| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Retail Pharmacy Market Size 2024 |

USD 8,620.33 million |

| UAE Retail Pharmacy Market, CAGR |

2.38% |

| UAE Retail Pharmacy Market Size 2032 |

USD 10,403.13 million |

Market Overview

The UAE Retail Pharmacy Market is projected to grow from USD 8,620.33 million in 2024 to an estimated USD 10,403.13 million by 2032, with a compound annual growth rate (CAGR) of 2.38% from 2025 to 2032. This growth reflects the steady expansion of the healthcare sector and the country’s focus on enhancing pharmaceutical access through regulatory support and digitalization.

Key drivers of the market include an increasing geriatric population, a rise in non-communicable diseases, and a shift toward preventive healthcare. Additionally, the integration of e-pharmacy platforms and digital health technologies is improving customer engagement and convenience, encouraging consumers to seek pharmacy services beyond traditional outlets. Pharmacies are also enhancing service offerings by including patient counseling and chronic care support to address evolving healthcare needs.

Geographically, Dubai and Abu Dhabi dominate the UAE retail pharmacy market due to higher urban populations and advanced healthcare infrastructure. However, northern emirates are also witnessing increased pharmacy penetration due to expanding healthcare coverage. Prominent market players include Aster Pharmacy, Life Pharmacy, BinSina Pharmacy, and Al Manara Pharmacy. These companies continue to invest in digital transformation, retail network expansion, and strategic partnerships to strengthen their market presence and meet rising consumer expectations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE retail pharmacy market is expected to grow from USD 8,620.33 million in 2024 to USD 10,403.13 million by 2032, with a CAGR of 2.38%, driven by increased demand for pharmaceuticals and wellness products.

- The Global Retail Pharmacy Market is expected to grow from USD 14,45,920.00 million in 2024 to USD 19,65,958.05 million by 2032, at a CAGR of 3.92% from 2025 to 2032.

- Key drivers include an aging population, a rise in chronic diseases, and growing demand for over-the-counter (OTC) medications. E-pharmacy platforms and digital health technologies are further boosting consumer engagement.

- Challenges include intense competition from both traditional and online pharmacies, which pressures pricing and profit margins. Regulatory constraints and pricing controls may also limit growth potential.

- Dubai and Abu Dhabi dominate the market, accounting for a significant portion due to high urban populations and advanced healthcare infrastructure, with increasing pharmacy penetration in the northern emirates.

- The integration of digital services such as online prescriptions, home delivery, and telehealth consultations is transforming the pharmacy landscape, enhancing convenience and accessibility for consumers.

- An increasing consumer focus on wellness and preventive care, including vitamins, supplements, and health screenings, is expanding the scope of retail pharmacy services in the UAE.

- Key players like Aster Pharmacy, Life Pharmacy, and BinSina Pharmacy lead the market, focusing on expanding their service offerings, strengthening digital channels, and enhancing customer loyalty programs.

