Market overview

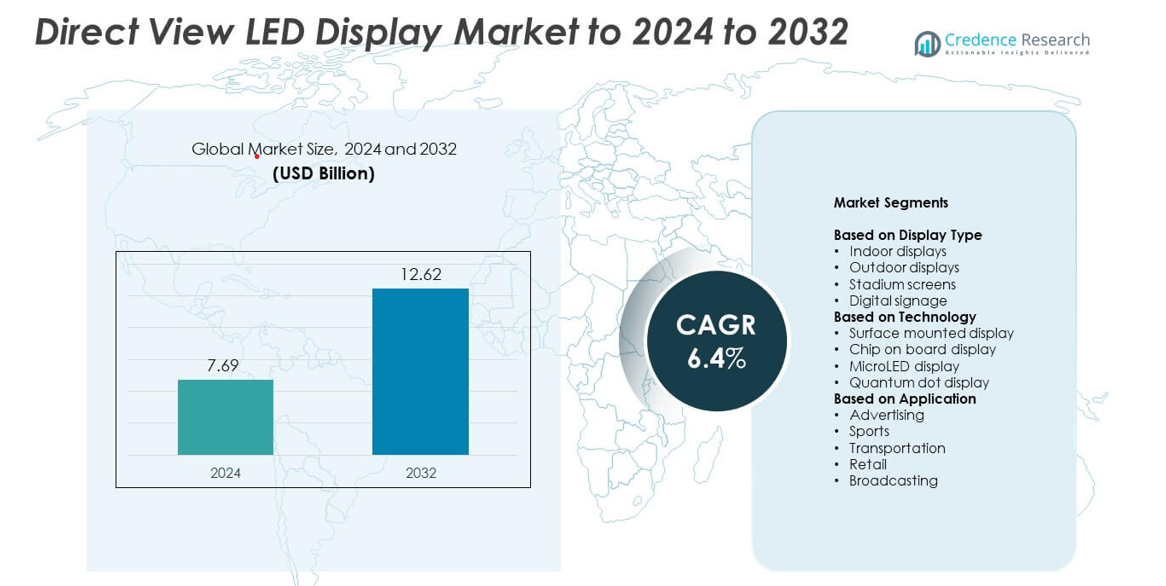

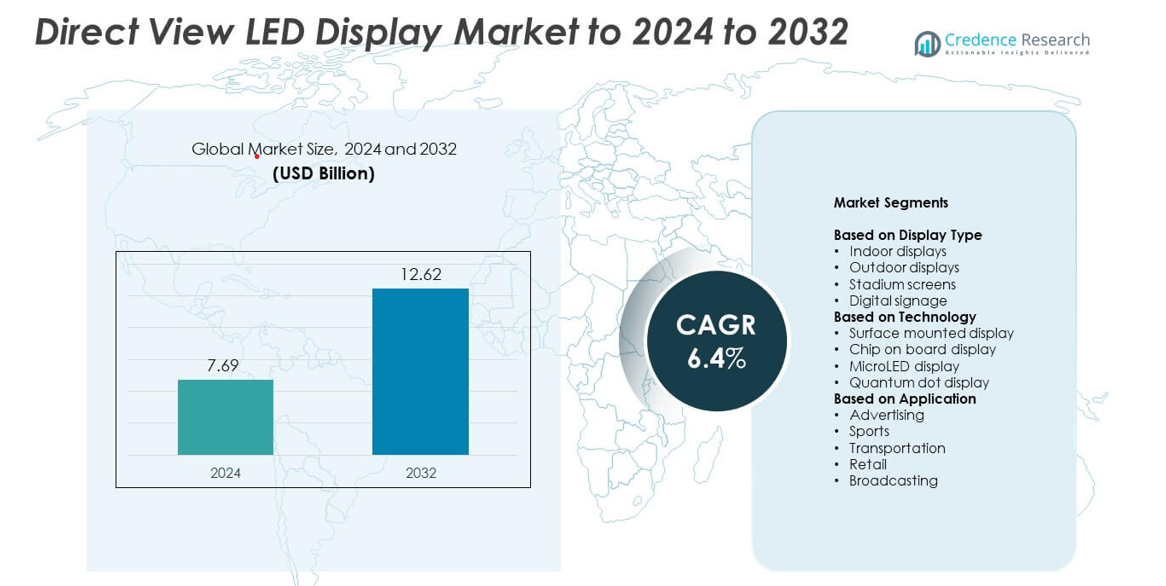

The Direct View LED Display Market size was valued at USD 7.69 billion in 2024 and is anticipated to reach USD 12.62 billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Direct View LED Display Market Size 2024 |

