Market overview

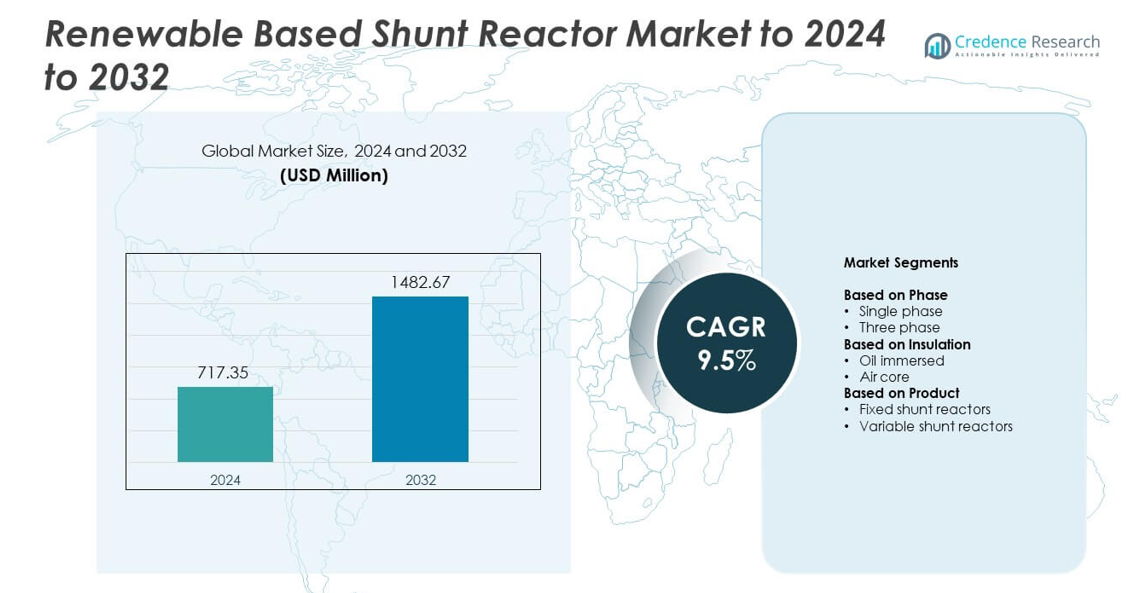

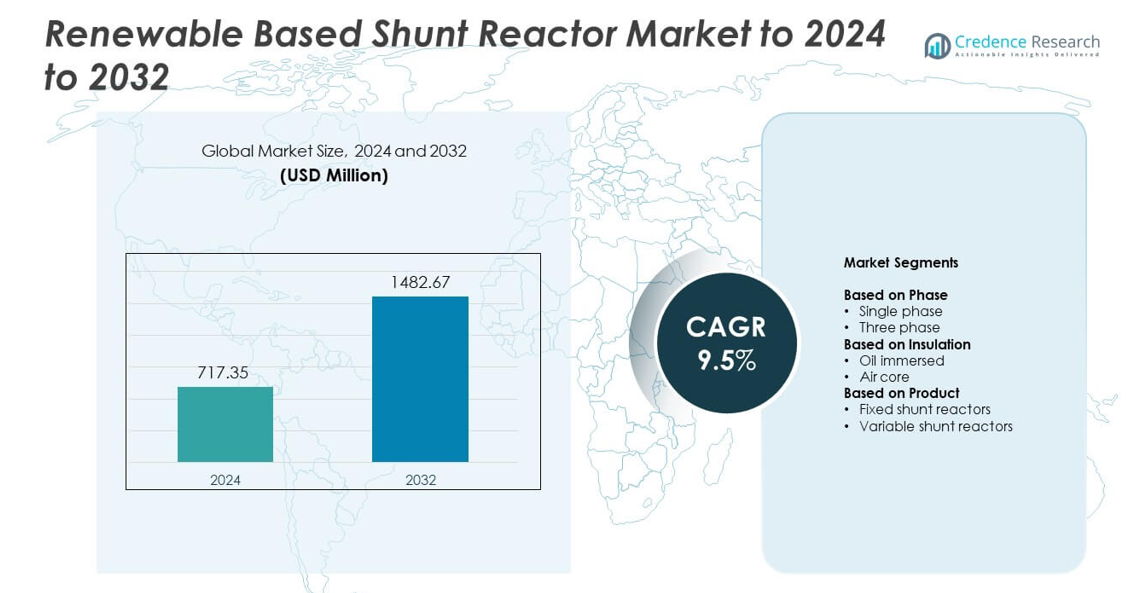

The Renewable Based Shunt Reactor Market size was valued at USD 717.35 million in 2024 and is anticipated to reach USD 1482.67 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renewable Based Shunt Reactor MarketSize 2024 |

