Market Overview

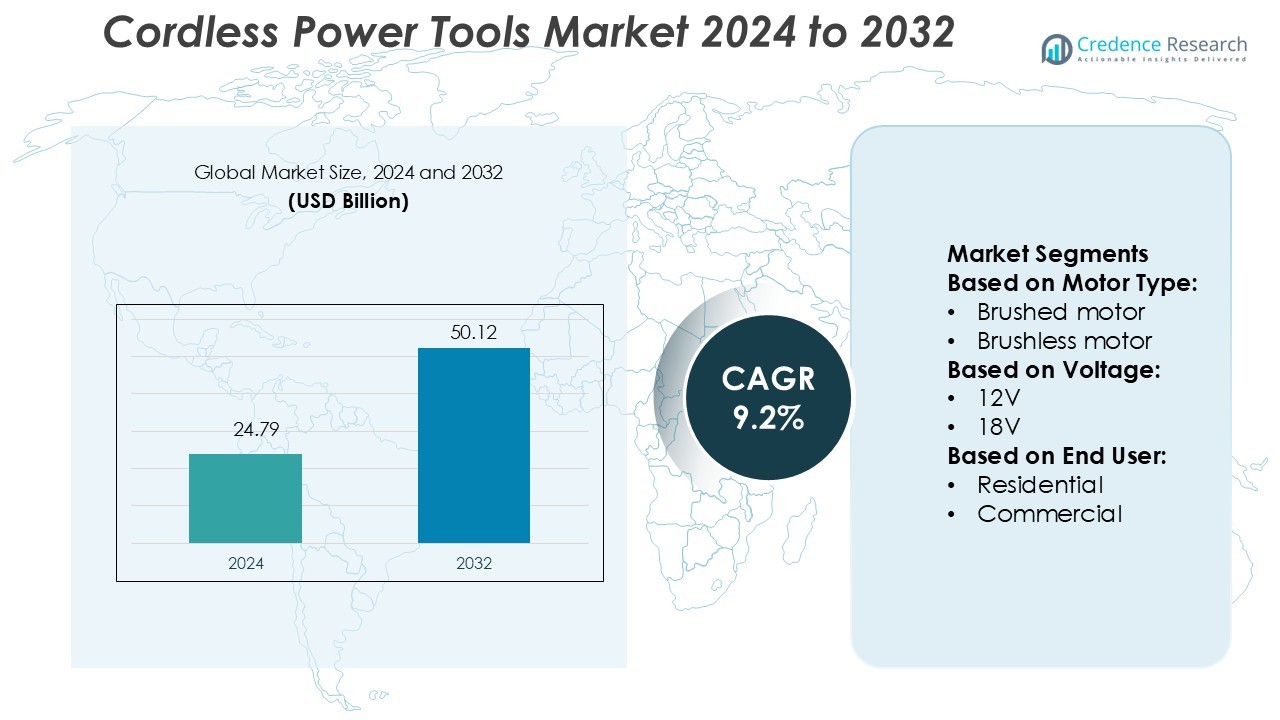

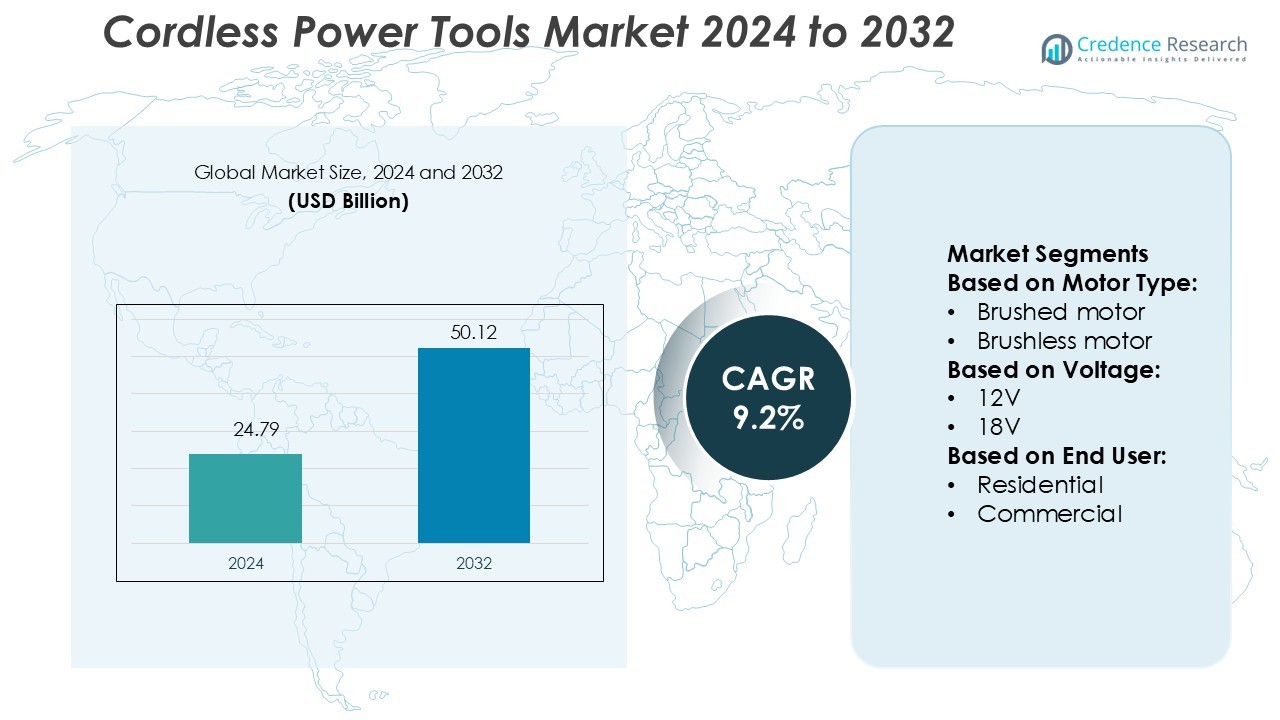

Cordless Power Tools Market size was valued USD 24.79 billion in 2024 and is anticipated to reach USD 50.12 billion by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cordless Power Tools Market Size 2024 |

USD 24.79 Billion |

| Cordless Power Tools Market, CAGR |

9.2% |

| Cordless Power Tools Market Size 2032 |

USD 50.12 Billion |

The cordless power tools market is led by top players such as Makita, Ryobi, Hilti, Dynabrade Power Tools, Robert Bosch, Festool, Apex Tool, Snap-on Tools Company, Hitachi Koki, and KEN Holding. These companies focus on continuous product innovation, improved battery technology, and the integration of smart features to enhance performance and efficiency. Their strategies include expanding product portfolios, strengthening distribution networks, and increasing investments in R&D to maintain a competitive edge. Asia Pacific dominates the market with a 34% share, driven by rapid industrialization, infrastructure development, and growing adoption across construction and manufacturing sectors, supported by strong local and global manufacturing bases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cordless power tools market size was valued at USD 24.79 billion in 2024 and is expected to reach USD 50.12 billion by 2032, registering a CAGR of 9.2% during the forecast period.

- Rising infrastructure development and growing demand from the construction and automotive industries are driving strong market growth globally.

- Technological advancements such as brushless motors, improved battery life, and smart connectivity features are reshaping the product landscape.

- Asia Pacific leads the market with a 34% share, followed by North America at 32%, supported by rapid industrialization and renovation activities.

- The brushless motor segment holds the largest share among motor types, driven by its efficiency and durability, while the 18V voltage segment remains dominant due to its balance of power and portability.

