Market Overview

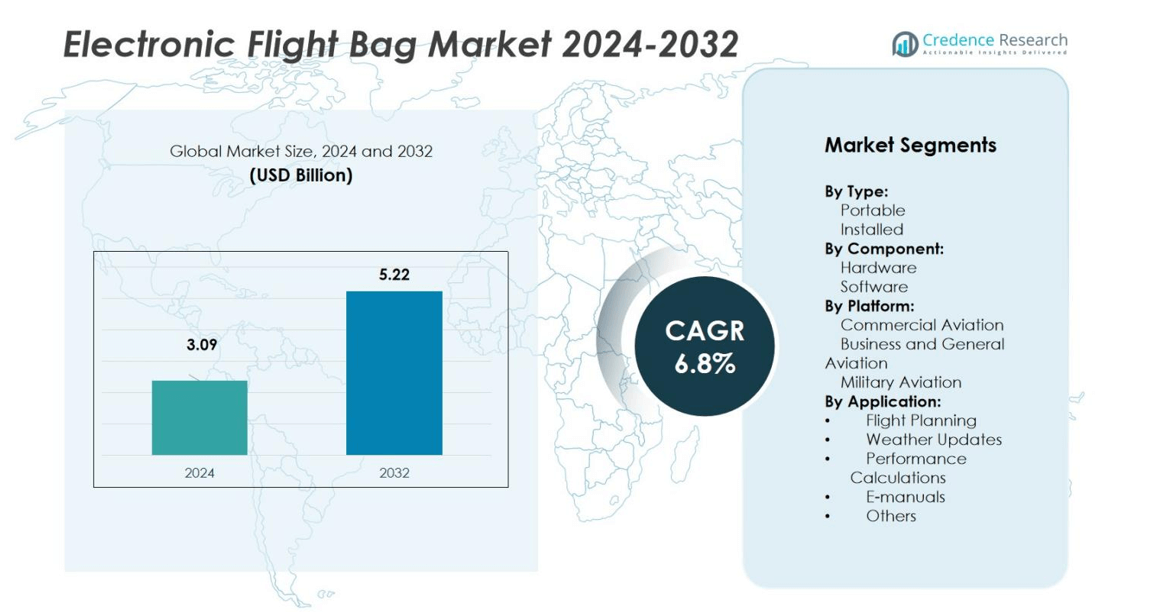

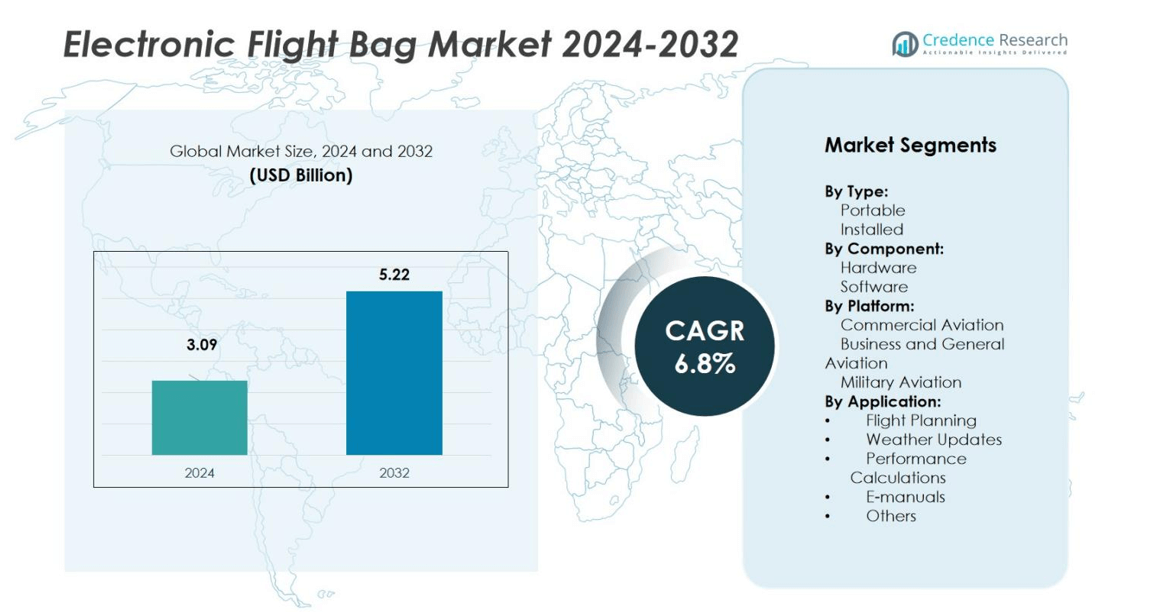

The Electronic Flight Bag Market size was valued at USD 3.09 billion in 2024 and is anticipated to reach USD 5.22 billion by 2032, growing at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Flight Bag Market Size 2024 |

