Market Overview:

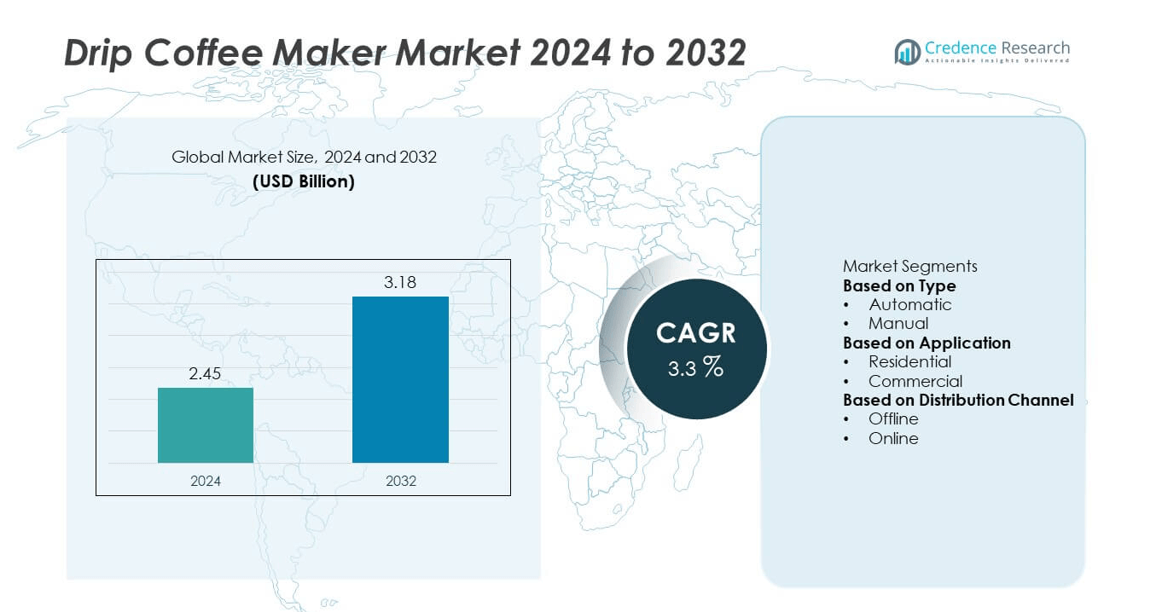

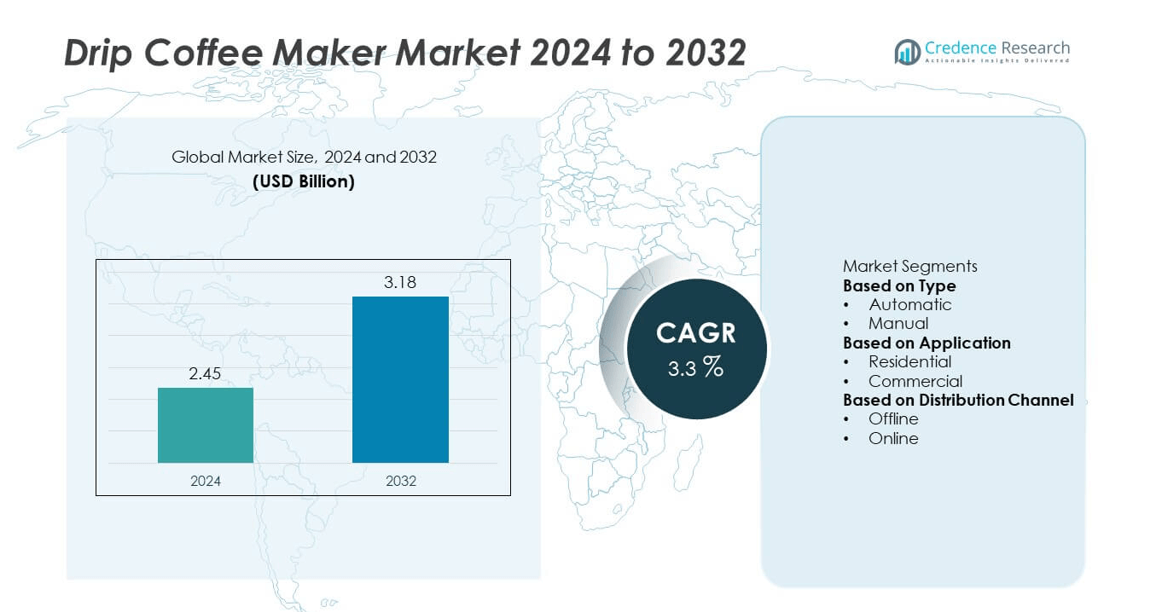

The drip coffee maker market was valued at USD 2.45 billion in 2024 and is projected to reach USD 3.18 billion by 2032, growing at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drip Coffee Maker Market Size 2024 |

