| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

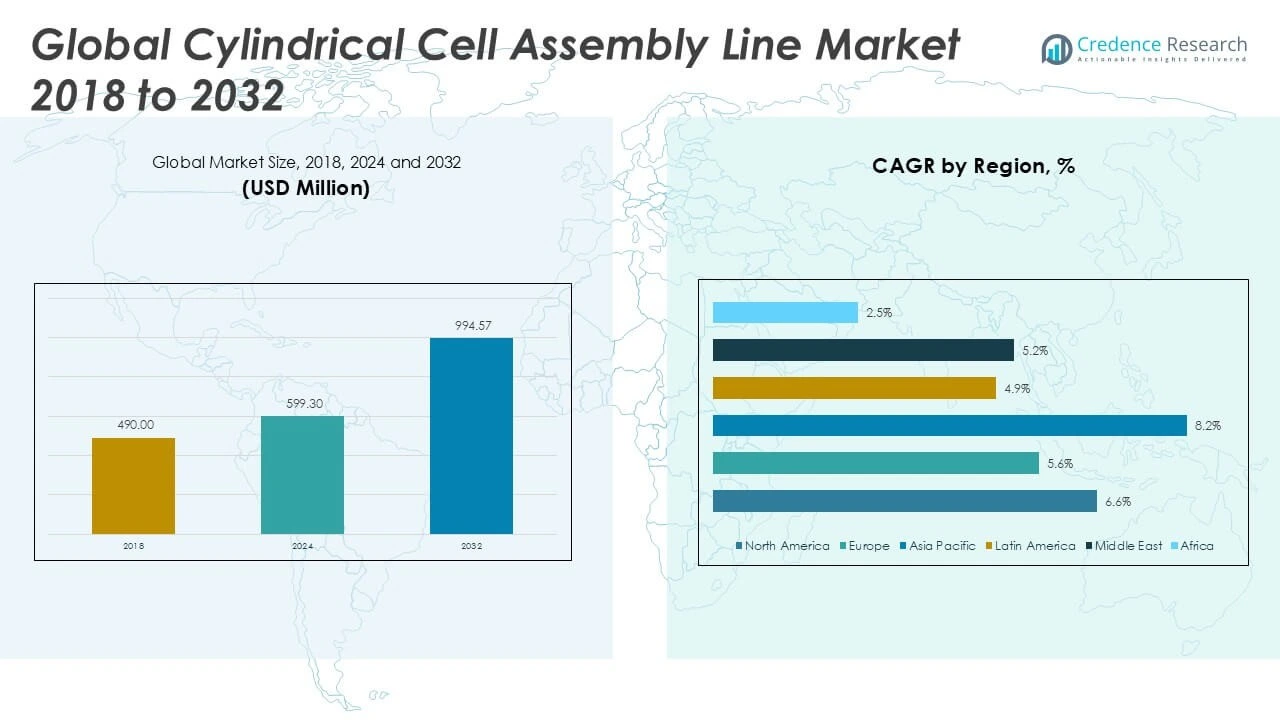

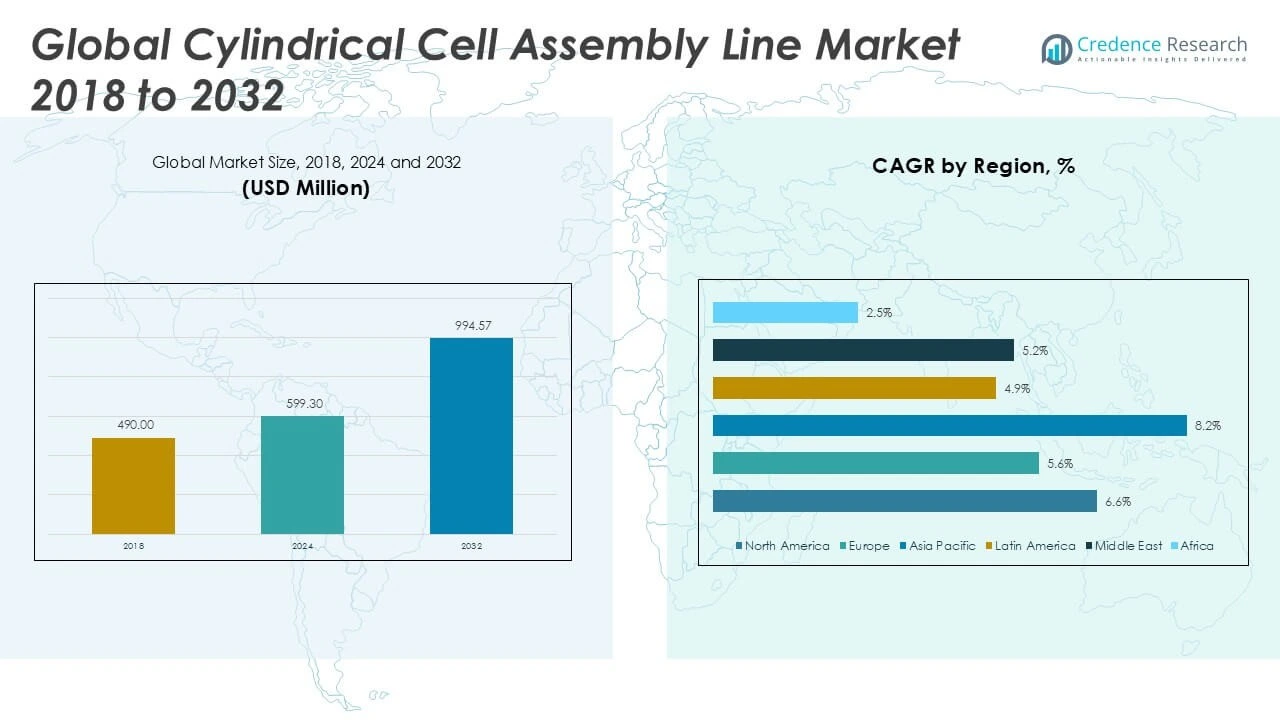

| Assembly Line Market Size 2024 |

USD 599.30 Million |

| Assembly Line Market , CAGR |

6.59% |

| Assembly Line Market Size 2032 |

USD 994.57 Million |

Market Overview

The Global Cylindrical Cell Assembly Line Market is projected to grow from USD 599.30 million in 2024 to an estimated USD 994.57 million by 2032, with a compound annual growth rate (CAGR) of 6.59% from 2025 to 2032.

The market is primarily driven by the rapid expansion of the electric vehicle industry and rising demand for high-density battery storage solutions. Automation and Industry 4.0 integration in battery production are reshaping manufacturing operations, improving throughput, and minimizing human error. Key trends include the adoption of AI and machine learning technologies for real-time quality monitoring and predictive maintenance, along with a growing emphasis on sustainability and reducing material wastage during cell production.

Geographically, Asia Pacific dominates the market, led by China, Japan, and South Korea, where robust EV manufacturing infrastructure and strong government incentives continue to fuel growth. North America and Europe are also witnessing substantial investments in domestic battery manufacturing to reduce import dependence. Prominent players in the global cylindrical cell assembly line market include Hitachi High-Tech Corporation, Manz AG, Shenzhen Yinghe Technology Co., Ltd., Wuxi Lead Intelligent Equipment Co., Ltd., and CKD Corporation, who are actively developing innovative and efficient solutions to meet rising industry demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cylindrical Cell Assembly Line Market is projected to grow from USD599.30 million in 2024 to USD994.57 million by 2032, at a CAGR of 6.59% from 2025 to 2032.

- Rising demand for lithium-ion batteries in EVs, energy storage systems, and consumer electronics is driving market expansion.

- Automation, Industry 4.0 integration, and the need for high-volume battery production are key market growth enablers.

- High capital investment and system complexity act as major barriers for small and mid-sized manufacturers.

- Asia Pacific dominates the global market share, led by China, Japan, and South Korea due to robust battery manufacturing infrastructure.

- North America and Europe are witnessing increased domestic investments to strengthen regional battery supply chains.

- Sustainability initiatives and demand for energy-efficient assembly solutions are shaping future technology developments in the market.

