Market Overview

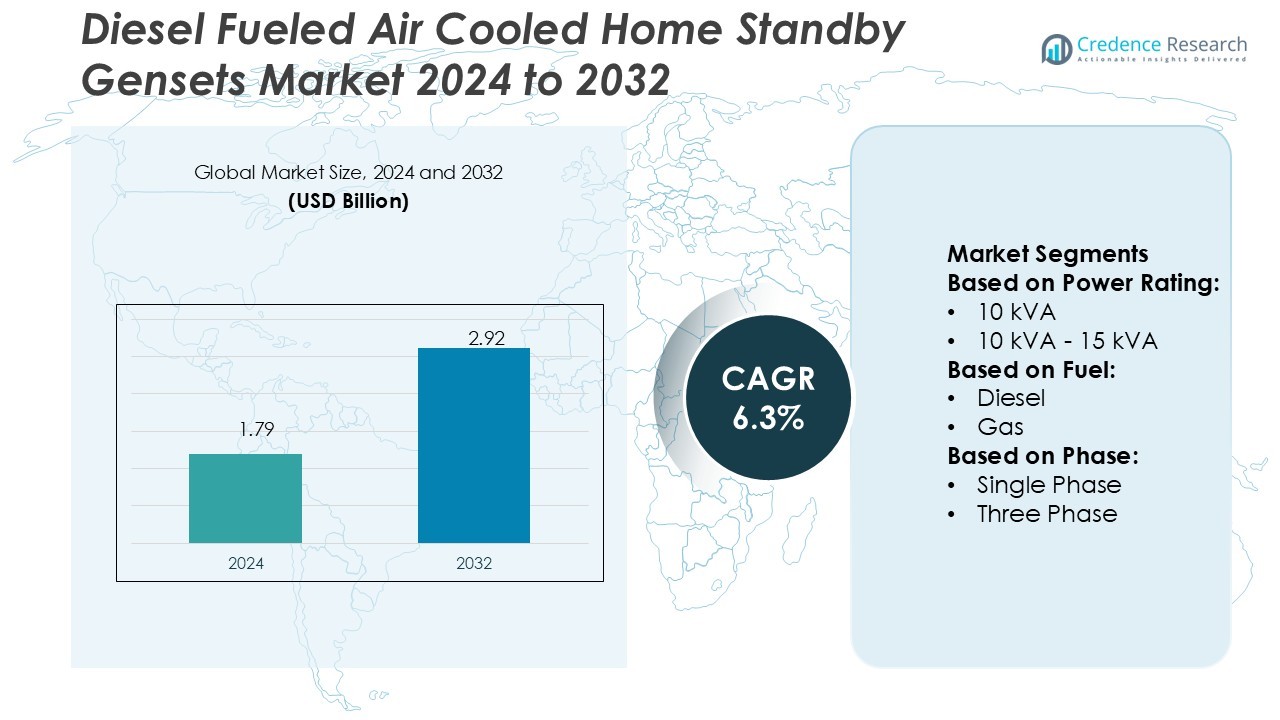

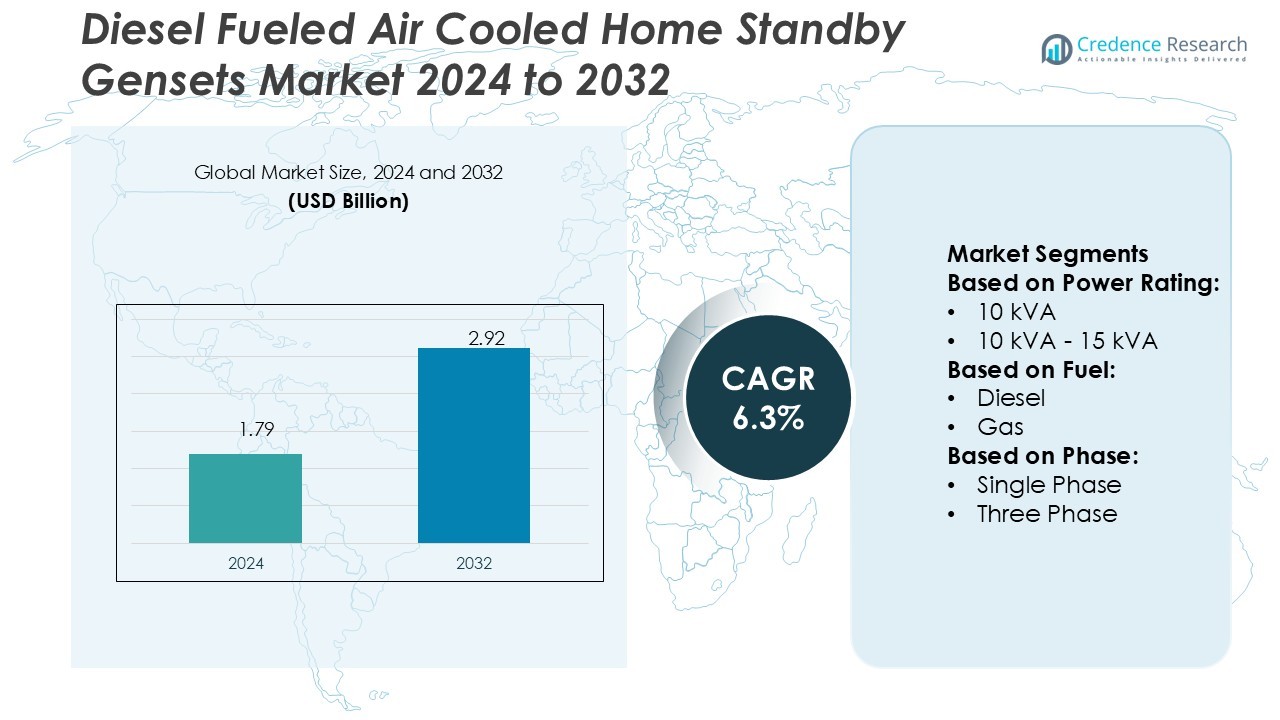

Diesel Fueled Air Cooled Home Standby Gensets Market size was valued USD 1.79 billion in 2024 and is anticipated to reach USD 2.92 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Fueled Air Cooled Home Standby Gensets Market Size 2024 |

USD 1.79 Billion |

| Diesel Fueled Air Cooled Home Standby Gensets Market, CAGR |

6.3% |

| Diesel Fueled Air Cooled Home Standby Gensets Market Size 2032 |

USD 2.92 Billion |

The Diesel Fueled Air Cooled Home Standby Gensets Market is characterized by strong competition among top players, including HIMOINSA, Pinnacle, Powerica, Hipower, Mahindra Powerol, Gillette Generators, PR Industrial, Kirloskar, Caterpillar, and Generac Power Systems. These companies focus on advanced engine technology, enhanced fuel efficiency, and compact product designs to expand their market presence. Strategic investments in smart control systems, low-noise operations, and after-sales service strengthen their competitive edge. Asia Pacific leads the global market with a 36% share, driven by rapid urbanization, unreliable grid networks, and growing residential power backup needs. Expanding production capacities and distribution networks in this region continue to reinforce its dominance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diesel Fueled Air Cooled Home Standby Gensets Market was valued at USD 1.79 billion in 2024 and is projected to reach USD 2.92 billion by 2032, growing at a CAGR of 6.3%.

- Rising demand for reliable residential power backup and increasing grid instability are driving steady market growth across key economies.

- Companies focus on advanced engine technology, low-noise operation, and smart control systems to strengthen their competitive positioning.

- High initial costs, emission concerns, and the growing shift toward renewable solutions act as restraints in some regions.

- Asia Pacific leads with a 36% share, followed by North America at 32%, while the ≤10 kVA power rating segment dominates with a significant share due to its strong adoption in urban and rural households.

