Market Overview

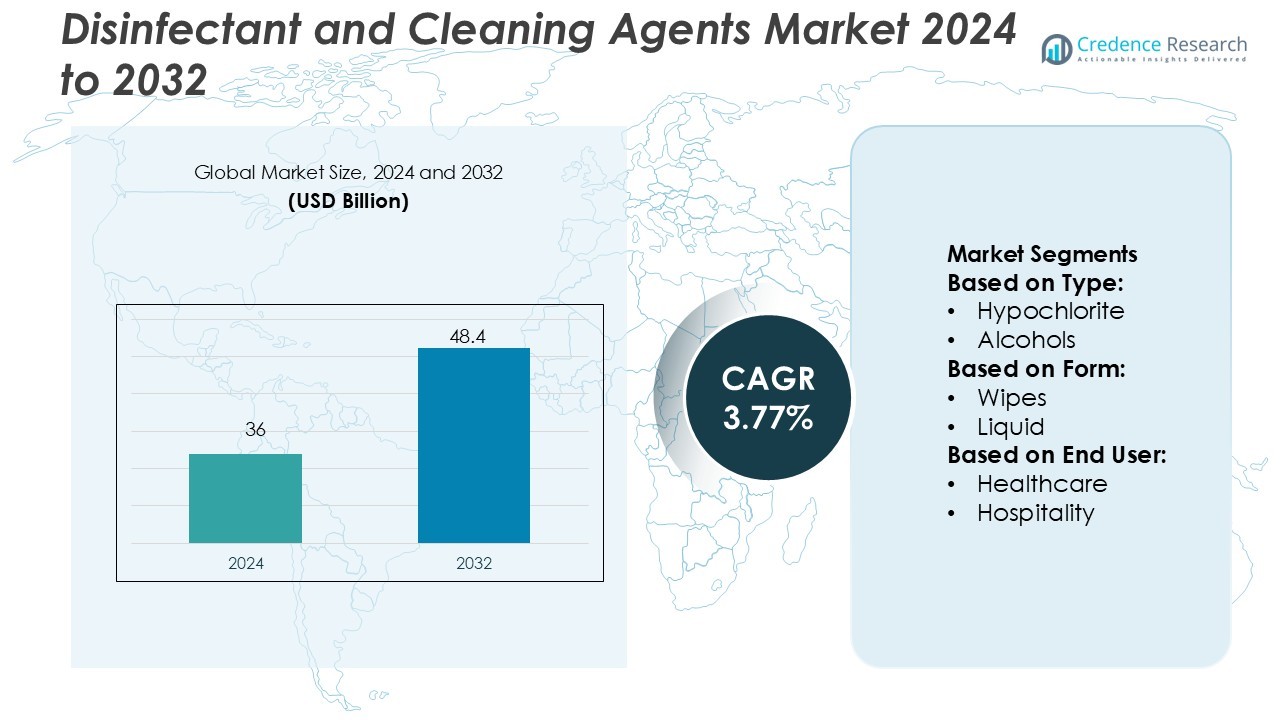

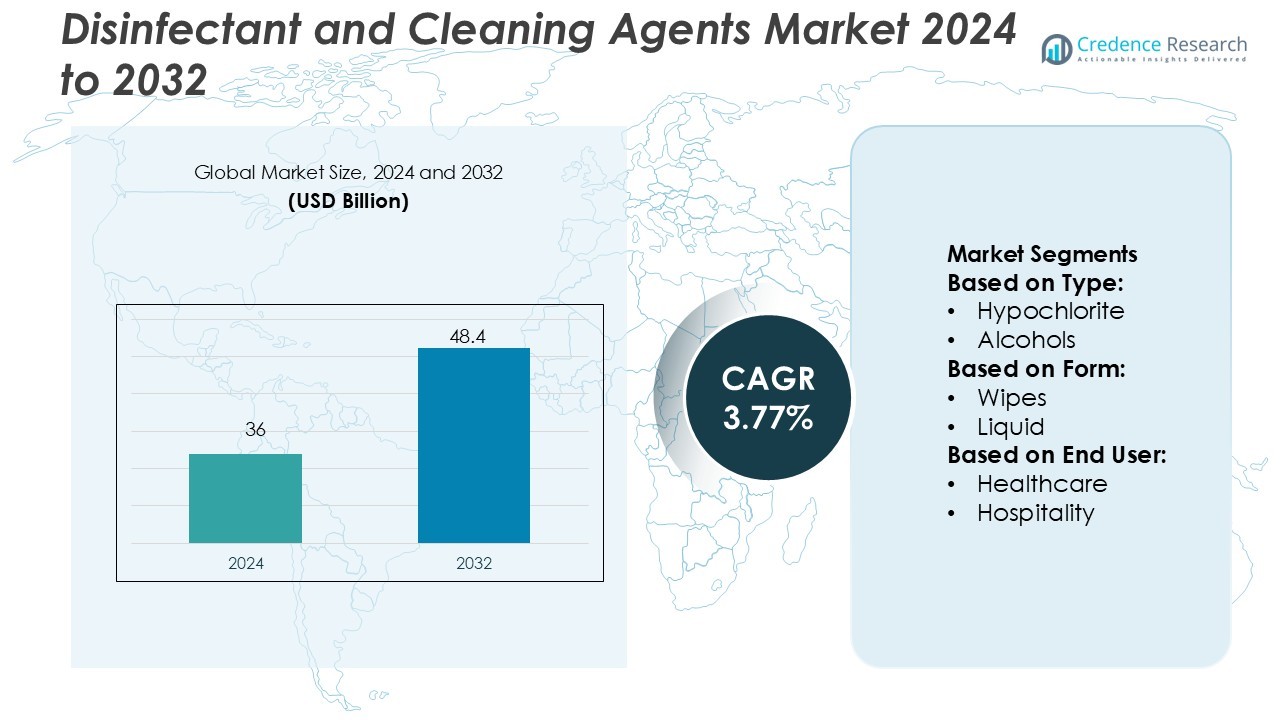

Disinfectant and Cleaning Agents Market size was valued USD 36 billion in 2024 and is anticipated to reach USD 48.4 billion by 2032, at a CAGR of 3.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disinfectant and Cleaning Agents Market Size 2024 |

USD 36 Billion |

| Disinfectant and Cleaning Agents Market, CAGR |

3.77% |

| Disinfectant and Cleaning Agents Market Size 2032 |

USD 48.4 Billion |

The Disinfectant and Cleaning Agents Market is led by strong global brands that focus on high-efficiency, fast-acting formulations for medical, commercial, and household use. Companies invest in safer, low-toxic and eco-friendly products to comply with hygiene regulations and shifting consumer preferences. The market also benefits from large distribution networks, brand awareness, and continuous product innovation, especially for hospital-grade disinfectants and multi-surface cleaners. Asia-Pacific remains the leading region with a 38% market share, driven by rapid industrial growth, healthcare expansion, and strong consumer demand for surface sanitization across homes, workplaces, and public facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Disinfectant and Cleaning Agents Market was valued at USD 36 billion in 2024 and will reach USD 48.4 billion by 2032, at a CAGR of 3.77%.