Market Drivers

Surge in Electric Vehicle Adoption Catalyzes Demand for Battery Manufacturing Automation

The rapid global shift toward electric vehicles (EVs) continues to propel the demand for cylindrical lithium-ion cells, which are widely used in EV battery packs. Governments worldwide are offering subsidies and policy incentives to accelerate EV production, prompting automakers to scale battery output. The Global Cylindrical Cell Assembly Line Market benefits directly from this transition, as manufacturers seek automated systems that can handle high-volume production. Companies are investing in end-to-end assembly solutions to ensure consistent quality, increase throughput, and reduce labor costs. It enables the production of reliable cells necessary to meet the growing performance expectations of EV applications. The automation also supports traceability and stringent quality requirements crucial for automotive compliance.

For instance, over 57,000 automated cylindrical cell assembly systems were deployed globally in 2024 to support the rising demand for EV battery production

Rising Demand for Energy Storage Systems Drives Manufacturing Expansion

The growing need for energy storage systems (ESS) in grid infrastructure and residential applications is increasing the consumption of cylindrical cells. Renewable energy projects, particularly those focused on solar and wind, require reliable battery storage to ensure continuous power supply. The Global Cylindrical Cell Assembly Line Market supports this shift by providing scalable production capabilities that align with fluctuating grid demands. It helps battery manufacturers maintain competitive pricing and meet delivery schedules in high-demand scenarios. Standardization of cell formats across multiple industries further enhances the relevance of cylindrical cell production lines. Companies are now targeting rapid setup and high operational uptime to serve the expanding energy storage segment effectively.

For instance, more than 1,000 energy storage projects globally incorporated cylindrical lithium-ion cells in 2024 to enhance grid stability and renewable energy integration

Shift Toward Smart Factories and Industry 4.0 Enhances Assembly Line Efficiency

The adoption of Industry 4.0 technologies is transforming traditional manufacturing lines into smart, interconnected systems. Automation in the Global Cylindrical Cell Assembly Line Market incorporates machine learning, AI, and IoT sensors to improve real-time monitoring and predictive maintenance. It reduces production downtime and ensures consistent product quality. Data-driven insights from these systems enable better decision-making and faster resolution of production bottlenecks. Companies prioritize flexible line configurations that support multiple cell variants and quick changeovers. This approach aligns with manufacturers’ goals of operational efficiency and reduced cycle time.

Focus on Quality Control and Material Utilization Strengthens Market Growth

Precision and material optimization remain top priorities in cylindrical cell assembly due to safety and performance requirements. The Global Cylindrical Cell Assembly Line Market addresses these concerns by integrating automated inspection and rejection systems. It helps eliminate defective units early in the process, minimizing waste and improving yield. Manufacturers are adopting laser welding, robotic handling, and automated electrolyte filling to maintain exacting quality standards. These technologies reduce human error and enhance repeatability in critical assembly stages. The ability to ensure cell consistency plays a significant role in gaining customer trust, especially in high-risk applications like EVs and aerospace.

Market Trends

Integration of Artificial Intelligence and Machine Vision Enhances Operational Precision

Manufacturers are increasingly integrating artificial intelligence (AI) and machine vision systems into cylindrical cell assembly lines to improve inspection and quality control. These technologies enable real-time defect detection, dimensional verification, and process optimization without manual intervention. The Global Cylindrical Cell Assembly Line Market is witnessing strong demand for smart systems that ensure consistency in welding, electrolyte filling, and cell sealing. It supports high-speed production while maintaining stringent quality standards required in energy storage and EV applications. AI-based analytics also offer actionable insights into process deviations and equipment performance. This capability enables predictive maintenance and reduces unexpected downtime.

For instance, research institutions have achieved 90% accuracy in identifying 18,650 cylindrical cells using automated optical character recognition and machine vision techniques.

Growing Preference for Fully Automated and Modular Production Lines

Industry players are shifting toward fully automated, modular assembly lines that offer flexibility and scalability in cell production. The modular design enables easy reconfiguration of machinery to accommodate different cell sizes or changes in production volumes. The Global Cylindrical Cell Assembly Line Market is evolving to support dynamic manufacturing setups where rapid customization is critical. It allows manufacturers to adapt to shifting customer demands and launch new battery products with minimal delay. Automation reduces human intervention, thereby improving safety, accuracy, and repeatability. Standardized modules also simplify maintenance and spare parts management.

For instance, automation solutions for EV battery cell assembly now incorporate high-speed defect detection systems, ensuring precise alignment and reducing errors in production.

