Market Overview:

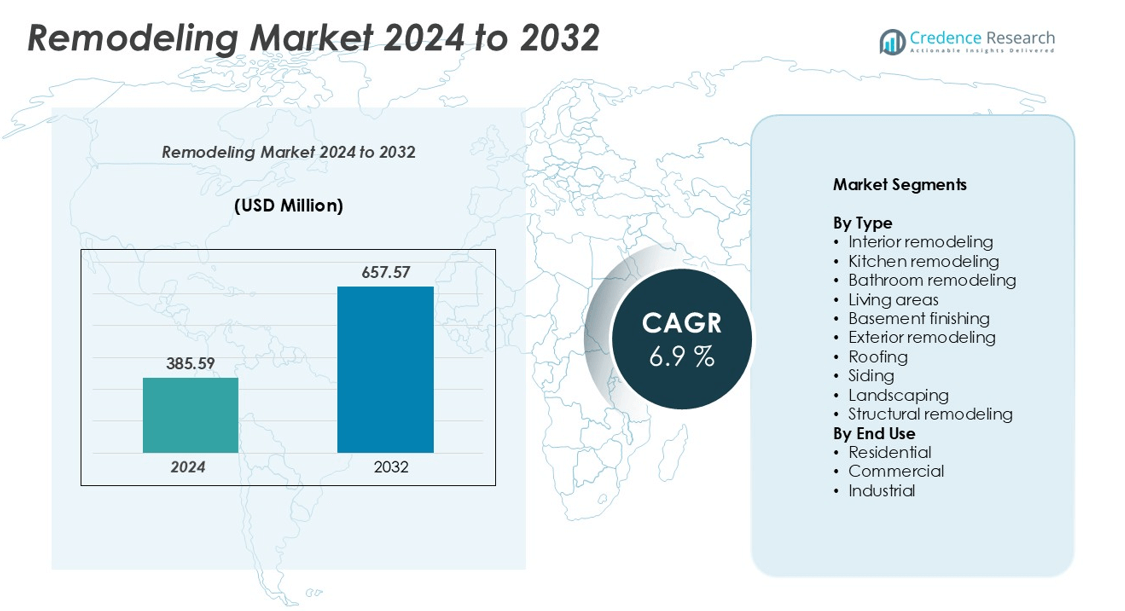

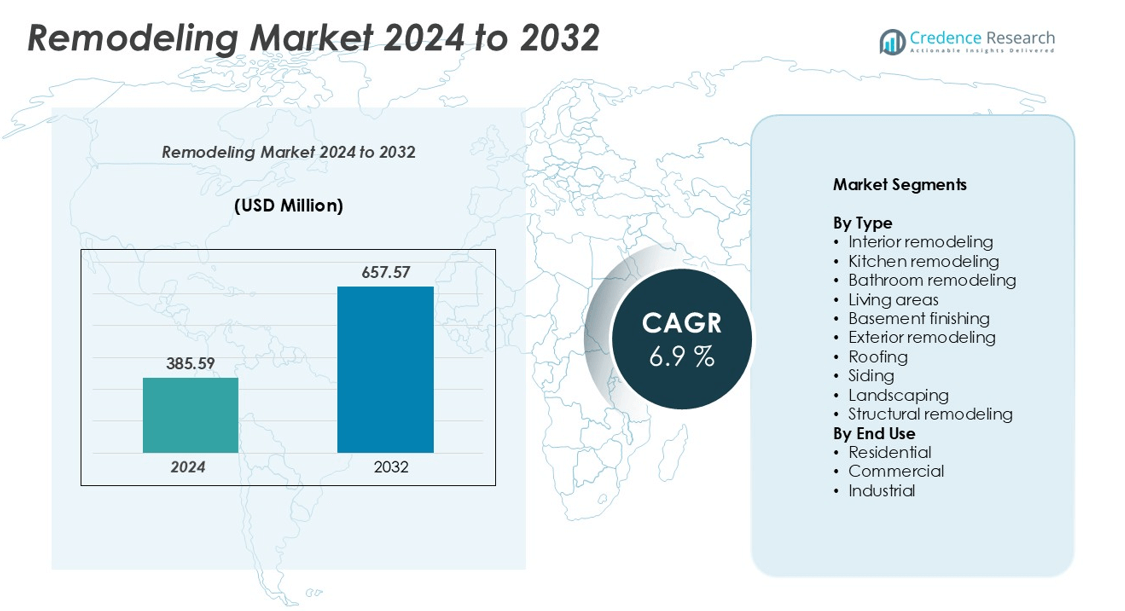

The remodeling market size was valued at USD 385.59 million in 2024 and is anticipated to reach USD 657.57 million by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Remodeling Market Size 2024 |