- Rising healthcare demand, stringent sanitation rules, and hospital-grade disinfectants drive market expansion, supported by high usage in food processing, retail, and households.

- Leading companies introduce eco-friendly, low-toxic, and fast-acting formulas as consumers shift toward safer products; strong advertising and large distribution networks add to competitive strength.

- High product cost, chemical toxicity concerns, and regulatory approvals slow adoption in price-sensitive markets, while biodegradability and safety remain key challenges for manufacturers.

- Asia-Pacific leads with a 38% market share, followed by North America at 32%; liquid disinfectants remain the dominant segment because hospitals, commercial facilities, and homes prefer easy-to-use products with wide surface coverage and fast action.

Market Segmentation Analysis:

By Type

Chemical-based disinfectants held the largest share due to strong pathogen removal, long shelf life, and broad compatibility with surfaces. Quaternary ammonium compounds lead this category with high usage in hospitals, food processing, and commercial spaces. Alcohols and hypochlorite remain essential for fast-acting surface sanitation, while peroxides and aldehydes serve high-risk infection control. Growth is driven by strict hygiene rules, hospital-acquired infection prevention, and increased cleaning frequency in offices and transit hubs. Bio-based disinfectants are gaining demand in schools and homes, pushed by rising preference for non-toxic and eco-friendly products.

