Market Overview:

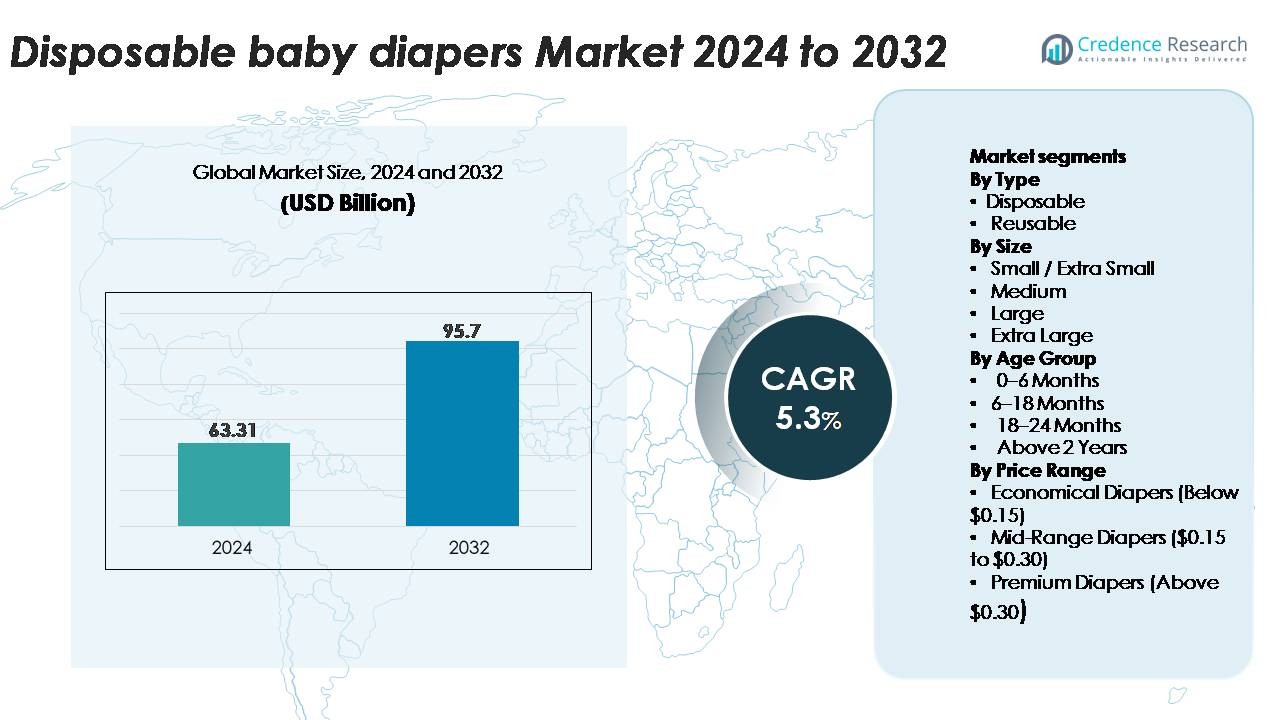

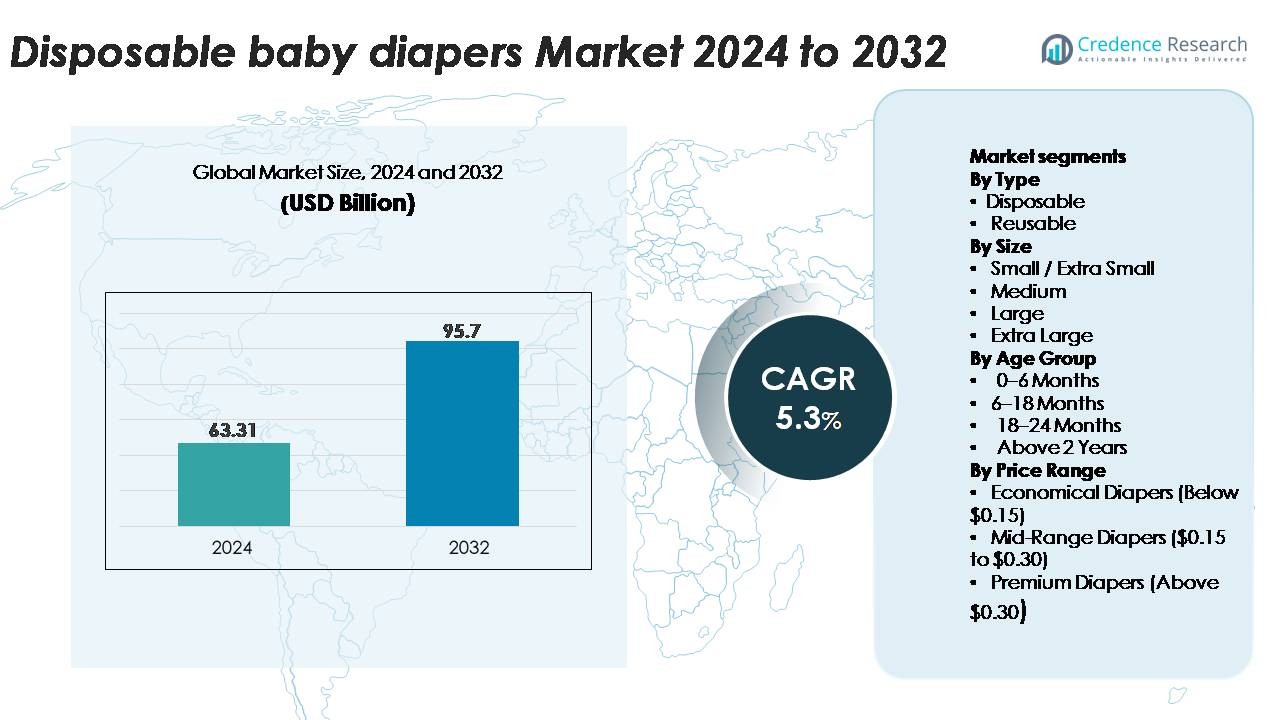

The global disposable baby diapers market was valued at USD 63.31 billion in 2024 and is projected to reach USD 95.70 billion by 2032, expanding at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Baby Diapers Market Size 2024 |

USD 63.31 Billion |

| Disposable Baby Diapers Market, CAGR |

5.3% |

| Disposable Baby Diapers Market Size 2032 |

USD 95.70 Billion |

The disposable baby diapers market is highly competitive, led by major global companies including Ontex Group, Johnson & Johnson, Hengan International, Kao Corporation, The Honest Company, Inc., First Quality Enterprises, Essity AB, Kimberly-Clark Corporation, The Procter & Gamble Company (P&G), Unicharm Corporation, and The Hain Celestial Group Inc. These brands compete through innovation in absorbent core technologies, skin-friendly materials, and premium comfort features across multiple price tiers. Asia-Pacific remains the leading regional market with around 38% share, driven by large infant populations, rapid urbanization, and expanding retail networks, while North America and Europe collectively contribute strong demand for premium and eco-friendly diaper solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global disposable baby diapers market was valued at USD 63.31 billion in 2024 and is projected to reach USD 95.70 billion by 2032, expanding at a CAGR of 5.3% during the forecast period.

- Market growth is driven by rising infant populations, increased hygiene awareness, and strong adoption of premium diapers with enhanced absorbency, breathability, and skin-protection features across both developed and emerging markets.

- Key trends include the shift toward eco-friendly, plant-based, and biodegradable diapers, along with growing demand for ultra-thin cores, pant-style formats, and smart moisture-monitoring technologies.

