Market Overview

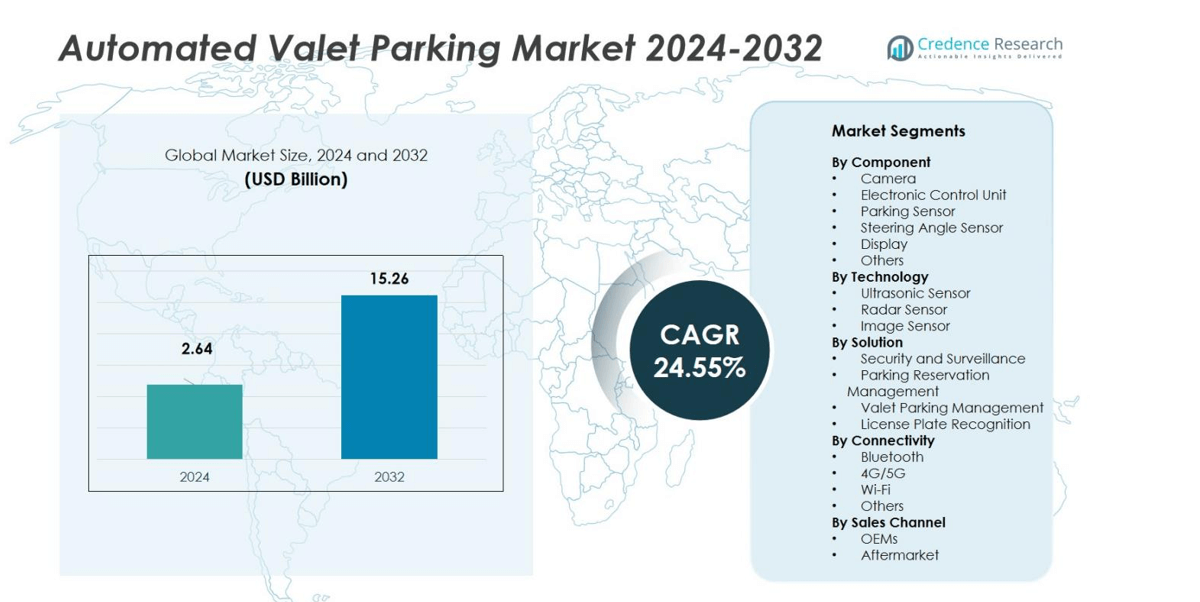

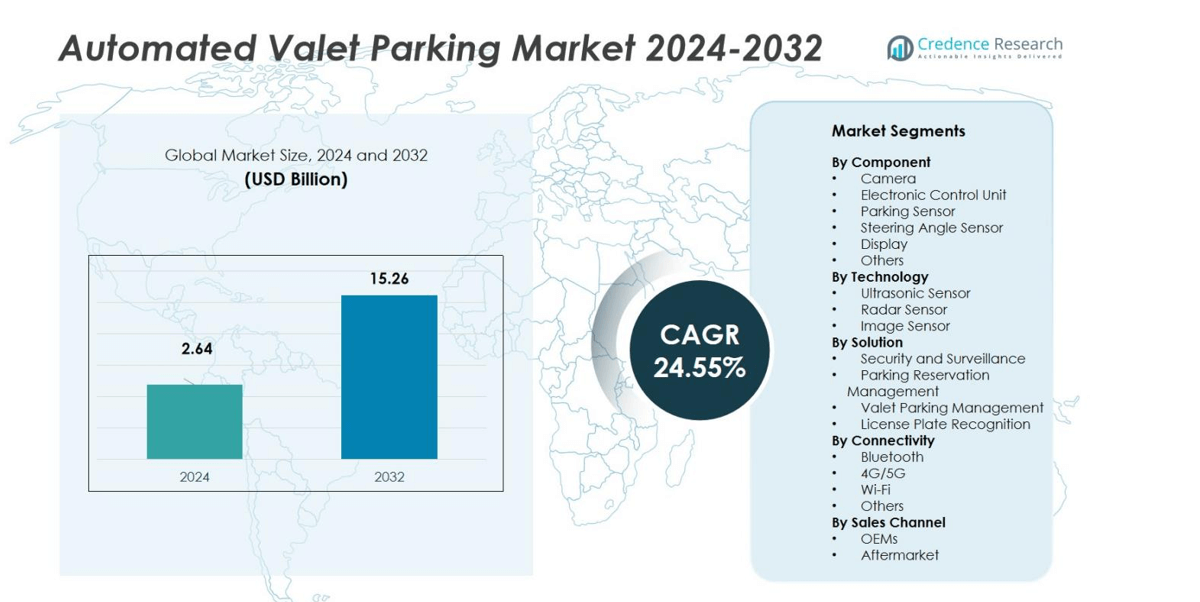

The Automated Valet Parking Market size was valued at USD 2.64 billion in 2024 and is projected to reach USD 15.26 billion by 2032, expanding at a CAGR of 24.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automated Valet Parking Market Size 2024 |