Emphasis on Sustainable Manufacturing and Material Efficiency

Sustainability has become a strategic focus across battery manufacturing, driving innovations in waste reduction and energy-efficient assembly processes. Companies in the Global Cylindrical Cell Assembly Line Market are developing systems that minimize raw material usage and optimize energy consumption. It supports industry efforts to reduce environmental impact while complying with evolving regulations. Environmentally friendly coolant systems, closed-loop recycling of materials, and energy recovery mechanisms are gaining traction. These trends reflect a broader industry shift toward responsible manufacturing practices. The drive for sustainability also enhances brand reputation and investor appeal.

Advancements in Laser Technology and Robotic Automation Improve Process Reliability

The adoption of advanced laser welding systems and robotic automation is redefining precision and speed in cylindrical cell production. These technologies ensure strong, clean welds and precise handling during delicate stages such as tab welding and cell assembly. The Global Cylindrical Cell Assembly Line Market is incorporating such systems to meet the rigorous requirements of automotive and aerospace sectors. It ensures reliability, reduces rework rates, and enhances the overall quality of finished cells. Robotic arms enable seamless material flow, improving production line synchronization. The continuous innovation in equipment design supports long-term competitiveness.

Market Challenges

High Initial Capital Investment and Complex System Integration Limit Market Adoption

The significant upfront investment required for setting up a cylindrical cell assembly line remains a primary barrier for small and mid-sized manufacturers. Advanced automation systems, precision machinery, and cleanroom infrastructure drive up capital costs. The Global Cylindrical Cell Assembly Line Market faces resistance from companies lacking the financial resources to deploy these systems at scale. It also involves complex integration of hardware and software, demanding skilled personnel and extended setup timelines. Delays in achieving return on investment further deter new entrants. These challenges slow the pace of market penetration, particularly in cost-sensitive regions.

For instance, over 120,000 cylindrical cell assembly units were produced globally in 2024, reflecting the increasing demand for lithium-ion battery manufacturing

Supply Chain Volatility and Technological Obsolescence Create Operational Risks

Fluctuations in raw material availability and price instability impact the smooth functioning of battery manufacturing operations. The Global Cylindrical Cell Assembly Line Market is vulnerable to disruptions in supply chains, especially for key components such as precision motors, sensors, and control systems. It heightens the risk of production delays and unmet delivery commitments. Rapid advancements in battery technologies also lead to shorter product lifecycles, requiring frequent updates to assembly lines. Companies struggle to keep pace with evolving standards, risking technological obsolescence. This uncertainty complicates long-term investment decisions and strategic planning.

Market Opportunities

Expansion of Battery Manufacturing in Emerging Economies Presents Growth Potential

Emerging economies in Asia, Latin America, and Africa are investing in domestic battery manufacturing to support local EV adoption and energy storage projects. The Cylindrical Cell Assembly Line Market has significant opportunity to supply advanced, cost-effective equipment to these regions. It can benefit from government-backed industrial policies and joint ventures with global battery producers. Localized production facilities will require scalable and modular assembly lines tailored to varying output capacities. Vendors that offer customization, remote support, and rapid installation will gain a competitive edge. Rising labor costs in mature markets will further encourage regional diversification of manufacturing operations.

Growing Demand for Advanced Technologies in Battery Production Lines

Demand for next-generation cylindrical cells with higher energy density and improved performance creates a need for precision-engineered assembly systems. The Cylindrical Cell Assembly Line Market can capitalize on the trend toward automation, AI integration, and smart control systems. It offers opportunities for manufacturers to develop high-speed, flexible lines capable of handling complex chemistries and strict quality requirements. Industries such as aerospace, defense, and healthcare are adopting advanced battery solutions, expanding the addressable market. Innovation in material handling, laser welding, and inline inspection systems will drive value-added differentiation. Companies that invest in R\&D and digital integration will position themselves as preferred solution providers.

Market Segmentation Analysis

By Type

The Global Cylindrical Cell Assembly Line Market is segmented by type into Winding Assembly Line and Stacked Assembly Line. The winding assembly line holds a larger share due to its compatibility with high-speed production and mature technology infrastructure. It is widely preferred in electric vehicle and consumer electronics applications for its cost-effectiveness and stable output. Stacked assembly lines are gaining attention for their ability to support next-generation high-capacity cells with enhanced energy density. While the stacked method remains in a nascent phase, ongoing innovation is expected to boost its adoption in premium battery applications. Manufacturers are balancing cost and performance to select the appropriate type based on production scale and end-use requirements.

