Market Overview

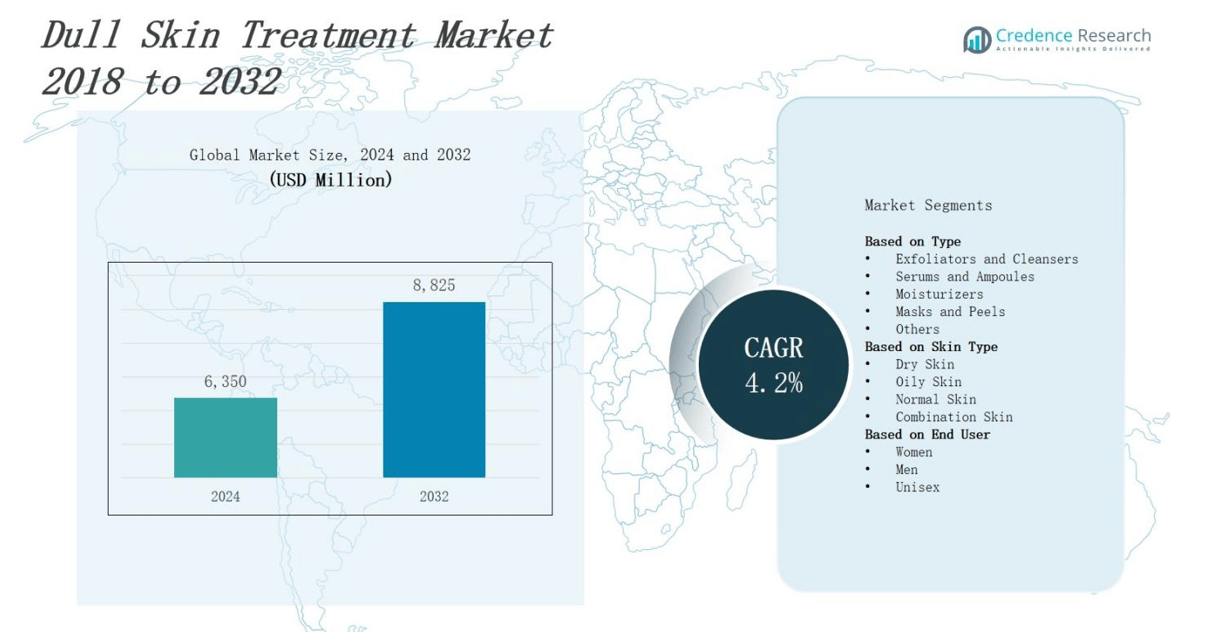

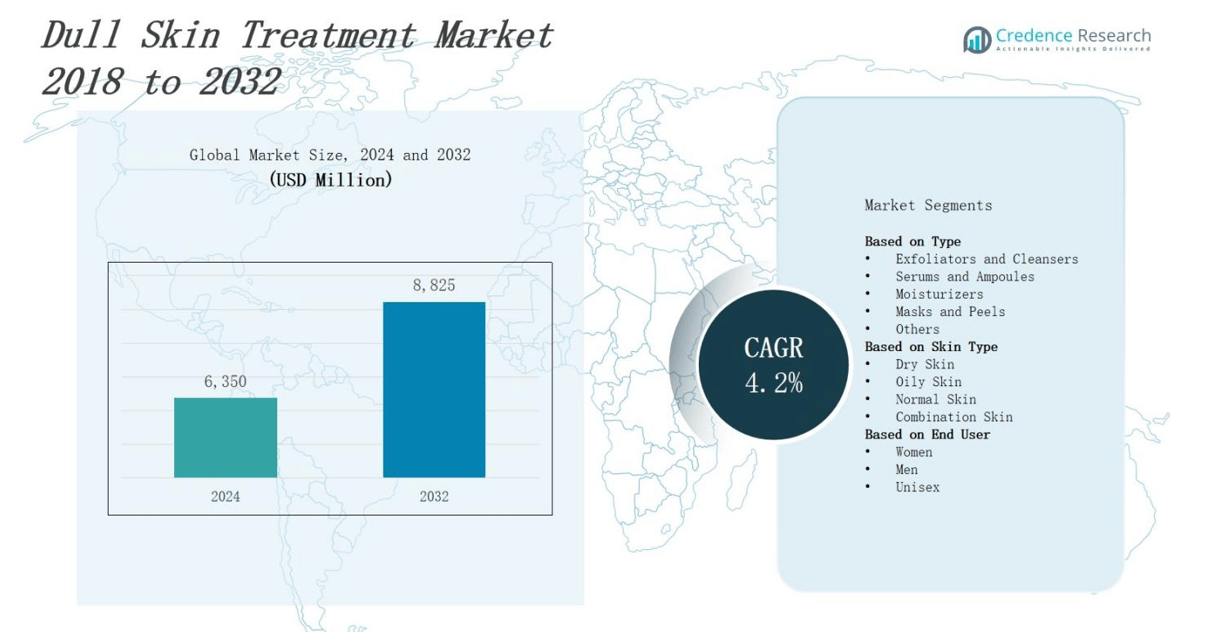

The dull skin treatment market is projected to expand from USD 6,350 million in 2024 to USD 8,825 million by 2032, at a CAGR of 4.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dull Skin Treatment Market Size 2024 |

USD 6,350 million |

| Dull Skin Treatment Market, CAGR |

4.2% |

| Dull Skin Treatment Market Size 2032 |

USD 8,825 million |

Rising consumer awareness of skin health and growing demand for radiant complexions drive the global dull skin treatment market. Social media and influencer endorsements propel adoption of exfoliating products, brightening serums, and professional therapies. Advancements in active ingredients such as vitamin C, alpha hydroxy acids, and plant‑derived antioxidants enhance efficacy. Rapid expansion of e‑commerce platforms and direct‑to‑consumer models increases accessibility. Consumers favor personalized regimens guided by AI‑powered skin analysis tools. Demand for noninvasive, at‑home devices like LED masks and microdermabrasion kits continues to grow. Natural and clean‑label formulations gain traction as sustainability concerns influence purchasing decisions and support market growth.

Geographical analysis of the dull skin treatment market highlights regional performance and players. North America drives 35% share, dominated by L’Oréal S.A. and Procter & Gamble Co. Europe holds 30%, anchored by Unilever PLC and Estée Lauder Companies Inc. Asia‑Pacific captures 20% with Shiseido Company Limited and Kao Corporation leading demand. Latin America accounts for 10% through Beiersdorf AG and Avon Products Inc. Middle East & Africa claims 5% as Amway Corporation, Johnson & Johnson, Revlon Inc., Coty Inc., and Clarins Group expand distribution. It adapts strategies to preferences and regulations.

Market Insights

- The market will grow from USD 6,350 million in 2024 to USD 8,825 million by 2032 at 4.2% CAGR.

- Consumer demand for radiant complexions drives exfoliators, brightening serums, and professional therapies.

