| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Endocrine Testing Market Size 2023 |

USD 13,277.0Million |

| Endocrine Testing Market , CAGR |

8.23% |

| Endocrine Testing Market Size 2032 |

USD 25,074.5 Million |

Market Overview

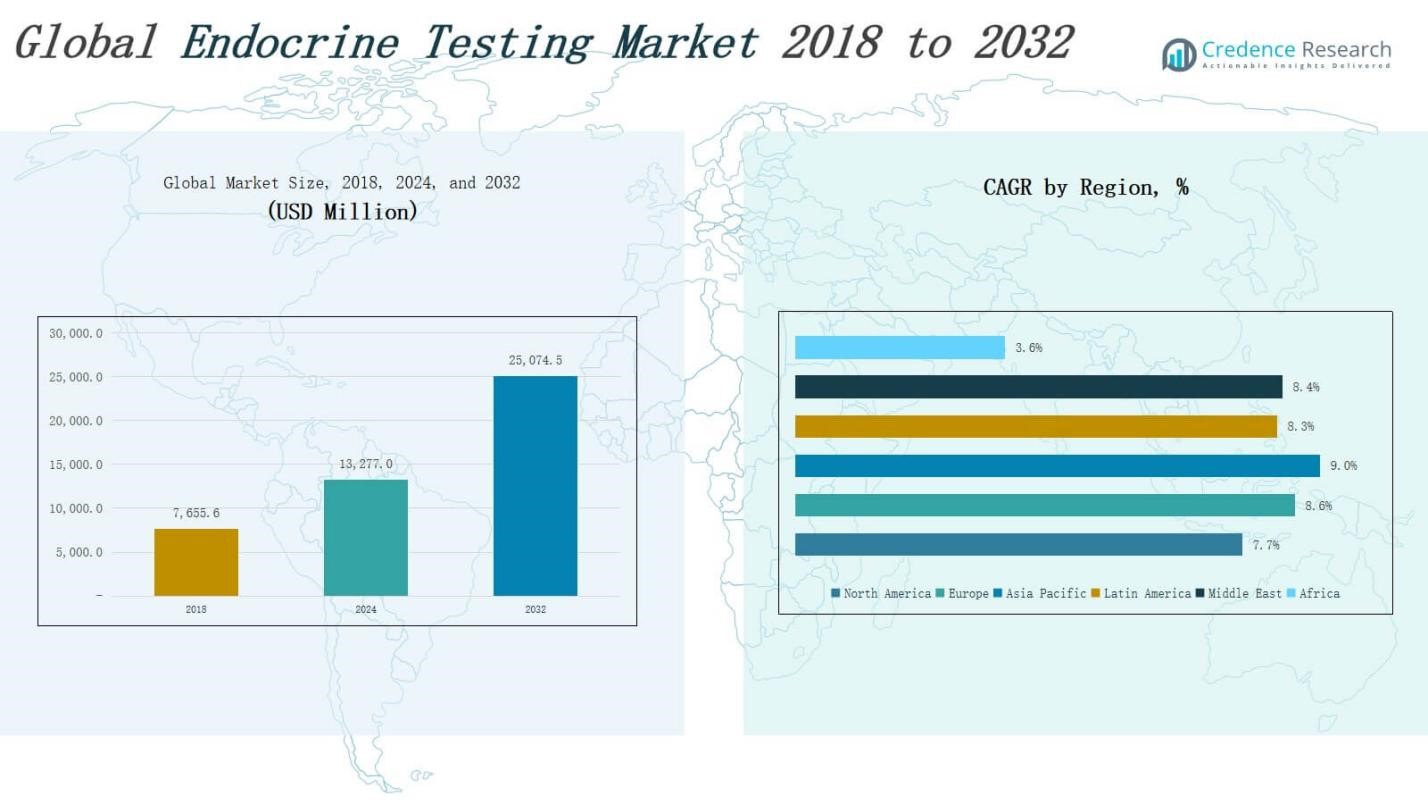