Report Scope

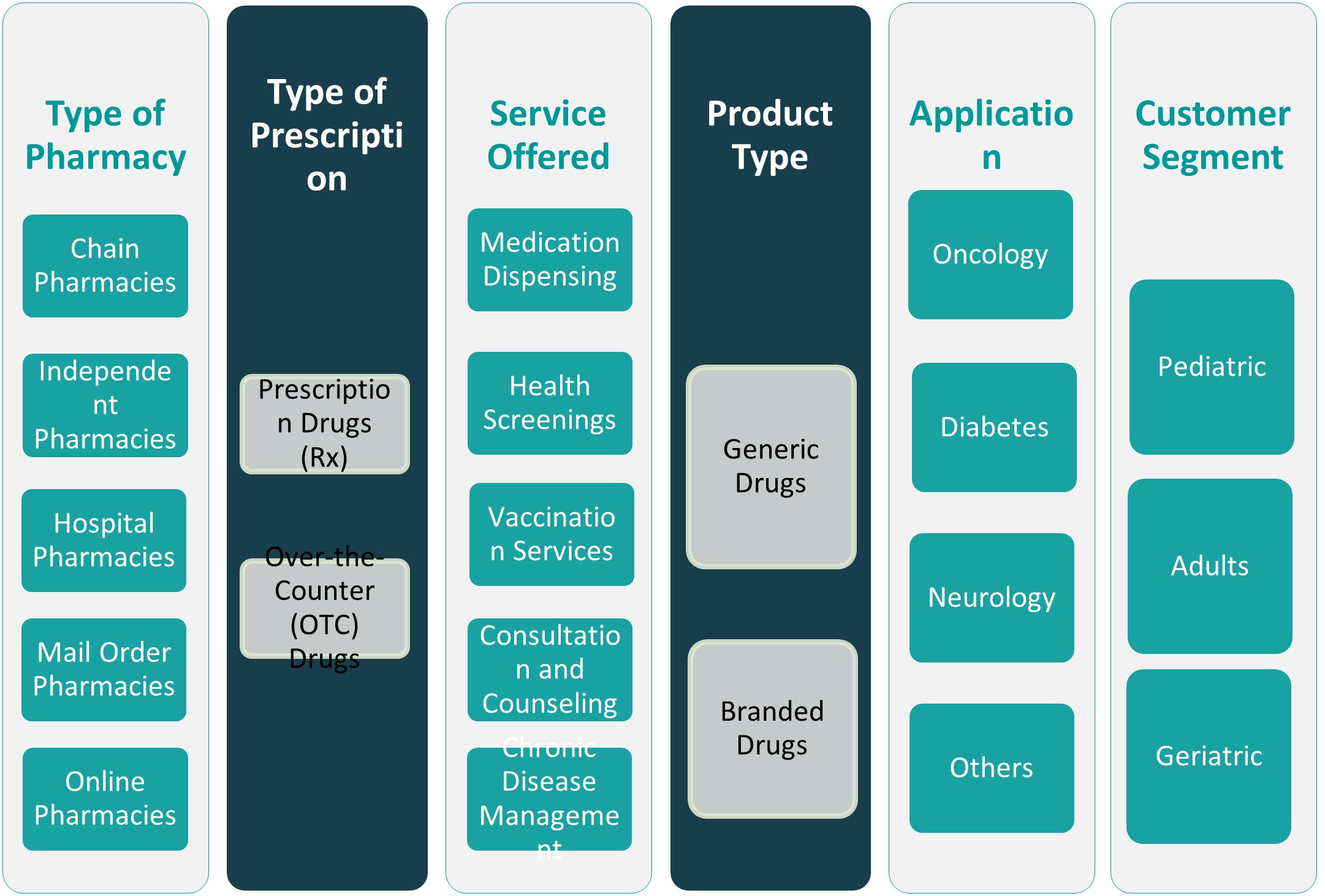

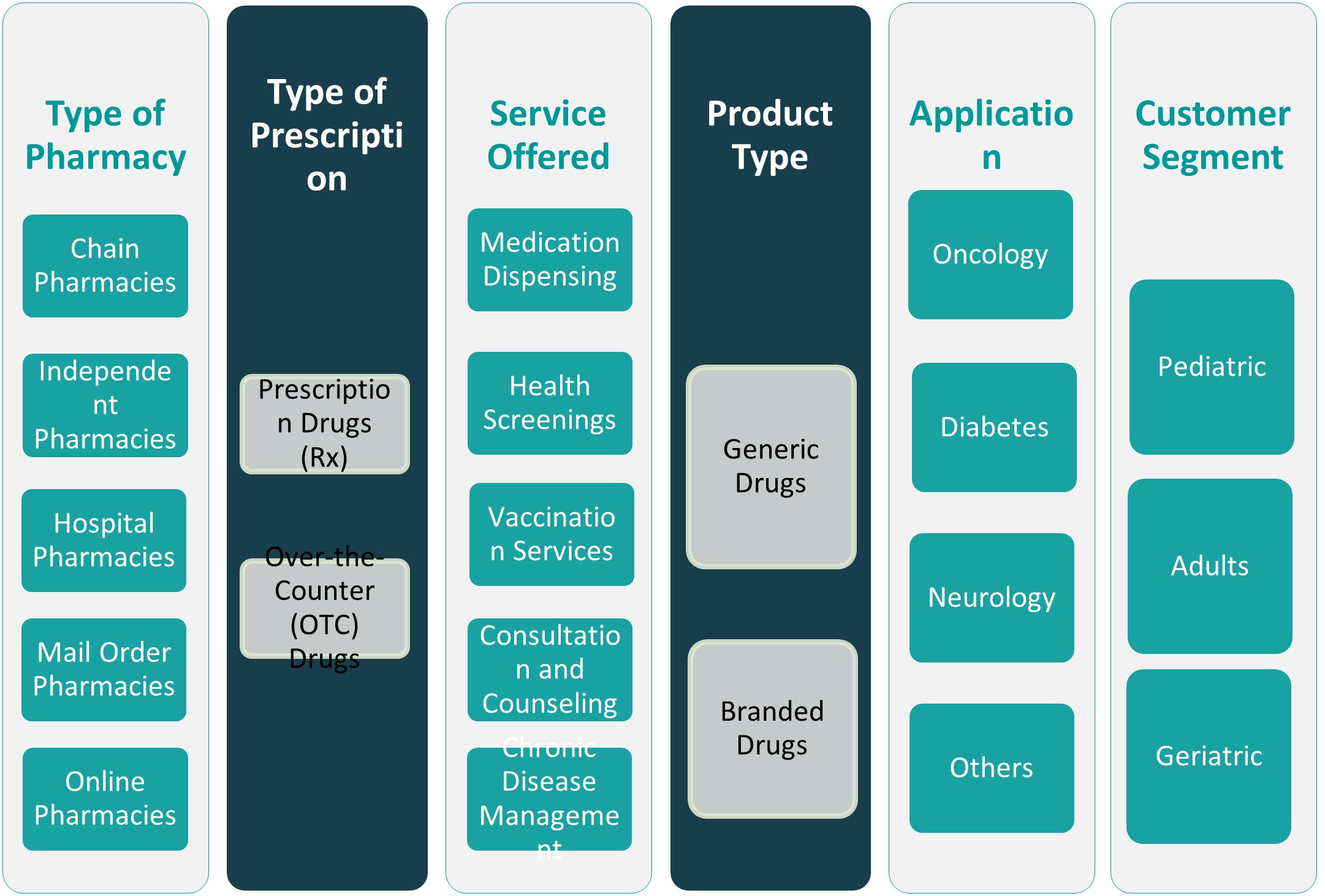

This report segments the UAE Retail Pharmacy Market as follows:

Market Drivers

Rising Prevalence of Chronic Diseases and an Aging Population

The increasing incidence of chronic illnesses, such as diabetes, cardiovascular diseases, and hypertension, is one of the primary drivers of the UAE retail pharmacy market. According to the International Diabetes Federation, the UAE had a diabetes prevalence rate of 16.3% in 2021, ranking among the highest globally. This condition, along with other long-term ailments, necessitates continuous medication and regular healthcare monitoring, which significantly boosts demand for pharmaceutical products and services. As patients require recurring prescriptions and supportive care, retail pharmacies serve as accessible healthcare hubs for chronic disease management. In parallel, the UAE’s demographic shift toward an aging population has further intensified pharmaceutical consumption. For instance, the UAE’s National Health Survey reported that over 11% of the population aged 60 and above suffers from multiple chronic conditions, necessitating frequent pharmacy visits. Retail pharmacies are expanding their services to include health screenings, medication reviews, and personalized patient support to address this growing segment. With a healthcare system aiming to offer comprehensive and patient-centered care, pharmacies play a crucial role in delivering accessible solutions for the aging population and individuals with chronic conditions.