USD 7.69 billion |

| Direct View LED Display Market, CAGR |

6.4% |

| Direct View LED Display Market Size 2032 |

USD 12.62 billion |

The Direct View LED Display Market is led by major players such as Samsung Electronics, Daktronics, Barco NV, Absen, BOE Technology Group, and LG Electronics. These companies focus on advancing fine-pitch and MicroLED technologies that improve brightness, color accuracy, and energy efficiency. Strategic investments in R&D, manufacturing expansion, and partnerships across advertising, sports, and entertainment sectors continue to strengthen their market positions. Asia-Pacific dominated the market with a 40% share in 2024, driven by large-scale production capacity, rapid digital infrastructure growth, and rising deployment of LED displays in commercial and public installations

.Market Insights

- The Direct View LED Display Market was valued at USD 7.69 billion in 2024 and is projected to reach USD 12.62 billion by 2032, growing at a CAGR of 6.4%.

- Rising demand for high-brightness digital signage and immersive visual experiences is a key growth driver across advertising, retail, and sports venues.

- Advancements in MicroLED and chip-on-board technologies are setting trends toward ultra-fine pitch, energy-efficient, and bezel-free display systems.

- The market remains competitive, with global and regional players focusing on R&D, production scaling, and strategic partnerships to expand presence.

- Asia-Pacific led the market with a 40% share in 2024, followed by North America at 36% and Europe at 28%, while the indoor display segment dominated with a 46% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Display Type

The indoor display segment dominated the Direct View LED Display Market with a 46% share in 2024. High adoption across retail, corporate lobbies, and control rooms drives this leadership. Indoor displays offer superior pixel density, seamless modular design, and energy efficiency for close-range viewing. Increasing demand for immersive visual experiences in hospitality and entertainment venues further supports growth. Rapid integration of HDR and fine-pitch LEDs enhances visual performance, solidifying indoor displays as the preferred choice for commercial and public installations worldwide.

- For instance, LG MAGNIT LSAB009 specifies 0.94 mm pixel pitch and 1,500 nit peak / 600 nit max brightness.

By Technology

The surface mounted display segment held the largest share of 41% in 2024, driven by its strong reliability and fine pixel accuracy. This technology ensures high brightness uniformity and color consistency for both indoor and outdoor environments. Its cost-effectiveness and compatibility with large video walls enhance its adoption across advertising and event applications. The development of chip-on-board and MicroLED displays continues to expand premium applications, but surface mounted displays remain dominant due to mature production processes and wide availability across consumer and professional sectors.

- For instance, Barco XT0.9-Q uses IMD (4-in-1) with 0.95 mm pixel pitch and 600 nits brightness per tile (27-inch, 16:9, 640×360 pixels).

By Application

The advertising segment led the market with a 39% share in 2024, fueled by strong digital transformation across retail and urban infrastructure. Direct View LED displays are increasingly used for high-impact outdoor and indoor brand promotions. Their superior brightness, weather resistance, and dynamic content capabilities make them ideal for 24-hour visibility. Smart advertising networks with real-time content updates further drive adoption in metropolitan areas. Expanding retail digitization and integration of interactive, AI-driven advertising screens continue to strengthen this segment’s global dominance.

Key Growth Drivers

Rising Demand for High-Brightness Displays in Outdoor Advertising

Outdoor advertising has become a major driver for Direct View LED Displays, owing to their superior brightness and weather-resistant features. Businesses are deploying large-format LED billboards to improve brand visibility and audience engagement in high-traffic zones. The displays’ ability to operate efficiently under varying light and weather conditions ensures consistent performance. Increasing investments in digital out-of-home (DOOH) advertising by retail, automotive, and entertainment sectors are further accelerating the use of high-nit, energy-efficient LED panels across global metropolitan areas.

- For instance, Unilumin Ustorm III lists up to 13,000 nits brightness and maintains >8,000 nits after 3 years of high-output use.

