Market Overview:

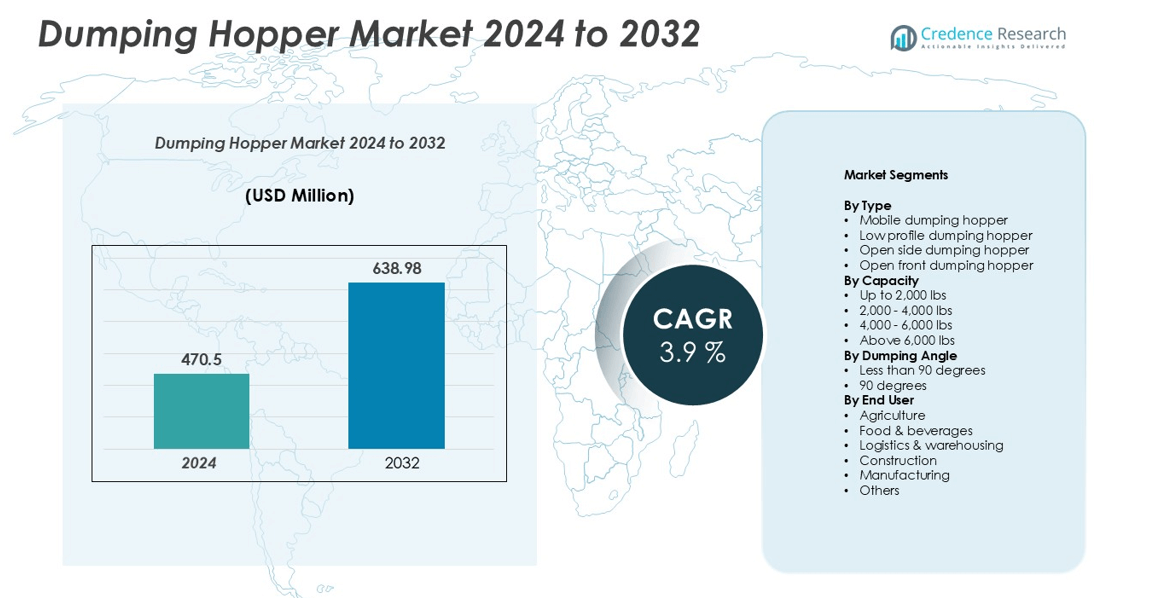

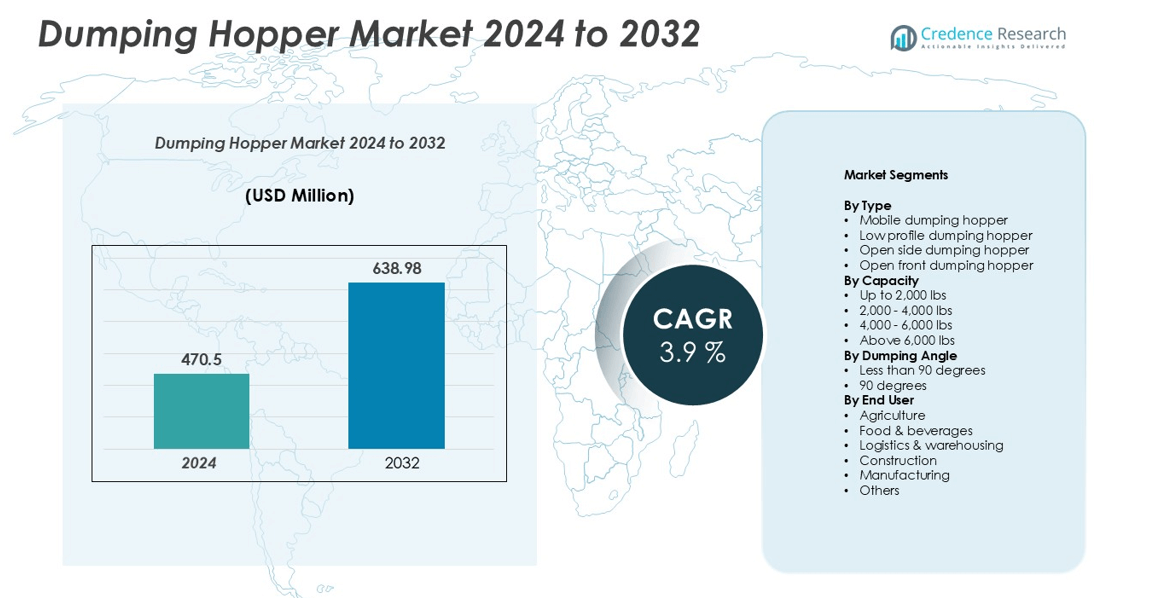

The dumping hopper market size was valued at USD 470.5 million in 2024 and is anticipated to reach USD 638.98 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dumping Hopper Market Size 2024 |

