Market Overview

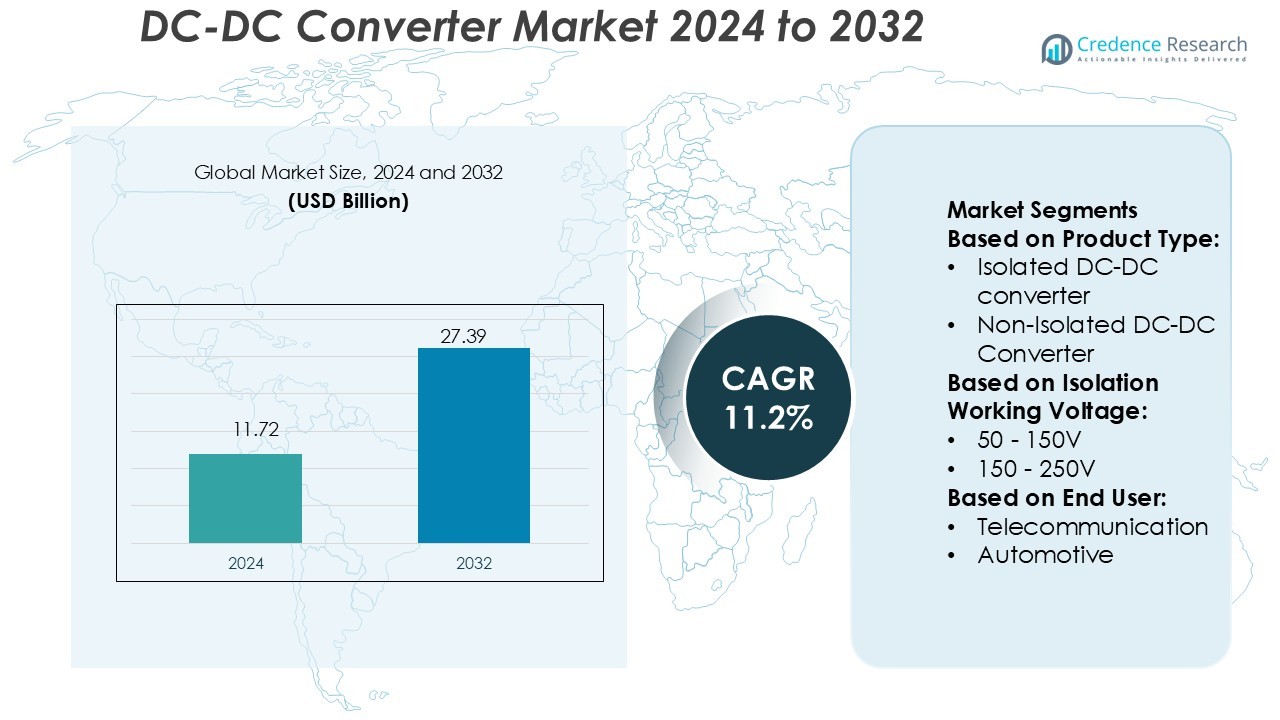

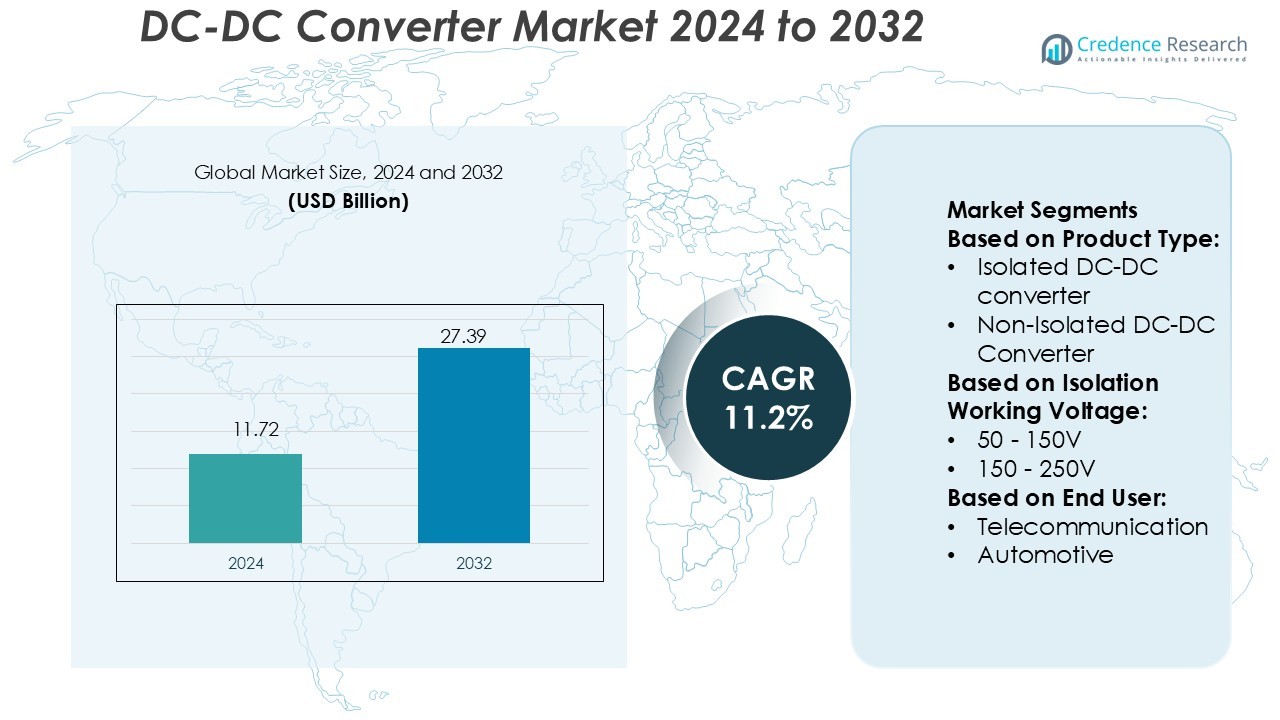

DC-DC Converter Market size was valued USD 11.72 billion in 2024 and is anticipated to reach USD 27.39 billion by 2032, at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC-DC Converter Market Size 2024 |

USD 11.72 Billion |

| DC-DC Converter Market, CAGR |

11.2% |

| DC-DC Converter Market Size 2032 |

USD 27.39 Billion |

The DC-DC Converter Market is led by key players including Murata Manufacturing Co., Ltd., Skyworks Solutions, Inc., Renesas Electronics Corporation, Delta Electronics, Inc., Advanced Energy Industries, Inc., NXP Semiconductor, TDK Corporation, STMicroelectronics, Infineon Technologies AG, and Flex Ltd. These companies dominate through advanced semiconductor integration, miniaturization, and enhanced conversion efficiency technologies. Infineon and STMicroelectronics maintain a competitive edge in high-performance automotive and industrial converters, while Delta Electronics and Murata lead in power modules and consumer electronics. Regionally, Asia-Pacific holds the largest market share of 42%, driven by strong manufacturing bases in China, Japan, and South Korea. The region’s rapid adoption of electric vehicles, renewable energy systems, and 5G infrastructure continues to strengthen its leadership, supported by growing government incentives for clean energy and local semiconductor production.

Market Insights

Market Insights

- The DC-DC Converter Market size was valued at USD 11.72 billion in 2024 and is projected to reach USD 27.39 billion by 2032, growing at a CAGR of 11.2%.

- The growing demand for compact, energy-efficient power solutions in electric vehicles and renewable systems drives market growth.

- Increasing use of wide-bandgap semiconductors and digital power control solutions shapes major market trends.

- Strong competition among leading players continues to focus on innovation, cost reduction, and advanced semiconductor integration.