- AI‑powered skin analysis and virtual consultations personalize regimens and boost adoption rates.

- E‑commerce platforms and subscription models expand global accessibility and repeat purchases.

- LED masks, microdermabrasion kits, and at‑home devices deliver noninvasive treatment convenience.

- Natural extracts, clean‑label formulations, and eco‑friendly packaging align with sustainability goals.

- North America leads with 35% share, followed by Europe 30%, Asia‑Pacific 20%, Latin America 10%, and MEA 5%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Heightened Consumer Focus on Skin Radiance and Health

Growing consumer demand for evening tone and vibrant complexions fuels product expansion. It targets dullness by promoting exfoliating cleansers and vitamin C serums. The dull skin treatment market innovates with combinations of antioxidants and mild acids. Social media advocates demonstrate benefits and teach regimen steps. Dermatologists prescribe chemical peels and microdermabrasion for visible improvements. It integrates AI-based skin assessments to refine recommendations.

- For instance, L’Oréal’s SkinConsult AI uses deep learning algorithms on millions of facial images to analyze skin conditions like pigmentation and recommend personalized antioxidant and mild acid-based treatments.

Technological Innovation Enhances Treatment Efficacy and Access

Advances in ingredient science support formulation of stable vitamin C derivatives and plant-derived antioxidants. It incorporates microencapsulation techniques to preserve potency until application. The dull skin treatment market leverages LED devices and microcurrent tools for at-home use. Brands deploy AI-driven diagnostics to customize regimen selection. E‑commerce platforms expand reach through virtual consultations and subscriptions. Manufacturers invest in research validating efficacy through clinical studies.

- For instance, companies like BASF have expanded production capacity for microencapsulated ingredients such as omega-3 powders used in functional skin/nutritional products, ensuring consistent supply and quality for advanced formulations.