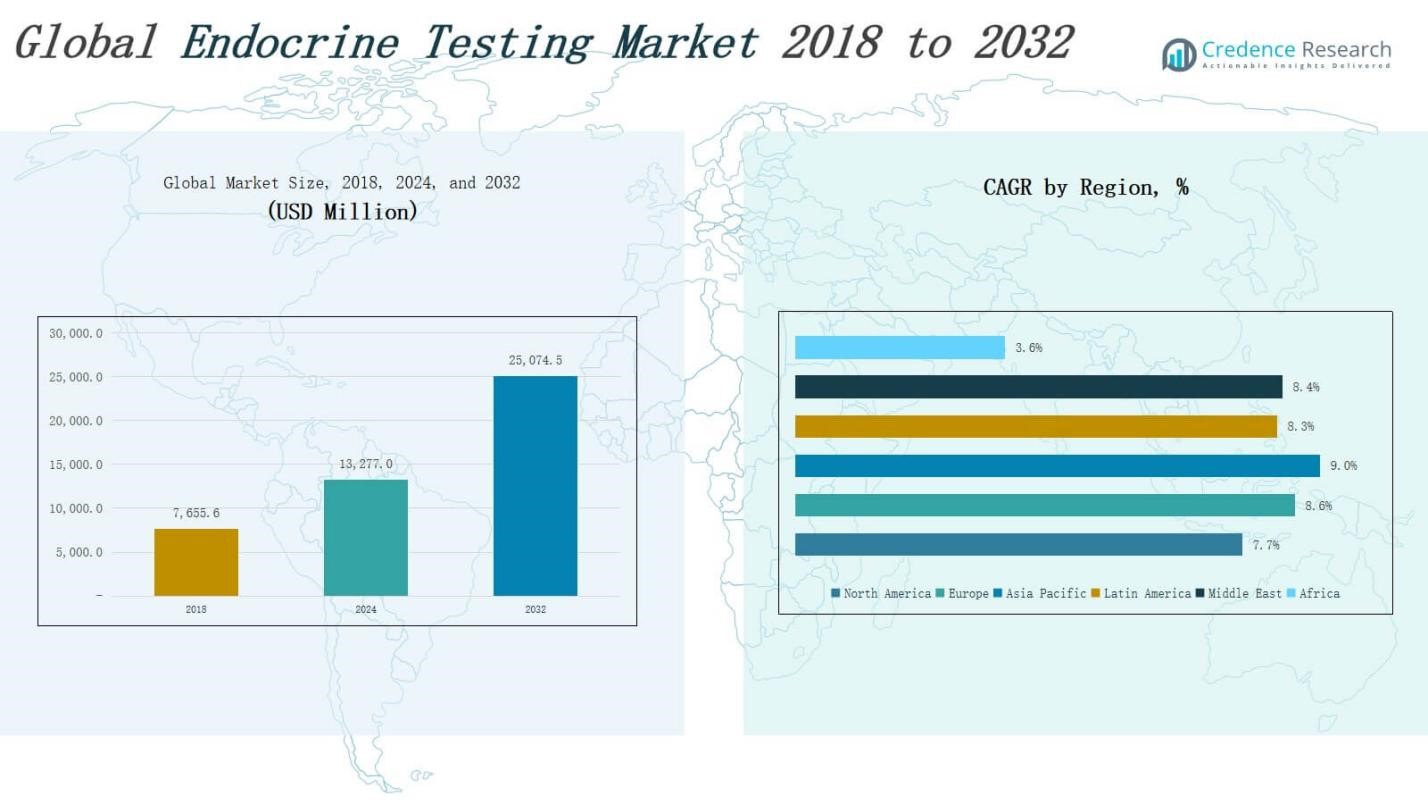

The Endocrine Testing Market size was valued at USD 7,655.6 million in 2018 to USD 13,277.0 million in 2024 and is anticipated to reach USD 25,074.5 million by 2032, at a CAGR of 8.23% during the forecast period.