Market Segmentation Analysis:

By Power Rating

The ≤10 kVA segment holds the largest market share in the diesel-fueled air-cooled home standby gensets market. This dominance is driven by strong residential demand and ease of installation. Households prefer compact units due to lower maintenance and operating costs. Their lightweight structure allows quick setup in both urban and rural homes. Rising power outages and backup needs in developing regions also support adoption. Manufacturers such as Cummins and Generac offer efficient ≤10 kVA models with improved fuel economy and noise control features, which strengthens market penetration and accelerates growth.

- For instance, Pinnacle’s 20 kVA air-cooled generator model PG-20-02 uses PU fire-retardant acoustic insulation. According to the manufacturer’s website, the generator is equipped with a 100 L fuel tank and has a weight of 1,020 kg.

By Fuel

The diesel segment dominates the market due to its higher efficiency and longer runtime. Diesel gensets deliver better load handling and require less frequent refueling than gas or other alternatives. Their reliability during extended outages makes them ideal for residential and light commercial applications. Advanced engine technologies have improved combustion efficiency, reducing emissions and maintenance costs. Brands like Kohler and Caterpillar have enhanced diesel engine designs to meet environmental standards, further boosting market acceptance. This segment benefits from well-established diesel fuel infrastructure across most regions.

- For instance, Powerica’s CPCB IV+ compliant CI 750D5P genset, rated at 750 kVA, integrates Cummins heavy-duty engines with a 990 L base fuel tank that provides approximately 8 to 9 hours of continuous operation at 75% load.

By Phase

The single-phase segment leads the market, supported by widespread residential use. Single-phase gensets meet most home energy requirements with minimal wiring complexity. Their compact size and lower cost make them accessible for households and small facilities. Manufacturers are integrating smart monitoring systems and auto-start capabilities to improve performance. For example, Briggs & Stratton’s single-phase air-cooled diesel gensets offer advanced load management features, ensuring stable backup power. Their simplicity, affordability, and ease of integration continue to drive segment dominance in the home standby generator market.

Key Growth Drivers

Rising Frequency of Power Outages

Frequent power cuts in residential areas are boosting demand for reliable backup solutions. Diesel air-cooled standby gensets offer stable power during emergencies without complex maintenance. Their quick start-up and long operational life make them suitable for homes in remote or unstable grid zones. For instance, Cummins’ air-cooled home gensets can run up to 10,000 hours with minimal servicing. This operational reliability drives consumer preference in both rural and semi-urban markets, ensuring stable energy access during outages.

- For instance, Hipower’s HSY-10 T6 model is rated at 10.7 kW standby / 9.8 kW prime, runs at 1,800 rpm with a Yanmar 3TNV76 engine (displacement 1.116 L), and consumes 0.74 gallons/hour at 100% prime power load (or 0.82 gallons/hour at standby load).

Increasing Residential Electrification and Appliance Usage

Growing household electrification and reliance on appliances create higher power backup requirements. Modern homes use sensitive electronics that require stable power flow during blackouts. Diesel air-cooled gensets support higher load handling and cost-effective operation. Manufacturers like Generac offer residential gensets with capacities up to 20 kVA, supporting HVAC, lighting, and kitchen systems simultaneously. This adaptability and power efficiency drive wider adoption in high-consumption households, especially in regions with weak grid infrastructure.

- For instance, Mahindra Powerol offers a 15 kVA diesel genset with 1,500 rpm operation, A1 governing class, and an approximate genset footprint of 1,700 x 900 x 1,250 mm for the model with the 2205 GM C2 engine.

Product Advancements and Fuel Efficiency Improvements

Continuous innovation in genset design and engine technology enhances performance and durability. Modern diesel gensets feature reduced vibration, low fuel consumption, and improved noise control. Companies such as Kohler and Briggs & Stratton have integrated electronic fuel injection systems to achieve 15–20% better fuel efficiency compared to older models. These upgrades make air-cooled gensets more appealing to residential users who seek long-term cost savings and environmental compliance with evolving emission standards.

