Market Overview

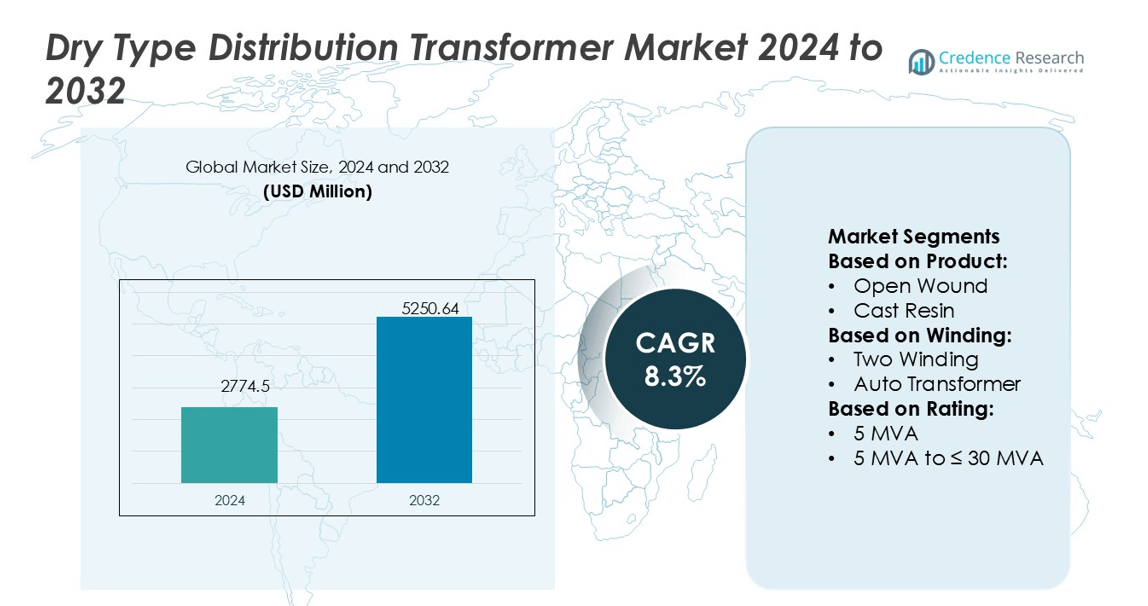

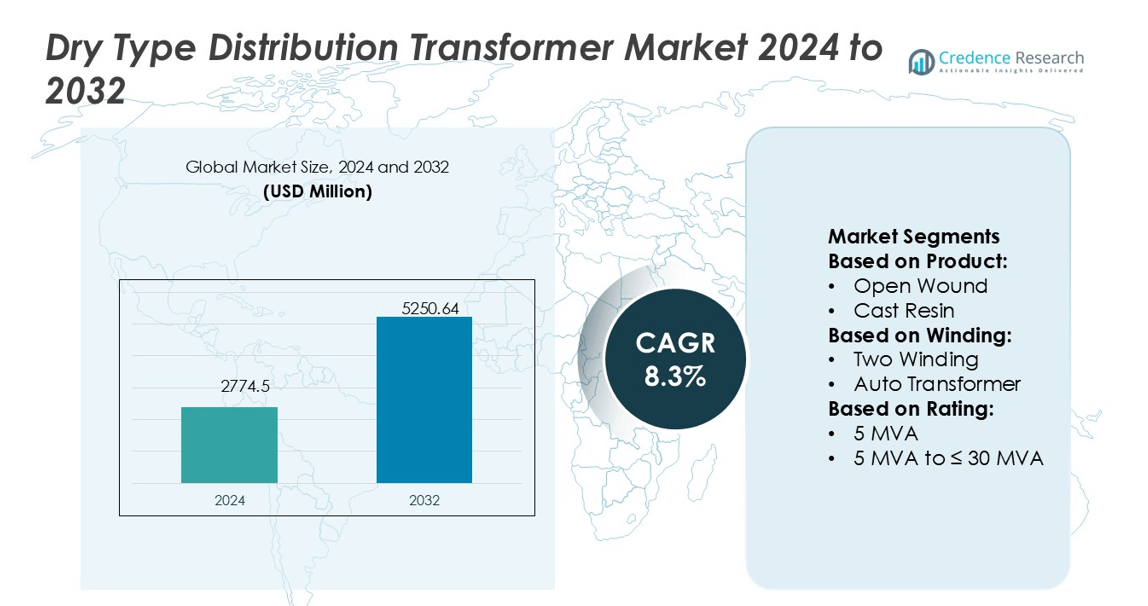

Dry Type High Voltage Power Transformer Market size was valued USD 2774.5 million in 2024 and is anticipated to reach USD 5250.64 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Type High Voltage Power Transformer Market Size 2024 |

