Market Overview

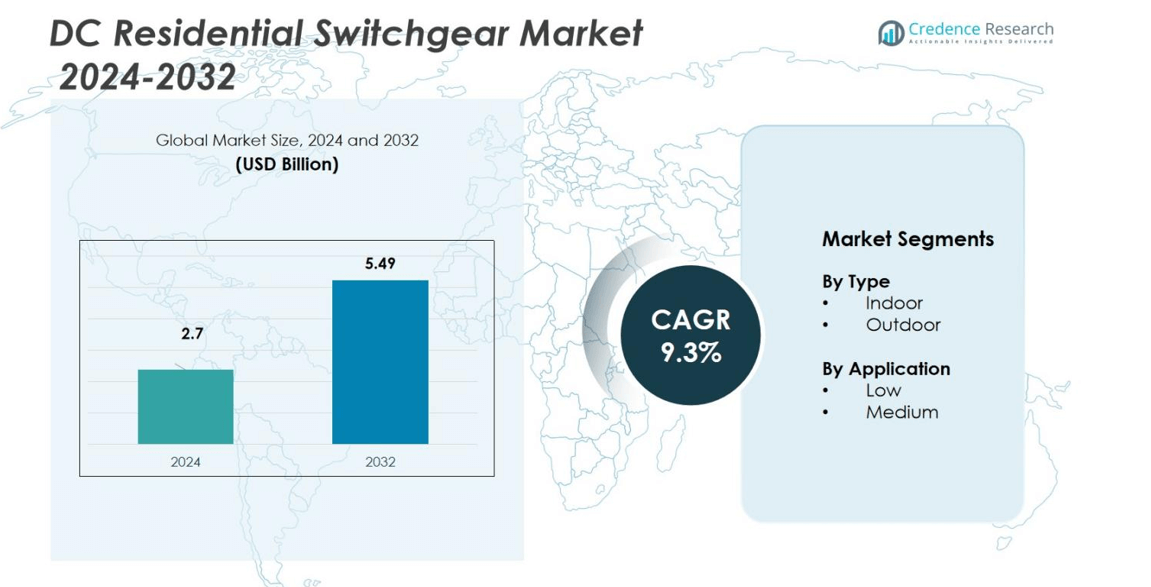

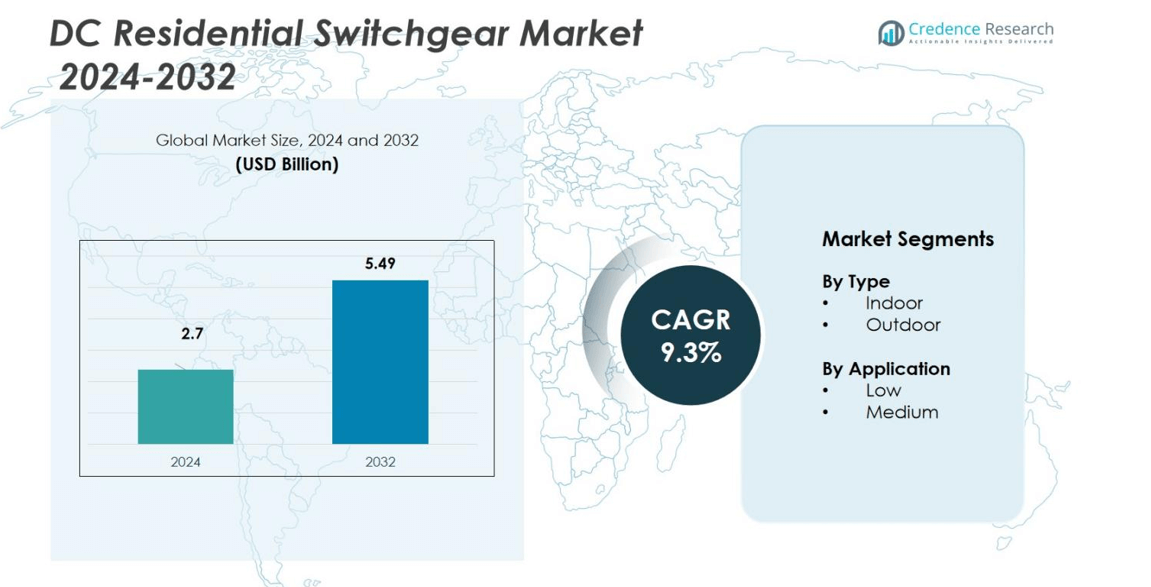

DC Residential Switchgear Market size was valued USD 2.7 Billion in 2024 and is anticipated to reach USD 5.49 Billion by 2032, at a CAGR of 9.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Residential Switchgear Market Size 2024 |

