Market Overview

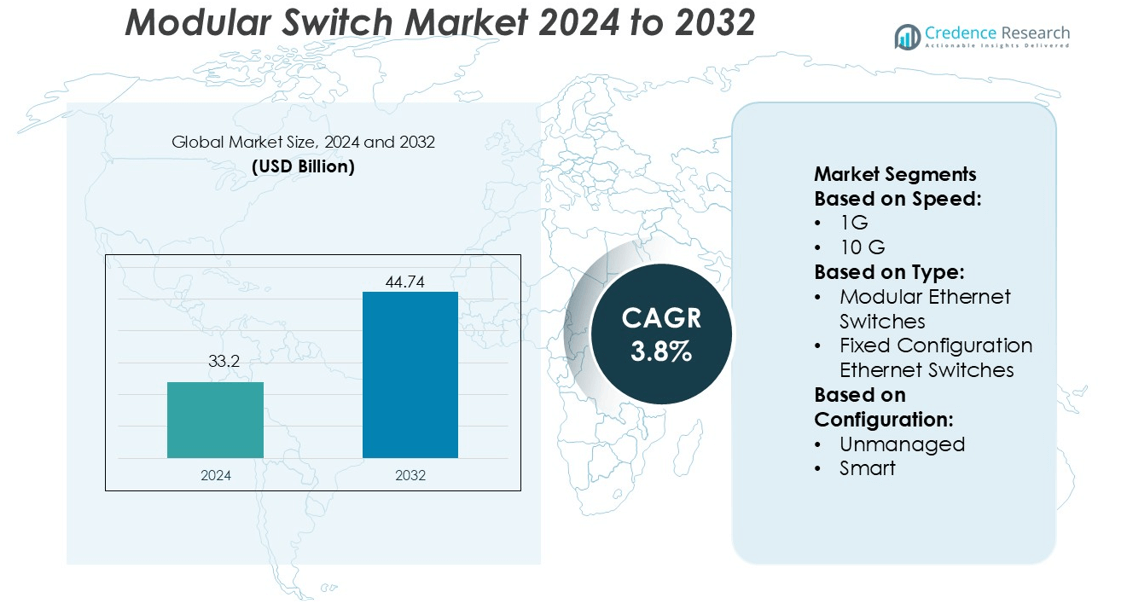

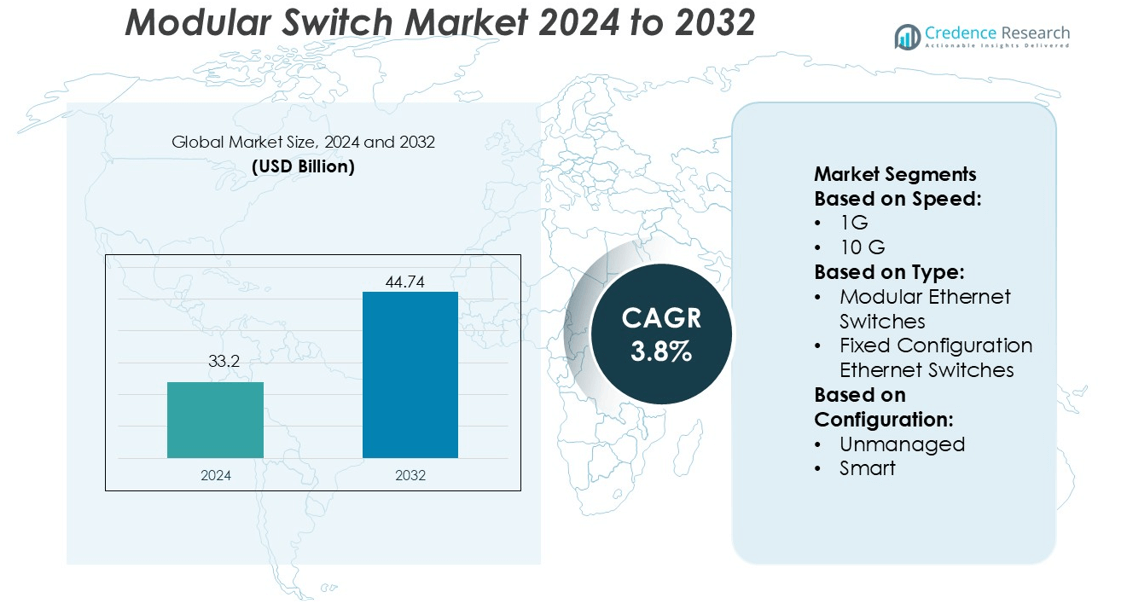

Modular Switch Market size was valued USD 33.2 billion in 2024 and is anticipated to reach USD 44.74 billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Switch Market Size 2024 |

USD 33.2 billion |

| Modular Switch Market, CAGR |

3.8% |

| Modular Switch Market Size 2032 |

USD 44.74 billion |

The Modular Switch Market include Polycab India Limited, Havells India Ltd, Legrand (India) Private Limited, Panasonic Life Solutions India Pvt. Ltd, Crompton Greaves Consumer Electricals Limited, Goldmedal Electricals Pvt. Ltd, Wipro Enterprises (P) Limited, Signify Innovations India Limited, ABB India Limited, and Siemens Limited. These companies compete through smart switch portfolios, premium aesthetics, IoT integration, and strong dealer networks. Their strategies focus on safer materials, surge protection, and automation-ready modules for residential, commercial, and industrial use. Asia-Pacific leads the global market with a 38% share, supported by rapid construction, expanding smart city projects, and rising adoption of connected home solutions across developing economies.

Market Insights

- The Modular Switch Market was valued at USD 33.2 billion in 2024 and will reach USD 44.74 billion by 2032 at a CAGR of 3.8%.

- Demand rises due to smart homes, IoT-enabled controls, and safer electrical systems, pushing buyers toward modular, fire-retardant, and surge-protected switches in both residential and commercial spaces; the residential segment holds the largest share due to rapid housing and remodeling activities.

- Top companies compete through premium finishes, touch panels, Wi-Fi connectivity, and fast product customization; strong dealer networks and wide retail coverage help increase market penetration across developed and emerging cities.

