Market Overview

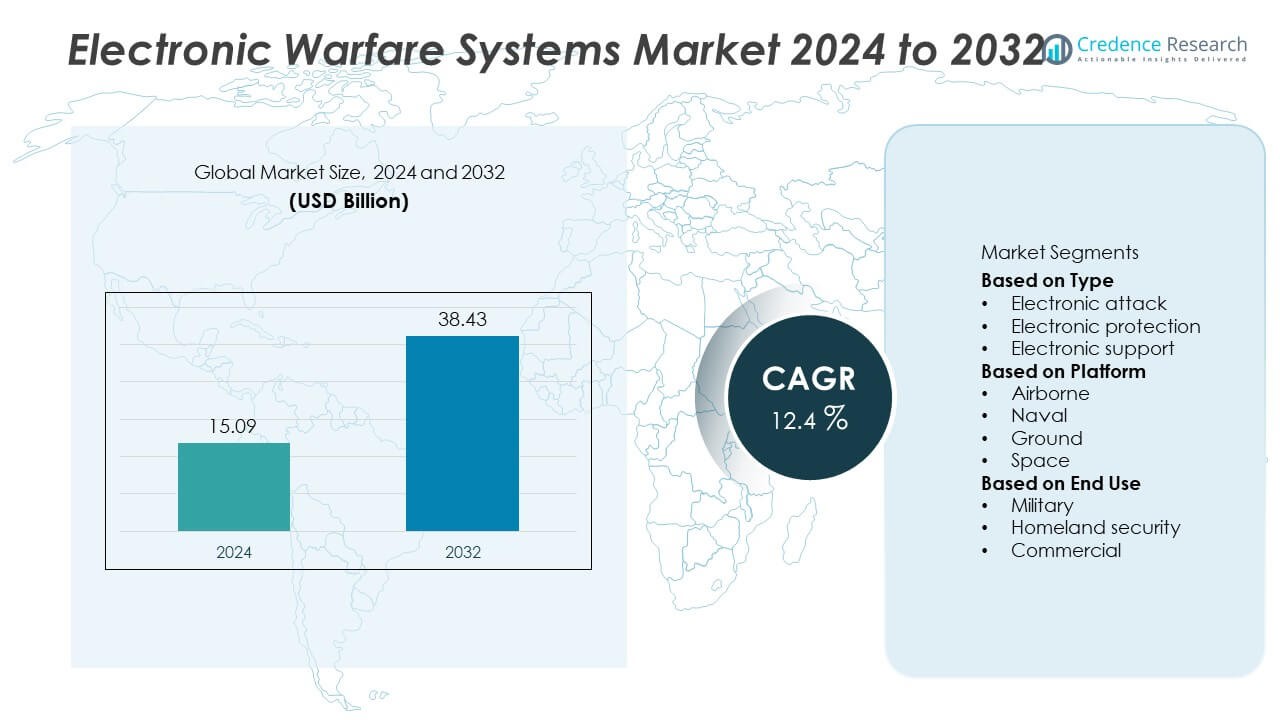

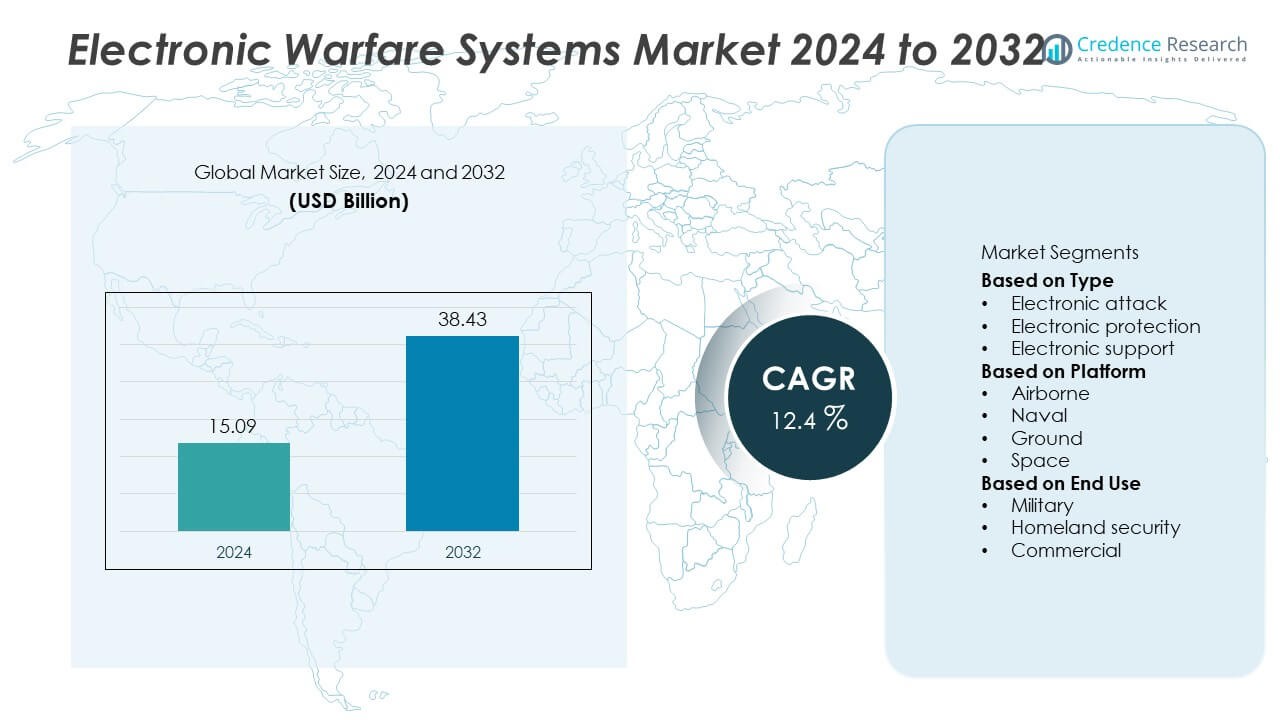

The global electronic warfare systems market was valued at USD 15.09 billion in 2024 and is projected to reach USD 38.43 billion by 2032, growing at a CAGR of 12.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Warfare Systems Market Size 2024 |

USD 15.09 Billion |

| Electronic Warfare Systems Market, CAGR |

12.4% |

| Electronic Warfare Systems Market Size 2032 |

USD 38.43 Billion |

The electronic warfare systems market is led by major players such as Elbit Systems, China Electronics Technology Group, ASELSAN, Bharat Electronics, IAI, Hanwha Systems, Indra Sistemas, Hensoldt, EDGE Group, and BAE Systems. These companies dominate through advanced research, integrated defense technologies, and strong government partnerships. North America led the market in 2024 with a 37% share, driven by high defense budgets and modernization of air and naval fleets. Europe followed with a 29% share, supported by collaborative defense programs and indigenous technology development, while Asia-Pacific accounted for a 25% share, propelled by increased regional defense spending and growing adoption of AI-driven electronic warfare systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global electronic warfare systems market was valued at USD 15.09 billion in 2024 and is projected to reach USD 38.43 billion by 2032, growing at a CAGR of 12.4% during 2025–2032.

- Rising defense modernization programs, cross-border conflicts, and increased investment in signal intelligence and radar countermeasure technologies are driving market growth.

- Key trends include AI and machine learning integration, development of space-based EW platforms, and focus on cyber-resilient electronic protection systems.

- Leading players such as Elbit Systems, BAE Systems, Hensoldt, Bharat Electronics, and ASELSAN are expanding portfolios through partnerships and next-generation EW solutions.

- North America led with a 37% share, followed by Europe at 29% and Asia-Pacific at 25%, while the electronic attack segment dominated with a 46% share, supported by growing demand for advanced jamming and countermeasure technologies across air, land, and naval platforms.