USD 717.35 million |

| Renewable Based Shunt Reactor Market, CAGR |

9.5% |

| Renewable Based Shunt Reactor Market Size 2032 |

USD 1482.67 million |

The Renewable Based Shunt Reactor Market is driven by major players including Siemens Energy, GE, Hitachi Energy, Toshiba Energy Systems & Solutions, Fuji Electric, WEG, Hyosung Heavy Industries, Grid Solutions, NISSIN Electric, CG Power & Industrial Solutions, SGB SMIT, GBE, TMC Transformers Manufacturing Company, GETRA, and Shrihans Electricals. These companies focus on developing advanced, energy-efficient reactors to support renewable grid integration and voltage stability. Asia-Pacific led the global market with a 31.2% share in 2024, supported by large-scale renewable expansion and grid modernization in China, India, and Japan. North America and Europe followed, driven by smart grid deployment and offshore wind development.

Market Insights

- The Renewable Based Shunt Reactor Market was valued at USD 717.35 million in 2024 and is projected to reach USD 1482.67 million by 2032, growing at a CAGR of 9.5%.

- Growing renewable energy integration and grid modernization are driving strong demand for voltage stabilization and reactive power management solutions.

- Technological advancements in smart and compact reactor designs are shaping market trends, with rising adoption of digital monitoring systems for grid reliability.

- The market remains competitive with key players focusing on energy-efficient, low-loss designs and strategic collaborations to strengthen their global footprint.

- Asia-Pacific led with a 31.2% share in 2024, followed by North America at 34.8% and Europe at 29.6%, while the three phase segment dominated with a 72.6% share across global renewable transmission projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Phase

The three phase segment dominated the renewable based shunt reactor market with a 72.6% share in 2024. Its strong position stems from widespread adoption in high-voltage renewable substations and grid-connected wind and solar farms. Three phase reactors efficiently regulate voltage fluctuations and reactive power in large-scale renewable installations. They offer superior energy balance and reduced transmission losses, making them ideal for modern grid integration. Growing renewable capacity additions across Europe, China, and India further support the demand for three phase shunt reactors in utility-scale applications.

- For instance, GE Vernova will supply over 70 765 kV-class transformers and shunt reactors to POWERGRID for renewable corridors in India.

By Insulation

The oil immersed segment accounted for the largest share of 63.4% in 2024, driven by its high reliability and superior cooling efficiency. Oil immersed reactors are preferred in high-capacity renewable substations where continuous voltage stability is critical. These systems offer extended operational life and lower thermal stress compared to air core types. Rising renewable grid expansion and increased use of high-voltage alternating current (HVAC) transmission lines reinforce this segment’s dominance. Manufacturers are enhancing insulation oil formulations to improve heat dissipation and environmental safety in renewable energy infrastructure.

- For instance, Nissin Electric catalogs 66–77 kV shunt reactors rated up to 120,000 kvar for grid voltage control.

By Product

The fixed shunt reactors segment held a leading 59.7% share in 2024, supported by their wide use in stabilizing reactive power in wind and solar transmission systems. Fixed units are favored for their low maintenance, compact design, and suitability for consistent load conditions. They play a key role in maintaining voltage stability across renewable energy grids operating under fluctuating generation. Growing utility-scale renewable projects and grid modernization initiatives across Asia-Pacific and Europe continue to drive the adoption of fixed shunt reactors for long-term network reliability.

Key Growth Drivers

Rising Renewable Energy Integration into Power Grids

The increasing penetration of wind and solar power has boosted demand for voltage stabilization solutions. Renewable based shunt reactors help manage reactive power and maintain grid reliability under variable generation conditions. As renewable installations expand across China, the U.S., and India, utilities are investing in advanced grid compensation equipment. The need for efficient energy balancing and minimized transmission losses positions shunt reactors as vital assets for modern renewable infrastructure.