USD 470.5 million |

| Dumping Hopper Market, CAGR |

3.9% |

| Dumping Hopper Market Size 2032 |

USD 638.98 million |

The global dumping hopper market is led by prominent players including Doosan Group (Bobcat), Wastequip LLC, Camfil Group, Vestil Manufacturing Corporation, Synergy Equipment, Rubbermaid Commercial Products, and Denios Inc., which drive growth through innovation, high-quality products, and strong distribution networks. North America remains the largest market, accounting for 35% of the global share, supported by advanced industrial infrastructure and high adoption of mechanized material handling solutions. Europe follows with a 25% share, driven by strict safety standards and modernized industrial practices, while Asia-Pacific holds 28%, fueled by rapid urbanization, infrastructure projects, and mechanized agriculture. These regions, combined with strategic investments in technology and smart hoppers by leading companies, continue to shape competitive dynamics and expand market reach, reinforcing the dominance of established players globally.

Market Insights

- The dumping hopper market was valued at USD 470.5 million in 2024 and is projected to reach USD 638.98 million by 2032, growing at a CAGR of 3.9%. The mobile dumping hopper type and 2,000–4,000 lbs capacity segment dominate the market.

- Market growth is driven by rising industrial automation, expanding construction and infrastructure activities, and increasing demand from agriculture and food processing sectors, which require efficient and reliable material handling solutions.

- Key trends include the adoption of IoT-enabled smart hoppers for real-time monitoring, and the demand for customizable and modular hoppers to meet diverse industrial requirements.

- Competitive dynamics are led by players such as Doosan Group (Bobcat), Wastequip LLC, Camfil Group, Vestil Manufacturing Corporation, Synergy Equipment, Rubbermaid Commercial Products, and Denios Inc., focusing on innovation, quality, and regional expansion.

- Regional analysis shows North America 35%, Europe 25%, Asia-Pacific 28%, MEA 7%, and Latin America 5%, highlighting major growth hubs and market share distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The dumping hopper market is segmented by type into mobile dumping hoppers, low profile dumping hoppers, open side dumping hoppers, and open front dumping hoppers. Among these, mobile dumping hoppers hold the dominant share, driven by their versatility and ease of transport across construction, agriculture, and industrial sites. Their ability to streamline material handling while reducing labor costs has made them highly preferred in dynamic work environments. The growth is further supported by increased mechanization across warehouses and construction sites, where operational efficiency and mobility are critical performance metrics.

- For instance, Valley Craft offers several models of 2 cubic yard powered self-dumping hoppers, with different models having different load capacities and steel gauges.

By Capacity

Capacity-based segmentation includes up to 2,000 lbs, 2,000–4,000 lbs, 4,000–6,000 lbs, and above 6,000 lbs. The 2,000–4,000 lbs segment dominates the market, reflecting the balance between manageable load handling and operational efficiency. This sub-segment is favored by SMEs and medium-scale industrial users who require reliable performance without excessive strain on equipment or operators. Market growth is driven by rising demand in logistics, agriculture, and food processing sectors, where moderate load capacities offer cost-effective, safe, and consistent material transfer solutions.

- For instance, The Vestil D-200-MD is a medium-duty, self-dumping hopper with a 2 cubic yard volume and a 4,000 lb capacity. It is constructed of durable, 10-gauge steel with a powder-coated finish. The hopper features a 67° dump angle and is suitable for medium-scale industrial applications requiring efficient material handling.

By Dumping Angle

Dumping hoppers are classified by dumping angle as less than 90 degrees and 90 degrees. The 90-degree dumping angle segment leads the market due to its ability to achieve complete discharge of materials, enhancing productivity in industries like construction, manufacturing, and food processing. This sub-segment is driven by the increasing need for precision and speed in material handling processes. Additionally, regulatory standards and safety requirements across sectors encourage the adoption of hoppers with optimal dumping angles, ensuring minimal spillage and reduced operational downtime.

