Market Overview

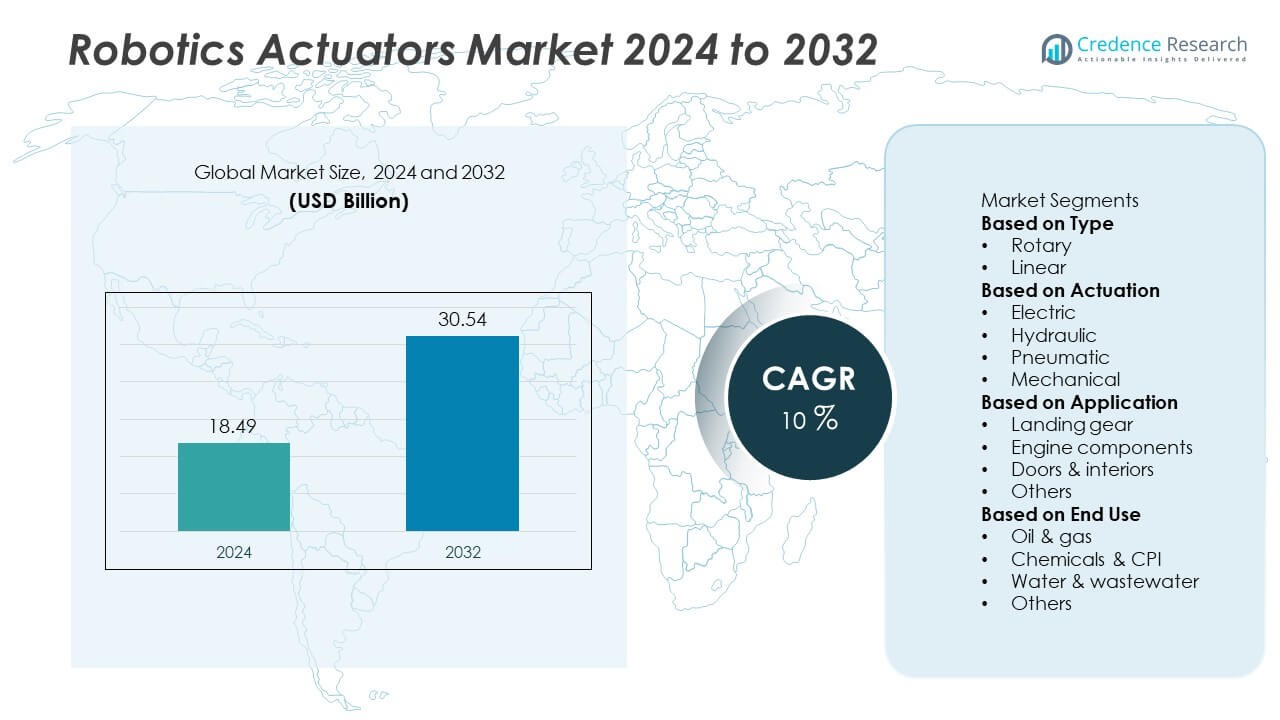

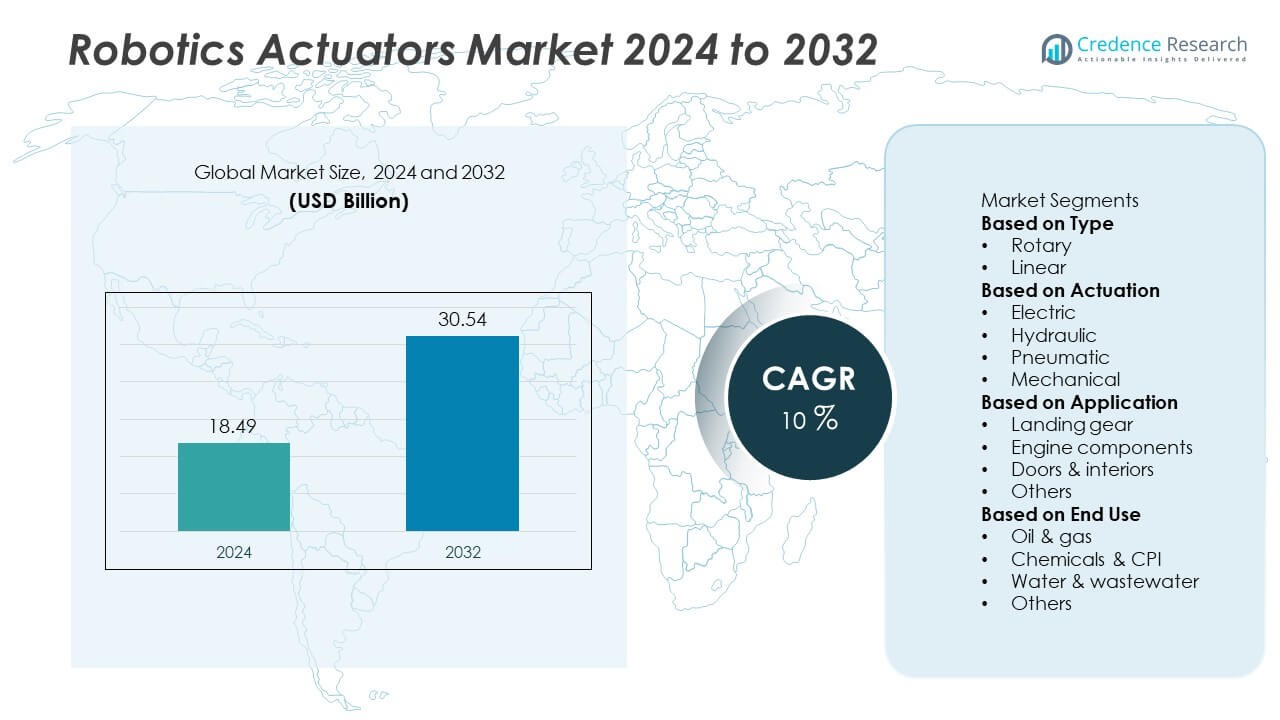

The global robotics actuators market was valued at USD 18.49 billion in 2024 and is projected to reach USD 30.54 billion by 2032, registering a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotics Actuators Market Size 2024 |

USD 18.49 Billion |

| Robotics Actuators Market, CAGR |

10% |

| Robotics Actuators Market Size 2032 |

USD 30.54 Billion |

The robotics actuators market is led by major players including Moog, Emerson Electric Co., ABB, Harmonic Drive LLC, MISUMI Group Inc., DVG Automation, Cedrat Technologies, Altra Industrial Motion, Macron Dynamics, and Curtis Wright. These companies dominate the market through technological innovation, strong global distribution networks, and diverse actuator portfolios. Asia-Pacific emerged as the leading region with a 32% share in 2024, driven by rapid industrial automation in China, Japan, and South Korea. North America followed with a 34% share, supported by advanced robotics adoption in automotive and manufacturing sectors. Continuous R&D investments in electric and smart actuators further strengthen global competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global robotics actuators market was valued at USD 18.49 billion in 2024 and is projected to reach USD 30.54 billion by 2032, growing at a CAGR of 10% during the forecast period.

- Market growth is driven by increasing industrial automation, rising adoption of collaborative robots, and expanding applications in aerospace and healthcare.

- Key trends include the development of lightweight electric actuators, AI-enabled motion control, and integration of smart sensors for precision and efficiency.

- The competitive landscape is led by Moog, ABB, Emerson Electric Co., Harmonic Drive LLC, and MISUMI Group Inc., focusing on innovation and energy-efficient actuator systems.

- North America held 34%, Asia-Pacific 32%, and Europe 29% market shares in 2024, while the rotary actuator segment dominated with 58% share, supported by high use in industrial robots, manufacturing automation, and motion control systems.

