveillance networks, urban safety initiatives, and automated traffic management further elevate demand for real-time thermal analytics, crowd monitoring, and emergency response operations.

- For Instance, Critical infrastructure operators, such as electrical utilities, increasingly use thermal platforms like the FLIR FC-Series ID for automated perimeter analytics, providing real-time detection in fog, rain, and total darkness.

Growing Adoption in Industrial Inspection & Predictive Maintenance

Thermal imaging cameras continue to gain traction across manufacturing, oil & gas, energy, and utilities as industries accelerate their shift toward predictive maintenance and enhanced asset reliability. These cameras enable early detection of electrical faults, insulation failures, overheating motors, and process anomalies that could lead to costly downtime or equipment damage. Their integration into routine inspection cycles improves operational safety, reduces repair expenditure, and supports regulatory compliance. Industry 4.0 adoption further boosts demand for intelligent monitoring systems, where thermal cameras connect with IoT platforms, automated diagnostics, and AI-driven maintenance analytics. The affordability of uncooled cameras makes thermal inspection accessible to small and medium industries as well. Additional growth stems from rising demand for energy-efficiency audits, HVAC inspections, and monitoring of renewable energy assets such as solar plants and wind turbines.

- For Instance, Duke Energy uses thermal cameras during electrical substation inspections to identify overheating connectors and transformer anomalies, preventing failures that could cause outages affecting tens of thousands of customers.

Increasing Adoption in Automotive Safety & Advanced Driver Assistance Systems (ADAS)

Thermal imaging is increasingly integrated into automotive systems as manufacturers seek enhanced safety capabilities under all lighting and weather conditions. Thermal sensors allow the detection of pedestrians, wildlife, cyclists, and roadside hazards that may remain invisible to standard cameras or LiDAR during nighttime, fog, rain, or glare. This capability supports next-generation ADAS and autonomous driving platforms, where multi-sensor redundancy is essential for reliable navigation and decision-making. Premium vehicle models and commercial fleets adopt thermal night-vision systems for improved visibility and collision avoidance. Off-road, mining, and construction vehicles also benefit from thermal imaging for safer operations in low-visibility environments. As vehicle safety regulations tighten globally and autonomous driving technologies mature, the integration of thermal sensors across automotive platforms continues to accelerate, creating strong growth momentum.

Key Trends & Opportunities

Rapid Technological Advancements in AI, IoT, and Edge Analytics

A significant trend shaping the Thermal Imaging Cameras Market is the fusion of thermal imaging with AI analytics, IoT connectivity, and edge-processing capabilities. Modern devices now perform automated anomaly detection, object classification, temperature mapping, and real-time decision-making without reliance on external computing. In industrial environments, AI-enabled diagnostics enhance predictive maintenance by identifying early signs of equipment degradation. Surveillance systems increasingly use machine learning to differentiate between human movement, vehicles, animals, and environmental patterns. IoT-enabled thermal cameras support multi-site monitoring, remote diagnostics, and automated alerts through cloud platforms. Edge analytics significantly lowers latency by processing thermal data directly on the device, a vital advantage for defense, emergency response, and real-time safety operations. As component costs decrease and AI integration becomes standard, thermal imaging solutions expand into new markets, from smart buildings to autonomous equipment.

- For Instance, The FLIR A500f/A700f smart thermal cameras include onboard edge analytics that perform automatic fire/flare detection, temperature trending, and object recognition without external processors widely used in industrial plants for unattended monitoring.

Expanding Opportunities in Healthcare, Veterinary Diagnostics & Smart Homes

Thermal imaging is expanding rapidly into healthcare, veterinary services, and residential applications, creating substantial new market opportunities. In healthcare, thermal cameras are increasingly used for non-contact fever screening, vascular assessment, early inflammation detection, and postoperative monitoring—all providing diagnostic advantages without radiation exposure. Veterinary professionals adopt thermal imaging for identifying musculoskeletal injuries, infections, and temperature changes in livestock and companion animals. The smart home and consumer markets present fast-growing opportunities, driven by the availability of compact and smartphone-attached thermal cameras. Homeowners use them for detecting heat leaks, electrical risks, moisture intrusion, and insulation deficiencies. Real estate inspectors, insurance assessors, and home-service technicians also use thermal imaging for property diagnostics. As prices decline and awareness increases, thermal imaging is transitioning from specialized industrial applications to mainstream consumer and commercial environments.