USD 2.7 Billion |

| DC Residential Switchgear Market , CAGR |

9.3% |

| DC Residential Switchgear Market Size 2032 |

USD 5.49 Billion |

The DC Residential Switchgear Market is led by key players such as General Electric, Bharat Heavy Electricals, Eaton, Fuji Electric, Hitachi, Hyosung Heavy Industries, HD Hyundai Electric, CG Power and Industrial Solutions, and E + I Engineering. These companies drive innovation through compact, energy-efficient, and smart DC systems tailored for modern residential power distribution. Their focus on IoT-enabled products and renewable integration strengthens competitiveness in the evolving energy landscape. Regionally, Asia-Pacific dominates with 33% of the total market share, driven by rapid urbanization and large-scale housing electrification. North America holds 31%, supported by advanced smart grid adoption, while Europe accounts for 28%, backed by strict energy-efficiency policies and widespread renewable energy integration across residential sectors.

Market Insights

- The DC Residential Switchgear Market was valued at USD 2.7 billion in 2024 and is projected to reach USD 5.49 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

- Market growth is driven by expanding residential electrification, rising adoption of renewable energy systems, and increasing demand for compact, energy-efficient switchgear solutions across urban housing and smart home developments.

- Key trends include growing integration of IoT-enabled monitoring systems, shift toward sustainable and modular switchgear designs, and rising adoption of DC microgrids for residential applications.

- The competitive landscape features major players such as General Electric, Eaton, Hitachi, Fuji Electric, and Bharat Heavy Electricals, focusing on innovation, product reliability, and renewable integration.

- Asia-Pacific leads with a 33% share, followed by North America at 31% and Europe at 28%, while indoor switchgear dominates by type with a 67% share and low-voltage applications hold 72% in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Indoor switchgear dominates the DC Residential Switchgear Market with a 67% share in 2024. Its dominance stems from rising adoption in urban housing, apartments, and smart residential complexes requiring compact, enclosed systems for safety and ease of maintenance. The growing demand for efficient space utilization and enhanced electrical protection in residential setups further supports segment growth. Outdoor switchgear holds a smaller share, mainly used in standalone houses and villas, where weather-resistant enclosures and high-capacity systems are required for external power distribution.

- For instance, Schneider Electric launched the EasySet MV indoor switchgear in April 2024, featuring modular air-insulated design and vacuum circuit breaker technology to enhance safety and ease of maintenance.

By Application

Low-voltage switchgear leads the market with a 72% share in 2024, driven by its extensive use in residential power distribution and small-scale renewable energy setups. It offers cost-effectiveness, simple installation, and reliable protection for household circuits. Increasing adoption of rooftop solar systems and electric vehicle charging infrastructure accelerates demand. Medium-voltage switchgear, accounting for the remaining share, finds niche use in larger residential estates and gated communities requiring higher load handling and enhanced fault tolerance capabilities.

- For instance, ABB’s low voltage switchgear products are designed to optimize energy efficiency and support rooftop solar integration in homes, meeting rising demand from residential solar and electric vehicle charging infrastructure.

Key Growth Drivers

Rising Residential Electrification and Urban Development

Rapid urbanization and expanding residential construction projects are fueling the demand for DC switchgear systems. Smart housing developments increasingly adopt DC networks to improve energy efficiency and support integration with renewable energy sources. Growing electrification in developing regions enhances the need for reliable and compact switchgear. The preference for modular indoor installations in multi-unit buildings further drives market expansion, ensuring safety, space optimization, and ease of maintenance.

