Market Overview:

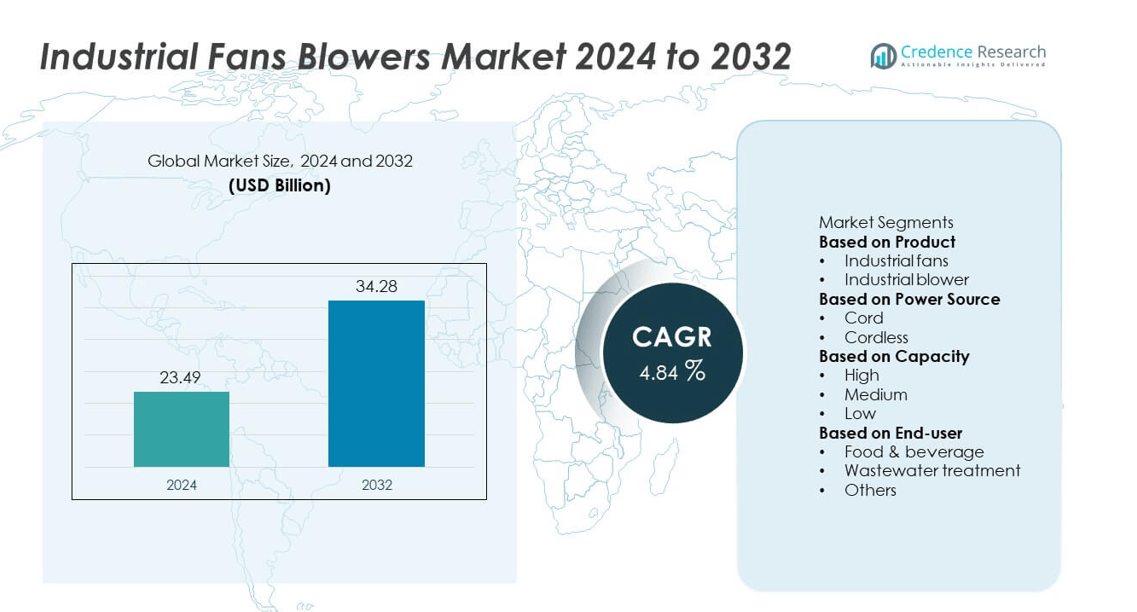

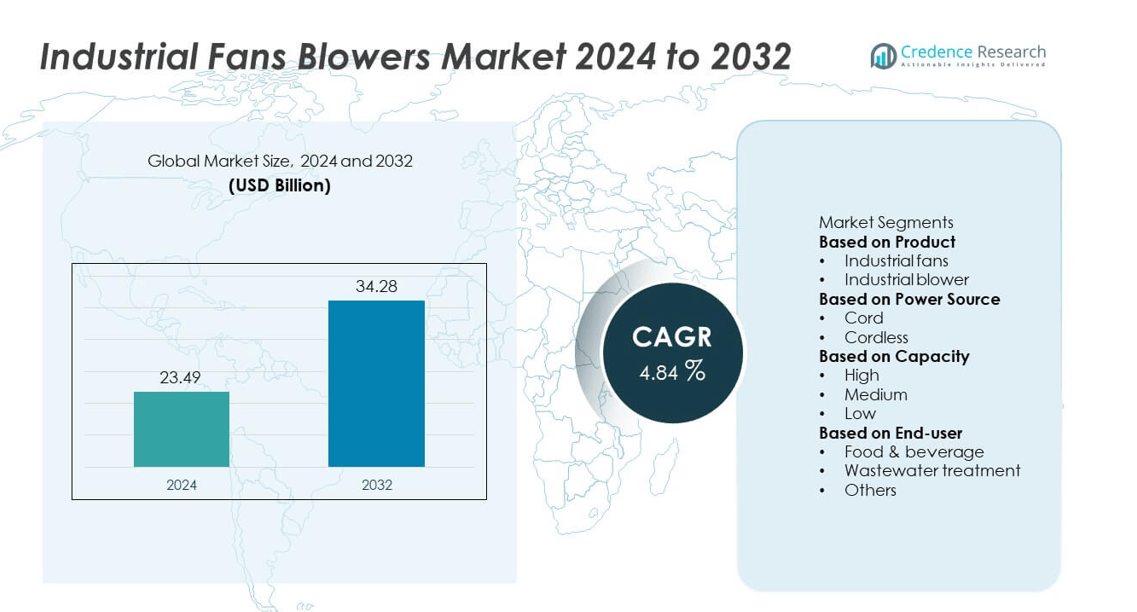

The Industrial Fans and Blowers Market was valued at USD 23.49 billion in 2024 and is projected to reach USD 34.28 billion by 2032, growing at a CAGR of 4.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Fans and Blowers Market Size 2024 |