Key Trends & Opportunities

Integration of Smart Monitoring Systems

Manufacturers are adding IoT-enabled monitoring features for real-time performance tracking and remote operation. Smart gensets allow homeowners to check fuel levels, start or stop units remotely, and receive maintenance alerts. For example, Generac’s Mobile Link technology enables users to control gensets through mobile apps. This growing digital integration offers a competitive edge and aligns with the trend toward smart home ecosystems, opening opportunities for value-added services and premium product lines.

- For instance, Gillette’s SPVD-2500 industrial diesel standby unit uses a Basler DGC-2020 digital controller, giving full text LCD readout and programmable engine functions, with modes such as “stop-manual-auto” and built-in shutdown alerts.

Expansion in Emerging Residential Markets

Urbanization in Asia-Pacific, Africa, and Latin America is creating new demand for backup power. Rising housing construction and expanding middle-class populations are increasing home electrification rates. Diesel air-cooled gensets offer a cost-effective and low-maintenance solution for these markets. Local manufacturing and government subsidies also support adoption. This geographic expansion presents significant growth opportunities for both global and regional players seeking to establish strong distribution networks.

- For instance, Kirloskar’s product literature, including the technical datasheet for the 320–750 kVA range, specifies that the genset noise level with the canopy is less than 75 dB(A) at 1 meter, in compliance with CPCB IV+ norms.

Development of Hybrid Backup Power Solutions

Growing interest in sustainable power is driving hybrid system development. Genset manufacturers are integrating solar panels and battery storage with diesel gensets to reduce fuel use and emissions. For instance, Caterpillar has developed hybrid residential systems that reduce fuel consumption by up to 40%. These solutions align with global energy transition goals, opening new opportunities for innovation, partnerships, and government-backed programs promoting cleaner power backup options.

Key Challenges

Stricter Emission Regulations

Tightening emission standards for diesel engines pose a challenge for manufacturers. Many regions are adopting Tier 4 or equivalent norms, requiring lower NOx and particulate emissions. Achieving compliance often increases product cost due to advanced exhaust after-treatment systems. Small residential buyers may prefer cheaper, non-compliant units, reducing demand for premium models. This regulatory pressure pushes companies to innovate faster and increase investment in cleaner engine technologies.

High Noise Levels and Maintenance Concerns

Despite efficiency gains, diesel gensets still face criticism for noise and upkeep requirements. Air-cooled models produce higher sound levels compared to liquid-cooled units, affecting residential comfort. Additionally, regular oil changes and periodic maintenance increase ownership costs. In dense urban areas, local noise regulations further limit installation. These issues may shift consumer preference toward alternative power solutions like inverter or solar-hybrid systems, impacting diesel genset market penetration.

Regional Analysis

North America

North America holds a 32% market share in the diesel fueled air cooled home standby gensets market. Strong adoption across residential and small commercial facilities drives this growth. Rising grid instability, frequent weather disruptions, and increasing power backup requirements support demand. The U.S. leads the region due to its widespread use of standby systems in hurricane-prone areas. Manufacturers focus on noise reduction, improved fuel efficiency, and compact designs to meet homeowner needs. Companies like Generac and Briggs & Stratton are expanding distribution and service networks to strengthen their market presence.

Europe

Europe accounts for a 24% market share in this market. Growing emphasis on energy reliability and climate resilience boosts adoption across residential areas. Countries such as Germany, France, and the U.K. are increasing investments in distributed power systems. Strict emission regulations encourage manufacturers to design low-emission and fuel-efficient gensets. Backup power demand in remote rural and coastal regions further strengthens sales. Key companies are introducing advanced monitoring systems to meet consumer expectations for cleaner and quieter operation. This aligns with Europe’s broader energy transition goals.