- For instance, Hyosung highlights that its 765 kV transmission networks significantly reduce energy losses compared to lower-voltage systems like 345 kV and 500 kV. This is a core benefit of ultra-high-voltage (UHV) transmission, which enables more power to be carried over longer distances with greater efficiency.

Expansion of High-Voltage Transmission Networks

Growing investments in high-voltage alternating current (HVAC) and direct current (HVDC) networks drive market expansion. Shunt reactors play a crucial role in reducing voltage rise and improving line stability over long transmission distances. Emerging economies are modernizing their grids to handle renewable load fluctuations and increase transmission efficiency. Government-led renewable integration programs further strengthen the adoption of shunt reactors for grid voltage management and reactive power compensation.

- For instance, Nynas NYTRO BIO 300X lists viscosity at 40 °C ≤ 4.5 cSt and pour point ≤ −45 °C, meeting IEC 60296.

Technological Advancements in Reactor Design

Ongoing R&D in compact and high-efficiency reactor systems supports market growth. Innovations in insulation materials, magnetic core design, and oil cooling systems enhance performance and durability. Manufacturers are developing reactors with improved energy density and lower maintenance requirements to align with evolving grid demands. These technological improvements are key in meeting the operational efficiency needs of hybrid and renewable-based grids worldwide.

Key Trends & Opportunities

Shift Toward Digital Monitoring and Smart Grid Integration

The market is witnessing adoption of digital monitoring and IoT-enabled control systems in shunt reactors. Smart sensors and real-time diagnostics improve grid responsiveness and reduce outage risks. Integration with advanced SCADA and predictive maintenance tools enhances reliability and operational safety. The transition toward smart grids provides long-term opportunities for adaptive and automated reactor solutions in renewable infrastructure.

- For instance, Hitachi Energy’s CoreSense™ M10 measures 9 dissolved gases online and integrates via TXpert™ Hub.

Increasing Investments in Offshore Wind Projects

The rapid growth of offshore wind farms in Europe and Asia-Pacific is fueling new demand. Offshore installations require efficient reactive power control to maintain voltage stability in remote grid connections. Compact, corrosion-resistant, and high-capacity reactors are becoming essential for these challenging environments. This expanding offshore segment presents lucrative opportunities for manufacturers offering specialized reactor solutions.

- For instance, Siemens Energy supplied two 190 MVA / 220 kV shunt reactors for the East Anglia One offshore link.

Key Challenges

High Initial Installation and Maintenance Costs

The high cost of reactor installation and oil-based insulation systems remains a barrier to adoption. Utilities face significant capital expenditure for high-capacity systems needed in renewable grids. Maintenance of oil immersed units also adds to operational expenses due to handling and safety requirements. Cost reduction through modular designs and alternative insulation materials is crucial for wider deployment.

Complexity in Grid Integration with Intermittent Renewables

Integrating shunt reactors within renewable-heavy grids poses operational challenges. Fluctuating voltage levels from wind and solar sources complicate system coordination and reactive power control. Advanced control algorithms and real-time adjustment mechanisms are required to prevent grid instability. The complexity of managing hybrid renewable networks continues to be a key technical constraint for utilities and reactor manufacturers.

Regional Analysis

North America

North America held a 34.8% share of the renewable based shunt reactor market in 2024, driven by extensive renewable integration and grid modernization projects. The U.S. and Canada continue expanding wind and solar capacities, creating strong demand for voltage stabilization systems. Federal energy transition programs and investments in smart grids support adoption of advanced shunt reactors. The region also benefits from technological advancements and active participation by major utility providers focusing on transmission efficiency and reactive power management to ensure stable renewable power distribution across vast networks.

Europe

Europe accounted for a 29.6% market share in 2024, supported by rapid renewable expansion and interconnection of cross-border grids. Nations such as Germany, France, and the U.K. are investing heavily in offshore wind and solar projects. The European Green Deal and energy efficiency directives further enhance the need for grid stabilization equipment. Utilities are adopting advanced oil immersed and air core reactors to manage fluctuating renewable outputs. Continuous upgrades in transmission infrastructure and the integration of digital monitoring systems reinforce Europe’s position in this market.

