| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latex Medical Disposables Market Size 2024 |

USD 8,708.34 Million |

| Latex Medical Disposables Market, CAGR |

6.85 % |

| Latex Medical Disposables Market Size 2032 |

USD 14,764.24 Million |

Market Overview

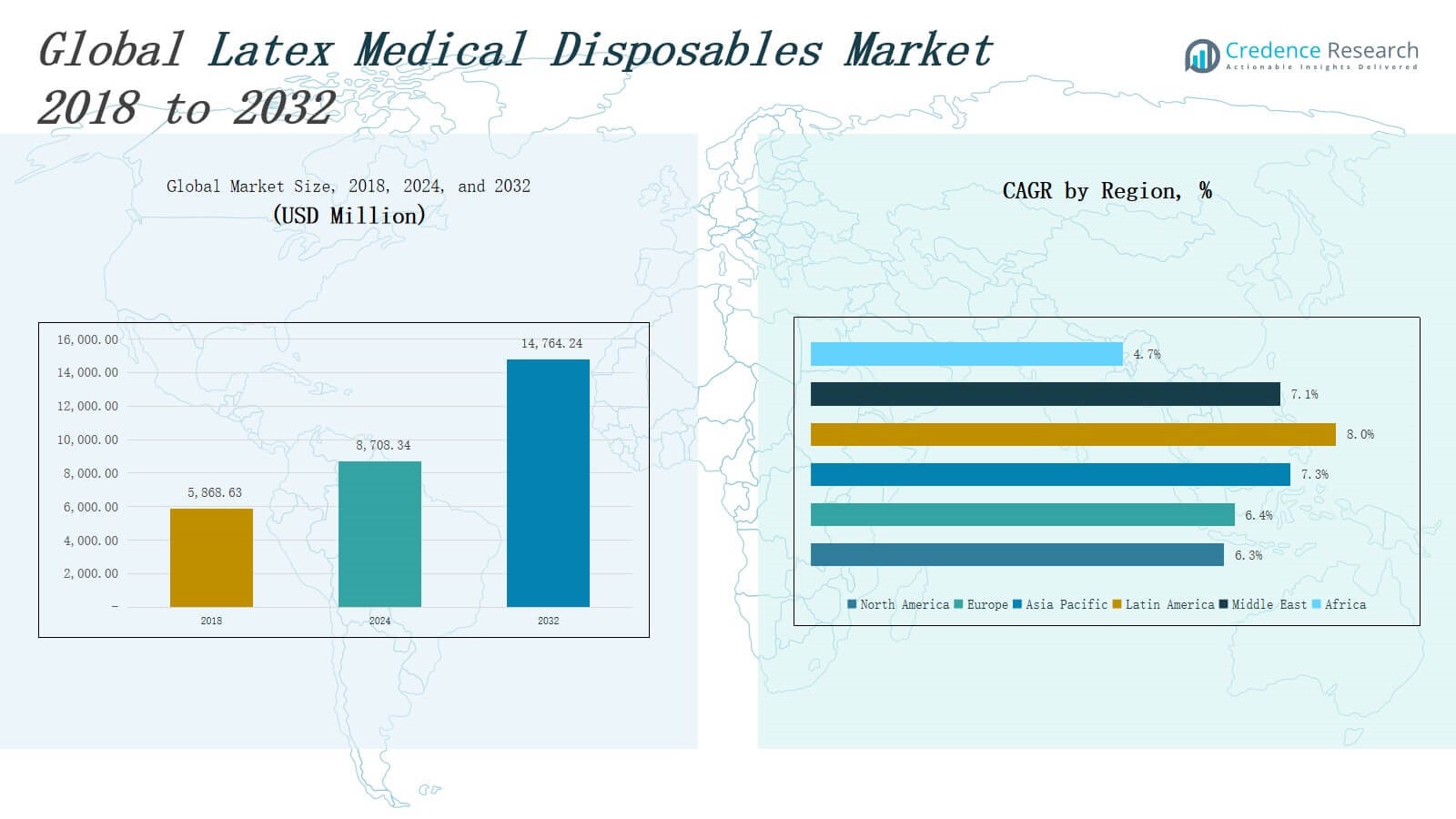

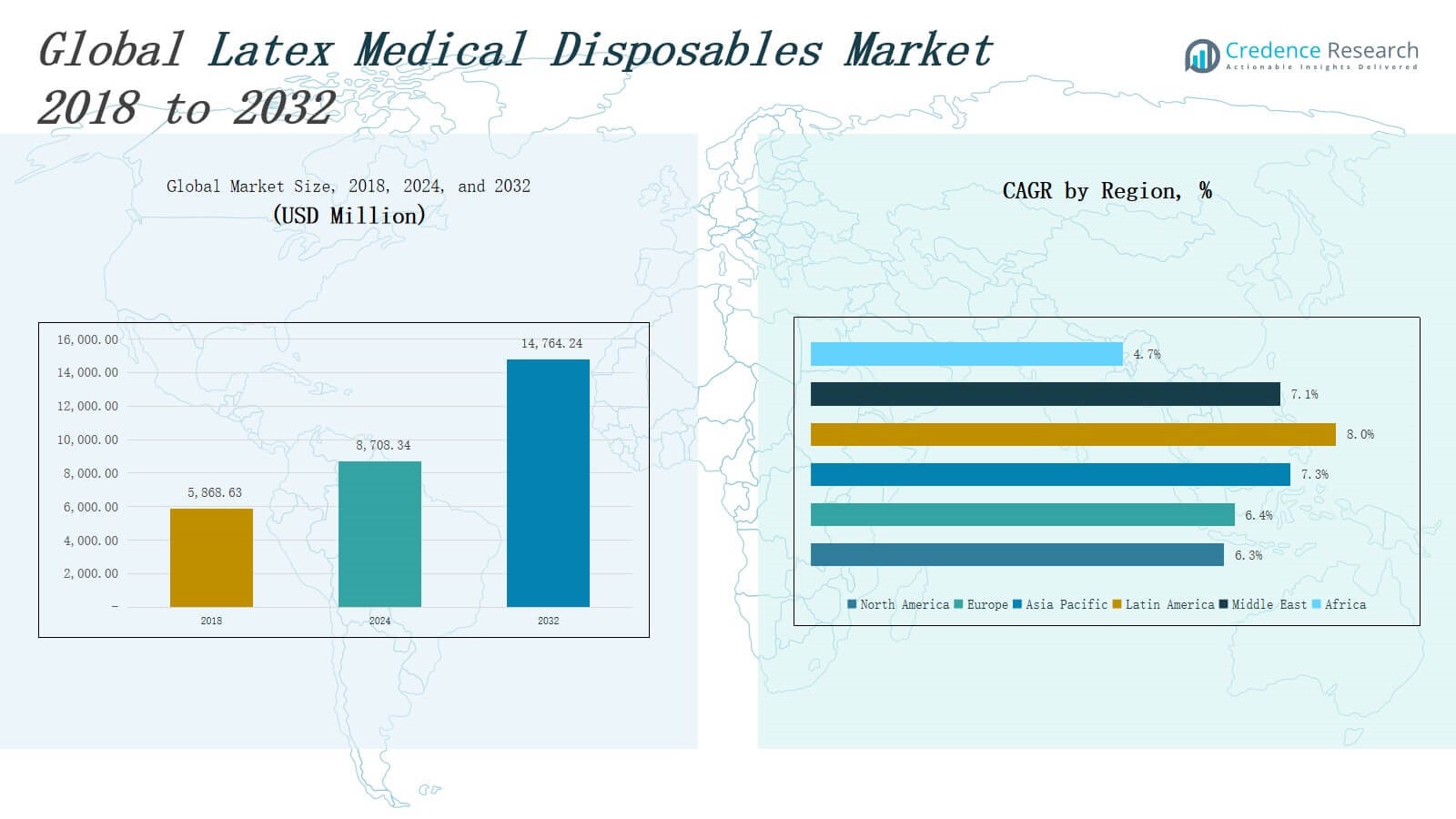

The Latex Medical Disposables Market size was valued at USD 5,868.63 million in 2018 to USD 8,708.34 million in 2024 and is anticipated to reach USD 14,764.24 million by 2032, at a CAGR of 6.85 % during the forecast period.