USD 2.64 billion in |

| Automated Valet Parking Market, CAGR |

24.5% |

| Automated Valet Parking Market Size 2032 |

USD 15.26 billion |

The Automated Valet Parking Market is shaped by key players including Bosch, Continental, Valeo, ZF Friedrichshafen, Aptiv, BMW, Mercedes-Benz, Ford Motor, Magna International, and Volkswagen. These companies lead innovations in autonomous driving, sensor integration, and smart mobility systems. Bosch and Continental dominate with sensor fusion and vehicle control technologies, while automakers like BMW and Mercedes-Benz focus on in-vehicle automation and AI-based valet functions. ZF and Valeo emphasize advanced driver-assistance modules supporting self-parking capabilities. North America stands as the leading region, accounting for 34% of the market share, driven by strong OEM presence, early adoption of autonomous technologies, and robust smart infrastructure initiatives supporting large-scale deployment of automated parking systems.

Market Insights

- The Automated Valet Parking Market was valued at USD 2.64 billion in 2024 and is projected to reach USD 15.26 billion by 2032, growing at a CAGR of 24.55% during the forecast period.

- Rising adoption of autonomous vehicles, advanced driver-assistance systems, and IoT integration drives the demand for automated valet solutions in smart mobility ecosystems.

- Key trends include AI-driven parking guidance, 5G-enabled connectivity, and cloud-based parking management improving vehicle safety and user experience.

- Leading players such as Bosch, Continental, Valeo, ZF Friedrichshafen, and Aptiv focus on R&D, partnerships, and OEM integration to gain competitive advantage across major automotive segments.

- North America leads with 34% share, supported by robust infrastructure and early adoption, while the Electronic Control Unit (ECU) segment dominates with 32% share, highlighting the growing importance of vehicle intelligence and control automation in regional markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The Electronic Control Unit (ECU) segment holds the dominant share of 32% in the Automated Valet Parking Market. ECUs manage communication between sensors, cameras, and vehicle control systems to ensure precise navigation and safety. Their demand increases with the integration of AI algorithms that support autonomous parking decision-making. Growth is driven by the need for real-time data processing and reduced human intervention. Rising adoption of high-performance chips and microcontrollers in premium vehicles further enhances the ECU segment’s leadership across the component category.

- For instance, Renesas Electronics has deployed R-Car microcontrollers in automated parking systems that support real-time AI algorithms processing multi-sensor data to precisely detect obstacles and optimize parking trajectories, demonstrating scalable high-performance microcontroller integration in premium vehicles.

By Technology

The Ultrasonic Sensor segment leads the market with a 41% share due to its critical role in close-range object detection. These sensors provide high accuracy in measuring distances, preventing collisions during automated parking. Their low cost, compact size, and energy efficiency make them widely preferred across passenger and luxury vehicles. Radar and image sensors also gain traction, yet ultrasonic technology dominates because of its easy integration with existing electronic control units and consistent performance in low-light or confined environments.

- For instance, onsemi’s NCV75215 ultrasonic sensor interfaces combine piezoelectric transducers with advanced time-of-flight distance measurement, detecting objects between 0.25 and 4.5 meters, making them effective, compact, and energy-efficient for integration into ADAS features in various vehicle models.

By Solution

The Valet Parking Management solution dominates with a 38% market share, driven by growing smart parking infrastructure and connected mobility systems. This solution enables seamless vehicle drop-off and retrieval through mobile-based or automated commands. It improves user convenience while optimizing parking space utilization. Increasing partnerships between automakers and tech firms for fully autonomous valet systems strengthen this segment’s growth. Additionally, security and surveillance solutions are expanding due to rising emphasis on safety and theft prevention in modern parking facilities.

Key Growth Drivers

Rising Demand for Autonomous and Connected Vehicles

The growing adoption of autonomous and connected vehicles acts as a major growth catalyst for the Automated Valet Parking Market. Automakers integrate advanced driver-assistance systems and IoT connectivity to deliver seamless, hands-free parking. The increasing consumer preference for convenience and safety strengthens this trend. Enhanced connectivity through 5G networks supports real-time navigation and communication between vehicles and parking infrastructure, enabling precise parking maneuvers and reducing congestion in urban areas.