- For instance, Lanxess AG’s Rely+On™ Virkon achieves complete inactivation of tested enveloped viruses (such as SARS-CoV-2) within 60 seconds at a 1:100 dilution and has a documented active ingredient content of approximately 49.7% potassium peroxymonosulfate, with an available oxygen content of 10.49%, enabling its validated use for disinfecting hard surfaces in healthcare and livestock environments.

By Form

Liquid disinfectants accounted for the dominant share, supported by large use in healthcare, industrial cleaning, and institutional sanitation. Liquids offer better dilution control, deeper penetration, and compatibility with sprayers and automated cleaning systems. Wipes continue to rise in personal and commercial settings due to single-use convenience and controlled dosage. Spray formats grow with domestic cleaning demand and contact-less application. Product innovation in scented, low-residue, and quick-dry formulas supports adoption across public facilities, airports, and retail spaces.

- For instance, Neogen’s Synergize® multipurpose disinfectant-cleaner in liquid format uses a dilution rate of 0.5 oz per gallon (≈4 mL per litre) for general use and 3.8 oz per 10,000 ft² (≈24 mL per litre) for hatchery fogging.

By End User

Healthcare remained the leading end-use segment with the highest market share, pushed by strict disinfection standards and continuous cleaning cycles in hospitals, clinics, and diagnostic centers. The need to prevent healthcare-associated infections drives bulk consumption of chemical-based liquids and surface wipes. The hospitality and food & beverage sectors adopt high-grade disinfectants to meet food safety norms and guest hygiene expectations. Residential usage continues to expand as consumers prioritize home sanitation and surface protection, boosting sales of multi-surface sprays and wipes.

Key Growth Drivers

Rising Hygiene Awareness and Infection Control

Growing hygiene awareness across residential, commercial, and industrial areas pushes demand for strong disinfectant and cleaning agents. Hospitals, food processors, and public facilities follow stringent sanitation standards to limit cross-contamination and pathogen spread. Frequent cleaning routines, surface disinfection, and sanitation audits increase product consumption across high-traffic zones. Government-led sanitation campaigns and strict workplace infection control frameworks further support product adoption. Manufacturers respond with value-added solutions like multi-surface cleaners, eco-safe formulations, and longer-acting antimicrobial products. These factors steadily expand product penetration across both developed and emerging markets.

- For instance, Huntsman’s textile division introduced AVITERA® SE dyes that reduce production water and energy usage by up to 50% and increase mill throughput by up to 25% or more compared to conventional dyeing processes.

Expansion of Healthcare, Food Processing, and Hospitality

The healthcare, food processing, and hospitality sectors remain major users of cleaning agents due to strict hygiene regulations. Hospitals depend on surface disinfectants, enzymatic cleaners, wipes, and sterilizing liquids to ensure safe patient environments. Food processors use industrial cleaners to maintain equipment hygiene and avoid microbial contamination in production lines. Hotels, restaurants, and commercial kitchens invest in powerful degreasers and antibacterial surface cleaners to maintain customer safety. Rapid infrastructure growth, rising food exports, and expanding medical facilities increase product usage across these sectors, boosting overall market growth.

- For instance, NICCA’s NICCANON RB-560 finishing agent achieves a high antiviral effect on polyester, cotton, and nylon, and maintains antiviral performance after repeated washing cycles (per ISO 18184 tests).

Innovation in Eco-friendly and Bio-based Products

Growing environmental concerns encourage the shift toward bio-based, non-toxic, and biodegradable disinfectants. Consumers and institutions prefer plant-derived formulas that carry low chemical residue and meet global safety standards. Manufacturers invest in natural antimicrobials, enzyme-based cleaning solutions, and green certifications to attract buyers. Regulations limiting hazardous chemicals like VOCs and chlorine-based agents speed up this transition. The rise of concentrated liquids, reusable packaging, and refill systems also reduce waste. These sustainability-driven innovations create new market opportunities and expand product offerings for environmentally focused buyers.

