Table of Content

Chapter No. 1 :….. Introduction.. 22

1.1. Report Description. 22

Purpose of the Report 22

USP & Key Offerings 22

1.2. Key Benefits for Stakeholders 23

1.3. Target Audience. 23

Chapter No. 2 :….. Executive Summary.. 24

Chapter No. 3 :….. DUBAI MEAT MARKET FORCES & INDUSTRY PULSE.. 26

3.1. Foundations of Change – Market Overview.. 26

3.2. Catalysts of Expansion – Key Market Drivers 28

3.3. Momentum Boosters – Growth Triggers 29

3.4. Innovation Fuel – Disruptive Technologies 29

3.5. Headwinds & Crosswinds – Market Restraints 30

3.6. Regulatory Tides – Compliance Challenges 31

3.7. Economic Frictions – Inflationary Pressures 31

3.8. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 32

3.9. Market Equilibrium – Porter’s Five Forces 33

3.10. Macro Forces – PESTEL Breakdown. 35

3.11. Price Trend Analysis 37

3.11.1. Price Trend by Meat Type. 38

Chapter No. 4 :….. Regulatory and Compliance.. 39

4.1. Impact of regulatory requirements and compliance frameworks 39

4.2. Import regulations and restrictions by origin. 39

4.3. Halal certification and food safety compliance. 40

4.4. Tariffs, taxes, and import duties 40

Chapter No. 5 :….. COMPETITION ANALYSIS. 41

5.1. Company Market Share Analysis 41

5.1.1. Dubai Meat Market Company Volume Market Share. 41

5.1.2. Dubai Meat Market Company Revenue Market Share. 43

5.2. Strategic Developments 45

5.2.1. Acquisitions & Mergers 45

5.2.2. New Meat Type Launch. 46

5.2.3. Agreements & Collaborations 47

5.3. Competitive Dashboard. 48

5.4. Company Assessment Metrics, 2024. 49

Chapter No. 6 :….. Origin-Wise Meat Supply Analysis. 50

6.1. Dubai Beef Market by Exporting Country – Volume, Value, and Price. 50

6.2. Dubai Lamb and Mutton Market by Exporting Country – Volume, Value, and Price 51

6.3. Dubai Poultry Market by Exporting Country – Volume, Value, and Price. 52

6.4. Dubai Other (Goat, Camel, Specialty & Processed Meats) Meat Market by Exporting Country – Volume, Value, and Price. 53