- For Instance, Veterinary clinics and equine centers use systems such as the FLIR Vue Pro and IRT Vet Thermography platforms to detect tendon inflammation and circulation anomalies in horses often identifying issues days before visible symptoms appear.

Key Challenges

High Cost of Advanced Thermal Imaging Technology

The adoption of advanced thermal imaging cameras remains constrained by their high cost, stemming from the expense of precision infrared sensors, cooling systems, optical components, and image-processing technology. Cooled cameras, essential for long-range, high-resolution, and high-sensitivity applications, remain too expensive for small businesses and budget-restricted agencies. Even mid-range uncooled cameras cost significantly more than visible-light cameras, limiting adoption in sectors with tight operational budgets such as municipal services, firefighting units, and small industrial enterprises. Additional expenses related to calibration, maintenance, and specialized operator training increase the total cost of ownership. As market competition intensifies, manufacturers face pressure to offer affordable solutions without compromising performance. Although technological advancements are lowering costs gradually, price sensitivity remains a major barrier in emerging economies and across cost-constrained commercial segments.

Regulatory Restrictions and Export Controls on Thermal Imaging Devices

The Thermal Imaging Cameras Market is significantly impacted by strict export controls and regulatory frameworks governing infrared technologies, especially due to their dual-use nature in civilian and military applications. Many countries enforce stringent licensing requirements to prevent misuse of high-resolution or long-range thermal sensors, resulting in compliance complexity and delayed international shipments. Regulations such as ITAR and similar national guidelines require extensive documentation, limiting the ease of global distribution for thermal imaging manufacturers. These restrictions create challenges for companies targeting emerging markets where demand for surveillance, border security, and wildlife monitoring is rising but regulatory approvals are difficult to obtain. Additionally, certain applications require site-specific government clearances, further slowing deployment. Increasing regulatory oversight of next-generation infrared systems may tighten controls even more, affecting market expansion and limiting availability in geopolitically sensitive regions.

Regional Analysis

North America

North America dominated the Thermal Imaging Cameras Market with 34.7% market share in 2024, driven by strong adoption across defense, law enforcement, industrial inspection, and automotive safety systems. The U.S. leads the region due to significant defense spending, widespread deployment of advanced surveillance systems, and rapid integration of thermal imaging in oil & gas, utilities, and manufacturing. High demand for predictive maintenance and AI-enabled thermal analytics further boosts market growth. Expanding smart city projects, rising wildfire monitoring initiatives, and increased adoption in autonomous vehicle development continue to reinforce North America’s leadership.

Europe

Europe accounted for 28.3% of the market share in 2024, supported by strong demand for industrial safety, energy audits, and predictive maintenance applications across Germany, the U.K., and France. The region benefits from stringent workplace safety regulations and growing investments in industrial automation. Defense modernization programs and border surveillance upgrades also contribute to market expansion. Europe’s push toward sustainability increases the use of thermal cameras for energy-efficiency assessments in buildings and smart infrastructure. Advancements in automotive safety technologies, particularly night-vision integration, and growth in firefighting and emergency response applications further bolster regional adoption.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, holding 25.6% of the market share in 2024, driven by expanding industrial infrastructure, increasing defense procurement, and rising demand for advanced security systems. China, Japan, South Korea, and India contribute significantly through large-scale adoption in manufacturing, automotive, public safety, and border monitoring. Smart city development and investments in critical infrastructure surveillance fuel widespread deployment of thermal analytics. The region’s strong electronics manufacturing base supports cost-efficient production of thermal imaging components. Rising use in energy audits, facility inspections, and automotive ADAS systems further strengthens market growth across Asia Pacific.

