Market Overview:

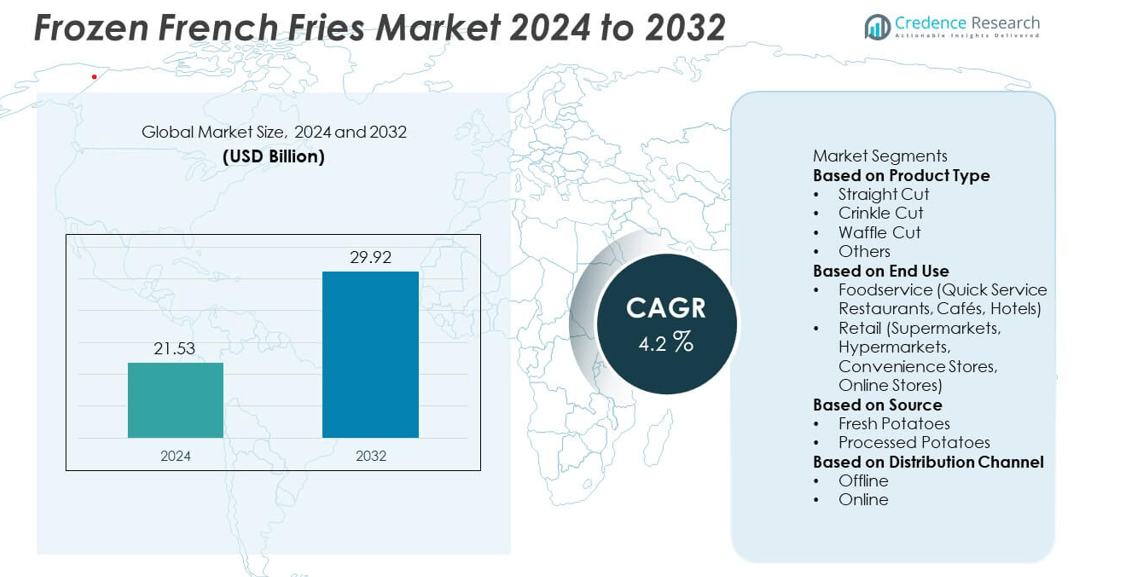

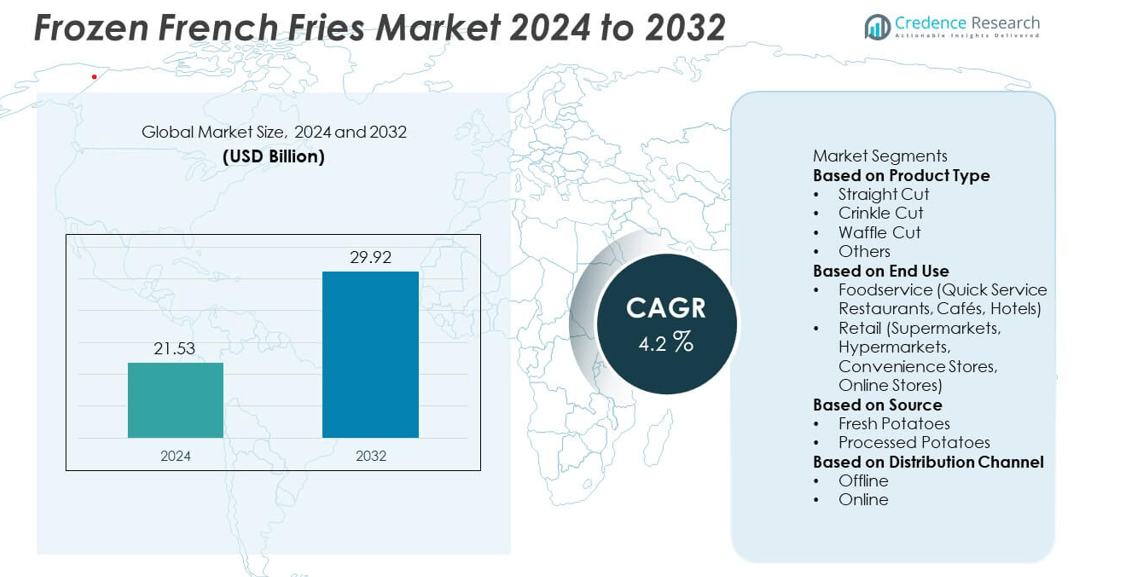

The frozen French fries market was valued at USD 21.53 billion in 2024 and is projected to reach USD 29.92 billion by 2032, expanding at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen French Fries Market Size 2024 |