Key Growth Drivers

Increasing Industrial Automation

The rising adoption of industrial automation across manufacturing, logistics, and warehousing sectors is a major growth driver for the dumping hopper market. Automated material handling systems, including robotic-assisted loading and unloading, require hoppers that can efficiently integrate with conveyors and other mechanized equipment. Companies are investing in high-capacity and precision-engineered dumping hoppers to enhance operational efficiency, reduce manual labor, and minimize material spillage. For instance, industries handling bulk grains, chemicals, or construction materials are leveraging automated hoppers to streamline workflow while ensuring consistent performance. This shift toward mechanized operations is expected to continue driving market demand, particularly in regions experiencing rapid industrialization and urban infrastructure development. The enhanced productivity and reduced operational costs associated with automated hopper systems strengthen their adoption across end-user industries, fueling sustained market growth.

- For instance, Valley Craft offers multiple models of 2 cubic yard powered self-dumping hoppers. A representative model (F89141) has a 2,000 lb. capacity and features heavy-duty 12-gauge steel construction with continuous, solid welds, ensuring durability and reliability for industrial applications. Higher capacity 2-cubic-yard hoppers are available with heavier-gauge steel, such as a 6,000 lb. capacity model constructed from 7-gauge steel.

Expanding Construction and Infrastructure Activities

Construction and infrastructure development globally is contributing significantly to the growth of the dumping hopper market. Projects such as road construction, commercial buildings, and large-scale urban developments require efficient material handling solutions to transport and dump bulk materials like sand, gravel, and cement. Dumping hoppers, particularly mobile and high-capacity models, provide operational efficiency by minimizing manual labor and enabling faster material discharge. The surge in government-led infrastructure initiatives, urbanization, and smart city projects has driven investments in advanced hoppers with optimized dumping angles and capacities. Furthermore, end users are increasingly focusing on safety-compliant and ergonomically designed hoppers, supporting reduced workplace accidents. Consequently, the growing construction and infrastructure activities directly contribute to increased adoption of dumping hoppers across multiple regions, establishing this sector as a key market growth driver.

- For instance, Hoppers Direct provides heavy-duty self-dumping hoppers in a range of sizes, which can be deployed throughout a construction project, from managing large-scale demolition debris to smaller-volume waste during the finishing phase. When used as part of a proper waste management plan, these hoppers can improve job site organization, safety, and compliance with local and federal waste regulations.

Rising Demand from Agriculture and Food Processing Sectors

The agriculture and food processing industries are increasingly adopting dumping hoppers to enhance productivity and reduce manual handling of bulk commodities. Farmers and processing units rely on mobile and open-side hoppers to transport grains, fertilizers, and raw materials efficiently, reducing operational time and labor costs. The expansion of mechanized farming, modern storage facilities, and automated processing plants has further driven the need for reliable hoppers that can manage varying load capacities. In addition, the emphasis on maintaining hygiene and preventing spillage in food handling encourages the use of stainless steel and food-grade hoppers. As the demand for processed food and agricultural output rises globally, these industries continue to drive the deployment of specialized dumping hoppers, offering significant growth potential in both emerging and developed markets.

Key Trends & Opportunity

Integration of Smart and IoT-Enabled Hoppers

The integration of smart technology and IoT-enabled monitoring in dumping hoppers is emerging as a key trend and opportunity. Modern hoppers equipped with sensors can provide real-time data on load weight, material flow, and operational status, enabling predictive maintenance and reducing downtime. Industries like logistics, manufacturing, and food processing benefit from these intelligent systems, which improve accuracy, operational efficiency, and resource management. Additionally, data analytics from smart hoppers support informed decision-making for inventory management and workflow optimization. This trend offers manufacturers an opportunity to differentiate their products by incorporating automation, remote monitoring, and advanced safety features. As industries increasingly focus on digital transformation, the adoption of smart hoppers is expected to accelerate, creating a lucrative avenue for innovation and market expansion.

- For instance, Roura’s Ultimate self-dumping hoppers have a capacity ranging from 8,000 to 10,000 pounds and are constructed from 1/4-inch carbon steel, making them suitable for extreme material handling requirements.