USD 2.45 billion |

| Drip Coffee Maker Market, CAGR |

3.3% |

| Drip Coffee Maker Market Size 2032 |

USD 3.18 billion |

The drip coffee maker market is dominated by major players such as Electrolux AB, illycaffè S.p.A., GROUPE SEB UK, Ltd., BSH Hausgeräte GmbH, Spectrum Brands, Gruppo Cimbali S.p.A., Morphy Richards India, Espresso Supply, Inc., De’Longhi Appliances S.r.l., and Koninklijke Philips N.V. These companies lead through product innovation, efficient brewing technology, and strong global distribution networks. Continuous advancements in automatic and smart coffee machines enhance their competitive edge. North America remains the leading region with a 38% market share in 2024, driven by high coffee consumption and household adoption, followed by Europe with 32%, supported by premium home appliance demand and sustainability-focused consumers.

Market Insights

- The drip coffee maker market was valued at USD 2.45 billion in 2024 and is projected to reach USD 3.18 billion by 2032, growing at a CAGR of 3.3% during the forecast period.

- Growth is driven by rising demand for convenient, programmable, and energy-efficient home brewing appliances, fueled by increasing coffee consumption and lifestyle modernization.

- Key trends include the adoption of smart, Wi-Fi-enabled drip machines, sustainability-focused designs, and growing popularity of compact models suited for urban households.

- The market is competitive, with leading players such as Electrolux AB, De’Longhi Appliances S.r.l., BSH Hausgeräte GmbH, and GROUPE SEB UK, Ltd. focusing on innovation, digital integration, and eco-friendly manufacturing.

- North America dominated with a 38% share, followed by Europe at 32% and Asia-Pacific at 21%; by type, automatic models led with a 64% share, while the residential segment accounted for 58% of total market demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The automatic segment dominated the drip coffee maker market with a 64% share in 2024. Its leadership is driven by rising consumer preference for convenience, consistency, and programmable brewing features. Automatic machines offer time-saving benefits, appealing to busy households and small offices. The availability of smart models with digital controls, thermal carafes, and adjustable brew strength further enhances popularity. Manufacturers are also integrating energy-efficient systems and compact designs, strengthening adoption across both developed and emerging markets.

- For instance, the De’Longhi All-in-One Combination Coffee Maker & Espresso Machine (COM532M) features a dual heating system, a large 47-ounce water reservoir for the espresso side, and a digital touchscreen. The machine supports customizable strength control and includes a 24-hour programmable timer.

By Application

The residential segment accounted for a 58% share in 2024, making it the leading application area. Increasing home coffee consumption and lifestyle shifts toward premium brewing experiences drive this dominance. Consumers are investing in drip coffee makers to enjoy café-style beverages at home. The rise of remote working has also boosted daily household coffee preparation. Compact, easy-to-clean, and aesthetically designed drip coffee makers are gaining traction, especially in urban homes where convenience and modern design are key purchasing factors.

- For instance, Koninklijke Philips N.V. launched the Café GAIA Drip Coffee Maker equipped with a 1.2-litre glass jug and 1000-watt heating element. The system brews up to 10 cups in 10 minutes, maintaining a stable extraction temperature of 93 °C. The model’s auto shut-off function after 30 minutes of inactivity improved household energy efficiency across European markets.

By Distribution Channel

The offline segment held a 67% share in 2024, remaining the dominant sales channel for drip coffee makers. Supermarkets, specialty stores, and brand-exclusive outlets offer consumers direct product testing and demonstrations, influencing purchase decisions. Strong retail presence and promotional discounts enhance offline sales globally. However, manufacturers are increasingly expanding online distribution through e-commerce platforms to capture younger consumers and digital shoppers. The combination of in-store engagement and digital convenience supports balanced growth across both channels.

Key Growth Drivers

Rising Demand for Convenient Home Brewing Solutions

Increasing consumer preference for convenience and premium home-brewed coffee is driving demand for drip coffee makers. Busy lifestyles and the growing remote work culture have boosted daily coffee consumption at home. Automatic drip machines with programmable timers and customizable brewing options appeal to users seeking effortless preparation. Manufacturers are launching compact, easy-to-use models catering to small households and apartments, further expanding residential adoption.