- For instance, Mercedes‑Benz AG and Bosch GmbH received a permit in July 2019 to operate driverless parking in mixed traffic at the S-Class with infrastructure support at the P6 garage at Stuttgart Airport.

Smart City Initiatives and Infrastructure Development

Government-backed smart city programs and large-scale infrastructure investments accelerate the adoption of automated parking systems. Cities worldwide focus on improving urban mobility and reducing space congestion through intelligent parking solutions. The integration of AI, cloud computing, and sensor technologies enables efficient vehicle management and optimized space utilization. These initiatives encourage collaboration between technology providers and automotive OEMs, propelling growth in high-density metropolitan regions with limited parking availability.

- For instance, VinAI’s Touch2Park technology utilizes only four fish-eye cameras combined with advanced machine learning algorithms to provide 360-degree vehicle surroundings coverage, enabling precise object detection within centimeters and allowing diverse parking scenarios without relying on ultrasonic sensors.

Growing Emphasis on Safety and Efficiency

Automated valet parking enhances safety by minimizing human error and preventing vehicle damage during parking operations. The use of radar, camera, and ultrasonic sensors ensures precise vehicle positioning and collision avoidance. Consumers increasingly favor automated systems for their reliability and convenience. Fleet operators and commercial establishments also adopt such systems to optimize space use and reduce operational time, driving demand in both passenger and commercial vehicle segments.

Key Trends & Opportunities

Integration of AI and Machine Learning in Parking Systems

The adoption of AI and machine learning technologies transforms the efficiency and accuracy of automated parking solutions. These technologies enable vehicles to analyze their surroundings, learn parking patterns, and execute complex maneuvers autonomously. Automakers leverage AI-based algorithms to improve real-time decision-making and path prediction, enhancing parking safety. The integration of adaptive software updates and edge computing offers significant growth opportunities for technology developers in the coming years.

- For instance, BMW’s Parking Assistant Professional system incorporates machine learning that memorizes up to ten different parking maneuvers, each up to 200 meters in length, allowing the vehicle to repeat these maneuvers autonomously in real-world parking scenarios.

Expansion of Cloud-Based Parking Management Solutions

Cloud connectivity plays a vital role in enhancing scalability and integration across automated parking systems. It allows real-time monitoring, data storage, and predictive maintenance, improving overall performance and uptime. Cloud-based solutions enable multi-location parking management, essential for smart cities and commercial complexes. As consumer demand for contactless mobility grows, cloud integration offers new business models such as subscription-based valet management and on-demand parking services.

- For instance, Siemens’ Smart Parking System employs advanced sensors for real-time monitoring, delivering occupancy data with accuracy that enables effective management of over 20,000 parking spaces in urban deployments.

Key Challenges

High Initial Implementation and Maintenance Costs

The deployment of automated valet parking systems requires substantial investment in sensors, control units, and connectivity infrastructure. These high costs limit adoption, especially among small parking operators and mid-tier vehicle manufacturers. Maintenance expenses, software upgrades, and calibration needs further increase operational costs. Cost reduction through economies of scale and technological advancements remains crucial to improving market penetration in developing regions.

Regulatory and Integration Barriers Across Regions

Differences in regional automotive regulations and infrastructure standards create significant challenges for market expansion. Automated systems must comply with varied safety, data privacy, and vehicle communication protocols. Integration with legacy parking systems and city infrastructure also poses technical complexities. These barriers slow global implementation, emphasizing the need for harmonized standards and cooperative efforts between governments, automakers, and technology firms.

Regional Analysis

North America

North America leads the Automated Valet Parking Market with a 34% market share in 2024, driven by high adoption of autonomous vehicles and strong technological infrastructure. The United States dominates due to early integration of ADAS and AI-based mobility solutions by automakers such as Ford and General Motors. Increasing investments in smart parking systems across urban centers and airports further boost growth. Canada also witnesses steady adoption supported by government initiatives promoting smart city development. Advanced connectivity, strong OEM presence, and consumer preference for convenience sustain the region’s leadership.

Europe

Europe holds a 29% market share, supported by the presence of major automotive manufacturers like BMW, Volkswagen, and Mercedes-Benz that are advancing autonomous parking capabilities. Germany, France, and the U.K. lead regional adoption through innovation in connected vehicle infrastructure and partnerships with technology providers. Strict emission norms and space-efficient urban planning drive the use of automated parking systems in metropolitan cities. The European Union’s emphasis on mobility digitization and sustainable transportation fosters collaboration between carmakers and smart infrastructure developers.