Expansion of Health Insurance Coverage and Government Healthcare Reforms

Government-led initiatives and policy reforms supporting broader healthcare access have significantly influenced the retail pharmacy landscape in the UAE. Mandatory health insurance laws in Dubai and Abu Dhabi have resulted in nearly 98% insurance coverage among residents, according to the UAE Ministry of Health and Prevention (MOHAP). This shift has led to a higher volume of prescriptions and OTC purchases, as insured patients are more inclined to seek timely medical intervention and adhere to treatment plans. Additionally, the UAE government has consistently invested in enhancing healthcare infrastructure and regulatory frameworks to improve pharmaceutical service delivery. For instance, reforms targeting the pricing and local distribution of drugs have reduced medication costs by up to 30%, as reported by MOHAP. Retail pharmacies have benefited from these measures through a more streamlined supply chain and increased consumer trust in the quality and affordability of pharmaceutical products. These policy-driven enhancements are not only making medications more accessible but are also fueling growth in retail pharmacy networks across urban and semi-urban areas.

Digital Transformation and the Rise of E-Pharmacy Platforms

The integration of digital technologies in the healthcare sector has brought transformative changes to the UAE retail pharmacy market. The rise of e-pharmacy platforms, mobile health applications, and online prescription services is reshaping how consumers access medications and wellness products. In response to evolving consumer preferences for convenience, safety, and speed, retail pharmacies are increasingly offering digital services such as home delivery, e-consultations, and automated prescription refills. During and after the COVID-19 pandemic, e-commerce adoption accelerated in the pharmaceutical sector, making digital channels a permanent fixture in the retail pharmacy ecosystem. Consumers are now accustomed to seamless digital experiences, pushing traditional brick-and-mortar pharmacies to adopt omnichannel strategies. Many leading pharmacy chains, including Aster and Life Pharmacy, have launched comprehensive online platforms to enhance customer engagement and broaden their reach. These initiatives have not only improved accessibility for patients in remote areas but have also created new revenue streams for pharmacy businesses. The continued investment in digital infrastructure, AI-enabled tools, and inventory management systems is expected to elevate operational efficiency and customer satisfaction.

Growing Health Awareness and Demand for Preventive Healthcare Products

There is a noticeable shift in consumer behavior toward preventive healthcare in the UAE, influenced by rising health awareness, wellness trends, and lifestyle changes. The increasing emphasis on maintaining physical and mental well-being has boosted demand for dietary supplements, vitamins, immunity boosters, and fitness-related health products. Retail pharmacies have responded by expanding their product portfolios beyond traditional medicines to include a wide range of preventive and wellness items. This trend is particularly evident among the younger population, expatriates, and health-conscious consumers who prefer self-care and early intervention strategies. Pharmacies are becoming wellness destinations that offer health education, nutritional advice, and preventive care solutions under one roof. Additionally, campaigns led by both government bodies and private sector players have promoted the importance of regular health screenings and responsible medication use, further encouraging foot traffic into pharmacies. Retailers are also capitalizing on seasonal demands, such as flu prevention or allergy management, by offering specialized product bundles and promotional health packages. This proactive approach not only fosters consumer loyalty but also supports public health goals by reducing the burden on hospitals and clinics. With wellness becoming a lifestyle priority, the role of retail pharmacies in supporting preventive healthcare will continue to expand, positioning them as integral components of the broader healthcare delivery model.