Market Segmentation Analysis:

By Motor Type

Brushless motors hold the dominant share in the cordless power tools market. This segment leads due to higher efficiency, longer lifespan, and lower maintenance compared to brushed motors. Brushless motors deliver more power output and extended battery life, making them ideal for professional and industrial use. Leading manufacturers invest in advanced motor control technologies to enhance torque and precision. The increasing shift toward compact and lightweight tools further boosts demand. Growing adoption in construction, automotive, and woodworking industries drives the segment’s continued expansion.

- For instance, Makita’s 18 V LXT® brushless impact driver XDT13Z delivers a maximum torque of 1,500 in-lbs (≈170 N·m) and a no-load speed range of 0-3,400 RPM and 0-3,600 IPM.

By Voltage

The 18V segment leads the market with the largest share. This voltage range offers the best balance between power and portability, making it popular among professional users. 18V tools support heavy-duty tasks while remaining easy to handle, enhancing productivity on job sites. Companies integrate improved lithium-ion battery packs to increase run time and reduce charging intervals. The segment benefits from wide compatibility across multiple tool categories, encouraging bulk purchases. Growing demand from the construction and renovation sectors strengthens this segment’s position in the market.

- For instance, RYOBI 18V ONE+ HP Brushless 4‑Mode ½″ Impact Wrench features up to 600 ft-lbs of breakaway torque, 450 ft-lbs of fastening torque, and delivers 3,200 IPM (impacts per minute) according to the manufacturer’s technical specification.

By End User

The industrial segment dominates the cordless power tools market with the highest share. Industrial users require high-performance tools for continuous operations in construction, manufacturing, and automotive applications. Brushless motor technology and advanced battery systems support efficient performance under demanding conditions. Many manufacturers focus on rugged, ergonomic designs and smart connectivity features to enhance durability and monitoring. Growing infrastructure development and expansion of production facilities worldwide continue to fuel demand. The segment’s focus on productivity and cost-efficiency reinforces its market leadership.

Key Growth Drivers

Rising Demand for Efficient and Portable Tools

The demand for cordless power tools is increasing as users prioritize mobility and ease of use. Professionals in construction, automotive, and manufacturing prefer cordless models due to their flexibility and reduced downtime. Advanced lithium-ion batteries enable longer operating hours and faster charging. Brushless motor technology further boosts power output and energy efficiency. These advantages reduce operational costs and improve productivity. Expanding infrastructure and repair projects in developing economies significantly contribute to the rising demand for cordless solutions.

- For instance, Hilti’s cordless hammer drill-drivers, such as the SF 6H-22, use the Nuron 22V battery platform and can generate a maximum hard-joint torque of 85 Nm (approximately 752 in-lb) for heavy-duty applications.

Expansion of Construction and Industrial Sectors

Rapid urbanization and growing infrastructure investments are key drivers of market growth. Cordless power tools are widely used in residential, commercial, and industrial construction for drilling, fastening, and cutting applications. Contractors prefer these tools for their ease of handling, safety, and durability. Government spending on smart cities, transport networks, and energy infrastructure accelerates adoption. Industrial manufacturing facilities are also upgrading to advanced tools to improve efficiency and reduce downtime. This sector-wide modernization supports strong long-term demand for cordless power tools.

- For instance, Dynabrade, Inc. manufactures the Autobrade red 3-inch Long-Neck Cut-Off Tool (model 18075), which features a 20,000 RPM motor. This tool’s long-neck extension allows it to be used for cutting in hard-to-reach and confined areas, including applications like weld-flange cuts.

Technological Advancements in Power Tool Design

Ongoing advancements in motor technology, battery capacity, and ergonomic design strengthen the market. Manufacturers integrate IoT connectivity, smart sensors, and Bluetooth-enabled controls to enhance tool performance and maintenance monitoring. Improved brushless motors offer longer lifespans and higher torque levels. Compact and lightweight designs increase user comfort during extended use. Battery innovations, such as fast-charging and high-energy density packs, further enhance productivity. These innovations make cordless power tools more attractive across professional and DIY applications, driving global market expansion.