- Competition intensifies as global leaders such as P&G, Kimberly-Clark, Unicharm, Kao, and Essity expand portfolios, while regional and private-label brands gain traction through cost-effective offerings and localized product innovations.

- Asia-Pacific leads with 38% regional share, followed by North America at 28% and Europe at 24%; by segment, disposable diapers dominate with over 85% share, while medium size remains the most widely used due to high consumption during 6–18 months.

Market Segmentation Analysis:

By Type

Disposable diapers remain the dominant type in the baby diaper market, accounting for over 85% of total market share, driven by strong consumer preference for convenience, hygiene assurance, and rapid absorption technologies. Their widespread adoption is supported by continuous product innovation, such as thinner cores, breathable materials, and wetness indicators that enhance comfort and ease of use. Reusable diapers continue to grow but hold a comparatively smaller share due to higher maintenance requirements. However, rising eco-consciousness and the availability of modern cloth diapering systems are enabling gradual adoption among sustainability-focused parents.

- For instance, Procter & Gamble’s Pampers Swaddlers incorporate an Ultra-Absorb Core capable of locking in wetness for up to 12 hours and use a BreatheFree Liner with Air Channels to improve airflow, reinforcing the appeal of premium disposable formats.

By Size

Medium-size diapers represent the largest market share at approximately 40%, supported by high usage frequency during the 6–18-month growth phase when babies exhibit increased mobility and require superior absorbency solutions. This segment benefits from product innovations such as stretchable waistbands, improved leak guards, and multi-layer core technologies tailored for active infants. Small/Extra Small and Large sizes follow in share, reflecting their shorter usage cycles. Extra Large sizes grow steadily as manufacturers expand offerings for toddlers transitioning through extended diaper-wearing stages, driven by improved comfort-fit designs and overnight protection features.