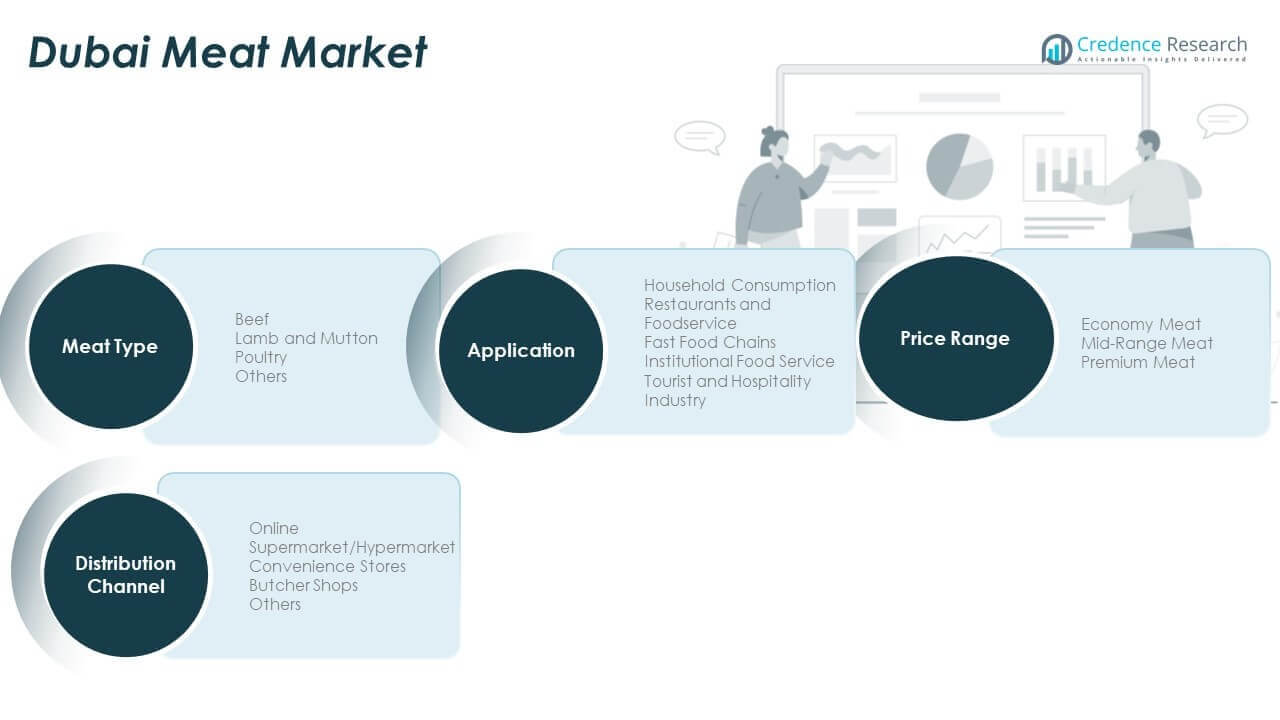

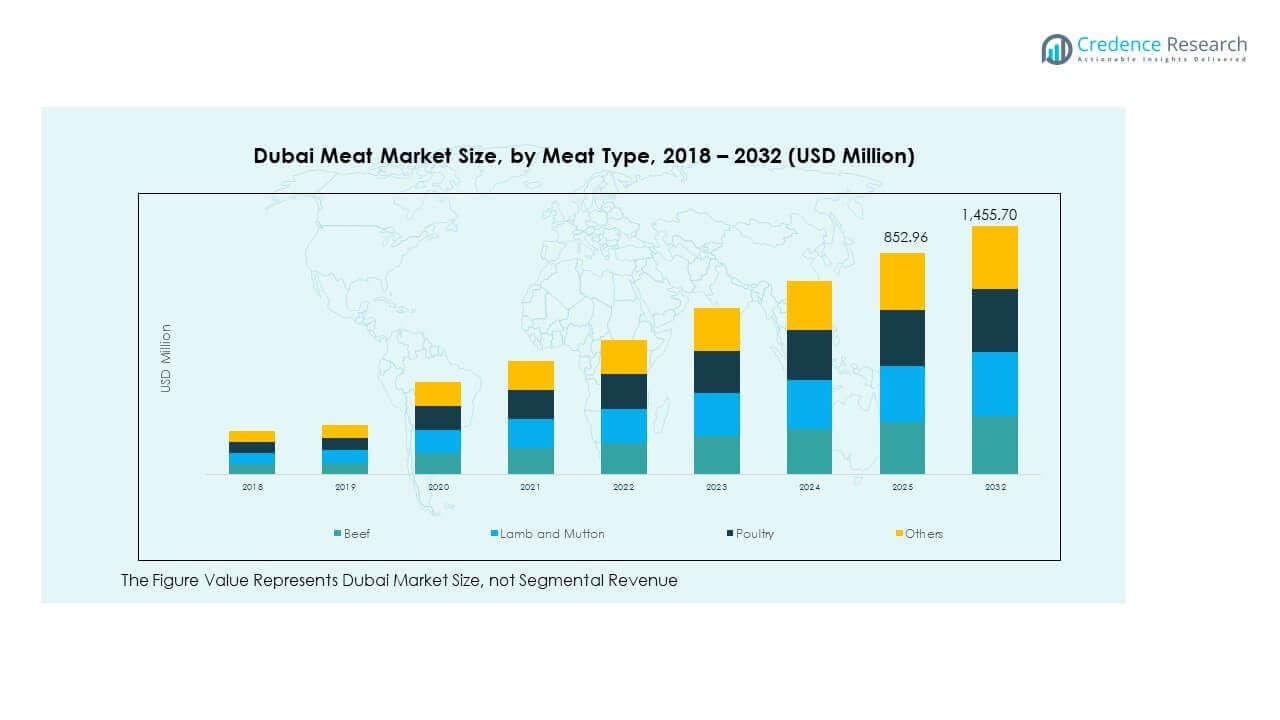

Chapter No. 7 :….. Dubai Market Analysis, Insights & Forecast, by Meat Type.. 54

Chapter No. 8 :….. Dubai Market Analysis, Insights & Forecast, by Application.. 59