The Endocrine Testing Market is driven by the rising prevalence of hormonal disorders such as diabetes, thyroid dysfunction, and adrenal insufficiency, along with increasing awareness of early disease detection. The growing geriatric population, expanding access to diagnostic services, and the global surge in lifestyle-related conditions further support market demand. Technological advancements in immunoassay platforms, mass spectrometry, and point-of-care testing are enhancing test accuracy, speed, and accessibility. Healthcare providers are increasingly adopting automated and high-throughput endocrine analyzers to improve diagnostic efficiency and patient outcomes. The market is also experiencing a notable trend toward personalized medicine, where endocrine markers guide tailored treatments. Integration of digital health tools, such as remote monitoring and electronic health records, is streamlining endocrine disorder management. Additionally, partnerships between diagnostic companies and research institutions are accelerating biomarker discovery and validation. With a shift toward minimally invasive and home-based testing, the market is poised for sustained growth across both developed and emerging healthcare systems.

The Endocrine Testing Market demonstrates strong geographical diversification, with North America holding the largest share due to advanced diagnostic infrastructure and high disease awareness. Europe follows with widespread adoption of preventive care and public health initiatives. Asia Pacific leads in growth rate, driven by rising healthcare investments and increasing endocrine disorder prevalence in China, India, and Japan. Latin America shows steady expansion through public-private partnerships and diagnostic outreach, while the Middle East benefits from hospital modernization and rising lifestyle-related diseases. Africa holds a smaller share but is gradually advancing through mobile diagnostics and urban healthcare initiatives. Key players shaping the global market include Thermo Fisher Scientific, Siemens Healthineers, Abbott, Roche, Bio-Rad Laboratories, bioMérieux, Agilent Technologies, DiaSorin, and Ortho Clinical Diagnostics, each leveraging technology, partnerships, and regional expansion to strengthen market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Endocrine Testing Market was valued at USD 7,655.6 million in 2018, reached USD 13,277.0 million in 2024, and is projected to reach USD 25,074.5 million by 2032, growing at a CAGR of 8.23%.

- Rising prevalence of hormonal disorders such as diabetes, thyroid dysfunction, and adrenal insufficiency is driving demand for early and accurate endocrine diagnostics.

- Technological advancements in immunoassays, tandem mass spectrometry, and point-of-care testing are enhancing diagnostic speed, accuracy, and accessibility.

- Growth in geriatric population and lifestyle-related diseases is increasing demand for condition-specific hormone testing across primary and outpatient settings.

- North America leads the market with USD 4,143.18 million in 2024, followed by Europe and Asia Pacific; the latter is the fastest-growing region with a 9.0% CAGR.

- Cost, diagnostic complexity, and access barriers in low-income regions remain key challenges, limiting adoption despite growing awareness.

- Key players include Thermo Fisher Scientific, Siemens Healthineers, Abbott, Roche, Bio-Rad, bioMérieux, Agilent Technologies, DiaSorin, and Ortho Clinical Diagnostics.

Market Drivers

Rising Prevalence of Hormonal Disorders Drives Demand for Diagnostic Solutions

The Endocrine Testing Market is expanding due to the increasing incidence of hormonal disorders such as diabetes, hypothyroidism, hyperthyroidism, and adrenal insufficiency. These conditions require timely and accurate diagnosis to prevent complications and guide treatment. The growing global burden of chronic endocrine diseases has led to increased testing volumes across healthcare settings. It is driving clinical laboratories and hospitals to invest in advanced testing platforms that offer improved sensitivity and faster results.

- For instance, Mayo Clinic Laboratories has expanded its test menu to include advanced diagnostics for adrenal and thyroid disorders, utilizing high-sensitivity assays designed to deliver reliable results for clinical decision making.

Technological Advancements Improve Testing Efficiency and Accuracy

Ongoing innovations in diagnostic technology are strengthening the Endocrine Testing Market by enhancing the speed, accuracy, and accessibility of hormone analysis. Immunoassay systems, tandem mass spectrometry, and fully automated analyzers are enabling precise quantification of endocrine markers. It allows clinicians to make quicker and more informed decisions. These advancements are reducing turnaround times and supporting high-throughput testing, which is essential in large-scale diagnostic operations. Innovation is supporting personalized treatment planning.