The Latex Medical Disposables Market is driven by increasing surgical procedures, rising hospital admissions, and growing awareness of infection control practices. Heightened concerns over hospital-acquired infections (HAIs) have accelerated demand for single-use latex products such as gloves, catheters, and probes. The expanding geriatric population and rising incidence of chronic diseases are further supporting market growth due to greater reliance on continuous medical care and hygiene-intensive procedures. Favorable government regulations promoting safety standards and improved healthcare infrastructure across emerging economies are also contributing to market expansion. Key trends shaping the market include the growing adoption of powder-free and hypoallergenic latex products to minimize allergic reactions, and the integration of antimicrobial coatings to enhance product safety. Sustainability is emerging as a critical focus area, with manufacturers exploring biodegradable latex alternatives and eco-friendly production practices. Moreover, advancements in manufacturing technologies are enabling better tactile sensitivity and durability, enhancing usability across medical and diagnostic applications.

The Latex Medical Disposables Market spans North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa, each contributing to global demand through distinct healthcare dynamics. Asia Pacific leads the market due to large patient populations and expanding healthcare infrastructure, while Europe and North America follow with strong regulatory standards and advanced hospital systems. Latin America and the Middle East show robust growth driven by rising medical investments and infection control awareness. Africa remains a developing market, gaining traction through public health programs. Key players operating globally include Hartalega Holdings Bhd., BD, Shield Scientific, Rubberex, Dynarex Corporation, B. Braun Melsungen AG, Other Key Players, Medtronic plc, Top Glove Corporation, and Ansell Inc. These companies compete on quality, innovation, sustainability, and supply chain efficiency to address rising demand across public and private healthcare settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latex Medical Disposables Market was valued at USD 5,868.63 million in 2018 and is projected to reach USD 14,764.24 million by 2032, growing at a CAGR of 6.85%.

- Rising surgical procedures, hospital admissions, and focus on infection control drive demand for gloves, catheters, trays, and probe covers.

- Growing elderly population and chronic disease burden boost the need for disposable, hygiene-focused medical supplies.

- Strict global regulations on safety and sterilization increase reliance on certified latex medical disposables.

- Asia Pacific holds the largest market share (33%), followed by Europe (26%) and North America (21%), while Latin America and the Middle East show high growth potential.

- Key players include Hartalega, BD, Shield Scientific, Rubberex, Dynarex, B. Braun, Medtronic, Top Glove, Ansell, and others focusing on innovation, quality, and sustainability.

- Market faces challenges from latex allergies, regulatory restrictions, raw material price volatility, and global supply chain disruptions.

Market Drivers

Rising Prevalence of Infectious Diseases and Surgical Procedures

The Latex Medical Disposables Market is witnessing strong demand due to the increasing burden of infectious diseases and the rising number of surgical interventions worldwide. Hospitals and clinics are prioritizing sterile, single-use medical supplies to maintain strict hygiene standards and prevent cross-contamination. Latex-based products such as gloves, catheters, and examination probes remain essential in routine and emergency procedures. The growing volume of inpatient and outpatient care significantly boosts product consumption. It is also reinforced by the global rise in chronic conditions requiring sustained hospital interaction. The demand for protective and diagnostic consumables directly supports growth.

- For instance, B. Braun’s Contiplex® catheters, which are manufactured using latex for flexibility and sterility, are widely adopted in pain management during surgical procedures across Europe’s leading healthcare institutions.