Expanding Adoption Across Sports and Entertainment Venues

The growing number of stadiums, arenas, and event spaces adopting large-scale LED video walls is fueling market expansion. These displays offer immersive viewing, wide-angle visibility, and real-time content broadcasting capabilities. Major sports organizations and entertainment venues are upgrading to fine-pitch LED displays to enhance fan engagement and event broadcasting quality. The transition from conventional projection systems to modular LED formats provides better scalability and longevity, supporting widespread replacement and upgrade initiatives across global sports infrastructure projects.

- For instance, Samsung’s Infinity Screen at SoFi Stadium spans 70,000 sq ft with ~80 million pixels.

Technological Advancements in MicroLED and Chip-on-Board Displays

Continuous innovation in display technologies is another strong growth driver for the market. MicroLED and chip-on-board (COB) displays are improving energy efficiency, durability, and pixel precision for both commercial and residential environments. These technologies enable seamless ultra-high-definition visuals without bezels, supporting applications in broadcasting, retail, and corporate sectors. Enhanced production methods are lowering costs and driving large-scale adoption. The combination of superior image quality, low maintenance, and high contrast ratios positions these technologies as core enablers of next-generation LED display development.

Key Trends & Opportunities

Integration of Smart and Interactive Display Solutions

T

he market is witnessing a rapid rise in smart and interactive LED display installations. AI-driven analytics, touch-based interactivity, and IoT integration allow dynamic content personalization in real-time. Retail stores, airports, and corporate lobbies are leveraging these features to enhance engagement and deliver targeted messaging. Integration with mobile devices and sensor-based control is expanding application scope. This evolution toward connected display ecosystems opens new opportunities for data-driven marketing and audience interaction, strengthening the value proposition of intelligent LED display systems globally.

- For instance, Sony Crystal LED cites >1,000,000:1 contrast with 22-bit processing for smooth gradients.

Shift Toward Energy-Efficient and Sustainable LED Technologies

Sustainability is becoming a critical opportunity in the Direct View LED Display Market. Manufacturers are investing in eco-friendly materials and low-power LEDs to comply with global energy regulations. The adoption of recyclable substrates, improved heat dissipation designs, and lower power consumption modules supports green initiatives. End users in Europe and Asia-Pacific are increasingly prioritizing energy performance certifications. These advancements not only reduce operational costs but also align with corporate sustainability goals, driving demand for environmentally responsible and efficient LED display solutions.

- For instance, Absen A25 states consumption < 1 kWh/m² per day with >50% energy savings claim versus standard solutions.

Key Challenges

High Initial Investment and Maintenance Costs

The substantial upfront investment in Direct View LED Displays remains a major challenge for market expansion. Installation of large-scale, high-resolution panels requires significant capital expenditure, limiting adoption among small and mid-sized enterprises. Maintenance, calibration, and energy costs also add to long-term operational expenses. Despite declining component prices, the total cost of ownership remains relatively high compared to LCD alternatives. Overcoming this challenge will depend on advances in production efficiency and the availability of cost-effective leasing or financing models.

Complex Installation and Technical Integration Requirements

Deploying Direct View LED Displays involves intricate installation processes and technical alignment challenges. Factors such as pixel pitch accuracy, thermal management, and power supply design require skilled engineering support. Integrating LED systems with existing digital infrastructure can be time-consuming and resource-intensive. Any misalignment during installation may affect visual uniformity and performance consistency. The need for specialized technicians and extended installation timeframes limits scalability, particularly for projects with tight budgets or rapid deployment schedules in commercial and public spaces.

Regional Analysis

North America

North America held a 36% share of the Direct View LED Display Market in 2024, driven by strong adoption across retail, sports, and corporate sectors. The United States leads regional demand with widespread deployment of large-format LED video walls in commercial buildings and outdoor advertising. Technological advancements, coupled with rising investments in digital signage for smart cities, continue to enhance market penetration. The presence of key manufacturers and system integrators supports steady product innovation. Expanding entertainment infrastructure and replacement of legacy projection systems further contribute to market growth across the region.

Europe

Europe accounted for a 28% market share in 2024, supported by the growing use of LED displays in transportation hubs, retail environments, and live events. Countries such as Germany, the United Kingdom, and France are leading adopters due to robust demand for energy-efficient and high-resolution display solutions. Stringent environmental regulations are encouraging the use of low-power and recyclable LED materials. Increasing digital transformation in advertising networks and public information systems continues to boost regional growth. The ongoing modernization of sports venues and airports strengthens the market outlook across Europe.