- Asia-Pacific leads the market with a 38% share, supported by heavy real estate growth, smart city projects, and strong consumer shift toward smart lighting and connected living spaces, followed by North America and Europe.

- Supply chain fluctuations, presence of low-cost unorganized brands, and high pricing of premium smart switches limit faster adoption in price-sensitive regions, but rising income levels and digital infrastructure continue to create long-term opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Speed

1G modular switches held the largest share of the Modular Switch Market in 2024, driven by wide deployment across enterprise LANs, data centers, and campus networks. Their cost efficiency, low power consumption, and compatibility with legacy infrastructure keep demand strong for small and medium businesses. Cloud connectivity and IP-based communication systems also support 1G usage in developing regions. While faster categories like 10G and 25G are rising, most organizations still prefer 1G for stable performance in routine switching workloads, edge networks, and commercial environments.

- For instance, Schneider Electric’s EcoStruxure™ platform connects over 1 billion devices across enterprise networks, leveraging advancements in IoT, mobility, and analytics to deliver enhanced value around safety, reliability, efficiency, sustainability, and connectivity.

By Type

Modular Ethernet Switches dominated the market with the highest share due to their flexibility and scalability for hybrid enterprise environments. Businesses prefer modular designs because they support hot-swappable line cards, multi-rate ports, and power redundancy. This setup reduces operational downtime and allows network expansion without full hardware replacement. Large data centers and hyperscale operators also adopt modular architectures to handle rising traffic loads. Growing use of virtualization, multi-cloud, and high-bandwidth applications continues to strengthen demand in critical networking operations.

