Market Overview:

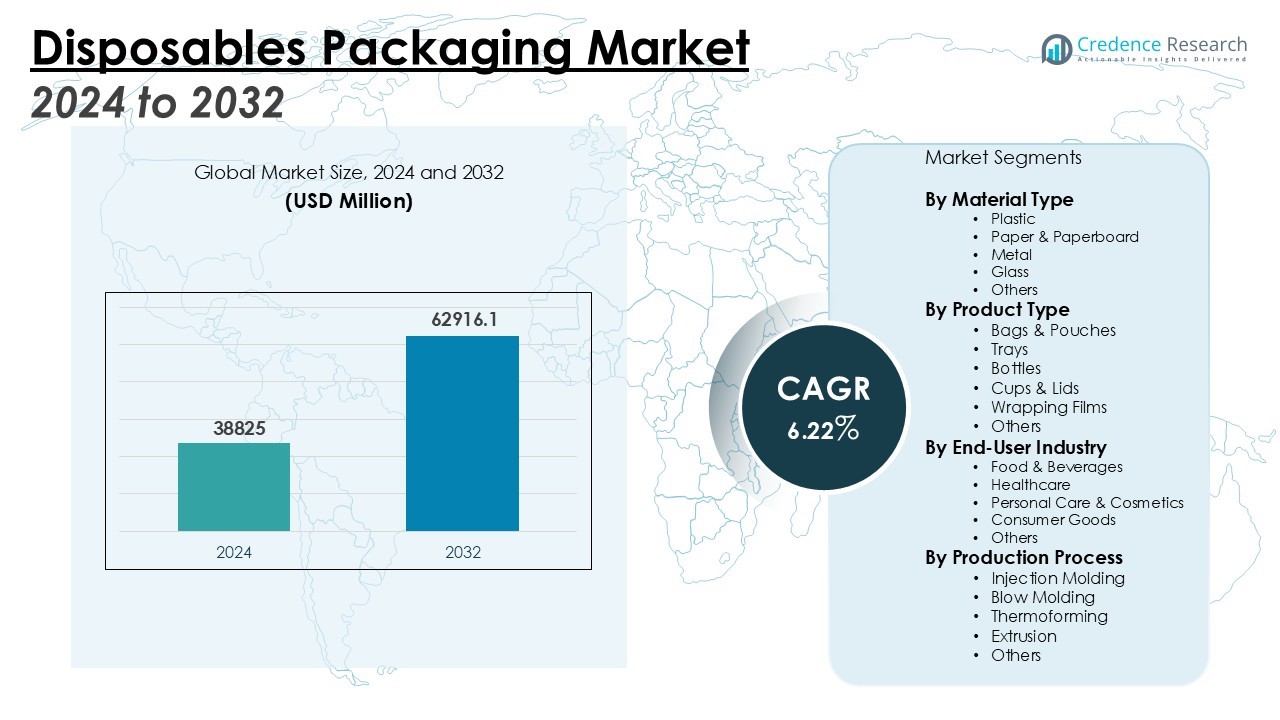

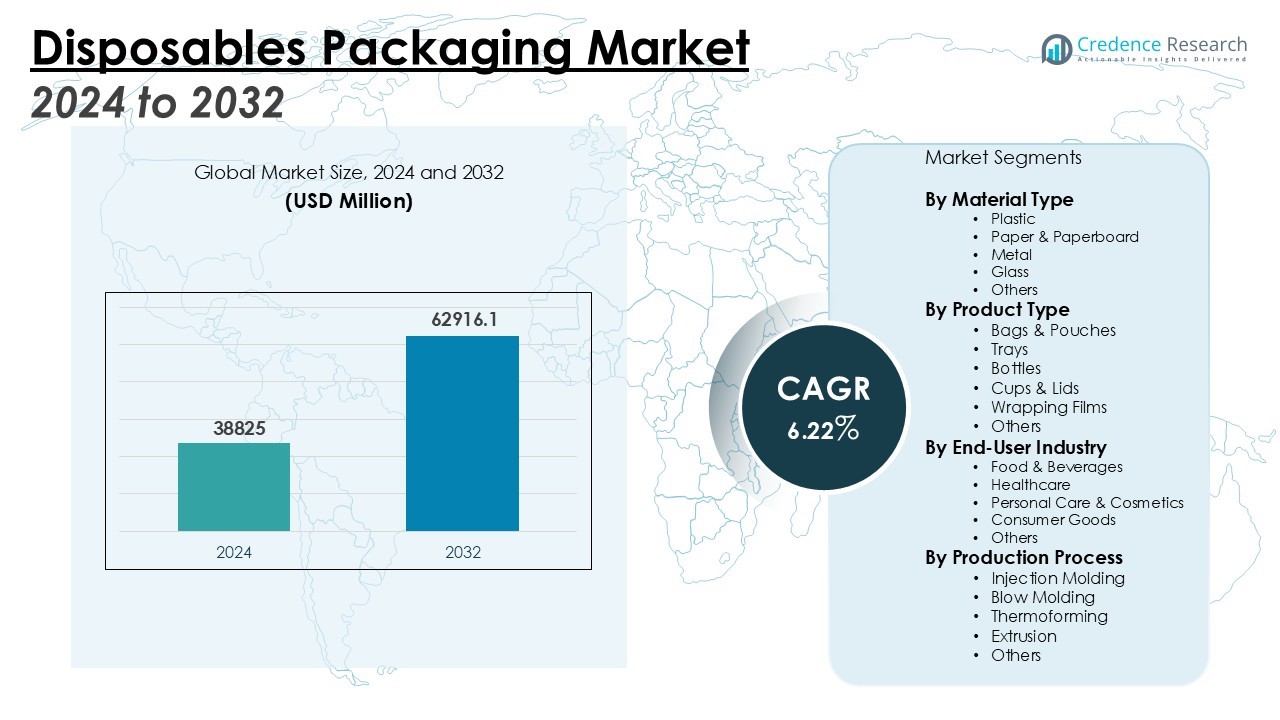

The Disposables Packaging Market size was valued at USD 38825 million in 2024 and is anticipated to reach USD 62916.1 million by 2032, at a CAGR of 6.22% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposables Packaging Market Size 2024 |

USD 38825 Million |

| Disposables Packaging Market, CAGR |

6.22% |

| Disposables Packaging Market Size 2032 |

USD 62916.1 Million |

Key drivers of the market include the rising consumer preference for convenience and hygiene, particularly in the foodservice and healthcare sectors. The need for cost-effective, lightweight, and easy-to-dispose packaging solutions is encouraging the widespread adoption of disposables packaging. Moreover, advancements in material technology, such as biodegradable and eco-friendly packaging options, are further propelling market expansion. Stringent regulations and growing environmental concerns also push the industry towards sustainable alternatives to traditional plastic packaging, further driving innovation in packaging solutions.

Regionally, North America holds the largest market share due to strong demand from the foodservice and healthcare industries, where disposable packaging ensures operational efficiency and safety. The Asia Pacific region is expected to witness the highest growth rate during the forecast period, driven by rapid industrialization, population growth, and increasing urbanization, especially in countries like China and India, which are adopting modern packaging solutions at a fast pace. Europe maintains a significant share, fueled by stringent regulatory measures and a rising focus on sustainable packaging solutions, as environmental concerns continue to shape consumer behavior.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Disposables Packaging Market size was valued at USD 38,825 million in 2024 and is anticipated to reach USD 62,916.1 million by 2032, growing at a CAGR of 6.22% during the forecast period.