- For instance, Siemens Energy’s modular gas-insulated DC switchgear for voltages up to ±550 kV and currents up to 5 kA reduces space requirements dramatically; their solutions reduce switchyard volume from 4,000 cubic meters to just 200 cubic meters, enabling compact installations even underground or inside prefabricated containers.

Integration of Renewable Energy and Storage Systems

The surge in rooftop solar installations and residential energy storage systems accelerates DC switchgear adoption. These systems require efficient control and protection for DC circuits managing solar power and batteries. The growing emphasis on energy self-sufficiency encourages the use of DC-based architectures for lower conversion losses. Switchgear manufacturers now design products compatible with high-voltage DC networks, optimizing performance and safety for home energy systems.

Advancement in Smart and IoT-Enabled Switchgear

Technological progress in smart grid infrastructure and IoT integration boosts switchgear adoption. DC residential switchgear now features monitoring, predictive maintenance, and real-time fault detection capabilities. Home automation trends further enhance demand for intelligent devices capable of seamless digital communication. Manufacturers incorporate sensors and communication modules that improve safety and energy optimization. This digital shift aligns with global energy efficiency goals and the modernization of residential power systems.

- For instance, Siemens’ Sm@rtGear® IE incorporates a dense network of sensors that continuously monitor voltage, current, thermal profiles, harmonic distortion, insulation integrity, and arc flash risk indicators.

Key Trends and Opportunities

Shift Toward Sustainable and Compact Designs

Consumers increasingly prefer compact, eco-friendly switchgear that reduces material use and enhances recyclability. Manufacturers are developing lightweight housings with advanced insulation materials to improve safety and performance. The trend aligns with stricter environmental regulations and the growing push for energy-efficient housing. Compact switchgear also suits modern apartment complexes with limited space, creating opportunities for modular and customizable product offerings.

- For instance, Schneider Electric’s SF6-free medium voltage switchgear uses pure air insulation combined with their Shunt Vacuum Interruption technology, proven effective in multiple pilot projects across Europe and industrial applications.

Rising Adoption of DC Microgrids in Smart Homes

The growing concept of DC microgrids in residential areas presents a major growth opportunity. These networks efficiently manage distributed energy resources like solar panels, batteries, and EV chargers. The reduced conversion losses and improved energy stability make DC switchgear critical to such setups. Expanding smart home adoption worldwide encourages investment in systems that integrate seamlessly with digital controls and renewable power generation.

- For instance, the EcoFlow Delta 3 Ultra system that integrates a 3072Wh battery with solar charging controllers and battery management in a compact form.

Key Challenges

High Initial Cost and Installation Complexity

Despite efficiency benefits, DC switchgear installation involves higher costs due to specialized equipment and safety requirements. Advanced protection mechanisms and conversion components raise overall project expenses. Homeowners and small developers often hesitate to invest in DC systems without clear cost benefits. Additionally, the lack of standardization across DC voltage levels complicates deployment and integration with existing AC infrastructure.

Limited Technical Awareness and Regulatory Support

Low awareness among installers and consumers about DC systems hampers widespread adoption. Many regions still rely on AC-based standards, creating regulatory and certification gaps. The absence of harmonized codes for DC residential wiring delays product standardization and acceptance. Training and policy reforms are essential to enable skilled workforce development and consistent market growth across emerging and developed economies.

Regional Analysis

North America

North America holds a 31% share of the DC Residential Switchgear Market in 2024, driven by strong demand for smart homes and renewable energy integration. The U.S. leads adoption due to advanced residential electrification and government incentives promoting solar and EV infrastructure. Canada follows, emphasizing sustainable housing and energy-efficient technologies. Continuous grid modernization and investment in intelligent switchgear systems enhance reliability and performance. The region’s mature electrical infrastructure and high disposable income further accelerate the replacement of conventional switchgear with advanced DC systems for improved energy control and safety.

Europe

Europe accounts for a 28% share in 2024, fueled by stringent energy-efficiency regulations and rapid expansion of smart residential projects. Countries such as Germany, the U.K., and France lead with strong investments in renewable energy integration and low-voltage DC networks. The European Union’s carbon neutrality goals encourage adoption of efficient power distribution solutions in households. Technological advancements in compact, modular switchgear designs support demand across urban housing developments. Moreover, growing deployment of EV charging infrastructure and home-based solar energy systems boosts the application of DC switchgear across residential communities.