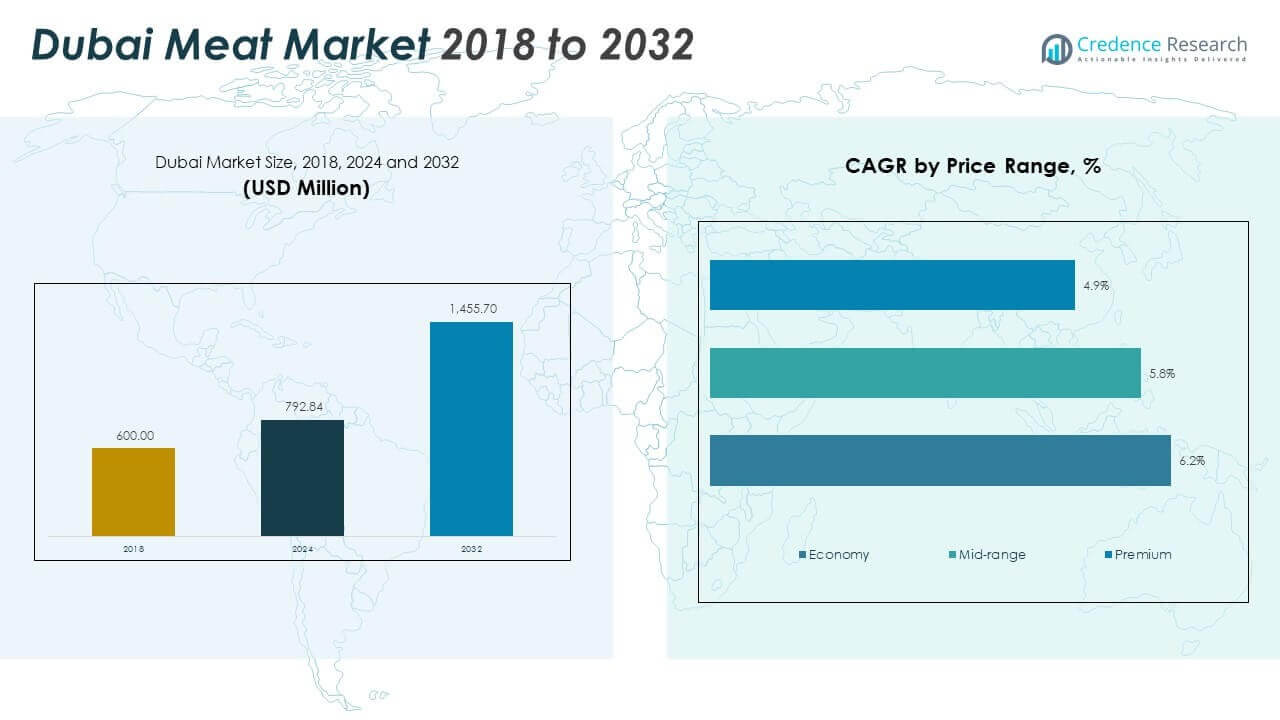

Chapter No. 9 :….. Dubai Market Analysis, Insights & Forecast, by Price Range.. 64

Chapter No. 10 :… Dubai Market Analysis, Insights & Forecast, by Distribution Channel.. 69

Chapter No. 11 :… Company Profile – Global Meat Suppliers. 74

11.1. JBS S.A. (Brazil) 74

11.2. Tyson Foods (USA) 77

11.3. Cargill Meat Solutions (USA / Global) 77

11.4. NH Foods (Japan) 77

11.5. Teys Australia (Australia) 77

11.6. Hormel Foods Corporation (United States) 77

11.7. Danish Crown A/S (Denmark) 77

11.8. Minerva Foods (Brazil) 77

11.9. Thomas Foods International (Australia) 77

11.10. Company 10 77

Chapter No. 12 :… Company Profile – Global Beef Suppliers. 78

12.1. JBS S.A. (Brazil) 78

12.2. Marfrig Global Foods (Brazil) 81

12.3. Minerva Foods (Brazil) 81

12.4. Tyson Foods (U.S.) 81

12.5. Cargill Incorporated (U.S.) 81

Chapter No. 13 :… Company Profile – Global Lamb and Mutton Suppliers. 82

13.1. Alliance Group Ltd. (New Zealand) 82

13.2. Silver Fern Farms (New Zealand) 85

13.3. ANZCO Foods (New Zealand) 85

13.4. Thomas Foods International (Australia) 85

13.5. JBS Australia (Australia) 85

Chapter No. 14 :… Company Profile – Global Poultry Suppliers. 86

14.1. BRF S.A. (Brazil) 86

14.2. JBS S.A. (Brazil) 89

14.3. Tyson Foods (U.S.) 89

14.4. Pilgrim’s Pride Corporation (U.S.) 89

14.5. Charoen Pokphand Foods (CPF) (Thailand) 89

Chapter No. 15 :… Company Profile – Global Others (Goat, Camel, Specialty & Processed Meats) Suppliers. 90

