| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Autonomous Off-Road Vehicles And Machinery Market Size 2023 |

USD 52.16 Million |

| UAE Autonomous Off-Road Vehicles And Machinery Market, CAGR |

10.23% |

| UAE Autonomous Off-Road Vehicles And Machinery MarketSize 2032 |

USD 125.67 Million |

Market Overview:

UAE Autonomous Off-Road Vehicles And Machinery Market size was valued at USD 52.16 million in 2023 and is anticipated to reach USD 125.67 million by 2032, at a CAGR of 10.23% during the forecast period (2023-2032).

Several factors are propelling the adoption of autonomous off-road vehicles in the UAE. The government’s strategic initiatives, including the Dubai Self-Driving Transport Strategy aiming to convert 25% of total trips to autonomous modes by 2030, play a pivotal role. Additionally, the scarcity of skilled labor in sectors like agriculture and construction is accelerating the shift towards automation to maintain productivity. Technological advancements, particularly in AI, machine learning, and sensor technologies, are enhancing the reliability and efficiency of autonomous systems. Moreover, the UAE’s commitment to sustainability and smart city initiatives is fostering an environment conducive to the deployment of autonomous solutions. The country’s emphasis on reducing emissions and improving operational efficiency in industries such as agriculture and construction further supports the adoption of autonomous machinery. Furthermore, the strong financial backing from the UAE government for technological innovation is helping fuel the growth of autonomous vehicle infrastructure in the country.

The UAE stands out as a leader in the Middle East regarding the adoption of autonomous off-road vehicles. Dubai’s Roads and Transport Authority (RTA) is actively testing and deploying autonomous vehicles, including electric trucks, in collaboration with international companies like Einride. The UAE’s regulatory framework supports the piloting and commercial use of autonomous vehicles, positioning it as a regional hub for autonomous technology development. This proactive approach, coupled with investments in infrastructure and technology, underscores the UAE’s commitment to becoming a global leader in autonomous transportation solutions. Additionally, the UAE’s close proximity to key emerging markets in the Middle East, North Africa, and Asia positions it as a strategic gateway for the expansion of autonomous vehicle technology in the broader region. The increasing demand for advanced technologies in neighboring countries further boosts the UAE’s role as a catalyst for innovation in autonomous vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UAE Autonomous Off-road Vehicles and Machinery market was valued at USD 52.16 million in 2023 and is expected to reach USD 125.67 million by 2032, growing at a CAGR of 10.23% during the forecast period.

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- The UAE government’s initiatives, including the Dubai Self-Driving Transport Strategy, are pivotal in driving the adoption of autonomous off-road vehicles, with plans to convert 25% of total trips to autonomous modes by 2030.

- Labor shortages in industries such as agriculture and construction are accelerating the shift toward automation, where autonomous vehicles offer enhanced productivity and reduced reliance on human labor.

- Technological advancements in AI, machine learning, and sensor technologies are significantly improving the performance, reliability, and efficiency of autonomous systems in complex environments.

- The UAE’s commitment to sustainability and environmental goals is fostering an environment for the growth of autonomous electric vehicles, contributing to reduced emissions and enhanced energy efficiency in various industries.

- The market is supported by strong government funding for technological innovations, aiding the growth of autonomous vehicle infrastructure and ensuring the UAE’s position as a leader in autonomous technology.

- While the UAE has established a favorable regulatory framework, challenges remain in terms of high initial investment costs, safety concerns, and public perception, which may slow the broader adoption of autonomous off-road vehicles.

Market Drivers:

Government Initiatives and Vision 2030

The UAE government plays a central role in accelerating the adoption of autonomous off-road vehicles and machinery. A key driver is the country’s Vision 2030, which emphasizes the development of smart cities and advanced technologies to create a more sustainable future. For instance, the Dubai Autonomous Transportation Strategy aims to convert 25% of all transportation in Dubai to autonomous mode by 2030, with the goal of reducing traffic accidents and losses by 12%, increasing individual productivity by 13%, and saving 396 million hours on transportation trips annually. This forward-thinking approach aligns with the UAE’s broader objective to reduce its carbon footprint, promote innovation, and establish itself as a leader in autonomous transportation solutions. These strategic policies provide the foundation for investments in research, development, and infrastructure to facilitate the widespread deployment of autonomous off-road vehicles, particularly in sectors like agriculture, construction, and logistics.