Stringent Regulatory Frameworks and Safety Protocols

Government mandates and healthcare regulations are compelling medical institutions to adopt certified, safe, and effective disposable products. The Latex Medical Disposables Market benefits from regulatory pressure to eliminate reusable or inadequately sterilized items from clinical environments. It plays a critical role in enabling facilities to comply with evolving health and safety standards. Certification norms around product quality and patient safety increase product replacement cycles. Manufacturers are expanding product lines to meet local and international guidelines. It strengthens supply chains by ensuring consistent quality compliance.

- For instance, Bexen Medical supplies over 500 certified disposable products to hospitals, maintaining compliance with ISO 13485:2016 and EU Medical Device Regulation 2017/745. Their adherence to these certification protocols ensures that 98% of Spanish national hospitals are equipped with compliant, safe disposables.

Expansion of Healthcare Infrastructure in Emerging Economies

The rapid development of healthcare systems across Asia-Pacific, Latin America, and parts of Africa is creating new growth avenues for the Latex Medical Disposables Market. Investments in public and private medical infrastructure support demand for disposable supplies across hospitals, diagnostic centers, and ambulatory care units. It responds to the growing need for affordable and accessible patient care supported by reliable consumables. Increasing health insurance coverage and government subsidies further drive procurement rates. These regions offer long-term revenue potential through high-volume, low-cost product models. Manufacturers are scaling up distribution to meet rising demand.

Increasing Focus on Infection Control and Hygiene Awareness

Heightened global awareness around infection control, especially post-COVID-19, continues to fuel the demand for latex medical disposables. The Latex Medical Disposables Market is reinforced by institutional and consumer-level emphasis on hygiene, safety, and disease prevention. It supports widespread adoption of disposable gloves, masks, and related items in medical and non-medical settings. Infection prevention programs and training in healthcare institutions further encourage product usage. Public health campaigns are influencing procurement patterns across clinics and outpatient facilities. Market participants are aligning product designs with high-performance, contamination-resistant standards.

Market Trends

Shift Toward Hypoallergenic and Powder-Free Latex Products

Healthcare providers are increasingly adopting hypoallergenic and powder-free latex products to reduce the risk of allergic reactions among patients and medical personnel. The Latex Medical Disposables Market is evolving to meet strict biocompatibility standards and minimize exposure to irritants. It is driving innovations in glove coatings, surface treatments, and raw material sourcing. Regulatory recommendations and rising awareness of latex sensitivity are steering the transition. Demand for safer, skin-friendly products is rising across hospitals and ambulatory centers. Manufacturers are adapting formulations to improve comfort without compromising durability.

- For instance, INTCO Medical showcased new eco-friendly TPE gloves at Hospitalar 2025 that combine hypoallergenic protection with improved biodegradability, supporting hospitals’ sustainability and safety requirements.

Integration of Antimicrobial Properties in Disposable Products

Manufacturers are embedding antimicrobial agents into latex-based medical disposables to enhance safety during use. The Latex Medical Disposables Market is seeing rising interest in infection-resistant materials that can limit the spread of pathogens. It supports growing healthcare concerns about surface-borne disease transmission in high-contact clinical environments. Antimicrobial technology is being integrated into gloves, catheters, and tubing used in intensive care and surgical units. This trend is gaining traction across both developed and developing healthcare settings. Product innovation in this area aims to improve protection and shelf-life.

- For instance, Summit Medical’s MARLUX recyclable privacy curtains are treated with Microban® antibacterial technology, offering continuous protection against bacterial growth and enhancing hygienic standards in clinical environments.

Growth of Eco-Friendly and Biodegradable Latex Alternatives

Sustainability is becoming a key focus in the production of medical disposables, prompting demand for eco-conscious latex alternatives. The Latex Medical Disposables Market is responding with the development of biodegradable products made from natural rubber latex and non-toxic additives. It enables healthcare providers to reduce environmental waste without compromising sterility. Hospitals and clinics are exploring procurement policies that include green certifications. This trend is supported by public and regulatory pressure to reduce medical waste. Industry players are investing in clean production processes and recyclable packaging.