Asia Pacific

Asia Pacific leads the global market with a 36% share, making it the largest regional contributor. Rapid urbanization, unreliable grid networks, and rising middle-class housing drive strong demand for diesel fueled air cooled home standby gensets. Countries like India, China, and Indonesia see large-scale adoption in both urban and semi-urban settings. Consumers prioritize cost-efficient and durable power backup solutions. Regional manufacturers are investing in compact, high-performance units to address growing demand. Local production and supportive government policies on power reliability further enhance regional competitiveness.

Latin America

Latin America represents a 3% market share in the diesel fueled air cooled home standby gensets market. Countries like Brazil, Mexico, and Argentina are witnessing steady demand due to aging power infrastructure and unreliable grid supply. Consumers seek affordable and low-maintenance backup power solutions for residential use. Rising extreme weather events are also pushing demand for reliable standby systems. Local distributors and international brands are expanding their presence through dealership networks. Government focus on energy resilience and off-grid solutions supports gradual market growth across the region.

Middle East & Africa

The Middle East & Africa region holds a 5% market share in the global market. Increasing residential infrastructure development and frequent power outages in African countries are key drivers. In Gulf nations, rising demand for uninterrupted power during peak load periods supports market expansion. Diesel gensets are preferred due to their durability in harsh climatic conditions. Local and international players are focusing on energy-efficient models to meet regional requirements. Strategic investments in rural electrification and infrastructure projects further strengthen demand in this region.

Market Segmentations:

By Power Rating:

By Fuel:

By Phase:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diesel Fueled Air Cooled Home Standby Gensets Market features key players such as HIMOINSA, Pinnacle, Powerica, Hipower, Mahindra Powerol, Gillette Generators, PR Industrial, Kirloskar, Caterpillar, and Generac Power Systems. The Diesel Fueled Air Cooled Home Standby Gensets Market is shaped by strong innovation, strategic expansion, and enhanced service capabilities. Manufacturers focus on developing compact, fuel-efficient systems with low maintenance needs to attract residential users. Companies are investing in advanced control technologies, improved noise reduction, and smart monitoring features to boost reliability and performance. Strategic partnerships with distributors and service providers are helping expand market reach and strengthen brand presence. Product differentiation through durability, cost-effectiveness, and compliance with emission standards plays a key role in gaining a competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HIMOINSA

- Pinnacle

- Powerica

- Hipower

- Mahindra Powerol

- Gillette Generators

- PR Industrial

- Kirloskar

- Caterpillar

- Generac Power Systems

Recent Developments

- In January 2025, Generac Holdings, Inc. launched a standby generator designed for residential applications with a capacity range of 10 to 28 kW and equipped with an air-cooled system. These designs include ecobee smart thermostats and PWRcell battery systems.

- In October 2024, Canter Power Systems acquired Grasten Power Technologies, a service provider and installer of home standby generators in Houston and the broader Texas market.

- In May 2024, Briggs & Stratton Energy Solutions expanded its 26 kW PowerProtect Home Standby Generator by making it more powerful than ever before. It has 65.6 kVA of motor starting capability and the new model delivers 68% more starting power than its leading competitor, ensuring smooth operation of large appliances such as air conditioners and refrigerators.

- In March 2024, Cummins India and Sudhir Power conducted a successful all-India road show regarding the features and reliability of CPCB IV+ compliant gensets. There was wide exposure with trust to bring state-of-the-art, energy-efficient solutions in the form of Cummins powered SDG gensets, and this was done with a robust customer base.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Fuel, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for residential backup power solutions will rise due to increasing grid instability.

- Manufacturers will focus on developing fuel-efficient and low-emission genset models.

- Integration of smart monitoring systems will enhance remote control and performance.

- Compact and lightweight designs will drive adoption in urban and rural households.

- Expansion of distribution networks will strengthen market reach in emerging economies.

- Hybrid power solutions combining diesel and renewable energy will gain traction.

- Technological advancements will reduce noise levels and improve operational efficiency.

- Strategic collaborations will accelerate innovation and product diversification.

- Government incentives and power reliability programs will support market growth.

- Focus on sustainability and emission compliance will shape future product development.