Demand for Clean‑Label Formulations and Sustainability

Heightened consumer focus on ingredient transparency prompts brands to use natural extracts and minimal preservatives. It sources plant-derived actives and avoids synthetic dyes. The dull skin treatment market adopts eco-friendly packaging and cruelty‑free testing standards. Retailers showcase certifications like organic and vegan to build trust. Brands conduct audits to confirm chain integrity. Consumers reward companies that demonstrate responsibility. It aligns with sustainability initiatives globally.

Expansion of Professional Services and Regulatory Support

Dermatology clinics extend service offerings with combination therapies and consultations. It secures approvals for innovative actives through regulatory pathways. The dull skin treatment market benefits from simplified compliance with cosmetic safety standards in key regions. Manufacturers partner with medical professionals to validate product claims and deliver training. Retail chains integrate in-store skin analysis stations. It invests in professional education to support practitioner adoption.

Market Trends

Implementation of AI‑Driven Skin Analysis Platforms

Brands deploy AI diagnostics to tailor treatment plans based on individual skin metrics. It combines image recognition with data analytics to recommend exfoliants and serums. The dull skin treatment market witnesses growth of digital consultation services hosted by specialized platforms. Clinicians use machine learning models to identify pigmentation patterns and track progress. Companies partner with tech firms to refine algorithms and improve accuracy. Consumers experience more precise solutions that reduce guesswork in regimen selection.

- For instance, Perfect Corp’s AI skin analysis tool, integrated by Cetaphil, allows consumers to upload selfies and receive detailed skin assessments along with tailored product recommendations for sensitive skin.

Expansion of At‑Home Device Adoption and Wearable Tech

It leverages handheld LED masks and microcurrent devices for use beyond clinical settings. Manufacturers integrate Bluetooth connectivity to sync devices with smartphone apps. Consumers use wearable patches infused with active ingredients to maintain glow throughout day. The dull skin treatment market sees increased demand for portable tools that deliver salon‑grade performance. Retailers bundle devices with curated product kits to enhance user convenience. It encourages consistent treatment routines by offering user feedback and progress tracking.

- For instance, BonPatch offers wearable patches infused with active ingredients like GHK-Cu, pomegranate extract, and green tea extract that support collagen production and skin hydration for up to 24 hours of continuous use.

Rise of Clean‑Label Formulations and Sustainable Practices

Consumers favor formulations that feature botanical extracts and free from synthetic dyes. It prioritizes transparency by listing full ingredient profiles on packaging and online. The dull skin treatment market adapts by sourcing fair‑trade and organic actives. Brands implement biodegradable containers and minimalistic design to reduce environmental impact. Certification by third‑party bodies boosts credibility for vegan and cruelty‑free claims. It builds loyalty by aligning brand values with consumer ethics and sustainability goals.

Growth of Omnichannel Sales and Subscription Models

E‑commerce platforms integrate virtual try‑on tools and personalized product recommendations. It shortens purchase cycles through curated subscription boxes that deliver treatments monthly. The dull skin treatment market experiences higher repeat purchases thanks to auto‑reorder options. Beauty retailers blend in‑store diagnostics with online follow‑ups to boost customer engagement. Brands launch DTC websites that offer exclusive bundles and loyalty rewards. It leverages data from sales channels to optimize inventory and tailor marketing strategies.

Market Challenges Analysis

Stringent Regulatory Compliance and Ingredient Stability Concerns

Brands must navigate diverse cosmetic and drug regulations across regions, complicating product launches. It conducts extensive safety and efficacy testing to meet varying requirements. The dull skin treatment market encounters inconsistent guidelines for active concentrations and claims. It allocates significant budgets to stability studies and preservative efficacy assessments. Regulatory bodies request clinical data to support brightening claims and ingredient tolerability. It labels formulations with full ingredient disclosures to maintain transparency. Manufacturers must update dossiers when authorities revise safety standards. It manages cross‑border labeling translation and adjusts packaging to satisfy local language and hazard communication standards. It negotiates with suppliers to secure high‑quality actives under new compliance frameworks. It monitors global policy shifts to anticipate deadlines and avoid market delays.

Intense Market Fragmentation and Consumer Skepticism

Thousands of brands flood online and brick‑and‑mortar channels, driving fierce competition on price and novelty. It struggles to differentiate genuine innovation from fleeting trends. The dull skin treatment market faces skepticism due to exaggerated claims and inconsistent results. It counters misinformation by partnering with dermatologists and publishing peer‑reviewed studies. Retailers train staff to recommend evidence‑backed solutions and manage expectations. It invests in consumer education campaigns that demonstrate product benefits through before‑and‑after data. It evaluates influencers and clinical endorsements to ensure credibility and guard against misrepresentation. It leverages targeted marketing to build trust and gather consumer feedback that refines product positioning.