USD 21.53 billion |

| Frozen French Fries Market, CAGR |

4.2% |

| Frozen French Fries Market Size 2032 |

USD 29.92 billion |

The frozen French fries market is dominated by major companies such as McCain Foods Limited, Lamb Weston Holdings, Inc., J.R. Simplot Company, Aviko B.V., and Agristo NV. These players lead through extensive global distribution networks, advanced freezing technologies, and partnerships with quick-service restaurants. Asia-Pacific emerged as the leading region, accounting for a 23.8% market share in 2024, driven by expanding fast-food chains and increasing urban consumption. North America followed with a 34.7% share, supported by mature foodservice infrastructure and consistent demand. Europe held 30.5%, fueled by large-scale potato production and strong export capabilities.

Market Insights

- The frozen French fries market was valued at USD 21.53 billion in 2024 and is projected to reach USD 29.92 billion by 2032, growing at a CAGR of 4.2%.

- Rising demand for convenient and ready-to-cook foods drives market growth, with the straight-cut segment holding a 46.7% share due to its popularity in QSRs and retail outlets.

- Increasing adoption of automation and sustainable freezing technologies is shaping industry trends, improving efficiency and maintaining consistent product quality.

- The market is moderately consolidated, with key players such as McCain Foods Limited, Lamb Weston Holdings, and J.R. Simplot Company focusing on product innovation and global expansion.

- North America led with a 34.7% share in 2024, followed by Europe at 30.5% and Asia-Pacific at 23.8%, driven by fast-food chain growth, cold chain development, and rising urban consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The straight-cut segment dominated the frozen French fries market in 2024, holding a 46.7% share. Its widespread use in quick-service restaurants and fast-food chains drives this dominance. Straight-cut fries are favored for their uniform size, quick cooking time, and consistent texture, making them ideal for large-scale food operations. Rising global demand for Western-style fast foods and increasing home consumption through retail channels further support growth. Manufacturers focus on advanced freezing technologies to preserve crispness and flavor, ensuring product quality throughout the cold chain.

- For instance, Lamb Weston uses innovative water gun knife systems to cut its potatoes, which enhances efficiency and consistency in the production of their frozen fries. These advanced systems use high-velocity water to carry potatoes through knives, ensuring uniform shapes and reducing waste by using smaller pieces for other products.

By End Use

The foodservice segment accounted for the largest 64.2% share of the frozen French fries market in 2024. Quick-service restaurants, cafés, and hotels drive demand due to menu standardization and bulk purchasing. Growth in global fast-food chains such as McDonald’s and KFC boosts volume consumption. The segment benefits from rising dine-out culture, expanding QSR presence in emerging economies, and partnerships between potato processors and foodservice distributors. Convenience and consistent quality make frozen fries a preferred choice for professional kitchens worldwide.

- For instance, McCain’s SureCrisp fries feature a patented clear coating that maintains crispness during delivery. McCain’s SureCrisp fries are designed for dine-in and delivery, with a longer hold time compared to regular fries.

By Source

The fresh potatoes segment led the frozen French fries market in 2024 with a 57.5% share. Preference for natural ingredients and improved sourcing from contract farming models drive this segment’s dominance. Fresh potato-based fries offer better flavor and texture compared to processed alternatives. Leading producers invest in advanced processing plants near cultivation zones to ensure freshness and supply stability. Additionally, the shift toward premium and clean-label frozen foods encourages manufacturers to emphasize traceable, farm-fresh potato varieties for higher quality and consumer trust.

Key Growth Drivers

Rising Consumption of Convenience Foods

The growing preference for ready-to-cook and quick-to-serve foods strongly drives market demand. Frozen French fries fit consumer lifestyles that favor convenience, minimal preparation time, and consistent quality. Increasing participation of quick-service restaurants and expansion of fast-food chains in developing markets further boost consumption. Retail availability and effective cold-chain logistics also enhance accessibility, reinforcing steady growth in both developed and emerging regions.