- For instance, Roche’s cobas e 801 module utilizes electrochemiluminescence immunoassay (ECLIA) technology to deliver up to 300 tests per hour with high precision, supporting faster clinical decisions.

Growth in Geriatric Population and Lifestyle-Related Conditions

Aging populations and rising lifestyle-related health issues are increasing demand for hormone-related diagnostics. The elderly face higher risks of endocrine disorders, including osteoporosis and thyroid disease. Obesity, stress, and sedentary behavior contribute to metabolic imbalances that require clinical evaluation. The Endocrine Testing Market is responding with tailored diagnostic solutions to meet age-specific and condition-specific testing requirements. It is enabling early detection and monitoring of disease progression, particularly in primary care and outpatient settings.

Increased Awareness and Access to Diagnostic Services

Wider awareness of endocrine health and improved access to diagnostic infrastructure are supporting the growth of the Endocrine Testing Market. Government initiatives, public health campaigns, and insurance coverage expansion are encouraging routine hormone testing. It is prompting earlier interventions and preventive care across urban and rural populations. Growing adoption of point-of-care testing and home sampling kits is further expanding diagnostic outreach and improving patient compliance across healthcare ecosystems.

Market Trends

Adoption of Automated and High-Throughput Testing Platforms

Laboratories and healthcare facilities are integrating automated systems to meet growing testing demands in the Endocrine Testing Market. High-throughput analyzers reduce manual errors, accelerate processing, and support large-scale diagnostic workflows. Automation is becoming essential in hospital laboratories and reference labs where hormone panels are frequently requested. It enhances reproducibility, cuts down labor costs, and supports continuous workflow. This shift toward fully automated endocrine analyzers is helping laboratories manage rising sample volumes efficiently and accurately.

- For instance, Abbott’s ARCHITECT i2000SR immunoassay analyzer supports continuous access to samples and reagents, allowing labs to process over 200 tests per hour with minimal hands-on time—ideal for high-demand endocrine assays like TSH and cortisol.

Shift Toward Personalized and Targeted Hormonal Diagnostics

Personalized medicine is influencing test development in the Endocrine Testing Market by promoting biomarker-driven diagnostic approaches. Clinicians now rely on specific hormone profiles to tailor treatment plans for patients with thyroid disorders, infertility, or adrenal dysfunction. This trend is increasing demand for multiplex hormone assays and specialized diagnostic panels. It allows for deeper insight into endocrine system imbalances. Research in endocrinology is fueling development of targeted diagnostics that support individualized care and therapeutic monitoring.

- For instance, Siemens Healthineers introduced the Atellica IM Multianalyte Thyroid Panel, allowing simultaneous measurement of multiple thyroid biomarkers so physicians can more accurately diagnose and individualize treatment strategies for thyroid disorders.

Expansion of Point-of-Care and Home-Based Testing Solutions

The demand for decentralized testing is driving growth in point-of-care and home-based diagnostic tools within the Endocrine Testing Market. Portable analyzers and self-sampling kits are enabling patients to monitor hormone levels outside clinical settings. This trend supports early detection and long-term disease management for conditions such as diabetes and thyroid dysfunction. It also enhances accessibility in remote or underserved regions. Consumer preference for convenient, fast testing is prompting manufacturers to design compact, user-friendly platforms.

Integration of Digital Health Tools in Endocrine Diagnostics

Digitalization is transforming the Endocrine Testing Market through electronic health records, telemedicine, and AI-driven analytics. Health systems are leveraging digital platforms to track hormone levels, analyze trends, and support clinical decisions. Real-time data integration improves continuity of care and enhances patient engagement. It helps clinicians detect abnormalities early and adjust therapies promptly. Diagnostic providers are incorporating connectivity features into instruments to enable cloud-based monitoring and streamline communication between labs and clinicians.