Rising Demand from Non-Hospital Settings and Home Healthcare

Demand for latex medical disposables is expanding beyond traditional hospital environments into outpatient clinics, home healthcare, and emergency medical services. The Latex Medical Disposables Market is adapting to serve a broader range of care settings with compact, easy-to-use, and pre-packaged disposable solutions. It aligns with the growing trend of decentralized healthcare and telemedicine-assisted procedures. Non-hospital demand is also fueled by an aging population receiving care at home. Distributors are targeting pharmacies, homecare providers, and urgent care facilities. Convenience, safety, and accessibility remain core product design priorities.

Market Challenges Analysis

Allergic Reactions and Regulatory Restrictions on Latex Use

Latex allergies remain a persistent concern affecting both healthcare workers and patients, prompting regulatory scrutiny and limiting product adoption in sensitive environments. The Latex Medical Disposables Market faces pressure from institutions that prefer synthetic alternatives such as nitrile and vinyl. It must continuously invest in product innovation to reduce allergenic potential and comply with evolving safety standards. Regulatory bans or usage restrictions in some regions further constrain market penetration. Hospitals and clinics are revising procurement policies to favor hypoallergenic materials. These dynamics create both compliance costs and competition from non-latex substitutes.

Volatile Raw Material Prices and Supply Chain Constraints

Natural rubber latex, the primary raw material for many disposable products, is subject to price volatility due to climate, geopolitical factors, and supply disruptions. The Latex Medical Disposables Market encounters challenges in maintaining cost stability and production efficiency amid fluctuating raw material availability. It must also navigate global supply chain disruptions that delay delivery and impact inventory planning. Small- and mid-sized manufacturers face margin pressure and difficulties in securing long-term supplier contracts. Shifting trade policies and export restrictions from producing countries further exacerbate procurement risk

Market Opportunities

Expansion into Emerging Markets with Underserved Healthcare Systems

Rising investments in healthcare infrastructure across emerging economies offer strong growth prospects for the Latex Medical Disposables Market. Countries in Asia-Pacific, Latin America, and Africa are increasing healthcare spending and expanding public hospital networks. It creates demand for cost-effective, high-quality disposable products to support patient care and infection control. Growing awareness of hygiene and safety standards among healthcare providers fuels procurement. Local production partnerships and government tenders present strategic entry points. Manufacturers can capture long-term value by aligning with regional health priorities.

Innovation in Product Design and Sustainable Manufacturing

Demand for advanced, eco-conscious, and patient-friendly disposables is opening new product development opportunities. The Latex Medical Disposables Market can benefit from designing biodegradable gloves, antimicrobial coatings, and allergy-free materials. It aligns with shifting regulatory and environmental priorities in global healthcare procurement. Sustainable packaging and recyclable materials can also differentiate offerings. Customization for niche use cases such as pediatrics, geriatrics, and home care creates room for value-added innovation. Companies investing in R&D and green manufacturing gain competitive leverage.

Market Segmentation Analysis:

By Type

The Latex Medical Disposables Market includes a range of products designed for infection control, diagnostics, and treatment. Latex gloves hold the largest share due to their widespread use in surgical, examination, and general healthcare settings. Latex urethral catheters follow, driven by their role in urological procedures and critical care. Latex Foley trays are gaining demand in catheterization procedures requiring complete sterile kits. Latex probe covers are used in diagnostic imaging to maintain hygiene. The “Others” category includes various specialty items used across different departments. It supports broad application across surgical and non-surgical settings.

By End Use

Hospitals dominate the end-use segment in the Latex Medical Disposables Market due to high patient volumes, surgical procedures, and adherence to infection control protocols. It remains the primary buyer of all major product types. Private clinics are emerging as a key segment with growing procedural capacity and outpatient services. Ambulatory Surgical Centers (ASCs) show rising adoption of latex disposables due to their focus on cost-effective, short-duration procedures. Diagnostic centers use latex products extensively for ultrasound, sample collection, and testing processes. Each setting contributes distinct procurement patterns, influencing product design and distribution strategies.