Market Trends

Omnichannel Integration and E-Pharmacy Expansion

The UAE retail pharmacy market is undergoing a significant transformation driven by omnichannel integration. For instance, during the COVID-19 pandemic, pharmacies in the UAE reported a 50% increase in online prescription orders, reflecting the growing reliance on digital platforms. Consumers increasingly expect seamless experiences across physical stores, mobile apps, and online platforms. Pharmacies are investing in customer relationship management (CRM) systems and AI-powered chatbots to enhance digital engagement and deliver personalized recommendations. Integration of e-prescription portals and real-time inventory tracking allows for greater efficiency and fulfillment accuracy. With rising smartphone penetration and government support for digital health innovation, the omnichannel model is set to become the dominant retail format. This shift not only broadens the market reach for pharmacy operators but also streamlines supply chain logistics, strengthens brand loyalty, and meets evolving consumer expectations in a digitally connected healthcare landscape.

Increased Emphasis on Preventive and Lifestyle Healthcare

Preventive healthcare is gaining momentum in the UAE as consumers adopt proactive wellness routines to maintain long-term health and reduce the risk of chronic diseases. For instance, over 70% of UAE residents actively purchase health supplements and immunity boosters, showcasing the growing emphasis on preventive care. Pharmacies are capitalizing on this opportunity by diversifying their product range to include nutraceuticals, organic skincare, functional foods, and wellness accessories. In-store health consultations and personalized recommendations are being introduced to guide customers in their preventive healthcare journeys. Furthermore, pharmacies are offering packages for blood pressure checks, glucose monitoring, and cholesterol testing, with data showing a 30% increase in demand for these services in recent years. Public health awareness campaigns, supported by the Ministry of Health and Prevention (MOHAP), are reinforcing the importance of early detection and self-care, boosting pharmacy footfall. This lifestyle-oriented approach aligns with the government’s focus on creating a healthier population and reducing the burden on tertiary care facilities. The result is a pharmacy environment that fosters holistic wellness and encourages repeat visits through added value and education-driven services.

Pharmacy Chain Consolidation and Network Expansion

A notable trend in the UAE retail pharmacy market is the consolidation of smaller players and aggressive expansion by established chains. Larger pharmacy groups are increasing their market share through mergers, acquisitions, and strategic partnerships. This consolidation trend is driven by the need to scale operations, achieve cost efficiency, and increase bargaining power with suppliers. Chain pharmacies such as Aster, Life, and Al Manara continue to expand their presence across shopping malls, residential areas, hospitals, and airports. Their growth strategies focus on building brand equity, ensuring consistent customer experience, and leveraging centralized procurement systems to offer competitive pricing. These consolidated networks also support digital integration, inventory optimization, and robust distribution logistics. Moreover, pharmacies with broad footprints are better positioned to roll out value-added services, such as loyalty programs and telehealth support. As market competition intensifies, the expansion of branded outlets helps secure a loyal customer base and fortify long-term profitability. This trend is expected to continue as retailers aim to meet rising demand while navigating regulatory changes and evolving consumer preferences.

Technology Adoption in Pharmaceutical Services

Technological advancements are reshaping pharmacy operations in the UAE, with a strong focus on improving accuracy, efficiency, and patient care. Automated dispensing systems, AI-powered inventory management tools, and cloud-based point-of-sale (POS) software are being deployed to reduce errors and enhance service delivery. Smart pharmacy solutions also enable real-time prescription tracking, stock level alerts, and customer data analytics, which help operators tailor their offerings based on buying behavior and seasonal demand. Additionally, the use of telepharmacy services is growing, particularly in remote or underserved areas, allowing patients to access licensed pharmacists through video consultations. Blockchain integration is being explored to secure pharmaceutical supply chains and prevent counterfeit drug circulation. Regulatory authorities such as the Dubai Health Authority (DHA) are actively encouraging the adoption of such technologies to align with the UAE’s broader digital health vision. By embracing innovation, retail pharmacies are positioning themselves as modern healthcare service providers, capable of delivering high-quality, tech-enabled experiences that align with the country’s goal of building a smart and patient-centric healthcare ecosystem.