- Asia-Pacific dominates with 42% market share, led by China, Japan, and South Korea, followed by North America and Europe with expanding adoption across automotive, telecom, and industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The DC-DC Converter Market is segmented into isolated and non-isolated types. The isolated DC-DC converter segment dominates with over 62% share due to its ability to provide galvanic isolation and prevent electrical noise in sensitive circuits. It is widely used in industrial automation, data centers, and medical electronics. Demand is driven by safety standards and the need for reliable power transfer in harsh environments. Non-isolated converters, such as buck and boost types, serve compact devices like smartphones and tablets, where low voltage regulation efficiency is prioritized.

- For instance, Murata’s MGJ6 delivers 6 W with 5,200 VDC isolation, the MPQ0125 converts 18–75 V to 12 V at 25 A, and the OKI-T/3-W40 handles 16–40 V input with 3 A output. NXE1 provides 1 W and 3,000 VDC isolation with 50 mV ripple.

By Isolation Working Voltage

Among voltage categories, converters rated between 200–1,000V hold the largest share of 41%. This range supports renewable energy, automotive, and industrial applications requiring efficient mid-voltage conversion and insulation strength. The segment grows rapidly with electric vehicle adoption and solar inverters’ expansion. Higher voltage converters (>1,000V) cater to aerospace and grid systems needing robust insulation. Meanwhile, converters under 150V remain popular in portable electronics, IoT devices, and telecom power supplies. Continuous material and semiconductor advancements enhance efficiency across all voltage categories.

- For instance, Skyworks Solutions, Inc.’ Si88x2x series integrates an isolated DC-DC converter and digital isolators, offering power output up to 5 W and isolation rating up to 5,000 Vrms in a compact package.

By End User

The automotive sector dominates the DC-DC Converter Market with a 34% share, driven by rapid electrification trends and the expansion of EV architectures. Electric vehicles require efficient voltage regulation to power auxiliary systems and battery management. Telecommunication follows, supported by high data traffic and 5G infrastructure growth demanding stable DC conversion for network reliability. Consumer electronics and energy & power industries also exhibit strong adoption. Aerospace, defense, and healthcare sectors utilize advanced converters for precision, reliability, and compact integration in mission-critical applications.

Key Growth Drivers

Rising Adoption of Electric Vehicles (EVs)

The rapid expansion of the electric vehicle industry significantly drives the DC-DC Converter Market. These converters are essential for managing power between high-voltage batteries and low-voltage systems, ensuring optimal performance and safety. Growing government incentives for EV adoption and emission reduction targets further stimulate demand. Leading automakers integrate advanced DC-DC systems to enhance efficiency and extend driving range, fueling large-scale deployment across passenger and commercial vehicles.

- For instance, Renesas developed a bi-directional converter for 12 V/48 V systems, targeting mild hybrids and motorcycles. The design supports bidirectional energy flow between 12 V and 48 V nets and incorporates functional-safety features.

Increasing Demand for Power Efficiency in Electronics

The growing need for compact and energy-efficient electronic devices drives converter adoption. Modern consumer electronics, including smartphones, laptops, and wearables, require stable voltage levels for performance and safety. DC-DC converters offer high conversion efficiency, reduced energy loss, and extended battery life. Miniaturization of components and advanced semiconductor integration enhance design flexibility, supporting manufacturers’ pursuit of lightweight and high-performance devices.

- For instance, Delta’s DJ06S/D series offers 6 W output in a miniature DIP package, with isolation ratings of 1 500 VDC or 3 000 VDC, and typical efficiency of 84% at full load.

Expanding Renewable Energy and Industrial Automation Applications

The shift toward renewable energy and smart industry operations propels market growth. DC-DC converters are critical in solar power systems, battery storage units, and automated production lines, ensuring consistent power supply and voltage regulation. Growing investment in green energy infrastructure and industrial digitization enhances converter demand. Manufacturers focus on wide input voltage ranges and improved thermal performance to meet industrial efficiency and sustainability standards.