- For instance, McCain Foods operates a production plant in Mehsana, Gujarat, and uses advanced freezing technology and a cold chain to deliver frozen products like French fries. The company ensures fry texture stability by maintaining products at a temperature of -18°C or below throughout distribution.

Expansion of Quick-Service Restaurants (QSRs)

The rapid global expansion of QSRs and casual dining chains supports sustained demand for frozen fries. Chains like McDonald’s, Burger King, and KFC rely on standardized frozen potato products to maintain taste and texture consistency. Urbanization and the popularity of Western food culture in Asia-Pacific significantly strengthen this trend. The segment’s scalability and reliance on frozen inputs ensure stable sales across both domestic and international markets.

- For instance, the J.R. Simplot Company has been a long-standing potato supplier for McDonald’s globally, with a joint venture in China known as Beijing Simplot Food Processing. This facility, like others in the modern food processing industry, utilizes automated optical grading systems to ensure product quality.

Growth in Cold Chain and Storage Infrastructure

Improved cold storage facilities and advanced logistics systems are key enablers of market expansion. Modern freezing technologies help retain texture, flavor, and nutritional quality during storage and transport. Government investments in cold chain development and private sector partnerships ensure efficient product distribution. This infrastructure supports longer shelf life and wider retail penetration, helping producers maintain consistent supply throughout all seasons.

Key Trends & Opportunities

Rising Demand for Healthier and Premium Variants

Consumers increasingly seek low-fat, air-fried, or organic frozen fries made from non-GMO and additive-free potatoes. Brands are introducing seasoned and skin-on varieties to enhance flavor and health appeal. This trend creates opportunities for premiumization, especially in mature markets. Producers investing in healthier alternatives capture growing demand from health-conscious consumers and retail buyers.

- For instance, Aviko B.V. launched its SuperCrunch Pure & Rustic line, utilizing advanced steam-peeling technology to minimize waste. Its fries are coated with a thin batter that helps them stay hot and crispy for longer. These innovations cater to consumer demand for high-quality frozen potato products with improved texture.

Expansion of E-commerce and Retail Distribution

Online grocery platforms and delivery apps are transforming frozen food distribution. Consumers prefer digital channels for convenience, discounts, and variety. Retailers are increasing frozen aisle capacity to meet demand. Strategic partnerships between manufacturers and e-commerce platforms boost product visibility and reach, driving sales across both urban and semi-urban regions.

- For instance, The Kraft Heinz Company uses a digital ecosystem, including AI, to create a “self-driving” supply chain with end-to-end visibility and improved demand forecasting. This system aggregates and analyzes supply chain data, working with technology partners like Microsoft and o9 Solutions to enable faster, more accurate decision-making for a variety of products.

Key Challenges

Supply Chain and Storage Limitations in Emerging Economies

In developing regions, inadequate refrigeration facilities and high electricity costs hinder product storage and transport. Temperature fluctuations compromise quality and shelf life. Small producers face challenges in maintaining cold-chain consistency, leading to limited market penetration. Addressing these issues requires investment in energy-efficient and affordable storage systems.

Fluctuating Raw Material Prices

Volatility in potato prices directly affects production costs and profit margins. Unfavorable weather conditions and inconsistent supply chain management amplify price instability. Processors must adopt strong procurement strategies and invest in contract farming to ensure raw material stability. This challenge remains a key concern for sustaining competitiveness in the global frozen French fries market.

Regional Analysis

North America

North America accounted for a 34.7% share of the frozen French fries market in 2024. The region’s dominance stems from a well-established fast-food industry and high per capita consumption of processed potato products. The U.S. leads production and exports, supported by large-scale potato farming and advanced freezing technologies. Growing demand for premium and seasoned fries in retail outlets further supports market expansion. Increasing health awareness is also driving manufacturers to introduce low-fat and air-fried variants. Strong distribution networks and innovation in packaging continue to reinforce North America’s leadership position.

Europe

Europe held a 30.5% share of the frozen French fries market in 2024. The region benefits from extensive potato cultivation in countries such as Belgium, the Netherlands, and France, which are major global exporters. Demand is driven by the widespread consumption of fries in foodservice and retail channels. Manufacturers focus on sustainable production and traceable sourcing to meet strict EU food standards. Rising popularity of private-label frozen snacks across supermarkets boosts domestic consumption. Technological advancements in freezing and preservation also enhance product quality and shelf stability across European markets.