Market Opportunities

Expansion into Emerging Regional Markets and Personalized Care Demand

Emerging markets in Asia‑Pacific and Latin America show rising demand for specialized skincare solutions. It leverages growing middle‑class spending power and digital adoption to introduce region‑specific formulations. The [dull skin treatment market] can tailor products to local skin types and climate conditions to improve efficacy. Brands extend distribution through cross‑border e‑commerce and local partnerships to drive penetration. Companies refine pricing strategies to balance affordability and margins. It taps into wellness tourism to offer treatment packages in medical spas. Dermatology clinics can form alliances with beauty retailers to expand service portfolios.

Integration of Biotech Innovations and Collaborative Partnerships

Biotechnology advances in peptide delivery and enzyme‑based exfoliation promise new product lines. It applies microencapsulation to stabilize sensitive actives until application. The [dull skin treatment market] benefits from academic‑industry collaborations that accelerate R&D cycles. Firms negotiate licensing agreements with biotech startups to gain access to novel compounds. They develop co‑branded offerings with dermatologists and influencers to enhance credibility. It invests in pilot studies to generate clinical evidence that supports premium positioning. Strategic alliances with device manufacturers can combine topical formulations with at‑home treatment tools.

Market Segmentation Analysis:

By Type

The dull skin treatment market divides by product type into exfoliators and cleansers, serums and ampoules, moisturizers, masks and peels, and others. Exfoliators and cleansers hold leading share by delivering immediate removal of dead cells. It innovates with new mild acids and botanical scrubs. Serums and ampoules follow by offering targeted brightening. Moisturizers maintain glow through hydrating actives. Masks and peels deliver periodic intensive therapy. Other products address niche concerns.

- For instance, Murad’s AHA/BHA Exfoliating Cleanser combines chemical acids with physical exfoliants to gently reveal smoother, glowing skin and balance oil for oily and combination skin types.

By Skin Type

The dull skin treatment market segments by skin type into dry skin, oily skin, normal skin, and combination skin. Dry skin category attracts robust demand for hydrating brightening formulas. It emphasizes ceramide blends and vitamin C boosters. Oily skin segment offers lightweight gel cleansers and mattifying serums. Normal skin category sees balanced product launches. Combination skin segment drives dual‑formula solutions that target both oily and dry areas with precision.

- For instance, Dr. Sheth’s Ceramide & Vitamin C Daily Brightening & Repair Cream is designed for dry skin; it features a 1% Ceramide Complex and 5% Vitamin C to deeply moisturize, restore the skin barrier, and reduce discoloration, targeting dullness effectively.

By End User

The dull skin treatment market classifies end users into women, men, and unisex categories. Women segment holds dominant share by adopting multi‑step regimens and high‑strength actives. It integrates targeted marketing and influencer collaborations to drive loyalty. Men segment gains momentum with male‑focused cleansers and quick‑absorb serums. Unisex category expands reach by formulating neutral scents and universal textures. Brands deploy demographic insights to tailor communications. It enhances retention through subscription programs and personalized offers.

Segments:

Based on Type

- Exfoliators and Cleansers

- Serums and Ampoules

- Moisturizers

- Masks and Peels

- Others

Based on Skin Type

- Dry Skin

- Oily Skin

- Normal Skin

- Combination Skin

Based on End User

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America captures 35% share of the dull skin treatment market. It drives growth through robust retail networks and advanced R&D investments. Leading skincare brands fund clinical trials and adopt cutting‑edge technologies. Strong consumer spending motivates frequent product adoption and premium pricing strategies. Distribution spans specialty stores, e‑commerce platforms, and professional clinics. It shapes global trends and influences regulatory standards. Market share distribution includes Europe at 30%, Asia‑Pacific at 20%, Latin America at 10%, and Middle East & Africa at 5%.

Europe

Europe controls 30% share of the dull skin treatment market. It benefits from well‑established dermatology infrastructure and heritage cosmetic brands. Consumers demand clinical‑grade formulations backed by safety data. E‑commerce growth and cross‑border trade expand product availability. It aligns new launches with EU Cosmetic Regulation to ensure compliance. Retailers combine in‑store diagnostics with online consultations to drive sales. Regional share distribution includes North America at 35%, Asia‑Pacific at 20%, Latin America at 10%, and Middle East & Africa at 5%.