USD 385.59 million |

| Remodeling Market, CAGR |

6.9% |

| Remodeling Market Size 2032 |

USD 657.57 million |

The remodeling market is led by prominent players such as Andersen Corporation, Masco Corporation, Owens Corning, Kohler Co., Lowe’s Companies, Inc., Jeld-Wen Holding, Inc., and Pella Corporation, which collectively account for a substantial share of global revenue. These companies dominate through advanced product innovation, sustainable design integration, and extensive retail and distribution networks. North America remains the leading region, capturing approximately 35% of the global market share in 2024, driven by strong consumer spending on home renovation and modernization. Europe and Asia-Pacific follow, supported by stringent energy-efficiency regulations and rapid urban development, respectively, shaping the global remodeling industry’s competitive dynamics.

Market Insights

- The global remodeling market was valued at USD 385.59 million in 2024 and is projected to reach USD 657.57 million by 2032, growing at a CAGR of 6.9% during the forecast period.

- Rising demand for home renovation, modernization, and energy-efficient solutions is driving market growth, supported by increased consumer spending and government incentives for sustainable construction.

- Key trends include the growing adoption of smart home technologies, modular remodeling solutions, and the use of eco-friendly materials to enhance building efficiency and aesthetic appeal.

- The competitive landscape features major players such as Andersen Corporation, Masco Corporation, Owens Corning, Kohler Co., and Lowe’s Companies, Inc., focusing on innovation, sustainability, and strategic partnerships to expand market presence.

- North America leads the market with 35% share, followed by Europe (27%) and Asia-Pacific (25%), while the interior remodeling segment holds the largest share due to high demand for functional and aesthetic home upgrades.

Market Segmentation Analysis:

By Type:

The remodeling market by type is segmented into interior remodeling, kitchen remodeling, bathroom remodeling, living areas, basement finishing, exterior remodeling, roofing, siding, landscaping, and structural remodeling. Interior remodeling held the dominant share of the market in 2024, accounting for over 28% of total revenue. The segment’s growth is driven by rising consumer focus on modern aesthetics, smart home integration, and energy-efficient designs. Increasing renovation projects in urban households and demand for space optimization further propel the adoption of interior remodeling solutions across both new and existing structures.

- For instance, Interio by Godrej, a leading Indian furniture and design brand, now operates well over 1,000 retail stores across India and serves customers both online and offline.

By End Use:

Based on end use, the market is divided into residential, commercial, and industrial segments. The residential segment dominated the remodeling market, contributing more than 60% of the total share in 2024. This dominance is attributed to rising urbanization, growing disposable income, and the surge in home renovation projects among homeowners seeking modern living standards. Additionally, government incentives for green buildings and the integration of sustainable materials in residential remodeling projects have significantly bolstered market demand in this segment.

- For instance, Kansai Nerolac Paints is India’s largest industrial paint manufacturer and the third-largest company in the overall Indian paint industry, which is dominated by decorative paints. In 2023, Kansai Nerolac had an estimated market share of around 15%, behind Asian Paints and Berger Paints.

Key Growth Drivers

Rising Demand for Home Renovation and Modernization

The increasing emphasis on home renovation and modernization serves as a major growth driver for the remodeling market. Homeowners are investing in upgrading outdated structures to enhance comfort, functionality, and property value. The demand is particularly strong in urban areas, where limited space drives interest in interior redesign and space optimization. Furthermore, shifting lifestyle preferences, higher disposable incomes, and the influence of home improvement media have amplified interest in aesthetic renovations. Energy-efficient upgrades, smart home integrations, and customized interior designs are becoming standard, propelling consistent growth in remodeling activities across residential sectors.

- For instance, Origin AI’s TruPresence™ technology, using WiFi sensing, provides real-time occupancy data to enable connected smart home devices like lights and HVAC systems to be automatically adjusted, promoting both comfort and energy efficiency.

Growing Adoption of Sustainable and Energy-Efficient Solutions

Sustainability has emerged as a defining factor in remodeling decisions, with consumers increasingly opting for eco-friendly materials and energy-efficient systems. Governments and regulatory bodies are promoting green building initiatives and offering incentives for adopting energy-saving technologies. This trend has encouraged remodeling companies to integrate solar panels, low-emission windows, recycled materials, and smart thermostats into their projects. The growing awareness of carbon footprints and the long-term cost savings from sustainable designs further stimulate demand. As a result, the remodeling market is experiencing a shift toward green construction practices, aligning with global sustainability goals.

- For instance, Nerolac Excel Total with Heat-Guard Technology” to reduce indoor temperatures, decrease the need for air conditioning, and contribute to energy conservation.