· For instance, Huggies Little Movers incorporate a DryTouch® Liner that absorbs wetness on contact and feature a contoured shape with a stretchy SnugFit waistband and Double Grip Strips for a better fit during movement.

By Age Group

The 6–18 Months age group leads the market with over 45% share, driven by peak diaper consumption during this developmental period when babies require frequent changes due to increased activity and feeding cycles. Manufacturers focus on creating highly absorbent, rash-resistant products that cater to longer wear times and better mobility support. The 0–6 Months group follows, backed by demand for ultra-soft, sensitive-skin diapers. Usage tapers in the 18–24 Months and Above 2 Years segments, though demand persists for pant-style diapers offering toilet-training convenience and enhanced overnight leakage protection.

Key Growth Drivers

Rising Birth Rates and Expanding Infant Population

Rising birth rates in developing economies and an expanding infant population continue to be major forces propelling the disposable baby diapers market. Countries across Asia, Africa, and Latin America experience rapid demographic growth, directly increasing diaper consumption across all income groups. Governments promoting maternal and child health programs also strengthen awareness around infant hygiene and diaper usage, especially in rural and semi-urban areas. Additionally, the growing participation of women in the workforce drives higher adoption of disposable diapers due to convenience, reduced time for laundry, and enhanced hygiene compared to reusable alternatives. Premiumization trends further amplify this demand as parents increasingly prefer ultra-soft, dermatologically tested, and highly absorbent diapers to ensure skin protection and uninterrupted sleep. Collectively, these demographic and behavioural factors sustain long-term demand for disposable diapers across global markets.

- For instance, Unicharm’s MamyPoko Pants feature an absorbent core that is advertised to provide up to 12 hours of absorption or overnight protection. This is achieved using a “widespread crisscross sheet” or a 3-layer deep absorption system that can soak up to seven glasses of urine and spread it evenly to prevent heaviness and leakage.

Advancements in Absorbent Core and Skin-Friendly Materials

Technological advancements in absorbent core design and skin-friendly materials significantly strengthen market expansion by improving product performance and user comfort. Modern diapers increasingly incorporate superabsorbent polymers, channel-based distribution layers, and air-breathable films that allow faster liquid absorption and extended dryness. These innovations reduce leakage incidents, support overnight usage, and enhance mobility for active infants. Simultaneously, manufacturers focus on hypoallergenic and plant-based materials to minimize skin irritation and improve suitability for sensitive skin, aligning with rising parental concern for infant wellness. The integration of odor-neutralizing compounds, wetness indicators, and flexible waistband structures further improves the overall user experience. These product enhancements encourage parents to shift from basic diaper formats to premium, feature-rich alternatives, creating strong value-driven growth across all distribution channels.

· For instance, Kimberly-Clark’s Huggies® Special Delivery™ diapers use a plant-based topsheet and a core made with responsibly sourced plant-derived materials (specifically, 20%+ by weight, derived from sources like sugarcane and fluff pulp). They feature a fast-absorbing core engineered to lock away moisture and provide up to 12 hours of protection, ensuring dryness and reducing skin contact with irritants.

Expansion of Modern Retail and E-Commerce Distribution

The rapid expansion of modern retail formats hypermarkets, supermarkets, baby specialty stores, and pharmacy chains continues to amplify diaper accessibility and visibility, driving higher adoption across urban and semi-urban populations. Organized retail channels provide consistent product availability, promotional pricing, and better customer engagement, which elevate brand switching and exposure to premium offerings. Parallelly, e-commerce plays an increasingly transformative role, particularly in high-growth markets where online grocery and baby-care platforms offer subscription models, doorstep delivery, and multi-pack discounts. Digital retail also enables parents to compare features, read verified reviews, and access niche or eco-friendly diaper brands not widely available offline. These omnichannel developments fundamentally reshape consumer buying behaviour, improving product reach and reinforcing long-term market expansion.

Key Trends & Opportunities:

Growth of Eco-Friendly, Biodegradable, and Plant-Based Diapers

The industry experiences a strong shift toward eco-friendly, biodegradable, and plant-based diaper solutions as sustainability gains prominence in consumer purchasing decisions. Manufacturers increasingly explore renewable materials such as bamboo fiber, sustainably sourced pulp, and corn-based biopolymers to reduce the environmental footprint of disposable diapers. This trend opens significant opportunities for brands positioned around clean-label, toxin-free, and biodegradable diaper technologies. Regulatory pressure to reduce plastic waste further accelerates innovation, particularly in Europe and North America. The growing willingness of parents to invest in safer, environmentally responsible alternatives enables companies to develop differentiated product lines, premium pricing strategies, and new revenue streams within the green baby-care segment.