- The rising consumer preference for convenience and hygiene, particularly in foodservice and healthcare, continues to drive demand for disposable packaging solutions.

- Cost-effective, lightweight, and easy-to-dispose packaging options are contributing significantly to market growth, with manufacturers focusing on efficiency in production and transportation.

- Technological advancements in sustainable and biodegradable materials are creating new growth opportunities, with innovations that mimic traditional plastics while reducing environmental impact.

- Stringent regulations and growing environmental concerns are pushing the market toward sustainable alternatives, accelerating the transition from traditional plastic to recyclable and biodegradable packaging solutions.

- North America holds the largest market share at 35%, driven by high demand from the foodservice and healthcare industries, along with advanced packaging technologies and sustainability initiatives.

- The Asia Pacific region, with a 30% market share, is projected to experience the highest growth rate due to rapid industrialization, urbanization, and increasing demand for eco-friendly packaging solutions.

Market Drivers:

Rising Demand for Convenience and Hygiene in Foodservice and Healthcare Sectors

The growing consumer preference for convenience and hygiene significantly influences the Disposables Packaging Market. Increasing demand for quick-service meals and takeout, along with the rise of healthcare applications, has driven the adoption of disposable packaging solutions. In the foodservice industry, disposable packaging ensures convenience for both consumers and businesses by offering fast, easy, and hygienic solutions for food storage and transport. The healthcare sector also benefits from disposables, with packaging solutions critical for ensuring sterile, safe, and hygienic medical supplies. This trend is expected to maintain its momentum as consumer priorities continue to evolve toward convenience and hygiene.