Technological Advancements and Smart Home Integration

Technological innovation plays a pivotal role in shaping the remodeling market’s future. The integration of smart home technologies, including automated lighting, energy management systems, and security solutions, has significantly influenced remodeling preferences. Homeowners are increasingly upgrading existing infrastructures to accommodate connected devices, enhancing both convenience and efficiency. Additionally, advanced design tools such as Building Information Modeling (BIM) and virtual reality (VR) visualization streamline project planning and improve accuracy in execution. These technologies enable remodelers to offer customized, data-driven solutions, accelerating project timelines and improving customer satisfaction—factors that collectively boost market expansion.

Key Trends and Opportunities

Expansion of Modular and Prefabricated Remodeling Solutions

The adoption of modular and prefabricated remodeling solutions represents a major trend reshaping the market. Prefabrication offers faster installation, cost efficiency, and reduced material waste, making it an attractive choice for both residential and commercial projects. With rising labor costs and increasing demand for rapid construction, modular remodeling has gained traction among urban developers and homeowners. Companies are investing in off-site manufacturing facilities to enhance productivity and quality control. This trend aligns with sustainability goals while addressing growing urban housing needs, creating lucrative opportunities for innovation and scalability in remodeling services.

- For instance, Loom Crafts has delivered more than 600 prefab modular homes across India, including urban centers like Guwahati, and offers a 20-year warranty with a design life exceeding 50 years.

Rising Investment in Commercial and Infrastructure Renovation

Growing investment in commercial property upgrades and infrastructure renovation presents significant opportunities for market expansion. Ageing commercial buildings, offices, and industrial facilities are undergoing modernization to meet new safety standards and sustainability benchmarks. The demand for energy-efficient systems, modern layouts, and smart automation within workspaces is driving extensive remodeling projects. Additionally, the post-pandemic shift toward hybrid work environments has encouraged office redesigns focusing on flexibility and wellness-oriented spaces. These trends are creating strong prospects for contractors and suppliers specializing in large-scale remodeling projects across commercial and industrial sectors.

- For instance, Honeywell’s Zone-Based Smart Cooling system uses an array of wireless ambient and occupancy (PIR) sensors to gather real-time data on a space’s usage. This data is used by a proprietary algorithm to continuously optimize air distribution through motorized dampers and diffusers, allowing for “occupant-centric cooling”. By fine-tuning cooling to actual demand rather than operating at a fixed speed, the system can achieve significant energy savings, potentially up to 40%. This reduction in energy consumption directly contributes to lowering a building’s overall carbon footprint. The technology has also received industry recognition, including a “Most Innovative Project” award in 2022 from the Confederation of Indian Industry (CII).

Key Challenges

High Cost of Remodeling and Skilled Labor Shortages

One of the primary challenges in the remodeling market is the high cost of materials, labor, and project execution. Rising prices of construction materials, such as steel, wood, and insulation products, directly impact project affordability. Additionally, a shortage of skilled workers—particularly electricians, plumbers, and specialized remodelers—has led to longer project timelines and increased labor expenses. These factors often discourage homeowners and businesses from undertaking large-scale renovations. Addressing these challenges requires enhanced training programs, automation adoption, and supply chain optimization to maintain profitability and market competitiveness.

Regulatory Compliance and Project Delays

Strict building codes, zoning regulations, and permit requirements pose another major challenge for remodeling companies. Adherence to environmental, safety, and structural standards often leads to administrative delays and added costs. Inconsistent regional regulations further complicate project approvals and execution timelines. Moreover, frequent policy changes related to sustainability and emissions standards require continuous adaptation by industry stakeholders. Companies that fail to navigate these complex compliance frameworks risk project cancellations or penalties. Streamlining regulatory processes and promoting digital permit systems can mitigate these barriers, improving project efficiency and industry growth.

Regional Analysis

North America

North America dominated the remodeling market in 2024, accounting for over 35% of the global share. The region’s growth is driven by a surge in residential renovation activities, aging housing stock, and the increasing popularity of smart home technologies. Homeowners in the U.S. and Canada are investing heavily in kitchen and bathroom upgrades, energy-efficient designs, and sustainable materials. Additionally, favorable financing options and government incentives for green remodeling projects support steady market expansion. Strong consumer awareness and high spending power further reinforce North America’s leadership position in the global remodeling industry.

Europe

Europe held a significant 27% share of the global remodeling market in 2024, supported by stringent energy-efficiency regulations and rising investments in building modernization. The region’s mature housing infrastructure and demand for eco-friendly remodeling solutions have accelerated market growth. Countries such as Germany, the U.K., and France are leading in retrofitting initiatives focused on carbon reduction and thermal insulation improvements. The growing preference for aesthetic upgrades, coupled with advanced construction technologies, is reshaping the remodeling landscape. Moreover, public-private collaborations for sustainable housing projects continue to strengthen Europe’s remodeling market outlook.