Market Segmentation Analysis:

By Type

The rotary actuator segment dominated the robotics actuators market with a 58% share in 2024. This leadership is driven by its extensive use in robotic arms, industrial manipulators, and joint movement applications. Rotary actuators offer high torque output, precision control, and compact design, making them ideal for automated assembly and material handling tasks. Their integration into collaborative and industrial robots enhances flexibility and efficiency. Increasing adoption in automotive, electronics, and logistics sectors continues to strengthen the segment’s position as industries shift toward smart and flexible automation systems.

- For instance, Harmonic Drive LLC developed the FHA-C Mini Series rotary actuator, which can be equipped with an integrated servo drive and dual absolute encoder. The actuator can provide a maximum torque of up to 28 Nm (depending on the model and gear ratio) and a one-way positional accuracy of 90 arc-seconds.

By Actuation

The electric actuation segment held the largest share of 52% in 2024, driven by the rising demand for energy-efficient, precise, and low-maintenance robotic systems. Electric actuators enable smooth motion control, faster response times, and easy integration with digital control units. Their widespread use in service robots, collaborative robots, and surgical robotics supports market dominance. The global transition toward electrification and Industry 4.0 automation further accelerates adoption, as manufacturers prefer electric systems over hydraulic or pneumatic alternatives for cleaner and more reliable operation.

- For instance, Moog Inc. offers electromechanical actuators that can deliver up to 112 kN of peak static holding force, with certain models achieving speeds over 300 mm/s. These high-performance actuators utilize a brushless DC motor and roller screw drive to provide reliable and accurate motion control for demanding applications, such as air system gun and turret stabilization.

By Application

The landing gear segment accounted for a 41% share in 2024, emerging as the leading application for robotics actuators. The demand stems from aerospace and defense sectors, where actuators are essential for precise control, load handling, and safety in aircraft operations. Robotics actuators ensure efficient retraction and extension of landing gear systems, improving reliability and performance. Advancements in electromechanical actuator design and lightweight materials are enhancing durability and reducing maintenance needs. Expanding aircraft production and modernization programs further support segment growth across global aviation markets.

Key Growth Drivers

Rising Adoption of Industrial Automation

The growing focus on automation in manufacturing, logistics, and assembly operations is driving the robotics actuators market. Industries are integrating advanced robots to improve productivity, precision, and safety in repetitive tasks. Robotics actuators enable controlled motion and torque, enhancing robot efficiency. Expanding deployment of collaborative robots in automotive and electronics industries further fuels demand. Companies are investing in motion control solutions to optimize production speed and operational flexibility, strengthening the market’s global footprint.

- For instance, ABB offers variants of its IRB 1300 robot series, such as the IRB 1300-12/1.4, which is capable of handling payloads up to 12 kilograms and achieving a maximum reach of 1.4 meters. The IRB 1300’s actuator system, paired with the OmniCore controller, supports joint speeds that can reach up to 720 degrees per second on its sixth axis.

Advancements in Electric Actuation Technologies

Rapid advancements in electric actuators are transforming robotic performance, offering superior precision, lower energy consumption, and simplified maintenance. These actuators support faster response times and seamless integration with AI and sensor systems. Growing adoption of electric over hydraulic and pneumatic actuators reflects the industry’s shift toward clean, efficient, and digitally controlled mechanisms. Expanding use in humanoid, service, and industrial robots drives innovation in compact, high-torque, and programmable actuator designs.

- For instance, Altra Industrial Motion introduced its Kollmorgen AKM2G servo actuator featuring a peak torque output of 68 Nm and a maximum speed of 8,000 rpm. The unit delivers a torque density increase of 30% over earlier generations through a high-efficiency stator design and integrated feedback encoder with 23-bit resolution.

Expanding Use in Healthcare and Service Robotics

The increasing application of robots in medical surgery, rehabilitation, and service sectors is fueling actuator demand. Robotics actuators ensure precise motion control for tasks requiring high accuracy, such as robotic-assisted surgery and patient care. The healthcare industry’s focus on automation and minimally invasive procedures supports continuous development of lightweight and reliable actuators. Service robots in hospitality and logistics are also creating new growth opportunities through automation of complex, motion-intensive tasks.