Market Segmentation Analysis:

By Type

The electronic attack segment dominated the electronic warfare systems market in 2024, holding a 46% share. This dominance is driven by the growing need to disrupt, deceive, or disable enemy radar and communication systems in modern combat. Increasing adoption of jamming, spoofing, and directed-energy technologies enhances the effectiveness of electronic attack operations. Defense forces worldwide are investing in next-generation electronic attack suites to strengthen offensive capabilities and counter radar-guided threats. Continuous advancements in signal processing and electronic countermeasures are further boosting demand for these systems across both airborne and ground-based defense platforms.

- For instance, BAE Systems developed the AN/ASQ-239 electronic warfare suite for the F-35 Lightning II. The advanced system integrates wideband radar jamming and geolocation functions, providing offensive and defensive electronic attack capability across 360 degrees for enhanced situational awareness.

By Platform

The airborne segment led the market in 2024 with a 41% share, supported by the rising use of advanced aircraft-mounted EW systems for surveillance, jamming, and radar suppression. Modern fighter jets, UAVs, and military helicopters are increasingly integrated with sophisticated EW suites to enhance survivability and mission success in contested airspace. Nations such as the U.S., Russia, and China are investing heavily in airborne EW capabilities to gain tactical superiority. The segment benefits from growing adoption of next-generation radar warning receivers, electronic countermeasures pods, and cyber-resilient avionics.

- For instance, Elbit Systems equipped the Israeli Air Force’s F-16I aircraft with an advanced airborne self-protection suite featuring an electronic warfare system, an electro-optical passive missile warning and launch detection system (PAWS), and a chaff and flare dispensing system.

By End Use

The military segment accounted for a 78% share of the electronic warfare systems market in 2024, dominating due to extensive defense modernization and battlefield digitization initiatives. Global armed forces are prioritizing EW technologies to protect communication networks, detect enemy signals, and counter electronic threats in real time. The increasing use of electronic protection and support systems for intelligence, surveillance, and reconnaissance (ISR) further strengthens military dominance. Rising defense budgets in the U.S., China, India, and NATO countries continue to drive large-scale EW system procurement and integration across multiple platforms.

Key Growth Drivers

Increasing Global Defense Modernization and Military Spending

Rising geopolitical tensions and the growing sophistication of electronic threats are driving defense modernization efforts worldwide. Countries such as the U.S., China, and India are heavily investing in electronic warfare systems to enhance battlefield situational awareness and counter radar or communication disruptions. The focus on multi-domain operations—combining air, land, sea, and space—further supports adoption. Integration of advanced sensors, AI-enabled analytics, and networked EW suites strengthens defense forces’ ability to detect and neutralize hostile signals, ensuring operational dominance across evolving combat environments.

- For instance, RTX subsidiary Raytheon developed the AN/ALQ-249 Next Generation Jammer Mid-Band (NGJ-MB) system, which delivers significantly enhanced power through an active electronically scanned array (AESA) architecture.

Advancements in Signal Intelligence and Radar Countermeasure Technologies

Continuous advancements in signal intelligence (SIGINT) and radar countermeasure technologies are major growth drivers for the electronic warfare systems market. Modern EW platforms are increasingly equipped with adaptive jammers, frequency-hopping systems, and cognitive electronic attack tools to counter dynamic radar threats. These innovations improve mission accuracy and resilience against next-generation guided weapons. Governments and defense contractors are developing multi-spectral and digital radio frequency memory (DRFM) systems to enable faster, more efficient electronic responses, ensuring stronger protection and tactical superiority during high-intensity conflicts.

- For instance, HENSOLDT developed the Kalaetron Attack electronic countermeasure system, which uses artificial intelligence and a fully digitized, broadband sensor to quickly detect and counter a wide spectrum of modern radar threats.

Rising Demand for Integrated and Cyber-Resilient EW Solutions

The growing convergence of cyber warfare and electronic warfare has accelerated demand for integrated and cyber-resilient EW systems. Defense forces seek solutions capable of real-time signal interception, data analysis, and protection against electromagnetic and cyber attacks. Integrated platforms combining electronic attack, support, and protection capabilities offer comprehensive situational control. Major defense suppliers are emphasizing network security, encryption, and AI-based decision-making within EW frameworks. This integration ensures interoperability across command systems and provides enhanced protection against both electronic and digital threats in modern defense networks.