By Application

The Global Cylindrical Cell Assembly Line Market, by application, includes Automotive, Consumer Electronics, Medical Devices, and Others. The automotive segment dominates due to the rapid expansion of electric vehicle manufacturing and the growing need for reliable, high-volume battery production. It demands fully automated, high-speed assembly lines to meet strict quality and safety standards. Consumer electronics follows closely, driven by rising demand for portable devices that require compact, high-performance batteries. Medical devices represent a growing niche where precision and reliability are critical, prompting adoption of advanced cell assembly systems. The “Others” category includes energy storage and industrial tools, supporting broader market diversification.

Segments

Based on Type

- Winding Assembly Line

- Stacked Assembly Line

Based on Application

- Automotive

- Consumer Electronics

- Medical Devices

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Cylindrical Cell Assembly Line Market

North America holds the largest share in the Cylindrical Cell Assembly Line Market, accounting for 35.29% in 2024 with a valuation of USD 211.63 million. The market is projected to reach USD 352.43 million by 2032, expanding at a CAGR of 6.6%. The region’s dominance stems from strong electric vehicle adoption, large-scale battery manufacturing facilities, and robust investments in clean energy infrastructure. The United States leads the regional market with continued support for domestic battery supply chains. It benefits from incentives under policies such as the Inflation Reduction Act and growing EV manufacturing from companies like Tesla and General Motors. The demand for automated and intelligent cell assembly lines continues to grow to meet production scalability.

Europe Cylindrical Cell Assembly Line Market

Europe represents 23.46% of the global market share in 2024, valued at USD 140.70 million and projected to reach USD 217.59 million by 2032, growing at a CAGR of 5.6%. The region’s focus on electrification and sustainability drives significant investments in battery manufacturing, particularly in Germany, France, and the Nordic countries. The Cylindrical Cell Assembly Line Market in Europe benefits from strong regulatory support and environmental mandates aimed at reducing carbon emissions. It supports the development of gigafactories and automated assembly infrastructure aligned with local EV demand. The region’s emphasis on energy efficiency and advanced production capabilities strengthens the market outlook.

Asia Pacific Cylindrical Cell Assembly Line Market

Asia Pacific is expected to register the fastest growth with a CAGR of 8.2%, rising from USD 169.45 million in 2024 to USD 314.89 million by 2032. The region holds a 28.26% share of the global market, supported by the dominance of China, South Korea, and Japan in the lithium-ion battery ecosystem. The Cylindrical Cell Assembly Line Market benefits from large-scale EV manufacturing, technological innovation, and strong supply chain integration. China remains the regional leader due to aggressive industrial policies and massive production capacity. The region is also seeing rapid expansion in consumer electronics and renewable energy storage, increasing the need for efficient cell assembly lines.

Latin America Cylindrical Cell Assembly Line Market

Latin America holds a smaller market share of 4.5% in 2024, with a market size of USD 26.96 million projected to reach USD 39.41 million by 2032, growing at a CAGR of 4.9%. While the market is at a nascent stage, countries like Brazil and Mexico are exploring opportunities in battery production and EV assembly. The Cylindrical Cell Assembly Line Market in the region benefits from emerging clean energy initiatives and foreign investment in battery technologies. Limited domestic production capabilities and dependence on imports pose challenges to rapid growth. It presents untapped potential for global manufacturers looking to diversify and expand production hubs.

Middle East Cylindrical Cell Assembly Line Market

The Middle East market was valued at USD 24.45 million in 2024 and is expected to reach USD 36.59 million by 2032, with a CAGR of 5.2%. It holds a market share of 4.1%, driven by increasing interest in renewable energy integration and energy storage systems. The Cylindrical Cell Assembly Line Market in this region is supported by initiatives in the UAE and Saudi Arabia to diversify their energy portfolios. Government-backed industrial programs are encouraging the development of high-tech manufacturing capabilities. Though smaller in size, the market shows promise due to rising demand for grid-scale battery solutions and smart city infrastructure.