- For instance, Juniper Networks’ EX4000 series includes various switch models with different capacities. The highest-end model, the EX4000-48MP, achieves a bi-directional switching capacity of up to 200 Gbps, enabling high-throughput LAN environments when deployed using Virtual Chassis technology.

By Configuration

Managed L3 switches accounted for the dominant share in the configuration segment due to advanced routing capabilities, VLAN segmentation, and network automation support. Enterprises use L3-based designs to manage heavy multi-layer traffic across distributed systems, branch offices, and secure cloud-connected networks. Features like dynamic routing protocols, QoS, and enhanced security make L3 switches suitable for large IT environments. Rising adoption of SD-WAN, IoT devices, and intelligent enterprise networking continues to drive steady demand for L3-configured modular switches.

Key Growth Drivers

Growing Network Modernization Across Enterprises

Enterprises are upgrading legacy LAN infrastructures to support high-speed data flow, virtualization, and cloud connectivity. Modular switches offer flexible port configuration, power expansion, and scalability for growing workloads. Businesses deploy these switches to handle data-intensive tasks, improve uptime, and enhance network control. Demand rises across BFSI, IT, manufacturing, and telecom sectors with rapid digitization and edge computing adoption. Multi-gigabit speeds, PoE support, and strong data security features drive procurement decisions. These advantages make modular switches a preferred choice for long-term network planning and modernization.

- For instance, the Arista 7100 Series switches were noted for their low-latency performance in RFC 2544 tests. Specific models, such as the 7124S, were documented with latency as low as 600 ns.

Rising Data Center Construction and Cloud Expansion

Increasing hyperscale and enterprise data center investments boost modular switch installation. Organizations deploy cloud platforms, AI workloads, IoT devices, and storage networks that require high-bandwidth routing. Modular switches deliver redundancy, multi-layer management, and rapid failover to ensure uninterrupted data transfer. Vendors integrate automation, analytics-based traffic control, and SDN management to enhance network visibility. Colocation providers and cloud service operators rely on modular architectures to scale rack capacity. This construction surge across North America, Europe, and Asia fuels consistent growth in the market.

- For instance, Huawei’s Digital Power unit reported that a 1,000-rack data centre build can be shortened from more than 18 months to 6–9 months using its FusionDC solution.

Growth of Connected Devices and Industrial IoT

Factories, warehouses, smart buildings, and public infrastructure depend on IoT-enabled automation. Modular switches support large device clusters, low latency, and real-time communication across industrial systems. Industries adopt these switches to streamline production, remote monitoring, robotics, and safety systems. Harsh-environment Ethernet versions improve reliability in oil and gas, mining, power, and transportation sites. Rising industrial digitalization, automated machinery, and predictive maintenance accelerate deployment. Energy-efficient designs and rugged hardware further increase adoption in mission-critical environments.

Key Trends & Opportunities

Increasing SDN and Network Automation Adoption

The shift toward software-defined networking drives advanced traffic control, QoS management, and reduced manual configuration. Modular switches integrate programmable chips, centralized policy control, and automated routing to simplify administration. Organizations use analytics and AI-based engines to predict data congestion and improve resource allocation. Vendors launch switches compatible with private and hybrid cloud ecosystems, unlocking higher efficiency and faster network re-optimization. Automation reduces operating costs and downtime, creating strong uptake across IT and telecom networks.

- For instance, Dell’s SmartFabric OS10 (a Linux-based, disaggregated network OS) supports automation via Ansible, Puppet and Chef and runs on hardware platforms capable of 1G/10G/25G/40G/100G/400G port speeds.

Rising Demand for High-Speed and PoE-Enabled Ports

The need for 10G, 25G, 40G, and 100G connections rises due to video traffic, cloud workloads, smart devices, and 5G infrastructure. Enterprises expand PoE-enabled ports to power surveillance, access points, VoIP, and IoT hardware. This trend helps reduce wiring, increase device density, and simplify network scaling. Vendors release modular line cards supporting multi-gigabit switching, advanced security, and encrypted data flows. Demand creates opportunities for customized power modules, green-energy switches, and compact chassis configurations.