Key Trends & Opportunities

Emergence of AI and Machine Learning in EW Operations

Artificial intelligence and machine learning are transforming electronic warfare efficiency by enabling autonomous signal detection, classification, and response. AI-driven EW systems can rapidly analyze large electromagnetic datasets to identify threats and initiate countermeasures without manual intervention. This trend enhances operational speed and decision accuracy in dynamic combat environments. Defense organizations are partnering with tech companies to develop adaptive AI algorithms for next-generation EW platforms. As automation increases, AI integration presents opportunities for faster threat response and greater survivability across electronic battlefields.

- For instance, L3Harris Technologies is developing the AN/ALQ-249(V)2 Next Generation Jammer-Low Band (NGJ-LB) system, which will augment and eventually replace the AN/ALQ-99 Tactical Jamming System on the EA-18G Growler aircraft.

Expansion of Space-Based and Unmanned EW Platforms

Space-based and unmanned platforms are creating new growth opportunities for electronic warfare applications. Satellites and UAVs equipped with EW payloads offer enhanced surveillance, jamming, and communication disruption capabilities over large operational areas. Nations are developing space-enabled EW architectures to strengthen strategic defense postures. The integration of EW payloads on drones and small satellites enables persistent coverage, reduced operational risk, and cost efficiency. This shift toward unmanned and orbital EW systems represents a major evolution in future warfare capabilities and global defense strategy.

- For instance, Israel Aerospace Industries (IAI) developed the Scorpius-G electronic warfare system, a powerful ground-based platform mounted on a rugged all-terrain vehicle and deployable in network mode to protect a wide geographic area.

Key Challenges

High Development Costs and System Complexity

Developing advanced electronic warfare systems involves significant investment in R&D, specialized technology, and skilled personnel. The complexity of integrating multiple sensors, software, and communication modules into a single platform drives up costs. Smaller defense economies struggle to match the rapid pace of innovation due to limited budgets. Additionally, ensuring interoperability between legacy and modern EW systems adds further technical challenges. High production and maintenance expenses remain a key barrier to wider adoption, especially among developing nations and mid-tier defense contractors.

Vulnerability to Emerging Cyber and Electronic Countermeasures

As EW systems become more connected and data-driven, they face growing risks from cyberattacks and electronic countermeasures. Adversaries are developing advanced techniques to jam signals, spoof sensors, or infiltrate EW networks. These vulnerabilities can compromise operational integrity and battlefield communications. Ensuring data encryption, secure networks, and resilience against signal interference is increasingly critical. Defense organizations must continuously upgrade EW frameworks to stay ahead of evolving threats. The rising sophistication of enemy countermeasures poses an ongoing challenge for system reliability and defense readiness.

Regional Analysis

North America

North America held a 37% share of the electronic warfare systems market in 2024, driven by strong defense budgets and continuous modernization of military infrastructure. The U.S. Department of Defense remains the primary contributor, focusing on integrating advanced electronic attack and countermeasure systems into air, land, and naval fleets. The region benefits from a robust presence of key defense contractors such as BAE Systems, Northrop Grumman, and Raytheon. Increased investments in AI-powered threat detection and electronic protection systems strengthen operational readiness. Ongoing geopolitical focus on electronic dominance continues to support sustained market growth across North America.

Europe

Europe accounted for a 29% share of the global market in 2024, fueled by defense collaborations and modernization efforts across NATO member countries. Nations like the UK, France, and Germany are deploying advanced electronic support and protection systems to enhance situational awareness. The European Defence Fund supports joint research programs focusing on next-generation EW technologies. Regional defense firms such as Hensoldt, Indra Sistemas, and BAE Systems are leading innovations in radar countermeasures and signal intelligence. Growing tensions in Eastern Europe and regional security initiatives are further accelerating electronic warfare system adoption.