- For instance, Huhtamaki Oyj produced and supplied over 3 billion fiber-based food packaging units globally, including ready-meal trays used by major quick-service restaurants to enhance both hygiene and ease-of-use.

Cost-Effectiveness and Lightweight Characteristics Driving Market Expansion

Cost-effective, lightweight, and easy-to-dispose packaging solutions contribute to the growing preference for disposables. Manufacturers across various industries, such as food, beverage, and pharmaceuticals, are opting for lightweight materials to reduce transportation costs while ensuring product safety. Disposables offer a practical solution that meets the growing need for efficiency, particularly in packaging for fast-moving consumer goods (FMCG). These packaging options reduce production costs while maintaining high levels of convenience, ensuring continued market growth.

Technological Advancements in Sustainable and Eco-Friendly Packaging

The ongoing development of eco-friendly and sustainable materials is a significant driver of growth in the Disposables Packaging Market. Companies are increasingly adopting biodegradable and recyclable materials in their packaging solutions to meet environmental standards and consumer demand for sustainability. Advancements in material science have led to the creation of compostable and biodegradable packaging that mimics the performance of traditional plastic. These innovations are helping manufacturers reduce waste and lower their carbon footprints, making eco-friendly disposables more attractive.

Stringent Regulatory Pressure and Environmental Concerns

Stringent regulations surrounding packaging waste management are driving the shift towards more sustainable disposables. Governments globally are introducing policies aimed at reducing single-use plastics and encouraging the adoption of recyclable and biodegradable packaging. As environmental concerns continue to rise, industries are compelled to comply with these regulations, leading to increased demand for environmentally responsible packaging solutions. The growing awareness among consumers about environmental impact also influences their purchasing decisions, further accelerating the transition toward sustainable disposables.

- For instance, KW Plastics has processed more than 1 billion pounds of curbside-collected plastics for recycling, demonstrating a substantial contribution to sustainable packaging practices.

Market Trends:

Increasing Focus on Sustainable and Biodegradable Packaging Solutions

A significant trend in the Disposables Packaging Market is the growing shift towards sustainable and biodegradable packaging solutions. As environmental concerns intensify, consumers and businesses alike are demanding packaging that minimizes environmental impact. Manufacturers are investing in research and development to produce packaging materials made from renewable resources that are both biodegradable and recyclable. This shift is driven by increasing regulatory pressure to reduce plastic waste and consumer preference for eco-friendly options. Companies are adopting these innovative materials to meet sustainability goals, lower their carbon footprint, and align with global initiatives promoting environmental conservation. The growing demand for sustainable disposables is reshaping the packaging landscape, encouraging the industry to explore alternative solutions to traditional plastics.

- For instance, McDonald’s replaced plastic straws with paper straws in all of its UK and Ireland restaurants, a switch that affected the daily use of 1.8 million straws—removing that number of single-use plastics from waste streams each day.

Technological Advancements and Customization in Packaging Designs

Another important trend in the Disposables Packaging Market is the integration of advanced technologies for improving packaging performance and customization. Digital printing, for example, allows brands to create personalized packaging designs that enhance consumer engagement and improve product differentiation. The increasing use of smart packaging technologies, such as QR codes and RFID tags, also allows businesses to provide consumers with real-time product information, enhancing transparency and convenience. These advancements are enabling companies to offer more functional, user-friendly, and customized disposable packaging. Additionally, packaging solutions are being developed to improve functionality, such as tamper-evident seals, leak-proof designs, and microwave-safe materials, ensuring both consumer safety and convenience. This trend towards technological integration is driving growth and innovation in the market.

- For instance, Bravo Pack has implemented advanced digital printing on its poly mailers, offering custom prints with up to 10 color options and 100% coverage, enabling unique branding and design flexibility for clients.

Market Challenges Analysis:

Rising Pressure to Address Environmental Impact and Waste Management

One of the key challenges facing the Disposables Packaging Market is the growing pressure to address environmental concerns and manage packaging waste effectively. Despite the shift towards sustainable solutions, the widespread use of disposable packaging, particularly plastic, continues to contribute to pollution and waste accumulation. Governments around the world are implementing stricter regulations and policies aimed at reducing single-use plastic packaging, which increases the cost and complexity of production for manufacturers. The lack of efficient recycling systems and infrastructure in many regions further exacerbates the environmental impact of disposable packaging. This challenge requires companies to find innovative ways to meet sustainability goals while maintaining product functionality and affordability.