Key Trends & Opportunities

Growing Shift Toward Brushless Motor Technology

Brushless motor adoption is a strong trend shaping product development. These motors offer higher efficiency, lower heat generation, and extended tool life. Manufacturers increasingly replace brushed motors to meet industrial and commercial performance demands. The technology also enables compact tool designs without compromising output. This shift aligns with sustainability goals by reducing energy use. Rising acceptance in high-performance applications creates strong opportunities for product differentiation and premium pricing in the global market.

- For instance, Bosch GSR18V-400B12 18V Compact Brushless Drill/Driver features a brushless motor delivering up to 400 in-lbs of torque and a no-load speed range of 0–1,900 rpm, according to the manufacturer’s specifications.

Integration of Smart and Connected Features

Smart technologies are becoming a key differentiator in cordless power tools. IoT-enabled platforms allow real-time performance monitoring, remote diagnostics, and usage tracking. Connected tools support predictive maintenance, reducing unplanned downtime. Integration with mobile apps enhances safety and operator control. Manufacturers focus on data-driven improvements to increase productivity in industrial applications. These innovations create opportunities for premium offerings and recurring service-based revenue models.

- For instance, HiKOKI is a manufacturer of power tools and offers a range of cordless impact wrenches. The WR36DA is explicitly listed as a 36V MULTI VOLT™ impact wrench.

Expansion of DIY and Home Improvement Activities

The growing trend of DIY projects is boosting cordless power tool adoption among residential users. Consumers prefer lightweight and easy-to-use products for home renovations, gardening, and repair tasks. E-commerce platforms expand access to a wide product range, improving affordability. Marketing campaigns targeting hobbyists and casual users further strengthen sales. This trend offers strong growth opportunities for mid-range cordless power tools designed for non-professional use.

Key Challenges

High Initial Cost of Advanced Tools

Cordless power tools with brushless motors and smart features often have higher upfront costs than conventional wired tools. This limits adoption among price-sensitive consumers and small contractors. Battery replacement expenses also add to the total cost of ownership. Many buyers delay upgrades due to these financial barriers, particularly in developing markets. Manufacturers face the challenge of balancing performance enhancements with competitive pricing to expand market penetration.

Limited Battery Life and Performance Concerns

Despite technological improvements, battery performance remains a major challenge in continuous-use environments. Prolonged tasks may require frequent recharging or multiple battery packs, raising operational costs. High-load applications can also strain battery efficiency, leading to reduced runtime. Environmental conditions such as extreme temperatures affect battery performance further. Manufacturers must focus on improving energy density, thermal stability, and charging speed to address these limitations and maintain customer trust.

Regional Analysis

North America

North America holds a 32% share of the cordless power tools market, supported by strong construction and renovation activity. High adoption in residential and commercial projects drives tool demand. Professional users increasingly prefer cordless solutions for their mobility and efficiency. The presence of major manufacturers, advanced distribution networks, and steady industrial investments strengthen the region’s market position. Rapid infrastructure modernization and smart home upgrades further boost sales. Technological advancements and early adoption of brushless motor tools maintain North America’s dominance in this segment.

Europe

Europe accounts for a 27% market share, driven by industrial automation and stringent safety standards. The region shows strong demand from construction, automotive, and manufacturing sectors. Increasing renovation activities and green building initiatives fuel cordless tool adoption. Leading manufacturers emphasize energy-efficient and ergonomic tool designs to meet regulatory standards. Growth is supported by the region’s advanced infrastructure and expanding trade activities. The shift toward smart and connected tools enhances productivity and strengthens the competitive landscape across key European markets, including Germany, the UK, and France.

Asia Pacific

Asia Pacific leads the market with a 34% share, driven by rapid industrialization, urbanization, and rising infrastructure investments. Countries such as China, India, and Japan contribute significantly to tool demand. Expanding construction projects and strong government spending on transport and housing boost adoption. Affordable pricing and increasing DIY activities among homeowners further support growth. The region’s large manufacturing base enables competitive pricing and faster innovation cycles. Rapid integration of advanced technologies like brushless motors enhances productivity, making Asia Pacific the most dynamic regional market.