Technological Advancements and Innovation

Technological innovation, especially in artificial intelligence (AI), machine learning, and sensor technologies, is another critical driver of growth in the UAE autonomous off-road vehicles market. Advanced sensors, such as LiDAR and radar, enable autonomous vehicles to navigate complex environments with high precision, making them suitable for challenging terrains. AI algorithms enhance decision-making in real-time, allowing machines to optimize their performance and improve operational efficiency. As these technologies continue to evolve, autonomous off-road vehicles are becoming more reliable, reducing human intervention and operational risks. For instance, companies like SteerAI, launched by the Advanced Technology Research Council’s VentureOne, have developed AI-powered systems that transform standard industrial vehicles into autonomous machines capable of operating with high precision in logistics and defense sector. The continuous development of autonomous systems is making them increasingly viable for industries such as mining, agriculture, and construction, which require vehicles capable of operating in remote or hazardous environments.

Labor Shortages and Operational Efficiency

Another significant driver is the growing demand for automation due to labor shortages and the need for higher operational efficiency. In industries like agriculture and construction, where labor costs are rising and there is a shortage of skilled workers, autonomous off-road vehicles offer a viable solution. These machines can operate 24/7, reducing the reliance on human labor, especially in hazardous conditions. By automating tasks such as material handling, soil tilling, and mining operations, autonomous vehicles increase productivity while minimizing the risks associated with human labor. The ability of autonomous systems to optimize fuel consumption, reduce downtime, and improve safety further enhances operational efficiency. As a result, companies are increasingly adopting autonomous solutions to meet the growing demand for higher productivity at lower costs.

Commitment to Sustainability and Environmental Goals

The UAE’s commitment to sustainability and environmental stewardship is a major driver behind the market for autonomous off-road vehicles. The government has set ambitious goals to reduce emissions and promote green technologies as part of its efforts to diversify its economy and ensure long-term sustainability. Autonomous off-road vehicles, particularly electric-powered machinery, contribute to these environmental goals by reducing fuel consumption and lowering greenhouse gas emissions. The use of autonomous systems in industries like agriculture and construction also minimizes the environmental impact by optimizing resource use, reducing waste, and increasing energy efficiency. This commitment to sustainability aligns with global trends toward eco-friendly practices, further enhancing the attractiveness of autonomous vehicles as a solution to meet the UAE’s environmental targets.

Market Trends:

Integration of Electric and Autonomous Technologies

A significant trend in the UAE autonomous off-road vehicle market is the growing integration of electric technologies with autonomous systems. As the UAE pushes towards sustainability, there is a marked shift towards adopting electric-powered autonomous vehicles in off-road applications. This integration reduces dependence on fossil fuels, aligning with the country’s ambitious sustainability goals. Electric autonomous off-road vehicles are being increasingly deployed in industries such as agriculture, construction, and mining, where reducing operational costs and environmental impact is crucial. The combination of autonomous driving capabilities with electric propulsion systems not only improves fuel efficiency but also reduces emissions, providing a sustainable solution for heavy-duty machinery.

Rise of Smart Infrastructure and Digitalization

Smart infrastructure and digitalization are key trends shaping the UAE autonomous off-road vehicle market. The increasing adoption of Internet of Things (IoT) devices and cloud computing technologies is enabling the creation of connected, data-driven ecosystems that enhance the performance and management of autonomous vehicles. IoT sensors integrated into vehicles collect real-time data, allowing for precise monitoring of vehicle performance and environmental conditions. This data is then transmitted to cloud platforms for analysis, which helps optimize vehicle routes, maintenance schedules, and overall fleet management. For example, the smart transport project on Yas and Saadiyat Islands includes a fleet of 8 TXAI autonomous vehicles, supported by a “Digital Twin” system that uses cloud computing for advanced digital simulations and technical infrastructure services. These technological advancements are revolutionizing industries such as construction and agriculture, where autonomous vehicles can now operate more efficiently through remote monitoring and advanced analytics.