USD 23.49 billion |

| Industrial Fans and Blowers Market, CAGR |

4.84% |

| Industrial Fans and Blowers Market Size 2032 |

USD 34.28 billion |

The industrial fans and blowers market is led by major companies such as Kaeser, Busch, Everest, Howden, Dicheng, Atlas Copco, Atlantic Blower, Aerzen, Ingersoll Rand, and Kay International. These players dominate through advanced manufacturing capabilities, energy-efficient designs, and strategic partnerships across key industrial sectors. Product innovation in high-capacity, low-noise, and smart-controlled ventilation systems continues to drive competitive differentiation. North America emerged as the leading region with a 33.4% market share in 2024, supported by strong industrial infrastructure, strict air quality regulations, and increasing adoption of high-efficiency fans and blowers in power generation, manufacturing, and processing industries.

Market Insights

- The industrial fans and blowers market was valued at USD 23.49 billion in 2024 and is projected to reach USD 34.28 billion by 2032, growing at a CAGR of 4.84% during the forecast period.

- Growing industrialization, stricter air quality standards, and infrastructure expansion are major drivers fueling product demand across heavy industries.

- The market trend is shifting toward energy-efficient, low-noise, and IoT-enabled systems, with manufacturers investing in smart ventilation and predictive maintenance technologies.

- Key players such as Kaeser, Howden, Atlas Copco, and Ingersoll Rand are focusing on product innovation, strategic acquisitions, and expanding regional production capabilities.

- North America led with a 33.4% share in 2024, followed by Europe with 28.6%, while Asia-Pacific held 30.9% and emerged as the fastest-growing region; the industrial fans segment dominated the market with a 64.2% share due to high demand in manufacturing and power generation sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The industrial fans segment dominated the market with a 64.2% share in 2024, driven by widespread use in ventilation, cooling, and air circulation across manufacturing, power generation, and mining industries. Their high energy efficiency, low maintenance, and ability to handle large air volumes support strong demand. Increasing adoption of variable frequency drives (VFDs) and noise-reduction technologies further enhance operational performance. Continuous upgrades in aerodynamic design and material strength are enabling longer service life, making industrial fans the preferred choice over blowers in heavy-duty and high-airflow applications.

- For instance, Howden offers its Variax variable pitch axial fan system for underground mining operations. The system incorporates intelligent, automated airflow controls that adjust ventilation based on real-time demand, which enhances both safety and operational efficiency.

By Power Source

The corded segment accounted for a 72.6% market share in 2024, supported by consistent power delivery and suitability for high-capacity industrial environments. Corded models are preferred in factories and refineries where continuous operation and high torque are essential. The growth of cordless models remains moderate, limited to portable and maintenance-focused applications. However, advancements in lithium-ion batteries and brushless motors are gradually improving cordless efficiency, positioning them for niche adoption in compact industrial spaces and quick maintenance operations.

- For instance, Atlas Copco developed its new GHS VSD+ corded vacuum blower with an integrated 37 kW motor, capable of continuous operation up to 4,500 hours annually without downtime. The design includes intelligent energy recovery, which returns up to 75% of absorbed power as reusable heat within industrial systems, improving plant-wide energy management.

By Capacity

The high-capacity segment led the market with a 54.8% share in 2024, driven by extensive use in heavy industries such as cement, steel, and petrochemicals. These systems provide powerful airflow and pressure performance, essential for large-scale ventilation, combustion, and material handling. Demand is rising for energy-efficient, high-output fans and blowers that comply with emission and workplace safety regulations. Manufacturers are investing in advanced impeller designs and smart monitoring systems to optimize performance and reduce energy consumption in large-scale industrial environments.

Key Growth Drivers

Rising Industrialization and Infrastructure Development

Rapid industrial expansion across emerging economies is driving strong demand for industrial fans and blowers. Manufacturing, cement, steel, and mining facilities rely heavily on these systems for efficient air circulation and dust control. Infrastructure projects, including tunnels, power plants, and refineries, also require high-capacity ventilation systems. The continuous growth of construction and energy-intensive industries in Asia-Pacific and the Middle East further boosts equipment adoption, supporting steady market growth for large-scale and energy-efficient air movement solutions.

- For instance, Everest Blowers provides various air blowers, including twin-lobe and centrifugal models, to steel plants in India for applications such as combustion air supply and pneumatic conveying. The company offers solutions that are robust, energy-efficient, and designed for continuous heavy-duty industrial environments.