Latin America

Latin America holds a 4% share of the cordless power tools market, with growth supported by expanding construction and industrial development. Rising investment in commercial buildings, energy infrastructure, and renovation projects boosts demand. Brazil and Mexico lead regional consumption, benefiting from growing contractor networks. Manufacturers are focusing on affordable product ranges and strengthening distribution networks to capture mid-income users. Although market penetration is lower than in developed regions, increasing urbanization and infrastructure modernization present significant future opportunities for cordless tool adoption.

Middle East & Africa

The Middle East & Africa region represents a 3% market share, with growth driven by large-scale construction and infrastructure projects. Ongoing development of smart cities, transportation networks, and energy facilities supports tool demand. The UAE, Saudi Arabia, and South Africa are key contributors to regional growth. Market players are expanding distribution channels and introducing durable tools suited for harsh environments. The increasing focus on renewable energy projects also supports long-term demand. While overall adoption remains at an early stage, strong investment trends create promising future opportunities for cordless power tools.

Market Segmentations:

By Motor Type:

- Brushed motor

- Brushless motor

By Voltage:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The cordless power tools market is shaped by key players such as Makita, Ryobi, Hilti, Dynabrade Power Tools, Robert Bosch, Festool, Apex Tool, Snap-on Tools Company, Hitachi Koki, and KEN Holding. The cordless power tools market is highly competitive, driven by rapid technological advancements and rising demand across industries. Manufacturers focus on enhancing battery performance, extending tool life, and improving efficiency through advanced motor technologies. Many companies are integrating smart features like IoT connectivity, digital monitoring, and predictive maintenance to gain a competitive edge. Product differentiation, strong brand positioning, and effective distribution networks play a key role in market leadership. Companies also emphasize expanding their presence in emerging economies through localized production and pricing strategies. Sustainability, ergonomic designs, and enhanced user safety remain central to maintaining customer loyalty and market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Makita

- Ryobi

- Hilti

- Dynabrade Power Tools

- Robert Bosch

- Festool

- Apex Tool

- Snap-on Tools Company

- Hitachi Koki

- KEN Holding

Recent Developments

- In September 2024, Milwaukee Tool introduced next-generation deep cuts and band saws that deliver better user-cutting performance. The new band saws cut 4-inch black iron pipes 20% faster than old ones.

- In February 2024, Alpha and Omega Semiconductor Limited (AOS) has released the AOZ32063MQV gate driver for BLDC motor applications. AOS is a designer, developer, and worldwide provider of a comprehensive range of discrete power devices, wide band gap power devices, power management ICs, and modules.

- In January 2024, Bosch Power Tools plans to introduce more than thirty new cordless items, therefore expanding its range of cordless tools and accessories. During the 2024 World of Concrete Conference in Las Vegas, NV, this new product range and time-honored favorites will be displayed.

- In October 2023, Stanley Black & Decker Philippines collaborated with Wilcon Depot to launch Dewalt Cordless Power Tools that has improved ergonomics with well-balanced design and user-friendly grip with brushless motors for superior performance. These tools will be retailed in all Wilcon Depot stores across the country.

Report Coverage

The research report offers an in-depth analysis based on Motor Type, Voltage, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see higher adoption of brushless motor tools for improved performance.

- Battery technology advancements will extend runtime and reduce charging time.

- Smart and connected tools will gain traction in industrial and commercial sectors.

- Demand from construction, automotive, and manufacturing industries will continue to grow.

- DIY and home improvement activities will drive steady sales in residential applications.

- Companies will expand product lines to offer more lightweight and ergonomic designs.

- Sustainability goals will push the development of energy-efficient power tools.

- Expansion into emerging markets will boost global distribution and accessibility.

- Integration of digital monitoring features will enhance operational efficiency.

- Strategic collaborations and product innovation will strengthen competitive positioning.