- For instance, Morphy Richards India introduced its Brew Blend coffee maker equipped with a 600-watt heating system and 6-cup brewing capacity. It features an anti-drip function that prevents spillage during serving and a reusable filter design.

Growing Popularity of Specialty and Premium Coffee

Consumers are shifting toward specialty blends and high-quality brewing, enhancing the appeal of advanced drip coffee makers. Features like temperature control, adjustable brew strength, and multi-cup brewing are gaining traction. The availability of machines designed for single-origin and artisanal coffee promotes at-home café experiences. Rising disposable incomes and the trend toward premium lifestyle appliances further accelerate market growth, especially in urban regions.

- For instance, Gruppo Cimbali acquired a majority stake in Slayer Espresso in 2017 to expand its position in the high-end espresso segment. This strategic move allowed Slayer, known for its handcrafted machines and customizable features, to leverage Gruppo Cimbali’s manufacturing capabilities to reach a broader market.

Expansion of Commercial Coffee Consumption

The commercial segment, including offices, cafés, and quick-service restaurants, is increasingly adopting drip coffee makers for high-volume brewing. Consistent output, reliability, and low maintenance make these machines ideal for professional settings. Businesses are investing in energy-efficient and automated units to reduce operational costs. The hospitality sector’s recovery and growing demand for quick, freshly brewed coffee options in workplaces continue to support segment expansion globally.

Key Trends & Opportunities

Integration of Smart and Connected Features

Manufacturers are incorporating IoT and Wi-Fi connectivity into drip coffee makers, allowing users to control brewing remotely via mobile apps. Smart features such as voice commands, scheduling, and maintenance alerts enhance convenience and personalization. These innovations appeal to tech-savvy consumers seeking seamless smart-home integration. The trend also enables brands to differentiate their products and strengthen premium positioning in the market.

- For instance, Electrolux AB offers smart home compatibility for certain appliances like ovens and air conditioners, which can be controlled remotely through apps such as the Electrolux App, and are compatible with Google Assistant and Alexa.

Sustainability and Energy Efficiency Focus

Growing awareness of sustainability is pushing manufacturers to design energy-efficient, recyclable, and eco-friendly drip coffee makers. Consumers increasingly prefer models with reusable filters, reduced plastic use, and auto shut-off functions. Companies are also adopting environmentally responsible production practices and packaging. This shift toward green innovation aligns with global environmental goals and strengthens brand reputation among eco-conscious buyers.

- For instance, Groupe SEB UK Ltd., under its Tefal brand, offers an Evidence Eco-Design bean-to-cup machine that incorporates recycled materials into its components. This model includes an auto power-off function. Tefal has also introduced other eco-design products, such as its Renew range of cookware made from 100% recycled aluminum.

Key Challenges

Intense Competition from Alternative Brewing Methods

The drip coffee maker market faces strong competition from single-serve pod machines, espresso makers, and French presses. These alternatives attract consumers seeking faster or more customizable brewing experiences. Changing consumer preferences toward specialty coffee formats may limit demand for traditional drip machines. To remain competitive, manufacturers must focus on innovation, smart features, and aesthetic design enhancements.

High Maintenance and Limited Awareness in Emerging Markets

Maintenance requirements and low product awareness in developing regions restrain broader adoption. Consumers often perceive drip coffee makers as complex or expensive compared to manual brewing tools. Limited brand presence and inadequate after-sales support further affect demand. Educating users about convenience, cost-effectiveness, and performance benefits will be crucial to expanding penetration in untapped markets.

Regional Analysis

North America

North America held the largest 38% share in 2024, supported by a strong coffee culture and high household appliance penetration. The U.S. dominates the region, driven by the popularity of home brewing and advanced automatic coffee makers. Demand for programmable and smart-enabled drip machines continues to rise, particularly among working professionals. Major brands are launching premium models with thermal carafes and eco-friendly designs. Retail chains and online platforms further enhance accessibility, sustaining market leadership across residential and small commercial segments.

Europe

Europe accounted for a 32% share in 2024, driven by established café culture and growing adoption of premium home brewing systems. Germany, France, and the U.K. represent the key markets, emphasizing high-quality design and energy efficiency. Consumers prefer compact, stylish models with programmable brewing and temperature control functions. Rising demand for sustainable and recyclable appliances aligns with strict EU energy regulations. Continuous innovation and strong distribution networks from leading global brands support steady market expansion in both household and hospitality sectors.