USD 3.09 billion |

| Electronic Flight Bag Market, CAGR |

6.8% |

| Electronic Flight Bag Market Size 2032 |

USD 5.22 billion |

The Electronic Flight Bag Market is dominated by key players such as Thales Group, CMC Electronics Inc., Astronautics Corporation of America, DAC International, The Boeing Company, Jeppesen, Lufthansa Systems, Airbus SAS, Collins Aerospace, and L3Harris Technologies Inc. These companies focus on developing integrated software solutions, hardware compatibility, and cloud-based analytics to enhance flight efficiency and safety. Product innovation, strategic partnerships, and regulatory certifications are central to maintaining their market competitiveness. Thales and Collins Aerospace emphasize AI-driven systems for real-time navigation and flight optimization, while Boeing and Lufthansa Systems invest in software platforms that support paperless operations. Airbus and Jeppesen enhance their offerings through advanced data management and pilot-friendly interfaces. North America leads the Electronic Flight Bag Market with a 38% share in 2024, supported by robust aviation infrastructure and digital cockpit integration. Europe follows with a 29% share, driven by sustainability goals and stringent aviation regulations.

Market Insights

- The Electronic Flight Bag Market was valued at USD 3.09 billion in 2024 and is projected to reach USD 5.22 billion by 2032, growing at a CAGR of 6.8% during the forecast period.

- Rising demand for digital cockpit systems and the shift toward paperless operations drive market growth across commercial, business, and military aviation sectors.

- Cloud integration, AI-based analytics, and portable EFB adoption are key trends enhancing operational efficiency and real-time data management.

- The market is highly competitive, with major players such as Thales Group, Boeing, Collins Aerospace, and Lufthansa Systems focusing on product innovation and software upgrades.

- North America leads with 38% share, followed by Europe at 29% and Asia-Pacific at 23%, while the portable type segment dominates with 65% share due to flexibility, ease of use, and cost-effectiveness in modern aircraft operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The portable segment dominates the Electronic Flight Bag Market with a 65% share in 2024. Portable EFBs are preferred for their cost efficiency, flexibility, and ease of integration into various aircraft types without major modifications. Airlines and pilots increasingly adopt these devices for digital navigation charts, flight planning, and performance calculations. The installed segment, while smaller, is gaining traction in modern aircraft for its enhanced connectivity and real-time data synchronization, especially across commercial fleets equipped with advanced avionics systems.

- For instance, Delta Air Lines has equipped its fleet with Apple iPad-based portable EFBs, allowing pilots to access updated digital navigation charts and streamline flight planning without expensive cockpit modifications

By Component

The software segment leads the market with a 58% share in 2024, driven by the growing demand for flight management, weather updates, and navigation applications that enhance situational awareness. Software solutions also enable seamless integration with cloud-based data systems and ground operations. The hardware segment holds the remaining market share, supported by demand for durable tablets, display systems, and docking stations. However, software’s continuous updates and customizability make it the key revenue driver for airlines and defense operators adopting digital cockpit technologies.

- For instance, Honeywell’s Pegasus II flight management system, used in Airbus aircraft, incorporates advanced navigation software that improves operational safety and fuel efficiency.

By Platform

The commercial aviation segment holds the largest share at 62% in 2024, driven by the widespread implementation of EFBs across passenger and cargo aircraft for fuel efficiency, route optimization, and paperless operations. Airlines prioritize digital transformation to cut operational costs and improve regulatory compliance. The business and general aviation segment follows, supported by rising use among private jet operators. Meanwhile, military aviation is increasingly adopting EFBs for mission planning and situational awareness, contributing to steady growth across defense fleets.

Key Growth Drivers

Rising Demand for Digital Cockpit Solutions

Airlines are rapidly shifting toward digital cockpits to enhance operational efficiency and reduce pilot workload. Electronic flight bags (EFBs) replace traditional paper-based charts with digital tools for flight planning, performance monitoring, and weather tracking. Their real-time data access supports quick decision-making and compliance with aviation standards. Growing aircraft modernization programs across commercial and defense sectors further drive EFB installations, as operators prioritize automation and fuel-efficient flight operations to meet evolving safety and sustainability requirements.

- For instance, Collins Aerospace introduced new EFB applications that integrate airborne and ground data sources, improving real-time operations and pilot workflows.