Key Trends & Opportunities

Integration of Smart and AI-Driven Actuators

The integration of AI and IoT technologies in actuators is enhancing robotic intelligence and responsiveness. Smart actuators equipped with sensors and data feedback systems enable predictive maintenance and adaptive control. These features improve robot performance in dynamic industrial environments. Manufacturers are adopting real-time monitoring to optimize power usage and extend actuator lifespan. The trend supports automation scalability across industries such as aerospace, manufacturing, and healthcare, where intelligent motion systems are becoming standard.

- For instance, ABB developed its Smart Sensor platform that monitors the condition of motors and other rotating equipment by measuring parameters like vibration and temperature. The sensor uses Bluetooth Low Energy (BLE) to transmit encrypted diagnostic data to the ABB Ability cloud, where advanced algorithms analyze it for AI-based predictive maintenance and performance optimization.

Development of Lightweight and Compact Actuators

Growing demand for mobile, collaborative, and humanoid robots is accelerating the design of lightweight and compact actuators. Miniaturization and advanced materials such as carbon composites enhance energy efficiency and payload capacity. Compact actuators enable smoother motion and better flexibility in confined spaces, particularly for surgical and service robots. Manufacturers are prioritizing modular designs to improve integration and scalability, creating opportunities for customized actuator solutions across specialized robotic applications.

- For instance, Cedrat Technologies engineered the APA95ML piezoelectric actuator weighing 160 grams while providing a blocked force of 2100 N and a nominal stroke of 99 micrometers.

Key Challenges

High Manufacturing and Integration Costs

Developing high-precision robotic actuators involves significant costs in materials, design, and testing. Integration with control systems, sensors, and power units further increases production expenses. Small and medium enterprises face barriers in adopting advanced robotics due to high upfront investments. While electric actuators reduce long-term operational costs, the initial expense of advanced motion technologies limits large-scale adoption in cost-sensitive industries.

Complex Maintenance and Reliability Issues

Robotics actuators require consistent maintenance to ensure accuracy and durability in demanding environments. Exposure to heat, vibration, and mechanical stress can lead to performance degradation. In hydraulic and pneumatic systems, leakages and pressure variations affect precision. Maintaining consistent torque output and synchronization across multiple actuators adds to complexity. Manufacturers are focusing on improving sealing technologies, diagnostics, and materials to enhance system reliability and reduce downtime.

Regional Analysis

North America

North America held a 34% share in 2024, driven by strong adoption of industrial automation and collaborative robotics across manufacturing and logistics sectors. The United States leads the region due to heavy investments in advanced robotics for automotive, aerospace, and healthcare applications. Companies are focusing on integrating AI-enabled actuators for precision and energy efficiency. Supportive government initiatives promoting smart manufacturing further strengthen the regional market. Continuous innovations in electric and smart actuators, along with growing defense and medical robotics programs, reinforce North America’s leadership in advanced motion control technologies.

Europe

Europe accounted for a 29% share in 2024, supported by the rapid adoption of robotics in automotive manufacturing, electronics assembly, and process industries. Germany, France, and the United Kingdom are key markets emphasizing automation under Industry 4.0 initiatives. The region’s strong focus on energy-efficient and sustainable actuation systems drives growth in electric actuators. European companies are also advancing robotics for healthcare and aerospace applications. Increased collaboration between research institutes and robotics manufacturers continues to promote technological innovation and strengthen the continent’s competitive position in the global robotics actuators market.

Asia-Pacific

Asia-Pacific dominated the robotics actuators market with a 32% share in 2024, driven by the expanding industrial base and rising automation in China, Japan, and South Korea. The region’s strong presence in electronics and automotive manufacturing supports large-scale adoption of robotic systems. Governments are promoting automation through initiatives like “Made in China 2025” and Japan’s robotics innovation programs. Rapid deployment of electric and miniaturized actuators in industrial robots enhances production efficiency. The emergence of domestic robotics startups and continuous investment in AI-driven automation further accelerate regional market expansion.