Asia-Pacific

Asia-Pacific captured a 25% share in 2024, reflecting rapid expansion of defense capabilities and increasing regional security concerns. China, India, Japan, and South Korea are investing heavily in indigenous EW development to strengthen air and maritime defense. China dominates regional production with advanced jamming and interception systems, while India’s “Make in India” program supports localized manufacturing. Japan and South Korea are adopting EW systems integrated with stealth aircraft and naval platforms. Rising defense budgets, cross-border tensions, and technological collaborations continue to position Asia-Pacific as a fast-growing hub for EW advancements.

Latin America

Latin America accounted for a 5% share of the electronic warfare systems market in 2024, supported by gradual modernization of defense capabilities. Brazil leads the region with significant investments in radar surveillance and electronic protection systems for its air and naval forces. Mexico and Chile are also enhancing border and communication security using EW technologies. Despite limited budgets, partnerships with international defense firms are facilitating access to advanced technologies. The growing need for intelligence and counter-threat operations is slowly driving adoption of electronic warfare solutions across the region.

Middle East & Africa

The Middle East & Africa region held a 4% share in 2024, driven by rising geopolitical tensions and strategic defense investments. Countries such as Israel, Saudi Arabia, and the UAE are leading adopters of advanced EW systems for air and missile defense. Israel continues to dominate regional exports through technologies in radar jamming, signal interception, and electronic protection. The UAE’s focus on domestic production through partnerships with EDGE Group enhances regional self-reliance. In Africa, modernization of defense communication networks and counterterrorism operations are gradually increasing demand for electronic warfare capabilities.

Market Segmentations:

By Type

- Electronic attack

- Electronic protection

- Electronic support

By Platform

- Airborne

- Naval

- Ground

- Space

By End Use

- Military

- Homeland security

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electronic warfare systems market is characterized by leading players such as Elbit Systems, China Electronics Technology Group, ASELSAN, Bharat Electronics, IAI, Hanwha Systems, Indra Sistemas, Hensoldt, EDGE Group, and BAE Systems. These companies maintain strong global positions through continuous innovation, strategic partnerships, and defense modernization programs. Major players focus on developing integrated EW suites combining electronic attack, protection, and support capabilities across airborne, naval, and ground platforms. Investments in AI-based signal processing, cyber-resilient communication, and radar countermeasure technologies are enhancing operational precision. Companies are also pursuing government contracts and multinational defense collaborations to expand their market reach. With rising geopolitical tensions, leading firms are prioritizing R&D in advanced jamming, directed-energy systems, and multi-domain electronic warfare to strengthen national defense capabilities and gain a competitive edge in global military technology markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Elbit Systems

- China Electronics Technology Group

- ASELSAN

- Bharat Electronics

- IAI

- Hanwha Systems

- Indra Sistemas

- Hensoldt

- EDGE Group

- BAE Systems

Recent Developments

- In October 2025, HENSOLDT announced expansion of its production capacity at its Ulm facility to develop and produce radars and EW systems with around 3,000 employees to support increased demand.

- In August 2025, Elbit Systems secured an $80 million contract to supply advanced self-protection suites for F-16I aircraft, enhancing EW and protection capabilities for Israel’s air force.

- In January 2025, HENSOLDT and Airbus Defence and Space equipped the German Airborne Weapon Systems Electronic Warfare Centre with new hardware and software updates for mission data processing for A400M aircraft.

- In 2025, BAE Systems signed a contract with Hanwha Aerospace to integrate next-generation anti-jamming GPS technology into Hanwha’s Deep Strike capability precision-guided weapons, enhancing resistance to EW threats.

Report Coverage

The research report offers an in-depth analysis based on Type, Platform, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising global defense modernization programs.

- Integration of AI and machine learning will enhance signal detection and analysis.

- Space-based and unmanned EW platforms will gain greater military adoption.

- Nations will invest more in cyber-resilient and networked EW systems.

- Demand for multi-domain and integrated electronic warfare suites will increase.

- AI-driven autonomous response systems will improve real-time battlefield effectiveness.

- Partnerships between defense firms and governments will accelerate technology development.

- Miniaturized and modular EW components will support tactical and mobile deployments.

- Asia-Pacific will emerge as a key production and deployment hub for EW systems.

- Continuous R&D in radar countermeasures and directed-energy systems will shape future advancements.