Africa Cylindrical Cell Assembly Line Market

Africa accounts for 4.36% of the global market in 2024, valued at USD 26.12 million and projected to reach USD 33.66 million by 2032, growing at a CAGR of 2.5%. The Cylindrical Cell Assembly Line Market in Africa is still in early development, with limited local battery production facilities. However, demand for energy storage in off-grid and remote areas is creating interest in scalable cell assembly solutions. South Africa leads the regional market, followed by growing activity in Kenya and Nigeria. Infrastructure gaps and limited technological expertise hinder rapid expansion. International partnerships and investment are critical to unlocking the region’s potential in battery manufacturing.

Key players

- AOT BATTERY

- Xiamen Acey New Energy Technology

- TOB New Energy Technology

- SPT Instrument Co., Ltd.

- Xiamen Lith Machine Limited

- Gelon Lib Co., Ltd Company

- Wuxi Lead Intelligent Equipment Co., Ltd.

- Shenzhen New Power Technology Co., Ltd.

- MTI Corporation

Competitive Analysis

The Cylindrical Cell Assembly Line Market features a competitive landscape with both established players and specialized equipment manufacturers competing on technology, scale, and customization. Companies like Wuxi Lead Intelligent Equipment Co., Ltd. and MTI Corporation lead with strong global distribution networks and advanced automation capabilities. AOT BATTERY and TOB New Energy focus on offering modular and cost-effective solutions for mid-sized manufacturers. It emphasizes precision, throughput, and adaptability in manufacturing equipment to cater to electric vehicle, energy storage, and electronics sectors. Players are expanding their product portfolios and forming strategic alliances to enhance technological edge and market reach. Innovation, reliability, and after-sales support remain key differentiators in this competitive environment.

Recent Developments

- In 2025, Xiamen Acey New Energy Technology launched the 32140 Battery Pack Assembly Line, supporting large-format cylindrical battery manufacturing.

- In 2025, TOB New Energy Technology expanded its equipment portfolio to support the manufacturing of 4680 and 4690 tabless cylindrical cell formats. This expansion includes equipment for producing these cells and the materials needed for their manufacturing.

- In 2024, Shenzhen New Power Technology Co., Ltd. focused on manufacturing 46-series large cylindrical batteries, aiming for a 10 GWh annual production capacity.

- In 2024, MTI Corporation continued offering a comprehensive suite of lab-scale cylindrical cell assembly machines, supporting research and pilot-scale production.

Market Concentration and Characteristics

The Cylindrical Cell Assembly Line Market exhibits moderate to high market concentration, with a few dominant players holding significant global share. It is characterized by high capital intensity, strong emphasis on automation, and continuous technological advancement. Companies compete on precision, scalability, and integration capabilities, catering primarily to electric vehicle, consumer electronics, and energy storage industries. The market favors firms with established R&D capabilities and global service networks. It demands adherence to strict quality standards and process efficiency, making barriers to entry relatively high. Strategic partnerships and long-term supply contracts further reinforce the competitive positions of leading manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow rapidly due to increasing global adoption of electric vehicles. Governments and automakers are expanding EV production, driving demand for automated cell assembly lines.

- Manufacturers will prioritize automation and Industry 4.0 technologies. Integration of AI, IoT, and robotics will enhance production efficiency and real-time quality monitoring.

- Rising investment in large-scale battery plants will boost demand for scalable and high-throughput assembly solutions. Equipment vendors must support rapid deployment and line flexibility.

- Future battery designs will require precision engineering for high-capacity cells. Assembly lines must evolve to accommodate complex chemistries and tighter tolerances.

- Countries will promote domestic battery production to reduce import dependence. This trend will create regional demand for turnkey and modular assembly systems.

- Sustainability goals will drive innovations in material efficiency, energy use, and recycling integration. Assembly lines will need to support closed-loop processes and green certifications.

- Beyond automotive, growth in consumer electronics, medical devices, and industrial storage will widen the market base. Assembly systems must cater to varied output volumes and formats.

- Manufacturers will seek flexible line configurations that support quick changeovers and new product introductions. Customization will become a key differentiator in vendor offerings.

- Vendors will form alliances with battery producers and automation specialists. These collaborations will speed up product development and align technology with market needs.

- China, Japan, and South Korea will retain leadership in battery production. Equipment suppliers must maintain strong regional presence and support local production expansions.