Market Challenges

Intensifying Market Competition and Margin Pressures

The UAE retail pharmacy market is witnessing intensifying competition due to the rapid expansion of both domestic and international players. Established pharmacy chains, independent pharmacies, and emerging e-pharmacy platforms are all vying for a share of the market, leading to pricing pressures and shrinking profit margins. As major players aggressively expand their footprints and offer promotional pricing, smaller pharmacies struggle to maintain their market positions and financial viability. Moreover, consumer expectations for discounts, loyalty rewards, and value-added services further compress margins, compelling pharmacies to optimize operational costs without compromising service quality. For instance, the UAE has seen a significant rise in e-pharmacy platforms, with online pharmacies accounting for a growing share of retail pharmacy transactions, driven by consumer demand for convenience and competitive pricing. The proliferation of e-commerce and mobile health applications has also created new competitive pressures, as online platforms can often offer wider product selections at lower prices. As a result, brick-and-mortar pharmacies must continually invest in digital transformation, customer engagement initiatives, and service diversification, which increases operational expenditure. Balancing profitability while adapting to the competitive dynamics presents a significant challenge for pharmacy operators in the UAE, requiring strategic innovation and efficient resource management.

Regulatory Complexity and Compliance Requirements

Operating within the UAE’s highly regulated healthcare environment poses considerable challenges for retail pharmacy businesses. Stringent rules govern drug pricing, importation, labeling, advertising, and storage, and any deviation from compliance can result in severe penalties, including fines and license suspensions. Regulatory bodies such as the Ministry of Health and Prevention (MOHAP) and Dubai Health Authority (DHA) frequently update guidelines to ensure drug safety, quality control, and ethical practices, which requires pharmacies to maintain robust compliance frameworks. Additionally, navigating different emirate-specific regulations can create operational complexities for pharmacy chains that operate across multiple regions. Importantly, price controls on pharmaceuticals limit pharmacies’ ability to independently adjust margins, affecting revenue streams, especially during periods of rising operational costs. Compliance-related challenges also extend to new areas such as data protection in digital health services and the authentication of online sales. Keeping pace with evolving regulatory standards while ensuring cost efficiency and maintaining customer trust remains a critical challenge for the sustained growth of retail pharmacies in the UAE.

Market Opportunities

Expansion of Value-Added Services and Wellness Offerings

The UAE retail pharmacy market presents strong opportunities through the expansion of value-added healthcare services and wellness-focused products. As consumer expectations evolve beyond basic medicine dispensing, pharmacies can differentiate themselves by offering health screenings, chronic disease management programs, vaccination services, and personalized health consultations. Wellness categories, including nutraceuticals, organic skincare, fitness supplements, and mental health products, are also gaining traction among a more health-conscious population. Pharmacies that strategically invest in patient education, digital health tools, and preventive care packages are likely to capture a loyal customer base and increase per-visit revenue. Additionally, collaborating with insurance providers and healthcare networks to integrate pharmacy services into broader patient care pathways could create significant competitive advantages, particularly in urban centers where convenience and quality are key decision drivers.

Leveraging Digitalization and E-Pharmacy Platforms

The accelerated digital transformation across the UAE healthcare sector offers a major opportunity for retail pharmacies to expand their reach and operational efficiency. E-pharmacy platforms, mobile ordering apps, and teleconsultation services are reshaping how consumers engage with pharmaceutical care. Pharmacies that leverage AI-driven customer relationship management systems, automated prescription refills, and personalized marketing can enhance customer satisfaction and retention. Furthermore, underserved regions and remote communities represent untapped markets where telepharmacy and home delivery services can bridge accessibility gaps. By investing in omnichannel strategies and digital infrastructure, pharmacy operators can strengthen their brand presence, improve operational scalability, and tap into the growing preference for online health and wellness solutions.