Improved Safety and Automation Features

The enhancement of safety features in autonomous off-road vehicles is another key trend in the UAE market. As the technology continues to mature, autonomous vehicles are being equipped with advanced safety systems, including collision avoidance, real-time hazard detection, and automated emergency braking. These features significantly improve the safety of operations, particularly in hazardous environments like construction sites and mining operations. Moreover, automated systems can work in areas where human operators may be exposed to dangerous conditions, reducing the risk of accidents and fatalities. The increasing focus on safety and reliability is not only a regulatory requirement but also a response to the demand for greater productivity with minimal human risk in off-road operations.

Government Support for Testing and Deployment

The UAE government’s proactive approach to supporting the testing and deployment of autonomous off-road vehicles is another major trend. Through various initiatives, including collaborations with international technology companies, the UAE is positioning itself as a testing ground for autonomous vehicle technologies. Regulatory frameworks are evolving to support autonomous operations, and testbeds are being established to validate the performance of autonomous machinery in real-world scenarios. For instance, Abu Dhabi’s SAVI cluster brings together automakers, technology players, and researchers, offering state-of-the-art facilities and a regulatory sandbox environment for experimentation. The government has also incentivized the development of autonomous technologies by providing grants and investments in research, creating an environment conducive to innovation and rapid deployment. As a result, many local and international companies are focusing their efforts on scaling autonomous solutions in the UAE, further accelerating market growth.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the primary challenges facing the adoption of autonomous off-road vehicles in the UAE is the high initial investment and maintenance costs. For instance, the deployment of the Khalifa University autonomous shuttle in Abu Dhabi required an AED 170-million operating agreement to support research, development, and operational costs, illustrating the substantial financial commitment needed to launch and maintain autonomous vehicle projects in the UAE. Autonomous vehicles, especially those designed for off-road applications, require advanced sensors, AI systems, and electric drivetrains, which contribute to their high purchase price. Additionally, the maintenance of these advanced technologies often requires specialized expertise, further increasing operational costs. These financial burdens can be a significant barrier for small to medium-sized enterprises in sectors like agriculture and construction, which may struggle to justify the return on investment for autonomous machinery, especially in the early stages of adoption.

Regulatory and Safety Concerns

Another major challenge is the evolving regulatory landscape surrounding autonomous vehicle deployment. While the UAE has made strides in creating favorable conditions for autonomous technology, regulatory frameworks for the testing and widespread deployment of autonomous off-road vehicles are still in development. There are concerns regarding safety standards, insurance requirements, and the potential for accidents involving autonomous vehicles. The lack of clear, established regulations may hinder the rapid adoption of this technology, as companies remain uncertain about the legal implications and compliance requirements. This regulatory uncertainty can slow down the progress of autonomous vehicle integration into various industries.

Technological Limitations in Complex Environments

Despite significant advancements, the technology behind autonomous off-road vehicles still faces limitations when operating in highly complex and unpredictable environments. Off-road conditions, such as uneven terrain, extreme weather, and low-visibility situations, can challenge the effectiveness of autonomous systems. While AI and sensors have improved significantly, they still struggle in certain conditions that human operators might navigate with greater flexibility. This technological gap can limit the full operational capacity of autonomous vehicles, particularly in remote or hazardous locations where conditions can change rapidly.

Public Perception and Trust Issues

Lastly, public perception and trust in autonomous technology remain a significant hurdle. Many people remain skeptical about the safety and reliability of autonomous vehicles, especially when it comes to their operation in high-risk environments like construction sites and mines. Building trust in these systems is critical for broader adoption, as companies may hesitate to deploy autonomous vehicles until they are confident that they are as safe, reliable, and efficient as traditional methods.

Market Opportunities:

The UAE presents significant market opportunities for autonomous off-road vehicles and machinery, primarily driven by the government’s commitment to technological innovation and sustainability. As part of its Vision 2030, the UAE aims to become a global leader in smart technologies, with a specific focus on autonomous transportation solutions. This vision has led to the development of favorable policies and investments that encourage the adoption of autonomous vehicles, including off-road machinery used in industries like agriculture, construction, and mining. The increasing demand for efficient, sustainable, and cost-effective solutions presents a compelling case for the widespread deployment of autonomous off-road vehicles. With the government’s push for reducing emissions and enhancing operational efficiency, companies in the region are likely to embrace autonomous systems, positioning the UAE as a leader in the Middle Eastern market.