Market Challenges Analysis

Complexity of Hormonal Pathways and Diagnostic Accuracy Limitations

The Endocrine Testing Market faces challenges linked to the complexity of hormonal interactions and variations in test sensitivity. Hormone levels fluctuate based on age, gender, circadian rhythms, and comorbid conditions, which complicates interpretation. Clinicians often require multiple tests over time to confirm a diagnosis, leading to delayed treatment. It puts pressure on diagnostic providers to improve assay accuracy and specificity. False positives or inconsistent results can misguide clinical decisions, impacting patient outcomes.

High Cost of Advanced Testing Technologies and Limited Access in Low-Income Regions

Cost remains a significant barrier in the Endocrine Testing Market, particularly in regions with limited healthcare budgets. Advanced platforms like mass spectrometry and multiplex assays demand substantial capital investment, restricting their availability to urban centers and developed economies. It limits access for rural populations and underfunded healthcare systems. Infrastructure gaps, lack of skilled personnel, and minimal reimbursement policies further reduce adoption. These financial and logistical constraints hinder market expansion in price-sensitive regions.

Market Opportunities

Expansion of Preventive Healthcare and Wellness Screening Programs

The global emphasis on preventive healthcare is opening new avenues for the Endocrine Testing Market. Employers, insurers, and governments are promoting regular health screenings that include hormonal evaluations to detect conditions early. It supports market growth through increased demand for routine thyroid, cortisol, insulin, and reproductive hormone testing. Preventive diagnostics also align with public health goals to reduce the burden of chronic endocrine diseases. Market players can introduce accessible, cost-effective testing solutions to serve wellness initiatives across diverse populations.

Rising Demand in Emerging Economies with Healthcare Infrastructure Development

Emerging markets present strong growth potential for the Endocrine Testing Market due to improving diagnostic infrastructure and rising healthcare investments. Countries in Asia-Pacific, Latin America, and the Middle East are expanding laboratory networks and upgrading hospital capabilities. It creates opportunities for diagnostic companies to introduce scalable solutions tailored to local healthcare needs. Growing urbanization and awareness of endocrine disorders are also increasing test adoption. Strategic collaborations with local providers can accelerate market penetration and boost long-term profitability.

Market Segmentation Analysis:

By Test Type

The Endocrine Testing Market is segmented by test type into Estradiol (E2), Follicle Stimulating Hormone (FSH), Human Chorionic Gonadotropin (hCG), Luteinizing Hormone (LH), Dehydroepiandrosterone Sulfate (DHEAS), Progesterone, Testosterone, Thyroid Stimulating Hormone (TSH), Prolactin, Cortisol, Insulin, and others. TSH and insulin tests dominate due to the high global prevalence of thyroid disorders and diabetes. It supports continuous demand for routine screening and disease monitoring across both primary care and specialist clinics.

- For instance, Roche Diagnostics offers the Elecsys TSH assay, widely utilized in clinical laboratories to monitor thyroid function, reflecting their strong focus on high-throughput, automated endocrine testing platforms.

By Technology

Based on technology, the Endocrine Testing Market includes Tandem Mass Spectrometry, Immunoassay, Monoclonal & Polyclonal Antibody Technologies, Sensor Technology, Clinical Chemistry, and others. Immunoassays account for the largest share due to their widespread use in hormone detection, high sensitivity, and compatibility with automation. It enables cost-effective, high-throughput testing in clinical laboratories. Tandem mass spectrometry is gaining traction for its precision and ability to detect multiple hormones simultaneously.

- For instance, Siemens Healthineers provides the ADVIA Centaur XP Immunoassay System, which supports automated, high-sensitivity testing for key endocrine markers including fertility and thyroid panels, streamlining routine endocrine diagnostics in major hospitals.

By End User

The Endocrine Testing Market is segmented by end user into hospitals, clinical laboratories, and others. Clinical laboratories hold a major share due to their capacity to handle large test volumes and their role in routine diagnostic workflows. Hospitals follow closely, driven by inpatient and emergency testing demands. It supports market growth by integrating endocrine tests into broader diagnostic protocols for patient management and chronic disease evaluation.