Market Segmentation Analysis

By Type of Pharmacy

The UAE retail pharmacy market is segmented into chain pharmacies, independent pharmacies, hospital pharmacies, mail order pharmacies, and online pharmacies. Chain pharmacies hold a dominant share due to their widespread presence, brand recognition, and ability to offer consistent service across locations. Major players like Aster, Life, and BinSina continue to expand their footprint across malls, hospitals, and residential areas. Independent pharmacies, while still significant, face growing competition from larger chains and often rely on localized customer relationships. Hospital pharmacies serve inpatients and outpatients within medical facilities and are regulated under healthcare institutions. Meanwhile, mail order and online pharmacies are gaining traction as consumers increasingly seek convenience, especially for chronic medication refills and wellness products.

By Type of Prescription

Based on prescription type, the market is divided into Prescription Drugs (Rx) and Over-the-Counter (OTC) Drugs. Prescription drugs dominate the segment, driven by rising cases of chronic diseases that require regulated pharmaceutical care. However, the OTC drug segment is witnessing notable growth as consumers adopt self-care practices and seek accessible solutions for common ailments, supplements, and wellness needs without consulting a physician.

Segments

Based on Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Based on Type of prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Based on Service offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counseling

- Chronic Disease Management

Based on Product Type

- Generic Drugs

- Branded Drugs

Based on Application

- Oncology

- Diabetes

- Neurology

- Others

Based on Customer

- Paediatric

- Adults

- Geriatric

Based on Region

- Dubai

- Abu Dhabi

- Northern Emirates

Regional Analysis

Dubai (46.5%)

Dubai commands the largest share of the UAE retail pharmacy market, accounting for 46.5% of the total market value. The emirate’s strong position is attributed to its high population density, well-established healthcare infrastructure, medical tourism initiatives, and the significant presence of major pharmacy chains such as Life Pharmacy, Aster Pharmacy, and BinSina. Dubai’s progressive healthcare regulations, coupled with a tech-savvy consumer base, have accelerated the growth of omnichannel pharmacy models, digital health platforms, and wellness-focused services. Pharmacies in Dubai are increasingly diversifying their offerings to include preventive care, chronic disease management, and telehealth support, further consolidating the city’s leadership in the retail pharmacy sector.

Abu Dhabi (39.2%)

Abu Dhabi holds the second-largest market share at 39.2%, supported by government healthcare reforms, insurance coverage mandates, and the expanding network of retail and hospital-based pharmacies. The Abu Dhabi Health Services Company (SEHA) and other regulatory bodies have actively promoted healthcare accessibility, enabling pharmacies to play a central role in both urban and suburban communities. The emirate’s strong focus on chronic disease management, vaccination programs, and pharmaceutical standardization initiatives has increased pharmacy visitation rates and prescription volumes. Additionally, initiatives aimed at enhancing e-pharmacy platforms and encouraging local drug manufacturing are expected to reinforce Abu Dhabi’s pharmacy sector growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Aster Pharmacy

- Life Pharmacy

- Supercare Pharmacy

- Boots Pharmacy

- HealthFirst Pharmacy

Competitive Analysis

The UAE retail pharmacy market is characterized by the presence of several well-established players competing on service quality, brand reputation, geographic reach, and digital innovation. Aster Pharmacy and Life Pharmacy lead the market, leveraging expansive store networks, strong brand loyalty, and a growing focus on omnichannel engagement. Supercare Pharmacy maintains its market position by offering premium healthcare products and personalized services. Boots Pharmacy benefits from its global brand identity, attracting a diverse customer base seeking trusted pharmaceutical and wellness solutions. HealthFirst Pharmacy continues to expand its presence in strategic locations with a focus on affordability and customer-centric care. Competitive dynamics are further intensified by the rapid adoption of digital platforms, loyalty programs, and value-added healthcare services such as health screenings and chronic disease management. To maintain a competitive edge, key players are investing in technology, expanding service portfolios, and strengthening partnerships with healthcare providers and insurers.