Growth of Customizable and Modular Hoppers

Another notable trend in the dumping hopper market is the growing demand for customizable and modular designs. End users are seeking hoppers that can be tailored to specific capacities, dumping angles, and material types, allowing flexibility across diverse operations. Modular hoppers facilitate easy maintenance, replacement of components, and scalability, which is particularly attractive for industries managing multiple materials or shifting operational needs. Manufacturers are leveraging this opportunity by offering hoppers with interchangeable parts, adjustable frames, and enhanced ergonomic designs. The ability to customize hoppers to meet industry-specific requirements drives higher adoption rates in construction, agriculture, and manufacturing sectors, while simultaneously reducing operational costs. This trend also opens doors for technological innovation, enabling manufacturers to differentiate their offerings and capture niche segments within the broader dumping hopper market.

- For instance, McCullough Industries offers low-profile self-dumping hoppers with capacities from 1/4 to 1.5 cubic yards and load capacities of 4,000 to 5,000 lbs. These hoppers are available in 17 or 24-inch heights and feature a low, wide design suitable for small spaces and in-line production.

Key Challenges:

High Initial Capital Investment

One of the primary challenges in the dumping hopper market is the high initial capital investment associated with advanced and high-capacity models. Mobile, automated, or smart hoppers often require significant upfront expenditure, which can deter small and medium-sized enterprises from adoption. Additionally, industries with seasonal operations, such as agriculture, may find it difficult to justify the cost of purchasing specialized hoppers that are not in continuous use. The financial barrier is compounded by the need for trained personnel to operate and maintain technologically advanced hoppers. Manufacturers and distributors must address this challenge by offering financing options, leasing models, or modular systems that lower entry costs. Failure to manage these cost barriers can slow market penetration, particularly in emerging regions where budget constraints are more pronounced.

Maintenance and Operational Complexity

Maintenance and operational complexity represent another significant challenge for the dumping hopper market. Advanced hoppers with automation, IoT integration, or high-capacity designs require regular servicing, calibration, and skilled operation. Lack of trained personnel or inadequate maintenance infrastructure can lead to frequent downtime, reduced operational efficiency, and increased costs. Moreover, exposure to abrasive or corrosive materials in industries like construction or chemical processing can accelerate wear and tear, further complicating upkeep. Manufacturers need to focus on providing user-friendly designs, comprehensive training, and accessible after-sales support to mitigate these challenges. Ensuring reliability and ease of operation is critical to fostering wider adoption and sustaining long-term market growth.

Regional Analysis

North America

North America dominates the dumping hopper market with an estimated 35% market share, driven by advanced industrial infrastructure and widespread adoption of mechanized material handling solutions. The U.S. and Canada lead demand across construction, agriculture, and manufacturing sectors, where efficiency and labor optimization are key priorities. Mobile and 2,000–4,000 lbs capacity hoppers are highly preferred, reflecting the region’s focus on versatile and safe equipment. Technological integration, including IoT-enabled smart hoppers, further enhances adoption. Strong supply chains and high investment in industrial automation sustain North America’s leading position, contributing significantly to the global dumping hopper market.

Europe

Europe accounts for roughly 25% of the global market share, supported by strict safety regulations, advanced industrial practices, and significant infrastructure development in Germany, France, and the U.K. Industries prioritize high-capacity and precision-engineered hoppers to improve productivity and minimize downtime. Mobile and open-front hoppers are widely adopted in construction and logistics. Additionally, ergonomic and modular hopper designs enhance operational efficiency. The region’s emphasis on sustainable and efficient material handling solutions strengthens Europe’s market position while enabling steady growth through continued industrial modernization and innovation.

Asia-Pacific

Asia-Pacific holds an estimated 28% market share, emerging as a rapidly growing region due to industrial expansion, urbanization, and large-scale infrastructure projects in China, India, Japan, and Southeast Asia. Mobile and 2,000–4,000 lbs hoppers dominate demand across agriculture, construction, and manufacturing sectors. Rising mechanization and cost-effective material handling solutions drive adoption. Government-led smart city and industrial automation initiatives further support growth. With its expanding industrial base and increasing focus on productivity, Asia-Pacific is expected to witness the fastest growth rate among all regions in the global dumping hopper market.