Cost Pressures and Raw Material Supply Chain Disruptions

The Disposables Packaging Market also faces significant challenges related to cost pressures and disruptions in the raw material supply chain. Fluctuations in the prices of key materials, such as plastic resins, paper, and biodegradable alternatives, impact the overall cost of production. Global supply chain disruptions, often exacerbated by geopolitical issues or natural disasters, can lead to delays in raw material procurement and increased costs. These challenges make it difficult for manufacturers to maintain profit margins while adhering to sustainability initiatives. Companies must navigate these complex dynamics to stay competitive while meeting the evolving demands for both cost-effective and eco-friendly packaging solutions.

Market Opportunities:

Growing Demand for Eco-Friendly and Biodegradable Packaging Solutions

The growing demand for sustainable and biodegradable packaging presents a significant opportunity for the Disposables Packaging Market. As environmental awareness rises among consumers, companies are increasingly adopting eco-friendly materials, such as plant-based plastics, compostable packaging, and recyclable options. This shift offers manufacturers a chance to develop innovative packaging solutions that cater to environmentally conscious consumers while complying with stricter regulatory standards. The expansion of recycling infrastructure in various regions further enhances the potential for sustainable packaging growth. Businesses that embrace these trends can differentiate themselves in a competitive market and contribute to a cleaner environment, all while capitalizing on the demand for greener alternatives.

Technological Advancements in Smart Packaging and Customization

Technological advancements in smart packaging and customization provide another opportunity for growth in the Disposables Packaging Market. The integration of technologies like RFID, QR codes, and NFC allows brands to enhance product traceability, improve supply chain efficiency, and offer consumers real-time product information. Smart packaging also enables increased functionality, such as tamper-evident seals and temperature-sensitive materials, which can add value to disposable packaging. Furthermore, customization in packaging designs, driven by digital printing, allows companies to engage consumers more effectively and strengthen brand identity. These innovations offer packaging solutions that are both functional and appealing, opening new revenue streams for manufacturers.

Market Segmentation Analysis:

By Material Type

The Disposables Packaging Market is segmented by material type, with key categories including plastic, paper, and biodegradable materials. Plastic dominates the market due to its versatility, cost-effectiveness, and ability to provide durable packaging solutions. However, the increasing environmental concerns and regulatory pressures are driving the demand for biodegradable materials. Biodegradable packaging, made from plant-based materials, is gaining traction in response to consumer preference for eco-friendly products. Paper-based packaging also continues to grow, driven by its recyclability and sustainability. This shift toward sustainable materials is expected to shape the market in the coming years.

- For instance, The Coca-Cola Company launched the Plant Bottle™, a fully recyclable plastic bottle made using up to 30 percent plant-based materials.

By Product Type

The market is also segmented by product type, including containers, bags, wraps, and trays. Containers account for a significant share, primarily due to the food and beverage industry’s reliance on disposables for packaging liquids, snacks, and ready-to-eat meals. Bags and wraps are extensively used for packaging snacks, grocery items, and personal care products, benefiting from their lightweight and cost-effective nature. Trays, commonly used in foodservice applications, are also a key product type. The demand for convenience and portability is driving growth in all product categories, with a notable shift towards materials that support sustainability.

By End-User Industry

Key end-user industries in the Disposables Packaging Market include foodservice, healthcare, consumer goods, and pharmaceuticals. The foodservice sector holds the largest share, driven by the growing demand for takeout, ready-to-eat meals, and packaged food. Healthcare and pharmaceuticals rely heavily on disposable packaging for sterile medical products and medications. The consumer goods sector, including personal care items, also contributes significantly to market growth as it continues to demand convenient, hygienic, and single-use packaging solutions.

- For instance, Avery Dennison’s AD Clean Flake™ label technology now enables recycling compatibility across both PET and HDPE plastics, with the capacity to divert over 200 billion rigid plastic bottles and containers from landfills globally.

Segmentations:

- By Material Type:

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

- By Product Type:

- Bags & Pouches

- Trays

- Bottles

- Cups & Lids

- Wrapping Films

- Others

- By End-User Industry:

- Food & Beverages

- Healthcare

- Personal Care & Cosmetics

- Consumer Goods

- Others

- By Production Process:

- Injection Molding

- Blow Molding

- Thermoforming

- Extrusion

- Others

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading Demand and Technological Advancements

North America holds 35% of the Disposables Packaging Market share, driven by strong demand in the foodservice, healthcare, and consumer goods sectors. The region’s advanced infrastructure and high adoption rate of innovative packaging technologies contribute to this dominance, particularly in the U.S. The need for hygienic, convenient, and cost-effective packaging solutions remains crucial in industries like fast food, pharmaceuticals, and medical supplies. Stringent regulatory measures to reduce plastic waste are also influencing market dynamics, pushing the region toward sustainable packaging alternatives. Leading companies in North America continue to innovate, offering biodegradable and eco-friendly packaging solutions, further solidifying the region’s market position.