Asia‑Pacific

Asia‑Pacific holds 20% share of the dull skin treatment market. It experiences rapid urbanization and increasing disposable incomes. Local players introduce tailor‑made formulations for varied skin types. Mobile commerce channels accelerate reach into tier‑2 and tier‑3 cities. It collaborates with influencers to educate and engage consumers. Market share distribution includes North America at 35%, Europe at 30%, Latin America at 10%, and Middle East & Africa at 5%. Harmonized regulations will streamline future approvals and boost market entry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Procter & Gamble Co.

- Estée Lauder Companies Inc.

- Clarins Group

- Beiersdorf AG

- Amway Corporation

- Unilever PLC

- Revlon Inc.

- L’Oréal S.A

- Shiseido Company Limited

- Avon Products Inc.

- Johnson & Johnson

- Coty Inc.

- Kao Corporation

Competitive Analysis

The dull skin treatment market features intense rivalry among global players. L’Oréal S.A. leverages advanced R&D to launch stable vitamin C derivatives. Procter & Gamble Co. integrates AI diagnostics in e‑commerce platforms. Unilever PLC drives sales through sustainable sourcing and clean‑label formulas. Estée Lauder Companies Inc. focuses on high‑end serums with patented peptides. Johnson & Johnson expands clinical‑grade peels through dermatology channels. Shiseido Company Limited tailors offerings to Asian skin types and climate patterns. Avon Products Inc. uses direct‑selling networks to boost trial. Amway Corporation offers multistep regimens backed by nutritional supplements. Kao Corporation collaborates with biotech firms to commercialize novel actives. Coty Inc. differentiates based on fragrance‑infused masks. Revlon Inc. emphasizes affordability in mass‑market cleansers. Clarins Group combines plant extracts with microencapsulation. It monitors performance metrics and consumer feedback to refine portfolio. Companies compete on efficacy data, branding, and distribution strategies to secure leadership.

Recent Developments

- In 2023, Vaseline launched a new premium skincare range specifically targeting dull skin, with unique ingredients to revitalize and brighten the complexion.

- In January 2023, Bulldog Skincare introduced an AI Skin Advisor on its UK website through a partnership with Revieve, offering AI-powered selfie analysis aimed at improving skincare journeys for men, including dull skin concerns.

- In April 2025, Clarins achieved B Corp certification for both its flagship and MyBlend brands, affirming its commitment to rigorous social and environmental standards .

- In July 2025, PDO Max launched its LúmEnvy Skincare brand featuring a Brightening Facial enriched with papaya enzymes, vitamin E, and hyaluronic acid to revitalize dull complexions.

Market Concentration & Characteristics

The dull skin treatment market exhibits moderate concentration, with a handful of global leaders commanding significant share through diversified portfolios and extensive distribution networks. L’Oréal S.A., Procter & Gamble Co., Unilever PLC and Estée Lauder Companies Inc. drive innovation by funding clinical trials and launching patented brightening serums. It balances premium and mass‑market segments by offering high‑end peels in professional clinics alongside affordable exfoliating cleansers in retail chains. Regional champions adapt formulations to local preferences in Asia‑Pacific and Latin America, while North American and European brands leverage established e‑commerce platforms to maintain leadership. It uses targeted marketing campaigns and influencer partnerships to reinforce brand equity and capture repeat purchases through subscription models. Competitive dynamics hinge on efficacy data, sustainability credentials and regulatory compliance, which together shape product claims and launch timelines across key markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Skin Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The dull skin treatment market will personalize regimens through AI-driven analysis integrated into direct‑to‑consumer platforms.

- It will combine topical brightening agents with advanced at‑home devices to deliver professional‑grade treatment effectiveness.

- It will launch subscriptions ensuring seamless repeat delivery of customized product kits and skincare content.

- It will partner with startups to access innovative brightening actives, accelerate research through licensing agreements.

- It will adopt sustainable materials, biodegradable packaging to reduce environmental impact and attract eco‑conscious consumers.

- It will deploy virtual try‑on features and matching algorithms to boost online confidence and conversion.

- It will publish clinical data in peer‑reviewed journals to substantiate efficacy claims and enhance credibility.

- It will engage dermatologists and influencers for credible treatment education, driving trust, guiding consumer expectations.

- It will develop bundles pairing topical serums with at‑home devices to maximize efficacy and convenience.

- It will optimize supply chains via analytics and cross‑border logistics to ensure timely product availability.