Asia-Pacific

Asia-Pacific dominated the global market with a 40% share in 2024, driven by large-scale manufacturing, cost competitiveness, and rapid urbanization. China, Japan, and South Korea remain central to global production and technological innovation. Expanding infrastructure projects, high-density commercial zones, and growing retail digitization fuel regional demand. Government initiatives supporting smart cities and digital communication systems further enhance adoption. The region also benefits from strong exports of fine-pitch and MicroLED panels to global markets. Local suppliers’ competitive pricing and technological advancements ensure Asia-Pacific remains the largest and fastest-growing region.

Middle East & Africa

The Middle East & Africa held an 8% market share in 2024, primarily supported by increasing adoption of LED video walls in hospitality, retail, and outdoor advertising sectors. The United Arab Emirates and Saudi Arabia are leading the region with heavy investments in digital transformation and smart city projects. High demand for large-scale LED installations during major events and exhibitions is expanding opportunities. Energy-efficient display systems align with regional sustainability initiatives. Ongoing tourism development and the expansion of entertainment facilities are expected to further strengthen market growth across the region.

Latin America

Latin America captured an 7% share of the market in 2024, with Brazil and Mexico serving as key growth hubs. Rising demand for digital signage in retail centers, transportation terminals, and sports venues supports expansion. Local governments are investing in modern advertising infrastructure and public information systems that incorporate LED technology. Growing adoption of interactive and weather-resistant outdoor displays drives regional visibility. Despite cost barriers and limited manufacturing capacity, increased imports from Asia-Pacific and favorable economic reforms are expected to accelerate market development throughout Latin America.

Market Segmentations:

By Display Type

- Indoor displays

- Outdoor displays

- Stadium screens

- Digital signage

By Technology

- Surface mounted display

- Chip on board display

- MicroLED display

- Quantum dot display

By Application

- Advertising

- Sports

- Transportation

- Retail

- Broadcasting

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

Key players in the Direct View LED Display Market include Samsung Electronics, Daktronics, Barco NV, Absen, BOE Technology Group, Planar Systems, Christie Digital Systems, Shenzhen Absen Optoelectronic, LG Electronics, AOTO Electronics, ROE Visual, NEC Display Solutions, Leyard Optoelectronic, and Lighthouse Technologies. The market is characterized by continuous technological innovation and strategic expansion to strengthen global presence. Companies are investing in advanced manufacturing, fine-pitch LED production, and energy-efficient technologies to improve performance and reliability. Mergers, acquisitions, and partnerships with advertising agencies and entertainment sectors are enhancing distribution reach. Emphasis on research and development supports the creation of MicroLED and chip-on-board display solutions that deliver superior brightness and color precision. Competitive differentiation focuses on pricing efficiency, customization, and large-format integration capabilities. The increasing demand for immersive visual experiences across retail, sports, and transportation sectors continues to shape the competitive dynamics and innovation strategies within the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Samsung Electronics

- Daktronics

- Barco NV

- Absen

- BOE Technology Group

- Planar Systems

- Christie Digital Systems

- Shenzhen Absen Optoelectronic

- LG Electronics

- AOTO Electronics

- ROE Visual

- NEC Display Solutions

- Leyard Optoelectronic

- Lighthouse Technologies

Recent Developments

- In 2025, LG Electronics Announced a new AI-powered OLEDevo and QNEDevo TV lineup for 2025 in India.

- In 2024, Samsung Unveiled new QLED, MICRO LED, OLED, and Lifestyle displays featuring an advanced AI processor aimed at transforming smart displays

- In 2024, Leyard Launched the MicroLED VDS Series in Europe, using Chip-on-Board (COB) technology to achieve ultra-large viewing angles, high contrast, and 5G connectivity.

Report Coverage

The research report offers an in-depth analysis based on Display Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising adoption in digital signage.

- Fine-pitch LED displays will gain traction in retail, corporate, and control room applications.

- Advancements in MicroLED technology will enhance image clarity and energy efficiency.

- Integration of AI and IoT will enable smarter, real-time content management systems.

- Demand from sports and entertainment venues will continue to strengthen global sales.

- Sustainable and low-power LED solutions will become a major focus for manufacturers.

- Asia-Pacific will maintain leadership with expanding production capacity and exports.

- Outdoor and transport infrastructure projects will create new deployment opportunities.

- Cost optimization and modular designs will improve adoption among small enterprises.

- Strategic partnerships between display makers and advertisers will drive long-term innovation.