Stringent Air Quality and Safety Regulations

Tightening environmental and occupational safety regulations are propelling the installation of industrial ventilation systems. Governments across the U.S., Europe, and China are enforcing air quality standards that require effective dust, fume, and gas control. Industrial fans and blowers play a key role in meeting emission compliance and maintaining workplace safety. Rising awareness of employee health and sustainable operations has led industries to invest in advanced, low-emission ventilation solutions equipped with filtration and noise-reduction technologies.

- For instance, Aerzen developed its Delta Blower Generation 5 series with an integrated acoustic hood that lowers operating noise to 67 dB(A). Each blower unit includes precision oil-free compression stages capable of processing up to 9,000 m³/h of air, ensuring compliance with ISO 8573-1 Class 0 standards for clean air across industrial applications.

Growing Demand for Energy-Efficient Equipment

Industries are increasingly shifting toward energy-efficient fans and blowers to reduce operational costs and carbon footprints. High-efficiency impellers, smart control systems, and variable frequency drives (VFDs) are becoming standard design features. These innovations optimize airflow performance and energy consumption, offering long-term cost savings. Manufacturers are developing lightweight, corrosion-resistant materials to improve durability and performance. Global focus on sustainability and energy management programs, such as ISO 50001, continues to fuel the adoption of eco-efficient ventilation technologies across industrial sectors.

Key Trends & Opportunities

Integration of IoT and Smart Monitoring Systems

The adoption of IoT-enabled fans and blowers is rising, enabling predictive maintenance and real-time performance tracking. Smart sensors monitor temperature, vibration, and energy usage, allowing operators to detect faults early and reduce downtime. These digital solutions enhance operational efficiency in sectors such as power generation, chemical processing, and automotive manufacturing. The growing trend of Industry 4.0 and connected industrial equipment offers significant opportunities for manufacturers to develop intelligent, data-driven ventilation solutions that improve reliability and energy optimization.

- For instance, Ingersoll Rand’s Helix Connected Platform uses advanced sensor technology to provide real-time monitoring of compressed air systems. This system sends data via a cloud-based platform, enabling predictive analytics to improve machine health and reduce downtime.

Shift Toward Customized and Modular Systems

Industries are increasingly seeking customized and modular ventilation systems tailored to specific operational needs. Modular fans and blowers allow easy installation, scalability, and maintenance flexibility. This trend is gaining traction in industries such as food processing, pharmaceuticals, and electronics, where precision airflow control is critical. Manufacturers offering design flexibility and material customization—such as stainless steel or composite housings—are gaining a competitive edge. The demand for modular solutions is further supported by shorter project cycles and the need for cost-effective system integration.

- For instance, Kaeser Kompressoren offers rotary screw blowers with flow rates up to 160 cubic meters per minute (9,600 m³/h), or turbo blowers with flow rates up to 16,000 m³/h, in configurable, “plug-and-play” ready packages. These systems can be integrated into a secure network using the SIGMA AIR MANAGER 4.0 master controller for optimal efficiency and predictive maintenance.

Key Challenges

High Installation and Maintenance Costs

Industrial fans and blowers often involve significant initial investment due to their size, design complexity, and installation requirements. Maintenance costs also remain high, especially for high-capacity and specialized systems used in heavy industries. Wear and tear from continuous operation and harsh environmental conditions further increase operational expenses. Small and medium enterprises (SMEs) face difficulties adopting advanced, energy-efficient models due to limited budgets, which restrains market penetration in developing regions despite rising industrial demand.

Volatility in Raw Material Prices

Fluctuations in the prices of steel, aluminum, and composite materials directly affect the production costs of industrial fans and blowers. Manufacturers face pricing pressures that challenge profitability, particularly in competitive markets with thin margins. Supply chain disruptions and geopolitical tensions can further impact raw material availability. To mitigate these challenges, leading producers are focusing on long-term supplier contracts and using alternative materials to maintain stability. However, persistent cost fluctuations continue to influence pricing strategies and production planning across the industry.

Regional Analysis

North America

North America dominated the industrial fans and blowers market with a 33.4% share in 2024, supported by strong industrial infrastructure and stringent air quality regulations. The U.S. leads due to heavy demand from manufacturing, power generation, and HVAC applications. Rising investments in energy-efficient ventilation systems and modernization of industrial facilities further enhance market growth. The presence of major equipment manufacturers and high adoption of automation in process industries continue to strengthen regional dominance, supported by government initiatives promoting sustainable and energy-optimized air management technologies.