Recent Developments

- As of March 31, 2024, Apollo Pharmacy operated 6,030 stores across approximately 1,200 cities and towns in 22 states and 5 union territories. The company continues to expand its digital healthcare platform, offering services like online medicine delivery and virtual doctor consultations.

- In October 2024, Caring Pharmacy Retail Management Sdn Bhd, a 75%-owned unit of 7-Eleven Malaysia Holdings Bhd, announced acquisitions of equity interest and business assets in several pharmaceutical outlets for a combined cash consideration of RM48.86 million.

- In June 2024, the Australian Competition and Consumer Commission (ACCC) expressed concerns that the proposed acquisition of Chemist Warehouse by Sigma Healthcare could substantially lessen competition in pharmacy retailing, potentially leading to higher prices and reduced service quality.

- In January 2025, Watsons Philippines ended 2024 with 1,166 stores, expanding its community pharmacy format. The company opened more than 50 stores outside of Metro Manila.

Market Concentration and Characteristics

The UAE retail pharmacy market exhibits a moderate to high level of market concentration, with a few major players such as Aster Pharmacy, Life Pharmacy, and Boots Pharmacy holding significant market shares. These leading chains benefit from extensive retail networks, strong brand recognition, and advanced digital capabilities, allowing them to dominate high-traffic urban locations and capture a loyal customer base. The market is characterized by rapid digital transformation, a growing emphasis on preventive healthcare, and the integration of value-added services such as health screenings and chronic disease management. While independent pharmacies continue to serve niche segments, their competitiveness is challenged by the pricing power, marketing reach, and service innovation of larger chains. Additionally, regulatory oversight ensures standardized pricing and service quality across the sector, promoting consumer trust but limiting margin flexibility. The combination of healthcare reforms, insurance-driven demand, and rising health awareness continues to shape a dynamic and evolving retail pharmacy landscape in the UAE.

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmacy, Type of prescription, Service offered, Product Type, Application, Customer and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The growing adoption of digital platforms will drive the expansion of e-pharmacy services, offering consumers a more convenient and accessible way to purchase medications and health products. Online prescription services, home delivery, and telehealth consultations will continue to evolve as standard offerings.

- Pharmacies will increasingly diversify their service offerings beyond medication dispensing to include health screenings, vaccination services, and chronic disease management. These services will enhance customer loyalty and contribute to long-term growth.

- As the UAE’s population becomes more health-conscious, there will be a greater focus on preventive care, including vitamins, supplements, and wellness products. Pharmacies will play a central role in supporting this trend by offering a wide range of preventative health solutions.

- Ongoing government support for healthcare accessibility, insurance reforms, and the drive for innovation in the pharmaceutical sector will fuel growth in retail pharmacy services. Policies that promote digital health and integrate pharmacies into broader healthcare systems will be key growth drivers.

- The UAE retail pharmacy market will experience heightened competition as both local and international players continue to expand. The entry of global pharmacy chains and e-pharmacies will push domestic players to innovate and optimize customer service.

- The demand for specialized medications and personalized pharmacy services, including oncology, neurology, and diabetes care, will rise. Pharmacies will offer more tailored healthcare solutions, integrating patient counseling and monitoring for chronic disease management.

- The adoption of artificial intelligence and automation will streamline pharmacy operations, improve inventory management, and enhance customer service. AI-driven tools for personalized recommendations and prescription management will further drive the digital transformation of the market.

- While Dubai and Abu Dhabi will remain dominant, pharmacies in the Northern Emirates will see significant growth. Expanding infrastructure and healthcare access in these regions will increase demand for retail pharmacy services.

- Sustainability trends will influence the retail pharmacy market, with pharmacies focusing on eco-friendly packaging, sustainable sourcing of products, and reducing waste. This will resonate with environmentally conscious consumers.

- The aging population in the UAE will create a growing need for pharmacies to cater to geriatric-specific health needs, including mobility aids, senior-friendly medication, and specialized health consultations. This demographic shift will significantly influence pharmacy offerings in the future.