Latin America

Latin America captured 6.1% market share in 2024, supported by increasing adoption in industrial safety, oil & gas operations, and security & surveillance applications across Brazil, Mexico, and Argentina. The region’s infrastructure modernization initiatives, including airport and public facility upgrades, fuel demand for thermal imaging solutions. Growing interest in predictive maintenance among manufacturing plants and energy providers also contributes to market expansion. Security concerns in urban areas drive deployments of thermal surveillance systems for crime prevention and border monitoring. Although budget limitations persist, declining device costs and rising industrial automation offer growth opportunities.

Middle East & Africa

The Middle East & Africa region held 5.3% of the market share in 2024, driven by strong adoption in oil & gas, industrial safety, border surveillance, and defense applications. Countries such as the UAE, Saudi Arabia, and Israel invest heavily in advanced thermal imaging technologies for perimeter monitoring, infrastructure protection, and military operations. Harsh climatic conditions, including extreme heat and sandstorms, further increase reliance on thermal systems for reliable visibility. Emerging opportunities in energy audits, smart city development, and critical infrastructure security support long-term market growth, although economic disparities may limit adoption in parts of Africa.

Market Segmentations

By Type

- Handheld

- Fixed/Mounted

- Scopes & Goggles

- Smartphone-Attached Thermal Cameras

By Application

- Security & Surveillance

- Inspection & Monitoring

- Firefighting

- Automotive

- Industrial Process Monitoring

By End User

- Industrial

- Commercial

- Residential

- Defense

- Automotive

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Thermal Imaging Cameras Market features a strong mix of global defense contractors, industrial technology leaders, and specialized infrared imaging manufacturers, each competing through innovation, product performance, and application diversification. Companies such as BAE Systems, Elbit Systems, InfraTec GmbH, and ANVS Inc. strengthen their presence with advanced military-grade thermal solutions designed for surveillance, target acquisition, and reconnaissance. Hangzhou Hikvision Digital Technology and Fortive Corp. expand their portfolios by integrating AI-driven analytics and IoT connectivity into commercial and industrial thermal cameras. Bullard and CorDEX Instruments focus on rugged, firefighter-friendly and inspection-oriented thermal devices, while Chauvin Arnoux Group enhances its position through precision testing and measurement solutions. Cox Enterprises supports technology-driven thermal imaging initiatives through strategic investments. Overall, competition intensifies as manufacturers emphasize compact designs, higher resolution sensors, reduced costs, and multi-application versatility to address growing demand across industrial inspection, security, automotive, firefighting, and residential markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, FLIR launched its new flagship multi-spectral maritime thermal imaging camera series models FLIR M460 and FLIR M560.

- In August 1 2025, Opgal Optronic Industries Ltd Opgal was acquired by Gevasol to bolster its thermal imaging and optical gas-imaging portfolio, underscoring a strategic move in emission-monitoring technologies.

- In 2025, LightPath Technologies secured an USD 18.2 million purchase order for advanced infrared camera systems from a global technology customer a deal that expands its backlog significantly

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong adoption across defense and homeland security as governments increase investments in advanced surveillance and night-vision technologies.

- Industrial sectors will expand usage of thermal imaging for predictive maintenance, electrical inspections, and energy-efficiency monitoring.

- Automotive manufacturers will integrate thermal sensors into ADAS and autonomous driving platforms to enhance night-time and all-weather visibility.

- Technological advancements will improve resolution, sensitivity, and compactness, enabling broader deployment across commercial and consumer applications.

- AI-driven analytics and edge processing will transform thermal cameras into intelligent diagnostic and monitoring tools.

- Demand for low-cost uncooled thermal cameras will grow as prices decline and availability expands in emerging markets.

- Firefighting and emergency response teams will increase adoption of rugged thermal devices for enhanced situational awareness and life-saving operations.

- Healthcare and veterinary applications will rise due to non-contact diagnostics and early detection benefits.

- Smart home and building automation systems will incorporate thermal imaging for security, energy management, and safety functions.

- North America, Europe, and Asia Pacific will continue to drive global expansion, supported by infrastructure upgrades and industrial modernization.