- For instance, Nokia and Keysight Technologies successfully completed an end-to-end “Ultra Ethernet” test of UET traffic across Nokia’s data center switch families, including the 7220 IXR and 7250 IXR.

Expansion of Edge Computing and Remote Operations

Edge infrastructure requires fast switching hardware near devices and users. Modular switches provide predictable latency, local data processing, and high availability in remote stations. Utilities, logistics hubs, retail chains, and smart cities integrate these switches for video analytics, automation, and connected sensors. Compact edge-ready modular platforms open opportunities for small and mid-size businesses. Growing adoption of 5G-enabled applications further accelerates market expansion.

Key Challenges

High Capital Investment and Maintenance Costs

Modular switches are costlier than fixed-configuration systems due to advanced chassis, line cards, and power modules. Small and mid-sized enterprises hesitate to invest in high-capacity platforms with long upgrade cycles. Service charges, firmware updates, training, and cooling requirements increase overall ownership costs. Some businesses instead choose cloud-managed or low-cost fixed switches. These budget concerns slow adoption in cost-sensitive regions.

Rising Cybersecurity Risks Across Network Layers

Expanding IoT usage and remote connectivity increase exposure to data breaches and malware. Modular switches store sensitive routing tables, configuration data, and device access controls. If breached, attackers can disrupt traffic, shut down systems, or steal data. Vendors respond with embedded encryption, ACLs, threat analytics, and secure boot technology. However, constant software updates and policy enforcement add operational pressure. Cybersecurity concerns remain a key barrier for large-scale deployment.

Regional Analysis

North America

North America holds a 31% share of the Modular Switch Market, led by strong enterprise IT spending, cloud data center expansion, and rapid adoption of high-speed networking. The United States remains the dominant contributor due to hyperscale operators, financial institutions, and government digitalization programs. Businesses upgrade to modular platforms to support cybersecurity, automation, and advanced traffic management in hybrid networks. Vendors integrate SDN compatibility and PoE innovations to meet smart building and industrial IoT needs. Canada shows rising deployment in healthcare, education, and telecom, supported by nationwide broadband investments and remote connectivity initiatives.

Europe

Europe accounts for a 26% market share, driven by established manufacturing hubs, advanced telecom networks, and early cloud migration. Germany, the U.K., France, and the Nordics lead consumption due to strong data privacy frameworks and Industry 4.0 adoption. Enterprises use modular switches to enhance reliability, lower latency, and manage multi-site operations. The region also invests in energy-efficient Ethernet, green data centers, and automation-ready hardware to support sustainability goals. Network modernization across public infrastructure, transportation, and digital banking further strengthens market demand.

Asia-Pacific

Asia-Pacific dominates the Modular Switch Market with a 38% share, supported by high data traffic, expanding hyperscale data centers, and 5G rollout. China, India, Japan, and South Korea drive demand through smart manufacturing, cloud adoption, and e-commerce growth. The region benefits from large-scale IoT integration across utilities, logistics, and smart city frameworks. Local and global vendors supply customizable chassis, multi-gigabit ports, and ruggedized switches suitable for industrial conditions. Strong government investment in digital infrastructure and rapid enterprise digitalization ensure continued growth in the region.

Latin America

Latin America represents a 2% market share, supported by telecom upgrades and data center construction in Brazil, Mexico, and Chile. Enterprises invest in modular switches to manage growing mobile traffic, fintech expansion, and remote workforce connectivity. Government digital inclusion programs and rising fiber deployment improve network stability and bandwidth. Vendors introduce scalable, cost-efficient modular platforms to address regional budget constraints. Despite economic volatility and slow modernization in smaller markets, gradual 5G rollout and cloud service growth create meaningful opportunities for future adoption.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, but adoption grows as governments expand smart city and cybersecurity projects. The UAE, Saudi Arabia, and South Africa deploy modular switches in telecom, oil and gas, and public infrastructure. Enterprises upgrade legacy systems to handle real-time analytics, surveillance networks, and automation. Vendors offer rugged and PoE-enabled designs suited for harsh industrial sites. Limited IT budgets and slower digital transformation in some African countries moderate growth, but infrastructure funding and cloud adoption improve the outlook.