Increased Adoption of Lightweight and Portable Devices

The growing preference for lightweight and portable electronic flight bags is a key growth factor. Portable EFBs minimize cockpit clutter and allow easy updates of navigation charts and manuals without additional wiring or system changes. Airlines adopt them to improve flight efficiency while lowering fuel costs through weight reduction. Continuous advancements in tablet technology, connectivity, and durability make these systems more appealing to pilots and fleet operators, encouraging higher adoption across commercial, business, and general aviation segments.

- For instance, Honeywell’s GoDirect Flight Bag Pro and Teledyne Controls’ GroundLink EFB have advanced portable solutions widely adopted in commercial and military aviation for their connectivity and durability.

Regulatory Push for Paperless Operations

Aviation regulatory bodies such as the FAA and EASA increasingly promote paperless cockpit operations for safety and environmental benefits. EFBs enable digital recordkeeping, flight documentation, and performance monitoring, aligning with green aviation initiatives. Airlines use these solutions to reduce paper waste, streamline compliance reporting, and enhance flight accuracy. The shift toward eco-friendly practices and efficient data management encourages airlines to integrate certified EFB systems, fostering greater standardization and compliance across both passenger and cargo carriers globally.

Key Trends & Opportunities

Integration of Cloud and AI Technologies

The integration of cloud computing and artificial intelligence is reshaping EFB functionality. Cloud-based platforms allow automatic data synchronization between aircraft and ground systems, while AI-driven analytics provide predictive insights for maintenance and route optimization. Airlines benefit from reduced delays and improved fleet management efficiency. This convergence of advanced technologies enhances data-driven decision-making and paves the way for fully connected aircraft ecosystems, creating long-term opportunities for EFB software developers and avionics manufacturers.

- For instance, United Airlines utilizes cloud technology to monitor aircraft engines in real-time, predicting failures before they occur and enhancing maintenance scheduling to reduce delays.

Growth in Retrofitting and Aftermarket Upgrades

The surge in retrofitting older aircraft with advanced EFB systems presents strong growth potential. Airlines are upgrading legacy fleets to meet evolving regulatory standards and operational demands without full cockpit replacements. Retrofitted EFBs provide access to digital documentation, fuel-saving analytics, and performance updates, extending aircraft lifespan and reducing maintenance costs. As global passenger traffic rises, retrofit programs become cost-effective solutions, especially for regional and low-cost carriers aiming to enhance digital capabilities affordably.

- For instance, Gulf Air successfully transitioned to paperless flight operations by retrofitting their fleet with Jeppesen FliteDeck Pro EFBs on iPads, enhancing operational efficiency and reducing pilot workload.

Key Challenges

Cybersecurity and Data Privacy Concerns

The increasing digitalization of cockpit systems exposes EFB networks to cybersecurity risks. Unauthorized access or malware can compromise sensitive flight data, affecting operational safety. Airlines face challenges ensuring secure communication between onboard systems and ground servers. Strengthening encryption, authentication, and real-time threat monitoring becomes essential. Compliance with global aviation cybersecurity regulations adds further complexity, making robust digital protection a key focus area for both software developers and aircraft operators.

Integration with Legacy Avionics Systems

Many airlines struggle to integrate modern EFB solutions with existing avionics systems in older aircraft. Compatibility issues can lead to delayed installations and increased operational costs. Legacy platforms often lack the processing power or connectivity required for advanced EFB applications. Upgrading such systems demands additional hardware investments and software customization. These challenges slow adoption rates, particularly among small carriers with limited budgets for modernization, restricting full utilization of EFB functionalities across global fleets.

Regional Analysis

North America

North America dominates the Electronic Flight Bag Market with a 38% share in 2024, driven by the presence of key aviation technology providers and widespread fleet modernization. The United States leads the region, with strong adoption across commercial and defense aviation. Continuous upgrades in aircraft operations and the FAA’s emphasis on digital cockpit integration further strengthen regional growth. Major airlines are implementing EFBs to reduce fuel costs and enhance operational safety, while collaborations among software developers and aircraft manufacturers continue to expand digital aviation ecosystems.

Europe

Europe holds a 29% share in 2024, supported by robust regulatory frameworks and strong participation from leading aerospace firms such as Airbus and Thales Group. The region’s focus on eco-friendly aviation and paperless cockpit operations boosts EFB demand. Germany, France, and the U.K. remain key markets adopting advanced digital flight management systems. Airlines invest in upgrading older fleets with certified EFB solutions to improve compliance and reduce maintenance costs, while rising integration of AI-driven analytics contributes to efficiency and safety improvements.