Additionally, the expanding infrastructure projects, particularly in the construction and agriculture sectors, offer vast opportunities for autonomous off-road vehicle deployment. The UAE’s growing focus on smart cities and large-scale construction projects, such as the Expo 2020 site in Dubai, increases the demand for advanced machinery capable of operating in challenging environments. Autonomous vehicles can significantly improve productivity and safety in these high-risk sectors by reducing human intervention and increasing operational efficiency. Furthermore, as the UAE positions itself as a regional hub for technology and innovation, there are ample opportunities for international companies to collaborate with local firms to develop and deploy cutting-edge autonomous solutions, further accelerating the growth of the market.

Market Segmentation Analysis:

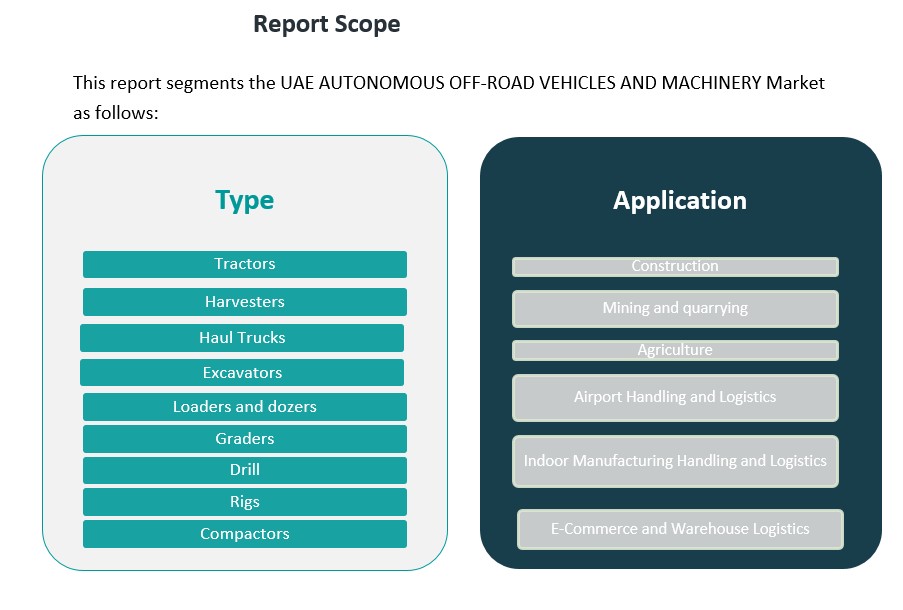

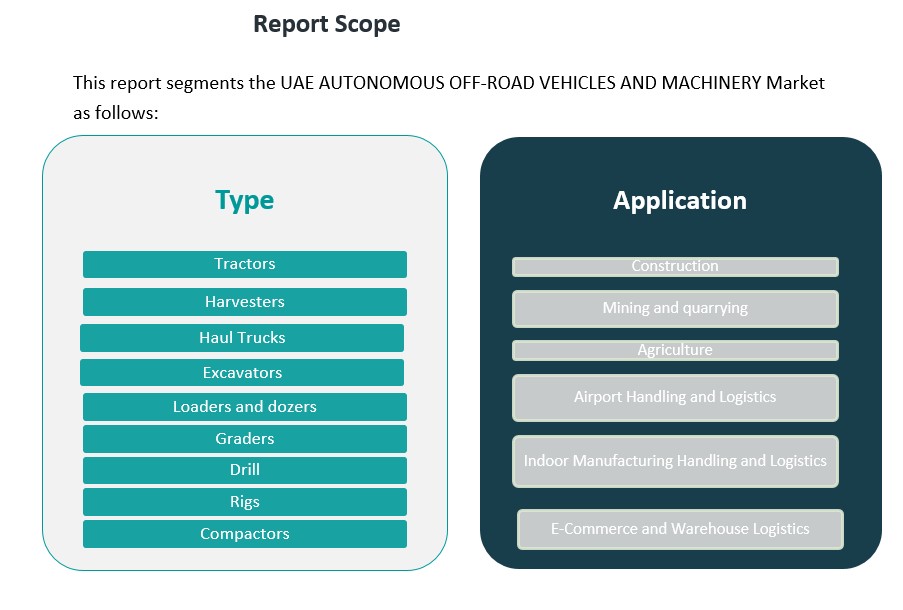

The UAE autonomous off-road vehicle market is segmented by type and application, with each category reflecting the diverse demands of industries that are increasingly adopting automation for enhanced efficiency and safety.