- For instance, Essity’s Eco by Libero diapers incorporate a plant-based topsheet made with over 50% renewable materials and use FSC-certified pulp, while Dyper’s compostable diapers contain up to 90% plant-derived components and are supported by a nationwide composting program processing thousands of tons of diaper waste annually.

Premiumization Supported by Smart Diaper Technologies

Premiumization remains a strong trend as consumers prioritize product quality, comfort, and performance over price sensitivity. Innovations such as moisture-locking channels, temperature-regulating fabrics, and ultrasoft topsheets position premium diapers as superior hygiene solutions for modern parenting needs. An emerging opportunity lies in smart diaper technologies, where embedded sensors monitor moisture levels, temperature changes, and urinary biomarkers, transmitting alerts to caregivers through mobile apps. These connected solutions cater particularly to first-time parents, working parents, and caregivers in neonatal health settings. As manufacturers invest in digital health integration, premium diaper categories are anticipated to experience accelerated adoption and enhanced brand loyalty.

- For instance, Procter & Gamble’s Lumi by Pampers system uses a connected sensor with a typical battery life of approximately 90 days that transmits wetness alerts and sleep-tracking data to caregivers. Meanwhile, the Monit smart diaper sensor used by several Asian diaper partners, such as Huggies Korea, detects increases in humidity and volatile organic compounds (ammonia).

Key Challenges:

Environmental Concerns and Waste Management Issues

One of the most persistent challenges for the disposable diaper market is its significant environmental impact, particularly the generation of non-biodegradable waste. Traditional diapers can take hundreds of years to decompose due to their plastic components, absorbent polymers, and chemical treatments. This creates mounting public and regulatory pressure on manufacturers to adopt greener materials and support responsible waste management solutions. Municipal authorities in several regions increasingly scrutinize landfill contributions and push for stringent packaging and recycling regulations. These rising environmental concerns elevate production costs, require major investments in R&D, and complicate compliance requirements, particularly for small and mid-sized players. As awareness increases, brands unable to adapt may face declining acceptance.

Volatility in Raw Material Prices and Supply Chain Disruptions

Price volatility in key raw materials such as petroleum-based polymers, fluff pulp, adhesives, and packaging materials continues to challenge profitability across diaper manufacturers. Supply chain disruptions driven by geopolitical instability, logistics bottlenecks, or global shortages further inflate costs and affect production continuity. Manufacturers face pressure to maintain affordability while absorbing rising operational expenses, particularly in competitive markets dominated by private labels and low-margin products. Additionally, fluctuations in foreign exchange rates impact import-dependent manufacturers. These cost pressures limit innovation budgets, slow down expansion plans, and compel companies to rethink sourcing strategies, strengthen supplier networks, and increase production localization to stabilize operations.

Regional Analysis:

North America

North America holds about 28% of the global disposable baby diapers market, supported by high spending on premium baby-care products, strong brand penetration, and widespread adoption of advanced absorbent technologies. The region benefits from high parental awareness regarding skin health, driving demand for hypoallergenic, fragrance-free, and ultra-soft diapers. Growth is further supported by rising preference for eco-friendly and plant-based alternatives, particularly in the U.S. Established distribution networks across supermarkets, pharmacies, and e-commerce platforms ensure consistent availability and rapid consumer uptake. Innovation in smart diapers and overnight protection formats also reinforces North America’s strong market position.

Europe

Europe accounts for approximately 24% of the global market, driven by strong demand for dermatologically tested, sustainability-focused diaper products that align with regional environmental regulations. Countries such as Germany, France, and the U.K. emphasize stringent quality standards, boosting adoption of biodegradable, chlorine-free, and certified-organic diapers. Private-label brands remain highly competitive, supported by robust retail penetration and cost-effective offerings. Additionally, Europe’s rising dual-income households prioritize convenience and premium absorbent features, ensuring steady product replacement cycles. Regulatory initiatives aimed at reducing plastic waste continue to influence product innovation, prompting manufacturers to accelerate development of recyclable and plant-based diaper materials.

Asia-Pacific

Asia-Pacific dominates the global market with around 38% share, driven by large infant populations, rapid urbanization, and rising disposable incomes across China, India, Indonesia, and Vietnam. Growing awareness of infant hygiene and expanding access to modern retail formats significantly boost diaper adoption. Premiumization accelerates as parents increasingly seek ultra-soft, breathable, and high-absorbency diapers for enhanced comfort and overnight protection. E-commerce growth further expands availability and encourages subscription-based diaper purchases. Local and international brands invest heavily in large-scale manufacturing facilities and localized product designs, strengthening competitiveness in this fast-growing, price-sensitive, and demographically strong region.