15.1. Al Islami Foods (UAE) 90

15.2. Al Kabeer Group (UAE) 93

15.3. Midfield Group (Australia) 93

15.4. Thomas Foods International (Australia) 93

15.5. BRF S.A. (Processed & Specialty Meats) (Brazil) 93

List of Figures

FIG NO. 1……… Dubai Meat Market Revenue Share, By Meat Type, 2024 & 2032. 54

FIG NO. 2……… Market Attractiveness Analysis, By Meat Type. 55

FIG NO. 3……… Incremental Revenue Growth Opportunity by Meat Type, 2024 – 2032. 56

FIG NO. 4……… Dubai Meat Market Revenue Share, By Application, 2024 & 2032. 59

FIG NO. 5……… Market Attractiveness Analysis, By Application. 60

FIG NO. 6……… Incremental Revenue Growth Opportunity by Application, 2024 – 2032. 61

FIG NO. 7……… Dubai Meat Market Revenue Share, By Price Range, 2024 & 2032. 64

FIG NO. 8……… Market Attractiveness Analysis, By Price Range. 65

FIG NO. 9……… Incremental Revenue Growth Opportunity by Price Range, 2024 – 2032. 66

FIG NO. 10……. Dubai Meat Market Revenue Share, By Distribution Channel, 2024 & 2032. 69

FIG NO. 11……. Market Attractiveness Analysis, By Distribution Channel 70

FIG NO. 12……. Incremental Revenue Growth Opportunity by Distribution Channel, 2024 – 2032. 71

List of Tables

TABLE NO. 1. :. Dubai Beef Market by Exporting Country – Volume, Value, and Price. 50

TABLE NO. 2. :. Dubai Lamb and Mutton Market by Exporting Country – Volume, Value, and Price. 51

TABLE NO. 3. :. Dubai Poultry Market by Exporting Country – Volume, Value, and Price. 52

TABLE NO. 4. :. Dubai Others (Goat, Camel, Specialty & Processed Meats) Market by Exporting Country – Volume, Value, and Price. 53

TABLE NO. 5. :. Dubai Meat Market Revenue, By Meat Type, 2018 – 2024 (USD Million). 57

TABLE NO. 6. :. Dubai Meat Market Revenue, By Meat Type, 2025 – 2032 (USD Million). 57

TABLE NO. 7. :. Dubai Meat Market Volume, By Meat Type, 2018 – 2024 (Tons). 58

TABLE NO. 8. :. Dubai Meat Market Volume, By Meat Type, 2025 – 2032 (Tons). 58

TABLE NO. 9. :. Dubai Meat Market Revenue, By Application, 2018 – 2024 (USD Million). 62

TABLE NO. 10. :……. Dubai Meat Market Revenue, By Application, 2025 – 2032 (USD Million). 62

TABLE NO. 11. :………………. Dubai Meat Market Volume, By Application, 2018 – 2024 (Tons). 63

TABLE NO. 12. :………………. Dubai Meat Market Volume, By Application, 2025 – 2032 (Tons). 63

TABLE NO. 13. :……. Dubai Meat Market Revenue, By Price Range, 2018 – 2024 (USD Million). 67

TABLE NO. 14. :……. Dubai Meat Market Revenue, By Price Range, 2025 – 2032 (USD Million). 67

TABLE NO. 15. :………………. Dubai Meat Market Volume, By Price Range, 2018 – 2024 (Tons). 68

TABLE NO. 16. :………………. Dubai Meat Market Volume, By Price Range, 2025 – 2032 (Tons). 68

TABLE NO. 17. :……. Dubai Meat Market Revenue, By Distribution Channel, 2018 – 2024 (USD Million). 72

TABLE NO. 18. :…… Dubai Meat Market Revenue, By Distribution Channel , 2025 – 2032 (USD Million). 72

TABLE NO. 19. :…… Dubai Meat Market Volume, By Distribution Channel, 2018 – 2024 (Tons). 73

TABLE NO. 20. :….. Dubai Meat Market Volume, By Distribution Channel , 2025 – 2032 (Tons). 73