By Type Segment

The types of autonomous off-road vehicles and machinery in the UAE market include tractors, harvesters, haul trucks, excavators, loaders, dozers, graders, drills, rigs, and compactors. Tractors and harvesters are particularly significant in the agriculture sector, where automation improves efficiency in crop production and harvesting. Haul trucks and excavators are essential in the mining and construction industries, enabling heavy-duty operations without the need for human operators in hazardous environments. Loaders, dozers, and graders, used in construction and earth-moving applications, benefit from automation by reducing operational risks and improving precision in grading and material handling. Drills and rigs, particularly in the oil and gas industry, leverage autonomous systems for more precise and efficient drilling operations. Compactors are also increasingly integrated with autonomous technologies to enhance safety and productivity in road construction projects.

By Application Segment

In terms of applications, autonomous off-road vehicles in the UAE are primarily deployed across several key sectors, including construction, mining, agriculture, and logistics. The construction sector benefits significantly from automation in earth-moving and material handling tasks, while mining and quarrying operations leverage autonomous haul trucks and excavators to improve productivity in dangerous environments. In agriculture, autonomous tractors and harvesters are revolutionizing crop management and harvesting, offering a sustainable alternative to traditional labor-intensive methods. Airport handling and logistics, indoor manufacturing handling, and e-commerce warehouse logistics are also seeing growing adoption of autonomous machinery to streamline operations, reduce labor costs, and improve efficiency in material transport and storage.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

The UAE is a leader in the Middle East when it comes to the adoption and development of autonomous off-road vehicles and machinery. As a result, the market in the UAE is expected to experience significant growth driven by favorable government policies, investments in infrastructure, and the increasing need for automation in various industries such as construction, agriculture, and mining. The UAE’s strategic location as a regional business hub further positions it as the focal point for autonomous off-road vehicle deployments across the Middle East, providing a competitive edge in terms of market share and technological adoption.

UAE Market Share and Growth Dynamics

As of 2023, the UAE is one of the largest markets for autonomous off-road vehicles in the Middle East, capturing a significant share of the regional market. The country’s share is estimated to be approximately 40% of the total autonomous off-road vehicle market in the Middle East. The rapid adoption of advanced technologies, coupled with government initiatives such as the Dubai Self-Driving Transport Strategy and Vision 2030, is accelerating market growth. These initiatives have laid the groundwork for testing and deploying autonomous systems in various industries, driving the demand for autonomous off-road vehicles.

Middle East Market and Regional Expansion

Beyond the UAE, the broader Middle East market is showing increasing interest in autonomous off-road vehicles, although it remains in the early stages of development compared to more mature markets in Europe and North America. Countries such as Saudi Arabia, Qatar, and Kuwait are expected to experience rapid growth in autonomous vehicle adoption due to their expanding infrastructure projects and large-scale investments in sectors like construction and oil & gas. The regional market share of the UAE is expected to remain dominant due to its early adoption of autonomous technologies and the establishment of a strong regulatory framework for autonomous vehicle testing and deployment.

In Saudi Arabia, the market is expected to account for around 25% of the Middle East’s autonomous off-road vehicle market by 2030. This is due to the country’s large mining and construction sectors, alongside substantial investments in autonomous technologies. Qatar and Kuwait are also gradually increasing their focus on smart technologies and automation, contributing to the regional market’s growth but remaining behind the UAE in terms of total market share.

Key Player Analysis:

- Caterpillar Inc.

- Komatsu Ltd.