Market Segmentations:

By Speed:

By Type:

- Modular Ethernet Switches

- Fixed Configuration Ethernet Switches

By Configuration:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Modular Switch Market players such as Polycab India Limited, Goldmedal Electricals Pvt. Ltd, Crompton Greaves Consumer Electricals Limited, Panasonic Life Solutions India Pvt. Ltd, Signify Innovations India Limited, Havells India Ltd, Wipro Enterprises (P) Limited, Legrand (India) Private Limited, ABB India Limited, and Siemens Limited. The Modular Switch Market is driven by strong innovation, premium aesthetics, and safety-focused designs. Companies introduce modular systems with smart controls, IoT compatibility, and energy-saving features to meet rising demand from residential, commercial, and industrial users. Firms expand portfolios with flame-retardant materials, enhanced insulation, and surge protection to strengthen electrical safety. Premium categories such as touch panels, matte finish switches, and customizable plates gain wider acceptance in modern real estate. Manufacturers also invest in automation-enabled modules and smart home ecosystems that integrate lighting, security, and appliance control through mobile apps. Regional brands compete through large dealer networks, after-sales service, and competitive pricing, while global manufacturers focus on cutting-edge R&D and high-quality manufacturing standards. Marketing partnerships with developers, architects, and interior firms further boost product visibility. As smart homes and infrastructure projects scale, competition intensifies around technology upgrades, durability, design differentiation, and energy-efficient switching solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Polycab India Limited

- Goldmedal Electricals Pvt. Ltd

- Crompton Greaves Consumer Electricals Limited

- Panasonic Life Solutions India Pvt. Ltd

- Signify Innovations India Limited

- Havells India Ltd

- Wipro Enterprises (P) Limited

- Legrand (India) Private Limited

- ABB India Limited

- Siemens Limited

Recent Developments

- In March 2025, Infineon Technologies unveiled its Power PROFET + 24/48V switch family, tailored for today’s vehicle power systems. Engineered to reduce power losses in high-current situations, these devices meet the stringent requirements of modern automotive electrical systems.

- In January 2025, Sunbelt Modular Inc. acquired BRITCO Structures, USA (BUSA), a Texas-based modular building manufacturer specializing in complex commercial projects. BUSA, founded in 2011, complements Sunbelt’s strategy of providing custom modular solutions.

- In November 2024, NOVOSENSE, unveiled a suite of high-side switches. These switches were designed to drive traditional resistive, inductive, and halogen lamp loads in automotive body control modules (BCM). Additionally, they catered to large capacitive loads typically found in first and second-level power distribution within zone control units (ZCU).

- In September 2024, ATCO Structures completed its acquisition of NRB Limited (NRB), a leading Canadian manufacturer of modular educational, industrial, and residential buildings.

Report Coverage

The research report offers an in-depth analysis based on Speed, Type, Configuration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and Wi-Fi enabled switches will grow as home automation expands.

- Modular panels with touch controls and voice integration will gain higher adoption.

- Energy-efficient and low-power switches will become standard in residential and commercial sites.

- Manufacturers will increase use of recyclable materials and eco-safe components.

- Premium design finishes will attract real estate developers and interior-focused buyers.

- IoT-based safety features, motion sensing, and remote monitoring will improve product value.

- Industrial and commercial users will adopt rugged and high-load modular systems for heavy equipment.

- Local manufacturing will rise as companies invest in production capabilities and cost efficiency.

- Faster product customization and modular add-ons will strengthen customer preference.

- Growing construction in smart cities and infrastructure projects will accelerate long-term market expansion.