Middle East & Africa

The Middle East & Africa captured a 3% share in 2024, supported by growing industrial diversification and automation projects in manufacturing and energy sectors. Countries such as the UAE and Saudi Arabia are adopting robotics actuators in industrial automation and defense applications. Infrastructure modernization and investments in advanced machinery are driving demand. Africa is gradually adopting robotic technologies for mining and logistics. The expansion of smart factories and adoption of energy-efficient actuators will strengthen market potential, supported by rising awareness of automation benefits across key regional industries.

Latin America

Latin America represented a 2% share in 2024, driven by increasing automation in manufacturing, mining, and food processing industries. Brazil and Mexico lead the regional market with growing adoption of industrial and collaborative robots. Government support for modernization and rising demand for cost-efficient production processes are encouraging investment in robotics. The transition toward electric and lightweight actuators improves operational reliability across production lines. Strengthening partnerships with global robotics manufacturers and integration of smart technologies are expected to enhance automation adoption and market growth across the region in the coming years.

Market Segmentations:

By Type

By Actuation

- Electric

- Hydraulic

- Pneumatic

- Mechanical

By Application

- Landing gear

- Engine components

- Doors & interiors

- Others

By End Use

- Oil & gas

- Chemicals & CPI

- Water & wastewater

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the robotics actuators market includes key players such as Moog, Emerson Electric Co., DVG Automation, Harmonic Drive LLC, MISUMI Group Inc., Cedrat Technologies, Altra Industrial Motion, ABB, Macron Dynamics, and Curtis Wright. These companies compete by offering advanced actuation technologies with enhanced precision, torque, and energy efficiency. Leading manufacturers focus on electric and smart actuators integrated with sensors for real-time control and diagnostics. Continuous investments in R&D enable innovation in miniaturized, lightweight, and AI-compatible actuator systems. Strategic partnerships and acquisitions are expanding global footprints, particularly in the automotive, aerospace, and industrial automation sectors. Firms are emphasizing cost optimization, reliability, and compact designs to meet growing demand for high-performance actuators in collaborative and service robots. As automation adoption increases across industries, competition centers on technological advancement, motion control accuracy, and sustainable energy-efficient solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Moog

- Emerson Electric Co.

- DVG Automation

- Harmonic Drive LLC

- MISUMI Group Inc.

- Cedrat Technologies

- Altra Industrial Motion

- ABB

- Macron Dynamics

- Curtis Wright

Recent Developments

- In January 2025, Harmonic Drive LLC launched its FHA-Mini dual absolute encoder servo actuator with integrated drive: the unit includes a 14-bit (16,384 cpr) output encoder plus a 15-bit (32,768 cpr) input encoder within the same housing, while only needing four conductors for CANopen communication.

- In 2025, Moog Inc. opened a new electromechanical actuation manufacturing facility in East Aurora, New York—a 120,000 square-foot complex combining assembly, thermal/vibration test zones, and inspection space to support actuation systems for space and defence platforms.

- In 2024, Emerson Electric Co. introduced the Fisher easy-Drive 200R electric actuator for butterfly and ball valves, operating down to −40 °C, consuming less than 0.4 W in holding mode, and configured by single-button calibration via its software tool.

Report Coverage

The research report offers an in-depth analysis based on Type, Actuation, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising automation across manufacturing, logistics, and service industries.

- Electric actuators will dominate due to higher efficiency, precision, and easier integration with control systems.

- AI and IoT integration will improve actuator performance and predictive maintenance capabilities.

- Lightweight and compact actuators will gain traction in collaborative and humanoid robots.

- Increasing adoption of robotics in healthcare will drive demand for precise motion control solutions.

- Manufacturers will invest more in energy-efficient and sustainable actuator technologies.

- Asia-Pacific will remain a key growth hub with expanding industrial automation initiatives.

- Strategic partnerships between robotics manufacturers and component suppliers will strengthen innovation.

- Aerospace and defense sectors will continue to adopt actuators for high-performance robotic systems.

- Continuous advancements in materials and miniaturization will enhance actuator reliability and lifespan.