Asia-Pacific

Asia-Pacific captured a 21% share in 2024, emerging as the fastest-growing regional market. Rising urbanization, disposable incomes, and exposure to Western coffee culture are fueling adoption across China, Japan, and South Korea. Growing café chains and expanding office spaces drive demand for commercial-grade drip machines. Consumers increasingly prefer mid-priced models offering automation and modern design. Manufacturers are focusing on localized marketing and energy-efficient features to attract new users. Expanding e-commerce platforms and rapid lifestyle changes further accelerate regional growth.

Latin America

Latin America accounted for a 6% share in 2024, supported by increasing coffee consumption and a strong café tradition. Brazil and Mexico dominate regional demand due to their established coffee production and growing domestic consumption. Rising middle-class income and the availability of affordable automatic machines contribute to steady adoption. However, limited awareness of premium features and higher costs of imported models pose challenges. Local distribution partnerships and promotional campaigns are helping international brands strengthen their foothold in the region.

Middle East & Africa

The Middle East & Africa held a 3% share in 2024, reflecting gradual adoption of modern brewing appliances. Urban centers such as the UAE, Saudi Arabia, and South Africa are driving demand through expanding hospitality sectors and café chains. Consumers increasingly favor convenient and stylish coffee makers suited for office and household use. However, limited product availability and price sensitivity in several African markets restrict widespread adoption. Growing café culture, tourism, and entry of global brands are expected to enhance regional market presence.

Market Segmentations:

By Type

By Application

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drip coffee maker market includes leading players such as Electrolux AB, illycaffè S.p.A., GROUPE SEB UK, Ltd., BSH Hausgeräte GmbH, Spectrum Brands, Gruppo Cimbali S.p.A., Morphy Richards India, Espresso Supply, Inc., De’Longhi Appliances S.r.l., and Koninklijke Philips N.V. These companies focus on product innovation, energy efficiency, and smart brewing technologies to strengthen market presence. Manufacturers are introducing advanced automatic machines with programmable settings, improved filtration systems, and thermal carafes to meet diverse consumer needs. Strategic partnerships, mergers, and product expansions are key strategies to enhance brand visibility and distribution networks. Premium design, digital integration, and sustainability remain central to competition. Continuous investment in R&D and product differentiation supports growth, while strong retail and e-commerce channels help these companies maintain leadership across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Electrolux AB

- illycaffè S.p.A.

- GROUPE SEB UK, Ltd.

- BSH Hausgeräte GmbH

- Spectrum Brands

- Gruppo Cimbali S.p.A.

- Morphy Richards India

- Espresso Supply, Inc.

- De’Longhi Appliances S.r.l.

- Koninklijke Philips N.V.

Recent Developments

- In July 2024, Ninja introduced the Ninja Luxe Café, a versatile three-in-one coffee maker designed to brew precisely measured espresso, cold brew, and drip coffee.

- In 2024, BSH Hausgeräte GmbH (owner of Bosch/Siemens home appliances) published a historical review of its coffee machine evolution, emphasising next-generation electric drip/filter and bean-to-cup machines.

- In May 2023, De’Longhi America introduced TrueBrew, a groundbreaking fully automatic drip coffee machine. This innovative appliance features built-in technology that precisely grinds, measures, and brews coffee in various sizes with just the press of a button, thanks to De’Longhi’s patented Bean Extract Technology.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The drip coffee maker market is expected to show steady expansion through 2032 due to rising home coffee consumption and technological improvements.

- Automatic models with smart controls and advanced brewing features will continue to dominate market demand globally.

- Growing awareness of sustainability will encourage adoption of energy-efficient and recyclable drip coffee makers.

- Manufacturers will emphasize digital integration, app connectivity, and personalized brewing settings to attract tech-savvy users.

- Residential demand will remain strong, supported by the popularity of compact and stylish coffee appliances.

- Commercial spaces such as offices and cafés will increase investments in reliable and high-capacity drip systems.

- North America will maintain its leadership position, while Asia-Pacific will record the fastest growth through urban lifestyle shifts.

- Competitive intensity will rise as brands enhance product design, performance, and online presence.

- Companies will adopt strategic partnerships and mergers to strengthen regional distribution networks.

- Sustainable manufacturing, reusable filters, and recyclable components will define the industry’s long-term direction.