- For instance, Advanced Energy AXA series isolated DC-DC converters offer an ultra-wide 4:1 input range of 9 V to 36 V or 18 V to 75 V for nominal 24 V or 48 V supplies.

Key Trends & Opportunities

Integration of GaN and SiC Semiconductors

The adoption of gallium nitride (GaN) and silicon carbide (SiC) technologies is transforming converter design. These materials deliver higher switching speeds, reduced power losses, and better thermal management compared to traditional silicon. Their integration enhances converter performance in high-power-density applications such as EVs and renewable systems. Manufacturers leveraging GaN and SiC benefit from smaller form factors, increased reliability, and long-term energy savings.

Rising Penetration of 5G and Data Centers

The global rollout of 5G networks and growth of data centers create strong opportunities for DC-DC converter suppliers. These systems require stable, efficient, and high-density power modules to manage extensive data traffic and equipment loads. Advanced converters support uninterrupted operation of servers, routers, and telecom base stations. The demand for power-dense designs and efficient thermal management drives innovation across digital infrastructure.

Growing Emphasis on Smart Power Management Systems

Manufacturers are integrating intelligent power management features to optimize converter performance. Smart DC-DC systems enable real-time monitoring, predictive maintenance, and adaptive load control. This development supports Industry 4.0 environments, electric mobility, and renewable grid management. Increased digitalization and IoT adoption enhance the demand for connected and self-regulating power systems.

Key Challenges

Design Complexity and Cost Constraints

Developing high-efficiency DC-DC converters involves complex circuit architectures and premium semiconductor materials. These factors raise production costs, limiting adoption in cost-sensitive applications. Maintaining compact size while achieving high reliability and safety adds to design challenges. Small-scale manufacturers face hurdles in balancing innovation with affordability, affecting market penetration in emerging economies.

Thermal Management and Reliability Issues

Efficient heat dissipation remains a major challenge for high-power converters. Overheating can reduce lifespan and compromise performance in industrial, automotive, and aerospace environments. Ensuring consistent operation under extreme conditions requires advanced cooling systems and robust material selection. Continuous improvement in thermal design and component durability is essential to enhance converter reliability and long-term operational stability.

Regional Analysis

North America

North America holds a 32% share of the DC-DC Converter Market, driven by strong demand from automotive, aerospace, and defense sectors. The U.S. leads adoption due to rapid electric vehicle deployment and the expansion of data centers requiring stable power systems. Technological advancements in high-efficiency converters and the presence of major manufacturers such as Texas Instruments and Vicor Corporation strengthen regional growth. Increasing renewable energy integration and government incentives for energy-efficient solutions further boost market expansion across the U.S. and Canada.

Europe

Europe accounts for 28% of the DC-DC Converter Market, supported by growing adoption in automotive electrification, industrial automation, and renewable energy applications. Countries such as Germany, France, and the U.K. lead due to strong environmental regulations and electric mobility programs. The presence of established automotive OEMs accelerates the integration of efficient power conversion systems. Investments in rail transport, aerospace, and solar energy projects drive sustained demand. Regional manufacturers focus on miniaturized, high-efficiency converters to meet evolving standards for energy optimization and low carbon emissions.

Asia-Pacific

Asia-Pacific dominates the DC-DC Converter Market with a 34% share, led by China, Japan, South Korea, and India. Rapid industrialization, rising EV production, and the proliferation of consumer electronics drive growth. China’s large-scale renewable energy projects and government-backed clean energy initiatives strengthen market expansion. Japan and South Korea focus on technological innovation in semiconductor-based converters for automotive and telecom applications. Expanding 5G infrastructure, data centers, and industrial automation further enhance regional demand. The presence of key players and cost-effective manufacturing make Asia-Pacific a key global hub.

Latin America

Latin America captures a 4% share of the DC-DC Converter Market, with Brazil and Mexico as primary contributors. Growing investment in renewable energy and the gradual shift toward electric vehicles support regional growth. Industrial modernization initiatives and expansion in telecommunications infrastructure also increase converter adoption. Local industries are progressively integrating power-efficient systems to enhance operational performance. Despite slower technology adoption compared to developed regions, government-led programs promoting sustainable energy transition create emerging opportunities for converter suppliers in the coming years.