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

Competitive Analysis:

The UAE autonomous off-road vehicle market is highly competitive, with both local and international players vying for market share. Key global companies like Caterpillar, Komatsu, Volvo, and Liebherr dominate the market with their advanced autonomous systems used in construction, mining, and agriculture. These companies have a strong presence in the UAE due to their established reputation, technological expertise, and comprehensive product portfolios, which include autonomous excavators, haul trucks, and graders. Additionally, UAE-based companies such as Al-Futtaim Automotive and Al Jaber Group are increasing their focus on integrating autonomous technologies into their machinery fleets, capitalizing on local demand and government incentives. The competition is further intensifying with the entry of newer players specializing in electric and autonomous solutions, including startups and tech firms collaborating with local entities. Strategic partnerships and joint ventures are common, as companies aim to enhance their technological capabilities and expand their market presence in the UAE’s growing autonomous vehicle market.

Recent Developments:

- In February 2025, EDGE, a leading advanced technology and defense group in the UAE, unveiled five new cutting-edge land platforms at the International Defence Exhibition and Conference (IDEX) 2025 in Abu Dhabi. Among the highlights were three new variants of NIMR’s AJBAN MK2, the MILREM HAVOC 8×8 Robotic Combat Vehicle (RCV), and AL JASOOR’s upgraded RABDAN 8×8 Recovery Vehicle. This launch demonstrates EDGE’s commitment to expanding its portfolio of autonomous and robotic land systems, enhancing operational capabilities for both manned and unmanned missions, and reinforcing its position as a leader in next-generation land systems for global defense forces.

- In April 2025, Uber and WeRide announced a strategic partnership with Dubai’s Road and Transport Authority (RTA) to introduce autonomous vehicles to Dubai. This collaboration is a significant step in Dubai’s Self-Driving Transport Strategy, which aims to make 25% of all city journeys autonomous by 2030.

- In March 2025, Baidu’s Apollo Go entered into a strategic partnership with Autogo, a UAE-based autonomous mobility company and subsidiary of Kintsugi Holding, to build Abu Dhabi’s largest driverless fleet. The initial phase will see the deployment of dozens of Apollo Go autonomous vehicles in select areas of Abu Dhabi, with plans for phased expansion ahead of full commercial operations by 2026.

Market Concentration & Characteristics:

The UAE’s autonomous off-road vehicle and machinery market is moderately concentrated, characterized by a blend of established global manufacturers and emerging local players. International companies such as Caterpillar, Komatsu, and Volvo dominate the market, leveraging advanced technologies and extensive experience to offer a wide range of autonomous solutions across sectors like construction, agriculture, and mining. These companies benefit from strong brand recognition, established distribution networks, and substantial R&D capabilities. Concurrently, local entities are increasingly investing in autonomous technologies, aiming to capitalize on government initiatives and the growing demand for automation. The UAE government plays a pivotal role in shaping the market dynamics by implementing policies that encourage the adoption of autonomous systems, offering incentives, and facilitating regulatory frameworks that support innovation. This supportive environment fosters competition and collaboration between global and local players, driving technological advancements and market growth. As a result, the market is evolving towards a more diversified and competitive landscape, with opportunities for both established and new entrants to contribute to the development of autonomous off-road vehicles and machinery in the UAE.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UAE autonomous off-road vehicle market is expected to experience significant growth, driven by increased automation across key industries.

- Government initiatives, such as Vision 2030 and the Dubai Self-Driving Transport Strategy, will continue to influence the market’s development.

- Growing demand for autonomous vehicles in agriculture and construction will be fueled by labor shortages and the need for improved operational efficiency.

- Technological innovations in AI, sensors, and electric propulsion will enhance the functionality and attractiveness of autonomous vehicles.

- Ongoing investments in infrastructure, including smart cities and digitalization efforts, will facilitate the widespread adoption of autonomous systems.

- The mining sector is likely to adopt more autonomous machinery to improve safety and productivity in challenging environments.

- The UAE will remain a leading regional hub for autonomous technology, fostering partnerships between international and local players.

- Regulatory frameworks will evolve to support the faster integration and scaling of autonomous solutions.

- Environmental sustainability goals will drive the adoption of electric autonomous vehicles, helping reduce emissions in industrial operations.

- The growth of e-commerce and warehouse logistics will drive increased demand for autonomous vehicles in material handling and transportation.