USD 2774.5 million |

| Dry Type High Voltage Power Transformer Market, CAGR |

8.3% |

| Dry Type High Voltage Power Transformer Market Size 2032 |

USD 5250.64 million |

The Dry Type High Voltage Power Transformer Market is shaped by major players such as ABB, Hitachi Energy, General Electric, CG Power and Industrial Solutions, Hyundai Electric, Hyosung Heavy Industries, Daihen, Bharat Heavy Electricals, Bharat Bijlee, and JSHP Transformer. These companies emphasize technological advancement, digital monitoring integration, and sustainable manufacturing to meet growing energy efficiency standards. Asia-Pacific leads the global market with a 34% share in 2024, driven by rapid industrialization, smart grid expansion, and renewable energy investments. The region’s focus on safety, compact infrastructure, and modernization of transmission networks strengthens its dominance in the global landscape.

Market Insights

- The Dry Type High Voltage Power Transformer Market was valued at USD 2774.5 million in 2024 and is projected to reach USD 5250.64 million by 2032, growing at a CAGR of 8.3%.

- Rising demand for energy-efficient and fire-safe power solutions drives market expansion, supported by increasing renewable energy projects and industrial electrification.

- Growing adoption of digital monitoring, IoT-enabled diagnostics, and smart grid technologies defines key market trends, improving reliability and predictive maintenance.

- High initial installation costs and limited cooling efficiency in extreme environments remain major restraints, affecting deployment in cost-sensitive regions.

- Asia-Pacific leads with a 34% share, driven by rapid industrial growth, urbanization, and smart infrastructure development, while the cast resin segment dominates product share due to superior safety, insulation, and low maintenance features, consolidating the region’s strong market position in global power distribution and transmission applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The cast resin segment dominates the Dry Type High Voltage Power Transformer Market with a 46% share in 2024. Its popularity stems from superior insulation, moisture resistance, and fire safety features, making it ideal for urban and indoor installations. These transformers require minimal maintenance and perform efficiently in harsh conditions. For instance, ABB and Siemens deploy cast resin transformers in metro rail projects and renewable energy plants to ensure enhanced operational reliability and compact installation designs that meet modern grid standards.

- For instance, BHEL manufactures dry-type transformers that feature copper windings encapsulated in class-F epoxy resin via a vacuum casting process. These transformers are typically equipped with temperature monitoring systems that use embedded RTD PT100 sensors to detect winding hot-spot temperatures.

By Winding

The two-winding transformer segment holds the leading share of 63% in the market. This dominance is due to its widespread use in utility and industrial networks for effective voltage isolation between primary and secondary circuits. These transformers support improved energy transfer and reduced losses. For instance, Schneider Electric and Eaton produce two-winding units optimized for high-efficiency distribution grids, featuring digital monitoring and eco-friendly insulation materials that meet evolving energy efficiency regulations across industrial and commercial installations.

- For instance, CG Power supplied single-phase generator transformers to the NTPC Sipat project for its 765 kV grid system. Designed for Ultra High Voltage (UHV) grid conditions.

By Rating

The >5 MVA to ≤30 MVA segment leads the market with a 52% share. This range is widely preferred for industrial facilities, substations, and renewable power plants due to its balance between capacity and installation cost. These transformers enable efficient load management and reliable power delivery. For instance, Hitachi Energy and CG Power supply transformers in this range for industrial automation and grid stability projects, focusing on advanced cooling systems and high thermal endurance to support continuous heavy-load operations.

Key Growth Drivers

Rising Focus on Renewable Energy Integration

The global shift toward renewable energy sources significantly drives demand for dry type high voltage transformers. These transformers are essential for wind and solar power plants, where safety, reliability, and minimal maintenance are critical. They ensure stable voltage transformation under fluctuating loads. For instance, Siemens and Hitachi Energy supply cast resin transformers for renewable projects to enhance grid stability. Their eco-friendly design and low fire risk make them ideal for clean energy infrastructure expansion across Asia-Pacific and Europe.

- For instance, Hitachi Energy’s HiDry dry-type transformer family (originally ABB HiDry) offers ratings up to 63 MVA and high voltages up to 72.5 kV for standard applications, and leverages advanced technology for sub-transmission and specialized installations.