Segments:

Based on Type

- Latex Gloves

- Latex Urethral Catheters

- Latex Foley Tray

- Latex Probe Cover

- Others

Based on End Use

- Hospitals

- Private Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

Based on Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

The North America Latex Medical Disposables Market size was valued at USD 1,100.96 million in 2018 to USD 1,584.79 million in 2024 and is anticipated to reach USD 2,576.36 million by 2032, at a CAGR of 6.3% during the forecast period. The region holds a market share of around 21% and remains a key contributor due to its well-established healthcare infrastructure and high surgical volume. The U.S. drives demand through extensive use of latex gloves, catheters, and trays in hospitals and outpatient facilities. It benefits from strong regulatory standards and a high focus on infection control. Canada and Mexico support growth with increasing adoption of disposable medical supplies across public and private institutions. Manufacturers focus on compliance and product innovation to meet regional safety standards.

Europe

The Europe Latex Medical Disposables Market size was valued at USD 1,608.01 million in 2018 to USD 2,333.84 million in 2024 and is anticipated to reach USD 3,838.70 million by 2032, at a CAGR of 6.4% during the forecast period. Europe holds the second-largest market share, accounting for approximately 26%. The region supports growth through universal healthcare access, strong demand for sterile consumables, and strict regulatory oversight. Germany, France, and the UK are major contributors to product usage across public and private hospitals. It benefits from early adoption of powder-free and hypoallergenic latex products. Regional procurement practices are increasingly aligned with sustainability and safety mandates.

Asia Pacific

The Asia Pacific Latex Medical Disposables Market size was valued at USD 2,034.66 million in 2018 to USD 3,097.93 million in 2024 and is anticipated to reach USD 5,430.29 million by 2032, at a CAGR of 7.3% during the forecast period. Asia Pacific holds the largest market share at nearly 33%, driven by rapid urbanization, rising healthcare spending, and expanding hospital networks. China, India, Japan, and Southeast Asia lead in product consumption due to increasing patient volumes and surgical procedures. It benefits from local manufacturing capacity and favorable trade policies. Rising awareness of hygiene and infection prevention supports widespread adoption across healthcare institutions. Cost-effective product offerings continue to expand reach in rural and semi-urban areas.

Latin America

The Latin America Latex Medical Disposables Market size was valued at USD 586.86 million in 2018 to USD 933.16 million in 2024 and is anticipated to reach USD 1,722.99 million by 2032, at a CAGR of 8.0% during the forecast period. Latin America accounts for around 11% of the global market, supported by improved access to healthcare and increased investment in medical infrastructure. Brazil and Argentina dominate regional demand through government-funded health programs and expanding private clinics. It benefits from rising surgical activity and enhanced focus on disposable supplies in infection control protocols. Regional distribution networks are improving, offering better access to a wide range of latex medical products. Local manufacturers are gaining presence through cost-competitive offerings.

Middle East

The Middle East Latex Medical Disposables Market size was valued at USD 227.12 million in 2018 to USD 342.61 million in 2024 and is anticipated to reach USD 593.52 million by 2032, at a CAGR of 7.1% during the forecast period. The region holds a market share of approximately 5%, driven by healthcare modernization and rising demand for surgical consumables. GCC countries, particularly Saudi Arabia and the UAE, are investing in hospital upgrades and infection control solutions. It sees growing preference for certified, high-quality latex disposables in line with international healthcare standards. Imports dominate supply, though regional manufacturing is gradually scaling up. Expansion of ambulatory and diagnostic care boosts product demand across specialized facilities.

Africa

The Africa Latex Medical Disposables Market size was valued at USD 311.04 million in 2018 to USD 416.01 million in 2024 and is anticipated to reach USD 602.38 million by 2032, at a CAGR of 4.7% during the forecast period. Africa holds the smallest market share, under 4%, but shows steady progress in adopting disposable healthcare solutions. South Africa leads regional consumption, followed by Egypt and Kenya, where public health initiatives and donor-funded programs support procurement. It faces infrastructure and affordability challenges but gains from international aid and growing awareness of hygiene practices. Local sourcing remains limited, making imports essential to meet demand. Market potential remains strong with efforts to modernize healthcare systems and reduce infection risks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hartalega Holdings Bhd.