Asia-Pacific

Asia-Pacific captured a 23.8% share of the frozen French fries market in 2024, emerging as the fastest-growing regional market. Rising disposable income, growing urban populations, and rapid expansion of QSR chains like McDonald’s and Burger King fuel demand. China, India, and Japan dominate consumption, supported by increasing Western-style dining preferences. Expanding cold storage infrastructure and e-commerce retailing further enhance market accessibility. Manufacturers are strengthening local processing capacities to reduce import dependency and meet rising domestic consumption. The trend toward convenient, ready-to-cook meals continues to drive significant regional growth.

Latin America

Latin America accounted for a 6.1% share of the frozen French fries market in 2024. Brazil and Mexico lead consumption, driven by a growing fast-food culture and improving cold chain logistics. Rising middle-class income levels and increased exposure to Western eating habits stimulate market demand. Local producers focus on expanding potato processing facilities to serve domestic and export markets. However, limited cold storage infrastructure and higher energy costs restrain broader market penetration. Despite these challenges, continued investment in retail expansion and frozen snack categories supports steady regional growth.

Middle East & Africa

The Middle East & Africa region held a 4.9% share of the frozen French fries market in 2024. Rapid urbanization, tourism growth, and rising QSR penetration in Gulf countries drive demand. Saudi Arabia and the UAE dominate due to strong foodservice expansion and increasing consumer preference for Western-style snacks. The market benefits from growing imports from Europe and North America to meet high demand. Investments in local potato processing and cold chain systems are improving supply consistency. The expanding hospitality and catering sectors further strengthen regional consumption of frozen French fries.

Market Segmentations:

By Product Type

- Straight Cut

- Crinkle Cut

- Waffle Cut

- Others

By End Use

- Foodservice (Quick Service Restaurants, Cafés, Hotels)

- Retail (Supermarkets, Hypermarkets, Convenience Stores, Online Stores)

By Source

- Fresh Potatoes

- Processed Potatoes

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The frozen French fries market is highly competitive, with key players including McCain Foods Limited, Lamb Weston Holdings, Inc., J.R. Simplot Company, Aviko B.V., The Kraft Heinz Company, Agristo NV, Cavendish Farms Corporation, Agrarfrost GmbH & Co. KG, Idahoan Foods, LLC, and Himalya International Ltd. These companies focus on expanding production capacity, enhancing cold chain logistics, and launching innovative product varieties such as low-fat, seasoned, and organic fries. Strategic mergers, partnerships with QSR chains, and investments in automated freezing and packaging technologies strengthen their global presence. Leading producers emphasize sustainability by optimizing water and energy use and promoting recyclable packaging. Continuous R&D efforts in flavor innovation, shelf-life enhancement, and healthier formulations help brands cater to evolving consumer preferences. Regional players are also entering private-label partnerships with retailers, intensifying competition across both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Lamb Weston Holdings, Inc. opened its Mar del Plata plant. The site can process 200 million pounds annually. It serves Latin America demand.

- In September 2025, Idahoan Foods, LLC introduced +PROTEIN mashed potatoes. The product provides 6g protein per serving. It extends Idahoan’s potato lineup.

- In July 2025, J.R. Simplot Company moved to acquire Clarebout Potatoes. The planned deal targets expanded frozen potato capacity. It signals a major industry shift.

- In June 2025, Cavendish Farms Corporation unveiled a regenerative “Discovery Farm.” The initiative supports P.E.I. growers with sustainability research. Findings will guide local practices.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End Use, Source, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for convenient and ready-to-eat foods will continue to rise globally.

- Expansion of quick-service restaurant networks will boost large-scale frozen fry consumption.

- Health-focused variants such as low-fat and air-fried fries will gain popularity.

- Asia-Pacific will emerge as a key growth region with increasing urbanization and dining-out culture.

- Sustainable packaging and energy-efficient freezing technologies will shape production trends.

- Strategic partnerships between manufacturers and foodservice chains will strengthen supply stability.

- Growth in e-commerce grocery platforms will enhance product accessibility in emerging markets.

- Premium and seasoned product lines will expand to meet evolving consumer preferences.

- Investments in cold chain infrastructure will improve quality and reduce wastage.

- Manufacturers will focus on clean-label formulations to attract health-conscious consumers.