Expanding Urban Infrastructure and Industrialization

Rapid urbanization and industrial growth are accelerating electricity demand in developing regions. Dry type transformers are preferred for metro stations, airports, manufacturing zones, and high-rise buildings due to their compact design and operational safety. For instance, ABB provides dry type transformers for metro rail systems in India and Southeast Asia to ensure energy-efficient performance in confined environments. These installations reduce fire hazards and maintenance costs, supporting the modernization of urban electrical distribution networks and boosting adoption across industrial applications.

- For instance, Hyosung Heavy Industries delivered 400 kV ester-oil transformers to European utilities, including a supply agreement with Scottish Power. These transformers are designed with enhanced safety features.

Growing Emphasis on Safety and Environmental Compliance

Rising environmental regulations and fire safety standards fuel the adoption of dry type transformers. Unlike oil-filled models, they eliminate leakage and explosion risks while offering enhanced operational safety. For instance, Schneider Electric develops eco-friendly dry type units compliant with IEC and ISO standards for industrial and commercial facilities. These transformers operate efficiently in high humidity and contaminated environments, supporting sustainability goals and reducing lifecycle costs, making them the preferred choice for eco-conscious utilities and large infrastructure projects.

Key Trends & Opportunities

Digital Monitoring and Smart Grid Integration

The increasing adoption of IoT and digital monitoring systems in transformer operations presents a major growth opportunity. Smart dry type transformers equipped with sensors enable real-time performance tracking and predictive maintenance. For instance, Eaton and General Electric integrate data analytics platforms into their dry type units for remote monitoring, fault detection, and energy optimization. This trend enhances operational efficiency, extends equipment life, and aligns with the broader global shift toward intelligent power distribution and grid modernization initiatives.

- For instance, GE’s transformer and grid‑support portfolio spans medium through ultra‑high voltage domains. They offer power transformers ranging from 5 MVA up to 2,750 MVA, and voltage capabilities from 1200 kV AC to ±1100 kV DC.

Expansion of Rail and Transportation Electrification

The electrification of railways and transportation networks offers significant growth prospects for dry type transformers. Governments are investing in sustainable public transport systems that require compact, fire-safe, and maintenance-free transformers. For instance, ABB and TMC Transformers deliver dry type units for traction substations and metro lines in Europe and Asia. These transformers provide reliable performance in tunnels and underground environments, enabling efficient power conversion and supporting global efforts to develop sustainable, energy-efficient transportation systems.

- For instance, Hyosung Heavy Industries’ oil‑immersed transformers support voltage ratings up to 77 kV and power handling from 100 kVA to 80 MVA, and the company has shipped more than 150000 units to date.

Key Challenges

High Initial Investment and Manufacturing Costs

Dry type high voltage transformers involve higher upfront costs than oil-filled variants. Advanced insulation materials, resin encapsulation, and digital components increase production expenses. This cost barrier limits adoption in cost-sensitive markets. For instance, smaller utilities and industrial users in Africa and Latin America often prefer conventional transformers due to lower capital requirements. Addressing cost competitiveness through modular manufacturing and material innovation remains a key challenge for market players targeting emerging economies.

Limited Cooling Efficiency in Extreme Conditions

Cooling constraints under high-load and extreme-temperature conditions pose a major operational challenge. Dry type transformers rely on air-based cooling, which can be less efficient than oil-based systems. This limits their use in heavy-duty outdoor applications and high ambient temperatures. For instance, manufacturers like CG Power and Hitachi Energy are developing advanced air-flow and vacuum pressure technologies to enhance cooling capacity. However, achieving consistent performance across diverse climates remains a technical and design hurdle for the industry.

Regional Analysis

North America

North America holds a 27% share of the Dry Type High Voltage Power Transformer Market in 2024. The region’s growth is driven by grid modernization programs, renewable energy integration, and investments in smart substations. The United States leads with extensive adoption of cast resin transformers in wind and solar plants. Canada emphasizes eco-friendly electrical systems and industrial safety compliance. Manufacturers like Eaton and General Electric dominate the market through digitalized transformer technologies and efficient cooling systems, supporting the region’s transition toward sustainable, low-emission power infrastructure.

Europe

Europe accounts for 24% of the market share, supported by strong environmental regulations and renewable energy commitments. The region’s focus on reducing carbon emissions and upgrading power infrastructure accelerates demand for dry type transformers. Germany, France, and the UK lead installations in wind farms, metro systems, and industrial complexes. For instance, Siemens and ABB deliver high-voltage cast resin units optimized for urban and renewable applications. EU-backed energy efficiency directives and grid interconnection projects continue to strengthen the market’s expansion across industrial and utility sectors.