Key Trends & Opportunities

Growth of Ready-to-Use Wipes and Sprays

Ready-to-use disinfectant wipes and sprays gain strong demand due to convenience and single-use hygiene appeal. Offices, public transport, healthcare centers, and households use portable wipes for fast cleaning without dilution or mixing. The trend supports premium-priced products with pleasant fragrances, non-corrosive formulations, and streak-free performance. Manufacturers also launch alcohol-free, baby-safe, and food-contact-safe variants. Customized packaging in sachets, canisters, and bulk dispensers opens new B2B opportunities.

- For instance, Archroma’s NTR Printing System uses renewable feedstock in pigment, binder, and fixing agents; the pigment black component PrintoFix BLACK NTR-TF achieves 79 % renewable carbon content.

Automation and Smart Cleaning Technologies

Automation supports large-scale sanitization in commercial and industrial settings. Autonomous floor scrubbers, electrostatic sprayers, and robotic cleaning equipment improve efficiency and reduce labor dependence. These machines use controlled chemical dispensing and optimized spray patterns to cut wastage. IoT-enabled cleaning systems track usage, chemical levels, and disinfection cycles in real time. The integration of automation creates new supply opportunities for chemical manufacturers and equipment suppliers.

- For instance, Sumitomo’s COMFORMER® resin is a phase-change material integrated into fiber form (not microcapsulated) that can absorb and release heat in the 20-50 °C range and still be processed via melt spinning.

Bio-based and Non-toxic Chemical Alternatives

Natural and plant-based ingredients create new value in homecare and institutional cleaning. Citrus extracts, enzymes, essential oils, and botanical antimicrobials replace harsh chemicals in surface cleaners. These products serve sensitive environments like childcare centers, food zones, and healthcare units. The opportunity grows as retailers stock eco-labeled products and governments promote safer cleaning practices. The rising demand for dermatologically safe, low-allergen, and fragrance-free formulas broadens product range, attracting health-conscious users.

Key Challenges

Stringent Regulatory Approvals

Disinfectant and cleaning agents must comply with chemical safety, toxicity, and environmental standards. Registration requirements, mandatory testing, and formulation restrictions increase product launch timelines and cost. Bans on harmful chemicals and persistent organic pollutants require constant reformulation. Manufacturers must invest in R&D, specialized testing, and compliance audits. Small producers struggle to meet global and regional regulations, limiting their competitiveness.

High Competition and Price Sensitivity

The market contains many small and large players offering similar products, leading to price competition. Bulk buyers in healthcare, hospitality, and facility management often negotiate low-cost contracts. Private-label brands further pressure premium manufacturers. Companies need differentiation through performance claims, scent innovations, eco-certifications, and multipurpose use. High marketing expenses and supply chain fluctuations increase cost burden. Without clear value-added features, margins shrink and customer retention becomes difficult.

Regional Analysis

North America

North America holds a market share of 32% in the Disinfectant and Cleaning Agents Market. Demand rises due to strict hygiene policies in hospitals, food processing plants, and public facilities. The United States leads adoption, supported by advanced surface sanitizers, eco-friendly solutions, and strong commercial cleaning activities. Rising infection-control programs and household disinfection habits also support sales. Key manufacturers invest in biodegradable chemicals and high-efficacy formulations that meet EPA and FDA standards. Growth remains steady because public awareness of health threats continues to influence buying patterns across residential and commercial sectors.

Europe

Europe accounts for a market share of 28%, driven by strong regulations on hygiene, workplace safety, and product quality. Countries like Germany, France, and the U.K. lead consumption due to strong healthcare infrastructure and food safety enforcement. Consumers prefer non-toxic, fragrance-free, and biodegradable options made from plant-based chemicals. The hospitality and tourism sector also boosts demand for advanced cleaners used in hotels, airports, and retail centers. EU industrial cleaning standards push companies to innovate in low-VOC chemical formulations. Continuous product certification and sustainability goals help the region maintain stable market demand.

Asia-Pacific

Asia-Pacific leads the global market with the largest market share of 38%. Growth is driven by rising healthcare spending, urbanization, and rapid expansion of food service chains. Countries such as China, Japan, and India invest in commercial disinfection for schools, offices, hospitals, and public transit. Government cleanliness campaigns and increasing household hygiene awareness push cleaning agent adoption. Local manufacturers supply large volumes at competitive prices, while international brands expand through distribution partnerships. Industrial growth and strict infection-control practices after COVID-19 continue to raise demand across commercial and residential sectors.