Asia Pacific: Rapid Growth Driven by Urbanization and Industrialization

Asia Pacific accounts for 30% of the Disposables Packaging Market share and is expected to see the highest growth rate during the forecast period. This rapid expansion is fueled by urbanization, rising disposable incomes, and industrial growth, particularly in China and India. As consumer preferences shift toward convenience, the demand for disposable packaging in foodservice, retail, and healthcare industries has surged. Manufacturers are focusing on sustainable packaging to meet the growing consumer demand for eco-friendly solutions. Government initiatives aimed at improving recycling infrastructure also support the market’s growth in this region, offering additional opportunities for innovation.

Europe: Regulatory Focus and Rising Demand for Sustainable Solutions

Europe holds 25% of the Disposables Packaging Market share, driven by stringent environmental regulations and growing demand for sustainable packaging. The European Union’s regulations, including the ban on single-use plastics, have significantly impacted the region’s packaging industry, accelerating the adoption of recyclable and biodegradable materials. In response, companies are increasingly investing in eco-friendly packaging solutions to meet both regulatory requirements and consumer preferences. The food and beverage industry in Europe, in particular, is embracing disposable packaging options that align with sustainability objectives, supporting continued market growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Falcon Pack

- Formacia

- Damati

- Jebel Pack LLC

- Caterpack-me

- Packware

- Detpack-Detmold Group

- Precision Plastic products Company LLC

- Genpak

- Global Packaging Solutions

- Fresh Pack Trading LLC

- AVECO Packaging

Competitive Analysis:

The Disposables Packaging Market is highly competitive, with major players like Amcor plc, Sealed Air Corporation, and Berry Global, Inc. leading through strategic acquisitions, technological advancements, and a focus on sustainable solutions. These companies capitalize on their vast manufacturing and distribution networks to maintain a strong presence globally. Regional players also contribute by offering cost-effective and localized packaging options. As the demand for eco-friendly packaging increases, companies are investing in recyclable, biodegradable, and reusable materials, driving continuous innovation to meet evolving consumer preferences. This dynamic environment fosters intense competition, with both established and emerging players vying for market share.

Recent Developments:

- In December 2023, Detpak launched a broad range of compostable, no-added PFAS sugarcane plates, bowls, and containers called Vanguard®, becoming the first Australian company to offer this line.

- In May 2024, Detmold Group’s venture arm backed the merger of European packaging companies CUPSZ and De Jong Ecocups, facilitating operational efficiencies and expanding product offerings in the cup and cardboard takeaway packaging sectors.

Market Concentration & Characteristics:

The Disposables Packaging Market exhibits moderate concentration, with a few dominant players controlling a significant share. Companies like Amcor plc, Sealed Air Corporation, and Berry Global, Inc. lead the market, benefiting from their large-scale operations and extensive distribution networks. While these industry giants maintain a competitive edge through technological advancements and sustainability initiatives, smaller players focus on niche markets, offering innovative, eco-friendly packaging solutions. The market is characterized by continuous product innovation, driven by consumer demand for sustainability and convenience. Companies are increasingly investing in recyclable, biodegradable, and reusable materials to align with environmental trends. This dynamic landscape fosters both competition and collaboration, as companies seek to differentiate themselves through advanced packaging technologies and sustainability efforts.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Product Type, End-User Industry, Production Process and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue to see increased demand for sustainable packaging solutions as consumers become more eco-conscious.

- Biodegradable and recyclable materials will play a significant role in the market’s growth, with companies investing in innovative, eco-friendly options.

- E-commerce growth will drive the need for protective and efficient packaging to meet the demands of home deliveries.

- Technological advancements, including smart packaging, will enhance product safety and consumer interaction.

- The healthcare sector’s reliance on single-use, hygienic packaging will increase, contributing to market expansion.

- Regulations around waste management and packaging sustainability will become stricter, pushing manufacturers toward environmentally friendly alternatives.

- Consumer preference for lightweight, cost-effective, and easy-to-dispose packaging will continue to dominate purchasing decisions.

- North America will maintain a strong market position, supported by a high demand for disposables in foodservice and healthcare sectors.

- The Asia Pacific region is expected to witness the highest growth rate, driven by industrialization, urbanization, and increased disposable incomes.

- Collaborative efforts between packaging companies and environmental organizations will foster innovations and advancements in sustainable packaging solutions.