Segments:

Based on Test Type

- Estradiol (E2) Test

- Follicle Stimulating Hormone (FSH) Test

- Human Chorionic Gonadotropin (hCG) Hormone Test

- Luteinizing Hormone (LH) Test

- Dehydroepiandrosterone Sulfate (DHEAS) Test

- Progesterone Test

- Testosterone Test

- Thyroid Stimulating Hormone (TSH) Test

- Prolactin Test

- Cortisol Test

- Insulin Test

- Others

Based on Technology

- Tandem Mass Spectrometry

- Immunoassay

- Monoclonal & Polyclonal Antibody Technologies

- Sensor Technology

- Clinical Chemistry

- Others

Based on End User

- Hospitals

- Clinical Laboratories

- Others

Based on Region

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis

North America

The North America Endocrine Testing Market size was valued at USD 2,458.20 million in 2018 to USD 4,143.18 million in 2024 and is anticipated to reach USD 7,522.34 million by 2032, at a CAGR of 7.7% during the forecast period. North America holds the largest market share in the global Endocrine Testing Market, driven by advanced healthcare infrastructure, high awareness, and strong reimbursement frameworks. The United States leads regional growth due to early adoption of advanced diagnostic platforms and a high prevalence of diabetes and thyroid disorders. It continues to invest in digital health solutions, home-based diagnostics, and integrated laboratory networks. Leading diagnostic companies are headquartered in this region, further boosting innovation and accessibility.

Europe

The Europe Endocrine Testing Market size was valued at USD 1,667.38 million in 2018 to USD 2,953.18 million in 2024 and is anticipated to reach USD 5,732.02 million by 2032, at a CAGR of 8.6% during the forecast period. Europe accounts for a significant share of the Endocrine Testing Market, supported by rising preventive care adoption, aging demographics, and widespread public healthcare access. Countries such as Germany, the UK, and France dominate the market due to early diagnostic intervention programs and increased funding in chronic disease management. It benefits from standardized testing protocols and government-led screening initiatives that ensure test reliability and coverage across the population.

Asia Pacific

The Asia Pacific Endocrine Testing Market size was valued at USD 1,897.05 million in 2018 to USD 3,448.23 million in 2024 and is anticipated to reach USD 6,910.52 million by 2032, at a CAGR of 9.0% during the forecast period. Asia Pacific is the fastest-growing regional market, driven by increasing urbanization, healthcare spending, and awareness of endocrine disorders. Countries like China, India, and Japan are witnessing rising demand for hormone tests due to high diabetes and thyroid disease prevalence. It is also benefiting from expanding laboratory infrastructure and supportive government health initiatives. International and local players are targeting this region with affordable, scalable testing solutions.

Latin America

The Latin America Endocrine Testing Market size was valued at USD 861.25 million in 2018 to USD 1,498.78 million in 2024 and is anticipated to reach USD 2,843.44 million by 2032, at a CAGR of 8.3% during the forecast period. Latin America shows steady growth in the Endocrine Testing Market, supported by increasing public-private partnerships, expanding diagnostics access, and rising lifestyle-related diseases. Brazil and Mexico represent the largest country-level markets. It is seeing growing investment in clinical laboratories and mobile diagnostic services, especially in underserved regions. Cost-sensitive diagnostic solutions are key to expanding market reach.

Middle East

The Middle East Endocrine Testing Market size was valued at USD 413.40 million in 2018 to USD 723.22 million in 2024 and is anticipated to reach USD 1,381.60 million by 2032, at a CAGR of 8.4% during the forecast period. The Middle East market is growing due to rising incidence of obesity, diabetes, and infertility. Gulf Cooperation Council (GCC) countries lead regional growth due to significant investments in hospital expansion and diagnostic modernization. It benefits from increasing demand for personalized healthcare and routine endocrine screening. Public health campaigns and partnerships with international diagnostic providers are expanding access across the region.

Africa

The Africa Endocrine Testing Market size was valued at USD 358.28 million in 2018 to USD 510.41 million in 2024 and is anticipated to reach USD 684.53 million by 2032, at a CAGR of 3.6% during the forecast period. Africa holds the smallest share in the global Endocrine Testing Market, limited by underdeveloped healthcare systems and low diagnostic penetration. It faces challenges related to affordability, infrastructure, and trained personnel. However, NGOs, public health bodies, and mobile labs are gradually improving diagnostic coverage. Urban centers in South Africa, Egypt, and Kenya are leading adoption of hormonal testing services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific, Inc.