Asia-Pacific

The Asia-Pacific region captured approximately 25% of the remodeling market in 2024 and is projected to witness the fastest growth through 2032. Rapid urbanization, rising middle-class income, and expanding real estate development drive remodeling demand in countries such as China, India, and Japan. Increasing adoption of smart and modular designs, coupled with the influence of Western lifestyle trends, fuels modernization efforts in both residential and commercial properties. Government initiatives promoting sustainable infrastructure and green building certifications further accelerate regional market growth, making Asia-Pacific a major hub for remodeling investments.

Latin America

Latin America accounted for nearly 8% of the global remodeling market in 2024, with steady expansion led by Brazil, Mexico, and Argentina. Growing urban development, modernization of old housing structures, and rising homeownership rates are key growth contributors. The increasing demand for affordable remodeling solutions and local investments in residential infrastructure are enhancing market potential. Additionally, supportive government housing programs and the growing influence of sustainable construction practices are encouraging the adoption of modern remodeling techniques. However, economic fluctuations and limited access to financing slightly constrain large-scale market expansion in the region.

Middle East & Africa

The Middle East & Africa (MEA) region represented around 5% of the global remodeling market in 2024 and is expected to show steady growth over the forecast period. The expansion is driven by rapid urbanization, tourism-led infrastructure development, and rising commercial renovation projects in countries such as the UAE, Saudi Arabia, and South Africa. Growing investments in luxury housing and modernization of hospitality spaces further stimulate market activity. Additionally, government initiatives to diversify economies beyond oil dependency and promote sustainable construction practices are creating new opportunities in the regional remodeling industry.

Market Segmentations:

By Type

- Interior remodeling

- Kitchen remodeling

- Bathroom remodeling

- Living areas

- Basement finishing

- Exterior remodeling

- Roofing

- Siding

- Landscaping

- Structural remodeling

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The remodeling market is highly competitive, characterized by the presence of both global and regional players focusing on innovation, product quality, and sustainability. Key companies such as Andersen Corporation, Masco Corporation, Owens Corning, Kohler Co., and Lowe’s Companies, Inc. dominate the market through extensive product portfolios and strong distribution networks. These players invest heavily in research and development to introduce energy-efficient materials, modular designs, and smart remodeling solutions. Strategic initiatives such as mergers, acquisitions, and partnerships are common, aimed at expanding geographic reach and strengthening service capabilities. Additionally, manufacturers are increasingly adopting digital tools for design visualization and project management to enhance customer engagement. Intense competition, coupled with growing demand for sustainable and customized renovation solutions, is encouraging companies to differentiate through eco-friendly offerings and advanced technologies, thereby maintaining a strong foothold in the global remodeling market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Andersen Corporation

- CertainTeed Corporation

- CRH plc

- Fletcher Building Limited

- James Hardie Industries

- Jeld-Wen Holding, Inc.

- Kohler Co.

- Lowe’s Companies, Inc.

- Masco Corporation

- MasterBrand Cabinets, Inc.

- Owens Corning

- Pella Corporation

Recent Developments

- In November 2023, The Home Depot acquired International Designs Group (IDG), a company that owns and operates Construction Resources and several other design-focused subsidiaries. Construction Resources is a prominent distributor of design-oriented surfaces, appliances, and architectural specialty products, catering to professional contractors engaged in renovation, remodelling, residential home building, and multi-family projects.

- In July 2023, Masco Corporation completed the acquisition of Sauna360 Group, a step intended to broaden its line of products in the home renovation and wellness industries. Masco’s market presence improved by this strategic acquisition as it incorporated Sauna360’s sauna and steam solution expertise. The acquisition is consistent with Masco’s expansion strategy and dedication to providing a wide array of superior products.

Report Coverage

The research report offers an in-depth analysis based on Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The remodeling market is expected to experience steady growth driven by rising global demand for modernized living spaces.

- Increasing adoption of smart home technologies will significantly influence remodeling design and functionality.

- Sustainable and energy-efficient renovation practices will remain a primary focus among consumers and developers.

- Advancements in modular construction and prefabricated materials will accelerate project completion times.

- Growing urbanization and limited housing space will boost demand for interior and space-optimization remodeling solutions.

- Integration of digital design tools and virtual visualization will enhance customer engagement and project accuracy.

- Commercial and industrial renovation activities will expand as businesses upgrade existing infrastructures.

- Skilled labor shortages and rising material costs may encourage greater use of automation and prefabrication.

- Strategic collaborations and mergers among leading players will strengthen global market competitiveness.

- Asia-Pacific will emerge as the fastest-growing region, supported by rapid infrastructure development and modernization trends.