Middle East & Africa

The Middle East & Africa region accounts for 2% of the DC-DC Converter Market, driven by expanding energy and power projects. The UAE and Saudi Arabia lead with investments in solar energy, industrial automation, and electric mobility initiatives under their sustainability visions. The growing demand for reliable power conversion in harsh climatic conditions supports the need for durable converter systems. Africa’s industrial development and grid modernization projects contribute to gradual market expansion. However, limited local manufacturing and higher import dependency restrict large-scale adoption in several countries.

Market Segmentations:

By Product Type:

- Isolated DC-DC converter

- Non-Isolated DC-DC Converter

By Isolation Working Voltage:

By End User:

- Telecommunication

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The DC-DC Converter Market players such as Murata Manufacturing Co., Ltd., Skyworks Solutions, Inc., Renesas Electronics Corporation, Delta Electronics, Inc., Advanced Energy Industries, Inc., NXP Semiconductor, TDK Corporation, STMicroelectronics, Infineon Technologies AG, and Flex Ltd. The DC-DC Converter Market features moderate consolidation, driven by strong competition across power electronics and semiconductor sectors. Companies focus on developing high-efficiency, miniaturized converters to meet the growing demand for energy optimization in automotive, industrial, and consumer applications. Continuous innovation in wide-bandgap semiconductor technologies, such as gallium nitride (GaN) and silicon carbide (SiC), enhances conversion efficiency and thermal performance. Firms also emphasize modular designs and digital control solutions to support next-generation electric vehicles, 5G networks, and renewable energy systems. Strategic alliances, R&D investments, and global manufacturing expansions further shape the market landscape, fostering product differentiation and regional competitiveness.

Key Player Analysis

- Murata Manufacturing Co., Ltd.

- Skyworks Solutions, Inc.

- Renesas Electronics Corporation

- Delta Electronics, Inc.

- Advanced Energy Industries, Inc.

- NXP Semiconductor

- TDK Corporation

- STMicroelectronics

- Infineon Technologies AG

- Flex Ltd

Recent Developments

- In January 2025, Minda Corporation partners with Flash Electronics to develop an EV platform, acquiring a 49% stake for INR 1,372 crore to expand its presence in India’s automotive industry.

- In September 2024, Advanced Energy launched the ADH1300-48S28, a high-power density 1300 W, 28 V half-brick DC-DC converter with digital control and ultra-high efficiency, designed for telecom wireless base stations and RF power amplifiers.

- In June 2024, Renesas Electronics Corporation has announced the completion of its acquisition of Transphorm, Inc. With this acquisition finalized, Renesas will immediately begin offering GaN-based power products and related reference designs to address the increasing demand for wide bandgap (WBG) semiconductor products.

- In February 2023, Micross acquired Infineon’s High-Reliability DC-DC Converter business, strengthening its power management solutions for space, defense, and aerospace. The acquisition expands Micross’ IP portfolio, geographic reach, and manufacturing capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Isolation Working Voltage, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand for efficient power management in electric vehicles.

- Integration of wide-bandgap semiconductors such as GaN and SiC will enhance conversion efficiency.

- Expanding renewable energy projects will drive adoption of high-power DC-DC converters.

- The rise of 5G networks will increase demand for compact and high-frequency converter modules.

- Manufacturers will focus on digital control and modular converter architectures for flexibility.

- Growth in aerospace and defense sectors will strengthen demand for rugged power solutions.

- Automation in industrial facilities will create new opportunities for intelligent converter systems.

- Miniaturization trends will lead to smaller, lighter, and more thermally efficient designs.

- Strategic partnerships between semiconductor and power solution companies will boost innovation.

- Regulatory pressure on energy efficiency will encourage continuous technological advancements.

Market Insights

Market Insights