Asia-Pacific

Asia-Pacific dominates the global market with a 34% share in 2024. Rapid industrialization, urbanization, and renewable energy expansion in China, India, Japan, and South Korea drive demand. Governments in the region are investing heavily in smart grid and rail electrification projects. For instance, Hitachi Energy and Schneider Electric supply dry type transformers for renewable and metro rail applications. The region’s focus on energy efficiency, safety, and compact installations boosts adoption across commercial and industrial infrastructures, solidifying Asia-Pacific’s leadership in the global transformer landscape.

Latin America

Latin America holds an 8% market share, led by Brazil, Mexico, and Chile. The region is witnessing growing demand for reliable and low-maintenance transformers to support industrial expansion and renewable power projects. Governments emphasize energy diversification and grid reliability. For instance, ABB and WEG supply dry type transformers for hydro and solar installations across Brazil. The region’s increasing foreign investment in clean energy and transmission networks supports market development, though cost-sensitive customers still limit large-scale adoption compared to developed regions.

Middle East & Africa

The Middle East & Africa region accounts for 7% of the market share. Growing investments in power distribution, data centers, and urban development projects drive transformer deployment. GCC countries focus on renewable integration and infrastructure modernization. For instance, Schneider Electric and CG Power supply dry type transformers for smart cities and industrial hubs in the UAE and Saudi Arabia. In Africa, electrification programs and grid upgrades across South Africa and Kenya fuel demand. However, high costs and import dependencies remain barriers to faster regional growth.

Market Segmentations:

By Product:

By Winding:

- Two Winding

- Auto Transformer

By Rating:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Dry Type High Voltage Power Transformer Market features key players such as Daihen, Bharat Heavy Electricals, JSHP Transformer, Hyundai Electric, CG Power and Industrial Solutions, ABB, Hitachi Energy, Hyosung Heavy Industries, Bharat Bijlee, and General Electric. The competitive landscape of the Dry Type High Voltage Power Transformer Market is defined by strong technological innovation, sustainability initiatives, and expanding global reach. Market participants focus on developing advanced insulation materials, enhanced cooling systems, and digital monitoring capabilities to improve efficiency and reliability. The integration of IoT-based predictive maintenance and smart grid compatibility has become a key differentiator, driving product modernization across industrial and utility applications. Companies are also investing in eco-friendly designs to align with stricter environmental standards and energy efficiency regulations. Strategic partnerships, capacity expansions, and localization of manufacturing facilities further strengthen competitiveness and market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Daihen

- Bharat Heavy Electricals

- JSHP Transformer

- Hyundai Electric

- CG Power and Industrial Solutions

- ABB

- Hitachi Energy

- Hyosung Heavy Industries

- Bharat Bijlee

- General Electric

Recent Developments

- In December 2024, SSE and Siemens Energy have announced a partnership “Mission H2 Power,” aimed at advancing gas turbine technology to operate on 100% hydrogen. This initiative supports the decarbonization of SSE’s Keadby 2 Power Station, which currently utilizes natural gas.

- In June 2024, Adani Power Ltd (APL) announced that its arm Mahan Energen Ltd has approved a proposal to merge coal mining firm Stratatech Mineral Resources with itself which will help improve fuel security.

- In January 2024, GE Vernova and IHI Corporation have initiated the next phase of their collaboration to develop a gas turbine combustion system capable of burning 100% ammonia, potentially transforming natural gas fired electricity generation.

- In February 2023, Indonesia announced the launch of the first mandatory carbon trading for coal power plants. This step is a part of Southeast Asia’s biggest economy to boost renewable energy and achieve net zero emissions by 2060

Report Coverage

The research report offers an in-depth analysis based on Product, Winding, Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to rising demand for energy-efficient power distribution systems.

- Renewable energy integration will boost adoption of dry type transformers in wind and solar projects.

- Smart grid development will drive demand for transformers with digital monitoring and control features.

- Industrial automation will increase the need for compact, low-maintenance transformer solutions.

- Advancements in resin and insulation technologies will enhance safety and operational reliability.

- Urban infrastructure expansion will create opportunities for indoor and underground transformer installations.

- Government initiatives promoting green energy and low-emission systems will support market growth.

- Emerging economies in Asia-Pacific and Africa will see higher adoption through infrastructure investments.

- Manufacturers will focus on modular, customizable transformer designs for diverse voltage requirements.

- Collaboration between utilities and technology firms will accelerate innovation in high-voltage transformer performance.