Latin America

Latin America represents about 6% of the global disposable diapers market, with Brazil, Mexico, and Argentina contributing the largest shares. Market growth is driven by increasing awareness of hygiene practices, rising participation of women in the workforce, and expanding distribution through supermarkets and online platforms. Demand for economical and mid-range diapers remains strong due to income-sensitive consumer segments, although premium varieties gain traction among urban families. Manufacturers focus on improved absorbency, better fit, and skin-friendly formulations suited to humid climates. Currency volatility and economic fluctuations pose challenges, but long-term demographic trends support steady consumption.

Middle East & Africa

The Middle East & Africa (MEA) region holds around 4% market share, supported by a growing infant population, expanding urban centers, and improving retail infrastructure across the Gulf countries, South Africa, and North Africa. Disposable diaper adoption increases as households shift from traditional cloth usage toward convenient, hygienic alternatives. Demand is highest in mid-range price tiers, though premium diapers gain popularity in urban Gulf markets. International brands expand presence through supermarkets, pharmacies, and e-commerce channels. However, affordability constraints, import dependency, and economic disparities across sub-regions limit uniform growth, prompting manufacturers to introduce cost-effective, locally tailored product lines.

Market Segmentations:

By Type

By Size

- Small / Extra Small

- Medium

- Large

- Extra Large

By Age Group

- 0–6 Months

- 6–18 Months

- 18–24 Months

- Above 2 Years

By Price Range

- Economical Diapers (Below $0.15)

- Mid-Range Diapers ($0.15 to $0.30)

- Premium Diapers (Above $0.30)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the disposable baby diapers market is characterized by the strong presence of global brands, regional manufacturers, and rapidly expanding private-label players. Leading companies such as Procter & Gamble, Kimberly-Clark, Unicharm, Essity, and Kao dominate through extensive distribution networks, advanced material technologies, and continuous product innovations focusing on ultra-absorbent cores, breathable layers, and skin-friendly formulations. These players invest heavily in R&D to enhance leak protection, softness, and environmental performance while also introducing plant-based and biodegradable product lines to meet rising sustainability expectations. Regional competitors in Asia-Pacific and Latin America gain traction through cost-effective offerings tailored to local preferences. Private-label brands increasingly challenge established players by offering competitive pricing and improved quality across supermarket and e-commerce channels. Strategic initiatives such as manufacturing capacity expansions, localized production, brand partnerships, and targeted marketing campaigns further intensify competition, shaping a dynamic and innovation-driven market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ontex Group

- Johnson & Johnson

- Hengan International

- Kao Corporation

- The Honest Company, Inc.

- First Quality Enterprises

- Essity AB

- Kimberly-Clark Corporation

- The Procter & Gamble Company (P&G)

- Unicharm Corporation

- The Hain Celestial Group Inc

Recent Developments:

- In June 2025, Essity’s Oława factory in Poland expanded its baby-diaper production lines, creating 70 new jobs and installing 6,500 solar panels; the new equipment runs 4 times faster than previous lines.

- In March 2025, Hengan announced its 2024 annual results, noting a focus on its disposable diapers segment as part of its three core business units and indicated growth in household products, reinforcing its intent to grow in diaper markets.

Report Coverage:

The research report offers an in-depth analysis based on Type, Size, Age group, Price range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue shifting toward eco-friendly, biodegradable, and plant-based diaper materials as sustainability becomes central to consumer preference.

- Premiumization will rise as parents increasingly choose ultra-soft, dermatologically tested, and high-absorbency diapers for enhanced comfort and overnight protection.

- Smart diaper technologies with moisture and health-monitoring sensors will gain gradual adoption, especially among tech-savvy and first-time parents.

- Manufacturers will expand local production capabilities to reduce supply-chain risks and meet region-specific product requirements.

- E-commerce and subscription models will strengthen as parents prioritize convenience, home delivery, and bulk-buying options.

- Private-label brands will continue capturing market share by offering improved quality at competitive prices.

- Emerging markets in Asia-Pacific, Latin America, and Africa will drive long-term growth through rising birth rates and increasing disposable incomes.

- Innovations in ultra-thin absorbent cores and breathable fabrics will enhance comfort and mobility for active infants.

- Regulatory pressure will push companies to adopt recyclable packaging and reduce plastic usage.

- Product diversification will increase, with more specialized diapers for sensitive skin, nighttime use, and potty-training stages.