Asia Pacific

Asia Pacific captures a 25% market share and is the fastest-growing region due to rapid urbanization and expansion of smart mobility networks. China, Japan, and South Korea dominate regional growth, driven by government-backed initiatives for intelligent transport systems and rising vehicle ownership. Increasing infrastructure investments in smart parking projects and partnerships between automakers and tech startups strengthen market adoption. India and Southeast Asia also show potential as demand for contactless and space-optimized parking grows in congested urban centers.

Latin America

Latin America accounts for a 7% market share, with Brazil and Mexico leading due to expanding automotive production and growing interest in intelligent parking systems. Economic recovery and urban population growth stimulate investments in connected vehicle technologies. Although infrastructure challenges persist, increasing private sector participation and smart city projects support market expansion. Partnerships between parking operators and technology companies enhance service efficiency, creating long-term opportunities for market participants in the region.

Middle East & Africa

The Middle East & Africa region holds a 5% market share, driven by smart city development initiatives in the UAE, Saudi Arabia, and South Africa. Projects such as NEOM in Saudi Arabia and Dubai’s autonomous mobility plan fuel adoption of advanced parking automation systems. Rising luxury vehicle demand and expanding commercial complexes accelerate the use of automated valet systems. However, limited awareness and uneven infrastructure development in some African economies restrain broader adoption, though technological investments continue to gain momentum in premium urban centers.

Market Segmentations:

By Component

- Camera

- Electronic Control Unit

- Parking Sensor

- Steering Angle Sensor

- Display

- Others

By Technology

- Ultrasonic Sensor

- Radar Sensor

- Image Sensor

By Solution

- Security and Surveillance

- Parking Reservation Management

- Valet Parking Management

- License Plate Recognition

By Connectivity

- Bluetooth

- 4G/5G

- Wi-Fi

- Others

By Sales Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automated Valet Parking Market features major players such as Bosch, Continental, Valeo, ZF Friedrichshafen, Aptiv, BMW, Ford Motor, Mercedes-Benz, Magna International, and Volkswagen. These companies focus on strategic partnerships, technology integration, and product innovation to strengthen their market presence. Bosch and Continental lead with advanced sensor fusion and intelligent control systems, while OEMs like BMW and Mercedes-Benz integrate these solutions into premium vehicle models. Valeo and ZF Friedrichshafen emphasize AI-based driver assistance and autonomous mobility platforms. Collaborations between automakers and technology firms accelerate product commercialization, enhancing vehicle connectivity and parking automation. Increasing investments in R&D for camera-based guidance and cloud integration continue to shape competition. The market also sees new entrants focusing on AI algorithms and low-cost modular solutions for mid-range vehicles, intensifying rivalry. Strategic mergers, acquisitions, and pilot projects in smart cities further define the evolving competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, ERTICO – ITS Europe and the EAVP Consortium highlighted the readiness of automated valet parking technology at the European Parking Conference, emphasizing a shift from Type 2 to scalable Type 1 AVP systems.

- In January 2024, Bosch and CARIAD SE, a subsidiary of Volkswagen Group, began testing an integrated system combining automated valet parking and automated charging in Germany. The setup allows electric vehicles to drive themselves to a parking bay, charge through a robotic system, and return to their spot autonomously.

- In January 2023, Robert Bosch GmbH partnered with APCOA PARKING Group to deploy infrastructure-based driverless SAE Level 4 automated valet parking across 15 parking garages in Germany. The project aims to scale smart, fully autonomous parking solutions in commercial environments.

- In February 2023, BMW Group and Valeo entered a strategic partnership to co-develop next-generation Level 4 automated parking systems aimed at enhancing fully autonomous parking capabilities

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Solution, Connectivity, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automated valet parking systems will become standard features in premium and electric vehicles.

- Integration of AI and machine learning will improve parking accuracy and speed.

- Cloud-based and connected parking platforms will enhance remote management and user experience.

- Smart city projects will drive large-scale adoption of automated parking infrastructure.

- Partnerships between automakers and technology companies will expand commercial deployments.

- Advancements in 5G connectivity will enable real-time vehicle-to-infrastructure communication.

- Cost reduction in sensors and ECUs will support wider adoption in mid-range vehicles.

- Regulatory standardization across regions will accelerate global market penetration.

- Sustainability initiatives will promote energy-efficient and space-saving parking systems.

- Expansion in Asia Pacific and Middle Eastern markets will create significant growth opportunities.