Asia-Pacific

Asia-Pacific accounts for a 23% market share in 2024, driven by rapid aviation expansion in China, India, and Japan. Growing commercial fleets and increasing passenger traffic encourage airlines to deploy digital flight tools for operational optimization. Government-led modernization programs and the introduction of new aircraft fleets fuel adoption across both commercial and military aviation sectors. The region’s expanding low-cost carrier segment, coupled with strong investment in aviation infrastructure, further accelerates demand for EFBs to enhance navigation accuracy and reduce pilot workload.

Latin America

Latin America represents a 6% share in 2024, with growing adoption among regional carriers seeking cost-efficient operational solutions. Brazil and Mexico lead the market, emphasizing fuel efficiency and improved data connectivity in flight operations. Airlines are increasingly replacing paper-based documentation with portable EFB devices to streamline workflows. Economic recovery in air travel and modernization of older aircraft fleets contribute to steady regional growth. Ongoing partnerships between local operators and global avionics firms also support the implementation of standardized EFB systems across diverse fleets.

Middle East & Africa

The Middle East & Africa hold a 4% market share in 2024, driven by investments from premium airlines and military aviation projects. The UAE and Saudi Arabia lead EFB adoption, focusing on enhancing cockpit efficiency and sustainability. Fleet expansions by major carriers and government initiatives toward digital transformation encourage market growth. In Africa, adoption remains gradual due to limited technological infrastructure, though regional modernization and training programs are improving integration. The growing presence of international aerospace companies is expected to strengthen EFB deployment in the coming years.

Market Segmentations:

By Type:

By Component:

By Platform:

- Commercial Aviation

- Business and General Aviation

- Military Aviation

By Application:

- Flight Planning

- Weather Updates

- Performance Calculations

- E-manuals

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electronic Flight Bag Market features major players such as Thales Group, CMC Electronics Inc., Astronautics Corporation of America, DAC International Inc., The Boeing Company, Jeppesen, Lufthansa Systems, Airbus SAS, Collins Aerospace, and L3Harris Technologies Inc. These companies compete through continuous innovation, software integration, and product customization to meet airline and regulatory requirements. The market is characterized by strong partnerships between avionics providers and aircraft manufacturers to develop connected cockpit ecosystems. Leading firms focus on expanding software-based offerings that enhance flight planning, navigation, and data management capabilities. Mergers and acquisitions also play a key role in consolidating market presence, while ongoing investment in artificial intelligence, cloud connectivity, and cybersecurity ensures advanced EFB functionality. Companies are increasingly emphasizing user experience, system reliability, and compliance with international aviation standards, maintaining intense competition across both commercial and military aviation segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thales Group (France)

- CMC Electronics Inc. (Canada)

- Astronautics Corporation of America (The U.S.)

- DAC International, Inc. (The U.S.)

- The Boeing Company (The U.S.)

- Jeppesen (The U.S.)

- Lufthansa Systems (Germany)

- Airbus SAS (The Netherlands)

- Collins Aerospace (The U.S.)

- L3Harris Technologies Inc. (The U.S.)

Recent Developments

- In September 2025, Thales Group signed two long-term contracts with IndiGo (India’s largest airline) for avionics maintenance and the implementation of EFB systems across its fleet.

- In early 2025, Deutsches Zentrum für Luft‑ und Raumfahrt (DLR) successfully tested two new EFB-related systems: a ‘Virtual Co-Pilot’ and ‘Remote Co-Pilot’ app for one- and two-pilot cockpits.

- In November 2024, Lufthansa Systems introduced an upgraded version of its Lido mPilot navigation solution, allowing Airbus A350 aircraft to display electronic flight bag (EFB) content directly on cockpit screens through seamless mirroring of iPad-based EFB applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Platform, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increased digitalization in aviation operations.

- Airlines will continue adopting advanced EFBs to improve flight efficiency and reduce operational costs.

- Cloud-based EFB solutions will gain traction for real-time data sharing and remote updates.

- Integration of AI and machine learning will enhance predictive maintenance and route optimization.

- Portable EFBs will dominate due to flexibility, lower installation costs, and ease of use.

- Regulatory support for paperless cockpit operations will strengthen market expansion globally.

- Retrofitting older aircraft with modern EFB systems will create long-term opportunities.

- Cybersecurity advancements will become essential to safeguard flight data and communication networks.

- Strategic collaborations among avionics firms and airlines will boost innovation and software development.

- Emerging markets in Asia-Pacific and the Middle East will drive future demand through fleet modernization programs.