Europe

Europe accounted for a 28.6% market share in 2024, driven by the region’s strong emphasis on industrial efficiency and environmental compliance. Countries such as Germany, France, and Italy lead the market through high adoption of low-noise, energy-efficient ventilation equipment. Stringent EU emission norms and carbon reduction targets encourage industries to upgrade existing systems. Demand from automotive, food processing, and chemical manufacturing sectors remains high. Ongoing technological innovations and circular manufacturing initiatives are enabling companies to reduce energy use while maintaining high airflow efficiency.

Asia-Pacific

Asia-Pacific held the largest and fastest-growing share at 30.9% in 2024, driven by rapid industrialization, urbanization, and strong infrastructure development in China, India, and Japan. Expanding sectors such as cement, steel, mining, and electronics are major consumers of high-capacity fans and blowers. Government support for industrial modernization and emission control further drives equipment demand. Local manufacturers are focusing on cost-effective and energy-efficient models to meet rising regional demand. The growth of manufacturing clusters and export-oriented industries continues to position Asia-Pacific as a key production and consumption hub.

Latin America

Latin America captured a 4.1% market share in 2024, with Brazil and Mexico leading demand across the region. The growing industrial base in manufacturing, food processing, and mining sectors is supporting the installation of high-efficiency fans and blowers. Increasing awareness of workplace air quality and adoption of emission control systems are key contributors. Government-led initiatives to enhance energy performance in industrial operations are also creating new opportunities for advanced ventilation technologies, although budget constraints and limited local production still challenge widespread adoption.

Middle East & Africa

The Middle East & Africa region accounted for a 3.0% share in 2024, driven by industrial expansion in oil, gas, and construction sectors. Rising investments in petrochemical plants and infrastructure projects across the UAE, Saudi Arabia, and South Africa are key growth drivers. The region’s hot climate further amplifies the need for effective air movement and cooling systems. Growing industrial automation and energy diversification initiatives are encouraging the use of efficient and durable fans and blowers, particularly in high-temperature and dust-prone environments.

Market Segmentations:

By Product

- Industrial fans

- Industrial blower

By Power Source

By Capacity

By End-user

- Food & beverage

- Wastewater treatment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The industrial fans and blowers market is highly competitive, featuring leading companies such as Kaeser, Busch, Everest, Howden, Dicheng, Atlas Copco, Atlantic Blower, Aerzen, Ingersoll Rand, and Kay International. These players focus on product innovation, energy efficiency, and technological advancement to strengthen their global presence. Companies are investing in high-performance fans and blowers designed for lower energy consumption and minimal maintenance. Strategic collaborations, mergers, and acquisitions are common to expand product portfolios and geographic reach. Continuous improvements in impeller design, smart control systems, and materials enhance durability and performance. Market leaders emphasize customized solutions tailored to specific industrial needs such as petrochemicals, power generation, and manufacturing. The shift toward sustainable, noise-reduced, and digitally connected systems continues to redefine competition, positioning innovation and environmental compliance as key differentiators among global and regional manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kaeser

- Busch

- Everest

- Howden

- Dicheng

- Atlas Copco

- Atlantic Blower

- Aerzen

- Ingersoll Rand

- Kay International

Recent Developments

- In September 2025, Atlas Copco AB highlighted its ZS4 VSD+ rental blower unit and ZB7 turbo blower at the WEFTEC 2025 event, targeting wastewater aeration with digital control and rental flexibility.

- In 2025, Howden Group expanded deployment of variable-speed centrifugal blowers in hydrogen production and waste-heat recovery projects, marking a shift toward low-carbon applications.

- In August 2024, Kaeser Kompressoren launched its SFC 110M compressor series featuring a 150 hp permanent magnet motor and air flow up to 742 cfm at 100 psig

Report Coverage

The research report offers an in-depth analysis based on Product, Power Source, Capacity, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and low-noise ventilation systems will continue to rise across industries.

- Smart and IoT-integrated fans and blowers will gain wider adoption for real-time monitoring.

- Manufacturers will focus on lightweight and corrosion-resistant materials to improve durability.

- Growth in renewable energy and power generation sectors will boost high-capacity equipment demand.

- Industrial automation and predictive maintenance technologies will drive product innovation.

- Environmental regulations will encourage the replacement of outdated ventilation systems.

- Asia-Pacific will remain the fastest-growing market due to rapid industrial expansion.

- Modular and customized designs will become standard for process-specific applications.

- Strategic partnerships and mergers will strengthen global distribution networks.

- Increased focus on sustainability will promote the use of recyclable and eco-friendly components.