- BD (Becton, Dickinson and Company)

- Shield Scientific

- Rubberex

- Dynarex Corporation

- Braun Melsungen AG

- Medtronic plc

- Top Glove Corporation

- Ansell Inc.

- Other Key Players

Competitive Analysis

The Latex Medical Disposables Market features intense competition with a mix of global giants and regional manufacturers. Key players focus on expanding product portfolios, enhancing quality standards, and investing in sustainable production. It is witnessing strategic moves such as mergers, capacity expansions, and partnerships to secure market position and global reach. Companies like Hartalega, Ansell, and Top Glove dominate with advanced manufacturing capabilities and extensive distribution networks. BD, Medtronic, and B. Braun leverage strong R&D and diversified product offerings to serve institutional buyers. Emerging players are entering with low-cost solutions and localized supply chains to meet regional demand. Innovation in allergen-free materials, antimicrobial features, and biodegradable latex products is shaping competitive differentiation. Competitive pricing, regulatory compliance, and rapid delivery timelines have become essential success factors. Firms are also leveraging digital tools to streamline procurement processes and strengthen customer relationships across hospitals, clinics, and diagnostic centers globally.

Recent Developments

- In April 2025, INTCO Medical launched Syntex™ Synthetic Disposable Latex Gloves, offering enhanced elasticity, puncture resistance, and a latex-like feel without allergy risk. The product meets EN455, EN374, FDA, and CE standards.

- On March 3, 2025, Ansell expanded its product portfolio by acquiring Kimberly-Clark’s PPE brands—Kimtech™, KleenGuard™, and RightCycle™—across North America and Europe.

- In May 2025, INTCO Medical introduced Syntex™ Synthetic Disposable Latex Gloves, featuring high elasticity, puncture resistance, and latex-like comfort without allergy risk. The product complies with EN455, EN374, FDA, and CE certifications.

- In April 2025, Radians entered the powder‑free glove market, introducing 14 new styles to meet rising demand in latex-free hand protection.

Market Concentration & Characteristics

The Latex Medical Disposables Market exhibits moderate to high market concentration, with a mix of multinational corporations and regional suppliers competing on product quality, pricing, and distribution. It is characterized by strong demand for sterile, single-use products across hospitals, clinics, and diagnostic centers. Leading companies such as Hartalega, Top Glove, BD, and Ansell control significant global shares due to advanced production capacity, regulatory compliance, and broad product portfolios. Entry barriers remain moderate due to regulatory requirements and raw material dependencies, but local manufacturers continue to penetrate emerging markets with low-cost offerings. The market relies on continuous innovation in hypoallergenic formulations, antimicrobial coatings, and eco-friendly materials to meet evolving healthcare standards. It serves a broad range of end users, from large hospital systems to smaller outpatient centers, and maintains year-round demand due to its essential role in patient care, infection control, and diagnostics. Supply chain resilience and product standardization shape competitive dynamics.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for latex medical disposables will grow due to rising surgical procedures and infection control protocols.

- Hospitals and clinics will continue to prioritize single-use products for hygiene and patient safety.

- Manufacturers will invest in hypoallergenic and powder-free latex products to reduce allergic reactions.

- Biodegradable and eco-friendly latex alternatives will gain traction in response to sustainability goals.

- Technological improvements will enhance product durability, tactile sensitivity, and barrier performance.

- Asia Pacific will remain the leading market due to expanding healthcare infrastructure and population growth.

- Regulatory compliance will shape product development and procurement strategies across all regions.

- Supply chain optimization will become critical to meet rising global demand and ensure timely delivery.

- Home healthcare and outpatient services will create new opportunities for disposable latex products.

- Strategic collaborations and regional manufacturing will strengthen market position and reduce import dependency.