Latin America

Latin America holds a market share of 6%, supported by growing sanitation awareness in homes, clinics, and food service outlets. Brazil and Mexico lead adoption because of rising consumer awareness and stronger retail availability of disinfectant sprays, wipes, and liquids. Public hygiene programs encourage frequent cleaning in schools, supermarkets, and transport hubs. Many buyers choose cost-effective chlorine-based cleaners, but demand for biodegradable and scented products is growing. Expansion of hospitals and diagnostic labs also supports market progress. Local producers compete with global brands through affordable packaging formats and bulk supplies.

Middle East & Africa

The Middle East & Africa accounts for a market share of 4%. GCC countries lead adoption due to strict hygiene rules in commercial buildings, hospitals, and hotels. Demand grows for disinfectant wipes, strong antimicrobial sprays, and surface sanitizers used in public facilities. Africa shows rising usage as healthcare investments expand and sanitation programs improve. Suppliers focus on high-performance liquid cleaners that work in harsh climates and dusty environments. International brands continue to grow through retail penetration, while local manufacturers offer affordable cleaning chemicals, helping increase product availability across households and small businesses.

Market Segmentations:

By Type:

By Form:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Disinfectant and Cleaning Agents Market players such as Cantel Medical, Lanxess AG, Neogen Corp, Proctor & Gamble, STERIS Plc, Dupont, 3M Group, The Clorox Company, Ecolab, and Reckitt Benckiser Group. The Disinfectant and Cleaning Agents Market remains highly competitive, driven by rapid product innovation, regulatory compliance, and strong brand recognition. Companies focus on developing high-performance disinfectants with quick action, low toxicity, and compatibility across healthcare, food processing, and residential applications. Many firms invest in eco-friendly, biodegradable, and plant-based formulations to meet rising sustainability demand. Strict hygiene standards in hospitals, public facilities, and commercial buildings further increase the need for advanced cleaning solutions. Leading brands expand through partnerships, acquisitions, and retail penetration, especially in high-growth regions across Asia-Pacific and Latin America. Product certification, efficient supply chains, and large distribution networks help key competitors strengthen their global positioning.

Key Player Analysis

- Cantel Medical

- Lanxess AG

- Neogen Corp

- Proctor & Gamble

- STERIS Plc

- Dupont

- 3M Group

- The Clorox Company

- Ecolab

- Reckitt Benckiser Group

Recent Developments

- In May 2025, HF Foods Groups Inc., unveiled that they are expanding their digital presence by launching a new online platform specifically designed for restaurant staff, along with a group of targeted consumers.

- In February 2025, Unifi, Inc. launched Integr8™, a spandex-free stretch yarn made with REPREVE® recycled polyester. It offered softness, moisture management, and advanced functionality, positioning it as one of the most versatile and sustainable yarns in the textile industry.

- In September 2023, Yoplait expanded its product offering by launching high-protein yogurt products under its SKYR Energy brand.

- The new product line is high in protein, fat-free, made to an original Icelandic recipe, and is the first Skyr product to contain real fruit pieces.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong demand from hospitals, clinics, and diagnostic centers due to strict hygiene protocols.

- Consumer awareness of home and surface disinfection will continue to support sales in household cleaning products.

- Eco-friendly, plant-based, and non-toxic cleaners will gain popularity as buyers shift toward safer formulations.

- Manufacturers will focus on fast-acting disinfectants with broad-spectrum antimicrobial action to meet industrial needs.

- Automated and touchless dispensing systems will expand in offices, airports, and public spaces.

- Growth in food processing and retail chains will drive demand for certified surface sanitizing agents.

- Online retail and direct-to-consumer channels will become stronger sales routes for packaged cleaners.

- Technology-driven product innovations will improve stain removal, odor control, and germ-killing efficiency.

- Companies will expand in emerging markets through localized production and affordable packaging sizes.

- Sustainability initiatives will encourage recyclable packaging and reduced chemical emissions in manufacturing.