- Ortho Clinical Diagnostics

- Siemens AG (Siemens Healthineers)

- Bio-Rad Laboratories, Inc.

- DiaSorin S.p.A.

- Hoffmann-La Roche AG

- Abbott

- Agilent Technologies Inc.

- bioMérieux S.A.

- Other Key Players

Competitive Analysis

The Endocrine Testing Market features intense competition driven by innovation, product range, and global presence. Leading companies such as Thermo Fisher Scientific, Abbott, Siemens Healthineers, and Roche focus on expanding their diagnostic portfolios through advanced immunoassay platforms and integrated testing systems. It attracts investments in automation, biomarker discovery, and point-of-care solutions to meet rising demand for accurate and rapid hormonal analysis. Market participants pursue strategic collaborations, regional expansion, and technology licensing to strengthen their position. Emerging players target niche applications and cost-effective solutions, especially in developing regions. Companies differentiate by offering high-throughput instruments, user-friendly software, and robust service support. The Endocrine Testing Market rewards firms with strong R&D capabilities, regulatory compliance, and efficient supply chains. Innovation, pricing strategies, and customer engagement remain key to sustaining competitive advantage across global markets.

Recent Developments

- In January 2025, Siemens Healthineers launched a new software solution for AI-powered interpretation of endocrine test results, providing enhanced diagnostic support.

- On July 13, 2025, AIM Doctor & Endocrine Society launched an AI-powered diagnostic app at ENDO 2025 that enables faster and more accurate detection of endocrine cancers using CT, MRI, ultrasound, and histopathology on internet‑connected devices.

- In December 2024, Roche launched the cobas® Mass Spec solution, a fully automated mass spectrometry system developed in collaboration with Hitachi High-Tech, to integrate precise hormone testing into routine clinical workflows.

- In 2025, EUROIMMUN (Revvity) received FDA 510(k) clearance and CE mark for a chemiluminescence-based immunoassay to measure free testosterone, delivering results in under 48 minutes.

Market Concentration & Characteristics

The Endocrine Testing Market demonstrates moderate to high market concentration, with a few global players holding significant shares due to their strong diagnostic portfolios, advanced technologies, and international distribution networks. It is characterized by a blend of well-established companies and emerging players offering specialized and cost-effective solutions. The market favors firms with high R&D capacity, regulatory expertise, and scalable manufacturing capabilities. Innovation in immunoassays, mass spectrometry, and digital diagnostic platforms is shaping competition. Demand for accurate, rapid, and minimally invasive hormone tests is prompting manufacturers to expand product lines and integrate automation. Strategic collaborations, mergers, and geographic expansion are common growth strategies among key participants. The market remains highly regulated, with product quality, reliability, and clinical validation playing critical roles in customer adoption. It also reflects a strong emphasis on disease-specific testing, personalization, and preventive care. While developed regions dominate revenue, emerging markets are gaining attention due to rising healthcare investments and diagnostic awareness.

Report Coverage

The research report offers an in-depth analysis based on Test Type, Technology, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for endocrine testing will rise due to increasing cases of diabetes, thyroid disorders, and hormonal imbalances.

- Point-of-care and home-based hormone tests will gain popularity for convenience and faster diagnosis.

- Automation and high-throughput analyzers will become standard in clinical laboratories for efficiency.

- Digital health integration will support real-time monitoring and personalized treatment plans.

- Emerging markets will offer strong growth potential with expanding healthcare infrastructure.

- Regulatory bodies will emphasize accuracy, quality control, and clinical validation in test development.

- Research partnerships will accelerate discovery of novel biomarkers for endocrine disorders.

- Immunoassay and mass spectrometry technologies will continue to dominate hormone testing platforms.

- Aging populations worldwide will drive routine endocrine screenings in preventive care.

- Diagnostic companies will focus on affordable, scalable solutions to serve underserved regions.