Asia-Pacific

Asia-Pacific dominates the market with a 33% share in 2024, supported by massive urbanization, rising disposable incomes, and large-scale residential construction in China, India, and Japan. Government-led initiatives promoting renewable energy and smart housing accelerate DC infrastructure deployment. Rapid adoption of rooftop solar installations and home energy storage systems drives segment growth. Japan and South Korea focus on advanced smart grid technologies, while India’s residential electrification programs expand the addressable market. Increasing local manufacturing and cost-effective production also strengthen regional supply, making Asia-Pacific the primary growth hub for DC residential switchgear.

Latin America

Latin America holds a 5% share in 2024, supported by growing electrification programs and renewable energy projects in Brazil, Mexico, and Chile. The rise in residential construction and government focus on modern energy infrastructure stimulate adoption of DC switchgear. Expansion of rooftop solar installations in suburban and off-grid homes further contributes to market growth. While cost sensitivity limits large-scale penetration, improving regulatory frameworks and supportive policies for sustainable energy drive gradual adoption. Manufacturers target this region through affordable product lines and partnerships with local distributors to enhance market reach.

Middle East & Africa

The Middle East & Africa region captures a 3% share of the global market in 2024, mainly driven by infrastructure expansion and increasing demand for reliable residential power systems. The Gulf nations, including the UAE and Saudi Arabia, invest heavily in smart city developments that integrate advanced switchgear technologies. Africa’s growth remains moderate but rising due to rural electrification and solar home system deployment. Harsh climatic conditions push demand for durable, weather-resistant DC switchgear. Government initiatives to diversify energy sources and improve residential safety standards further support market expansion across the region.

Market Segmentations:

By Type

By Application

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the DC Residential Switchgear Market features key players such as General Electric, Bharat Heavy Electricals, Eaton, Fuji Electric, Hitachi, Hyosung Heavy Industries, HD Hyundai Electric, CG Power and Industrial Solutions, and E + I Engineering. These companies compete on product innovation, energy efficiency, and smart integration capabilities. Leading players focus on compact, modular, and IoT-enabled designs to meet rising residential electrification and safety standards. Strategic collaborations, technology upgrades, and expansion into renewable energy-based applications are central to their growth. Global brands strengthen portfolios through R&D investments and sustainable product lines, while regional manufacturers emphasize cost-effective solutions to cater to developing markets. Continuous investment in digital monitoring, intelligent fault detection, and eco-friendly materials supports long-term competitiveness. The market remains moderately consolidated, with top players leveraging advanced manufacturing technologies and global distribution networks to maintain strong market presence and customer loyalty across major regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, ABB Ltd. formed a strategic partnership with Zumtobel Group to develop advanced DC-based building solutions and intelligent lighting systems.

- In July 2025, Q-Tec Switchgear, a subsidiary of KBN Group, collaborated with Siemens AG to manufacture next-generation DC switchgear equipment aimed at enhancing performance, efficiency, and reliability in residential power systems.

- On June 3 2025, Eaton formed a partnership with Siemens Energy to provide modular power-and-switchgear systems including DC distribution for data-centers and large buildings, potentially extending into residential-scale DC infrastructure.

- In February 2023, LS Electric announced the launch of its new DC switchgear product line tailored for renewable-energy systems including PV and energy-storage applications

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing residential electrification and smart home adoption.

- Integration of renewable energy systems will drive stronger demand for DC-compatible switchgear.

- Advancements in IoT and digital monitoring will enhance product intelligence and safety features.

- Manufacturers will prioritize compact, modular, and sustainable designs for urban housing applications.

- Rising use of energy storage systems and EV charging points will strengthen DC infrastructure demand.

- Asia-Pacific will continue to dominate due to large-scale construction and local manufacturing strength.

- North America and Europe will focus on energy efficiency and grid modernization initiatives.

- Cost optimization and standardization of DC voltage systems will improve adoption in emerging markets.

- Strategic partnerships between technology providers and utilities will shape future product innovation.

- Increasing regulatory focus on low-emission and energy-efficient electrical components will sustain long-term growth.