Middle East & Africa (MEA)

MEA contributes around 7% of the global market share, driven by construction, mining, and logistics activities in GCC countries, South Africa, and Nigeria. Hoppers with higher dumping angles and durable materials are preferred to manage heavy loads in challenging environments. Expanding infrastructure projects, including roads and industrial zones, boost demand for mobile and low-profile hoppers. Despite challenges like maintenance costs and harsh operating conditions, the growing construction and industrial sectors present significant opportunities for market expansion in MEA.

Latin America

Latin America holds approximately 5% of the global market share, with demand largely from agriculture, construction, and manufacturing sectors in Brazil, Mexico, and Argentina. Hoppers with capacities of 2,000–4,000 lbs and open-side designs are widely used due to operational flexibility and cost-effectiveness. Increasing mechanization, warehouse modernization, and infrastructure development support growth. Limited industrial automation and high upfront investment moderately restrain adoption. However, government-backed industrial initiatives and rising urbanization are expected to boost demand for versatile and reliable dumping hoppers, strengthening Latin America’s position in the global market.

Market Segmentations:

By Type

- Mobile dumping hopper

- Low profile dumping hopper

- Open side dumping hopper

- Open front dumping hopper

By Capacity

- Up to 2,000 lbs

- 2,000 – 4,000 lbs

- 4,000 – 6,000 lbs

- Above 6,000 lbs

By Dumping Angle

- Less than 90 degrees

- 90 degrees

By End User

- Agriculture

- Food & beverages

- Logistics & warehousing

- Construction

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dumping hopper market is moderately fragmented, with several key players competing based on product innovation, quality, and service capabilities. Leading companies such as Doosan Group (Bobcat), Wastequip LLC, Camfil Group, Vestil Manufacturing Corporation, Synergy Equipment, Rubbermaid Commercial Products, and Denios Inc. focus on developing advanced hoppers with features like mobile operation, high-capacity handling, optimized dumping angles, and smart IoT integration. Market players are increasingly investing in R&D to enhance efficiency, durability, and ergonomics, addressing specific end-user requirements across construction, agriculture, logistics, and manufacturing sectors. Strategic partnerships, mergers, and regional expansions are common to strengthen distribution networks and capture emerging markets. Competitive differentiation also relies on after-sales support, modular designs, and compliance with safety standards. Overall, innovation, customer-centric solutions, and strategic regional penetration define the competitive dynamics of the global dumping hopper market, fostering sustainable growth for leading players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Lifting Equipment Store USA announced a new partnership with Vestil to introduce over 600 new product lines, including improved self-dumping hoppers and ergonomic material handling solutions designed for greater workplace safety and efficiency. These product launches highlight Vestil’s continued commitment to innovation and market responsiveness in early 2025.

- In June 2025, McCullough Industries announced new developments in the Dumping Hopper Market, including expanded product variations, innovative bump release hoppers, low profile and quick attach designs, new accessories for increased adaptability, and improved continuous weld construction for enhanced reliability.

- In November 2024, Roura Material Handling continued its leadership in the Dumping Hopper Market by maintaining its position as a leading value producer of self-dumping hoppers with over 60 standard models and sizes, including specialty and custom designs to meet specific customer needs.

- In October 2022, Flexicon launched a new manual dumping system, designed to meet strict sanitary standards along with offering versatility & contamination control. It caters to industries, such as dairy, pharmaceuticals, and bulk foods, by providing efficient material-handling solutions with an integral conveyor and a separate dust collector. Its mobility and adaptability enhance product handling & safety, making it a valuable addition to the market growth.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Dumping Angle, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing automation in industrial and construction sectors.

- Mobile and high-capacity hoppers will continue to dominate demand across multiple industries.

- Smart and IoT-enabled hoppers will gain wider adoption for real-time monitoring and predictive maintenance.

- Customizable and modular designs will drive market expansion by offering flexibility to end users.

- Agriculture and food processing sectors will increasingly adopt hoppers to improve efficiency and reduce manual labor.

- Rising infrastructure projects in emerging economies will create new opportunities for market growth.

- Manufacturers will focus on sustainable and durable materials to meet environmental and regulatory requirements.

- Technological innovation will support ergonomic and safety-enhanced hopper designs.

- Strategic partnerships, mergers, and regional expansions will strengthen competitive positioning.

- Overall, market growth will be fueled by efficiency, automation, and increased mechanization across key sectors.