Asia-Pacific

Asia-Pacific dominated the renewable based shunt reactor market with a 31.2% share in 2024, led by China, India, and Japan. Rapid renewable energy deployment, particularly in solar and wind, drives substantial demand for grid voltage stabilization solutions. Large-scale renewable projects and government-backed electrification programs are key growth enablers. Ongoing transmission network upgrades and high renewable penetration rates in emerging economies continue to strengthen regional adoption. The region’s focus on power reliability and sustainable energy integration makes it the fastest-growing market segment globally.

Latin America

Latin America held a 2.8% market share in 2024, with growth fueled by increasing renewable investments in Brazil, Chile, and Mexico. Expanding solar and wind capacities are pushing utilities to enhance grid efficiency using advanced shunt reactors. Supportive energy transition policies and cross-border transmission projects are improving regional power stability. However, limited funding for high-voltage infrastructure slightly restricts market expansion. Continued focus on decarbonization and public-private energy partnerships are expected to boost reactor deployment across renewable grids in the coming years.

Middle East & Africa

The Middle East & Africa region captured a 1.6% share in 2024, supported by emerging renewable projects and grid expansion in nations such as the UAE, Saudi Arabia, and South Africa. Growing solar power installations and national clean energy programs are driving the need for voltage control technologies. Infrastructure modernization and electrification initiatives contribute to steady market growth. Although adoption remains moderate due to high installation costs, increasing renewable diversification goals are projected to enhance reactor utilization across developing energy networks.

Market Segmentations:

By Phase

By Insulation

By Product

- Fixed shunt reactors

- Variable shunt reactors

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Renewable Based Shunt Reactor Market features strong competition among leading players such as Siemens Energy, GE, Hitachi Energy, Toshiba Energy Systems & Solutions, Fuji Electric, WEG, Hyosung Heavy Industries, Grid Solutions, NISSIN Electric, CG Power & Industrial Solutions, SGB SMIT, GBE, TMC Transformers Manufacturing Company, GETRA, and Shrihans Electricals. Companies are focusing on expanding their renewable grid support portfolios through advanced voltage control and reactive power compensation technologies. Continuous R&D efforts aim to enhance thermal performance, reduce losses, and improve reliability for large-scale renewable integration. Strategic collaborations with utility providers and renewable developers are strengthening global market positions. Additionally, regional manufacturers are prioritizing cost-efficient and compact reactor solutions tailored for decentralized renewable systems. Product innovation and digital monitoring capabilities are becoming key differentiators as firms compete to provide smarter, more efficient solutions for renewable-based transmission networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Energy

- GE

- Hitachi Energy

- Toshiba Energy Systems & Solutions

- Fuji Electric

- WEG

- Hyosung Heavy Industries

- Grid Solutions

- NISSIN Electric

- CG Power & Industrial Solutions

- SGB SMIT

- GBE

- TMC Transformers Manufacturing Company

- GETRA

- Shrihans Electricals

Recent Developments

- In 2025, Siemens Energy delivered its first shunt reactor made from 100% recycled copper to the German grid operator TenneT

- In 2024, Grid Solutions department of General Electric procured orders from India’s Power Grid Corporation for 765 kV shunt reactors.

- In 2023, Hitachi Energy entered a strategic partnership with TenneT, a Dutch transmission system operator, to supply transformers and shunt reactors for modernizing Germany’s grid.

Report Coverage

The research report offers an in-depth analysis based on Phase, Insulation, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with expanding renewable power generation worldwide.

- Utilities will increase adoption of shunt reactors to improve grid voltage stability.

- Technological innovations will enhance reactor efficiency and reduce operational losses.

- Digital monitoring systems will gain traction for predictive maintenance and real-time control.

- Asia-Pacific will remain the fastest-growing region due to rapid grid modernization.

- Demand for compact and eco-friendly reactor designs will rise across renewable grids.

- Offshore wind projects will drive strong demand for corrosion-resistant reactor systems.

- Integration with hybrid and smart grid networks will create new growth opportunities.

- Government incentives for renewable integration will encourage large-scale reactor deployment.

- Manufacturers will focus on sustainable materials and improved insulation technologies.